Accepting Credit Card Payments on Android

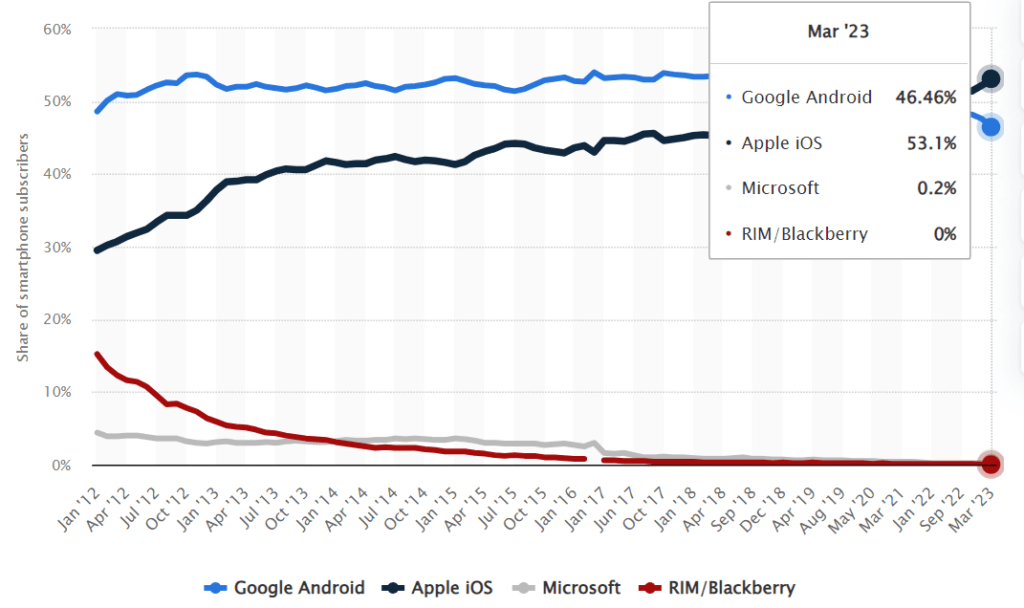

Android smartphones are quickly becoming as popular as the iPhone and offer many of the same apps (also see: Best iPhone Credit Card Processing Apps). In fact, the U.S. is the only country where the iPhone has more market share than Android, with Android dominating over 80% of the global smartphone market. Gone are the days when developers left Android as an afterthought to their app development. If company wants to compete, they need to take Android just seriously as iPhone. Due to this, there are now numerous credit card processing apps for Android that were once only available on Apple devices. Most Android payment apps offer all the same features and conveniences that you would find on Apple devices and in some cases Android has better compatibility.

Article Summary:

Before we dive into the rest of the article, here's a summary of what we'll cover.

- Android credit card processing allows businesses to accept payments from customers using their Android devices.

- There are a number of different Android credit card processing options available, each with its own advantages and disadvantages. We'll cover them below.

- These options offer a variety of features, including mobile payment acceptance, contactless payments, and chip card processing.

- The pricing for Android credit card processing varies depending on the provider and the features offered.

- Some of the potential drawbacks to using Android credit card processing include the possibility of funding holds and limited customer support.

The Rise of Mobile Payments and the Importance of Accepting Credit Cards on Android Devices

In recent years, the world has witnessed a significant shift in the way consumers make payments. With the widespread adoption of smartphones and the rise of mobile payment solutions, traditional payment methods are rapidly giving way to more convenient and secure alternatives. One of the most prominent players in this digital revolution is Android, the world's most popular mobile operating system, which has become an essential platform for businesses wanting to embrace mobile payments.

The increasing prevalence of mobile payments can be attributed to several factors. Firstly, the convenience offered by mobile payment apps such as those with Android. Consumers can make payments with just a few taps using their smartphone, eliminating the need to carry physical wallets or rummage for loose change. As a result, businesses that adopt mobile payment methods can offer a streamlined checkout process, reducing waiting times and enhancing the overall customer experience.

Secondly, mobile payments are more secure compared to traditional card transactions. Advanced encryption and tokenization techniques protect sensitive payment data, minimizing the risk of data breaches and fraud. For Android devices, Near Field Communication (NFC) technology enables secure contactless payments, adding an extra layer of security for both customers and businesses.

The emergence of mobile wallets like Google Pay and Samsung Pay has also played a crucial role in driving mobile payment adoption. These digital wallets allow users to store multiple credit cards and make payments effortlessly, making it a convenient choice for consumers seeking a seamless payment experience.

For businesses, accepting credit cards on Android devices is not just a matter of keeping up with the latest trends; it has become a strategic imperative. Embracing mobile payments enables businesses to stay competitive and relevant in an increasingly digital world. Companies that fail to offer mobile payment options risk alienating a significant portion of their customer base, particularly tech-savvy millennials and Generation Z consumers who prefer mobile transactions.

