Overview

This review provides a comprehensive review of High Risk Commerce, a credit card processing company specializing in services for high-risk merchants. We will detail the range of services offered, including merchant accounts, payment gateways, and chargeback management tools. The article will also cover the company's pricing structures, contract terms, and overall reliability. Additionally, we will assess customer feedback and support quality to provide a thorough understanding of the user experience. Comparisons with other high-risk payment processors will also be included to help you determine if High Risk Commerce is suitable for your business needs.

About High Risk Commerce Overview

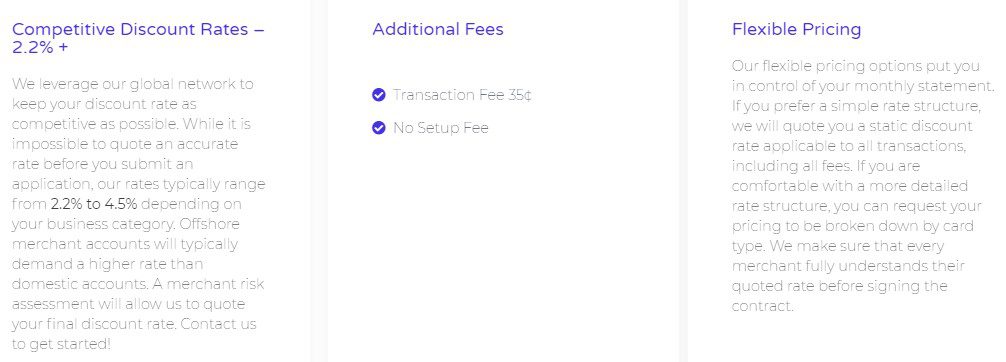

Founded in 2014, High Risk Commerce is a merchant account provider that specializes in high-risk business types. The company appears to be either a DBA or a subsidiary of Conquest Financial, as the two companies share an address and their owners share last names. Conquest Financial is a reseller of Elavon products and services, but High Risk Commerce may be partnered with a number of backend processors and acquiring banks in order to serve a wide range of high-risk businesses. Notably, single transactions made through High Risk Commerce cannot exceed $750.

High Risk Commerce Products and Services

Payment Processing for High-Risk Merchants

High Risk Commerce provides payment processing services tailored for high-risk merchants, including industries like online gambling, pharmaceuticals, and adult entertainment. These sectors face higher regulatory scrutiny and associated risks, and High Risk Commerce aims to offer secure and reliable transaction processing to help these businesses manage payments effectively while complying with industry standards.

Recurring Billing

High Risk Commerce offers solutions for recurring billing that automate the regular collection of payments from customers. This is particularly beneficial for subscription-based businesses, allowing them to handle recurring transactions without manual intervention, ensuring timely payments and better cash flow management.

Fraud Detection

High Risk Commerce provides fraud detection services to help businesses protect themselves from fraudulent activities. These services include real-time monitoring and advanced tools designed to identify and prevent fraudulent transactions. By using these measures, businesses can reduce their risk of fraud and protect their revenue and reputation.

Processes Over 120 Currencies

High Risk Commerce supports the processing of payments in over 120 currencies, making it possible for businesses to operate on a global scale. This capability allows businesses to accept payments from customers worldwide, facilitating international trade and expanding market reach.

Virtual Terminals

High Risk Commerce provides virtual terminals that allow businesses to process payments using any internet-connected device. This service is useful for businesses that need to accept payments remotely, such as over the phone or via mail orders. Virtual terminals offer a flexible solution for managing transactions in real-time, which can enhance operational efficiency.

Testimonials & Complaints

How Did High Risk Commerce Treat You?