Overview

In this review of Unified Payments, a mobile and tablet-based POS system provider and subsidiary of Net Element, Inc., we'll take a close look at their offerings. We’ll cover their POS solutions, rates and fees, contract terms, and the pros and cons of their services. We'll focus on customer and employee feedback and delve into controversial allegations against Net Element's CEO, Oleg Firer.

Additionally, we'll discuss the company's marketing strategies, legal challenges, and overall industry and online ratings. This review will aim to provide a concise yet comprehensive overview of Unified Payments, offering valuable insights for merchants and industry professionals.

About Unified Payments

A subsidiary of Net Element, Inc., Unified Payments is a merchant account provider that specializes in mobile and tablet-based point-of-sale systems. Founded in 2010, the company claims to serve “over 1,000 sales agents, referral partners, and value-added resellers nationwide.”

Unified Payments Products and Services

Point of Sale

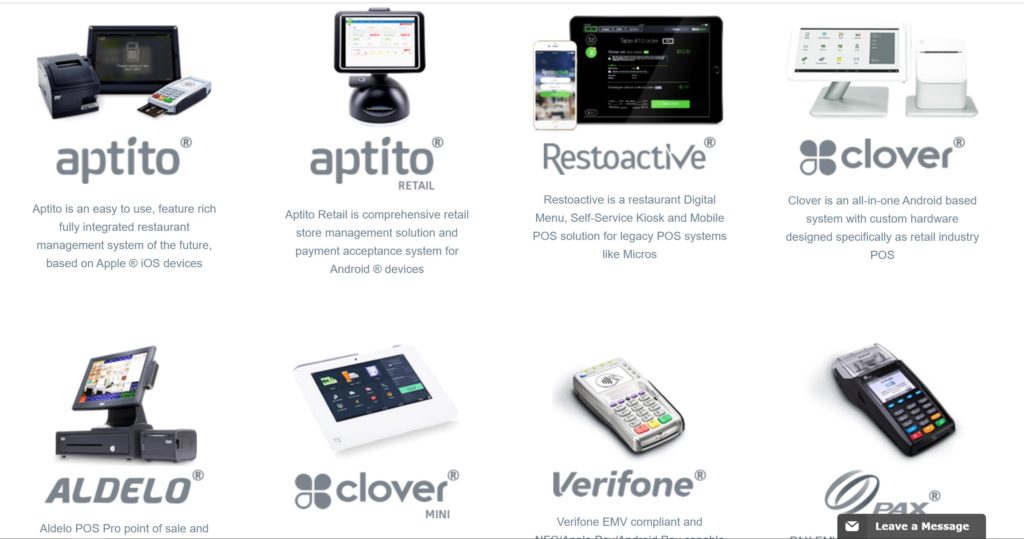

Unified Payments offers a large number of point-of-sale solutions, primarily focusing on their own proprietary Unified Payments mobile software. For this, they offer a mobile swiper to go along with their software, which is available for both Apple and Android. They also offer a variety of physical POS systems from Aptito, Restoactive, Clover, Aldelo, Verifone, PAX, and Poynt.

Oleg Firer Allegations

There appears to be some controversy over the business dealings of Oleg Firer, the CEO of Net Element. We previously found a website that was created by someone claiming to be a former business associate of Oleg Firer's, but which is no longer operational. The site previously claimed the following: that Oleg Firer acquired Unified Payments' custom POS solution, Aptito, but did not compensate its creator as agreed; that Oleg Firer has artificially manipulated Net Element's stock value through unfunded acquisitions; that Oleg Firer has previously been charged with grand theft in a private real estate deal; and that a Russia-based subsidiary of Net Element called TOT Money has some sort of connection to Russian organized crime. These accusations are severe in nature, and the accuser seems to have posted them on several websites in an attempt to increase their visibility. We do not know whether these allegations are true or false, but we have independently found the following details that may be relevant to these claims:

- There is evidence that Oleg Firer (here) and Vlad Sadovskiy (here) have faced litigation that accuses them or their companies of defaulting on agreed-upon payments

- There is evidence that at least some investors in Net Element are dissatisfied with Oleg Firer's leadership or feel that Oleg is a “scam artist”

- There is evidence that Oleg Firer agreed to purchase Aptito for 125,000 shares of Net Element stock

- There is evidence that Net Element has secured a court order prohibiting Gene Zell, the founder of Aptito, from posting any information about Oleg Firer on any website or contacting the company's business partners and investors

James Smith

Netevia Merchant Processor Is the Worst Merchant Processor they work with Luminous payments and United Payments they will freeze your funds and make your life hell for no reason they are a smaller processor do not use them they are a headache. There risk is worst than any other processor they will not listen to what you have to say no matter how many times I told them.

CHARLES SMITH

I was just contacted by a collection agency for $447.53 for Unified Payments for a processing terminal. I had agreed to change to Unified and then declined. The terminal had already been shipped. The rep told me that I would be contacted with instructions to return the terminal. I never was. The collection agency informed me that I can no longer return the terminal for credit.

Jon Carleton

I’m glad I found this. Thank you for a thorough write up.

Steve Banks

Horrible they said I owed 1000 on a machine I never received. They are crooks and thieves. Dont deal with them . Beware of them

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

Alexei Goncharov

More in depth information about the CEO:

This post will help: How to Report Bad Credit Card Processors

-Phillip

David Rodriguez

Great rates but terrible customer service, i switch bank account and in the proccess they ask me to provide info to submit and make the change, its been 2 weeks and my money is in hold, i give them extra info plus bank statement to proof that this account is real, today my account is overdraft over 1k cause there is traffic of payments to my vendors and unified payments have not fix or care to get this resolved, this morning i call for a manager, but they transfer me to a voicemail … im very upset with this situation and done with this company.