Overview

In this review of TAPLocal Now, a versatile marketing firm offering merchant accounts and point-of-sale solutions, we will take a closer look at their services. We'll cover their payment processing options that aim to simplify transactions for businesses and their digital tools for boosting online presence on platforms like Google and Facebook. We'll also explore TAPLocal's customer engagement strategies, including reputation management and text messaging services, along with their web design and marketing services to drive customer interaction and sales.

Key aspects such as contract terms, pricing strategies, and the range of their service packages will be discussed. We'll provide insights into customer reviews, industry ratings, and the company's approach to sales and employee management. This review aims to give a thorough overview of TAPLocal Now, highlighting its offerings, operations, and the experiences of those who have worked with the company.

About TAPLocal Now

Short for Transactions and Promotions, TAPLocal Now is a marketing firm that also provides merchant accounts and point-of-sale equipment to most standard-risk business types. Also known as TAPLocal Marketing, the company is a dba of Paradigm Services, Inc. TAPLocal operates as a reseller of First Data (now Fiserv) products and services, such as Clover POS. The company offers a price-match guarantee and the choice between flat rate and customized pricing. It appears TAPLocal is also going by the name Transaction and Promotions Inc., though there is almost no mention of this name outside of their BBB profile.

TapLocal Products and Services

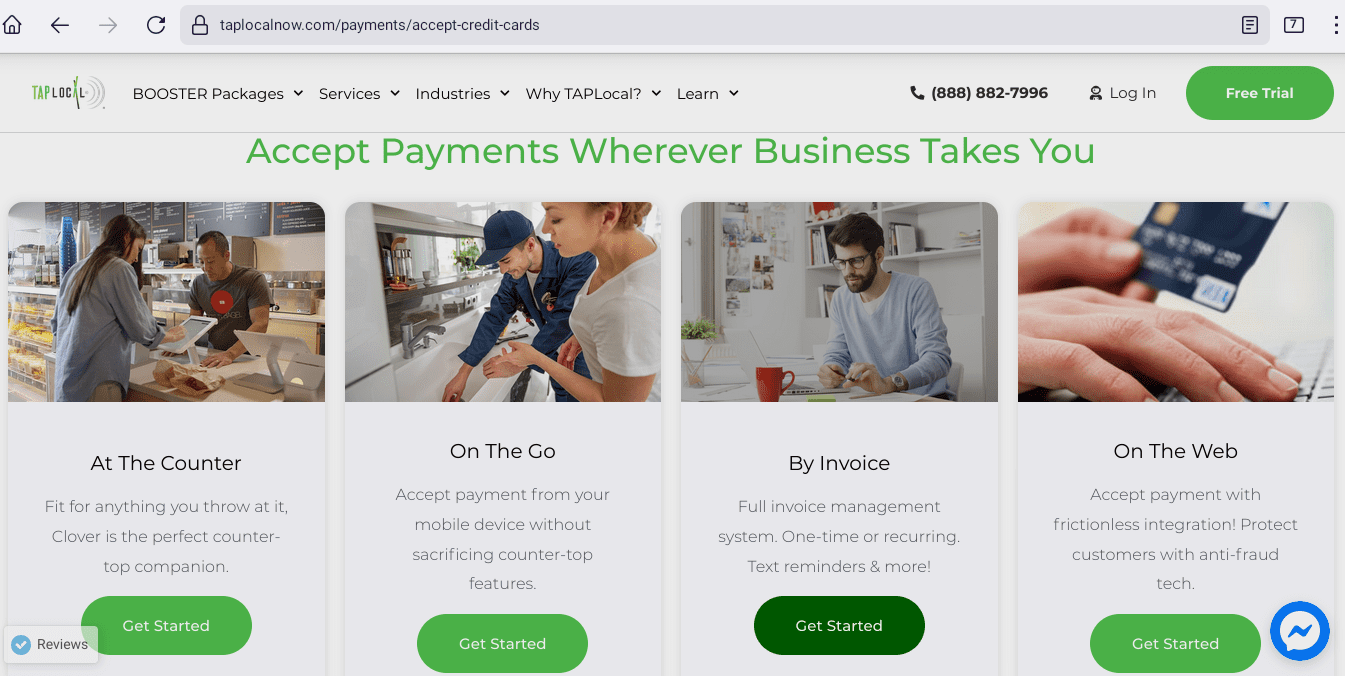

Payment Processing

TAPLocal provides payment processing services designed to streamline the process of receiving payments for businesses. Their offerings include tools to help businesses manage their online presence, such as listing services on platforms like Google, Yelp, and Facebook.

Customer Engagement and Reviews

The company focuses on the significance of customer reviews, offering reputation management services to assist businesses in generating and responding to reviews. They also offer a business text messaging services.

Web Design and Marketing

TAPLocal offers web design services to help businesses create an online storefront, which can enhance customer interactions and potentially increase sales. Their marketing services aim to attract customers through platforms like Google, Facebook, Instagram, and Bing.

Avery harper

Mr. Randell Wright was very professional and helpful in every way and also very informative

Jeannette Garcia

During this new business venture and with this uncertainty in the world i procrastinate alot when making decisions but Tanner Craig over @ TapLocal was above and beyond professional and such a sweetheart while helping me really bring my new business full circle…

I am very happy that i was able to speak with someone who made me feel comfortable and not like i was just another sale. Very positive attitude and super knowledgeable of services provided..

TapLocal is very lucky to have that young man on their team as well as myself.

Thank you Tanner :)