PayPal Here Credit Card Processing Reviews & Complaints

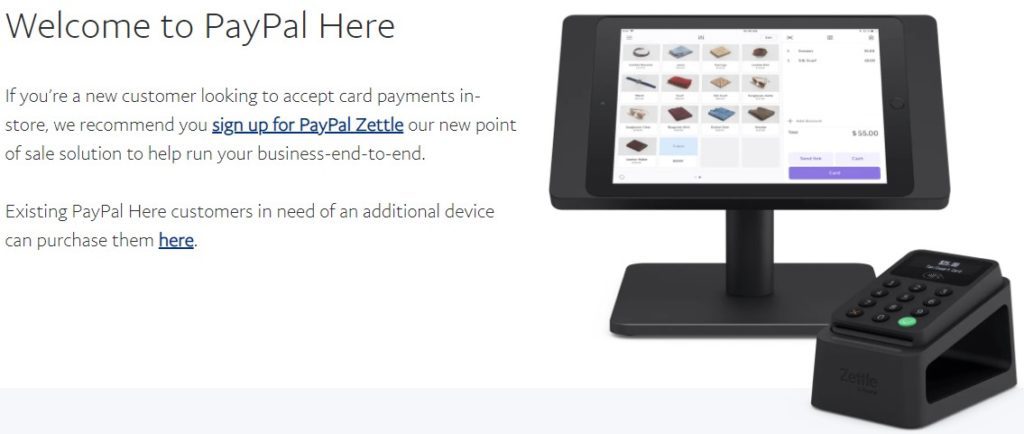

Note: PayPal has announced that as of September 30, 2023, the PayPal Here service will be discontinued in favor of PayPal Zettle. Read the full statement below.

Company Overview

PayPal formerly offered the “PayPal Here” mobile payment app and line of card readers. The service was yet another carbon copy of other mobile credit card processing services like Intuit’s GoPayment, Square, and North American Bancard’s Pay Anywhere.

However, PayPal made the following announcement in 2023:

“After September 30, 2023, PayPal Here services (including both the card reader devices and the PayPal Here App) will no longer be available. This means you will not be able to accept payments through PayPal Here with the card reader device or via the PayPal Here App from that date. You can upgrade to our latest point-of-sale solution, PayPal Zettle, to continue accepting payments, manage inventory, and track sales. To learn more, click here. If you are an existing PayPal Here customer and have any questions, please contact our help center.”

Article Summary

Before we dive in, here's a short summary of what we'll cover:

- PayPal Here's former payment processing services.

- The service has been discontinued in favor of PayPal Zettle.

Related Articles

PayPal Here Payment Processing

PayPal Here's chief innovation is that it is integrated into a regular PayPal account and, therefore, clients have access to a wide range of other features not found with most competitors. Funds from PayPal Here transactions that fall within normal risk tolerances will be available immediately to the client within his/her PayPal account. Clients have the choice of transferring the money into an attached checking account or using an attached debit card to make purchases and ATM withdrawals.

PayPal Debit Card Features

PayPal advertises that by accessing the funds through purchases with its “PayPal Business Debit MasterCard,” clients will get same-day access to funds and receive a 1% cashback bonus -bringing their effective processing rate down to as low as 1.7%. PayPal Here only offers automatic fund transfers to the attached checking accounts.

Location & Ownership

Daniel Schulman is the CEO of PayPal, which is headquartered at 2211 North First Street, San Jose, California 95131.

PayPal Here Review Table of Contents

- Costs & Contract: PayPal Here offers a month-to-month contract with no early termination fee.

- Complaints & Service: PayPal Here has received more than 100 public complaints.

- BBB Rating: PayPal Here has no independent BBB profile. Its parent company PayPal has an “A-” rating and has received 27,150 complaints and 2,221 reviews in the past 3 years. The company has been accredited by the Better Business Bureau since 2001.

- Sales & Marketing: PayPal Here does not hire independent sales agents and has not received any complaints about its sales practices.

PayPal Here Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | 100+ |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | Fund-Holds |

| Recent Lawsuits | Yes |

Fund-Hold Issues

We have located more than 100 negative PayPal Here reviews, some of which accuse the service of being a scam or ripoff. By far the most common issue encountered by merchants appears to be funds held by PayPal, which is a problem that PayPal Here has in common with its parent company. Merchants should know the steps to take when dealing with fund holds and are cautioned to understand PayPal’s fraud prevention policies in order to avoid having accounts frozen or funds withheld in the first place. If you have your own PayPal Here review to make, please do so in the comments below.

PayPal Here Lawsuits

In 2017, PayPal was sued in the matter of Zepeda v. PayPal Inc., a class-action lawsuit that alleged the company had improperly handled disputed transactions, placed holds, reserves, or limitations on customers’ accounts without notice, and closed client accounts without notice. The company agreed to pay a sum of over $4 million to plaintiffs who were part of the class action.

2021 saw a flurry of legal activity concerning PayPal. It began in February 2021, when the company announced that it was under investigation by the Securities and Exchange Commission and the Consumer Financial Protection Bureau.

According to Bloomberg, “The SEC is investigating whether the swipe fees paid to the banks that issue PayPal’s debit cards are consistent with Federal Reserve guidelines, the San Jose, California-based company said Thursday in a quarterly regulatory filing. The agency is also investigating how PayPal reports marketing fees earned from its branded-card program. […] Separately, PayPal said it received a civil investigative demand from the CFPB in connection to the marketing and use of PayPal Credit in connection with merchants that provide educational services. The regulator asked PayPal to produce documents, written reports and answers to written questions. The company said it is cooperating.”

Following the announcement of this investigation, PayPal Inc. stock dropped significantly. This led to a bevy of class-action suits being announced against the company, including one here, here, here, here, here, here, and here. With such heavy legal action underway against one of the world’s largest and most well-known payment processors, these cases are sure to set standards for the industry going forward.

PayPal Here Customer Support Options

One of the biggest frustrations cleints have with PayPal’s competitor Square is the lack of live customer support and communication regarding reserves and fund holds. PayPal Here has both live phone and online support; however, it is difficult to determine how the company handles communication regarding holds and reserves, and how the customer support fares with the service. PayPal itself has a very high volume of online complaints, but it is also a huge company that services many clients, some of whom might be uninformed and easily frustrated. The comments located here and elsewhere that specifically discuss PayPal Here do not describe inaccessible customer support, so PayPal Here will receive a “B” in this category until further information is available.

PayPal Here Online Ratings

Here's How They Rate Online

| BBB Reports | 31,345 |

|---|

Note: We have adjusted this company’s BBB rating according to our own standards. To better understand why we adjust BBB ratings, please see our Rating Criteria.

No Independent PayPal Here Profile

Since PayPal Here is an app created by PayPal, there is no Better Business Bureau report specifically for PayPal Here. The BBB report for PayPal, however, shows accreditation and an “A” rating despite having 31,345 complaints filed in the last 36 months. PayPal has resolved 12,199 complaints to the merchants’ satisfaction, while 19,146 complaints either were resolved to the dissatisfaction of the merchant or did not receive a final response from the client.

What Merchants Say

PayPal has also received 1,619 informal reviews, almost all negative. However, many of these reviews are from customers, as opposed to clients. One recent review from a merchant related to issues using a merchant account for personal money transfers:

PayPal limited my account after one of my customers sent me money as family and friends,they held the money and told me to upload a photo ID and Bank statement for a review before they can release the money,when I registered the PayPal account,I used a photo ID to register it,I chatted PayPal’s support and told them that I don’t have a bank account connected to the PayPal account but a bank card,they didn’t respond to my messages,so I went ahead and upload the photo ID I used to register the PayPal account and the statement of the bank card I’m using on the PayPal account since ********************** couldn’t allow me link a bank account but a bank card, PayPal permanently limited my account immediately I uploaded the things they asked me to upload for a review, please I want you people to help me and resolve the issue so that I can have my account back, thanks.

