Overview

In this review of Transparent Merchant Services, we will provide a detailed overview of the company's credit card processing services. We will cover the range of services they offer, including point-of-sale (POS) systems, mobile payment solutions, and e-commerce capabilities. The review will identify the types of businesses that might benefit from these services. Additionally, we will examine client and customer reviews to highlight common trends and potential concerns. The article will also address the company's pricing structure, contract terms, and specific services provided. By the end of this review, you will understand whether Transparent Merchant Services meets your payment processing needs.

About Transparent Merchant Services

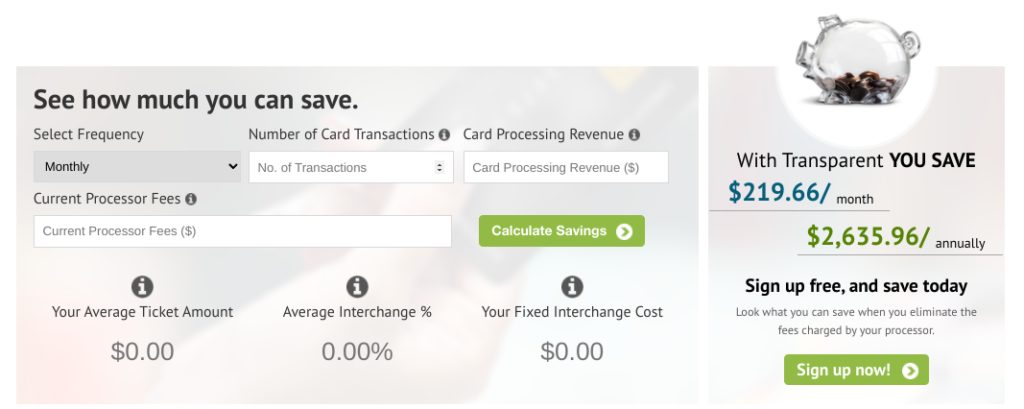

Transparent Merchant Services is a merchant account provider based in Scottsdale, Arizona. The company offers standard credit card processing solutions for all business types, but what sets it apart from most of its competitors is its unique pricing model. Similar to Payment Depot or BaseRates Merchant Services, Transparent Merchant Services charges merchants a flat monthly rate with a per-transaction fee of interchange plus a fixed dollar amount. This means that Transparent does not keep a percentage of each sale for itself, which could make it appealing for merchants with high average tickets who want the cheapest credit card processing possible.

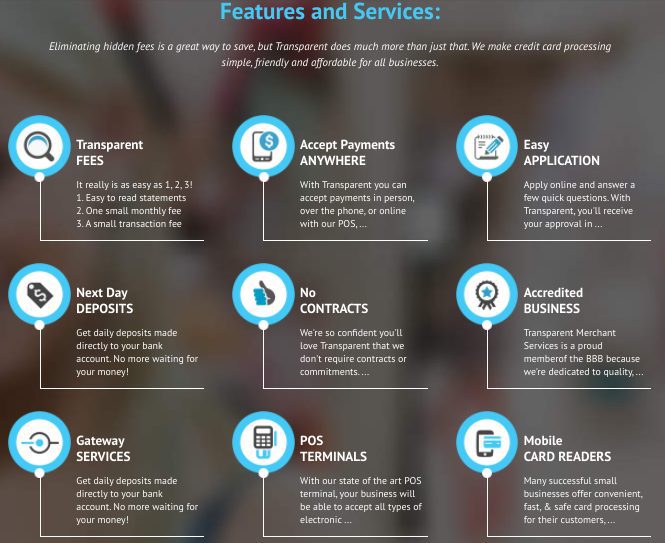

Transparent Merchant Products and Services

Payment Processing

Transparent Merchant Services processes most major debit and credit cards. They provide POS solutions via Ingenico, Walker mobile payment equipment, and the Poynt 5 terminal. They also offer PCI compliance services through Conformance and provide a payment gateway, though the specific gateway is not specified.

Rita Carnevale

I’ve left many different forms of messages for their sales dept. to contact me as a potential customer, but my efforts were fruitless. Can you imagine a company not responding to a potential customer’s numerous messages???? I shudder to think how they treat their existing customers!!!! **POOR SALES SERVICE**