Finical Inc. Reviews & Complaints

Overview

In this article, we explore Finical Inc., a merchant account provider serving a diverse range of businesses in the U.S. and Canada. We'll investigate Finical's acquisition history, including its takeovers of Safeguard Bankcard and Zero Charge Processing, and examine its alleged affiliations with CardPayment Solutions and iPayment. Our focus will be on Finical's service offerings, including their payment processing capabilities, security measures, and customer support quality.

Additionally, we'll assess Finical's rates, fees, and contract terms, alongside a balanced analysis of customer and industry feedback. This includes a look at the pros and cons based on user reviews and professional ratings. The article will also cover the company's legal history and its impact on their reputation and operations.

Concluding with a summary, we aim to provide readers with a concise yet comprehensive view of Finical Inc., aiding in making informed decisions regarding their merchant services.

About Finical Inc.

Formerly known as Prudential Payment Systems, Finical Inc. is a merchant account provider that serves standard-risk and high-risk businesses throughout the U.S. and Canada. In November 2016, the company acquired Safeguard Bankcard, LLC., an Atlanta, Georgia-based credit card processor. The company then acquired Platinum Processing, LLC, DBA Zero Charge Processing in 2021.

There is evidence to suggest that Finical Inc. was at one point a reseller of CardPayment Solutions, which is itself a reseller of iPayment (now Paysafe). We have also found evidence to suggest that CardPayment Solutions and Finical are still partners, as the footer of Finical's now-defunct “Careers” page contains a link to CardPayment Solutions' merchant access portal and both companies use identical copy across some official materials. The CEO of Finical has stated that the company has no affiliation with iPayment or CardPayment Solutions.

Finical Inc. Payment Processing

Finical Inc. offers merchant account services that enable businesses to accept various forms of payment, including all major credit and debit cards, as well as Electronic Benefit Transfer (EBT). They emphasize ease of account setup and provide free equipment for payment processing.

Dual Pricing and Security

The company provides a dual pricing model, which potentially allows businesses to offset credit card processing fees. They prioritize transaction security by encrypting data and monitoring transactions to protect against fraud.

Quick Fund Access

Finical Inc. asserts that they offer rapid access to funds, with a promise of having payments deposited in the merchant's bank account within 48 hours. They also offer customer support and tout the use of the latest payment technology.