Readers should review their options for merchant accounts with a history of great customer service to avoid situations like this.

A “C” Performance

The BBB justifies its rating by citing the length of time PayPal has been in business, the complaint volume versus PayPal’s size, the company’s response to complaints, the rate of resolution of those complaints, and the fact that the BBB has sufficient background information on PayPal. Based on PayPal’s complaint count, resolution ratio, and size, we are adjusting this section’s rating to a “C” for the purposes of this review.

PayPal Here Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | No |

|---|---|

| Monthly & Annual Fees | No |

| Processing Rates | Variable |

| Equipment Leasing | No |

PayPal Here Pricing

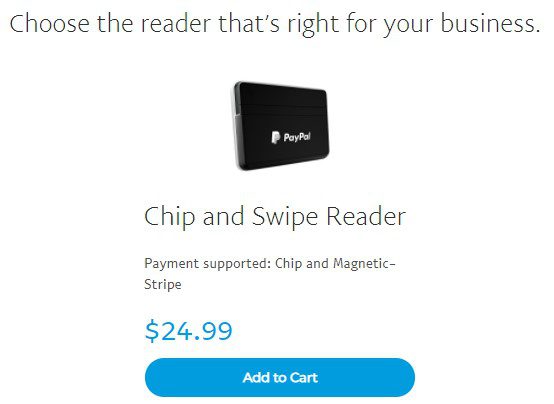

PayPal Here, considered to be one of the best mobile processing options, offers a selection of four different card readers and an app that is compatible with most iPhone and Android devices. The swipe fee for processing a VISA or MasterCard transaction by sliding a card through the attached reader is a flat percentage of 2.7%, and the keyed rate is 3.5% + $0.15 per transaction. PayPal Here has no setup fees, monthly fees, processing minimums, or cancellation fees.

Updated Pricing Structure

PayPal Here formerly had some caveats in its pricing that apparently expired on April 15, 2012. For instance, PayPal Here charged 3.5% for swiped American Express cards but was rebating clients the difference to bring the final fee down to 2.7%. It appears that the rate for all cards, including American Express, is now lowered to 2.7%. Additionally, clients who already use PayPal’s Virtual Terminal may see an increase in their pricing as all Virtual Terminal Transactions are subject to a rate of 3.5% + $0.15, which also applies to keyed-in PayPal Here transactions. Clients who already use PayPal Pro products may also see a decrease in their pricing as all PayPal Payments Pro transactions are charged the 2.7% that applies to Swiped PayPal Here transactions. It’s a little confusing, but these rare cases may occasionally cause merchants to notice pricing discrepancies.

PayPal Here Readers

PayPal Here charges 2.9% plus $0.30 per invoice payment through the app and an additional 1.5% above its usual fees for international payments. PayPal Here offers a headphone jack card swiper free when you sign up for the service (MSRP of $14.99), though sales through this hardware are subject to the company’s automatic reserve policies. The reserve policy for this reader means that keyed-in transactions and sales over $500 in a 7-day period are subject to an automatic 30-day reserve where funds are held in your PayPal account to cover the high risk associated with these types of transactions. Clients who wish to avoid holds of their funds under this policy may benefit from exploring high-risk merchant accounts better suited to process these transactions. Alternatively, PayPal Here’s most popular piece of hardware is an EMV-compatible Bluetooth chip and swipe reader which is also free when signed up (MSRP of $24.99). The company’s most comprehensive piece of hardware is an EMV/NFC-compatible Bluetooth swiper for $79.99.

PayPal Here Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | No |

|---|---|

| Telemarketing | No |

| Misleading Marketing | No |

| Discloses All Important Terms | Yes |

Full Disclosure

Because PayPal is such a high-profile company, PayPal Here is marketed primarily through the PayPal website. The PayPal Here website is easily navigated and clearly outlines the terms of PayPal Here, including a notice regarding the keyed-in rate of 3.5% plus $0.15. Clients are advised to bear in mind that key-in transactions almost always carry a higher transaction fee because they are higher-risk transactions than swipes. Businesses operating in high-risk sectors should consider opting for a dedicated high-risk merchant account provider to ensure their needs are met without issue.

Transparent Pricing

The company’s use of direct marketing and its clear disclosure of pricing and contract terms have earned it an “A” rating in this category.

Our PayPal Here Review Summary

Our Final Thoughts

Due in no small part to its already 361 million registered users, PayPal has become a major player in the credit card processing arena with PayPal Here. The app seemed to be holding its own in the face of numerous competitors and rapid changes and has shown itself to be a solid mobile processing service for U.S. and UK-based merchants alike. However, the service is now mothballed in favor of the newer PayPal Zettle.

If you found this article helpful, please share it!

Susan J. Leslie

PayPal is holding my $53,832.06 hostage. Remove all of your funds from PayPal Now! I am CEO of an online business and PayPal has been my merchant processer for 18 years. My company, Dream Skin and CAH, inc owns a made in the USA moisture technology textile/ pillowcase and sleep mask that hydrates your skin and reduces facial wrinkles. I received an email a few days before Christmas that I could no longer use or access MY $53,832,06 and could not receive online payments from customers for 6 months. Christmas and first quarter are our most profitable times and this is dehabilitating to our online business. And we have already spent an enormous amount of advertising dollars to market for the season. PayPal is being completely secretive and the 2 supervisors I spoke to refused to be transparent and reveal the reason for this drastic and unethical seizure of MY funds. They are a merchant processing provider and my company is their customer. They are in business to accept money from customers and I have paid considerable fees to them for 18 years. If this is their policy to take my money without reason than everyone BEWARE. Sounds like a criminal policy to me. I filed a complaint with BBB and it’s now in my attorneys hands, but it’s disturbing that we have to pay our attorney for PayPals bad behavior and sneaky contract rules.

Ellen Torre

PayPal is participating in an international fraudulent scam by protecting Dang Thi Kim Ngoc who operates suspiciously his stores with stock of poor quality material made by unskilled labor, falsely advertises the products as premium, charges premium prices. PayPal conspires with him for I am sure a generous fee without considering the consequences of your actions. This company utilizes different onsite names initially I purchased boots on xahera.net. I have kept the receipt. boots arrived in a plastic bag, no box, all squished. leather was the farthest from premium, was so thin, appeared to be cut by and unsteady hand. The sewing of the pieces of leather were even worse. only way to describe would be a blind child sewing the boot with an old fashion needle and thread. The boot strings appeared in the picture same color as the boot, tan and leather. These boot strings orange and are sneaker strings made from cloth. When I called to return I was refused as they were not damaged or not defective. These boots were totally defective. I called my credit care company as I knew PayPal was not going to protect my interest. after many conversations I decided To mail them back no matter what. I sent them back to the Rhodes Island store. I received an email from Dang Kim Ngoc who stated he would take them back however I had to pay to mail them to china. To late. That is a trend of his as I have investigated this on many sites where complaints against him and you. After months of going back and forth, nothing occurring and your site being a nightmare for any user I could not get refund for the boots I returned. When I went back to Xahera.net the site is gone and so is the address. His new store is named Keenwalk Pete LtD and is in CA. After reading one after another complaint and it is the same issue, poor quality boots and shoes, unable to return or send to china, change in address, not getting reimbursed and PayPay smack in the middle supporting the offending fraudulent provider who has had a lawsuit for this very reason that is document. PAYPAL has also had legal issues for similar reasons. I have all the time in the world, I will continue to write everyone and wherever his product is advertise and post pictures of these Boots and share my experience. Direct all to the hundreds of nightmare experience with him and PayPal. Be prepared as I did investigation for a living, quality review, and appeals.I am determines for others not to have this experience happen to them.