Android Devices are Cheaper

When you are considering the adoption of mobile apps to accept credit card payments, the choice of hardware plays a crucial role in determining the overall efficiency and cost-effectiveness of the payment process. Android devices emerge as a standout option for businesses due to the wide range of choices available and the cost advantages they offer compared to other platforms.

Diverse Device Options

Android devices offer a wide variety of options for businesses to choose from. These devices come in different sizes and configurations, allowing businesses to find the perfect fit for their specific needs and budget. Whether they require small and portable tablets for mobile sales or larger ones for fixed point-of-sale (POS) systems, the Android platform provides numerous options to cater to different business requirements.

Affordability and Cost-Effectiveness

For businesses, especially small and medium-sized enterprises, cost considerations are crucial. Android devices are often more budget-friendly compared to other platforms like iOS. The availability of competitively priced Android tablets and smartphones allows businesses to equip their employees with payment-capable devices without breaking the bank. This cost-effectiveness is particularly beneficial for businesses that require multiple devices for multiple checkout stations or mobile sales teams.

Seamless Integration with Payment Apps

Android's open-source nature facilitates easy integration with a wide range of payment apps and software solutions. Payment providers and third-party developers prioritize developing and updating their applications for Android devices due to the larger user base and more flexible development environment. As a result, businesses have access to a plethora of payment processing options and features that can be tailored to their specific needs.

Customizability and Flexibility

Android devices offer businesses a higher degree of customization and flexibility. Companies can customize the user interface, install additional software, and adapt devices to suit their unique workflows. This level of customization is particularly advantageous for businesses operating in niche industries or those with specialized requirements.

NFC Technology and Contactless Payments

Near Field Communication (NFC) technology is prevalent in Android devices, enabling contactless payment methods such as Google Pay, Samsung Pay and Apply Pay. With the growing popularity of contactless payments, businesses that accept credit cards on Android devices can provide customers with a faster and more secure payment experience, enhancing customer satisfaction and encouraging repeat business.

Wider Availability and Accessibility

Android devices are widely available across the globe, making it easier for businesses to find and acquire the necessary hardware for their payment systems. Additionally, Android devices are not tied to a single manufacturer, making it less challenging to replace or upgrade devices if needed.

Robust Support and Development Community

Android benefits from a large and active community of developers and tech enthusiasts. This support ecosystem ensures ongoing updates, security patches, and a wealth of resources for businesses to troubleshoot issues and stay up-to-date with the latest advancements in mobile payment technology.

Android vs iPhone Market Share, U.S.

How to Choose a Great Android Credit Card Reader

Choosing a credit card processing app for an Android smartphone requires careful consideration of your specific business needs. Here are some key factors to consider:

- Costs: Every provider has a different fee structure, including transaction fees, monthly fees, setup fees, and potential incidental fees. Look for a clear, upfront pricing model that aligns with your sales volume and budget.

- Security: The app should follow PCI-DSS standards to ensure the secure handling of card information. Look for features like tokenization and encryption that protect data during transactions.

- Usability: The app should be user-friendly for both you and your customers. It should have a simple interface, easy setup, and intuitive features that make processing transactions seamless.

- Compatibility: Make sure the app is compatible with your Android device and software version. If you're using other business software, check if the app can integrate with these systems for things like sales reporting or inventory management.

- Payment Types: Your chosen app should be able to accept a variety of payment types including magnetic stripe cards, chip cards (EMV), and contactless payments like NFC (Near Field Communication).

- Customer Support: Reliable customer support is crucial. Look for providers that offer 24/7 support via multiple channels like phone, email, or live chat.

- Reputation: Check reviews and ratings on the Google Play Store and other online platforms. Also, consider the provider's reputation within the industry.

- Features: Depending on your business needs, you may require additional features like invoicing, recurring billing, multi-currency support, or the ability to add tips.

- Funding Time: This is how long it takes for funds from a transaction to reach your account. Faster funding times can improve cash flow.

- Hardware: Some apps may require specific hardware, like a card reader. Make sure you understand what's needed and whether it's included or must be purchased separately.

Our Picks for The Best Apps to Accept Android Credit Card Payment

#1 Helcim

Helcim bubbled straight to the top when we were researching Android credit card processing options. First, the company has a dedicated app in the Google Play Store and offers an inexpensive card reader that can be synced over a bluetooth connection. From there, Helcim offers the best pricing and customer support of all the options we reviewed.

