Shopify Payments Reviews & Complaints

Simple and Robust E-Commerce Payment Processing

Shopify is an Ottawa, Ontario-based merchant account provider that specializes in e-commerce solutions for small businesses. Founded in 2005, the company offers a broad range of services for online businesses, including debit and credit card processing through an online shopping cart, website creation and customization, marketing and SEO solutions, payment gateway integration, and an app store with a large number of additional features.

Shopify Merchant Services

In mid-2013, Shopify launched its own payment processing platform called Shopify Payments, which is powered by Stripe Payments and is the primary payment option advertised by the company. Business owners can set up their own merchant accounts and payment gateways through third parties (such as PayPal or Authorize.net) and integrate these accounts into Shopify, but they will be subject to additional transaction fees. The company also offers an in-store point of sale (POS) system compatible with the iPad for merchants with retail locations.

Standout Features

The Shopify app store offers a huge base of add-ons and plugins to facilitate a range for credit card processing needs. Customers of Shopify receive dedicated support for over 70 payment gateways, an SSL-secured shopping cart, their own domain name, and unlimited bandwidth. Business owners who also opt to accept card payments through Shopify Payments will receive real-time payment tracking as well as a chargeback recovery service, which alerts merchants to chargebacks, provides customer contact information, and even prepares customized order information to help merchants dispute chargebacks. As for the Shopify app store, additional features available to all customers include accounting integration, email marketing integration, digital download support, rewards programs, and social media integration.

Shopify Mobile Phone Payments

The company also offers a service called Shopify Mobile, which allows its users to accept payments using an iPhone and a mobile card reader. Shopify Mobile is available to existing Shopify customers at no extra cost except for a variable per-transaction fee.

Location & Ownership

Shopify is located at 151 O'Connor Street Ground Floor, Ottawa, ON K2P 2L8. Tobias Lütke is the founder and CEO of Shopify.

Video Summary

| Pros: | Cons: |

|---|---|

| 24/7 customer support. | Locked into Shopify ecosystem. |

| Seamless integration with Shopify stores. | Higher fees than some alternatives. |

| Secure, reliable payment processing. | Limited customization for checkout. |

| User-friendly interface and setup. | Mandatory Shopify account for use. |

| Multiple payment options supported. | Potentially slower payouts. |

| Detailed financial reporting features. | Transaction fees for non-Shopify payments. |

Shopify Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | 50+ |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | Fund Holds |

A Standout In Service

Shopify consistently demonstrates a strong commitment to customer support, earning it recognition as one of the best mobile payment apps. Unlike some of its competitors in the e-commerce space, such as Amazon.com, Shopify places a significant emphasis on customer service quality, addressing an area where merchants have expressed dissatisfaction with similar platforms.

Shopify Lawsuits

In a notable legal challenge, Boom Payments! filed a lawsuit against Shopify and Stripe on February 1, 2019, for patent infringement (Boom! Payments, Inc. v. Stripe, Inc. et al). This lawsuit claims infringement of two patents held by Boom Payments! related to processing transactions.

In 2020, Shopify successfully averted a class action lawsuit in California alleging violations of the Telephone Consumer Protection Act due to the use of robocalls.

Moreover, Shopify experienced a significant data breach in August and September of 2020, resulting in a class-action lawsuit filed against the company, primarily blaming two rogue employees for the incident. This lawsuit was still active as of 2021.

Additionally, a lawsuit was filed against Shopify in 2021 concerning data collection and consumer behavior tracking, which is reportedly ongoing.

Shopify Customer Service Options

Shopify provides phone, email, and live chat support across all service tiers, reinforcing its commitment to comprehensive customer assistance. While there are a few negative Shopify reviews citing issues such as fund-holds, service cancellation difficulties, billing concerns, chargeback disputes, and operational challenges, these complaints are not indicative of a widespread problem. Out of approximately 40 reviews, some have been addressed promptly by company representatives, demonstrating Shopify’s dedication to resolving customer concerns efficiently.