Ihsan

Avoid Paypal Here at all costs. It’s a scam. I was sent an email for a special 1.99% rate if I signed up within a certain time. I did so for 2 businesses. They never applied the rate! Thankfully I kept the email confirming the rate which I had to forward to them because they claimed they didn’t have record of it. Fast forward a few month after being told the accounts were corrected. I find out they are still not. I have to call again hours before a show and low and behold they have no records again. I once again forward the email. They then tell me they can only apply the rate to one of the business accounts. Not the one I needed at the moment. Who the hell has time to keep checking they didn’t alter the rates. I’m sticking with Payanywhere. Stay away from Paypal Here.

Jill

Good and very poor. Card reader and application are easy to install and get running. But poor, poor, poor is the reporting. It allows for a catalog and items along with options. Well when you go try to pull an end of day report- all the catalog, item and options are LOST. After calling them, their response is that their reporting is basic. Well they could have at least put it in the export functionality so I could do via excel. But NO.

This post will help: Best Mobile Card Processing Apps

-Phillip

Breault, Christine

Have to wait for customer assistance FOREVER, and then the customer service representative interrupts me repeatedly, never even listening to my complete issue. It’s appalling customer service, it takes forever and nothing gets resolved . My time is valuable and I can’t conduct business when I’m on hold all day long with PayPal only to be continuously interrupted by the person who supposed to be helping me .

This post will help: Best PayPal Alternatives

-Phillip

Leslie Sirag

I’ve used Paypal online approximately forever, with few problems easily solved with a phone call.

I’m not as happy with their mobile app–I started out using the triangle swiper, which was actually pretty good, but it stopped working & they informed me that it had an integral non-replaceable battery. They did send me a new one, but also sold me an “upgrade”, for $29.95 which is supposed to take chips & charges extra for swipes or manually entered numbers.

Mostly the chip reader doesn’t work, the swipe sometimes does, so I have to enter numbers (inconvenient for me & customers) and pay extra.

Plus, I did a show this weekend where wifi was interrupted, and while Square continued to function, Paypal didn’t. Luckily I was next to an ATM, & despite the $3.50 charge to customers I lost only one sale, but it was not a good situation.

I do continue to use Paypal online but will give Square another shot for mobile.

This post will help: Best Mobile Card Processing Apps

Peggy Muraco

My daughter and I attend shows where she accepts Paypal Here. At our last show on April 22, 2018, a woman purchased $72.00 worth of products and gave her credit card as payment. My daughter used Paypal Here to process it. The reader she had did not work many times, so she had to manually key in the numbers. In order for the order to go through, she had to key in the customer’s zip code. The customer gave her the zip code and it worked the first time. One month later Paypal contacts my daughter to say an unauthorized transaction took place on this woman’s credit card and Paypal gave the $72.00 back to the woman. In addition, Paypal charged my daughter a $20 fee for the charge back. My daughter is not allowed to get the woman’s name, email, or address, or anything about the customer – Paypal claimed they didn’t have the information; thus, she can not file a police report or do anything to get this money.

Sometimes the app would tell the customer to sign and other times it would not. There was no signature on this transaction. It might have been that my daughter presented the phone to the customer and the customer tapped the screen without signing and then clicked next, but who knows what happened?

The app would not accept Amex.

Paypal reps told her she should have had a reader with a chip, she used the one Paypal originally sent her.

Paypal said originally that they would have no information on the customer if the customer did not have a Paypal account. Later on a Paypal supervisor said she had the information but could not give the customer’s info to my daughter.

Paypal claims they are currently in a dispute against the credit card and said… Once we file a case on your behalf with the buyer’s financial institution, it could take up to 75 days to get a resolution.

Paypal said merchants have no recourse when they accept Paypal Here and an unauthorized transaction is filed.

I feel Paypal is not responsible in obtaining the customer’s name and placing it on the transaction receipt. After all, the merchant is the person doing business with the customer and by all means is entitled to the customer’s information since it is the merchant who is losing the money.

In this situation, we clearly remember the woman and dealing with her since she bought so much.

I would not recommend Paypal Here to use since this program does not collect enough information to make it safe for the merchant.

This post will help: Best PayPal Alternatives

-Phillip

RJ

I have been using Paypal Here since 2015, no problem. We have a seasonal business and don’t need cc processing most of the year and we also don’t have phone or internet service at the site.

Unfortunately, just over a month ago we charged over $700 and my account showed an “account limitation” for which we needed to send in information. It has been over a month and this has not been resolved yet (hopefully this week?). I want to switch services, but I am wondering if I would have the same problem with Square or Pay Anywhere? Or if there is another service that might work – most of the others seem to have their own problems – monthly fees, etc. Any suggestions, or do I just cross my fingers and hope paypal here works now that I have sent in the requested information?

The positive is that they DO have a phone number to call that I can speak to someone. That was always why I didn’t want to go with Square.

From The Editor

This Post Might Help: Best Seasonal Merchant Accounts

prestige loans

love paypal, i have been doing business with them for over 10years

DENISA bUGA

Never switch from Square to PAY PAL.

They have a limit withdrawal on your own money?

We run a service business and PAY PAL is a huge SCAM. They put limit on how much money we can take each month?

Don’t use them! Go with Square! No limit! They don’t hold your money to make profit off it for a month and then deposit them.

What a bullshi* of a company!

J R

PayPal Swipers should come with a warning. Cannot use immediately even though you have many years with the account. After reading the reviews, we will likely return them and search for a better solution. Spent 4+ hours on customer service with no resolution.

chico

Paypal will apply your payment to a promotion that is not due instead of applying it to the balance due and make you incurre interest. It has happened to me more then once. You then have to call them and tell them how to apply your payment. If your lucky they will follow through or else you will be wasting lots of time on the phone trying to have them make the correction.

Kalicia Newsome

I will NEVER use PayPal again. I was a victim of identity theft and had money stolen at of my account. When I contacted paypal, they had me verify my name (which was correct on the transaction hence IDENTITY THEFT) however the address was one I hadn’t used in over 5 years and the receiving email wasn’t mine either. PayPal did absolutely nothing with this information and denied my claim. I consider them to be just as guilty as the perso who stole my money. They have lost a customer in me and I will continue to speak on their poor service in hopes of informing others and hopefully shutting down their crooked business

Anthony W Dios

If you have a small business, I would AVOID using Paypal here at all costs. If you make over $500 in 7 days, they will automatically hold your funds for 30 days without exception. As a small business owner, every sale we make is essential for paying bills and operating costs, and I can’t wait 30 days for my funds. If you call to ask about it, they will put you on hold for 15 minutes, then transfer you to 3 different people and then tell you there’s nothing they can do about it. Do not trust them with your money, I almost had my cell phone shut off because I couldn’t access my funds. Avoid like the plague and use SQUARE instead

Michele Roberts

I use Paypal for my small business as an alternative to a merchant account, but I use it sparingly and I EMAIL invoices to my customers who then pay with their credit card online, whether or not they have a Paypal account. This has been a great option for me.

