Overview

In this review of CardConnect, a subsidiary of First Data (now Fiserv), we will provide an in-depth look at its role in the credit card processing industry. We'll examine the company's rates and fees, contract terms, and customer feedback to offer insights for businesses considering their services.

Key topics include an overview of common complaints and how they reflect on CardConnect's customer service. We will also look at industry ratings and employee reviews to give a comprehensive perspective on the company's operations and ethics.

The effectiveness of CardConnect's main product, the CardPointe platform, as a payment processor and gateway is assessed, along with the company's security measures like tokenization and P2PE. We also explore legal challenges, including recent lawsuits, to understand the company's compliance and ethical standards.

We will evaluate CardConnect's customer support options and analyze its online ratings from various trusted sources. The article concludes with a balanced view of CardConnect's performance in the market, providing helpful information for businesses making decisions about their payment processing solutions.

About CardConnect

CardConnect, formerly known as Financial Transaction Services, is a rapidly growing merchant account provider that operates as an independent credit card processing subsidiary of First Data (now Fiserv). Founded in 2006 by CEO Brian P. Shanahan before changing its name and moving to Pennsylvania, Card Connect was acquired by First Data (Fiserv) in 2017 and is now the primary independent sales agent network used by First Data/Fiserv. The company has previously partnered with FTV Capital, Bank of America, and SecureNet Payment Systems to expand its merchant account products and services.

Jump Ahead:

CardConnect Products and Services

Payment Processing

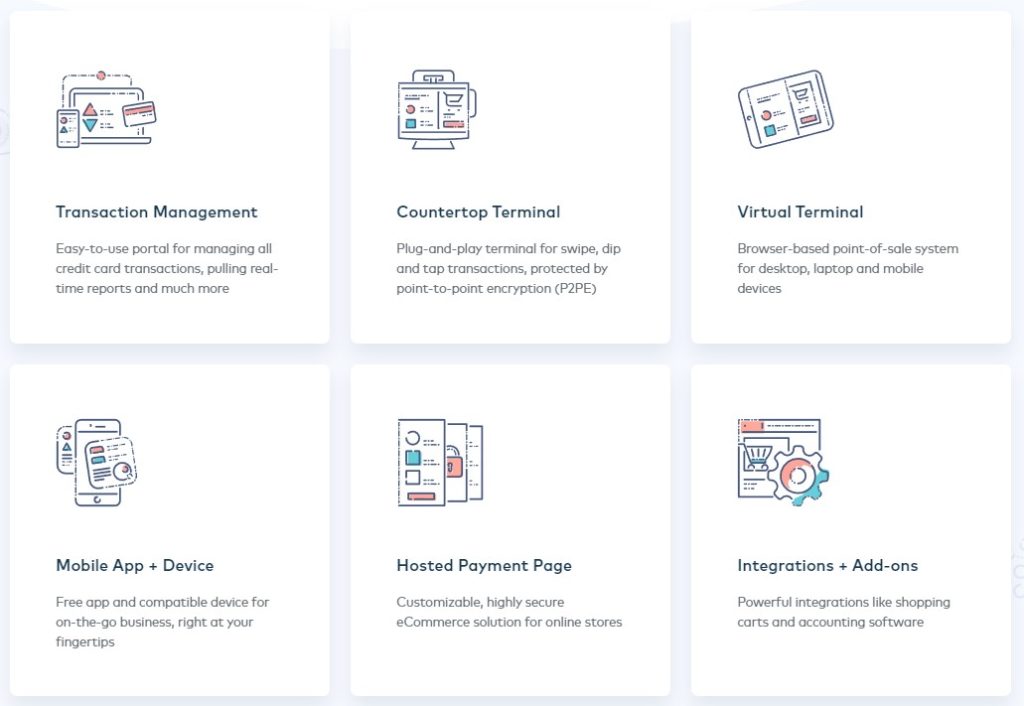

CardConnect, a subsidiary of Fiserv, provides payment processing services for major credit and debit cards, catering to various business types. The company offers the CardPointe virtual payment gateway, which integrates with a virtual terminal, a mobile credit card processing app, and a card reader named “CardPointe.” Additionally, CardConnect supplies Clover point-of-sale (POS) hardware and a software solution called “Bolt,” which allows merchants to integrate payment processing into their own software. The “CoPilot” tool helps ISOs track their portfolios and revenue. The company provides interchange-plus pricing and supports Level II and III data processing through its POS system and payment gateway.

CardPointe Platform

CardConnect's primary product is the CardPointe platform, designed to offer a comprehensive credit card processing solution and streamline transaction experiences.

Payment Processor and Gateway

CardPointe functions as both a payment processor and a payment gateway, featuring real-time reporting capabilities.

Point of Sale Systems

CardConnect provides POS systems to facilitate transactions at physical business locations.

Third-Party Business Integrations

The company supports a wide range of third-party business integrations, enhancing the functionality of their services.

Security Features

CardConnect uses patented tokenization and Point-to-Point Encryption (P2PE) to secure credit card transaction data. These security measures aim to reduce PCI compliance scope and associated fees.

Mark Savoia

Phone support never answers the phone

Kari

There is no customer service! Our device has not been working for weeks and we cannot run payments in person. I have submitted 2 different support tickets over the past 3 weeks and no response at all. I called was on hold for 45 min X 2 different occasions, no response. I called at 4:30 pm on 4/9/24, was on hold for 1 hour and 36 min before someone picked up and told me that they were the “after hours team” and could not help me, I should call back in normal business hours (which I did but was on hold so long). I was then told a third ticket was created and someone would call me the next day…..no response. I have been on hold so far today for over 2 hours, no one has picked up yet. I do not believe they have any technical support during normal business hours.

Michael Pesochinsky

Card Connect has been consistently debiting funds from my bank account since January 2022 without my authorization. Each month, they impose varying fees under the guise of being my designated Merchant Processor. They claim that my business engaged with their sales associate, Ignite Sales Group. However, I want to emphatically state that I never consented to any offer from them, nor did I enter into any form of agreement. Shockingly, they somehow gained access to my bank credentials and proceeded to siphon money from my account without providing any invoices or statements. The total extent of their unauthorized charges exceeds $1500.

Attempts to resolve this issue with Card Connect have proven futile. Their customer service system is designed to deflect accountability, with all calls being rerouted to India. After enduring hours of fruitless conversation, no satisfactory resolution is reached.

It is abundantly clear that Card Connect and its associates are engaged in fraudulent practices and must be subject to a thorough investigation. I have no doubt that numerous small businesses have fallen victim to similar deceptive tactics, resulting in significant financial losses. I urge others to steer clear of Card Connect and to promptly report any instances of fraud perpetrated by them.

Tara B

I have been dealing with card pointe for about a month now. We discovered that they have been taking money out of my account even though we don’t use their merchant service.

A few years ago I spoke to them with interest in switching my card services. We started to go through the process but quickly realized this wasn’t a fit. I didn’t proceed with this company.

A couple months later I received a PCI compliance notice and called this company to make sure I wasn’t being charged and my account wasn’t live. I was assured that my account wasn’t activated. This was in sometime in 2021

We never received any equipment and we said no to service.

Flash forward to October 2023, my accountant noticed that this company has been pulling money out of my account every month. The same amount 2x per month. This has been going on for a long time. Thousands of dollars has been siphoned out of my business account over time. It wasn’t noticed because it was labeled with a generic merchant services and it took some doing to figure out who this was.

I contacted the company a bunch of times, always on a Monday and asked for my money back and to cancel the accounts. I was promised call backs from supervisors and a quick resolve. None of this happened. I spoke to different employees who gave me the run around, from saying that it was cancelled and refund on way to saying they can’t cancel it because I have to do it in writing, which I copied you on but now I can’t get confirmation that it was actually done. My phone calls go unanswered or disconnect while on hold.