Helcim's Pricing

Helcim offers Interchange-plus pricing to all of its clients at a low markup starting at just 0.30% plus $0.08 per transaction. This means that you pay the exact cost to process a credit as set my the card issuing bank plus the Helcim's fixed markup. In general, Interchange-plus is the most transparent and most cost effective way to accept credit card payments. On top its low processing fees, Helcim charges not other fees, including no monthly fees, no annual fees, and no other junk fees whatsoever. The combination of Interchange-plus and no monthly fees is something that we have found to be unique to Helcim.

Helcim's Customer Support

One of the biggest issues that most businesses complaint about when they use more well-know Android payment apps, is the lack of quality customer support. This, again, is where Helcim stands out. This processor has 24/7 dedication phone support that is highly rated among customer reviews. Many other Android credit card processing options only offer email and chat support. If they do offer phone support, it is only to businesses that process a certain threshold of payment volume. With Helcim, you can reach a human whether you process $5 or $5MM. Overall we feel that Helcim is the best Android app for taking credit card payments.

To get all the details or to signup, start at Helcim's website here or call (888) 506-7812.

#2 CDG Commerce

A very close second on this list is CDG Commerce. Like Helcim, CDG offers a dedicated Android credit card processing app available in the Google Play Store and inexpensive wireless card reader. Also like Helcim, CDG offers highly rated 24/7 customer phone support. The main differences between the company are in their pricing and technology.

CDG Commerce Pricing

CDG offers three different pricing options depending upon a businesses processing volume. These range from a fixed rate for all transactions with no monthly fees, to Interchange-plus, to Interchange with no markup and only a monthly fee. All of CDG's pricing is competitive, but Helcim's costs wins out in most scenarios we tested.

Technology & App

Like Helcim, CDG offers modern technology for its Android card acceptance. However, after testing the two, we preferred the design and user interface of the Helcim Android payment app. CDG's app performed to our standards, but the look is just a little dated and feels a little clunky as compared to Helcim. That said, we still recommend CDG for Android card processing and think that it is a solid choice. This is especially true considering that CDG offers customer support by phone.

To get all the details, start by visiting CDG's website here or call (888) 393-1079.

#3 Square

We can't call this a real list of Android credit card processing options without mentioning the Square card reader and app. Square was the first credit card processing app to hit the market and has been the most popular options for taking credit cards though Android devices since. Not only does this company offer one of the easiest and quickest ways to take mobile Android payments, but it does it with great tech and very competitive pricing. The Square app and card reader are easy to use and users are only charged a flat and fixed fee of 2.9% plus $0.30 per card-present transaction with no other monthly or junk fees. Like Helcim, it also offer a broad range of other processing services for various business needs, such as invoicing and an e-commerce store builder.

Square falls short of the top picks on this list due to its less competitive processing fee and customer support. The most common complaint we see about Square is dissatisfaction with customer's ability to reach a human or get help they want. With Square's popularity, it is easy to see how the company might struggle to scale up a customer service division capable of handling every issue over the telephone. Square is a great option if you want test a business idea, but for those with established revenues, we recommend one of the picks above.

To get all of the detail or to sign up, start by visiting Square's website here.

#4 Shopify

Shopify is primarily known as an e-commerce platform for online merchants, but the company recently launched a point-of-sale software solution for Android devices. The Shopify POS app can accept cards via a headphone jack card swiper or a $89 EMV reader and includes features like inventory syncing with a webstore, emailed receipts, automatic tax calculations, basic email marketing, and in-store refunds. The service can also be paired with a Shopify online store, which comes with numerous customization options. Shopify POS is a great fit for mobile merchants who would like to accept payments on-site using their phones as well as through a webstore. Service-industry merchants should note, however, that Shopify's POS app does not currently support tipping.

Shopify Reviews

Shopify offers month-to-month pricing plans with variable pricing and product tiers. The company is headquartered in Ottawa, Ontario, and has been in operation since 2005. The company provides phone, email, and live chat support to all of its merchant tiers and enjoys very few online complaints despite its massive user base. The BBB gives Shopify an “A+” rating at this time, while CardPaymentOptions.com awards the company an “A.”

For more information, see the Shopify website.

Shopify POS Highlights

- $89 card reader

- 2.4% to 2.7% swiped

- 2.4% + $0.30 to 2.9% + $0.30 keyed

- Live customer support

Final Thoughts

We found that the most important features a person should consider when choosing an Android credit card processing app are: technology, pricing, and customer support. We reviewed dozens of options but the picks above were the ones that we feel most confident to recommend to our readers. If you have any thoughts, questions, or feedback, please leave it in the comment section below.

Zahra

I had a similar experience with the non-business version of Square. I transfered $100 to my son, he didn’t receive it. I complained. They took $100 from my son’s bank account and I didn’t receive it (there goes $200 so far). I complained, they continued to take money once frommy son’s and my account one after each other for their own. Customer care telephone was only for business and by e-mail “a no brainer” became “rocket science” for them to resolve.

