Note: After the 2019 FTC judgment against Allied Wallet and the 2020 arrest of their CEO, there are claims that they are out of business. However, they maintain their web presence, meaning there may still be some form of the company in operation. Because of this, we will maintain this review for now.

Company Overview

Headquartered in London, Allied Wallet is a rapidly growing merchant account provider that specializes in e-commerce payment processing for small to medium-sized businesses. The company, which was founded in 2002, appears to utilize First Data (Fiserv) as its processing network but may also be partnered with other international companies and banks. Allied Wallets' services include payment gateways, POS systems, e-wallets, ACH processing, e-commerce solutions, and PCI compliance.

Allied Wallet Overseas Operations

Allied Wallet claims to service 88 million users worldwide and claimed to process $55 billion in 2013, but the company has received very little coverage in the U.S. and is not showing very many reviews online. This is likely due to the fact that Allied Wallet appears to operate most heavily in Asia (specifically Russia and China) and the UK. In fact, Allied Wallet was the first company to win the international rights to transact the Chinese renminbi online, which has helped it to secure a large foothold in the growing Chinese e-commerce market.

Allied Wallet’s Point-of-Sale Solutions

Designed with user-friendliness in mind, Allied Wallet offers robust Point-of-Sale (POS) solutions. These systems support an array of payment options, enabling businesses to provide their customers with flexible and convenient payment choices. The POS systems are equipped with additional features like sales tracking and inventory management, streamlining business operations.

Mobile Payment Services by Allied Wallet

Understanding the evolving needs of the market, Allied Wallet offers a mobile payment solution. This allows businesses to accept payments on the go, ideal for mobile or field-based businesses. Utilizing a card reader and a mobile app, businesses can process payments easily and securely anywhere, anytime.

Allied Wallet’s eCommerce Payment Gateway

Allied Wallet offers a secure eCommerce payment gateway for businesses with an online presence. This feature allows the seamless integration of the payment platform into an existing website. The gateway can process a wide variety of payment methods, enhancing the online shopping experience for customers while ensuring transaction security.

Location & Ownership

Allied Wallet does not list its backing banks. Andy Khawaja is the CEO of Allied Wallet. Allied Wallet lists Bockenheimer Landstraße 2-4 60306 Frankfurt, Germany as its “German Support Office” address, while the BBB lists an American address at 7525 E Camelback Rd Ste 208 Scottsdale, AZ 85251-3550.