The last time I spoke to someone about the refund (right before the holidays) they said no because they had an application and that’s all they needed to open the account and charge me. I used the logic that if I had someone apply to my company It doesn’t mean they are hired because I have an application. I asked to talk to a supervisor or manager but this company seems to run without any. When I applied I thought it was in 2020 but they said 2021…and even though I never accepted the terms they can basically do what they want.

Pet in the City used Cayan (Tsys) and went to Lightspeed over a year ago. This company never has been involved in my business. I’ve been open from 6/18 until now.

I would like to press charges and I want my money back that they stole with interest I still do not know if I’m cancelled. I’ve sent that email 2x. I was told this is the only way to cancel. No response and no one returns calls. Now when they pick up I get disconnected right from the beginning.

Cardpointe or card connect is the company. Trustpiliot has real reviews peppered with fake 5 stars – as no one but someone from the company talks that way.

Ivan Kaplan

On several occasions now CardPointe has not funded despite having collected my receipts. It usually happens with Thursday receipts so I do not have access to these funds to cover Friday payroll. They never apologize and they never provide any kind of credit for my loss of access to my funds. This is not acceptable.

James L Penn

We have been struggling for two years trying to get our money back !!! They are withholding over $4000. They withheld taxes at 24% for three months before I noticed it. Once I noticed it, I tried to correct without success and stopped using the Card point system so that they could stop taking more of my money.

Customer support is horrible!!!! They will re-route you to different departments but tell you that they can’t find your account number that they list on a 1099-k.

please help,

Jim

JG

Unscrupulous and deceptive company that as noted has been sued for their actions in the past. Refuse to escalate complaints to a supervisory level. Took nearly 3 months to process a cancellation request. Considering small claims court to recover losses or hope another class action lawsuit is filed against them.

Took advantage of a non profit youth sports organization. Shame on them.

Duabe

Absolute worst merchant service I’ve ever used.

This company is a bunch of crooks. They charge me an exorbitantly high non-compliant fee. And many other fees that are unnecessary or even your contract. I would steer away from this merchant there is many others that are much better out there. Customer service is the absolute worst and they just talk in circles and try to get you off the phone. Tried to get a copy of my contract from them they made me jump through so many hoops and still never provided the contract they have withheld till this day.

Jason King

Warning Card Connect rates jumped for no reason!!

They did not tell their customers.

The new rate comes out to 3.4% to 6%

Check your statements, you are likely paying way more than you think!

Terri Cavoli

Worst company ever. My customer paid on a duplicate charge situation they NEVER Gave me the Money. Now they will not give her the money back or give to me so I can give to her. I closed the account and now they won’t talk to me at all to resolve this

Matthew Cashion

I warn against card connect services. We realized immediately that card connect would not work with our website and inventory but we were still chared the $184 setup with no refund and the account was not cancelled on their behalf and we were charged the monthly $69.95 maintenance fee and could not get a refund for any amount.

Shannon

Did you find a way to make them stop charging you monthly fees? We haven’t had their equipment in years and they won’t stop charging us. I’m about to have to shut down our bank account to make it stop. I’ve called, emailed, threatened.

Russ

Working with card connect is an absolute nightmare.

Stephen Schmitz

They sold me their services and a new Clover POS for $1500.00

Seven months later they called me on a Thursday afternoon to let me know that I’m being shut off the next day. They said CBD sales was a restricked item. CBD is legal and on national television we see top PGA pros talking about it. My business is my life line, and big companies shouldn’t have the ability to smack a small down like mine without warning. This company owns First Data which is the same company I’ve had my merchants services with since 2014.

Now I have a proprietary Clover system that only works with Card Connect and they won’t give me a refund, and they are unwilling to unlock the Clover system, which would allow me to continue using the POS that I paid cash for last year. I’ve done a few million in business with First Data over the years, I wonder if this letter will get me a little love.

Annette

Poor customer service. Unannounced fees added to statements and automatically withdrawn from my account. Customer service agents not helpful. Merchant relationship manager stopped responding. Supervisor took weeks to contact me after I made multiple calls and sent multiple emails to the company to discuss deceptive ‘security bundle fee’. I will be looking for another credit card processing company.

Holly

When I tried to sign up with my correct address, the site told me that it was an ‘invalid street address’ and wouldn’t let me proceed. Looks like I dodged a bullet from reading the comments. went there because I received a card advertising the product from a convention. When I asked for information from the desk the two representative seemed more interested in talking to one another about trivial matters than engaging a potential customer and basically gave me the card and sent me on my way. That should have been a tip off as to how the prioritize their customers as well. On to search for another supplier of the service.

Tammy Cortright

This is by far the worst Merchant service, I cannot believe they have not been charged with any criminal violations. (YET) They just take money out of your acct. whenever they feel like it & have ZERO customer service skills. I was charged for a “security bundle” When I called they put me on hold for 65 minutes & then hung up it was so on purpose!Then I talked to my Rep. & she said this is what they do? really??? Read the BBB it’s pages long! They are criminals!!!

Judy

I used this company for years and then they charge me 125.00 compliance fee. I was not told about this fee and I did not authorzie the fee. I was then refunded the charge and the follow month they charged a 119.95 compliance fee which I was not told and did not authorzie. Then again 2 months later they charged me 119.00 membership fees which I was not told about and did not authorize. I would not recommend this company. I am wondering if a class action lawsuit may be in the future for cardpointe

Michael Chau

DO NOT go with this payment processing for your business. Customer refund over 3weeks. Held $4500 and would not release it. They require documents like you’re buying a home to receive your money. The point here is, it your money, it got approved. What the problem? Them. They are terrible company. This is what cause people to do mass shooting. Companies like this. .

Elon

FRAUD! FRAUD! FRAUD!

These guys held $30,000.00 for almost a month! They said it was due to risk mitigation……We submitted all the requested documentation. 2 months later they did the exact same thing…..This time $28,000.00 has come out of my customer’s account, they are saying its on hold right now for risk mitigation….After a week of countless emails, chats, & phone calls where very rude people answer we have gotten nowhere and still do not have our money. Avoid frustration and go somewhere else!!!!

See below>>> The Risk Monitoring Team has identified a change in your current processing volume. We will need additional information to validate this activity and ensure there are no concerns. Please respond and provide the requested responses and documentation as outlined below.

Responses Needed- Please answer all questions in full to avoid a delay in the review

1. What is the reason for the increase/decrease in volume or large sale? This is normal volume for us. We are a commercial construction supplier, credit cards are only used when they need something ASAP, so we might have nothing for a month and then a huge payment comes in the next month or so

2. Is this an isolated situation or will your business continue to process at these volumes? This is normal, just not every month

3. Do you plan on processing more sales with this customer? Absolutely, they are our best customer. The money has posted on their account and they are absolutely ticked you guys are sitting on the money.

a. If yes, how much more do you expect to process and how frequent can we expect the sales to be processed? Our average is 3-5 transactions per month varying from a few hundred dollars up to $50,000.00

4. What monthly volume do you expect to process moving forward? $100,000.00 per month tops. If this is so complicated please put our monthly limit at $200,000.00

5. What product or service do you provide? Manufacturing, delivery & install of concrete Parking Curbs.

6. What’s the estimated delivery/completion timeframe for your products/services? Completed & ready to ship 6-20-22

a. If the product needs to be delivered, who handles the delivery? We do in house

7. If this increase or transaction is due to an order placed, are you in possession of the product? We have it in our warehouse ready to ship as soon as your the CardConnect BS goes away.

a. If you do not have the product, when do you expect to have the product in your possession? In our warehouse right now

8. When do you accept the payment from your customers? Upon completion and customer satisfaction

a. If deposits are accepted, what percent do you require up front? 5%

b. How far in advance do you take these payments? 1 week before delivery

9. If you have a supplier(s) for products or to complete the service, who are your suppliers? We manufacture everything.

a. Where are they located? N/A

b. How long have they been a supplier for the business? N/A

10. Do you have a website or retail location? Website for information only, no E-Commerce

a. If you are using a website:

i. What is your website address? [redacted]

ii. Do you have a shopping cart? No

b. If you do not use a website or retail location, how do you advertise for your business and take payments? Mostly repeat customers, We only take credit card payments over the phone.

lf

We used Cardconnect for a few months. Charged a fee for security for a year. Next month nothing would go through. Terrible company. Called so many times and nothing got done. Terrible service. Avoid.

