Overview

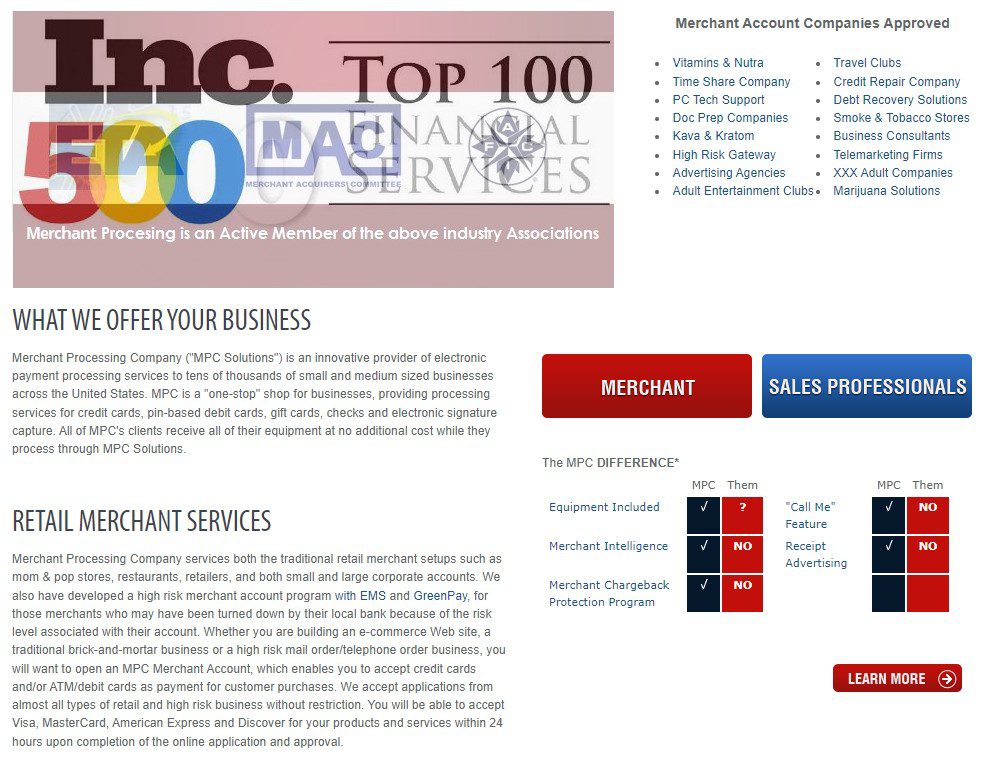

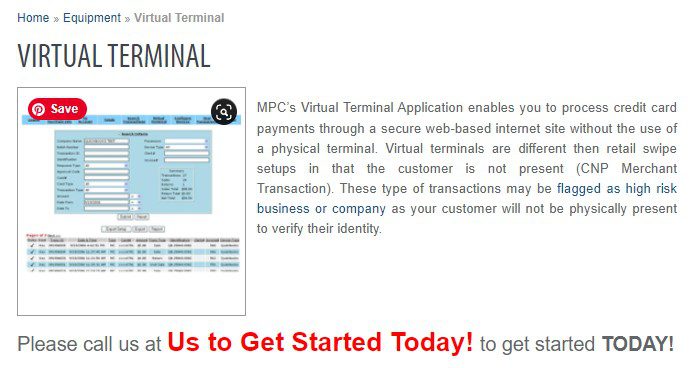

In this review of Merchant Processing Company (MPC Solutions), we examine the reputation and operations of this merchant account provider, which has connections to Crescent Processing Company. We’ll cover its rates, fees, contract terms, and services, including high-risk merchant accounts, point-of-sale systems, virtual terminals, e-commerce solutions, and gift card programs. The review also looks at MPC’s marketing tactics, customer and employee feedback, and its history of rebranding and associations with defunct providers such as Park Central Company and Future Payment Technologies. Despite its complicated background, our goal is to provide a clear picture of MPC’s operations, highlight its role in the market, particularly for high-risk businesses, and compare its offerings with other providers to help you make an informed decision.