Overview

In this review of Handepay, a key merchant account provider in the UK, we'll cover essential topics like their rates and fees, contract terms, and common customer complaints. We'll also discuss Handepay's services, which include online payment processing, next-day funding, and virtual terminal offerings.

Our analysis will evaluate the pros and cons of Handepay's services, drawing insights from customer reviews and feedback on Trustpilot. Additionally, we'll look into the quality of Handepay's customer support and the details of their service costs, including any cancellation penalties and equipment leasing terms. This review aims to give businesses a clear and comprehensive understanding of Handepay's offerings.

About Handepay

Handepay is a UK-based merchant account provider that operates as a reseller of Streamline, a much larger UK processor. The company is also partnered with EVO Payments International as an overseas reseller of EVO's products. Handepay appears to operate an equipment leasing subsidiary called “Merchant Rentals” that shares Handepay's address. In November 2020, Handepay was acquired by PayPoint, a UK-based merchant account provider, which also acquired Merchant Rentals (a possible DBA of Handepay) in the same agreement. In 2022, Handepay partnered with Funding Circle to provide business loans.

Handepay Products and Services

Payment Processing

Handepay facilitates credit and debit card processing for a variety of business types, with a particular emphasis on online payments. Their services encompass in-person processing through POS systems, mobile payment solutions, and contactless card readers. Additional offerings include PCI compliance, processing for Apple, Google, and Samsung payments, an online payment gateway, a virtual terminal, pay-by-link services, recurring payments, shopping carts, and a client referral program.

Next-Day Funding

Handepay enhances cash flow for businesses by offering next-day funding. They also do not impose fees for PCI DSS compliance or non-compliance.

Online Payments

Handepay's online payment gateway enables businesses to operate around the clock, securely accepting online payments.

Phone Payments

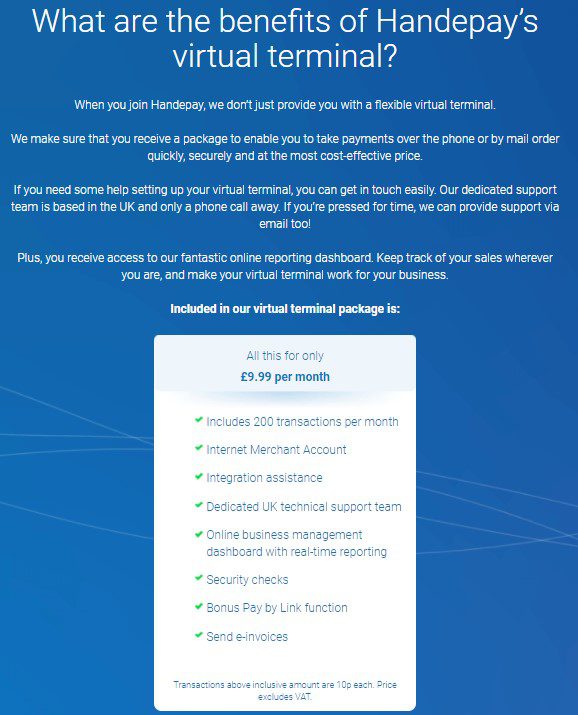

For businesses handling mail or telephone orders, Handepay provides a virtual terminal to process secure card payments over the phone.

Business Services

Handepay offers a range of additional business services, including financing through Funding Circle, EPOS systems, and business legal advice. They also support payment loyalty programs.

Kirsty berry

Absolutely disgusting treating of a family run business in chard not giving them there money forcing the shop into financial hardship where they can pay suppliers or staff!!!! Emerys newsagents in chard!!!!

CPO

Kirsty,

This article should help: How to Make a Credit Card Processor Release Your Money.

-Phillip

Michael Pittaros

Found Tyrone to be extremely helpful from start to finish. He managed to get me out of my existing contract.

CPO

Hi Michael,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!

