Overview

In this review of CreditCardProcessing.com, we will provide an insightful overview of this merchant account provider. We'll focus on key aspects of their service offerings, including their payment processing capabilities, pricing models like Interchange+ and flat rate pricing, and their specialized cash discount option for businesses.

We'll also discuss CreditCardProcessing.com's account management tools, PCI compliance standards, and provide a brief background on the company's history and leadership. Additionally, we'll explore the pros and cons based on customer feedback and industry reviews. Key elements such as customer service quality, online ratings, fees, and contract complaints will be covered to give a well-rounded view of the company. This article aims to offer businesses a clear understanding of what CreditCardProcessing.com provides in the realm of merchant services.

About CreditCardProcessing.com

CreditCardProcessing.com is a merchant account provider that appears to have operated as either a subsidiary or an ISO of Paysafe (formerly iPayment). An early version of the company's homepage described it as “an iPayment company,” so it is likely that CreditCardProcessing.com exclusively offered iPayment contracts prior to its acquisition by Paysafe Group. At the time of this update, CreditCardProcessing.com is a contracted reseller of First Data, now known as Fiserv.

CreditCardProcessing.com Products and Services

Payment Processing

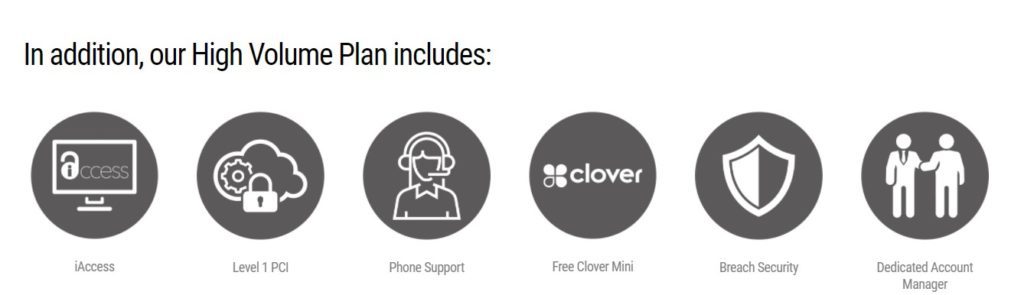

CreditCardProcessing.com facilitates the processing of most major credit and debit cards. They provide online reporting through iAccess, Level 1 PCI compliance, phone support, breach security measures, and a dedicated account manager.

Payment Gateway Services

The company's payment gateway services allow businesses to accept credit and debit card payments securely through their websites. This gateway can be customized and integrated with popular e-commerce platforms like Shopify, WooCommerce, and Magento.

Pricing Models

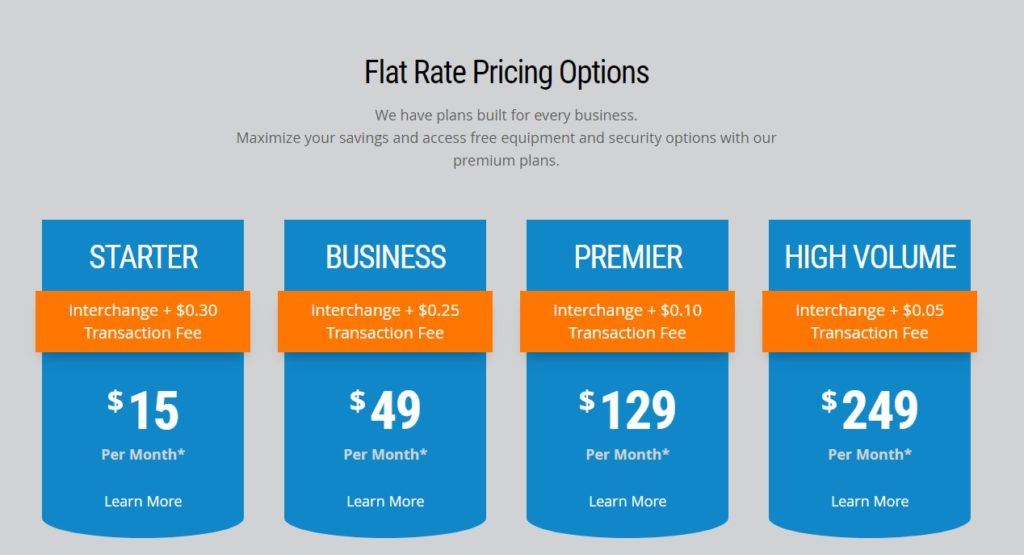

CreditCardProcessing.com offers various pricing models to meet different business needs. They provide Interchange+ pricing, which can be tailored to fit specific requirements.