Users typically access Shopify customer service through specific features within the app and website, streamlining the support process.

Shopify Online Ratings

Here's How They Rate Online

| Product & Service Complaints | 158 |

|---|---|

| Billing & Collection Complaints | 96 |

| Advertising & Sales Complaints | 32 |

| Guarantee & Warranty Complaints | 2 |

| Delivery Complaints | 8 |

Note: We have adjusted this company’s BBB rating according to our own standards. To better understand why we adjust BBB ratings, please see our Rating Criteria.

Over 250 BBB Complaints

Shopify has been accredited with the Better Business Bureau since 2012 and is currently showing an “A+” rating on the BBB website. The company has had 296 complaints filed against it in the last three years. 96 complaints were related to billing and collection disputes, 158 were due to problems with the product or service, 32 had to do with advertising issues, 8 were due to a delivery issue, and 2 were in regard to a guarantee or warranty complaint. Shopify successfully resolved 116 of these complaints, while the remaining 180 were either were resolved to the dissatisfaction of the merchant or did not receive a final response from the merchant.

What Merchants Say

Shopify Payments has also received 92 informal reviews from users, 90 of which were negative in tone and 2 of which were positive. One recent informal review describes frustrations with erroneous purchases and poor customer service:

This company will not help me resolve an issue with merchandise that I didn’t order or authorize. I have reached out to them about this and getting the same answer that it’s in the hand of the escalation department. I took it upon myself to pay and ship back the items that’s I didn’t order to keep it off my credit. I have provided them the tracking number and it shows the items were delivered back to where they came from. They are still harassing me for payments. I don’t owe you anything, I didn’t order the items and I sent them back trying to keep this unauthorized debt off my credit. I have emailed you the tracking slips and you still will not help me to resolve this issue. I didn’t place the order, I sent the merchandise back I provided you the tracking number to show that the items were received back and you still will not resolve this issue. I keep getting emails that I owe. I keep calling and no one will help me. I don’t need this to go on my credit especially when the items were sent back and received back from the company that aent them .

Many reviews on the company’s BBB accounts have been made by customers instead of merchants. In some instances, it appears that the issue lay with the merchant facilitating the shipment of a purchase instead of issues with Shopify’s payment processing. In any instance, customer satisfaction is imperative for any business. This makes the quality of customer service an important consideration when choosing a merchant account provider.

A “B” Performance Overall

Shopify’s current complaint total marks a significant increase in complaints from the time of our last Shopify Payments review, and we have accordingly adjusted the BBB’s rating to a “B.”

