Overview

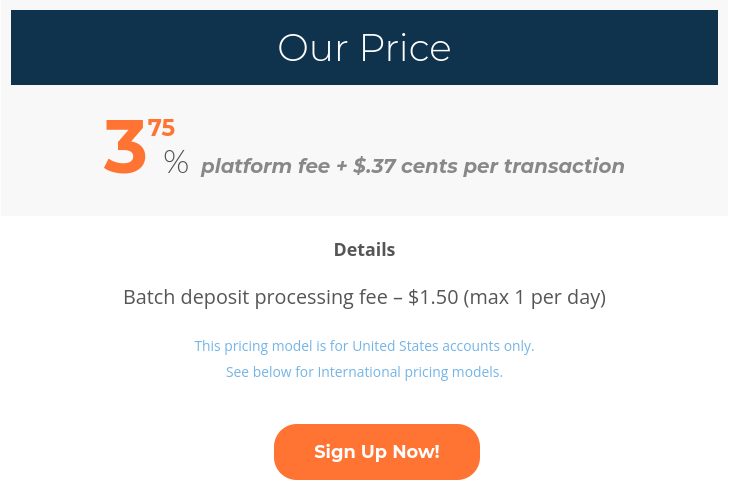

Click & Pledge provides payment processing services tailored for nonprofits, enabling them to manage donations and fundraising activities. This article will review the company's service offerings, pricing structure, contract terms, and customer feedback. We will examine the transparency of their fees, the quality of their customer support, and the overall satisfaction levels reported by clients. By the end of this article, you will have a clear understanding of what Click & Pledge offers and whether their services are suitable for your nonprofit's payment processing needs.

About Click & Pledge

Founded in 2000, Click & Pledge is a donor management and payment processing solution for non-profit merchant accounts. Although it previously used TransFirst to process transactions, Click & Pledge is now partnered with ProPay (a TSYS company) as its merchant account provider.

In 2023, Click & Pledge partnered with 360MatchPro and Double the Donation to offer automatic matching donation capability to clients.

Click & Pledge Products and Services

Payment Processing

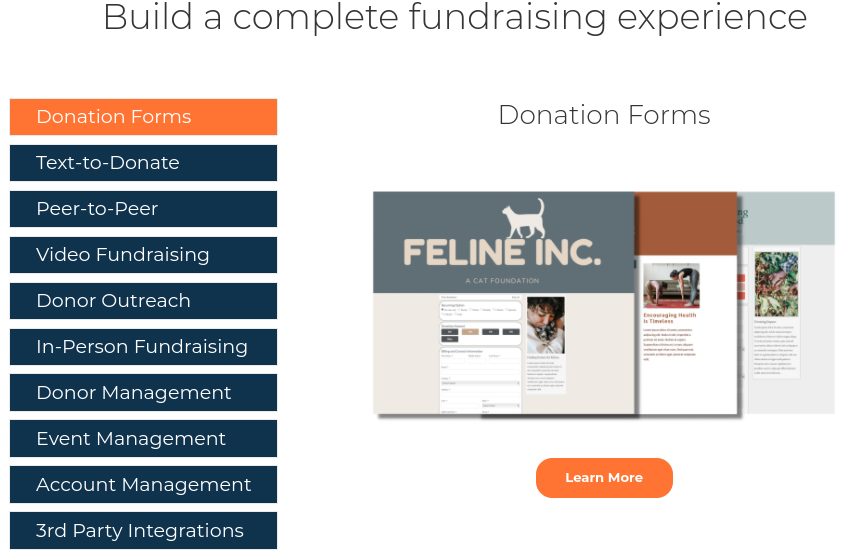

Click & Pledge specializes in processing major debit and credit cards for non-profits. They also offer a variety of fundraising services, including donation forms, text-to-donate, peer-to-peer fundraising, video fundraising, donor outreach, in-person fundraising, donor management, event management, and account management.

Event Management Capabilities

Click & Pledge includes event management tools in their service offerings. This encompasses ticket sales and online registration, enabling organizations to manage all aspects of event monetization and attendee management through one platform.

Peer-to-Peer Fundraising

The company offers peer-to-peer fundraising solutions, allowing organizations to enable their supporters to create personalized fundraising pages that can be shared online, expanding the reach of fundraising efforts.

Recurring Donations

Click & Pledge supports the setup of recurring donations, providing nonprofits with a stable source of income through automatic payment options for donors.

Mobile Payments and Swiper

To accommodate a broad audience, Click & Pledge provides mobile payment solutions, including a swiper that attaches to mobile devices, facilitating point-of-sale transactions during events or in-person fundraising activities.

Security and Compliance

Click & Pledge prioritizes security and compliance by adhering to Payment Card Industry (PCI) standards. They offer encrypted transactions and secure data storage, ensuring protection for both donors and organizations.

Jennifer Largin

Click and Pledge was amazing to work with. Customer support was always top notch and the amount of features they provide is unrivaled. If you are a non-profit, do business with Click & Pledge.

Phillip CPO

Hi Jennifer, please provide a your charity’s information to authenticate your testimonial.

Glenn Ruga

Click & Pledge is one of the worst online companies I have ever worked with. If you are looking for a company that is constantly looking out for their needs above your needs, then you have found the right one. If you want customer service, they will respond in three days to email queries and provide useless information.