HOWEVER, for my full-time job where I travel and host exhibits and sell our company’s books, I recommended Paypal to our controller because I like the other options it has regarding emailed invoices. I would never have imagined the technological troubles I encountered on the road with that Paypal Here Chip Reader! It worked 2-3 times per 20 attempts! So…desperate as I was, I took an Uber to the local office supply store to pick up the little triangle swiper, thinking bluetooth was my problem with the other one. It worked for my colleague the next business day so I was hopeful. NOW, I get a text from the same colleague at a different exhibit and it doesn’t work at all!

I gave you a try Paypal Here. Whatever issues you have with the swiping technology are unbelievably insurmountable for you. After reading the comments from others about the same problems and also the 30-day holds, etc….well, it’s time to say goodbye.

Marilyn Johnson

I just completed an event this weekend only to find out that Paypal Here is going to keep my money for 1 month because I swiped more than $500 a day.

They are unwilling to release my money. I will never use them again. I am going to call Paypl today. If they can’t resolve this matter I will be leaving them both. This is my first time and last time using Paypal Here.

Kevin Sexton

I give Paypal Here an “F” rating. I frequently deal with commercial accounts and it’s not uncommon to have invoices over $4000. A lot of these companies call in a credit card number to pay their bill so the info is entered manually. Paypal places a hold on funds over $4000 for 30 days! My most recent transaction was for $6400 where they charged me $245 to process the charge AND they are holding over $2000 hostage for 30 days. I am not a high risk account. I have a clean record with PayPal for over a decade. This is not how you treat a good customer.

Nancy G.

I did a lot of business – multiple, high dollar transactions with PayPal and was hesitant using PayPal here. I waited a long time before using it. As soon as I tried using it, I discovered the 30 day hold on everything over $500 for 30 DAYS!!! Yes, you heard me right 30 days. I am livid that in such a day of EFT banking they feel the need to hold your money. I will be going to a cash system shortly.

Jady Kasinger

So i heard that they will hold up your funds anything after 500 dollars. Is square also hold up fund as well?

ANGELA

They did the same thing to me. I called and asked them specifically if they hold funds and was told they do not. I told the customer service rep exactly how much business we do. my last conversation with them I was told by a paypal supervisor that we should take out a small business loan. We are a small repair facility, and cannot afford for our funds to be held. I would rather tell my customers that we only accept cash or checks than deal with them any longer. All they are supposed to do is process credit cards, it is our job to deal with our customers if they are not satisfied. Never have we had a customer dispute a card payment, our customers come to us if there is a problem. They told me that they have to make sure that we are an established business, I let them know that we have been in business for over 12 years. We are established. I am posting everywhere I can. I will personally never use them again either

AD

I began using Pay Pal Here with the chip reader on 9/24/16 and gave up after 15 days. With 10 years of operation of our retail store, we were running over 1000 dollars in credit/debit transactions on Saturdays. When the app functioned properly, it was a breeze. But, we had multiple errors that the app said the transaction failed and the card HAD NOT BEEN CHARGED, only to find that it actually processed. I had to check the transactions at the end of each day to make sure customers were not being charged double or triple when we ran the transactions multiple times for approval. The reason I finally gave up on Pay Pal Here is that they (the computer monitoring transactions) would freeze my account in the middle of a busy Saturday sales trend. I was required to upload photo ID, proof of last three transactions and a description of our business. I did this all three Saturdays! I never canceled my regular merchant agreement, so I had to pull out the old machine and use it for transactions when Pay Pal shut me down. When I spoke to Customer Service Reps (actually spoke English), they were unable to explain why my account was frozen each day that sales would have been the peak for the week. One Rep even told me Pay Pal Here wasn’t really designed for established businesses like mine. . . They had other “products” more suitable for me. I told him I really liked the “no surprises” aspect of Pay Pal Here and our customers were really enjoying the modern technology of signing a digital device. Why would Pay Pal not want a company like mine to do thousands of dollars a week? Here is the answer: They were not making enough money. I believe that 2.7% is within 1% of the discount rate on Corporate Cards? We have a lot of customers using rewards cards, not just regular credit and debit. So, anyone having problems with Pay Pal Here or Square freezing your account . . . maybe it’s the fees that they are not willing to absorb. They like small, start-up companies because their customers are often using debit cards. It appears this is just another problem we face as a brick and mortar business in this country.

lxnore

Doesnt work , will not sync, will not stay on , takes forever to power up, lost business with this device, do not buy

amazon196969

Doesnt work , will not sync, will not stay on , takes forever to power up, lost business with this device, do not buy

Nick

Paypal here is a joke. I have not even been on the platform 1 week and my account has been limited three times. Each time they asked for the same information, I dont have time to provide invoices, this is a brick and mortar service business (Gym). This is 100% not what I am looking for and I can not recommend Paypal to any merchant. We have used Transunion, Transfirst, First Data and Square, I have never had to jump through so many hoops just to get my money. Go square.

Lindsay Worley

PayPal here is not a good option for small business owners. If you receive more than $500 in sales in a 7 day period, PayPal will hold your funds (anything over $500) in “reserves” for a 30(!!) day period. This is not made explicit at the time of sign up, so it came as a huge surprise to me that I wasn’t able to transfer funds into my checking account at the end of the workday today. Never mind that I have business expenses due before the end of the month. Paypal’s customer service solution was to “Borrow money from a friend until your reserves are available.” Very unprofessional and insulting. I have been in business for several years but have been using Square prior to trying PayPal. I tried PayPal Here by recommendation of a friend. I will be switching back to Square immediately. They are honest and upfront, no hassle no insults. Your money is available in your checking account within 2 days every time. I have had nothing but problems with PayPal here. My card reader often just doesn’t work, no explanation from customer service as to why it works some days and won’t work other days. PayPal has randomly put a hold on my account twice now, making my funds unavailable, until I call to have them fix it. Again, no explanation. I am disappointed with PayPal and don’t think they are fit for small business card processing, due to the lack of respect they have for small business owners who can’t afford to wait 30 days to receive payment.

John

The card reader does not work well at all. I have to manually punch in data, which takes time and costs more.

Use Square. Much better.

kendra wood

Warning!! I have told all my clients to use paypal for their small business for years.

The new PayPal Here processing has changed and now I am telling everyone to stay away. PayPal Here will hold larger the $2000 transaction made over the phone or keyed in for 30 days. 30 days. If you purchase there new program for $30 they will not place these hold on keyed in transaction.

This is can put a small business in bankruptcy if they hold $5000 or more of what you need as operating capital for 30 days. WARNING!!

Jim thomas

I had a customer pay me 10,000.00 as per charge! Funds were available the next day!

This was 3 months ago! They have never held my money! They don’t need to!

Something else was wrong —

PayPal rocks!

Kevin

Jim, your comment “something else was wrong” is a little short sighted. There are many transactions where there is nothing wrong, it is simply Paypal policy to protect THEMSELVES. They hold your funds if the card is not present as opposed to swiping it. They offer a POS option where you pay them even more money so they won’t hold your funds. Tell me, how is that less risk just because you pay them more in fees. Simple, it isn’t. It’s just another way for them to hold your money. I now use Quicken to collect charges. The money ends up in my bank within 1-2 days

kens

Paypal customer service is a joke! I am a service provider in the electronics field. My first transaction went well. Second transaction showed “cannot process” a card from a long established government agency. Paypal would not tell me anything so I had my client call after verifying their card was good. The rep apologized and said the problem “would be fixed within a few hours”. That was almost a week ago. Repeated e mails to paypal only get an “:all is well” reply. Now I will have to wait 30-45 days to receive a check for my work.

