Three Pricing Tiers

Intuit offers a wide variety of payment processing options and seems to change its pricing and terms frequently. At this time, the company charges a one-time fee for Quickbooks POS with three different options:

- POS Basic – $1,200

- POS Pro – $1,700

- POS Multi-Store – $1,900

POS Basic

Quickbooks POS Basic allows a business to accept sales including contactless payments. Additionally, POS Basic includes e-commerce integration for retailers that also have an online store. Businesses can also manage inventory, customer data, and access “basic” reporting. The system works with tablets and integrates with QuickBooks Pro, Premier, and Enterprise Solutions. Additional hardware, such as scanners and receipt printers are sold separately.

POS Pro

Quickbooks POS Pro comes with everything that is included in the Basic plan. The additional $500 cost includes sales and promotional programs such as layaway, gift cards, loyalty and rewards. Businesses can also generate purchase orders, manage employees, payroll, and have access to “advanced” reporting. Advanced reporting includes reports for layaway, sales and work orders, and various employee items.

POS Multi-Store

As the name implies, Quickbooks POS Multi-Store allows businesses to have everything included in Basic and Pro, but with multiple locations. Business owners can manage multiple stores, manage and transfer inventory, and generate store-specific reports.

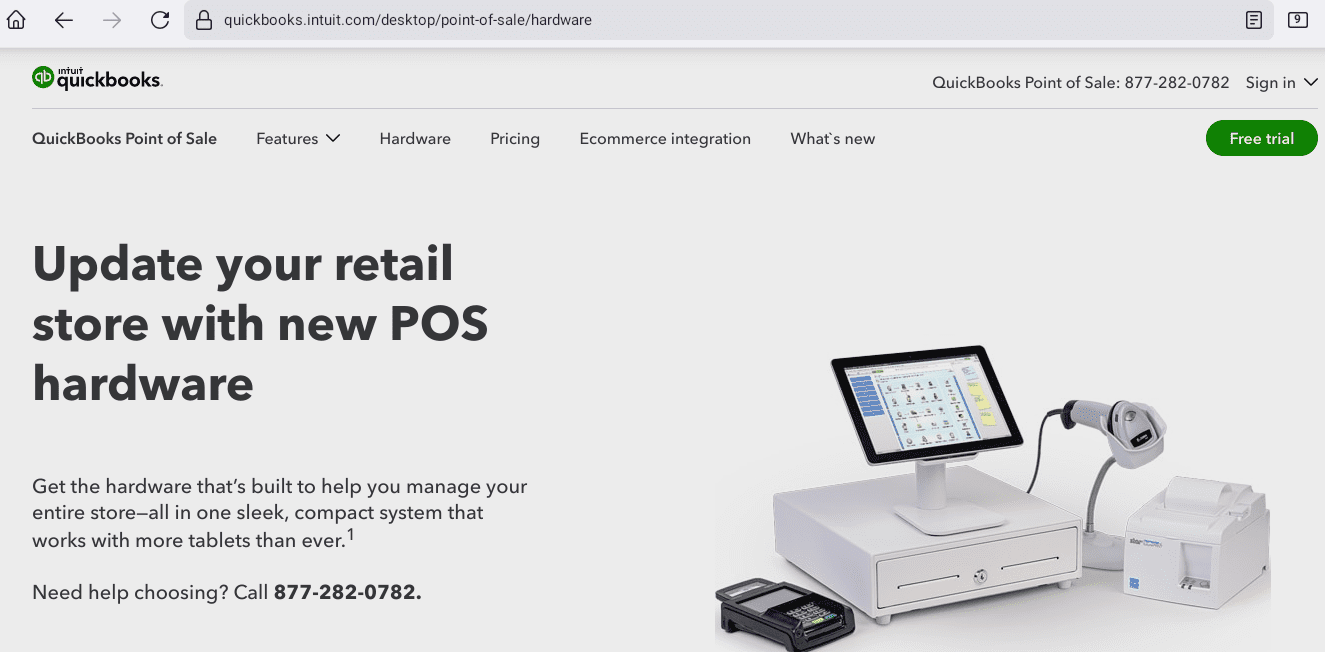

Point-of-Sale Hardware

Quickbooks sells a variety of hardware credit card processing options. These include full point of sale packages with scanners, printers, card readers, and cash drawers in both black and white for $900. Or, businesses can customize their point of sale by purchasing only the hardware they need. In general, Quickbook’s hardware costs are competitive with industry competitors.

