Overview

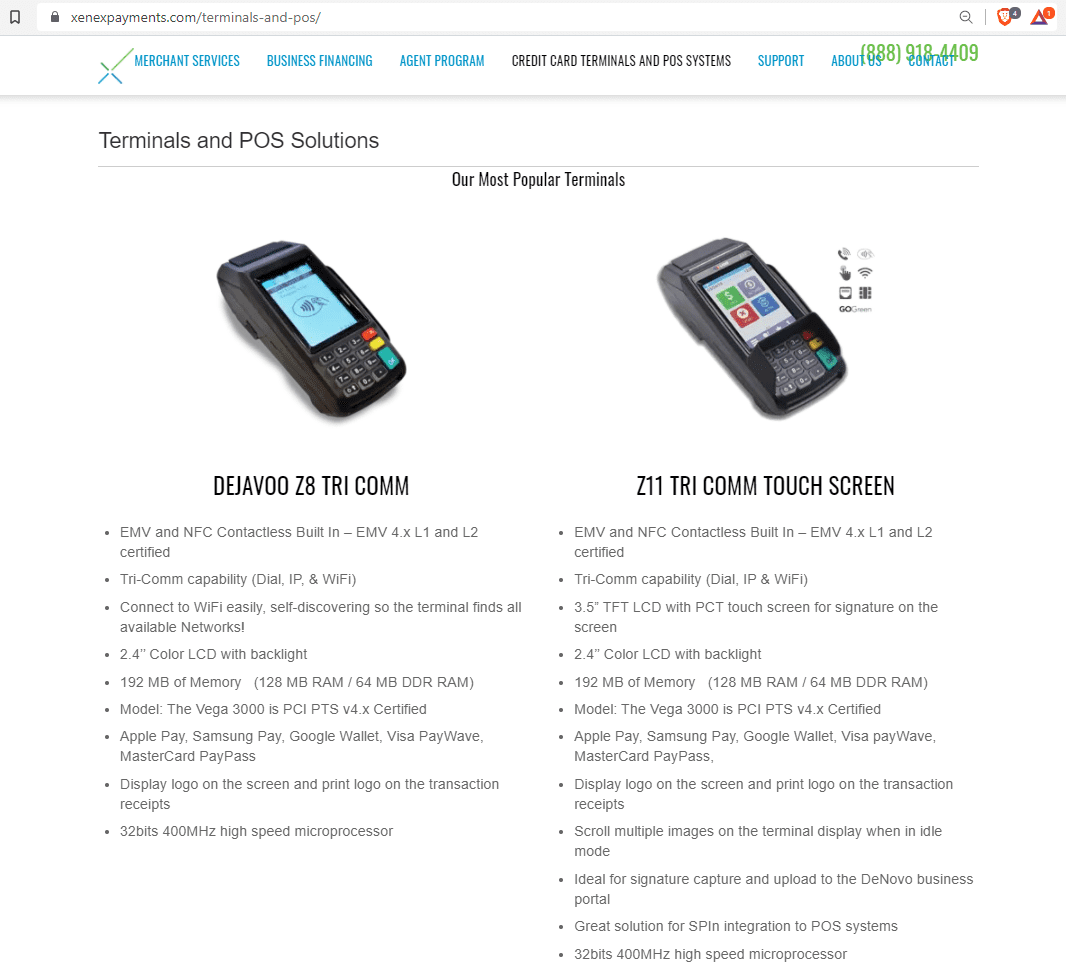

In this review of Xenex Payment Systems, we’ll provide a detailed look at the company’s services, reputation, and industry standing. Their offerings include support for major credit and debit card processing, a Zero Cost Program that shifts card fees to customers, a Gift & Loyalty Program, and funding options such as merchant cash advances and business financing. We’ll cover key details like rates, fees, contract terms, and potential issues such as cancellation penalties and equipment leasing costs, while also sharing background on the company’s history, ownership, and headquarters. Customer and employee feedback will be highlighted, focusing on common complaints such as hidden fees and the impact of independent resellers on client satisfaction. Finally, we’ll evaluate Xenex’s marketing and sales practices, industry ratings, and overall pros and cons to help businesses decide whether Xenex Payment Systems is a suitable payment processing partner.