Teledraft Review

We take our role in providing guidance and education regarding the card payment industry very seriously. At our own expense, we have vigorously defended our right to continue expose unethical and predatory practices in the industry, successfully defeating every attempt to silence us. However, fending off frivolous lawsuits is costly. To sustain these efforts, one of the ways we generate revenue is through affiliate partnerships with ethical providers. This means that some of our outgoing links connect business owners to trustworthy, low-cost payment processors, which is what most of our readers seek. We see this revenue channel as a win-win-win for everyone involved. Business owners find good processors, processors get good clients, and we are able to continue to provide a valuable service to the small business community. We also recommend and link to many services that do not compensate us. Our priority is to guide you to the best solutions for your needs, regardless of potential revenue. If you have questions, please feel free to contact us.

All mentions of rate and fee costs are estimations based on publicly available information and client feedback. Actual costs may vary based on a variety of factors unique to your business.

Customer Reviews & Sentiment

The only two serious blemishes on Teledraft’s record appear to have occurred under the supervision of the company’s previous owners. The first series of incidents was a handful of lawsuits in 2003-04 in which the company was successfully sued for providing ACH services to a telemarketing scheme that bilked its victims out of hundreds of dollars. Although Teledraft was not involved in the scam itself, it failed to stop providing services to the organization that was putting on the scheme. Several state attorneys general held Teledraft liable for their failure and ordered them to pay back the transaction fees they collected.

Aside from complaints that are related to that scam, there are a couple of complaints from 2012 of the company holding a large amount of funds in reserve after merchants closed their ACH processing services. When ownership of the company was transferred to Phoenix Payments, the merchants in question were told that Teledraft was no longer responsible for the held funds and were advised to take up the issue with the former owners. Although these two instances almost amount to criminal negligence and theft, the company has no other complaints filed on the usual websites and forums since Phoenix Payments assumed control.

Industry Scores & User Ratings

| Product & Service Complaints | 0 |

|---|---|

| Billing & Collection Complaints | 0 |

| Advertising & Sales Complaints | 0 |

| Guarantee & Warranty Complaints | 0 |

| Delivery Complaints | 0 |

Teledraft is not accredited with the Better Business Bureau, which means that it has not paid the BBB for the accreditation. As of this review, the BBB is reporting an “A+” rating based on zero complaints in the past three years. This is an improvement from an “F” at the time of our last update, when the BBB was penalizing the company for a single unresolved complaint. Given the company’s clean complaint record with the BBB, we agree with its rating.

Processing Rates & Fees

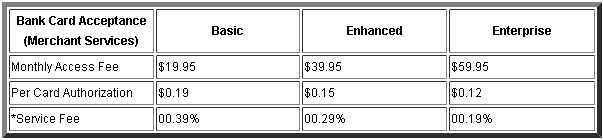

Teledraft advertises competitive merchant account rate pricing and contract terms and appears to offer uniform pricing to all businesses solely based on the type of Teledraft account the merchant chooses. As mentioned earlier in this review, the company offers only interchange-plus, which is the least costly and most transparent rate tier. Additionally, Teledraft offers month-to-month contracts, no minimum transaction fees and no cancellation fee. Below is Teledraft’s pricing as of this review:

Other fees include a $0.39 batch fee, $25 Chargeback fee and $99 annual PCI compliance fee.

Teledraft Competitors

Compare Teledraft to competitors that earned top marks.

Bottom Line

Aside from the problems with the lawsuits that Teledraft has been named in and a couple complaints about holds, the company appears to be good option for credit card processing services under its new ownership. Teledraft’s pricing and fees are lower than average and the company offers month-to-month contracts. As always, merchants are advised to thoroughly read and understand the terms of their merchant account agreement before signing with any provider.