Shopify Fees, Rates & Costs

A Closer Look at The Contract

| Swiped Rate | 2.40% - 2.70% |

|---|---|

| Keyed-in Rate | 2.40% - 2.90% + $0.30 |

| Basic Shopify Plan | $29 Per Month |

| Shopify Plan | $79 Per Month |

| Advanced Plan | $299 Per Month |

| Shipping Discount (Basic Plan) | Up To 64% |

| Shipping Discount (Standard Plan) | Up to 72% |

| Shipping Discount (Advanced Plan) | Up To |

| Early Termination Fee | $0 |

| PCI Compliance Fee | $0 |

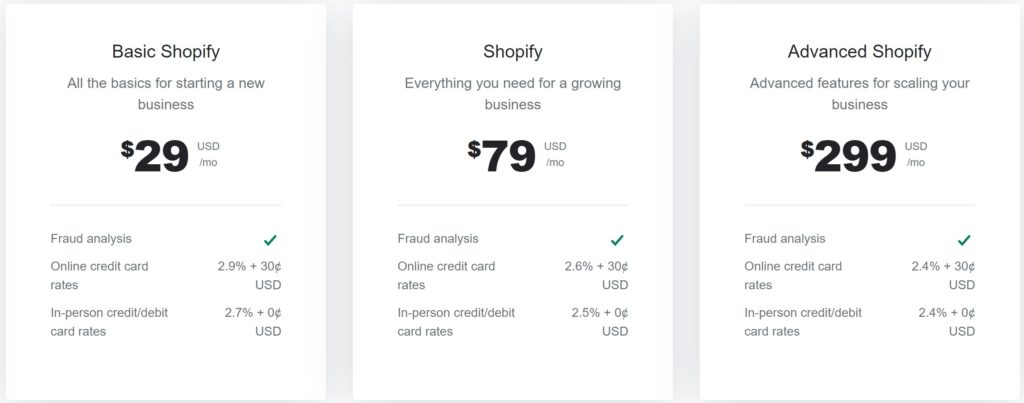

Several Shopify Pricing Plans To Choose From

While Shopify does not primarily feature the minimalist, pay-as-you-go pricing found with most of its competitors, it does offer substantial value through its various monthly pricing plans. All Shopify plans are month-to-month contracts with no setup fees or early termination fees, and PCI Compliance fees are included in Shopify’s rates. Customers can select plans at $29/month (Basic), $79/month (Standard), $299/month (Advanced), or opt for a customized amount with the Plus pricing plan for larger merchants. The Shopify transaction rate for each plan is listed as 2.9% plus $0.30, 2.6% plus $0.30, and 2.4% plus $0.30, respectively. The keyed-in transaction fees are set at 2.7%, 2.5%, and 2.4%.

Each plan allows for 2, 5, or 15 staff accounts and offers shipping discounts of up to 64%, 72%, or 74%. The Standard and Advanced plans also include gift card processing at a fixed rate and access to professional reports for analyzing the business’ finances.

Reasonable Pricing At Each Level

The fees and added features Shopify provides are in proportion to the monthly charges incurred by business owners. All Shopify plan subscribers have access to a broad selection of user-friendly e-commerce tools, though smaller businesses should consider if the Basic plan meets their needs before opting for the Standard plan. It is noted that Shopify may impose additional transaction fees if a merchant chooses to integrate a highly-rated merchant account with their Shopify store.

iPad Point Of Sale

Previously, Shopify offered a separate POS hardware package for an additional $49 per month. Currently, Shopify POS is included in the Standard and Plus plans at no extra cost. This package comes with an iPad stand, barcode scanner, EMV and swipe card reader, cash drawer, and receipt printer. The transaction fees for Shopify POS are 2.7% for the Basic plan, 2.5% for the Standard plan, 2.4% for the Advanced plan, and keyed-in rates are consistent with the online transaction rates for each plan. Shopify POS features include inventory syncing, analytics, email receipts, support for multiple staff accounts, customer tracking, seamless integration between online and retail outlets, and additional apps. However, retail and restaurant owners should note that the Shopify POS app does not support tipping functionality, affecting its utility among the best merchant accounts for restaurants.

Something For Everyone

Shopify’s pricing structure offers a significant number of features relative to the fees charged, and customer complaints regarding Shopify’s pricing are rare. The company’s flexible contract terms receive high marks for customer satisfaction.

Shopify Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Employs Independent Resellers | No |

|---|---|

| Advertises Deceptive Rates | No |

| Discloses All Important Terms | Yes |

No Outside Sales Reps

Shopify appears to primarily market itself through its website, through its growing online customer base, and through strategic partnerships. The company employs a sales team to handle inbound inquiries, but it does not appear to engage in telemarketing or in-person sales. We have located a handful of Shopify reviews that complain of misleading or deceptive advertising by the company, but upon further investigation, these customer reviews seem to have simply been confused or dissatisfied with the service they received.