Rob

They suck! There absolutely NO protection for the service work industry. So any customer can say not happy and that’s it, you automatically lose. I have been in business for 30 years and no how to do my job, but all they say is oh well, and it’s not bad enough you are out that money, but they fine you 20.00 on top of the chargeback…

kendra wood

I absolutely agree. They will hold a transaction for 30 days waiting for a client to change their minds. Pay Pal credit card processing is only meant for small business and this kind of practice can break a small business.

Melissa

I am really disappointed in Pay Pal Now. I use Bank of America (now Clover) for 90% of my transactions, but have been having some strange issues with AMEX and international cards being declined when I key them in. I called Pay Pal (whom I run about 20k worth of sales through per year on my website) and explained the situation. They assured me this would not be an issue and that keyed in transactions were fine. I had only used it a handful of times with AMEX cards. Today I ran a transaction for $3,075 and Pay Pal is holding 100% of the transaction for 30 DAYS!!! This is outrageous. I called and asked why and they said that keyed in transactions over a certain amount are held. On their website it says you get $500 per 7 days in keyed in transactions (most of my transactions are keyed in, which is why I called) and the rest after 30 days. I tried square years ago and they had this same issue – although even square would give me the first $5000 and then hold the rest for 30 days. I cannot believe a company as large as Pay Pal has worse rules than Square. I am now going to switch over my website sales to Bank of America as well so I never have to use Pay Pal again.

Christine Russell

About two years ago, I acquired 2 triangle card readers, neither of which worked properly – they failed to read cards about 50% of the time. When we had to default to manually entering info, of course, we got dinged a higher rate. When the chip card reader came along, I ordered one last October. It was defective – it will not power off, so we have to keep it plugged in constantly during shop hours, and it frequently drops the Bluetooth connection. The replacement has a defective cord socket, so it won’t charge at all. I’ve been struggling since January to get a working device. When I asked for a chip card reader replacement, PP sent a triangle reader (the wrong device) to the wrong address, so we had to open a show without a reliable card reader. To date, we still don’t have a replacement – after multiple calls and hours on the phone. Every promise they have made that they will fix this issue has been bogus. Bottom line: 100% of the readers we have been able to test are defective, as is their customer service. NO ONE has competently addressed this problem. We get lots of apologies, but I’d rather have a working device. PP Here has decent software, but their hardware and staff are not ready for prime time.

—

Are you with PayPal? Learn how to resolve this complaint.

Jennifer Urban

I signed up with paypal here credit card processing as a way to avoid monthly minimums and fees with my current merchant provider. Rates were comparable and no monthly fee so that part ran smoothly.

***BIG DRAW BACK*** my company provides a service not a product (plumbing contractor). So customers are not usually in my office when making payments. They are usually calling in to make payments. Which means you have to enter the card manually. That was fine on the 1st couple of transactions, but low and behold… Paypal here will hold ALL funds over $500 that are manually entered in a 7 day period for THIRTY DAYS! What did that mean for my small business. It meant that Paypal placed a hold on almost $1,200 for THIRTY DAYS. That was unacceptable for my small business so we switched providers.

So just beware-if you plan on manually entering in payments this is NOT the service for you.

—

Are you with PayPal? Learn how to resolve this complaint.

Auction Essistance

The fact is, if your personal PayPal account was limited, then there is not much use you can get out of this app. Since many users have been limited before, there is not much you can do.

Catherine

I switched our business to PayPal after having a terrible experience when Merchant Warehouse switched to “Cayan.” So far, so good. PayPal doesn’t slap us with random fees, and our money is available right away. Easy to deposit the funds into our bank account, and the funds transfer very fast compared to Cayan. By the way, the way PayPal takes their fees and then tells you here this is your cut, is great. Cayan wanted our bank info so they could randomly take money out when they felt like charging us huge random fees. The transactions would go through as some weird code number & our bank didn’t even know who was taking the money out. We’re not their personal piggy bank, and we were considering changing our bank account number because of Cayan! Anyway, I read that PayPal was doing a pilot program for Windows phones & I told them I was interested. They gave me the prototype ap to install right after that, and it worked great. They welcomed our feedback on how it worked. Too bad, they said they are taking access to it off for now while they prepare to launch. I hope they hurry up launching it because hoping to get WiFi signal on the Ipad is not too promising at outdoor markets coming up. Anyway, the swiping is so easy, and adding inventory, scanning barcodes, giving discounts, all of that is so easy. With the last company, they told us the only way we could do credit cards at markets was to take our laptop, log in, and type in everything: credit card number, exp date, 3 digits, name, description of what they are buying, how much does it cost, e-mail address, ugh! Customers don’t like waiting for you to type all of that, especially if their last name is Superkalifragilisticexpialidoscious! Who wants to bring a laptop anyway? Smaller devices PayPal is compatible with is obviously the easiest way to go! Customer service has been pretty good so far. People actually answer the phone and know answers to questions, which is a bonus compared to you know who.

Marilynne Lipshutz

When customers purchase a gift certificate now, the funds are immediately placed into merchant’s account.

In the past, Paypal withheld gift certificate funds until the customer “redeemed” the gift on line via their own account.

If the gift recipient does not have a Paypal account, they would be unable to redeem it. In fact, after countless hours trying to resolve this unneccessary complication, most people gave up.

However, as a business owner, I honored the gift since it was not the fault of the recipient they couldn’t get the money into my account. Many of us tried unsuccessfully , several times.

Fast forward to now.

Paypal places the funds immediately into the business account.

So why does Paypal still withhold the funds from gifts purchased a long time ago? Paypal is withholding a large chunk of money and refuses to transfer these funds to my account.

I requested Paypal send me all the information they have on these old funds. Name of gift buyer. Name of gift recipient. Date of purchase.

No response.

Mario

I did a Web design job and accepted $750 as a payment for a job, the job was completed, then received a chargeback issue where the customer did a chargeback from the cc company and paypal took my money away completely. I then submitted the emails and conversations and PDF’s of proof, and Paypal then said sorry, non-tangibles are not covered under the paypal protection. Basically I am out of $750, contacted the customer keeps saying he will call the card company and cancel it (apparently only way i can get my money back) and indeed does not. So watch out if you are selling services with Paypal here because anyone can issue a refund from a card and might I mention this happened over 9 months ago!!!!

Zachary Marshall

You can take this person to small claims court. Also, if you do have evidence you can contact the prosecuting attorney where you live as that person may have committed fraud.

Justin Hale

I agree, you better file in small claims sooner than later, because statue of limitations could be different in each area to file a case against the buyer. I really feel for ya, I had shipped something and because 1 of the transactions were signed for PayPal upheld the seller protection, but I ate it on the other because it was not signed for, not attached to an invoice, and was 2 transactions, so I got $20 twice ($40) taken cause of the chargebacks. Learned a few lessons, and never have had a problem or a chargeback attempt since.

Robert Valentino

Here is a problem I have with PayPal.

I was doing a charge of $30.00 but as I swiped the card some how I hit the 4 key as swiping and it brings up $300.04 Now the customer refuses to sign (I do not blame them) what do I do?

After a swipe you CANNOT change the Amount, You CANNOT cancel the transaction. You need to have them sign and then use their website to do a refund (cannot use the App to do a refund)

I cannot believe that after swiping a card there is no way to cancel the transaction if the customer refuses to sign.

I have heard that this is also a problem with the Square app as well.

At any time a customer should be able to cancel without us having to charge them or issue a refund.

To me this is some SERIOUSLY BAD Software that needs to be fixed.

Bob

Joni Lambert

This service has good news and bad news.

The Good News: The PayPal Here device itself has worked very well. I can also use the phone app to take phone orders and manually enter the card number (at a higher fee, but better than losing a sale).

