Overview

In this article, we will provide a comprehensive review of CardSmart Merchant Services, a credit card processing company. We will cover the services offered by the company, including merchant accounts, payment gateways, and point-of-sale systems. The review will examine the pricing structures, contract terms, and overall reliability of CardSmart Merchant Services. Additionally, we will assess customer feedback and the quality of support provided. Comparisons with other payment processors in the industry will be included to help you determine if CardSmart Merchant Services meets your business needs. This article aims to provide all the necessary information to make an informed decision.

About CardSmart Merchant Services

Founded in 1989, CardSmart Merchant Services is a payment processing company providing merchant accounts and point-of-sale solutions for retail businesses throughout the United States. The company advertises Clover, pcAmerica, and Retail Management Hero as the POS systems it offers. Business owners should note that they may also find reviews under the name of “Card Smart” Merchant Services. eProcessing Network is also referenced by the company's website as its chosen payment gateway. This means it is likely that the company resells those services through its POS solutions.

CardSmart Products and Services

Payment Processing

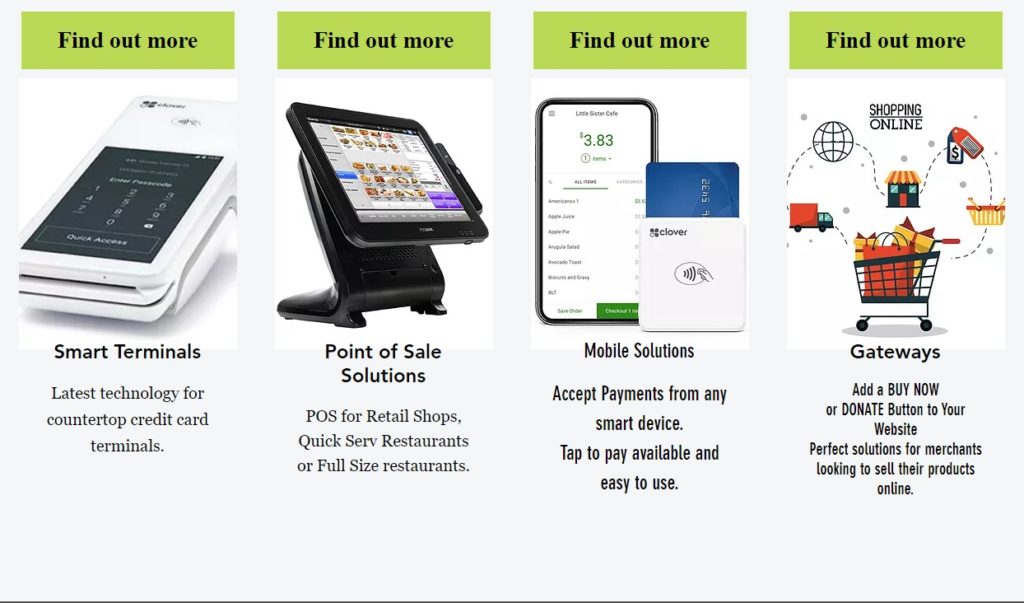

CardSmart Merchant Services offers payment processing for most major debit and credit cards across various business types. Their services include smart terminals, Clover POS solutions, mobile payments, and access to Shift4 and Authorize.net payment gateways. CardSmart provides omnichannel payment solutions, enabling both in-store and online payments according to business needs.

Integrated Payments

CardSmart offers point-of-sale (POS) systems and countertop terminals, integrated with their gateway for secure credit card transactions.

Transaction Security

CardSmart ensures transaction security through patented tokenization and point-to-point encryption (P2PE).

Mobile Payments

Their mobile payment processing solutions accommodate all payment types and require only internet connectivity to function.

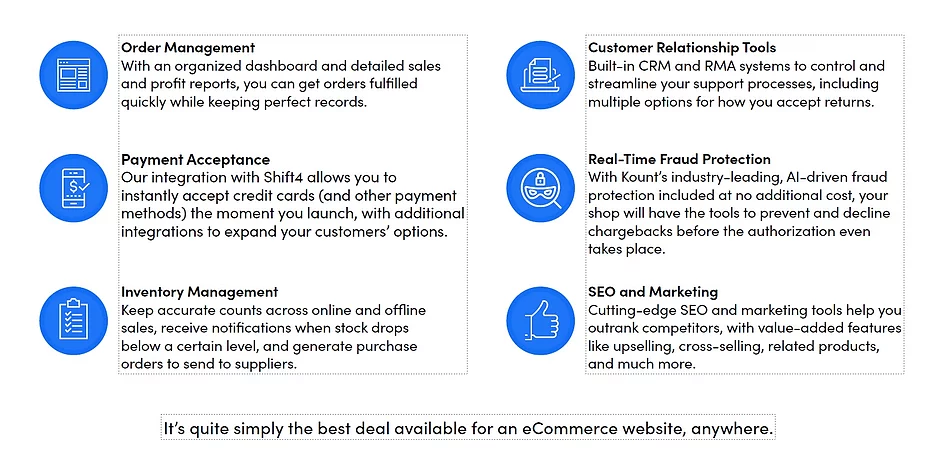

Hosted Payment Page

For businesses that do not need a full shopping cart, CardSmart provides simple solutions for creating and linking hosted payment pages.

Dedicated Reporting Centers

CardSmart's reporting centers offer real-time overviews of business payments and functionality for transaction management.

Seamless Integrations

CardSmart facilitates integration with various B2B or eCommerce software as an out-of-the-box add-on feature.

Konstantin Othmer

Smart Card Merchant Services cold called me and said our business rating had changed and wanted to know whether I wanted to accept an upgrade to our account for better credit card processing fees.

The telesales agent made it seem like we had a relationship with them, but when I asked they said we did not. I asked them to put the upgrade offer in writing but she said she could not, but could schedule an in-person interview. We scheduled a date and time and I asked her to send email confirmation, but it never appeared. Strike 1.

On the date in question, I called the number on the website and reached someone who confirmed there was an appointment and they had my email address wrong. So obviously they don’t know much about my business, and when I said it was a cold sales call, they insisted it was not since they knew our credit rating had improved.

I told her I would be a little late for the meeting since it wasn’t confirmed. I was five minutes late – the rep was 45 minutes late. Strike 2.

During the meeting, the rep would not put anything in writing and proceeded with a number of hard sell / hard close sales gambits. He was vague about details and said I have to commit, they only review accounts once a year and I have to decide now. I told him I needed to talk to my partners and he continued to try to close the sale.

He finally wrote some things on his business card with a *not guaranteed* on it. He said he was not selling me, but rather his goal was to screen me out.

I called the next day and told him we were interested and whether he could send me the contract so we can review the terms and sign. He told me he can only meet in person. Since my partner is in another state, I told him we would be happy to do that but he would have to fly across the country. He said he can’t do that. Strike 3.

We decided the sales process and business practices are too sketchy for us to engage with them. They promise great rates, but won’t put anything in writing and keep saying “it depends”.

While we have not done business with them, they managed to waste a lot of my time and proved to be incompetent with sketchy business practices at best. At least as far as we are concerned, they are out.

It’s strange they behave so unprofessionally. We are currently paying sky-high rates for credit card processing and it appears they can save us a lot of money. But we can’t risk a core part of our business dealing with a vendor who:

1) Has deceptive sales techniques

2) Insists on meeting in person and is 45 minutes late

3) Won’t send a contract to review