Note: as of 2022, Amazon has shut down Selz. We will therefore no longer be updating this review.

Company Overview

Launched in 2013, Selz is a merchant account provider that offers e-commerce solutions for businesses and bloggers. In February 2021, Amazon acquired Selz as part of a bid to compete with Shopify. It is possible this will have a major effect on the company, though that remains to be seen.

Selz Payment Processing

Selz provides a wide range of easily integrated online payment options such as online storefronts, a WordPress plugin, “Buy Now” buttons, and social media advertising, and is considered a top alternative to PayPal. Selz offers its own payment processing solution, Selz Pay, through a partnership with Stripe, but it also allows users to integrate payment gateways from PayPal. Selz also offers e-commerce options through Facebook and Instagram, as well as Google Smart Shopping. In addition to payment processing, Selz offers marketing services and business management, and it also helps people sell digital products such as ebooks, live sessions, videos, software, and more.

Selz Location and Ownership

Martin Rushe is the CEO and founder of Selz, which is located at 201 Spear St suite 1100-3255, San Francisco, CA 94105.

Selz Review Table of Contents

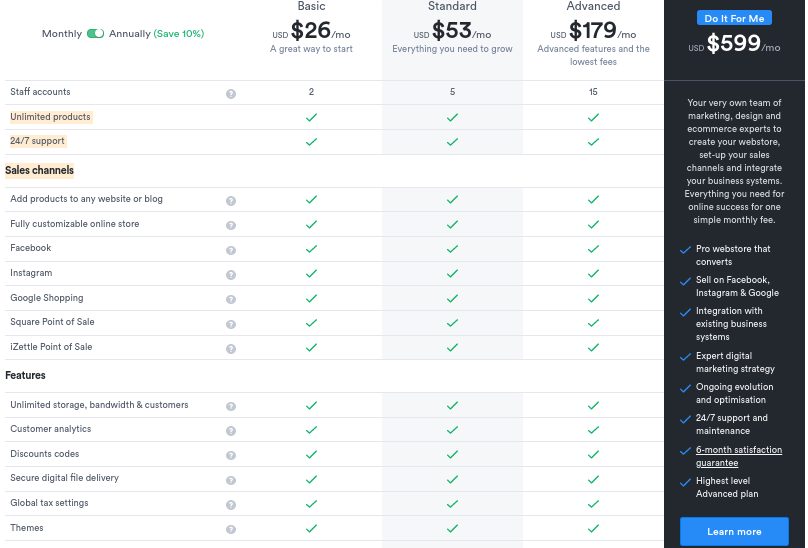

- Costs & Contract: Selz offers 3 pricing plans that can be canceled without payment of an…

- Complaints & Service: Selz has received fewer than 10 public….

- BBB Rating: Selz has no rating with the Better Business Bureau and has received…

- Sales & Marketing: Selz does not hire independent sales agents and has not received any complaints about its…

Caroline B

I love Selz and I’m always a happy customer as I continue to use their platform to sell my product and make a living. I sell my online fitness plans through Selz and they are by far the simplest and cheapest platform I’ve tried. Their customer support is ALWAYS there, and any time I ask a question or send an email to their support team they manage to respond to me with very little delay. Here are my favorite parts about them:

– Low cost (cheaper than anything else I’ve tried)

– Get your money’s worth (for the plan I pay I get all the features I need and their 24/7 support)

-They’re simple – I don’t understand web coding or anything like that, but their platform is so extremely easy to use and understand!

I will always stick with Selz and use them for my business!!!

CPO

Hi Caroline,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!