In the late 2000s, as a broke college student struggling to make ends meet, I was contacted by a merchant services company after uploading my resume to a job listings website. This company promised substantial commissions and ongoing residual income for simply persuading businesses to accept credit card payments. It seemed straightforward enough—after all, what business doesn’t need to process credit card payments? Following a phone interview with a persuasive “sales director,” I found myself embarking on what I believed would be an easy job that would significantly boost my bank account with reliable monthly income and large sales commissions. However, the lessons I learned would profoundly change my life in ways I could never have imagined.

After completing my sales training, I hit the ground running, eager to make sales. This broke college student was determined to improve his financial situation! My first attempt at a cold call, with no prior appointment, ended with a burly man in his 50s yelling at me to leave, claiming he had been “totally robbed” by someone like me before. As I hastily exited, puzzled and intimidated by his reaction, I couldn’t help but wonder what he meant. Throughout the day, I encountered similar hostility from other business owners, all expressing disdain for the industry I had been so excited to join that morning. Confused and curious, I decided to shift my approach from selling to listening.

I quickly uncovered that the merchant services sector was riddled with unethical practices, including hidden fees, deceptive marketing, fine-print traps, and much more. It dawned on me that I had nearly been tricked by a dubious company into selling overpriced services under contracts with long-term commitments, all without being fully aware of what I was promoting. Outraged, I resigned from that company but learned that there were indeed ethical credit card processing companies that treated their clients fairly. Over the next four years, I worked for one such company, assisting hundreds of businesses in securing cost-effective processing solutions. Yet, I also met many more who had been misled and trapped in onerous service agreements. Determined to help people steer clear of these unscrupulous providers, I launched this website in my spare time, dedicating myself to researching and sharing my findings on every merchant account provider I could investigate.

Gradually, more and more business owners began to discover my articles. As word spread, search engines started to rank my content highly, amplifying its reach. My efforts were making a difference! Eventually, the website garnered enough traffic to enable me to leave my job and focus on it full-time, a journey that has now spanned over a decade. This path has not been without its challenges; unscrupulous company owners have tried to intimidate and sue me into silence on several occasions. Yet, I have stood firm against each threat. Here I am, continuing to publish reviews and articles, hoping to safeguard others from the pitfalls of the credit card processing industry.

If you believe in my mission and wish to contribute, please share my articles on your websites and social media. Thank you for visiting!

Kevin Enny

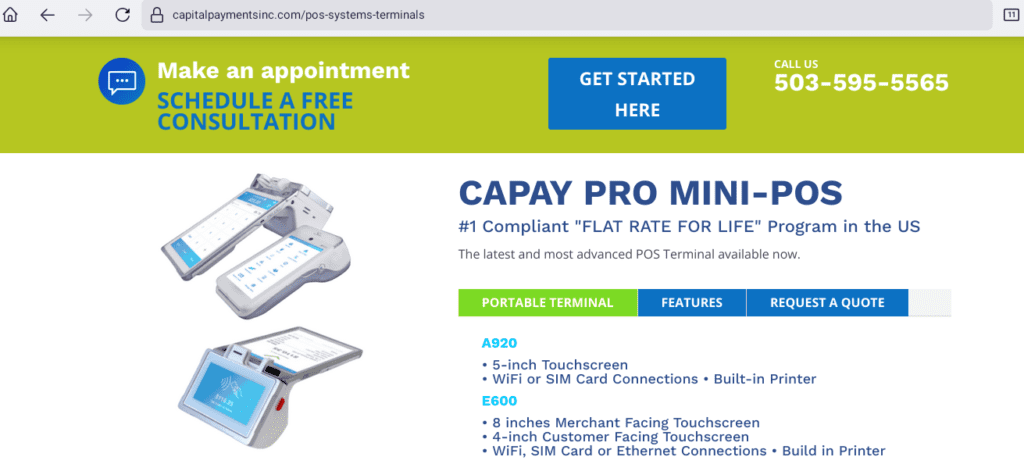

Capital Payments is not a reputable company. My small company was snookered into a 48 month lease for Clover equipment for an outrageous price. Then I was approached again late last year with a great offer. 3.28% Customer Credit card charge and $150 for life credit card processing fee. After asking about quite a few discrepancies with the contract they wanted me to sign, like debit card fees, and other fees I was assured those discrepancies did not pertain to me or I was reading it incorrectly. Once I signed the contract I was told too bad about the 3.28% customer credit card charge and it would be 3.5% and that was set by Clover and it was out of their hands. Guess what, I magically had another 48 month lease for Clover equipment that I am on the hook for. Do not do business with this company as they are cheats and get you into a lease you cannot get out of.