Additional Offerings

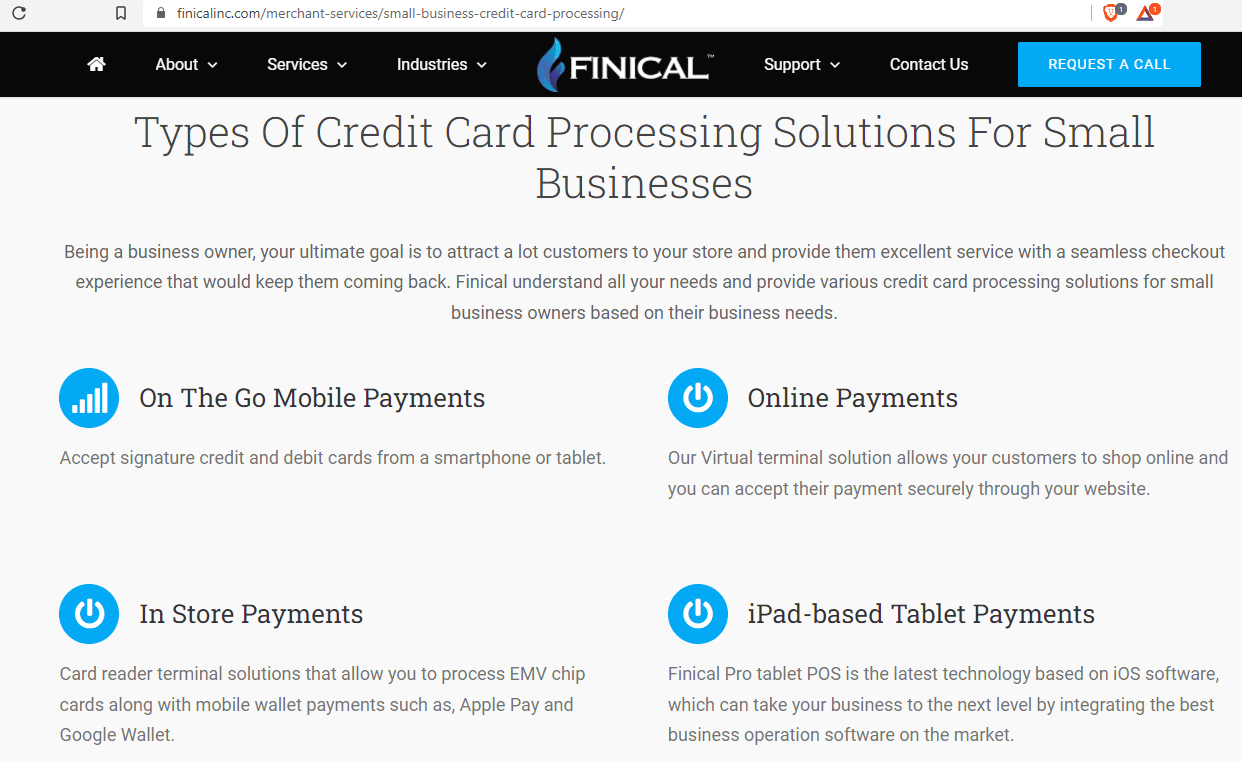

Beyond the standard merchant services, Finical Inc. also offers mobile credit card processing, online payment solutions, and specialized services for small businesses. They claim to provide custom account services tailored to the needs of individual businesses.

Location & Ownership

Finical is a registered ISO/MSP of Esquire Bank N.A., Jericho, NY; and Wells Fargo Bank, N.A., Concord, California. Aaron Nasseh, a former vice president of sales at iPayment, is the CEO of Finical. The company was originally headquartered in California but has moved to Texas and now lists its headquarters at 5429 Lyndon B Johnson Fwy Suite 725, Dallas, TX. While a handful of sources suggest that the company has been operating 1999, the California Business Registry and the company's LinkedIn page list Finical's founding date as November 2012.

| Pros: | Cons: |

|---|---|

| Positive customer feedback. | Possible hidden fees. |

| BBB "A+" rating (as of 2023). | Not BBB accredited. |

| Month-to-month contract available. | Some complaints unresolved. |

| Wide service range. | Equipment lease issues. |

| Competitive rates. | Independent sales agents. |

Finical Inc. Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | <10 |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | N/A |

| Recent Lawsuits | Yes |

Overview of Complaints Against Finical Inc.

In our investigation, we discovered a limited number of negative Finical Inc. reviews. A fraction of these express concerns over potential scam or ripoff accusations. Criticisms often center around the company’s “Cash Discount Program,” misleading sales strategies, and the complexity involved in terminating services. Despite Finical’s association with factors commonly linked to lower-rated firms—such as its partnership with Pivotal Payments, historical reliance on “teaser” rates, use of independent sales agents, a “slamming” allegation, and embedded equipment leases—its relatively clean complaint record is unexpected. This could reflect positively on Finical’s corporate ethos or possibly its smaller customer base. We invite you to contribute your own Finical Inc. review or customer complaints in the section below.

Legal Proceedings and Agreements Involving Finical Inc.

According to public records, a lawsuit concerning unpaid commissions, residuals, and bonuses involved Prudential Payment Systems and iPayment, resolved in 2015. It is important to note there is no evidence suggesting a cessation of the relationship between Finical and iPayment post-litigation, although some records hint at Finical’s current role as a Pivotal Payments reseller. Additionally, Finical faced a 2017 civil lawsuit with First Connect Inc. and its principal, Kent Kuszajewski. However, no ongoing class-action lawsuits or FTC complaints specifically targeting Finical Inc.’s merchant services have been found. Businesses seeking non-litigious resolutions are encouraged to report their concerns to appropriate oversight bodies.

Customer Support Evaluation for Finical Inc.

The company’s rating in this category has been adjusted to a “B.” This decision stems from an allegation of slamming—a highly deceptive sales tactic—coupled with reports that affected clients were directed to a legal team without being offered a resolution. The scarcity of complaints does not warrant a further downgrade. Finical provides phone and email support, though operational hours for these services are not explicitly stated.

Contact Information for Finical Inc.

- (888) 707-7258 – Toll-Free Customer Service

Additional Channels for Support

- Support request form available for submission

- Email support for inquiries: [email protected]

Despite the available avenues for assistance, Finical Inc. does not meet the criteria to be considered a leading merchant account provider in customer service based on the breadth and quality of its support options. Enhancing transparency regarding support hours and expanding the range of support channels could further improve customer satisfaction and trust, contributing positively to Finical Inc. customer reviews and reducing customer complaints.

Finical Inc. Online Ratings

Here's How They Rate Online

| BBB Reports | 2 |

|---|

Under 5 BBB Complaints

Finical Inc. has been accredited with the Better Business Bureau since 2020 and currently maintains an “A+” rating. The company has received 2 complaints in the past 36 months. Neither complaint was resolved to the satisfaction of the client.

