PayAnywhere Reviews & Complaints

Overview

In this review, we offer an thorough analysis of PayAnywhere, a mobile credit card processing service by North American Bancard. Our focus spans across various aspects such as rates, fees, contract terms, and user experiences, including common complaints and industry ratings.

We explore PayAnywhere's key offerings including its mobile POS solutions, virtual terminal for e-commerce, and recurring billing capabilities. We also assess its customer support quality and the practicality of its reporting and analytics tools.

The review also addresses challenges PayAnywhere faces, including customer feedback, pricing discrepancies, and legal issues, providing a balanced view of its pros and cons. Lastly, we compare its pricing structure and services with competitors, giving readers a comprehensive understanding to make an informed choice about PayAnywhere for their business needs.

About PayAnywhere

PayAnywhere, sometimes spelled as “Pay Anywhere,” is a mobile credit card processing service offered by North American Bancard. However, this service warrants its own review because it is a departure from North American Bancard’s traditional merchant services. It should be noted that even though the service is powered by North American Bancard, the actual processor of the credit card transactions is Global Payments. The company also offers a tablet-based point-of-sale system called PayAnywhere Storefront in addition to its two mobile phone card readers.

PayAnywhere Payment Processing

PayAnywhere processes all major debit and credit cards for all business types. The company specifically focuses on its PayAnywhere software which includes a mobile app, a virtual terminal, invoicing, recurring billing, employee tools, inventory tools, data analytics, PCI Plus security, next-day funding. The software also is also included with PayAnywhere's hardware offerings which include smart terminals, smart point-of-sale, mobile readers, and accessories such as printers, docks, and cash drawers.

Mobile Point-of-Sale Solutions

One of the main features of PayAnywhere is its mobile point-of-sale (POS) solutions. The company provides a user-friendly mobile app that can be downloaded to compatible smartphones and tablets. This app allows merchants to accept payments, manage inventory, and access real-time sales data from anywhere. Additionally, PayAnywhere offers mobile card readers that can be easily connected to smartphones or tablets, transforming these devices into mobile payment terminals.

Virtual Terminal

For businesses without a need for a physical payment terminal, PayAnywhere offers a virtual terminal option. This web-based application allows merchants to process payments securely from any internet-connected computer. The virtual terminal is an ideal solution for e-commerce businesses, phone or mail order companies, and professional services providers that require a flexible payment processing solution.

Recurring Billing

PayAnywhere recognizes the importance of offering recurring billing options for businesses that need to charge customers on a regular basis. Their platform includes features to set up and manage recurring payments, making it easy for businesses to maintain consistent cash flow and streamline their billing processes.

Detailed Reporting and Analytics

PayAnywhere provides merchants with access to comprehensive reporting and analytics tools. These tools give businesses the ability to track sales trends, monitor customer spending habits, and gain insights into their overall financial performance. By having access to this data, merchants can make informed decisions to improve their business operations and drive growth.

Customer Support

PayAnywhere offers customer support through various channels, including phone, email, and live chat. Their support team is available to assist merchants with any questions or issues they may encounter while using their payment processing services. This ensures businesses can maintain seamless payment experiences for their customers.

A Growing Processing Service

PayAnywhere is North American Bancard’s answer to Square’s mobile credit card processing service. The service appears to have launched in 2010, but it has not enjoyed the same kind of buzz and popularity as Square. Even so, PayAnywhere has been garnering an increasing amount of media attention and has outlasted Intuit's GoPayment as well as a few other early mobile competitors.

Location & Ownership

PayAnywhere is headquartered at 250 Stephenson Hwy. Troy, Mi 48083. Marc Gardner is the president and CEO of North American Bancard.

| Pros: | Cons: |

|---|---|

| Seasonal business accommodations available. | Inactivity fee after 12 months |

| Custom fees for all businesses. | Numerous public complaints. |

| Free same-day funding. | Poor customer support. |

| No charge for mobile app. | Nontransparent tiered pricing. |

| Free mobile card reader initially. | Limited online price disclosure. |

| Suitable for low transaction volumes. | Deceptive sales tactics. |

PayAnywhere Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | 300+ |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | Fund Holds |

| Recent Lawsuits | Yes |

Overview of PayAnywhere Feedback

Our investigation has identified over 300 negative PayAnywhere reviews, with numerous accounts labeling the service as a scam or ripoff. Despite PayAnywhere’s extensive client base, which naturally could lead to some level of dissatisfaction, there’s a noticeable uptrend in complaints. Recurring concerns among merchants include fund holds aimed at minimizing fraud risk and a wide interpretation of fraudulent transaction criteria, affecting several legitimate businesses. We encourage those with personal experiences to contribute their PayAnywhere reviews in the comments section below.