QuickBooks POS Processing Fees

As of this updated review, Quickbooks is no longer publishing the company’s processing rates and fees. This likely indicates that Quickbooks is offering customized processing rates. Generally speaking, such a pricing tactic is designed to charged businesses as much as possible without losing the account. Quickbooks POS reviews from customers, and our own analyzing of their merchant account statements, suggest that processing rates are expensive. Intuit also makes it difficult for other processing company’s to integrate with the accounting software. As such, the company charges high processing rates knowing that it can be headache for businesses to switch processors. If you are looking for other processing options, see our best credit card processors for Quickbooks integration.

Previosly, Quickbook’s had public facing processing rates as follows: The company’s standard pricing plans consisted of a “Pay As You Go” plan and a “Low Monthly Rates” plan. The Pay As You Go plan did not charge a monthly fee and offered a PIN debit rate of 1%, a swiped rate of 2.7%, and a keyed-in rate of 3.5%. The Low Monthly Rates plan offered a PIN debit rate of 1% plus $0.25, a swiped rate of 2.3% plus $0.25, a keyed-in rate of 3.2% plus $0.25, and a monthly service fee of $19.95.

Monthly, Annual, and Cancellation Fees

Intuit does not mention any PCI compliance fees, monthly minimums, or early termination fees associated with QuickBooks Point of Sale, but that doesn’t mean that these fees don’t apply. Business owners shouldinquire about all possible fees before completely a sign-up. Overall, QuickBooks Point of Sale appears to be much more expensive upfront than its lightweight, cloud-based competitors, but its integration with QuickBooks accounting software and its decent suite of features may make it worth the cost to some businesses. Others should look into top-rated iPad POS options for alternatives. Merchants who are considering QuickBooks Point of Sale should be prepared to operate entirely within Intuit’s closed software ecosystem. We also encourage merchants to check out our list of the providers of the best merchant accounts.

David V.

What we have found to really SUCK is the fact that every couple of ears, we get a notice that we will be required to update our software, which even with the discount offered, costs us thousands of $! Is there a way to get around this?

Denise

QBPOSSHELL stopped working.

Our company updated to the POS 12, (the newest version) and this is now 2018. The problem still happens about every other work order entered then generating a PO. I am disappointed that Intuit has not figured out how to fix the problem. Restarting the program multiple times is very, very time consuming.

DENISE MUNSTERMAN

I am very tired of the poor service from Quickbooks POS.

Today I was told I have to pay for a broken receipt printer because I didnt send it back.

I am absolutely sure no one said anything about sending it back although I expected them to send

me a shipping label to send back. No one ever did so I forgot about it and now

1) I had the inconvenience of having to sit with lengthy support session to see why it wouldnt work finally finding it was broken.

2) had to wait for new one come

3) had poor customer service re sending it back

4) on top of above I have to pay for the broken one

5) I called to find out what the charge was and it took about 20 minutes to get the answer — an example of my experience with your service — it just should not take so long. So I am sitting here fuming and looking for any where any way I can write a review on you guys.

My past experience with support is horrible. I absolutely dread having to call support and have to put aside hours if I do as it commonly takes 1 hour plus and I have gotten to the point where I try really hard to figure it out myself as the time goes on and on and usually do figure it out myself

—

Are you with Intuit? Learn how to resolve this complaint.