Charles Jandrow

I am processing on this company for first few days they released funds then all of sudden they put all of our money on hold and saying their risk team is reviewing. this company is a scam dont process with that company

brook shuffs

Once upon a time we were happy with this company. They updated their captcha security and now none of our clients can make payment with a mobile device or when using autofill and they just get an error code. They will not do anything to correct this issue. In this day and age everyone used mobile devices. Their customer support on this issue is horrible.

Adair Hasty-Vannoy

Absolutely atrocious customer service!!!! Now looking for a better option to process customer payments. We changed our banking account information in May 2020 and provided card connect with all of the relevant legal documentation. They failed to process it! More than a year later they are holding nearly $25K of our money. Did they call, email, text, send a letter, etc., to advise us that they were holding our money? ABSOLUTELY NOT!!!! Today when I reached out to them to ask about our money, there are no managers or supervisors available, the person assigned to my ticket, can’t be reached by phone (they reportedly don’t speak with the public), and they continued to deny that they had received all necessary documentation (albeit one can look and see that we sent them the info and it was received in their system). If I had not completed a financial review today, they still would be holding onto our money. Asked for this to be processed ASAP…their response, “well we can’t promise that it will be completed today…maybe by next Tuesday you should have your money.” ~ Never again!

Kelly

We had the same thing happen to us after switching our bank account. Finally received our money but it’s still not the full amount they owe us. So frustrating.

Kathy Marcey

I have the same issue we returned all of the equipment prior to ever using it, we were never told a cancellation form needed to be completed. After doing a accounting review I found that they were charging us for over a year for services that we NEVER used! I have contacted them several times received the same response as you NO manager or supervisor can speak to you they will call you back which NEVER happen!! I asked for contact information so that I could speak to someone who could help in refunding our money and was given this email address [email protected] which was just returned as a no deliverable address. If anyone who has had this issue and can please advise how I should go about getting my money back.

Catherine

Kathy Marcey We canceled our processing with CardConnect in January 2022. We are out of business. CardConnect keeps taking out Fees every month since then. Can’t get any help. Mail, Fax and telephone company but NO help. Has anyone had this problem besides Kathy? I suggest contacting the Better Business as I plan to do. Best of luck in any advent.

Jason Lee Followell

Simply terrible costumer service. I have tried since March to remove my mangers name from the company with little results. I have also asked since May to get a monthly report from the company only to be put on hold and rerouted numerous times. I have yet to see a monthly report that shows both ACH and Credit deposits and it is almost September.

Catherine

Kathy Marcey We canceled our processing with CardConnect in January 2022. We are out of business. CardConnect keeps taking out Fees every month since then. Can’t get any help. Mail, Fax and telephone company but NO help. Has anyone had this problem besides Kathy? I suggest contacting the Better Business as I plan to do. Best of luck in any advent.

Martin Otto

Go somewhere else. Go to other processors. Anywhere else. They flag your account after just a few transactions for “risk assessment monitoring”….and then you are shut down for several days while they require you to provide them with unnecessary data…delivery tickets, bank statements, etc… This company is bad for business. 0 stars. If I had more time I would write a more detailed review. Terrible company. I hope this review is visible and a warning to other companies. In process of changing back to more reputable processors.

Renee Padget

They sent me the wrong equipment I canceled right away didn’t feel comfortable with the company anymore seem to be too many lies told Send several emails they only get a once they want they claim they can’t get the cancel request but yet they’re all others sent to the same email and the person I talked to before confirmed that they had received it and they came up with excuses the cancelation department Way too many lies I put a stop payment on it spent 3 months of h*** since I talked to the personI requested to be canceled the supervisor said I was canceled I said I want to release refuse to give me a release Horrible Company and I’ve never even done business with them yet or ever will

Katie Allen

Hello,

We came across your review of Card Connect on their website. We are a small business located in Gulfport, Mississippi and recently upgraded our equipment and that’s where the nightmare began! We have been given the run around, no help, no one returns calls, system down for 2 weeks, and still no support or answers! We have to do something fast as we are losing money daily without our system up and running!

Are you still in a contract with them?

Can you give us any information or help of what steps to take?

Thank you so much!

Katie Allen

Nella Home Interiors & Gifts

Npl

I am very very dissapointed that card connect company is treating us like a trash i agree 100% we have been working with Eft pos for years they never give us such a terrible treatment that we getting from this company .They are really Bad and they don’t care about their customers at all

i will not advice anyone to bring his or her business to card connect they are really Bad .

SHAINA PRITCHARD

Aleksandra Karczmiarz “Merchant Relationship Manager” treated me like complete trash. It took me months to figure out why I was getting a charge for “merchant bank cd deposit”. After hunting down Cardconnect as the culperate I was bounced around from person to person telling me they could cancel my account and refund my charges.

This is where the wonderful “merchant relations manager” steps in and even after telling her I opened my salon November 2019 and was forced to close March 2020. Her repeated answer to me was well I can only refund your charges if you reopen/keep a connection with us. Cardconnect does not care. My salon is no longer open due to Covid as if that doesn’t hurt enough already.

She couldn’t rush me off the phone fast enough and I just felt at a loss.

The reasoning for my charges are supposedly for not setting up my account security questions….. really? IPC CIP or something idk?

SHAINA PRITCHARD

My charges randomly started November 2020 and are still being charged currently each month….

Sarah Whitehead

We use Square, and they are working great with us.

Our problem is that we canceled our service in March 2021 (again). It was confirmed . Then apparently it was re-opened again mysteriously in April 2021. Then charges were again being debited from our bank account. I noticed this in Jan, 2022 and called them. I am told I need to cancel (yet again!) and need all charges refunded. I was told the request would go to management & all would be refunded. Whenever I call back, it goes straight to voicemail. Based on other’s comments, this could be a battle. This is complete FRAUD. If they do this to our company, I am sure there are many others that are being charged without their consent nor knowledge. How is this company still operating??

Tia

I have the exact same story too. I had to stop working in the salon and attempted to cancel the account only to find out months later they still charged me. When I called they denied ever receiving a notification from me and two weeks later I’m still trying to close the account and still being charged. They have taken almost all my money and I have no choice but to cancel my bank account and transfer my funds so they don’t keep taking it from me. I have a confirmation of cancellation yet still got charged.

Vince

They stink card connect took inappropriate fees over for a looping problem that was on their side of the gateway. I’m in the process of pursuing legally . I would not recommend card connect / card pointe to anyone .

Alexis

I wish I would have seen this blog before my scheduling app recommended this company. They are bad business and I’m filing a complaint. Can’t speak to anyone in customer service that I can understand. Ticket after ticket to finally be told they basically don’t care and won’t make it right because i’m not swiping enough money for them during covid. They cancelled my account without notice and caused multiple NSF fees.

Jon

Terrible service. I requested a cancel of our account in writing and they proceeded to not cancel and then charge us over $100 in fees. I requested that they refund them and they agreed, then proceeded to not follow through, not call or email back, and basically stonewall me. I’ve probably tried calling 20+ times over the past few months and I can’t even get our rep to answer or call back anymore. Avoid at all costs.

