Note: As of 2023, the TabbedOut website has been gutted. It appears they are still in business, but we will monitor the situation.

Overview

In this review of TabbedOut, we will provide a detailed overview of the company's mobile payment solutions designed for the hospitality industry. We will discuss the service offerings, pricing structure, contract terms, and customer feedback to give you a clear understanding of what TabbedOut provides. Additionally, we will examine the transparency of their fees, the quality of their customer support, and the overall satisfaction levels reported by their clients. By the end of this article, you will have a comprehensive understanding of whether TabbedOut meets your business's payment processing needs.

About TabbedOut

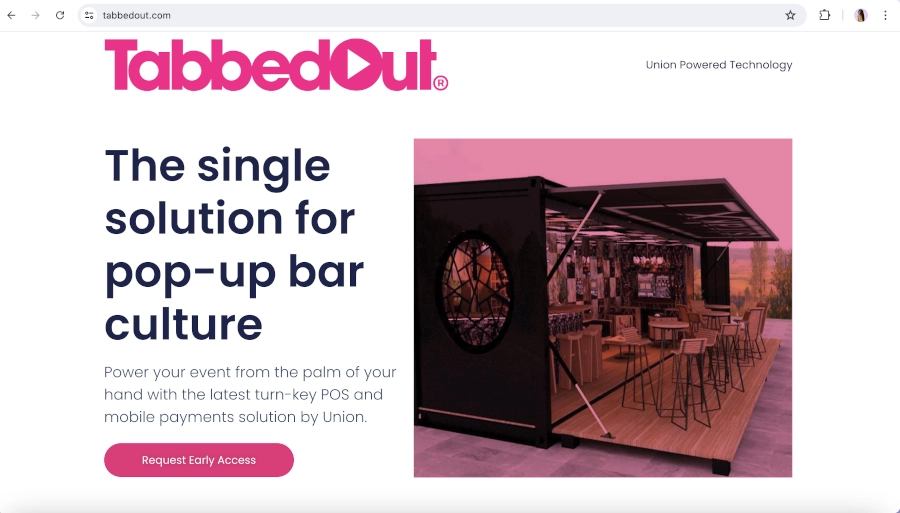

TabbedOut is an SaaS (Software as a Service) company that enables a business's customers to pay their tabs via a mobile phone app. Designed for businesses in the bar and restaurant sectors, TabbedOut also provides merchants with the ability to offer loyalty programs and discounts to customers who pay with TabbedOut. TabbedOut was launched in 2010 and has since secured partnerships with Harbortouch and Cayan to increase its use within restaurants and bars. The development group behind Tabbed Out, ATX Innovations, also offers UNION POS as a restaurant-focused POS solution. As of 2022, TabbedOut is advertising as “TabbedOut by UNION” and TabbedOut is now available through the UNION app, which may mean the company is transitioning in some form.

TabbedOut Products and Services

Payment Processing

TabbedOut offers a mobile payment platform tailored for the hospitality industry, enabling patrons to open, view, and settle their bar or restaurant tabs directly from their smartphones.

Integration with Point of Sale Systems

TabbedOut integrates with various Point of Sale (POS) systems, streamlining the payment process for both customers and the establishment's staff and management.

Secure Payment Processing

Security is a critical aspect of any payment solution. TabbedOut encrypts customer payment information, mitigating the risk of data breaches and fraud.

Marketing and Customer Insights

TabbedOut provides tools for businesses to utilize customer data, helping them understand their clientele, design targeted marketing campaigns, and foster customer loyalty.

Promotions and Loyalty Programs

TabbedOut supports the creation and management of promotions and loyalty programs, integrated within the mobile payment experience to boost customer engagement and repeat business.

Direct Customer Feedback Channel

After settling their tabs, customers can give immediate feedback on their experience through TabbedOut, providing businesses with valuable insights to improve their services.

Steve Schuler

Have you read anything about cyber security recently? Like maybe how scammers overlay QR codes with fakes that take you to an app install? And how you should NEVER say yes to an install that is triggered by a QR code?

Well, that’s what restaurant QR codes that are set up on this app do, if the app is not already installed. I spent a lot of time at a restaurant tonight because I couldn’t believe this was happening. A friend who had apparently previously already installed it ordered for me. Later on, I Googled to figure out what was going on.

The whole concept here is wrong from a consumer’s standpoint, and possibly from a restauranteur’s as well. TabbedOut is seeking to become a payment middleman. Don’t we already have Google Pay, CC companies, ad nauseum?

If the label next to the QR code had explained that it REQUIRED the TabbedOut app, I might not have been so frustrated, but I have to say the chutzpah of the blatent middleman grab for private data would still have left me appalled.