Overview

Partner Payments is a merchant account provider that offers credit card processing services. This article will review the company's services, pricing structure, contract terms, and customer feedback. We will discuss the company's fee transparency, customer service quality, and the overall satisfaction of its clients. By the end of this article, you will have a clear understanding of what Partner Payments offers and whether it meets your business's payment processing needs.

About Partner Payments

Launched in 2016, Partner Payments is a merchant account provider that serves most standard and high-risk business types. It is a subsidiary of Secure Payment Systems, a Nevada-based payment processor that has been active since 1996. Partner Payments may also operate under the name Partner Management Group, LLC. and as Inspivo. It is also reported that Revint Solutions purchased Partner Payments in 2019.

Partner Payments Products and Services

Payment Processing

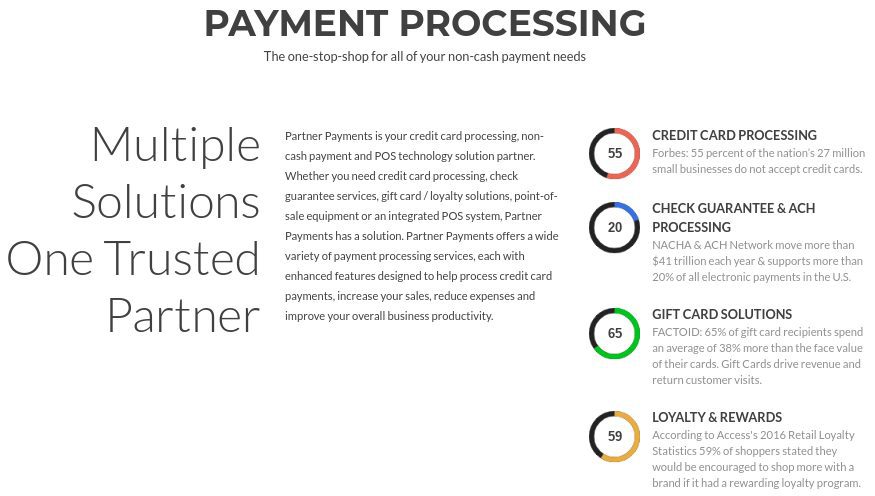

Partner Payments handles payment processing for most major debit and credit cards, catering to various business types, including small businesses and high-risk industries. Their services encompass payment gateways, mobile solutions, POS systems, MOTO, ACH, gift and loyalty programs, and recurring payments.

Check Guarantee Services

Partner Payments offers check guarantee services that ensure businesses receive the full amount of any approved check at the point of sale, mitigating the risks associated with accepting checks.

Gift Card & Loyalty Solutions

Partner Payments provides gift card solutions designed to increase foot traffic, sales, and customer retention. They help retailers establish and manage store-branded gift card and loyalty programs on various scales.

Comprehensive Payment Solutions Provider

Partner Payments presents itself as a comprehensive provider for all payment processing needs, regardless of business type or payment method. Their offerings include credit and debit card processing, gift card solutions, check guarantee services, and loyalty programs, aiming to be a one-stop shop for their clients.

Eli Judith

As a small business owner, I can’t help but gush about my incredible experience with SwitchPay. It’s not often that I find a service that seamlessly blends professionalism with a relaxed, user-friendly interface.

SwitchPay has been an absolute game-changer for my company’s payment processes. From the moment I signed up, their customer support team was attentive and helpful, guiding me through the setup process with ease. They truly understand the needs of businesses like mine.

One of the standout features of SwitchPay is the ability to accept multiple payment methods effortlessly. My customers love the convenience of choosing between credit cards, mobile wallets, and even bank transfers. This versatility has undoubtedly boosted our sales and customer satisfaction.

Security was a top concern for me, but SwitchPay left no room for worries. Their robust encryption and fraud detection systems give me peace of mind, knowing that my customers’ data is safe and transactions are secure.

But the benefits don’t stop there. The intuitive dashboard makes it simple to track sales, monitor trends, and generate insightful reports. I can now make data-driven decisions to improve my business further.

Another standout is the seamless integration with our existing software and POS systems. I was pleasantly surprised by how effortless it was to synchronize SwitchPay with our tools, saving us time and reducing the chances of errors.

To sum it up, SwitchPay is a dream come true for any business owner looking to streamline their payment processes. It’s the perfect blend of professionalism and user-friendliness. Their support team is top-notch, the security is rock-solid, and the features are abundant. I wholeheartedly recommend SwitchPay to fellow entrepreneurs seeking a reliable payment solution for their business.