Overview

In this review of Paystone, we will provide a detailed overview of the company's credit card processing services. We will cover the range of services they offer, including point-of-sale (POS) systems, mobile payment solutions, and e-commerce capabilities. The review will identify the types of businesses that might benefit from these services. Additionally, we will examine client and customer reviews to highlight common trends and potential concerns. The article will also address the company's pricing structure, contract terms, and specific services provided. By the end of this review, you will have a clear understanding of whether Paystone meets your payment processing needs.

About Paystone

Headquartered in Ontario, Canada, Paystone was founded in 2009 as Zomaron but became rebranded as Paystone in November of 2019. According to the company's website, Paystone serves over 25,000 locations in the United States and Canada, processing $6 billion from over 50 million transactions annually. The company is partnered with Elavon of Canada and First Data (now Fiserv) of Canada for its processing network.

Paystone Products and Services

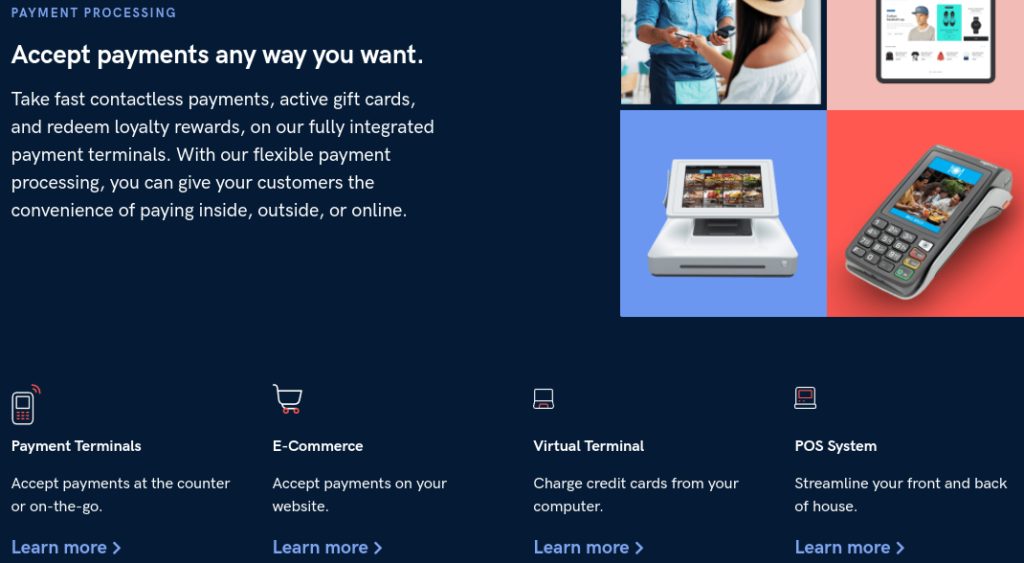

Payment Processing

Paystone processes major debit and credit cards for a variety of business types. They provide in-person, wireless, fundraising, and online payment solutions tailored for retailers, restaurants, and non-profit organizations. The company promotes Talech as a POS solution and also offers data reporting, analytics, and marketing automation services.

Acquisitions and Rebrand

On November 4, 2019, the company (then known as Zomaron) announced its acquisition of DataCandy. The newly acquired company was a software company based in Montreal that focused on gift card and loyalty program platforms. Zomaron's acquisition of DataCandy prompted the company to rebrand itself under its current name, Paystone. Following the rebrand, DataCandy's previous headquarters became Paystone's Montreal-based office. The acquisition of DataCandy was the company's third in 2019, following that of POS West and NXGEN Canada earlier in the year. In October 2021, Paystone acquired NiceJob, a reputation marketing service. This follows the acquisition of POS West, NxGen Canada, and Swift Payments, marking a major expansion from the company into the market. In 2022, Paystone acquired Canadian Payment Services, which they say makes them the biggest processor in Canada. See our Canadian Payment Services review here.

Kurt Wallman

what a rip off… the salesman told me monthly terminal charges were only $35 dollars…. didnt tell me about the $20 dollar cel charge and then a $20 dollar service fee.. and now a $20 dollar non compliance charge???? my current bill is over $120 dollars and my total dollars that my little company charged was uner $800.00… i am not happy camper this company misrepresented themselves..

BRANDY

Paystone is a terrible company to work for, they and they are only as big as they are now because they had money to through around. They think about money first and about the customer second