Note: As of 2022, the iPayHere website has been down for some time, and we can find no evidence of activity from the company in recent years. We consider this company closed and will no longer be updating this profile. If you have any information to the contrary, please let us know in the comment section below.

A Switch Commerce Subsidiary

Launched in February 2014, iPayHere is a subsidiary of Switch Commerce that offers merchant accounts for a wide range of business types, including retail businesses, restaurants, non-profits, and churches. iPayHere was originally founded in partnership with WorldPay, but it currently resells First Data‘s Clover point-of-sale products alongside its own hardware and software solutions. iPayHere's mobile phone reader is only capable of processing magnetic stripe payments at this time, but the company offers a mobile reader from Clover that accepts EMV payments. iPayHere appears to have supplanted SwitchPay as the primary mobile credit card reader offered by Switch Commerce.

iPayHere Location and Ownership

iPayHere is a registered agent of Citizens Bank, N.A., Providence, Rhode Island, and a registered ISO of Wells Fargo Bank, N.A., Concord, California. It is headquartered at 6565 N MacArthur Blvd, Suite 1000, Irving, Texas 75039. Roger Myers is listed as the president of Switch Commerce.

iPayHere Review Table of Contents

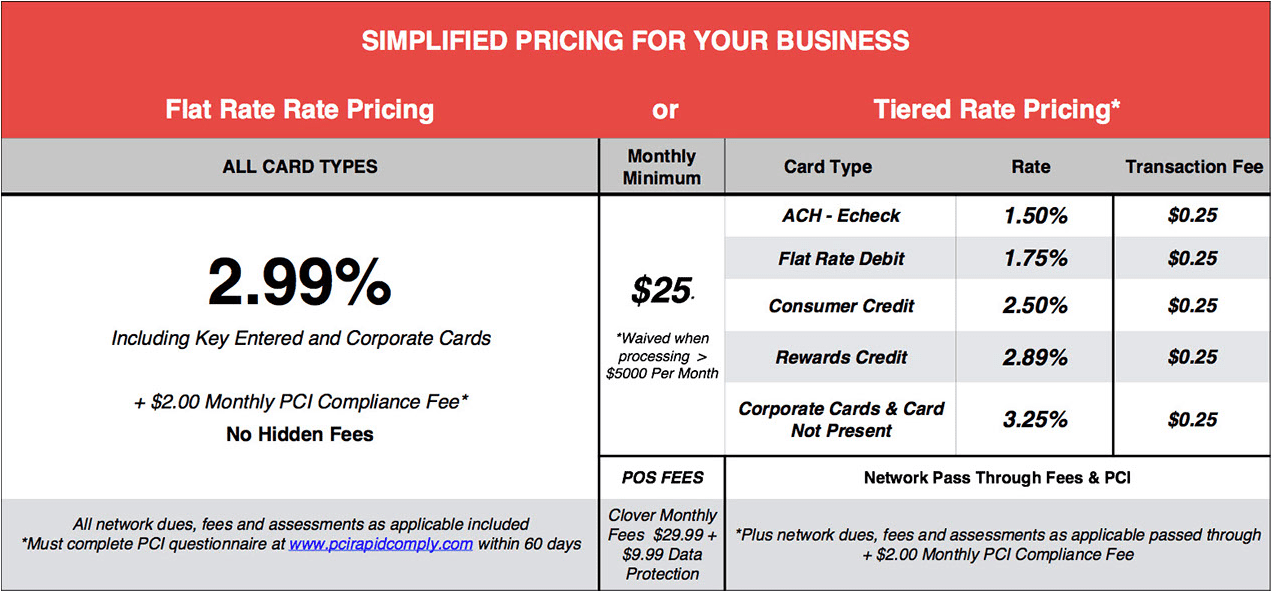

- Costs & Contract: iPayHere appears to offer a month-to-month contract with no early termination fee.

- Complaints & Service: iPayHere complaints number fewer than 10 on public complaints forums.

- BBB Rating: iPayHere does not currently have a profile with the Better Business Bureau.

- Sales & Marketing: iPayHere does not appear to hire independent sales agents and has not received any complaints about its sales practices.

Charles Diane

iPayHere has been an absolute game-changer for our business! As a small enterprise, we were looking for a seamless payment solution that would boost our sales and streamline transactions. iPayHere not only met our expectations but exceeded them. The platform’s user-friendly interface made it a breeze for both our team and customers to navigate, while its robust security features ensured that all transactions were protected.

From the get-go, the setup process was a breeze, and the customer support team was incredibly responsive and helpful. iPayHere’s integration with our existing systems was seamless, saving us time and effort. Since implementing iPayHere, we’ve noticed a significant increase in online sales and a reduction in payment-related issues.

We highly recommend iPayHere to any business seeking a reliable, efficient, and secure payment solution. It’s been a pleasure working with their team, and we’re excited to see our business continue to flourish with their support!