Overview

In this review of Advanced Merchant Services (AMS), we will look at their offerings, customer experiences, and business practices. As a reseller of First Data (now Fiserv) products and Clover POS solutions, AMS serves standard-risk domestic businesses with payment processing solutions. We'll cover AMS's services, including their rates, fees, contract terms, and EMV-ready terminal offerings through programs like Clover®.

We'll also examine common complaints against AMS, such as aggressive telemarketing tactics and customer dissatisfaction. By looking at industry ratings and employee reviews, we'll provide a comprehensive view of the company's standing in the market.

This review will highlight AMS's payment processing services, technology solutions, and customer support options, weighing the pros and cons of their offerings. We'll discuss the impact of the Visa & MasterCard lawsuit settlement on merchants and evaluate customer reviews and AMS's legal history to understand the overall client experience. Additionally, we'll cover their contract terms, pricing variability, and the costs of their virtual terminal and payment gateway services.

Finally, we'll shed light on AMS's marketing tactics, employee experiences, and allegations of misleading sales practices, critically assessing their approach to business development and customer engagement. Our goal is to provide a clear perspective on Advanced Merchant Services, helping businesses make informed decisions about their payment processing partnerships.

About Advanced Merchant Services

Advanced Merchant Services is a merchant account provider in operation since 1999 that serves most standard-risk domestic businesses. The company initially boarded high-risk merchant types under its subsidiary, Next Level Payment Solutions, but the subsidiary seems to no longer be active. Advanced Merchant Services appears to resell the products and services of First Data (now Fiserv) and Clover as a POS solution. Unfortunately, the company has received a high volume of complaints regarding telemarketing tactics from its ISOs and independent sales agents.

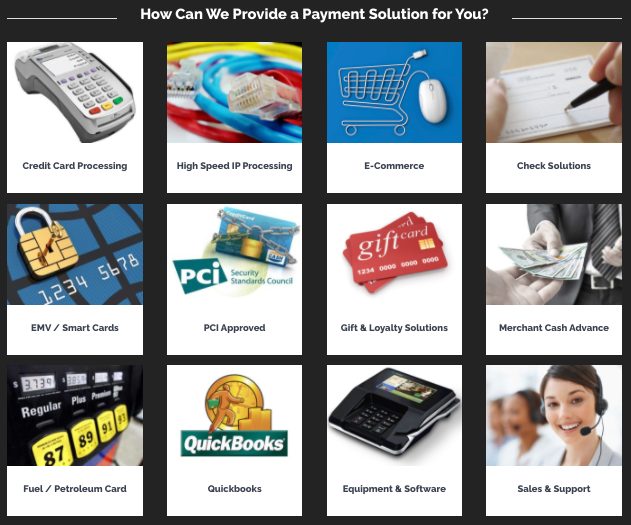

Advanced Merchant Services Products and Services

Payment Processing

Advanced Merchant Services (AMS) provides a variety of payment processing solutions for businesses. They focus on offering competitive rates and utilizing advanced processing technology.

EMV-Ready Terminal Offerings

AMS offers free EMV-ready terminals to businesses that use their services. EMV terminals are essential for meeting current global processing standards.

Clover® Program

The company provides the Clover® program, which features the latest in payment processing technology. Businesses can start with a free Clover® Go or may qualify for a free Clover® Mini, a modern and flexible payment processing hardware.

Chad J Mull

We have worked with, faxed, called numerous times to have a simple bank change take place. We received the pdf bank change form on 9-4 -19. On 9-13-19 i faxed that form and letter from new bank with information to come and find out that it was unacceptable because i signed it and not my wife on 9-20-19. I called back on 9-24-19 after faxing a new document change form with my wifes name and signature on 9-23-19 to find out that a new ticket had not been made and sent. Today 9-26-19 i called back to check on progress because now money owed has become over $3,200 and yet no money into this account. We are a small business with limited cash only to have been in a position to borrow money to pay bills due to the timely manner this company operates over a name and signature. We have been depositless since 9-4-19 granted our choice to have a bank change, however the lack of speed over now a 2 week period we are still $3,200 owed by Advanced Merchant Services. We are very upset how these requests have taken place and how we have been treated. I have recorded all calls and have a timeline charted for history purposes. We just wanted a simple bank change and our money for sales owed to us like has happened previously. I guess who would have thought a change in bank accounts could be so difficult to the tune of $3,200 plus and counting.

Chad & Lisa Mull

RJS Lounge

109 Main

Conrad, IA

This post will help: Best Merchant Accounts for Great Customer Service

-Phillip