Table of Contents

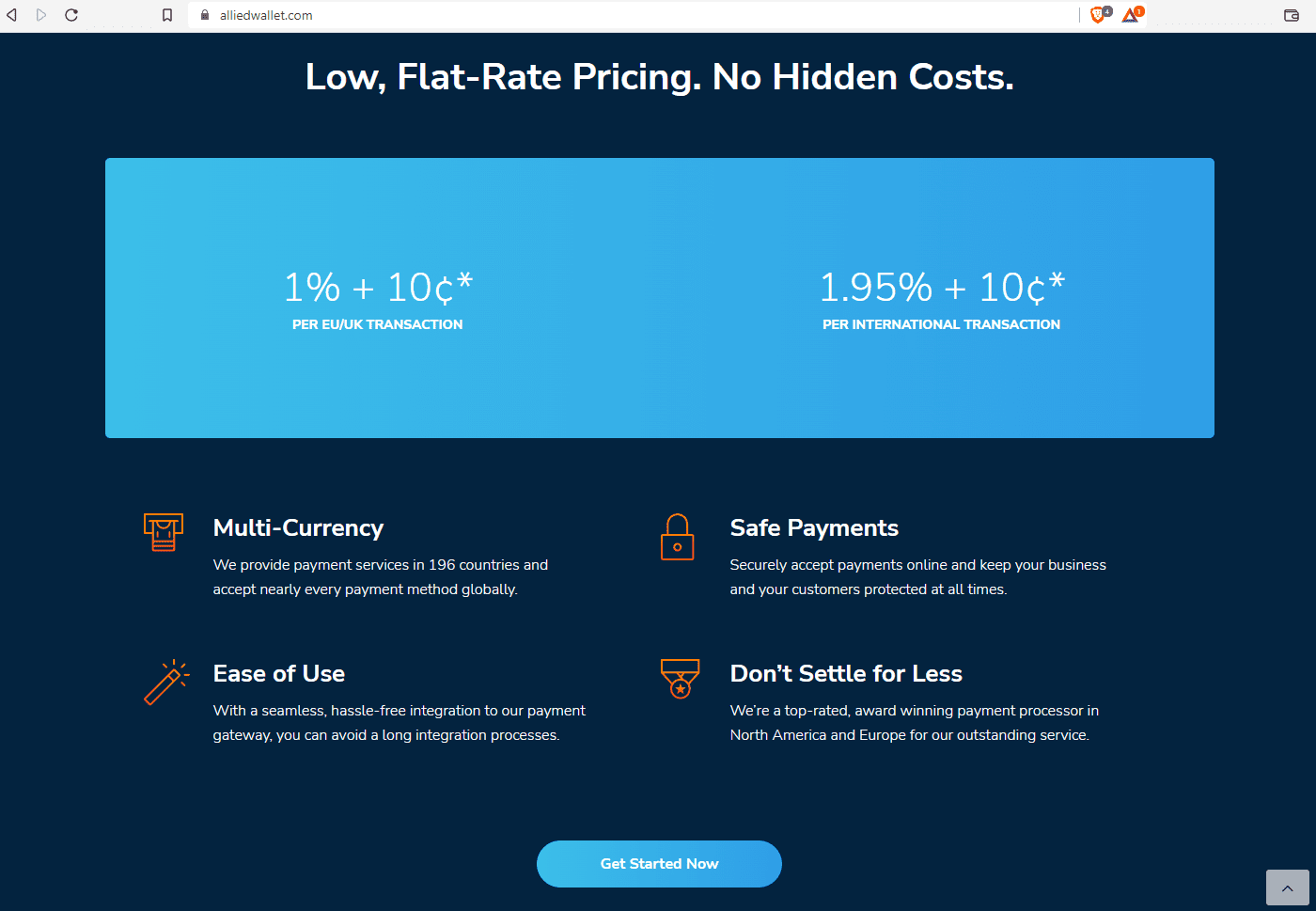

- Costs & Contract: Lists its base rates, but its contract terms will vary depending on…

- Complaints & Service: Complaints number more than 35 on…

- BBB Rating: Has no rating with the Better Business Bureau and has received 0 complaints in…

- Sales & Marketing: Has a history of utilizing misleading sales tactics, but it appears to…

Mohamad Kawabata

Very good company and best rate and every time I call they have good customer service

Marcos

With this company since 2011, Had two accounts with them The second account we have been defrauded for about 6000. The first account they canceled recently after years with the company. After they created a UK corporation for us to comply with regulations, Now they claim UK no longer accepts shelf companies. We put up with allot of incidents throughout the years, However since we are in a high risk industry we had to put up with it. Now at least I can voice our opinion of this fraudulent company. Avoid at all costs!!!

From The Editor

This Post Might Help: Best Merchant Accounts for High Risk

JenniferLay

Do never EVER trust Allied Wallet !! I registered my card i got from my company and NEVER EVER got an email back with log in data or pincode to get money at the bank. I contact the support twice a week and suddenly my card was suspended WITHOUT any reason. They say I have to wait 2-4 business days but now I am waiting since 100 business days for an email or unsuspending. They stole my money !! Do not ever trust allied wallet baddest company I ever experienced!!

James Martin

Using Allied Wallet as a backup payment option. I’ve had a good experience so far. Can be hard to get a hold of support with high call volumes sometimes, but so far pay outs have been on time and no serious issues.