The Bad News: PayPal puts unreasonable holds on a percentage of your charges, as other reviewers here have noted. In a week I ran $520 in charges and PayPal is holding $80 for a month. From what I read on PayPal’s community board I got off easy. Other folks said they’ve had up to 1/2 of their charges held and some for over 3 months. I’m actually on this website today looking for a better alternative.

aurelia urquiaga

the first time I used paypal here the buyer report me as i used her credit card with out permission I explain to pay pal but in last the one week of “investigation” they decide I m guilty I never will use paypal here this person took my money and my merchandise

thanks

Zachary Marshall

If it makes you feel better, it no different with a traditional merchant account. I always lose, regardless of the fact that I have them on video making the purchase.

Ricky

Beware of square ! They can and will hold your funds without warning without notice and without live customer service. Read the customer agreement. This is a ruthless company. I sighned up for square added all my products to their Pos register had the account verified and began taking credit cards. First few days business went well deposits were added to my account. By day three of doing business in excess of $200 my funds were deterred and i was asked to verify my account again this time Square wanted to know every aspect of my business every item I sold ect.. There was no way to contact square by phone there is no way of knowing if and when i will recieve my deposits. Very inconvienant for a small shop owner. I found it very odd that even though square had froze my funds that they encouraged me to still use their register and accept credit cards. I immediately called pay pal who answered in less than a minute with a representitive. I explained my situation and that my business could not operate without a credit card service and i did not trust Square. Paypal allowed me to stay open and let me conduct my business without senceless restraints or interrogation. Still trying to resolve issues with Square. Beware ! None of the mobile merchant services are perfect but paypal can handle day to day business transactions. Their customer service is top notch. If they could realease an app for Android Tablets it would be a better service but am just happy to be able to conduct business with a trusted company.

Michelle

Paypal is a joke. To the person above about using his card to place funds in his account that is illegal under paypal terms and the credit card companies decided that is considered a cash advance and unfortunate I was a business Verified member for 11 years and they LOCKED my account immediate after I used my debit card to place funds in my account to make a purchase on eBay. Yes just in the blink of an eye… Thankfully I on,y had 60 bucks in the account and to spite them Inrefunded my buyer so they could not draw interest off. Do not use Paypal they are NOT FDIC and your funds can be locked up.

Levi Adair

Beware of PayPal Here!!!!! First, they hold 100% of your funds above any amount of $2500.00 for up to 90 days. Second, they REFUSE to post my business account name or even my name on client’s billing statements. This has created a great amount of confusion as I have now had 2 clients file for fraudulent unauthorized charges. All they see is a charge from PayPal on their statement. I even had one client try to research who the merchant was that charged the total amount I charged them and were UNABLE to find my company info anywhere. At this point, I am fearful of authorities coming after me for fraud as I now show 2 fraudulent transactions against me. PayPal refuses to remedy this issue by simply applying my information to billing statements. PayPal simply says “that’s how the system is built and we will not change”, even one of their own customer service agents admits that this is wrong and confusing. Fortunately, my clients are really good smart people and have contacted their credit card companies, but it will take a week or more for the whole issue to be resolved. Also, be sure to check rates of swiped versus keyed in transactions. Does cost more for keyed in. Many of my clients are not on site when I charge their cards which requires keyed transactions.

Patricia

We had a little trouble initially getting the card to swipe consistently. They sent us a swiper with a longer attachment for the jack in our ipad mini and it has worked well. Our big problem is that we are getting charge backs like mad and Pay pal seems lax in the way they are handle these.They give you little info and put a hold on or take out the amount disputed and sort of act like you are at fault. I fear that customers get a bill with PAYPAL*MERCHANT and panic because they did not buy on Pay Pal and do not have an account. I have taken to putting stickers on the paper receipts I give out showing how it will appear. I think I am going to have to make sure I get photo ID and have a paper signature for each transaction. We used our bank merchant account for 30 years and had no charge backs.

Would love to know if others have this issue.

Lauren

Somewhere in the business setup options you can change what the customers receipt says. My customers receipts show up as **businessname and not PayPal. That helped out a lot.

Allen

Samsung Galaxy Centura is NOT compatible!

I am very disappointed that the advertising doesn’t indicate that there are so few Android phones/services that are compatible with PPH. I upgraded to a Smart phone using the ability to process credit cards as a motivation to do so. I did look into more detail as to what would work with PayPal’s service and my phone met the three criteria listed. Guess what…as you can see from many other reviews, not only are there MANY phones that don’t “qualify”, the service provider is also a factor. Of course, I didn’t find this out until after buying the card reader, signing up, getting a PayPal debit card and then finding that the app won’t load on my phone…GRRRRRR!

P.S. I just downloaded Intuit’s app and it downloaded fine. Looks like I’ll go with Intuit instead.

Mary

does PPH work with iPhone 5S?

OilLady

YES! I use it all the time with my S5. I love this tool, but am using it for less than $200 transactions at a time. I love that I can choose to apply tax or not…. nice feature. Plus the pictures of the items sold is nice. I use this in person, face-to-face with folks and print/email the receipt on the spot — explaining it to them if necessary. I think it is incredibly easy to use and carry the card-swipe device with me everywhere. ;-) Hope that helps!!

terry

what printer do you use

cammie

PayPal SUCKS! please do your research and post how many negative reviews you find about PayPal! I had a customer buy a $300 autographed program from me. After the payment was processed 2 weeks after the buyer received the program Paypal decided to reverse the charges for no reason! I NEVER got my money back! Paypal said it was a fraudulent transaction i gave paypal everything they requested but they never gave me my money back!

FORMER pissed paypal customer!

Brewz

I am having an issue with PayPal Here and it appears to be unresovable, so I am posting here and maybe save someone from my experience.

I looked at many of the payment processors, I really researched it. I decided to go with PPH and knew I needed to get a smartphone. (I text on cell, but limit the phone to pretty much being a well… phone) so I researched smartphones and I looked at this site:

to see which phones will work. I’m quite sure that PPH would want me to go out and buy the latest phone and be done with it. Anyways I bought a Pantech Crossover that supports 2.3.6 (post gingerbread). PPH claims that the phone needs to be at least at level 2.3.3 Guess what, the phone isn’t supported and according to PayPal it doesn’t matter that the phone could be upgraded it just wasn’t orginally released with that level. The funny thing is, when I try to download the app, Google Play tells me the phone isn’t supported. So here is my beef. If the phone isn’t going to be supported, why doesn’t PPH just have a list of phones that AREN’T supported? They have told Google Play which phones aren’t supported, so they should (imho) provide the list to the potential client. I have now signed up with both Square AND Intuit Go Payments and they will both work. I hope I didn’t seem to be ranting, but feel like now PPH really isn’t even a company I want to deal with, especially after reading some of your issues.

Brenda

Thanks for sharing your grief It is helpful. Some suggestions for others having similar issues.

Website states to download the app to verify your device. There is probably a program checking your settings and your hardware during installation, not a list known by anyone. if install fails it saves you from potential issues later.

In order to avoid grief, I would have a mobile phone salesperson attempt to download the app for the phone I am thinking of using before purchase – phone commitments are rough…

Unfortunately the carrier may modify some of the firmware/software of a given phone, so the brand and model may not be a useful thing.

The settings on your phone may also prevent the app from functioning if your location is not turned on for example.