Michael

Horrible horrible company. You are not a cared for customer just an account for their access to charge frivolous fees. This is the worst type of company you can think of. Do not fall into this web.

Farshad Zahiri

I started using their service through an agent (Mr. Hatim Alem) working for them. The agent stated there is no contract, no equipment fee and best rates (2.32%) in town and since there is no contract, I can stop working with them without any question or penalty.

Right away I noticed that the charges are much higher than that initial agreement and many times I complained and my agent had to call me back and explain why there are almost 10% charges!

After more than 3 years I thought I need to get out and find another company so, I called my agent and said and texted him (for record) that I no longer require his service.

After 5 weeks of not working with this company I noticed that there are almost $105 charges made to my account. I called my agent and questioned him about the charges made to my account after I cancelled the service and he answered that he no longer work with them! I asked him why he didn’t cancel or at least tell me to call them and cancel it myself. He said I couldn’t do that because the company might sue him that he contacted me after he stopped working with them.

Anyway I got the proper way of cancelling my account and send the company an official cancellation note. Next month again they hit my account with new charges. I call them and after 45 minutes I was able to talk to a representative in a foreign country (India?!) and he was not any help at all and instead of answering my questions he wanted to over and over again give him more information to make sure I am the legitimate person involved.

Now I am working with another processing company which charging 2.6% flat and emailing me right away how much is deposited to my account and how much they charged me.

Carpointe is a scam and I highly recommend to avoid it.

Irina

Would you be able to share what company you are using right now? I am looking for a new provider too.

Phillip CPO

Hi Irina, you can find the processors that have passed our strict standards here: Best Merchant Accounts

Vincent Pan

Horrible Horrible company, close our account, holding $24000 and release funding after 137 days, they stole $8000 from us and never can reach anyone. We will have some legal actions on cardconection.

John Krowiak

Scam: Card Connect/First Data charged me for nearly three years for an account that was closed in December of 2016. I was unable to reach anybody who could authorize a refund and cannot locate their legal department to speak with anyone there. I would warn anyone who is considering Card Connect or First Data to keep away. Their customer service is horrible and they stole over $3000 from me. You can’t reach anyone and they will not work with you to make things right. In addition, I was charged an addition $15 per month for Cardservice Intl. who cannot be reached at all. The number on their website circles back to Card Connect who claims to know nothing about them. It is impossible to stop the ACH payments from the bank account and there is nobody to correct the situation. Terrible operation for a budding small business. Go elsewhere this is a scam!

Amy Langdon

I spoke with 3 different people at CardConnect today and received three VERY different stories regarding my account. I finally spoke with a supervisor, Sean, who initially refused to put anything in writing (big red flag for me!). After 5 hours of dealing with them and then the IRS the issues hopefully has been cleared up. But according to the IRS it was CardConnect improper research that caused the issue. Unfortunately, I can not change providers as they are tied to another vendor I use. Otherwise today would have been CardConnect’s last day with me.

Ken & Chris Williams

errible. Cancelled and went back to my former processor after 2 months. Moved to CardConnect/CardPointe because new reservation system for my B&B had an automated interface with them. Save money? Not at all. Setup poorly managed. Sent wrong card reader, at a nonrefundable cost of $170 and never set me up for Amex like I had for 13 years with my previous processor. Expected better reliability and quality control but did not receive it. Look somewhere else for a processor.

This post will help: Top-Rated Merchant Accounts

-Phillip

Kyle

Terrible service they accuired Bluepay, which was awful. I had 2 merchant accounts, I send a certified letter over 3 years ago and have not used the account since but get charged monthly there their monthly service fee and pci compliance scan failed test penalty of $39.99 per month even though I don’t need pci compliance usimg PayPal as my merchant service. I did a DocuSign form from cardconnect to cancel both accounts they have failed to close them and still charging me monthly

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

Farhan Q

They are scammers. The representative named Mandy Hendrickson is definitely scam. Avoid the company as a whole. I was looking for merchant services in 11/2018 and signed up with this company. In negotiations I made sure that I will not be charged the Early termination fee and representative agreed to it and confirmed in email. They left the space of ETF in actual contract blank and when I questioned, she stated that she has made it $0 and that is why it doesn’t show anything in that space. Fair enough, 7-9 months later, customers don’t want to switch payments from PayPal to a different company. So I have no option but to cancel the plan which I emailed her to cancel without ETF as we agreed. She processed the cancellation, next statement I received the charge of $750 Early Cancellation fee. I called Mandy Hendrickson out of panic, I didn’t realize initially that she was in West Coast, so I called an early hour, as soon as I realized I hung up and called after 9 am PST. I called her twice and left her a voice message to please return the call.

I texted her the details of being charged the ETF. She texted me that it was unprofessional me calling her 3 times, to an extent I agree but on the other hand she gave me the number herself and stated I could reach her there. Anyways she had a family loss and stated I reach out to her colleague Phillip Larson. She became nasty on my texts while i kept it professional, she even got to the point where she was almost cursing at me while I still kept my calm. After an hour of everything she actually texted she was not going to help me at all as I was not her customer anymore.

This is what ticked me off but I still gave her benefit of the doubt that she was stressed out due to the loss of her family member. I contacted Phillip Larson, he stated to forward the emails and texts from Mandy confirming the no ETF. I sent him and he promised to get back in 3 days. It has been 7 days now and still no response from him. No response to my emails or calls. I called the cancellation department and they asked to forward the email to their cancellation inbox email and they will process refund based on that.

The tricky part is that the contract space being left blank per their terms means that the general policy of theirs will apply which had ETF of $750 which I never agreed to and was not provided.

NOTE: If you signup with this company, ensure you do see $0.00 Early Cancellation Fee, no field should be left blank. They even increased some price while I was offered 5 years price guaranteed.

By the way I worked for a bank when I got the service, I told her that my merchant services was unable to give pricing compared to what CardConnect gave but my rep was giving no contract and ETF and that is why Mandy agreed to it.

It has been almost over a week I have notified Card Connect. Hopefully they refund me the charge and I will update my review based on the facts, if not I will certainly dispute it through my bank or go to small claims court.

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

Thom K

They pulled the same crap on me I signed a 12 mo contract then was told it was a 48 mouth contact when I tried contacting Jack Moles he had a family emergency and would not be able to get back to me. I sent emails and got nowhere it’s a scam company and needs to be shut down on the good side the FBI has Peter Moles on a watch list as part of card connect so if everyone sends letters to the FBI naming key person’s who scammed them they might finally do something about it

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

Heidi D

I have tried multiple times to get a hold of my representative Ryan McKenzie with absolutely NO SUCCESS! He was to transfer our customers from one merchant service to card connect (card pointe) and that was over two months ago. Called the customer service number and got transferred several times before I was told by Samantha that a supervisor would call me back. I am still waiting! I feel like I have put my customers in complete jeopardy by trusting Card Pointe! Absolutely beyond irritated. Do No Use!

This post will help: Best Merchant Accounts for Great Customer Service

-Phillip

SHON

This company is very bad for small company!!

All different charges add up to more than 5% of your total processing!!! but first, they will promise you that they gonna have less than 3%.

This post will help: Find and Eliminate Hidden Fees in Your Monthly Bill

-Phillip

Kristin

We have never done business with CardConnect, and never signed a contract. We never even heard of them until they started taking money from our account. When we put a stop on the direct withdrawal through our bank, they tried to take us to collections. When we try to call we get a customer service rep who says management is too busy to talk. We think our old processing company (who we finished our contract with and returned gear to) sold our information to CardConnect. They are stealing from us and should be put out of business. We will be filing a complaint with the BBB and contacting our lawyer. DO NOT USE THIS COMPANY!!!