Separate Pricing for Third-Party Processors

Although the Shopify website does not seem to intentionally obscure its contract terms, it is not entirely clear about its pricing structure. The company’s “Pricing” page lists a series of transaction fees that vary depending on whether merchants are signed up for Lite, Basic, Standard, Advanced, or Plus pricing. These fees are only applicable to merchants who are signed up for a merchant account/payment gateway through Shopify Payments. Customers who have integrated a third-party payment processor will pay additional Shopify fees of 2% plus their third-party transaction fees on the Basic tier, 1% plus their third-party transaction fees on Standard, and 0.5% plus their third-party transaction fees on Advanced. Since Shopify Payments is now the company’s default merchant account, it’s likely that most new customers will not encounter these additional charges. If you would still prefer to integrate a third-party payment gateway with Shopify and pay the additional fees, we recommend keeping your total costs down with a cheap merchant account.

Our Shopify Review Summary

Our Final Thoughts

A Good Option for Online Payments

Shopify is an online store builder and merchant account provider. There are a low number of Shopify reviews complaining of fees and pricing issues, but the company scores well when comparing the number of complaints to the sheer number of customers with Shopify. Although it is possible to integrate preexisting merchant accounts, payments gateways, and websites with Shopify’s shopping cart, the company’s best prices and services are reserved for merchants who start fresh with Shopify Payments. For more information, visit the Shopify website.

If you found this article helpful, please share it!

Julio rincon

Scam site. Don’t ever trust your money and work to them. They closed my store with previous advice and stole my money. They are not answering my mails and I don’t count that I will have a solution for this situation, they dont put any effort in it

Whoever ask me for my opinion about Shopify I will say my experience was horrible with them

Mavoadansgroup.myshopify.com

Support ticket: 29941822

tatiana

I am so angry now!!!! After more than one year using the shopify I felt so unhappy . I had a international shipping cost $60 to Canada, I fill all information online for custom label, everything was fine. Do you know when you do international shipping label online, you cant leave any blank custom information. So I printed out the label and sent to my customer. For my surprise after 25 days I got the package back, the problem was no description about the product! I called the shopify support, they told me looks like the specific description font was the problem, and because I am the merchant I am the responsible to check the label. Whatttt??? If everything online was right, why I have to check after printed out? So I loss $60, Shopify don’t give any credit, I am so disappointed after at all was my first issues and nobody cares about it. I do normally international shipping and never had this problem. This is how shopify appreciated their customers.

RJ Mainardi

Shopify stole my domain name. I have tried everything from filing complaints with US and Canada BBB, to no avail; Complaint.biz; Tucows; APlus. This is the email I received from Freya@ Shopify telling me I no longer own it. I owned it since early 2019. I started with Shopify in 2020. I am looking for someone or company that can assist me in starting a class action lawsuit against them. Proof they did it is below from Freya in their risk management department:

Freya (Shopify)

Jun 24, 2021, 20:52 EDT

Hello RJ,

Thank you for your reply. You are more than welcome to take this up with our legal team: legalatshopfydotcom.

However, we did refund the domain to you, which means you do no longer own it. The domain does expire January 21st, 2022 which is when it will be available for purchase again from any buyer.

Regards,

Freya

Risk Analyst | Shopify

Nicholas

Total Bull**** Company ! Zero character !

Zero Customer service!

No Phone Number!

My prediction, Will Not be around long !

Stay Clear if this c Company !

Ken

Not good

Deceptive promotion get you signup and not deliver.

Joseph Mirsky

I closed my jewelry store in New Jersey and had lots of unsold items left after going out of business sale. I put them up on Shopify at 5% over cost/wholesale to cover expenses. Took forever with lots of live chats to get it set up more or less right. Less right are descriptions far below item image on some of the items.

Initially, some images were huge, blown up ridiculously large. After a number of chats I was told that this was so because the default image proportions are set to square so say, a long necklace, comes out square with the width and height the same resulting in a monstrous image way out of proportion to most other images. It took a number of chats for someone to tell me that I could set the image to unsquare and that did it for the image sizes. But still there are image descriptions far below the image for a number of products. Couldn’t get them to solve that one so I left it as is. The fix would be simple: allow images to be dragged in place and dewscriptions in a standard text box which could also be dragged in place. This is standard for web software.