Long story short, as it was no going anywhere but bankrupcy of mine & my son go figure how come, I finally gave up on Square and their MATH and way of doing business. I asked for help from the professionals of BofA. The Bank compensated the Squares malpracsis.

Oscar Rojas

I decided to use square since they made it so simple to sign up for their service. It all went well for a month but soon after it all went down hill. In my business my transactions could be as low as $30.00 and as high as a few thousand dollars. Square did not like the transaction activity in my account calling it “High Risk”. Square stop processing my transactions and asked me to provide them with my business permit, 3 months worth of bank statements, and all invoices pertaining to the transactions in question. I did as I was asked to do and they came back to tell me that after they were done reviewing all documents submitted my account was deactivated. They deactivated my account and retain my money telling me that I would get my money after 90 days. Well, it has been over 90 days and still waiting for my money. With out an active account you can not reach customer support and emails are not looked at all. The only way to communicate with Square is via Fax or messenger on their Facebook account. It’s hard to believe that a company of that level would ignore the basic tool for customer service. I strongly suggest against Square and I do tell as many people as I can to stay away from Square.

Lori

You need to update your information on PayPal. I have a seasonal business. I started using PayPal in September of last year and used it September through November. Started using it again in April. In the last few weeks we have had a bit more volume. PayPal, without us knowing, put a hold on almost $600 of our funds. I discovered this when I couldn’t transfer my funds to my bank account. They say the “hold” is just in case anybody does a chargeback. I have been running my business for nearly 20 years and have never had a chargeback. The only way I can get the “hold fund” back is to cancel the account and then wait for three months to make sure there aren’t any chargebacks and then I can have the remainder of my funds. This makes it extremely difficult for a small seasonal business when you have funds sitting in an account that you can’t draw against to pay your bills.

Julie

Hi!

This is really an informational site. I’m glad that I checked it out, it has helped me with a decision to NOT use the Square. I had just finished creating my account with the square and ordered my free card reader, but after reading the reviews on the other page, I’m not going to deal with them. I read your information regarding the 6 top Android card reading apps, and was over-joyed to see paypal listed. I immediately telephoned their office, (since I already have a paypal account), and was hoping for good news, but not…. at present paypal’s card reader only works with android phones and not the tablets. I just recently opened a physical location and require card readers for my tablets. I use Intuit (go payment) for my Samsung Galaxy Tab and it works very well. I haven’t had any issues as of yet and I’ve had my Intuit account for quite a while, since it is also my payment solution for my website. I purchased a second tablet, a Samsung Galaxy Tab3 but it isn’t compatible with the intuit card reader. I called intuit to make sure it wasn’t compatible and the rep was very nice, she is going to send me a usb card reader for my laptop. I’m ok with that although I really prefer to have the card reader work with the tablet. But the usb reader will be sufficient while I wait to see if they ever add my tab3 to the compatibility list.

John Gallagher

Why hasn’t wells fargo, as big as they are, came out with an android app for their merchant service account??? I know they process through first data so I’m wondering why and when these two large companies can get their ducks in a row and get us a badly needed android app for their processing.

This site is very informative,

Thanks!

Lesley Comassar

I second the question: when will any of the top-rated systems be availabe in Canada? Please keep us updated.

Phillip CPO

Hi Lesley,

Out of the above list, I believe GoPayment is the only one that offers service in Canada.

PAUL DEGRUCCIO

We started using SQUARE mid Jan 2012 It was like a dream come through . We were one of the first high volume Small business’s to use the Square system on our new I pad. Apple ‘s officers came down to see it in action, Square Called us (after a week of high sales) and gave us a welcome . Then about five days ago the dream became a NIGHTMARE . In the middle of transactions The app sent us error Signs . so easy just give them a call =YOU CAN NOT CALL THEM. So off went dozens of e mails. 2 days latter we get one back Reload the program. Now this Cafe is in the Hart of Williamsburg Brooklyn, Tons of soft /hardware Nurds just about live here.I the Cafe. The Problem is on their end . me and the nerds did everything , Call Apple, Called Verizion, all said it is on there end. The email response from SQUARE Try to load it up on your cell Phone. We have it on three of our cell phones and now all the nerds have it on their phones. THE CUSTOMER SERVICE IS BAD BAD BAD. Yes Now Pay Pal the E bay Wonder Looks real Nice Now. And Yes You can Call Them.

Pat Hutchinson

Are these systems compatable with our banking systems in Canada?

If yes, which ones?

Thank you,

Pat

Bobette Meer

Hey there this is a fantastic post. I’m going to e-mail this to my pals. I came on this while exploring on aol I’ll be sure to come back. thanks for sharing.

Ron Tedwater

Great work keep it coming