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

Tamme

I have been waiting over a month to simply process a bank change form w/card connect. Absolutely ridiculous at the amount of wrong information i have received, creating this extremely long and unnecessary delay. When voicing my frustration over the phone for the 4th time, I’m still not getting any apology or even empathy. When they told the office mngr that they needed HER information to process the change, a month ago, she specifically asked, why don’t you need the owner’s information. Now a month later, they are saying that they need the owner’s information. Now we’ll wait another few weeks for what should’ve been a 24 hr turn around. so disappointing in their processes, procedures, and customer service.

This post will help: Best Merchant Accounts for Great Customer Service

-Phillip

CS

CardConnect will charge hidden fees (charged me $53/month in hidden fees) I had to call and cancel my account several times because they would tell me it was cancelled and then the following month just charge my credit card another $53 (even though I never once used the service.) I finally got them to cancel my account… and a month later I recieved a collection notice demanding I pay a $30 cancellation fee! Never use CardConnect… they will lie to you and rip you off!

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

Tonika Outerbridge

Stay away from card connect. They treat small businesses like criminals but really they are crooks. I changed to a new bank and they don’t want switch my account so they’ve holding my funds for over 3 weeks now. They’ve been dismissive about the whole issue. shame on them.

This post will help: How to Make Your Payment Processor Release Your Money

-Phillip

Ed Burris

As a W2 Senior Advisor for CardConnect, I sympathize with all the folks that have been hosed by the 1099 salespeople mentioned. 1099 in our industry means no regulation on salespeople. This is why the W2 (ACE’s) were created. W2 means regulated and held accountable.

For CPO; why don’t you require validation from those who complain about the companies on your site? I agree with accountability but it should be for all, don’t you think?

I have been employed by a couple Credit Card Processor sales teams. CardConnects platform out performs all I have been a part. Now it is down to the sales representative, correct? All these complaints are directed at CardConnect but end up being caused by 1099 sales representatives. There are fantastic 1099 salespeople out there but are very few and far between. If I were a merchant searching for a good fit I would research credit card processors with W2 Salespeople, has PCI-Validated Encryption and find out the secondary features and benefits to see if they can create the best outcome for my business. Then, start discussing price. If you are searching for a merchant service provider based on price, you probably will get much less than you wanted. If you’re asking about rates first, you are setting yourself up for disappointment. If the merchant service provider starts out with price you will probably be disappointed. Go with a W2 salesperson and you will have layers of sales support even if the salesperson fails. It usually goes in some form like this; salesperson, manager, VP of Region, SVP of sales. 1099 goes something like; you get a 1099 salespeople and you are done. Thanks for letting me rant and I truly hope I helped business owners with this.

Thank you Phillip for this platform. The goal is always truth and helping others in truth, right? Thanks!

This post will help: Our Testimonial Policy

-Phillip

Darren Watzman

Hello Mr Burris

I strongly disagree with your review on W2 vs 1099 sakes agents. To say a merchant gets better service using W2 is about the grossest lie I’ve ever heard coming from a person who answers to a credit card processor vs a 1099 who answers to the merchant. Just look at Heartland Payments to validate this lie. 1099 are entrepreneurs taking the risk of there own pocketbook to build a business without any corporate support or shareholders to report to. 1099s report to merchants. They don’t have quotas or sales managers beating them up to produce. Sure you gave bad agents as this industry is not licensed like insurance or mortgage agents. The bad agents don’t last and I blame the card processing companies. The same people you are employed by that allows this to occur. 1099s bring more value as the have more autonomy and descretion to service there clients. W2 can only offer what there companies allow them too. Talk about support? Tell me one company that will drive out to a merchant location on a Saturday night when a machine fails? You got to be kidding if you think a W2 can outperform a successful 1099 on support. 1099s set the price and if they want to survive they better be competitive or they won’t survive. Your thesis makes absolutely no sense as you never took the risk starting and growing a business. You need to work for Heartland and offer just a machine and rate, Thats what I call a successful W2 employer

Ed Burris

Darren, you are correct! I apologize for my statements, they were uncalled for. I reacted on emotion rather than facts, I am totally wrong. The 1099’s built CardConnect and there are bad apples in every bunch. I applaud your passion and envy the 1099’s that get it done. Understand that no one at CardConnect holds my ill-stated opinions. All 1099’s that get it done, I respect you all and wish you great successes. You are connected to a good processor. I owned a business for 11 years and would like to own one again. My career started as a 1099 for a local ISO, it was great. And you are correct, when the banks and employees went home, I was traveling 2 hours on Friday night or a Saturday morning, I miss it. If you would like a conversation, look me up on LinkedIn, Thanks!

HUI JUN Li

Fraud Company, said no fee at the very start and comes with a buttload of fees and extra charges and charged $800 later for cancelation fee like wat?

This post will help: Cancelling a Merchant Account Contract Without Paying a Fee

– Phillip

Holly Weyhrauch

Stay Away!!

When we first started with this company many years ago everything was upfront and very clear. Then things started changing. Our monthly statements stopped being generated. Our fees being paid for processing started going very high. Started at 4% up until this year when they became upwards of 11% we through in the towel. Even after being PCI compliant and shaving just about every service we were still paying close to $100 monthly , plus the annual fee and, and, and……They even went as far as pulling a monthly service fee from our bank account the month after our contract was terminated. I tried working with the “cancellation team” to clear this matter up. All they did was regurgitate the obvious and do nothing. Do yourself a favor….Stay very far away from this company. Huge fees, poor at best customer services for the merchants.

This post will help: Best Merchant Accounts for Dental Offices

– Phillip

Mark Hasty

I would stay away from them. Card Connect has more fees than you can imagine along with an annual renewal fee for virtually nothing that cant be had for free at other companies. Their rates are not any better than other places without all the charges. Pay close attention to anything you receive from them because it generally means a new fee has either been increased or added to your original agreement.

From The Editor

This Post Might Help: Find and Eliminate Hidden Fees in Your Monthly Statement

Lucy I Aspinwall

I caught this company in the act of Forgery from February of 2018. It was lies from the beginning and I would never recommend working with them.

From The Editor

This Post Might Help: How to Report Bad Credit Card Processors

Kim

My advise – AVOID THIS COMPANY

Appears CardConnect needs additional revenue. What kind of company will put in fine print on a Nov 2018 statement that you will be charged a $199 Annual Membership Fee (in all the years we’ve done business with them we have NEVER paid a “membership fee”). I was told that it is to support the platform?! and it was for services provided in Jan-Dec 2018. Does not seem ethical to me that at the end of the year they impose a fee for you doing business with them in the prior 12 months. Wish I could blind side my customers with “hey, thanks for doing business with us in the prior 12 months, as a gift we are charging you $199”

Maybe their customer service will improve with the additional funds they raised this way, but we’ll never know as this is the last straw for us with this company.

From The Editor

This Post Might Help: Best Merchant Accounts for Great Customer Service

Anna

Samething happened to me Kim! I called and was transfered to several people, all to get a rude associate stating he was the “Supervisor” over the whole department and was hung up on after asking that very question you asked. Why are you charging retro? I have been a customer since 2012 and never been charged an annual fee! My annual fee I was charged was $288! Talk about a totally being blindsided! I canceled as well and currently on hold with my bank to dispute the charge! Warning stay away from this company!!

From The Editor

This Post Might Help: Best Merchant Accounts for Great Customer Service

Victoria M Dunn

DO NOT USE THIS COMPANY- READ THIS FIRST. When I was first introduced to this company I had a gut feeling and I ignored it. Though I did not feel as though my business had reached a point of volume that required this, the salesman called and emailed me anywhere from 5-13 times a day for three weeks. I repeatedly said I was not interested or that I was weighing my options. After weeks of pressure, I reluctantly agreed to utilize the services.