An “A” Performance

Given the company’s low complaint total, we agree with the BBB’s rating of an “A” at this time. Readers should note that there are good reasons to be skeptical of the BBB’s rating system.

Finical Inc. Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | Undisclosed |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | 1.00% - 4.99% |

| Equipment Leasing | Yes |

Month-To-Month Agreement

The standard Finical Inc. contract operates on a month-to-month basis through Pivotal Payments, involving a $25 monthly minimum fee and includes an equipment lease facilitated by First Data Global Leasing. Notably, the contract does not specify an early termination fee, suggesting that Finical leaves this determination to the agent or ISO handling the account.

Two Separate Agreements

While Finical’s month-to-month agreement generally offers a more appealing option compared to Pivotal Payments’ usual terms, it’s essential to recognize the separate, non-cancellable equipment lease through First Data Global Leasing, which persists beyond the Pivotal Payments contract term. It’s crucial for clients to grasp that they’re committing to two distinct agreements with potentially differing durations. Although there are no known instances of Finical or its agents exploiting this aspect, such practices are common in the credit card processing industry.

Virtual Terminal and Payment Gateway Pricing

In addition to its in-store payment processing services, Finical also showcases its virtual terminal and payment gateway services on its website. However, specific pricing details for these services are not provided. Additional fees such as gateway fees, technical support fees, batch fees, and transaction rates are typically applicable to these e-commerce solutions.

Lack of Contract Complaints

Despite Finical’s minimal complaints, its contract terms currently fall short of competing with the cheapest merchant accounts. Nevertheless, it warrants a “B” rating in this regard for now.

We always advise businesses to explore our list of the best merchant services.

Finical Inc. Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | Yes |

|---|---|

| Telemarketing | Yes |

| Misleading Marketing | No |

| Discloses All Important Terms | No |

Independent Sales Agents

Finical Inc.’s salesforce is 100% composed of independently contracted sales agents, and the company does not maintain a direct sales channel. This independent agents-only approach is uncommon for the industry, and it tends to result in increased complaint totals for the companies that use it. We have received one Finical Inc. review that accuses a Finical representative of a deceptive sales tactic known as “slamming“. The merchant states that the independent sales agent posed as a representative of their current merchant services provider and switched the business to Finical without their knowledge or consent. The business owner further states that Finical did not respond to his requests to be released from the agreement and referred him to the company’s legal department. This does not compare favorably to our list of best credit card processors.

Misleading Rate Quotes

At the time of a previous update, the Finical homepage advertised “[r]ates as low as 1.10%.” This is almost certainly the company’s qualified credit card rate, and the page made no mention of the mid-qualified and non-qualified rates that clients will pay on the majority of transactions. We consider this type of rate quote to be deceptive because it could give businesses an unrealistic expectation of the rates they will pay. This Finical Inc. rate has since been removed.

Some Causes for Concern

After weighing Finical’s generally clean complaint record with its reported sales approach and previous rate quoting tactics, we have given the company a “C” rating in this section. If you suspect that Finical is charging you undisclosed fees, we recommend seeking a third-party statement audit to find and eliminate hidden fees.

Our Finical Inc. Review Summary

Our Final Thoughts

Finical rates as an average credit card processing provider according to our rating criteria. A number of factors suggest that the company will not offer competitive contract terms to most clients, but there are very few public complaints to be found regarding its service. Our rating may be subject to change as more client feedback becomes available about Finical. Business owners are encouraged to fully read and review all contract terms before signing up for service and to compare the company’s pricing to the top-rated merchant account providers.

If you found this article helpful, please share it!

Marcus

I previously used another card processing company for my law firm. That company would charge all sorts of extra fees, forcing me to perform extra calculations in order to determine what to charge my clients in order to cover fees. Worse, at the end of every month, the company would take its fees from my account as a lump sum, which would require even more math to determine if the proper amount was charged.

With Finical, none of those hassles exist. I simply type in the amount of money to charge, Finical automatically calculates the additional fees, automatically forwards the fees to the client, and deposits the full amount originally charged into my bank account the next business day. There are no more monthly calculations and frustrations. Finical also offers auto charge options that make regular billing of clients smooth and simple. To top it all off, the customer service is fantastic, whether it’s responding to an email or taking a phone call. I would absolutely recommend this company to anyone looking to drastically simplify the card charging portion of their business, while still maintaining complete ease in processing.

CPO

Hi Marcus,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!

Sam Arnept

Terrible Company, I would run. Their “president “ said he was a direct ISO when I called and they are not. I got the same run around as these other clients where an agent came in said he was from my previous company Card Payment Solutions And would lower my rate took my info and then switched me over for a MUCH higher rate INSANE AMOUNT OF FEES & when I tracked Agent down after seven months he said he did not work there and their president Aaron Is the one who told him it’s easy to get sales that way from stealing old accounts from previous employers if you can’t sell “very unscrupulous”, I also found information connecting Aarons previous employers ( card payment solutions and iPayment )those three companies together which would mean they are not a direct ISO in fact a third party iso.