James Riley

waited the full 12 days after providing them with passports. bank statements. mortgage statements etc, only to be told after I CONTACTED THEM, that EVO??? needed to see full accounts for the last 2 years. We are a small trading partnership that do personal tax returns and don’t have full accounts. Waste of time, mine and theirs! ridiculous. If that’s hat thet’ll be like to deal with on a regular basis, I think we got off lightly.

Back to SQUARE one.

This post will help: Best UK Merchant Accounts

Paul

I would not trust Merchant Rentals. The staff were lovely on the phone but I was surprised to find out that after having my terminal for years I was trapped in some kind of automatic renewal. I have had to give up working for heath reasons and this is financially crippling. I explained to them that I needed to end my contract and why. They were not very helpful with me and I had to pay 7 months rental to escape. All well and good but when I am not working it is literally emotionally and physically going to affect me.

With this auto renewing contract that the sales rep all those years ago failed to explain to me and my current bad health I do not have the strength or mental ability to argue, but please be very careful.

Thanks to the staff for kind words, but sorry I could not recommend Merchant Rentals.

This post will help: Best EMV Card Readers for Purchase

– Phillip

Victoria Nagy

High pressure sales by quick talking salesman complaining of parking ticket time restriction for not having more time….The result;

I wasn’t properly explained that the contract is for four years. There is no cooling off period! None!

The sales person, though very politely, place a lot of pressure on me to hurry. both times he came to see me he was on short time as his parking was running out. I felt pressured but trusted him. It was my mistake. He had shown me a leaflet that if I didn’t save money I’d get £1000. Free rental till April and so on. He talked very fast and hurried me along. When I pulled up the contract on the screen he gave me no time at all to read just scrolled to the sign bit and told me to click there…and there and that he had “only four minutes left on his parking before he gets a fine”.

Had I been clearly told that the contract locks me in for four years, I would not have signed it. When he came by the next day I told Mr Martin the salesman that I don’t want the contract and he said to contact Handepay. (He then rushed out the door.) – So I wrote to My Fiona Lyons who unsurprisingly believed her sales staff’s as opposed to my word. She advised me to contact Merchant Rentals by phone. So I have spoken to Mandy who told me that I will probably have to pay four years worth of rentals and other costs. (over £1300+ in my calculations) – I am well and truly closed! – Seeing that my shop doesn’t make £1300 most months, there is no way I can afford to pay. – Although I found Handepay’s staff polite, they are also unrelenting and unsympathetic.

From The Editor

This Post Might Help: Cancelling a Merchant Account Without Paying a Fee

Brian Walklett

Almost a carbon copy of Victoria Nagy review above.

Rushed into a 4 year contract along very similar lines/tactics as above review and sales person appears to be believed and I am not. Tried to cancel day after signing 4 year contract and told I am locked in. I intend to retire in 1 to 2 years as I am already 65 years old. I would never have agreed to a 4 year contact if I had been aware. Feel angry and cheated.

John Stone

Avoid Handepay at all costs, terrible morals and shocking behaviour.

This is a long review but if you are thinking of using handepay please read it so you can see the type of company you are dealing with.

I have been with handepay for a while and put a lot of transactions through my terminals. Last year I took a cash advance from Quick capital … This was repaid through the card machines

Recently I was shopping around for the best rate on card terminals and wanted another cash advance for an equipment purchase.

I was offered both from an alternative company. I told handepay I was shopping around and they knocked a miniscule amount off my fees. I declined this and sadi I was going with another provided. Miraculously I was transferred to retentions who tells me they didn’t think I was seriously leaving, if I was I should have been passed to them.. after providing them with the fees I was offered I still haven’t had a counter offer from them but in the meantime they couldn’t compete with my cash advance from another supplier.

Here’s where they show their true colours . When I told them I was taking the cash advance from another supplier and paying it through my terminal (after Evo payments gave me a written confirmation this was fine) handepay got involved with Evo pay and told them not to change my bank details to the new supplier.. basically if they couldn’t have my business no one could. This just shows the true lack of integrity and resembles a child spitting their dummy out.