I was never told that it was a three year contract. When I left the business I was leasing from, I canceled all services associated, believing that they were all connected to the spa. When I called Merchant Services to cancel, they did not tell me I was in a contract or that there was a $750 cancellation fee or that I did not need to cancel as I could use their service independently. After taking the $750 from my account they agreed to refund the money and reactivate my account. I have emails that state this. MANY, MANY emails that all contradict each other. The original emails state I would be refunded in 30 days. Follow up emails state I had to receive 30% of what I was originally collecting: still no refund. Then I was told I had to collect my original volume (which varied greatly! $30 – $200). In the mean time, I did not receive any refund, yet they continued to take money from my account monthly, in total another $295.

The customer service is dishonest, I have emails to prove it. They take money from your account without permission. Please search my google review – it will have copies of all of the emails for the last year. You will see the deceit, redirect and awful ways they treat you. I have filed a complaint with the Better Business Bureau and joined a class action law suit. DO NOT USE THIS COMPANY!

From The Editor

This Post Might Help: Best Spa Merchant Accounts

Dina

IN reply to Victoria Dunn’s comment. How can we find the class action lawsuit. I’m in a similar situation to yours.

Don Murray

I signed up as a new merchant with Card Connect under some very specific criteria. Our little dog grooming business needed lower rates and better equipment. I asked for a full color screen on our card machine. (which is what pictures on their website show) The machine we got, the “IFC250” NEVER had color and always said “BOLTED”? I spent multiple phone calls and multiple hours on hold with tech support to try to get a resolution but none arrived. I additionally asked that our new credit card machine have the ability to offer our customers “pre-set tip amounts” like 15%, 20% 25% or custom amounts because that feature increases the money for our staff. That critical feature was never installed either and I was told by tech support that they did not know how to do it. They actually told me to “GOOGLE IT” … After weeks of phone calls, lower tips, network issues and what essentially amounted to ZERO customer support I decided to cancel. I requested to return my non-functioning machine but they declined me. I was told that any return needed to happen within 30 days and I was at 36 days. I noted the multiple calls to their tech support AND their customer service departments but my request to return their faulty equipment was further denied. I spent another week emailing every department my whole story but as of the date of this complaint filing I have yet to hear from a single person who is willing to help or listen. All emails to their “Deployment Team” were not returned. RUN FROM THESE CROOKS! I am seeking legal action.

From The Editor

This Post Might Help: Best Merchant Accounts for Great Customer Service

Dina Garcia

if you are a small business, or micro business like myself, run as fast as you can. Card connect has terrible systems in place and horrible customer service, not to mention they rip you off. Card connect purchased/acquired my original merchant account. Once they took over they started charging me monthly fees every month and a new annual fee. These fees are not part of my original contract. I called to ask for a refund and they told me no refund but I could cancel my account for $490 if I didn’t want to keep being charged these fees. So basically they can break the contract and charge me new fees but if I want to break the contract I get charged. On top of that every rep (except 1) was super rude and didn’t care at all that they were ripping me off. I was told that my local rep had to process the refunds, he says that customer service declined the request. I called back to customer service and they said he never put in a request to begin with. They have me running in circles. Next stop… filing a complaint with the BBB.

From The Editor

This Post Might Help: Best Merchant Accounts for New Businesses

Kevin Heck

Investigated CardConnect for our second location as we were in a 3 year contract with another processing company. We were a referral to CardConnect from another business owner…..Well 1.5 years later we found out that we were scammed by rep Mike Steffens and was put into a 5 year contract and not the 2 that we initially spoke of and the referral friend was also in. WHY WOULD I SIGN A 5 YEAR WHEN I DIDN’T WANT TO BE IN A 3 WITH MY OTHER COMPANY????? Be warned. SCAMMERS. $750 early term fee. This rep doesnt recall??? Seriously be warned. scammers.

From The Editor

This Post Might Help: How to Get Out of a Merchant Account Contract

Kayla Bartholomay

I had been with Card Connect since 2016. A friend of mine recommended I go with them since she knew the sales guy. I canceled and got a $750 early termination fee as well. Right before Christmas and tax season. The early termination was never stated upon signing up with them, and when I called to cancel I got a “We will absolutely take care of that for you” with no further information about any charge being taken. I am now making it my personal side mission to make sure everyone knows about this terrible company. Very poor communication upon signing up and when calling customer service. I’m so very disappointed and will never forget this. I’m going to do everything in my power to keep my little business afloat and when I get to the top, I will never give them my business. I will also continue to inform any business owner I know about Card Connect and their hidden fees.

From The Editor

This Post Might Help: Cancelling a Merchant Account Without Paying a Fee

Michelle

I was a former Cardconnect client. I cancelled today due to all of the fees that they add that they don’t tell you about. I won’t go into details as its not worth my time. I owna medspa and an academy. I would suggest everyone go to SQUARE as they are a great company. They don’t have fees that you don’t know about. Also, they don’t charge your $115 fee for closing your account. Keep your money and go with square!!! You won’t have to pay PSI or yearly fees.

P.S I’m so much happier with square and also all of my fellow spa owner friends.

Thom Kraak

was scammed by Jack moles July 2014 he is working under the umbrella of Northern Leasing of New York. The New York Attorney General has filed suite agents northern leasing and the FBI is now investigating CCI Peter Moles jacks Father who has spent time in jail before for fraud, and Jack him self for fraud. He miss represents the contract and lies about what it is Don’t trust the guy or his fathers company. we have been fighting it in court in New York and won now we are going after him in Wisconsin and in Illinois. Scam company. and has a track record to prove it just look up peter moles and Northern Leasing New York

From The Editor

This Post Might Help: How to Report a Bad Credit Card Processor

Calvin

I start with the company call merchant services and somehow I got switched to cardconnect didn’t get any notice the company or the salesperson that’s name j p I kept getting charged for 3 months from both companies for the same transactions I never get a penny back after discuss it with my salesperson many times and get ignored for months finally I decided to disconnect my services and they finally charged me for two transactions a full month pay and the month before one transaction for a full month pay they are thieves do not deal with them because they are Crooks

From The Editor

This Post Might Help: Best All-Purpose Merchant Accounts

Yuki

We used their service on Feb 2018, They scammed and held our transaction for over 4 months, and they keep avoiding and procrastinating deal with this issue, It caused us a huge money loss.

We have totally lost our trust on them, This is the worst experience that we have ever had with all our bank service.

We wish everyone who’s seeing this seriously consider their decision on this company, we won’t makeup anything fake to shame others.

Let’s boycott this company, and make them realize how they are supposed to treat their customers.

Sherri Hess

Do not use this company . Sales associates decides how to set your contract . For some no charge cancellation fee. For others Charging $ 450.00 cancellation fee on a 3 year contract. I was told no contract no fee .