Related: Best Rated Merchant Accounts in The U.S.A.

Deceived

If you’re looking for a company that will make a list of promises, jack up prices and end up charging you all kinds of hidden fees.. these are your guys!!! My company took a chance with Finical, Inc at a low up front cost, low monthly costs, no contract and no early termination fees. Well, that is what we were told. Once our bill started rising month after month and we requested that our rep find us a better processing company, not only were lawsuits threatened, but we were charged for 4 month after canceling our “no contract, no term fee” account. Once these charges were disputed a highlighted copy of the agreement we signed (which had NONE of these fees) along with an *internet page.. with a laundry list of terms and conditions that were never mentioned. We have dealt with other processing companies that were all up front good or bad, but at least honest. If you’re planning on signing with Finical, Inc.. have your attorney read the contract first. You’re going to need it.

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

Aynur Aytes

As a small business owner myself, I understand how small business have to stick together. I try to have the best to instill customer service with all my employees. In August I meet this man Aaron Ozrovitz he came to my café. He works for the company name Shift Processing ( Finical INC.) he came in and said that he can help us save money with our credit card systems. He told us that the customers will pay for the credit card fees up to 4% extra, we thought maybe this could help us save some money. Credit card was sent to us, and we didn’t open or activated the credit card system. At this time, we thought we can cancel or credit card system that we have with our bank but come to find out we cannot. So, we called Aaron to say that we are sorry, but we can’t get out of contract with our bank. Can we cancel and pick up your credit card machine. When to pick up, he was angry and not with us, we apologize to him and he took the machine. As time went on maybe 2mons or so went by and my money wasn’t returned to me. On November 2nd I emailed him asking him the status of my refund. He the responded in a email stating that “when I sales the terminal then I will get out you will get a refund”. On November 21st I emailed him to check again, he told us that “once we have possession of it you cant cancel it when its been programed just for our bank account and when, he will give it back the terminal and when I have someone who wants to buy it. I will contact you”. I never had this type of experience with any company. I don’t see why I cant get my money back if didn’t activate the machine or use the system at all. He dropped off credit card machine, it looks like he kept the machine with him and didn’t do anything with it. I then called the company Finical I talked to Regeena Lucia, she sent a cancellation form for the bank. Then she said to me that as a company rule, they cant give us money back. So then I asked for the managers name his name is Mike Haina. She gave a hard time about giving his name to me. So I a writing this about this company that is not real, about their services and how they treat their customers. Please don’t use them they are a SCAM..

Thank you,

A Mad Business Owner

I will keep you all updated if I get my money back.

From The Editor

This Post Might Help: Cancelling a Merchant Account Without Paying a Fee

Matthew D Moraga

I was promised from the beginning a 400 bonus one u did first it was 300 in sales with credit card. And i questioned Darius several times about the bonus at very first he said u get the 400 once u sign up then oh u have to do 300 in sales then the 400 will be deposit in your acct. Once i hit my sales quote i called him he said you have to do 400 in sales so i did 500 and called again then i got the run around that hr dept will have to send a check and it takes 30 days to approve it i was livid i told then i dont want their services anymore and i never got a pos system got the run around about that as well in a email they told me they will waive the $750 early termination fee so a few weeks go by and my bank acct is -close to $2400 negative I was mad they messed up and never fixed it i had to file a claim with wells fargo as fraud they fixed it forb me never never again will i use a pos system do it the old fashioned way pencil and paper.

John Doe Agent

This company has no Integrality. They stop paying residuals and stop giving you reporting. They are not a direct ISO you can get the same deal with Pivotal Payments or Paradise POS of the POS. Their Cash discount program is a joke and uses many 3rd party ISO. I would tell ISR and ISO to run from Aaron hes a crook.

Garry Conley

Independently contracted Sales Agent John Ahlf came into our business, claimed to be our new service rep for our credit card processing company. He made a phony call to our processor and told them to reduce some of our charges. We thought he was legit. Two weeks later he returns with a new card processor with a pin pad so our customer can enter their pin code and get us another reduction in rates. That day he switched us over to Finical and it was 2 weeks before we realized it. We were not aware of it and did not authorize it. He showed me a signature line on his Ipad and gave me no documents of the transaction. When I called the Finical number on the machine I was transferred twice to the “Legal” dept. They took my info, said they had to make a phone call and would call me right back. They have not called back and the direct line they gave me plays elevator music.