Flat Rate Pricing

They also offer flat rate pricing through monthly membership plans, designed to potentially reduce costs for businesses.

Cash Discount

For eligible businesses, CreditCardProcessing.com provides a cash discount option aimed at significantly reducing processing fees.

Account Management

The iAccess feature enables businesses to manage their accounts, access statements and reports, and create support tickets.

PCI Compliance

Level 1 PCI compliance is included with monthly membership plans and is available to qualified merchants across all pricing plans.

Eddie H

They have too many hidden and annual fees. They keep charging annual fee without notice after I canceled their service . Their service is worst ever. Do not give them your bank account number.

Joshua

I had a terrible experience with this company. After being assured by their representative this would be the most effective way for me to process credit card payments for my small business, I found myself pay a ton of hidden fees. I ended up paying $97.11 in fees for the $280 credit card transaction I processed in November, 2018. The customer service is awful, and wait times often exceeded 20 minutes. Upon closing my account they refused to refund me any of these hidden fees.

From The Editor

This Post Might Help: Best Merchant Accounts for Cleaning Services

Anonymous

Creditcardprocessing.com is the worst company I have dealt with in the 21 years I’ve been in business. They allow third party companies to charge you for services you never asked for . My processing rate went from 1.37% to over 6 % . PCI scans every 3 months is a joke . Something always go wrong so they can charge you a late fee . Plus it’s a real hassle. Plus the PCI annual fees . Not to mention all the monthly fees . Now I’m in the process of canceling. They have to email you a form to fill out and then ask you to fill it out . Of course after I filled it out two days later I still haven’t heard anything I called and was told they didn’t receive it . After I got upset he found it after a 5 minute hold . He said sorry it will take a little bit longer. I said more then 2 days to cancel an account? He said yes . I should have left a long time ago the first time I say $30 extra dollars being taken out of my account.

mike

Despite filling out an ACCOUNT CLOSURE form like I was instructed my bank account keeps being debited each month.

Customer service lies and deceives you will they rack up monthly charges on your bank account.

How this company can continue to be in business is beyond me, they should all be jailed

F Grade dishonest, liars, lack ethics and good faith

Michael Aquino

Agreed. They did the same exact thing to me!! The fact that they are so unwilling to refund ANY amount of $ is a crime. I hope they go bankrupt.

From The Editor

This Post Might Help: Cancelling a Merchant Account Without Paying a Fee

Alejandro

BEWARE! These guys are scam artists! They lure you into signing up with them offering you really good deals making you think that they’re a really competitive card processing company out there, however, you’ll find unexpected surprises whenever your account is charged excessive and undisclosed fees.

I signed up and asked the sales rep. multiple times what I would end up paying if I processed X amount of money in a month, he broke it down to me and it all made sense, after the money got deposited they still charged me an undisclosed and unauthorized $200 + amount.

I tried disputing it with them and they were obviously not helpful at all and refused to refund this money, so I took it to my bank and since they use an ACH system, they are able to get away with this theft because banks usually have a 1 business day windw to dispute any ACH transactions. I was unfortunately out of the country and couldn’t do anything but let them steal from me.

I’m warning you hardworking people out there, avoid these scammers!

Dan S.

Avoid creditcardprocessing.com and iPayment, Inc. They are thieves and will deny any wrong doing on their part, not to mention, outright lie to you right over the phone. They will charge fees for something you never asked for then refuse to refund anything unless you persistently demand it, like everyday. Which is an ordeal and such a headache. The customer service, customer relations dept, and management is absolutely terrible. I can’t imagine how many other customers were ripped off by unknown fees and when they found out tried getting a refund by this crappy company.

