Overview

In this comprehensive article, we delve into the multifaceted world of ExecuTech Lease Group, a prominent player in the credit card equipment leasing industry. We'll explore the company's rates and fees, dissecting the financial nuances that businesses must consider before partnering with them. We will scrutinize the contract terms, providing insights into the implications and commitments involved in these agreements.

A critical aspect of our analysis will cover common complaints and industry ratings, offering a balanced view of the company's performance and reputation in the market. This includes a deep dive into user reviews and employee feedback, shedding light on the experiences of those who have interacted closely with ExecuTech Lease Group's services and corporate culture.

Security is paramount in the financial transaction sector, and we evaluate ExecuTech Lease Group's adherence to security standards, particularly their compliance with the Payment Card Industry Data Security Standards (PCI DSS) and the use of advanced encryption technologies.

In addition to these core topics, we also touch upon the company's leadership and location, providing context on its corporate background and operational headquarters. Our report will include insights into recent legal matters, such as the Visa & MasterCard lawsuit, and how it pertains to ExecuTech Lease Group and its clientele.

About Executech Lease Group

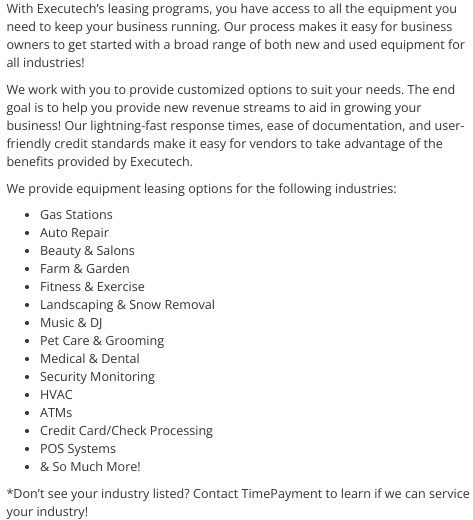

Founded in 2010, ExecuTech Lease Group is a credit card equipment leasing company that provides credit card terminals, check processing equipment, point-of-sale equipment, and ATMs. Like Northern Leasing Systems, Executech Lease Group does not process transactions or sell merchant accounts itself. Instead, sales agents will typically pair an Executech Lease Group equipment lease with a newly opened merchant account from a credit card processor.

ExecuTech Lease Group Products and Services

Mobile Payment Solutions

ExecuTech Lease Group provides mobile payment solutions, catering to the increasing demand for mobile payments. This service allows businesses to accept payments via mobile devices, making it a practical option for those with flexible or mobile operations.

E-commerce Payment Gateway

For online businesses, ExecuTech Lease Group offers an e-commerce payment gateway. This secure and reliable gateway integrates with existing online platforms, supporting multiple forms of payment.

Security Standards

ExecuTech Lease Group prioritizes transaction security, employing advanced encryption technologies to protect financial data. Their services comply with Payment Card Industry Data Security Standards (PCI DSS).

Sara Lee

We are caught in a terrible situation with Executech. We got railroaded by Retail Cloud into leasing six POS terminals for our carpet cleaning vans. By the time we realized that it was a trick, it was too late. Now we are stuck paying $450 a month for 4 years. By the end of the lease we will have paid $21,600 for the POS devices and we still will not own them. We should have never agreed to this. It is such a rip off. They should not be allowed to charge these exorbitant rates and the merchant has no way to get out of it.

John Fitzgerald

Sold their contracts to Northern Leasing which is under investigation and has many lawsuits for scamming family owned businesses on high priced contracts and make it impossible to cancel them. They are either a subsidiary or also involved with them.

John Fitzgerald

This company sells or had sold their contracts to Northern Leasing Company which has scammed and being shut down by the State of Attorney of New York.