Overview

In this review of Redstone Payment Solutions, we take an in-depth look at the company’s role in the merchant account industry. We cover their services and examine both the opportunities and challenges businesses may face when working with them. This includes a breakdown of Redstone’s rates, fees, and contract terms, as well as their payment processing solutions for credit cards, debit cards, e-commerce, and mobile transactions.

Customer Complaints and Industry Ratings

We’ll examine common complaints about Redstone Payment Solutions, along with industry ratings and user reviews, to offer a balanced perspective. Additionally, we’ll explore insights into their marketing strategies and employee feedback to provide a well-rounded view of the company’s overall operations.

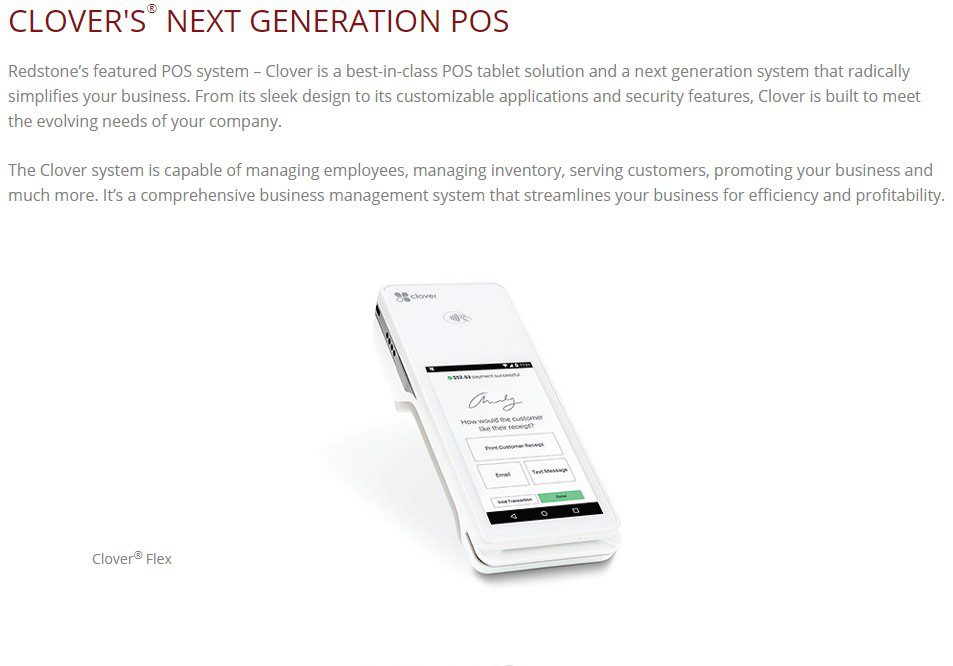

Point-of-Sale Systems and Payment Solutions

Redstone offers point-of-sale systems designed for various industries. We will discuss their mobile payment options and online payment gateways, focusing on security measures and fraud prevention to assess how well they protect businesses and customers.

Legal Issues and Customer Support

We’ll also address controversies involving Redstone, including lawsuits and fines. This section will cover their customer support options, providing insight into how they handle merchant issues and service requests.

Pros and Cons of Redstone Payment Solutions

Finally, we’ll weigh the pros and cons of choosing Redstone Payment Solutions as your payment processor. By evaluating their services, fees, and customer support, this review aims to help you make an informed decision that best fits your business needs.

Background of Redstone Payment Solutions

Founded in 2009, Redstone Payment Solutions serves most standard-risk businesses. It appears to be a reseller of First Data (now Fiserv) merchant services and also promotes Clover as a point-of-sale solution.