Both creditcardprocessing.com and iPayment, Inc (an ISO of Wells Fargo bank) fraudulently opened a second account without our permission back in April of 2016 which they had been charging fees on. The fees were ranging from about $35 to over $120 which I thought was for our physical in store terminal. We opened the account on May, 2014 with Brian Maloney (senior sales consultant) and he was the only person I contacted for questions or info about our account. Brett Erickson (#03313-063) at creditcardprocessing opened this fraud account without our knowledge, and there were no calls, emails, or letters from this person to open an account. I have called Brett and left a voicemail but never heard back from him, nor several other sales people at creditcardprocessing.com. I also called the “sales manager” who told me her name was “Sarah” who verbally promised me that she would investigate by looking up a recorded phone call that I had wanted a 2nd account opened (ridiculous) would call me back in 24 hours. I never heard back from “Sarah”. So I called back and the customer service rep told me that there is no “Sarah in this building, the sales manager is named Kim Nemet” So this Kim Nemet just lied to me by giving me a fake name and never doing what she said she was going to do. Also, no one else there wants to investigate what has happened. They immediately deny everything and blame the customer. They don’t seem to get that an account fraudulently opened isn’t a big deal. Is these companies you want to trust with your money??

md.

overcharged several months more than what was in the contract agreement, after i called they said it was for a specific service (which i did not enroll in). I asked them to remove that service and they said they would credit for those months but they never did. After a few months they began over charging again other bogus fees and again they said they would credit those fees but i have never seen those credits. I have cancelled their service but after cancelling, they continued to bill us for the merchant service.

FRANK NASSER

I was very dissatisfied with Credi CardProcessing and caution any small business owner to do due diligence before subscribing to the service. Startup was complex, tedious and full of legalese. The cost of operations far exceeded our expectations do to hidden charges, mostly nonqualified card fees. Trying to cancel the service was equally complex and tedious. I am still unable to obtain a finishing invoice despite receiving a dunning notice for final charges (which I don’t know what they are, because I don’t have the final invoice). Throughout the cancellation process and the request for a final invoice, Customer Service has been unhelpful and somewhat untruthful.

Christopher Reyes delarosa

I feel like I made a big mistake, everyone was polite and professional in the beginning but after the sign up process everything changed. I got questioned for asking questions. I called the risk department because I wanted to make sure there was complete transparency with me and credit card processing and I asked them. When do you guys usually hold funds and for what reasons ? This is my business and I have the right to call in as many times I feel necessary if I feel uncomfortable, or for whatever reason at all. The agent immediately says “my question to you is, what makes you inquire on something like that” I was in shock. The way the agent said it, it was almost as if I was the bad guy for asking questions. I then tell then answer the agents question politely and professionally and also mention that my sales agent told me to call and ask questions. Then I ask the agent am I not allowed to ask you questions ? The agent then says sarcastically well I’m allowed to answer questions too. And then puts me on hold and transfers me to someone else. The sales agent promised me in the beginning that everything was verified and that there wouldn’t be any sudden holds on my account but shortly after I get a notification that all of my transactions are now suspended and need to be verified. My sales agent then tells me that it is apart of the process and they need to verify a new business. The sales agent should have mentioned that to me when I asked priori to me signing up and I wouldn’t have even bothered. These sales agents will beat around the bush and not be transparent with you and when you’re signed up communication is little-none. I’m disappointed in my business decision. They asked me to send documentation on the transaction and I did and then I started getting asked more questions. Why did you send us a ID of a customer who paid ? (Sales rep told me that I should and that it would make it look more legitimate because I’m using a virtual terminal) Why is your DBA name Moving Services ? Who are you ? How long you been in business ? Have you had a processor before ? I ANSWERED ALL THEAE QUESTIONS IM THE FIRST PLACE BEFORE GETTING APPROVED NOW I HAVE TO GET APPROVED AGAIN AND HAVE MY FUNDS HELD FOR 2-5 days? They don’t message you after getting approved they message you when your scheduled to get a deposit of your funds to then look for any reason to hold your monies. I then told them I feel a little uncomfortable because credit card processing has a lot of complaints online they tell me we been in business since 1987 or somewhere around that time frame I did my research and that’s a LIE thgey have been inn business for about ten years. I told a agent at risk department and said that that have certain complaints that scare me they laughed and said well people are going to complain whenever there funds are held . Almost as if it was amusing to hold someone else’s hard earned money . I don’t know what the end result is I sent documentation I sent info and I’m waiting for a answer. But this company does not make you feel welcomed at all when you call. Be prepared to feel like a criminal everytime you call. And they will make you feel uneasy and very nervous. I feel like I’m about to be ripped off