Thom

Was scammed by CCI jack moles stated he and CCI could cut the cost by 50% instead we got hit with all kinds of monthly charges and other fees that more than double the cost. They also are part of northern leasing of New York who’s under investigation by the FBI and they are currently being sued by the New York States attorney. Stay away from this scam

AngelaPerko

I was a customer for the various mutations of what is now Cardconnect for 20 plus years. It always seemed that the fees were rather high, (all said, they ran around 5%) but a certain inertia on my part kept me with the company. In the last year or so, I fell into what is known as non PCI compliance. PCI compliance required filling out an extensive questionaire and I was normally notified by e-mail when it was due. This last time I was not notified. According to customer service, notification would have occurred somewhere on page 3 of my 5 plus page statement- though they couldn’t tell me exactly which statement that was. They let me go over a year in non-compliance, (no second notice) charging me $40. per month. Obviously I should have noticed it on my statements, but it is among lines and lines of fees, some as little as a penny. Statements were never all that easy to access, (not to mention difficult to understand) as the company changed its name and website often. Also they charge a $20. fee/ mo. for extra security that I wrote and told them was unnecessary and unwanted on my part, but still I had to pay. I have to take a good amount of responsibility here, but I am not unlike many small business owners who’s workload is heavy and can only devote small amounts of time to these sorts of details. I have now cancelled my account, with the $75. cancellation fee, the February fees added up to over 30% of the total processed, and now in March the fees still keep coming, apparently they are retroactive. Its a bitter pill after twenty years with a company, with never a charge-back or complaint. So there is no customer loyality, very little customer service, and a lot of fees. I certainly do not recommend this company, especially for a small business

Samantha

We are a small business that signed up with cardconnect because thet sync with quickbooks. After a week they said we had a fraud issue and turned off our account. They did not contact us, just turned it off. Our customers informed us it was not working. We call all day friday and everyone said our sales rep must handle the issue. We called Mark and he said he was contacting fraud dept. He then said we would get an email we never got. Then, he said he would resend and never got. After we called 6 times reaching voicemail he called back and said he cant get a hold of anyone. Then the weekend with no payments and excuses to customers of technical difficulties. Monday we heard nothing. We had left 20 emails and voicemails. On Tuesday we went to the bank and they took $21000 out of our business account. We filed fraud with the bank and got a new merchant that works with the bank. We finally reached someone and they said they had 3 invoices in question. We send receipts and invoices to the very disrespectful woman we spoke to. She had said she emailed us 3 times prior to our conversation which we never received. We asked why they didnt call. She really didnt have anything to say.

The invoices added up to 1900$, the letter she sent said they would hold 7700$, and the 21000$ was “just what they do”. We still have not heard anthing back about the “fraud” on our account but the bank got our money back for us. Luckily we caught it before 24hours were over or we would have to deal with the merchants ourselves. We would never have gotten our money back. Mainly because no one answers.

We signed with Cardpointe that was cardconnect also. Our payment terminal was Instantaccept. The bank statement listed Merchant bankcard financial as the company that took the $21000.

We are still worried about our customers and them taking more money from our account. We are closing the account all together as soon as the bank says so. DO NOT GET WITH THESE PEOPLE! First data seems to have bought them but we never spoke with anyone from first data. Go directly through them. This could have shut down our business.

Sam Hammel

I know what you mean, the government should take this over.

I have been ripped off by 2 companies in the past.

Daniel B

They seemed fairly good, and would probably be good for larger than very small businesses. I wouldn’t suggest it for folks with a hobby business. Lots of little fees that if I were doing larger amounts of revenue, the decreased % would deffinitely payout, but not on my little revenue.

I liked them while I was using them, good rep and seemed honest, my issue came when trying to cancel. They don’t handle everything themselves, so when I canceled apparently I didn’t cancel EVERYTHING, so I was still charged monthly for a few things. Never got refunded for the small things but they did refund the yearly renewal that shouldn’t have been charged.

Hope that was helpful. Go with square or something like that if you have a small hobby business, much easier and streamlined for those types of businesses in my opinion.

Julia Perry

After changing my merchant service company for many many times during 28 years of business I learned one thing.

It doesn’t matter which merchant company you deal with, what matters is how honest your rep is.

The rep can screw you or take care of you.

I am happy with Card Connect, not because of the company but because my rep has been upfront and honest with me.

Been with them 6plus years.

CPO

Hi Julia,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!

Stephanie King

I am so upset with this company. Never have I been so deceived by a so called legitimate business. I have been in business for 20 years and I have had other merchant vendors and have never had an issue in the past. ON December 15th, 2017 I received a letter that my contract was bought by Cardconnect and I would be charged a fee of $199 if I continued service past 12/31/2017. Ridiculous to receive 15 days notice of erroneous fees for a contract they decided to purchase. I then looked elsewhere and found a merchant who was nearly $90 less per month and decided to cancel. I sent in my cancellation letter so avoid my $199 fee. I have no contract and my documents do NOT state a cancellation fee and I am charged almost $500 to my checking account as a deposit that was debited out of my account and rantings from my sales person that I was charged fees for cancelling. How is it possible that I am to be charged $199 if I continue with the buy out and then I cancel as indicated as choice and I am charged nearly $500 for cancelling. I own all my equipment outright I have no contract and I never committed to this company. This is outrageous. I don’t care how nice any review is on this page read all the BAD ONES and be mindful of how they will charge you and STEAL YOUR Hard earned money. This company is crooked all the way.

Bryan

Stay away! They are thieves. They owe me me $30,000 & won’t pay because I switched companies. Awful customer service

Thomas Troyer

If I could give these guys a negative rating I would. The sales person altered the contract after he left my business. He lined out the early termination fee since I was going to be closing my business then changed it and they company still wants to charge it to me and won’t back down from it. Nothing but crooks.

Dana Rogers

I don’t even know where to start with Card Connect. I run an art gallery. We had a huge client come in and purchased a commissioned piece of art. We had in contract all sales are final and we also had her write she understands this is non-refundable. We put her card through and American Express paid them and a few days later Card Connect called and told us to go ask our client for money or a check but they would not give us the funds collected because we were ” high risk” after much debating I had to go ask my client for a check! then I get my card statement and there was a $2500 fee for a payment they would not give us!!! they called it an interchange fee. I thought it was in error obviously, but they told us no even though they wouldn’t fund us after collecting the money from American Express they still are charging us the processing fee. How can this be fair?

Dana Rogers

So I did call American Express and they said “YES the interchange fee should be credited back as CARD CONNECT returned it to American Express due to you being a “high risk”.” The problem is American Express is not our merchant, Card Connect is, and they said without a number generated by american express they can’t get in to see my account. My merchant needs to put the claim in and they will honor it. So I call Card Connect back and tell them what America Express said and they tell me there is nothing they can do. Then said “would you like to just cancel your account with us?” WHAT!!!!!! No not without getting my money back! This is a $2173.00 charge to an artist…not McDonalds an ARTIST!!! That is A LOT of money. I am livid. This is FRAUD.

Ethan Anderson

CardConnect is a scam. They’ll send you a teaser Schedule A, but then when it comes down to it, they won’t honor it. Read: Bait and Switch. Avoid them if you don’t want to waste your time.

Francis Monroe

If you are a good company that is honest and sometimes get charge backs that you should not lose DO NOT GO WITH THEM!! Card Connect, Bank Associates Merchant Services (BAMS) and Charge back system holding are the worst credit card processing company to have ever been in business. They hire people that don’t do their job as simple as notate an account when someone calls and make you lose your money by not providing accurate information. They’ll tell you a dispute is in your favor and the next day say you were supposed to respond and you failed to do so and now you lost your money and there isn’t anything that can be done. They never blame the rep on the phone that made a mistake and didnt do their job. They claim I never called or spoke to anyone on a specific day even though I have an actual fax that came from them dated and timed, call recording with the rep discussing the dispute in question, and optimum call log proving I was in fact on the phone with them that day discussing the charge back they claim I never called about! They are scam artists and will blame the customer before their employees even if you have actual proof and facts that you are truthful! The worst experience with a company. The Manager Audrey ID # 3401182 hears only what she wants when discussing a concern with a customer and will put words in your mouth to make her position in the matter better. She yelled, spoke over me, cut me off while speaking. She is the worst. After she said there is no proof I called that day and I said I do have a recording call you can hear with the rep discussing this dispute with me, she attempted to terminate the call, said she can’t accept that as proof and she can’t help me. Stay away if you’d like to make sure your hard work pay stays in your account.

Linda O

I’m very upset with this company and would NEVER recommend anyone to sign up unless you read ALL the contract’s fine print.