Mark

We are a customer with Allied Wallet and they have been a complete, incompetent disaster for us. The amount of recklessness by Allied Wallet regarding implementation and rollout has been nothing short of a train wreck. To the point that it has been 5 months since launching and we still can’t take credit cards. Get this, they only allow 300.00 a month per email address and/or card so if you have a company with recurring or multiple visits by customers in a given month, forget about it but that doesn’t even matter since they cannot get their stuff together to integrate properly to our eCommerce site.

The staff are rude and the emails fly like airplanes to various people in the organization with little to nothing to show for it and the Chief Compliance Office, Michael Carrasco in Los Angeles is an absolute jerk, goon and power hungry! He disrespects the client as if he had any control over them. If you value your business, DO NOT use this company for your processing, you’ll regret it immediately.

James

I wish I could get this message to everyone who is considering using Allied Wallet. It is absolutely the worst company I’ve ever dealt with!! I hope I never run into a company so pathetic in my life. We were able to do $30k in credit card payment and recieved a couple small payment after a month of begging to get our money. So obviously I closed the account in March after over 200+ day of the $30,000 I did they are offering to send me a check for $1450.00!!! In total I will have received only around $11k of the $30k I did and they run off with nearly $20k of my money!!! THIS IS CRIMINAL AND IF ANYONE ELSE IS PREPARED I’M FOR FILING A CLASS ACTION SUIT AGAINST THEM!!!

Oleh Hereliuk

Hi james,

We have the same story. We are ready for filing a class action too.

Oleh Hereliuk

Allied Wallet is the worst company to have business with. Allied Wallet has a poor performance and poor service. Once you process with this company you will never get your money back. FRAUD and SCAM company. Stay away

Vic

Hii All,

I have the same story . Allied wallet did the same thing with me and took my $20,000. I am almost broke and closing my business because of allied wallet . my business was very new and allied wallet destroyed it. Pleaseeeeeee do not sign up with these scammer .

Jay

Do not use that piece of crap company Allied Wallet. They steal your money. They wont pay me the $4000 they owe me after I closed the acct. They also pay a month later on the transactions.

Oleh Hereliuk

Hi Vic,

We are forming of group of companies to file a class action against Allied Wallet Ltd

Kedibone Mohati

Just had a terrible experience with Allied wallet. they told me my application for merchant was approved. later they send me a list of things that needs to be done on my online site, one of the things was registering and EU Corporation and they charged me 350$ for that. When all was done and ready for activation, they then send me another list saying its from compliance, the list included me obtaining a USA number even though I am based in South Africa and also that I was charging items too much I should discount my clothes by 50%.

I started having doubts and well I went ahead did all that, couple of days they then cam back to me saying their supporting bank is declining my application and they cannot support my line of business.

What makes me angry is that why did they waste my time all along knowing that they will never activate my account and also why did they accept payment from me to register the EU if they knew all this they do not support my line of business. Now that they cannot proceed, what on earth am I going to do with the EU Corporation and I do not think they will refund me. Allied wallet is a scam. they scam customers and scam business that wants to use them as payment gateway. I am pissed and irritated.

Please do not ever consider to use, useless set of people

SAM

Thanks for sharing your experiences with Allied Wallet. I was in middle of filling the application and thought probably I should first check the reviews. Your reviews made me realized what blunder could have happened with me if I have used their services.

Thanks for your input. Your feedbacks made our organization saved.

Ahmed

Hi,

I just signed up to AW and I’m very skeptical to start processing any transactions with them due to the many negative reviews online. I understand that a company cannot satisfy 100% of their clients but to withhold their money for that amount of time without any valid reason is just wrong.

I signed up for a virtual terminal and instead was given an ECOM account which I have no use for. I have emailed them numerous times and have not heard anything back from them all day.

If anyone can share a recent experience with AW, I would be happy to hear them.

Concerned Customer

Working with them right now and it has been a nightmare. Customer service is non-existent. Calling them is a waste of time as you can be on hold for an hour with no response and emails are ignored. I would not recommend this processor to my worst enemy.