Backfired… I’ve still got the funding elsewhere.. and am now changing card processor too.

Handepay are a very greedy company.

They want the business from everywhere and when they don’t get it they sulk.

Your terminals are rented from “merchant rentals” handepay set your rates and quick capital provide the cash advance.. on paper all seperate entities… BUT… all ran from and registered to the same building in haydock and a quick check on companies House shows same people involved in all of them.

I have also had numerous referrals that have never been paid…

One thing is for sure I would never ever refer or recommend handepay , terminal rentals or quick capital to anyone again and will make sure I let as many people I can know about their underhanded tactics.

Another thing they like to do is report negative reviews to trustpilot . I can assure you this is genuine , I have emails and phone call recordings to back it up and also my business is Stone Tyres in ST Helens should you or any prospective customer wish me to verify anything in here.. Shambles of a company and one to be avoided at all costs.

From The Editor

This Post Might Help: Best UK Merchant Accounts

john small

I have had a lot of trouble With Handepay.They keep you hanging on the phone for ages and it cost me a fortune.

also , they don’t reply to my letters to head office.

Sincerely,

John Small

Trevor Manning

I was recommended by a friend I found the service from beginning to end excellent Lindsay went far beyond my expectations in terms of information and service and after care once installation had been completed

Many thanks

CPO

Hi Trevor,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!

Adam

Signed with Merchant Rentals on the proviso that the other contract with Evo went through. We decided as a company that we weren’t comfortable with them having full access to our accounts and did not go ahead and sign. Now we are being threatened with legal action as we are refusing to pay Merchant Rentals. They only release a terminal once you have signed with Evo, we have informed them that we are not going to and were under the belief (via the sales person) that the contract would only be formed if all the different parts were confirmed. This is not so. They want us to pay for a terminal we do not have, have never had and will never have. They are refusing to do anything about it, merely stating that we have to pay. How can this be legal. I have tried to get them to cancel the contract and see sense but that is not something they hold in abundance.

From The Editor

This Post Might Help: How to Get Out of a Merchant Account Contract

sanjay makwana

Avoid handepay, going to take legal action for a terminal i dont even have and never will. Wasnt happy with the rep , tried cancelling less then 17 hours after hed gone at 16.00pm “working 9 -5pm ” Told rep at 9.00pm to cancel the whole, he obviuosly not bothered back in november, now they want me to pay 948.00 ang got a debt agecy involved. are these people human beings or what, the rep never mentioned about cooling off periods or anything else, Everybody on here and reading this need to go trust pilot and post there.

This post will help: Cancelling Your Merchant Account Without Paying a Fee

– Phillip

John

Came up with a 30% saving over my existing card provider. The terminal hire charges are rather high £9 a month higher than our previous company charges for WiFi terminal. Be very careful the will want to sign you up immediately with e dign. There is absolutely no cooling off period once you have signed and returned e sign form. Threaten you that you are committed to a 5 year contract. And no get out clause be very careful. Make sure before you sign I found customer care helpful and terminal was delivered 3 days late. But installed and set up and fully working by courtier.

Manjit singh

Hi Mr Deepak Sehdeva provided me with superb services and I would recommend anyone to handepay

CPO

Hi Manjit,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!

JEFF

Warning to all business owners please be aware of these CROOKS, they are just conmen in disguise, had the misfortune of signing up below are the results of three days……….

Terminal rejected over 150 transactions, in first day of trading lost well over £700 in free food given to upset customers, called the help desk on numerous occasions and they could not help after trying several times to resolve, when calling out of hours the call goes to the USA who claim the can not help as it is outwith the USA, NOW I AM STUCK WITH A FOUR YEAR CONTRACT, believe me it is better to pay than to stick with handypay.