Ashlie Voerg

DO NOT GIVE THESE PEOPLE A CHANCE!!!! Them or iPayment! They are absolutely horrible!! They held $3,000 of my money until their risk department spoke with 5 of my customers to make sure the transactions were legit! I get that they want to do a risk but there is other ways to go about doing this. The 5 customers are my regulars and it killed me that I had to bug them about this! They then cancelled my account so I couldn’t login while fighting them to release my money. Thank goodness I took pictures of all the tranactions before they locked me out of the app so I had some sort of proof! I’m still out $300 that I’m sure I will never see. They won’t call or email me back and charged me a withdraw and ledger fee? No clue what that’s for and of course I haven’t gotten an explanation. RAY in Risk Management is a horrible person (to put it midly). He basically told me that he doesn’t care if I call him to complain because he hears these complaints everyday all day. He said that it’s no sweet off his back and that I need to have backup funds in order to run a business just incase something like this ever happens!! Really, Ray?!? There are so many other things that happend but I don’t have time to write them all out. AGAIN, NEVER TRUST OR GO WITH THESE GUYS!!!

Carlos Ruiz

This company is HORRIBLE!! Don’t sign up with them it took me months to try and close an account with them. They are incompetent and very negligent, it’ seems they are trying to reach quota and don’t care about you afterwards. This is “company” is a disgrace, wasted my time and money.

Heather

RUDE and UNPROFESSIONAL. I called for their pricing structure. Ultimately I decided to go with a different company. When I told the sales guy that contacted me, he sent me back a rude email basically telling me that I’m going to get ripped off and when I do to call him… um… NO!

He ended all of his emails with the tagline, “Cheers!”… I didn’t know we were going out for drinks, I thought I was requesting information about credit card processing for my business.

Dustin Johnson

Absolutely horrific experience! The customer service is awful. Be prepared to wait a month for anything to happen, after sitting on hold for 20 minutes at time, over multiple calls. Everything goes through a terrible chain of command, therefore you are subject to tremendous delays. Sales reps are deceitful. I was made to think that I would be paying under 2% fee for credit card transactions; at the bottom of 1 email i received, there was a note about “high risk credit cards” incurring an addition 2%… What they don’t tell you is that nearly 100% of credit cards will be deemed high risk! I’ve been trying to close my account for over two weeks now, and they keep coming up with reasons why they can’t close my account…awful company, awful experience, horrible waste of time and money.

Hardworking Customer

We run a health care business and have been using CreditCardProcessing.com for roughly 3 years to process credit card payments. Our income from credit card payments is 10 to 20 k per month. The biggest issue with this company is they do not give you a peace of mind! We have to watch them closely EACH MONTH through the monthly statement for the additional fees or rate (qualified, midqual, nonqual) increase they try to sneak up on us – something we did not agreed upon when signing up services with them. In the 3 years we are with CreditCardProcessing.com, they’ve done that relentlessly. To give them credit, typically if you call Customer Services they would refund the additional fees or restore the rate. If you want to use them, prepare to make those calls often. We are seriously thinking of leaving them.

Margaret C

Thieves. Do NOT use them. They will rape your account. They are immoral heartless robots.

