Overview

In this review of Gotmerchant.com, we will provide a detailed overview of the company's credit card processing services. We will cover the range of services they offer, including point-of-sale (POS) systems, mobile payment solutions, and e-commerce capabilities. The review will identify the types of businesses that might benefit from these services. Additionally, we will examine client and customer reviews to highlight common trends and potential concerns. The article will also address the company's pricing structure, contract terms, and specific services provided. By the end of this review, you will understand whether Gotmerchant.com meets your payment processing needs.

About Simple Solutions

Founded in 1998 as a web hosting company called Simple Solutions, the company changed its name to “Gotmerchant.com” in 2001 as it shifted its focus to credit card processing.

Affiliation with Harbortouch

The Better Business Bureau lists Curtis Stevens as the CEO of Gotmerchant.com. We have also been repeatedly contacted by a sales agent named Curtis Stevens in the comment section of our Harbortouch review, and this second Curtis Stevens appears to be employed as an independent sales rep for Harbortouch.

Given the fact that the BBB lists a PO box in Fate, Texas, as the address for Gotmerchant.com, it appears very likely that the same Curtis Stevens who is the president of Gotmerchant.com is the Curtis Stevens who works as an independent sales agent for Harbortouch. In addition, a BBB complaint filed against Gotmerchant.com in November 2014 explicitly names Harbortouch as the entity with whom the client did business. It therefore appears that Gotmerchant.com and Harbortouch may not operate as entirely separate entities.

Gotmerchant.com Products and Services

Payment Processing

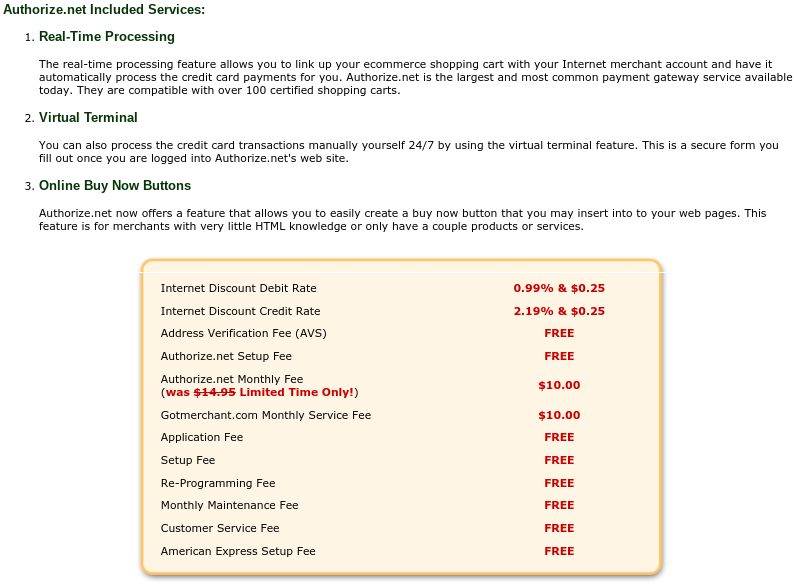

Gotmerchant.com is a merchant account provider that processes most major debit and credit cards for businesses of various sizes, from small startups to large corporations. The company features Harbortouch as part of its complimentary POS system offer. Their range of services includes electronic cash registers, card swipers, Yahoo Store merchant accounts, access to the Authorize.net payment gateway, virtual terminals, wireless and mobile processing, mail order and telephone order (MOTO) services, QuickBooks integration, e-commerce solutions with shopping carts, cash advances, and fraud and chargeback protection measures.

Liam Mary

I’ve been in the retail business for over a decade now, and I’ve tried my fair share of merchant service providers. However, ever since I signed up with Gotmerchant.com, my experience has been nothing short of exceptional.

From the get-go, their customer service team impressed me with their attentiveness and personalized approach. They took the time to understand my business needs and offered me a tailored solution that perfectly aligned with my requirements. Unlike some other providers, they didn’t try to upsell unnecessary services, which was truly refreshing.

One thing that really sets Gotmerchant.com apart is their user-friendly platform. It’s intuitive and straightforward, making it a breeze to navigate through the various features. I can easily track my transactions, manage inventory, and even generate insightful reports to help me make informed business decisions. All of this has significantly improved my operational efficiency, and I can now focus more on growing my business.

But the real game-changer for me has been their competitive pricing. Gotmerchant.com offers transparent and affordable rates, without any hidden fees. It’s such a relief to have a merchant service provider that values honesty and integrity, especially in an industry that’s notorious for its complicated fee structures.

Another aspect that I admire about Gotmerchant.com is their dedication to staying up-to-date with the latest technology and security standards. I feel confident knowing that my customers’ payment information is protected with top-notch security measures in place.

Overall, my experience with Gotmerchant.com has been top-tier. I can genuinely say that they have exceeded my expectations in every aspect of their service. Whether you’re a small business owner like me or a larger enterprise, I highly recommend giving Gotmerchant.com a try. Their winning combination of exceptional customer service, user-friendly platform, and competitive pricing is a game-changer in the merchant services industry.