Suchandan Adhikary

Hi All I am the owner of RTRSUPPORTS LIMITED and our UK Company NO: 10316152

This is a hundred percent Fraud company this company will take your all hard earn money, Trevor is in the sales department who will never reply your message, we have started selling in the month of September 13 2016, in agreement they told us us they will release the funds once it will reach 1000 units and every transaction they will keep 10% as a rolling reserve,but after 72 transaction we have got got total sale of of Approximately__14000 USD till 26 October 2016 when the payout date came they sent us email stating that your account is on hold hold without any reason, recent them email asking about the reason of hold but they never replied as back, I called Moe Diab but he ignored my call every time time I emailed him but he never replied me back also never explained us why the payout and the account is in hold but no explanation, we are in a a in a a website designing business if you are are not getting paid timely how can we run our our business. We have lost our our all investment and clients. I am doing attachments of conversation done with Trevor Lake.

If you need proof you can email me at info@rtrsupportslimited. com

Kumar

Hi Suchandan,

Is there any reason why your account is on hold? I just signed up with AW, after seeing all these comments, i am bit worried about sending my transactions to them.

Did you ever get any chargebacks? Share your further conversation with AW, i am curious to know.

James

I have the exact some problem right now going on with them they have over $20k of mine and refuse to contact me they told me to keep processing the said not to now says to but by not getting paid I can’t pay my help to continue. Does anyone know how to resolve the problem with them?

Biswaran

Your company name suggests you are a tech support company. Processors love to steal from you because you steal from everybody else. A warning to tech support companies. If you operate in fraud you will never see your money.

Kirstie B

Joining Allied Wallet in 2013 was a costly $5000 mistake.

With AlliedWallet you are guaranteed the following:

1) Loss of funds

2) Zero customer support

3) Unprofessional service

4) Become another foolish victim

I have experienced all 4.

My payouts suddenly stopped in August 2015 without any prior notice.

Receiving a response from AlliedWallet “customer support” has been virtually impossible, you have more chance of Leicester City football club winning the premier league.

The very brief and unhelpful reply from “customer support” stated my account was on hold due to low volume. In order for the funds to be released (approx $5000) volume should be increased.

Now, no one in their right minds would trust a tinpot company with more cash $$$?

Here is a little about my account:

I have zero charge backs

I have zero customer complaints

I have been in business 8+ years

My industry is mid-risk

Process approx $750/month via AlliedWallet

Let’s be clear:

I was never never never informed of any account issues

$5000+ is sitting in my account (not including rolling reserve)

My AlliedWallet merchant account is fully functional

My AlliedWallet account panel states “Active”

I’ve been polite in all email correspondence (I might as well improve my odds of a reply)

To this day I’ve received only 1x brief email from “customer support”

Fortunately for me, scam merchants AlliedWallet was never my 1st choice provider, simply a backup solution.

If you are looking to lose money and potentially ruin your livelihood, go ahead sign-up fool !!!!

Kirstie B

Update: Payout issue has been resolved successfully. I no longer feel my review is fair.

The lack of communication left me in limbo but Allied Wallet are not scam merchants.

Harry

Allied wallet is just sitting to take money and not pay they are payment processors, they are thief.

Trevor is the guy in sales, i guess entire company runs on 5-10 employees.

We started processing with AW in AUG2015 we processed around 14000 USD. we got 3-4 chargebacks. they never wired even a single settlement.

they are pathetic no professionalism . I am going to sue them soon.

John

Alliedwallet is rubbish I can’t even log in with the password that was sent to me. I have even clicked forgot password but didn’t get a new one sent. Now the item g ordered gap been cancelled by the seller because they didn’t receive payment.

Artem

Wondering I haven’t read these comments earlier!

Same story with our processing as above.

We have been processing for 2 month. Funds were released properly, however processing was low.

As soon as we pushed the volume up and in a week they should have settled us proper amount of money, we received and email from Moe Diab about the Chargebacks ration going high and we should pay attention on this or they will have to fine us $100 per Retrieval, not Chargeback.