Newer is not better in software world…. it is essential to remember that the minimum level of upgrade may also have the double meaning of “not much higher than this.” Using the Windows analogy — XP or above– might make one believe that Windows Home Premium 8.1 would be great when in fact it doesn’t run most xp software as it is not backward compatible, while 8.1 pro version can be.

beth

I had to switch from PayPal here to square at a recent art show, pph took too long to process the sale. Had to wait for the high volume warning to go away every time I used the app. That took too long, square processes the cards much more quickly than pph. Thank goodness I had the square app I know I would’ve lost some sales waiting for pph to finally process those sales.

Johanne

I recently got a swiper and started using it for a large transaction: after many failed attempts at swiping, I keyed in the card number only to realize the reality of the large hold this resulted in. I called customer support, was given a list of things to do with my device- ipad2 or iphone 4s- and was told the only way to avoid the hold was to refund the customer, return and reattempt swiping. I did that the next day, had the same problem despite all my new tips, called customer support in front of the client, again failed at getting a successful swipe. I was then told by the customer support rep to key in the card number and that they would forfeit the hold. I had her repeat the information for me again and she repeated the same thing. Only to find out a couple of days later that the money was on a 20 day hold. Two more phone calls later, Paypal is not budging: the hold is there for 30 days: nobody has access to my conversation with the customer service rep, they have reviewed and closed the case. They are happy to retrace the steps and apologize if my version of the facts is confirmed, but the hold will stay. So much for customer support!

Kat.K

I have been fighting with PPH for about a month now. My Ipod Touch is fully up to date on the OS. I download the app just fine (I have the card reader), I can log in just fine, but as soon as I am logged in, or three seconds later, I am “locked out” by a screen that says “location services need to be turned on for the app to work, please try again later.” Location Services ARE turned on!! I’ve removed and re-downloaded the app too many times to count. Any help?!?!!

Brewz

Make sure that your Touch is connected to the network. If you are roaming, you possibly might have to swipe say at a Starbucks (after connecting to their wifi).

Waglenut

It works great on my Note 2 cell phone. Customers feel OK signing with the Note’s pen. I send them an email receipt from the cell phone. If you don’t transfer to your bank account funds are available instantly using Paypal Debit card. Limit is $10.000 per transaction. You can swipe the same card as many time as you need if you have to go over this limit. The only thing I am worry about with Paypal versus Merchants services is withholding funds when you want to transfer to your bank account which takes much longer than with a Merchant. If you run a business and have to make checks that would be fatal. you cant wait 30 days to access your money. I would like to hear from other users.

MDF

Started using Paypal here this week at one of our fireworks stores. Everything seemed to be working OK until we started checking the sales history. By law we must charge for both sales tax and MI safety tax on all of our products. The biggest problem we have found is that if you offer your customers a discount, the app charges taxes on the pre-discount amount. For instance if I sell an item that is listed for $100 and I use the app to give my customer a 20% discount the app reduces the subtotal by $20 but charges sales tax on $100…NOT GOOD!!!

Taxes should be computed after the discount…NOT BEFORE…Not only are you overtaxing your customers but you will have a bookkeeping nightmare at years end.

The second issue we have found is that you cannot separate the two different taxes that we must collect i.e. 6% sales tax and 6% MI safety tax. We are forced to use one tax rate which is confusing to our customers when the only thing they see on their receipt is that they were charged 12% MI taxes instead of 6% sales and 6% safety.

The last thing that would be more user friendly would be the ability to sort your products alphabetically…

Sean

A way to get around this problem, at least where I live is to post that all prices include sales and safety tax.

Brenda

We have become accustomed to cash registers which are programmed to monitor transactions by item and tally smartly. PayPal Here is mostly the not-so-smart payment transaction terminal that is being tweeked to provide rudimentary register service like sales tax. Sales tax calculations are not easy and vary widely.

I would suggest a register system or calculator to itemize and then apply the total that requires tax to your Pay Pal Here.

You can create your own specialized app and use Paypal Here as the end point to process payment.

Farida

Hello,

I would like to know if anyone has used this on a Samsung Galaxy 3? Also how long does it take to get the device once you order it. I am in Winnipeg, MB.

Thanks

Kristy

yes, it works fine on the Galaxy S3

Kay

Mine worked on my Galaxy S3, and it only took a week for my card reader to get to me.

John

Just received my PPH card reader today and did a test with the app on my Android phone using a personal credit card. I initially had a problem getting the card to swipe properly, but after looking at the helpful information included in the app I learned that I hadn’t installed the card reader properly. In addition to inserting the card reader into the headphone jack on my phone, you have to slide the dark blue triangle downward to lock the device into the phone securely. After I did that, the card swipe was immediately accepted, and the funds were available in my PayPal account within minutes.

Although this was a very limited test, I’m thrilled at the prospects of providing my customers with immediate payment options when I’m mobile, including the ability to accept checks and account for cash. I’m not sure how those features will work, but if they’re as good as the card reader seems to be it’s going to be a great addition to our sales capability. I hope to do a full-blown test this coming weekend at an event with potential customers. We’ll see how it goes, but I’m really optimistic. PayPal is a great company.

Neal

Just started trying this week and discovered two things: 1) no swipes are allowed under $1, and 2) partial refunds are possible (not so with Square), but only on transactions which were originally done with Paypal. So, if you are switching from a traditional merchant processor, don’t cancel for a month or two so you can handle any returns on products bought using the old processor. Once you’ve gone past your return policy period and you know everything has been processed using Paypal, you can close your old processor account.

Robert

Can’t get mine to process.

Error-unable to auto-generate invoice number. Please enter manually.

Any ideas?

Bob

I want to use the PPH reader but am concerned about the access to my phone contacts that is enabled.

From Google Play store, ” Allows the app to read data about your contacts stored on your tablet, including the frequency with which you’ve called, emailed, or communicated in other ways with specific individuals….allows the app to determine the phone number and device IDs, whether a call is active, and the remote number connected by a call.”

I looked around the web but could not find any information…

Brenda

PayPal help… responds to this. https://play.google.com/store/apps/details?id=com.paypal.here if you “read more”

Jim Mickol

We used Paypal Here at a major event where we used tablets and other smartphone swipers in addition to Paypal Here to process transactions. PPH worked great and the funds were available immediately. It is 48 hours later and I have not seen any funds from the other devices. I hope to acquire several more PPH card readers!

Blackie Burak

I have a small criminal defense law practice. Was using Square with no problems. They increased my funds available limit without hassle on line. I recently received an email from paypay here claiming a slightly lower fee and immediate access to funds. Since I already had a paypal account, I thought I would start using them. The first time I used them, I found out that the claim of immediate access to funds was false. They withhold amounts over $2500. I called customer service and waited for over 20 minutes to talk to someone. I finally got a supervisor who agreed to release the funds this one time only. Fine, I’ll go back to Square for all future charges.

mark

I also used paypal here, swiped the card and completed the transaction only to find out later after the customer was gone that the sale was not completed and I had lost the money from those sales. I am curious as to how many other users have had this problem and what can be done to recoup what we have lost.

Victoria

I had this problem also when I tried to use it on my phone. I got all the way through the transaction and the craft fair customer walked away. When I hit “charge,” it said I needed to turn on GPS settings on my phone in order to use the app. I went back and did it, but then the transaction was completely gone. Could not find the customer again. They need to refuse to let you input any info into the app without turning on GPS settings, if that’s required.

Wilson

What kind of phone did you have/use and who was your phone carrier?

Fred Willey

I like Paypal Here and prefer it to Square, mostly due to features that PP offers that Square doesn’t. However, PPH lacks in some areas. It can be a pain to always have to input my password in PPH in order to open the app. Square always opens ready to work. I like/miss that.