I discovered that my gemstone earrings collection was not visible among the other collections. Took me quite a while to sort that one out. Why when I create a collection it isn’t automatically added to the other collections when saved is mystifying to me. .A friend with a store that sells used books and records in my town tried to set up a site on Shopify and he said it was so nonintuitive he gave up, and he’s a pretty smart guy. The Shopify store url is also mystifying, no http:// or www. Hyphens between the words in your store name followed by .myshopify.com. I registered my store name as a .com domain with Hostgator after all these Shopify problems just in case it didn’t work out. I’ve been dealing with the public for 40 years and have done 2 web sites from scratch myself and if I tell you it’s non-intuitive, it is. I’m an old guy now and I don’t need this aggravation.

marmar

I had a similar experience to Miss T and Shane. They have withheld my payments to me for over 2 weeks. They hold the funds, then ask you to provide documentation regarding manufacturing etc. They were very vague with what documents that thy needed, so I attached my manufacturing agreement. I heard back a few days later that the information was not what they needed. This is still on going and now they are forcing me to use another payment processor, dues to ‘risk’. Which in my opinion is absurd. They are not for the small business person. I hope people actually read this review and understand that there is something more going on with them behind the scenes. They are driving the small business person out. Beware!

CPO

Marmar,

This overview offers guidance on how to make a payment processor release funds being held. We also offer insight into how to navigate being a high risk merchant.

Michelle Wilson

We had someone hack our Shopify store and because they don’t have two step authentication like our other payment processors the hacker easily changed our account number to theirs and was putting all of our deposits into a bunch of diff accounts. Once we found this out we had been frauded for over 100k and Shopify blames Stripe and Stripe blamed Shopify both said there was nothing they could do. BEWARE they offer NO protection to their customers. We are switching payment processors and getting a lawyer.

This post will help: Best E-Commerce Merchant Accounts

-Phillip

John O'Brien

Healithop at Shopify took my $90 order and I did not get the product from China. When I went to the original order site on Shopify, Healithop URL was no longer working. When I called and talked to Shopify, they said that they could not resolve money paid to Healithop [email protected]. I’m out $90. Shopify has no support for Fraud and no responsibility if the vendor fails.

Shane

We have been with Shopify for about one year and it’s been pretty good… until now. Two days ago they started holding our payments without an explanation. We tried and tried to get an explanation and they refused to give one. Finally we received an email about on day after they notified us of the hold on our payments. They said that we might be selling unlicensed products and that they needed to verify that the products are licensed. I have no problem with that and provided the requested information, but they shouldn’t have held payments without checking with us first, and they shouldn’t hold payments for products that are not even in question. This is absurd!

Now, more than 48 hours after they started holding our payments and more than 24 hours after I provided the information they requested, they are still holding our payments… and no end in sight.

We have bills to pay and no way to pay them. We are a relatively new small business without any excess cash flow and no cash reserves to handle a situation like this. Shopify is seriously damaging our business. Their actions are completely inexcusable and are borderline criminal in my opinion.

I will leave negative feedback and complaints about them on ever forum I can find.

This post will help: How to Make Your Payment Processor Release Your Money

-Phillip

Lester

Be very careful with Shopify if you think you may want to use the site. I joined in Sept 18 to have a processor for some customers credit cards. Huge mistake!

When signing up and creating an account one is asked the general information they would need to collect and pay you your funds. Then when i sent out an invoice to be paid, they collected the $162.32 and a week later the funds showed in my account. After that i sent four more invoices out between Oct 3 and Oct 8. The total of those invoices is $2490 and change. This prompted them to take the funds hostage and demand basically everything one would need to successfully steal my identity. Along with my banking info, they would have a pretty complete package.

Of course the GURU’s tried to assure me that my personal identity was “safe”. I’m pretty sure Yahoo, some major banking institutions, our government and a host of others could “assure” that the info they had was “safe” too, until it wasn’t.