Richard .M

I run a non-profit for the homeless. First off they required me to open 5 accounts to run 10 swipers. Later I found that I only needed two accounts to do that. I opened these accounts for 2 fundraisers over a 30 day period. Today I went to close the accounts and was informed that I opened two accounts up for 3 year contracts and have to pay a $350.00 early termination fee on both….total scumbags. Of course there are no notes on the accounts during the opening process. Never again…

Teresa

This is a horrible company. I started with them March of this year. They didn’t get me the terminals on time. They have been over charging me for terminals that aren’t being used. It took them 60 days to credit me and still have not credited me the correct amount. and now, because I got rid of two terminals they charged my account and I can no longer access the iAcess website, I have been calling for 2 weeks and no one can get it right!!! they have the wrong email for me and refuse to change it!!! I am soooo done with this company. I will be canceling immediately….DO NOT USE THEM!!!!

Steve Crowder

Worst company I have dealt with, lie to you at every turn. Takes forever on hold to get ahold of customer service. RUN,RUN,RUN, FAST, did not know how well I had it with Elavon.

david barlow

horrible company to do business with. rates our not what they quoted and when you try to cancel they will keep billing you $32.95 a month. run as far as you can from these guys. customer service if you do get someone is the worst. nothing but attitudes

Paul Yost

Not too thrilled with it taking OVER a WEEK to get me a new terminal when it died in warranty. There backup for these situations is pretty sloppy and non-existent. I am stunned how ridiculous the whole process is and amount of time its taking, I know it would not be this long if they were in my position!

Richard Adams

Creditcardprocessing.com has the worst costumer service and rudest costumer service. I have sent numerous emails, faxes, and letters to cancel my account and even had email as well as verbal acknowledgement and yet for 5 months the continue to bill me and charge my bank. Each month I spend 2 to 3 hours on the phone with their very rude and uncooperative customer service trying to resolve this issue.

Alden Treadway

I have never been more unsatisfied with a service that I am paying plenty for. Once approved, I immediately ran into contradictions. The percentage taken out of each transaction was much higher than what was agreed upon and initially discussed with my representative. After trying to contact him for days, I finally got in touch with his supervisor, who told me “he is a sales person and doesn’t have time to return my calls”, even though I had a scheduled phone call with him (F++ customer service). I then noticed that transactions I was making were not being deposited into my account. Even worse, this company is STILL taking money out of my account while withholding MY money from me. I have been hung up on multiple times. I have been trying to speak with anyone who can help me on the phone for 4 days in a row to attempt to resolve this issue. I have only spoken to one person who told me “his hands are tied”. Please, please DO NOT DO BUSINESS WITH THIS COMPANY. At this point I am convinced it is a scam.

Monica Southerland

Don’t be tricked into signing with this company. There are hidden fees, and my fees change every month. Can’t get any help from the operators concerning the matter, and there very rude. I am also in a contract with them and can’t get out of it unless i pay a fee.

—

Are you with CreditCardProcessing.com? Learn how to resolve this complaint.

Steve Crowder

Signed up with Mytro, worst after the sale service ever. Took them a week longer than they promised to send machine, charged my account before anything was used or received still not up and running and no one will call back. Am going to turn over to my attorney to handle. Don’t walk away from this company, run fast.

Nate

They lied about the price. When I signed up I got a bill for 5x the price quoted. Plus it took them 6 weeks to get me the card reader, when they said I could get it by the end of the first week.

Bill Johnson

I tried to cancel service 3 times with Roy Bondurant” [email protected]

back in feb 2015 and twice in march. He said “he would take care of it. I have NEVER used this service.

They have been whacking me for $32.95/ea month since jan 2015 when I signed up a trial period.

Today I noticed I am still being charged monthly fees!

This company is a RIP OFF SCAM ALERT

Corey D

Sign-up and account approval is quick and easy, that’s where the “Pros” end. Prior to signing up I spoke in detail to their representative about fees and charges associated with the use of their products to ensure I had a good understanding. Unfortunately I found out I was completely mislead. To my dismay within about a month I was charged over $114 in various fees. I immediately called the company and explained this to them. Their representative was not even able to explain all of the fees they charged me yet I still had to pay them. I immediately canceled.