My sales rep Anthony Vigil, lied to me about cancelling my former card processing contract and paying for the fees. He also did not tell me of all the extra fees that would be charged to my account. He rushed me into signing the contract even tho I wanted to read them first.

Never sign contracts unless you read them over!!!!!!!!

I’m really angry of the way they take advantage of small businesses like mine.

I plan on cancelling my services with card connect. It’s sad how you can’t trust anyone anymore.

Fadi

Same thing happened to me with the same sales rep Anthony Vigil.

I am stuck with Northern Leasing on top of this scam

M.M.

I had canceled my account with CardConnect back in August 2016 because they were no longer compatible with the POS system that I was using. In fact, the CardConnect swipe device just stopped working one day with no warning, which as I understand, was a function of CardConnect’s doing.

Then, just two weeks ago, on January 3, 2017, I saw a charge to my bank account from CardConnect. I called them to determine why they still had access to debit my account and to see what the charge is for. They mentioned some sort of charge from MasterCard that they passed on to businesses, however there was no paperwork to back this up. I complained that it was unauthorized, as since we ended our affiliation with CardConnect over 4 months ago, they should no longer be authorized to debit my account. I was told I would receive a refund for this amount. I called again today follow up since I hadn’t seen a credit to my account, and spoke to Rich from the Cancellations Department. He was only able to see a note from the last person I spoke to but couldn’t tell if the refund had been issued or not. My main complaint here is that Rich was not overly helpful and incredibly rude with a very sarcastic attitude that I did not appreciate. This kind of service makes me want to warn people against using CardConnect as a merchant services provider, not to mention the unauthorized charge. I am very glad that I have canceled my account with CardConnect.

Bo

Had a great start with these guys, but after the first month of service couldn’t get any response back to my e-mails about questions regarding the machine they provided. My boss finally doubled down and said we should cancel, got an email from one of the customer service guys without so much as an apology. Only after I was halfway done with the form did I get an email from the rep I had originally dealt with, who didn’t even tell us he would be moving out-of-state and that someone else would be taking over our account 100%. Terrible communication!

Jay

CardConnect is one of the best merchant service companies in the industry for any business. I noticed the complaints are about agents and sub ISO’s using CardConnect’s name. You have to remember it is the same with any merchant service company. It all depends on the sales agent. I saw another review where a merchant said they noticed CardConnect got rid of two agents who were being dishonest. As a merchant, that means to me that they care and don’t just worry about signing up merchants. I didn’t see one complaint about the actual company. They were all about agents and other smaller companies using their name. Before I signed up for a merchant account, I called a bunch of merchant service companies just to see how the customer service team handles calls and how long wait times would be if I ever needed help. I found CardConnect to be the best with response times and handling any issues I might have as a merchant. The reporting features they offer my business are the best I have I have seen. I have other friends that own a business’s and I all I hear about is I can never get ahold of my credit card company. Again that just showed my homework paid off. I have used a few merchant service companies as a business owner and none of them compare to the professionalism of CardConnect. Not once have I had an issue with hidden fees. The customer service team is always willing to help when I call them or my agent (Scott) who is very responsive. When I had trouble with other companies and agents, the company would never respond or would never be willing to help. I realized I needed to do my homework also on the agent which I didn’t do before. You can’t go wrong by using CardConnect.

CPO

Hi Jay,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!

Nanette Makrauer

Michael,

I just wanted to thank you (again) for your amazing customer service and for a seamless, simple, and fair credit card processing service. It is literally night and day from my previous experience. I need to pinch myself to make sure it’s real. Many thanks!!!

Nanette

Beth

I have been working with Frank at the Chicago office for a little over a year now and could not be more pleased with my services! My expectations with Card Connect have been exceeded with Frank’s constant willingness to solve problems quickly, stay on track of activity and keep in contact with customers. Because of Frank, so much stress has been lifted off of me as a business owner knowing that I have someone I can rely on for help and that my business is in good hands!

CPO

Hi Beth,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!

Scott Fracalosy

Just another company that tells you one thing, and then erroneous charges popping up that were never discussed with me. It seems like every single page company is just sucking money out of clients for BS services. I am pissed off. they lied to me, total BS lies when I signed up. I’m going after them for my money, at this point, its the principle. DONE go w the company, you’ll be MUCH better off using the square. Thanks for lying to me Dan Santoli. Anything for a sale and commission. Im pissed and will take legal action. POORLY operated company. Another large company raping small business. Wait to go guys, how do you guys sleep at night, maybe you don’t.

—

Are you with CardConnect? Learn how to resolve this complaint.

rudy orona

very unhappy with the services from card connect. their sales agent are very dishonest and trick you into signing documents for the home office ! the home office will complete the forms for you and turn them into the leasing company. Terrance Blackmond is a independent sales rep for card connect . he convinced us that the clover system would be a good fit for our business. after 3 days in out store he gave up and never returned ! then the home office tried for 10 day to get programming right .the system never worked he had to pay a it guy to reinstall my old system so we could conduct day to day business. only to find out that card connect reported to northern leasing the the system was installed and up and running correctly. they have violated totally crossed the line! deceptive trade and misrepresentation . Terrance Blackmond is a thief. please save the trouble do not do busines with this company!

Dwight Perry

I have had the pleasure of dealing directly with Frank Bernacke and Card Connect/Financial Transaction Services for the past 10 or so years. During this time Frank and the staff were always there to support me 100%. Anytime I had any kind of problem or needed to borrow an additional machine it was handled immediately. If there was a technical question I could always count on getting the answer without getting the run around. The only reason I’m leaving their services now is because of retirement. If anyone were to ask me to give Card Connect/Financial Services a letter grade for the years I’ve been dealing with them it would surely be an A+.

Renee Tomasello

I have been a customer with Card Connect for the last 2 1/2 years. I am extremely happy with their rates, equipment and outstanding customer service. In addition, I appreciate how easy the statements are to read. Frank Bernacke is my contact and he is incredible. I had a problem one evening with the credit card machine and I called Frank who promptly returned my call. Keep in mind that I am on the West Coast and Frank is in Chicago. The machine worked fine but somehow I pushed a wrong button. \Within minutes the problem was fixed and I was able to process my next transaction. Another time I had a problem on a Saturday (I created the problem) and once again, Frank returned my call promptly and the problem was resolved. I cannot express my satisfaction and appreciation for the service Card Connect and Frank provides. I am so pleased with Card Connect that I referred one of my colleagues and she recently signed up with Card Connect. Keep up the good work!

This is the same site where I left my first review. I sure hope this review is posted.

Renee Tomasello

Dress Up Consignment Boutique

Michael Genoveswe

Listen, if I tried to count how many times day I get this call to change company’s and how they have this and they got that and the money I would save please all B.S. Come on it’s all about the attention you receive, and the customer service that you get . All I can tell Frank is off the charts with his service UNBELIEVABLE!!!! If everyone ran this way WOW the world would be right where it belongs. Again not to get into certain instances but today to find people with integrity and honest well it almost on the extinction list. I’ve saved BIG Money with Frank and his Company. Without out them in my corner fixing, glitches and mistakes that where even sometimes our fault it would have cost me money. End of store .

CPO

Hi Michael,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!

CPO

This comment has been authenticated.

David Gilfoyle

Absolutely the best service and rates from this company. Very transparent, no hidden fees. This credit card processor is far ahead of others in the way we get our reports and ease of doing business.

Steven Klink

I simply wanted to express how much I appreciate the wonderful assistance of Mr. Frank Bernacke of CardConnect! My experiences with CardConnect and with Frank have been excellent. He is readily available and always extremely helpful.

Alan James

Very deceptive “agents”, and I HATE ALL THE TELEMARKETING CALLS FROM CARD PROCESSORS anyway.