I looked around a bit to find that Shopify’s main IP address is actually shared with 90,427 other sites. I’m pretty sure they would not be contacting me to “assure” me that they will safeguard my personal info. I flat refuse to put the front and back of my DL online, nor a copy of my passport to them or anyone else. The more i dig, the more it becomes apparent that this “organization” at it’s core is not really about processing payments at all. They lure people in then hijack their money to force the person to give them every necessary detail of one’s identity to complete the package.

I have my thoughts on what they do with this info after bullying people into giving it to them but for now I’ll see how that compares in the near future to what the FTC finds. I’ll certainly help them all i can.

If you ask the GURU’s who is requesting this info, they like to try to make you believe its your bank. Simply go to your bank first as i did and you will find that has no truth in it at all. Why would it? The bank knows exactly who their customers are, after all they get that proof of id at time the account is opened.

Stay far far away friend.

From The Editor

This Post Might Help: Best Merchant Accounts for Online Invoicing

KeKe Brooks

I have read several of these comments and I agree with most of them. In the beginning I was excited about this app. It was fast, efficient, and the easiest app to use when transferring or receiving funds. I even referred several friends because of the convenience that I initially had with this app. Then I guess the saying “it sounds to good to be true” really showed it’s ugly head. It has gone on three weeks and I still haven’t received some funds a friend sent me using the cash app. It was requested 4/11/18 and was taken out of his account the very next day 4/12/18. However, the funds are still not in my account to this day. As others have stated their only form of communication is through email and they have constantly copied and pasted the same correspondence putting my bank at fault for not receiving the funds. I have asked for a supervisor and that is when the correspondence ceased. I’ve sent them emails back to back and no one has replied since. It has literally turned into a nightmare and my funds have either been stolen from this company or lost somewhere and their “support team” has not provided a resolve or restitution for my funds! Someone mentioned that it’s a good app until there’s a problem but I would have to disagree. It’s fraudulent when an app is a hit or miss withholding their consumer’s funds! I will never use this app again once my funds are received!

Miss T

Terrible. They withhold payments after a while and make you intensely prove and provide documents that you are a real legal company. The team that deal with that are only contactable via email..takes forever to resolve. They then made a mistake & made my account unable to cancel or refund orders. Which resulted in several chargebacks which cost me money as well extremely unhappy customers! The guru actually said he had never seen anything like that before. Soon after I was able to issue refunds but I never heard from shopify about this. I just took it as they realised their mistake & corrected it as though it never happened as it was their error. No apology or any kind of acknowledgement it just started working again after 2 weeks broken! Oh..guess what..my account worked nicely for 3 weeks but the payments account is now on hold again due to receiving chargebacks at the time shopify with held over 3000gbp the week leading upto xmas & straight after that unable to

Issue refunds…you see where I’m going with this? I have a backlog of orders & shopify withhold the payments with no say on when they will release. I may as well shut the business now. Cheers Shopify

lisa

After Square failed to pay out over $4,000 in sales and refused to provide any explanation, we switched to Shopify for POS as we had the web program. We LOVE IT! So easy and simple and ties in the retail to the web sales and tracks inventory so well. Always get tech support (a bit of a wait on the phone) talking to a REAL person who really knows the program! I am thrilled!!

CPO

Hi Lisa,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!

Joyce

Ordered and paid via PayPal. My Discover card has been charged, BUT no delivery of purchase. Have filled out a form with them, BUT NO REPLY. Not feeling very happy with this company. Will never order again because of lack of customer service. Will report to BBB and let PayPal deal with this.. I GIVE UP.

Rob

Sounds like a problem with the vendor more than Shopify itself. Can you describe the situation in more detail?

Asking because I’m curious how many BBB complaints involve things that Shopify can/should fix vs the number of complaints that should have been filed against the store owner.

Thanks.