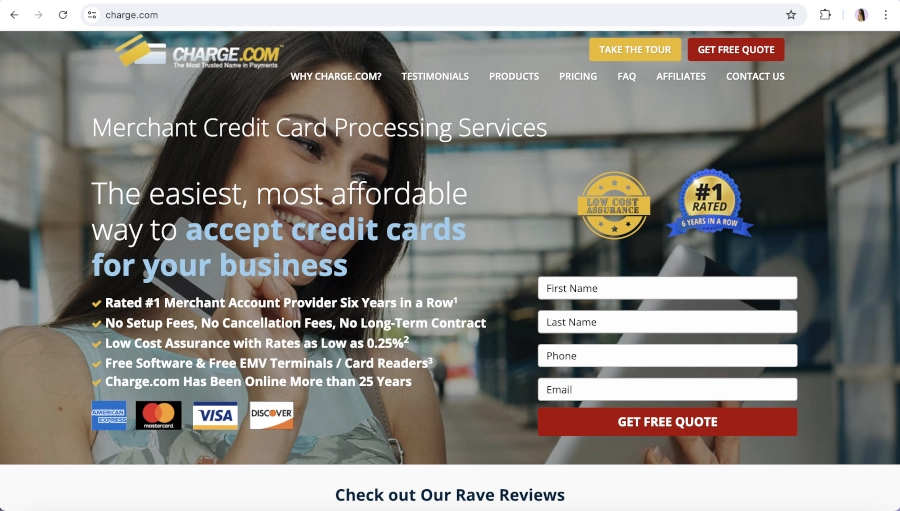

Payment Processing

(link unavailable) facilitates the processing of Visa, MasterCard, Amex, Discover, and checks, whether online, in-person, by phone, mail, or fax, for a variety of businesses. Their offerings include a free terminal or swiper, mobile solutions, a virtual terminal, e-commerce solutions like shopping carts, SEO services, online management and reporting, and SSL certification.

Virtual Terminals

(link unavailable) provides secure, web-based virtual terminals for businesses to accept payments online. This service is useful for businesses without a physical storefront or those primarily operating online.

E-commerce Payment Solutions

For online businesses, (link unavailable) offers e-commerce payment solutions, including a secure payment gateway that integrates with business websites for real-time transaction processing. These solutions enable businesses to accept payments globally.

Mobile Payment Processing

(link unavailable) offers mobile payment processing services, allowing businesses to accept card payments using mobile devices. This service is ideal for businesses operating outside traditional brick-and-mortar settings.

POS Systems

(link unavailable) provides Point of Sale (POS) systems designed to streamline business operations. These systems manage sales transactions, track inventory, and store customer information, offering a comprehensive business management tool. For details on specific POS systems, contacting the company directly is recommended.

Recurring Billing and Subscription Management

(link unavailable) supports businesses with subscription models or recurring billing needs by offering solutions that automate the billing process. This service allows businesses to collect regular payments for ongoing services or subscriptions without manual intervention.

ACH Processing

(link unavailable) provides ACH processing services for businesses to accept electronic payments directly from bank accounts. This fast, secure, and reliable service is ideal for businesses handling recurring payments or large payment volumes.

Chargeback Prevention

(link unavailable) offers chargeback prevention services to help businesses minimize the risk of chargebacks, which can lead to lost revenue and increased fees. These proactive services aim to resolve disputes quickly and efficiently.