Paypal Here app just didn’t work at all for me when I had two-factor authentication set-up to log-in to my online account. I had to remove it to use the PPH app. Little things like this PPH misses out on.

Paul

I used the PP card swiper this am, it worked great. I finally figured out, after the swiping the card several times, I had to remove the phone case on my android Galaxy II to get the PP card swiper to “seat” all the way into the phone. I also turned up the volume and turned on GPS location services, just incase since this is what Paypal advises to do.

I hope this method of charging and receiving payment works with out too many problems. This is really convenient!

Paul

Jill Gerlach

Used it for the first time this weekend for our booth at an Art show. Absolutely love it. Very easy to use and easy to search for information on translations.

DManzaluni

There appears to be a problem processing Paypal Here payments indoors! I have had these problems in a hotel on a promontory above Tyson’s Corner (i.e. not exactly in the wilderness) as had other merchants who had just got this service.

So after all transactions failed at the PROCESS PAYMENTS step, I tried running outside the building to press the button. Amazingly for a transaction which had failed 3 times, this actually worked! Every time. I also had this same experience at my place of business.

I do get the impression that when you open up the app, it tries to take a GPS reading and then tries again when you press the PROCESS button. This may be relevant in transactions failing but Paypal seem to have no comment on this and it may only be an impression.

There is obviously a problem with the software about which Paypal is in denial. However, when you are trying to take payments at a trade show and have to run outside to press PROCESS, this isnt the most practical of situations. I would like to know if the other processing systems have had this problem?

(I am also suspicious of payments systems which charge more for international payments as I dont believe this can be uniformly justified, especially where Paypal touts itself and has years of experience as a global money payments/receiving system. But I am aware that most payments systems seem to do this.) I am going to Madrid this month andam eager to see if the payments system works there.

I should add that when the system works, it works well. I might like someone to answer the phone help system when I have a problem. Because when this happens I tend to have a customer in front of me who wont want to wait hours for someone to answer the phone and assist with the problem!

Actually I am a bit surprised that Paypal Here isnt given more prominence on this site?

silvia

We used paypal for 8 years. Processes thousands of transactions. We used paypal only because of the low fees. They are unfair and not always straightforwars in their dialings with customers. They actually encourage online fraud in many cases, do not try to prevent it as they claim. Yesterday our account has been limited due to adult content although we do not have any such things… They just send a short note without any info where is this adult content. This limitation cannot be appealed against. We are happy that we will be leaving paypal as we are not happy with their attitude anyway, however the damage on our business is big… how about the hundreds of customers who have their recurrent subscription active with paypal? Are we gonna loose them for ever?

Nikki Bond

I was wondering if this card reader charges taxes

Gary

You can set it up to do so, yes.

Rosa

Hello guys, I do alot of traveling and have alot of international sales online. I would love to hear if someone has had any issues using this internationally? Unfortunately some of the countries that I travel for sales conventions has no PayPal support. Although I use my PP debit card internationally with no issues to date (keep my fingers crossed) So the question to answer is would the card swipe in application be issue free regardless of my location of swipe? Often times believe it or not I sit in airports for hours at a time and have honestly been bored and pitched possible customers that are willing to purchase and this would be a great ap if above can be answered as well as keying in CC info for customers that do not have a PP account, Please share anything international if possible. I truly would appreciate it, and thought to check around prior to ordering. thanks again.

JeanneT

09/2012 Had several problems with Paypal Here. Device was detected, but swiping often failed. Was told to up the volume on the iPhone. That wasn’t a show stopper. It drops charges from time to time. The card swipes, the customer signs with their finger, the transaction is completed, we say no thanks to a receipt. Then press Done. The screen displays the charge and the map. But then when I look at Sales History, the charge is there with a Pencil icon (incomplete) next to it instead of a green checkmark. Unfortunately the customer was gone. Called Paypal. They acknowledge that others have mentioned this. They could not retrieve or complete those transactions for me so we lost money. Make sure you check your Sales History before the customer leaves!

Tie Dyed & Happy

These Paypal Here readers work great with current gen iPads and iPod Touch devices, too. I just did a trade show where we were whipping through sales with both and our phones. A huge difference to using the readers is being able to stay with the customer all the way through a transaction, instead of going off to some computer or terminal someplace. We were able to hand swarms of customers cheap iPod Touch devices instead of our much more expensive iPhone 4S to “sign” and potentially drop. It happens, so be sure you have a good bumper case on whatever device you use. Some older customers liked being able to see the larger display of an iPad – and my clothing looks great on there. I also like not having ANY fees taken out if I accept a check – even my bank charges me a fee for those.

Iphone 4 user

Ive had my PayPal Here for months. At first i thought my card reader wasnt working. i was in a rush to use it so i went to the app then plugged in the paypal here. the card didnt swipe so i keyed it in. on my second attempt, i tried it with my sister. this time i plugged in the reader, then opened the app. it swiped & read info within seconds. i dont know if that has anything to do with but thought i’d share my experience…

Tamara

Recieved my card reader yesterday and could not get it to work after several conversations with paypal. Tried again today and no luck called paypaldid everything they told me to do to get it to work now they are telling me it is the card reader. They just ordered me another one so I will start from scrathc when I recieve it. Hope the new one works .

J9

Tamara, I’d appreciate it if you’d post here whether your second one worked; mine didn’t. Also, what kind of phone do you use?

Johnny

Received mine last week. Have run several test charges with my own credit cards for a few dollars. Both swiped and keyed entrys. No problems. Works great and sends receipts immediately.

Roberto

@J9 how do you order a another swiper? I’m having the same problem w/ my initial swiper.

J9

I called PP’s customer service number included with the card reader. I went through all kinds of help on the phone but nothing worked; they then offered to send me another reader.

J9

I’m now on my second PayPal card reader and neither of them will accept a card swipe. I really want to switch to this from the Square but am getting really frustrated with it. I use an iPhone 4 and per PP’s customer service advice I have my volume turned all the way up and have location services turned on. I’d rather not scan cards or manually input the card info and pay the higher rate. Is anyone else having this problem or have any advice?

Amy Tkachuk

I to am having issues with the reader recognizing a credit card. I just opened it out of the box and have tried several test runs with 4 different credit cards and debit cards with no such luck. I have spoken to customer service twice already and tried every step they told me to do to include uninstalling and reinstalling the application. I have my first event in just 1 week and really need a way to process credit cards without all the high extra fees as I only operate as a vendor at certain events so I don’t have a slew of transactions nor huge purchase amounts. Paypal says they are sending me a new card reader but if that one doesn’t work I will be screwed. Everything else I’ve looked into using charges a per transaction fee and/or charges a monthly fee and since I am a vendor only a few times a year without large transaction pricing, these are not feasible to be paying.

Jaron

Received mine today, I love it!

barry

What is the difference between the flat rate and the keyed rate?

Phillip CPO

Hi Barry, pricing is covered in detail in the review.

Winnie Man

I just downloaded the app, but have yet to explore its full functions. I did not know prior to downloading the app that it was to compete with the other credit-card accepting programs/companies out there. I think I will sign up to get their card swipe to see how goes. I’ve used Paypal Merchant Services online before to take orders and have not had any problems with them in that aspect because it was nice to give clients the option to use a credit card and not write a check if they didn’t want to. I will probably write a better review once I’ve tried their card swipe and have explored their app more. After reading you review and the mostly negative comments about Square, I’m glad I found your site to help me decide not to get Square for their lack of customer service. I’ve been a Paypal customer for years and have only recently used their Merchant Services side. I have yet to have a problem if needed to contact them for things awry. I think I’ll stick with Paypal over Square as they at least have customer service one way or another.