All the retrieval reports requested by AW were properly sent with overloaded volume of information necessary for CBs fight. No one report has been reviewed and in the end of the months Moes notification came.

Just next day we had a notice, that due to Fraud reports they have to terminate our accounts and money will be held for 180+ days due to investigation and possible disputes payouts.

Now they held settlement 36.000 GBP + 8.000 GBP holdback.

Customers support in this Cowboys office is simply missing! Never replied to our mails of requests. Only one person I can consider as a reliable there is Derek Baehr, IT support. Replies immediately to any issue discussed on skype.

Well, my suggestion is not to go for them and if happens, take the issue to the lawyers to try to blame them.

Hussain B

Very Funny!!

A much over disaster experience with Allied Wallet.

After reviewing and agreeing with the terms they have, my funds were holded for initial 90 days as a matter of high risk.

I kept on enquiring about funds release date and then was informed about the first release date i.e. 24th Dec’14 as per 90 days initial holding.

It was not done and was informed that they have found some wrong transactions and the number of chargebacks are more.

I agree it was however, the reason of holding the funds for initial 90 days was given for the same reason due to high risk account.

I didn’t get my payout and due to insecurity, I stopped transacting. It was then informed to me that in order to get a payout I should keep transacting and show a active processing however, my question is, if you are not releasing the funds on time as promised, why we should keep on transacting the amount.

These guys have many reason to hold the money for 180 days and use it.

Very bad experience and this is for the first time. I have signed up with other merchant provider which is far better then Allied Wallet.

Vic

Could you please let us know , now which merchant r u using that is far better , plz . I am going through with same situation.

Thank you

chris c.

After sending several transactions during 2 weeks, our account was around $5,000 usd. They missed the first and the second scheduled payment date, and then they said the account was suspended, and that they were not able to release the payment if we didn’t continue to send transactions.

After a phone call with the COO, he decided to cancel our account and release the payment after 6 months.

“Hello Chris,

Please note that we cannot release funds on any account that is not actively processing, you will need to process the volumes you requested on the application when you opened the account and it needs to be continuous without any interruption in order to receive weekly payouts, we cannot release otherwise.

Best Regards,

Moe Diab – COO

[Customer Service] 888-255-1137 | [Direct Phone] 310-424-5495 Ext 5005 | [Mobile] 818-967-7485| [Fax] 480-304-3434|

Harry

Dear Moe,

What if some one does not fulfill the commitment will you hold the money even after having a huge rolling reserve of 20% and first payment after 45 days.

John

Where is the money your owe our company £19,000 you promised this money would be into our account 2 days ago

Keith Woolley

Hi,

I read your article with interest.

For the past month I have been applying to open a merchant account with the UK arm of Allied Wallet.

Terms were agreed, rates were agree and paperwork signed and returned. I have apparently been dealing with both the UK I have been dealing with a Steve Wilson Managing Director, Allied Wallet Europe and Lewis ClarkUK & European Business Development Manager, Allied Wallet Europe – so both of them should know their jobs?

This isn’t a new application – we have been communicating for a month, and all business information has been supplied to Allied Wallet and their Risk Assessment team.

We agreed a card processing fee of 2.9 percent plus a 30p per transaction fee.

Forms were signed and returned to Allied Wallet.

Even as of yesterday, I was promised that the account would be live by 4pm.

Then today was the “bombshell”. I was asked – “Did you sign the termsheet with the new rate of 7% + £0.30p on?

Well no – I signed the terms sheet with 2.9 percent on plus 30p

This new term sheet had never been sent to me.

I am now presented with a take it or leave it?

Have any other members been held to ransom by Allied Wallet just before their website was to go live?

Robert

Hi,

I am currently applying with them. They told me that it will be up in about 48 hours. Can you tell me more about your experience?

James

Worst business experience of my life. I did $30k of transactions in a month after almost a year I’ve gotten just over $11k they stole nearly $20k from me!!! I had to close account after 2 months they refused to pay me! Pathetic company!!!