This review is especially targeted to business owners in Scotland be aware guys the so called Manager will visit you’re premises promising this and that do not be taken in they will deliver dog poo and not give a toss.

BE AWARE BE AWARE DO NOT SIGN UP

CONMEN CONMEN CONMEN

zaffar

where can I start from…………… unfortunately signed up and from day one been having issues with the terminal rejecting card payments, every second payment the terminal rejects, have made several calls to the so called help desk which by the way are as useful as a old broken chocolate teapot but no joy.

had the terminal for five days and have almost 150 rejected transactions and lots and lots of unhappy, angry customers.

be aware do not sign up as the service is crap terminal and software are crap, I am now going to have to pay four years charges to cancel which I will do it is that bad.

be aware do NOT SIGN UP WITH THE PROMISE OF SAVING MONEY YOU WILL LOSE OUT

RAY

very dis honest company, think three times before you start dealing with handy pay. I never had their PDQ machine in my shop but they start taking money from my account, when i find out I stop them and now they are taking me to court for service they never provided,

there are a lots of other companies out there as good as gold, MERCHANT MONEY OR CAPITAL ON TAP.

Mark Salisbury

Appalling company avoid like the plague handy pay and merchant rentals are in bed together constant harassment whilst under review by the financial ombudsman for selling terminal which we never received

Home Improvements

Absolute joke of a company. Cancellation letter sent along with a written notice of cancellation with the terminals. Claiming they never received and are now wanting to take another 2 years worth of direct debits out due to clause 1.3?? which was never made clear. the clause itself does not make any sense.

You pay for renting the machines if anything goes wrong or you would like to cancel it is impossible as they will keep you for as long as they like.

Threatened with court action when we cancel the direct debit.

STAY CLEAR OF THIS COMPANY.

Nic Skerten

Don’t touch Handepay and Merchant Rentals with bargepole. Just got caught by their automatic extension period and they are trying ot charge me £937 to get out of the lease. Sharp practice – the very least. I will be making a point of publicising this as much as possible.

John Beevor

Handepay (Merchant Rentals continues (Aug 2016) to impose draconian cancellation term and “automatic ” contract extensions .

The only hope is that in a recent case the court has held that a sole trader enjoys the protection of consumer legislation and that legislation makes such clauses unenforceable

Abbi Lewis-Smith

Any Handepay card terminal customers please be advised that if YOU don’t give them written notice A YEAR before your contract term is to end, they will

EXTEND the contract AUTOMATICALLY for another 2 years!!! One of mine was about to end but I have to pay over £700 to get out of it as it was automatically extended (nothing been sent to me to advise) DISGUSTING! It’s all in the small print apparently. Given notice on my other PDQ machines so will be looking for another, more empathetic card provider.

They are meant to help small businesses, not put them out of business for charging for something that’s not even being used.

Tracy Heppenstall

Please think twice before using this company ! The minute you have a problem with your card machine they are not interested , (I spent 48 hrs which when you work in a busy hairdressers cost me a fortune ). Trying to find out who I should get a machine from !! !!! !!!!! Eventually I got it sorted but I was exhausted at the end of it . I had a three year contract which I realised finished in July ! I was a month late as now automatically have signed up for another year !

Plus they have now told me that the machine is only guaranteed for 1 st 12 months ! So be where if you have a 2 or 3 year contract , you are only covered for 1st year !

Their fees are high too but I sighed up to that so only me to blame ,just would like a company that replace or talk you through how to repair a machine . Is that to much to ask !!!!!!

Rod

As I have decided to close my business, I contacted handepay/Merchant Rentals at Haydock to inform them of cessation of business. As with normal utilities viz electricity, gas etc all these processes are well tried and tested and taken in the stride. Not with Handepay though as I have discovered. They have sent me a bill amounting to £550 to cover the period up until October 2017 !!!! As I have only received this shock today, I haven’t decided what to do about it or even contacted Handepay with any response. Any advice would be welcome.