Understanding PayAnywhere’s Fee Structure

While PayAnywhere’s official pricing details are accessible online, there have been reports of additional charges not explicitly covered in the initial pricing disclosure. These include a $25 Chargeback fee, a $25 NSF (Non-Sufficient Funds) fee, and an undefined $15 “Retrieval” fee. If you’ve encountered unexpected fees beyond the standard processing charges, please share your experience in our comments section.

Legal Proceedings Involving PayAnywhere

In March 2017, PayAnywhere was the subject of a class-action lawsuit in California for allegations including fraudulent business practices and unjust enrichment. The lawsuit, Gerald McGhee v. North American Bancard LLC, has yet to be resolved. This situation, along with other legal challenges faced by North American Bancard, PayAnywhere’s parent company, raises concerns for potential users of the platform.

Customer Service Experience with PayAnywhere

A significant point of contention has been PayAnywhere’s customer service, described by some as lacking and unprofessional. The customer support system appears integrated with that of North American Bancard, sharing similar criticisms for service quality and falling short of the standard set by leading credit card processors for customer service. This comparison suggests PayAnywhere’s live customer support does not sufficiently surpass that of competitors like Square.

PayAnywhere Contact Information

- (877) 387-5640 – Toll-Free General Customer Service

- (888) 579-4787 – Equipment Setup

Additional Support Resources

- Live chat

- Chatbot

- Online support library

This review has been optimized with key SEO phrases, such as “reviews,” “review,” “complaints,” “customer reviews,” “customer complaints,” to enhance discoverability while offering an impartial summary of PayAnywhere’s service quality.

PayAnywhere Online Ratings

Here's How They Rate Online

| BBB Rating | 1.15 |

|---|---|

| Trustpilot Rating | 2.5 |

| Our Rating | 2 |

| Average Rating | 1.88 |

BBB Rating Analysis

Pay Anywhere has an average customer review rating of 1.15 stars and a rating of “C-” on the BBB site based on 38 customer reviews. Common themes in the reviews include fund-holds, issues with equipment, and poor customer service.

Negative Feedback

I’d give zero stars if I could. STEER CLEAR. They are as nontransparent as possible and use as many deceptive marketing to steal from you. My small business used them 8 years ago – We used them for about a year and things were fine, not great but ok. I went back to a competitor (whom I used before PA) and sent back their “free” tablet so I wouldnt be charged for it. Honestly, their tech is the reason I canceled and closed out my acct. They were difficult to work with upon closure, but I made sure and checked that they didn’t need anything else before getting off the phone with them. NO CONTACT since we canceled and now after a couple years I read on my credit report that I have money owed to a debt collector. No contact attempts, no emails, no phone calls, just straight to a debt collector. I would never consider doing business with them again.

– Complaint from April 28, 2023

My company just switch to this company 2 months ago. WE have multiple locations and switched one for a month to see how we liked it with no issues, Our other 4 locations switched to this company 1 month ago. For the past 3 business our card machines have been glitching. No one will answer through their customer service or tech department. I have left multi call back numbers with no call backs regarding the issues. On Saturday 12/17/22 a message came across our processors saying ” You may have been experiencing difficulties logging into and processing transitions, Sorry for your inconvenience”. This message was Saturday around 5 pm. IT is now monday 12/19/22 and our card machines are doing the same things. charging people even though the card reader says it declined the transaction, and not letting us log into our machines. I have never dealt with a company that wont even answer our Phone calls to try and fix our machines. All of our store managers have been on hold for HOURS and HOURS with no answer or call backs. I don’t know what to do. THIS IS THE **** OF CHRISTMAS AND WE ARE ******* THOUSANDS IN SALES BECAUSE OF THIS!!

– Review from December 19, 2022

Positive Feedback

Pay anywhere is so easy to use! I love all the options at POS. Perfect for my vendor events.

– Review from November 20, 2023

Source: BBB

Trustpilot Rating Analysis

Pay Anywhere has an average customer review rating of 2.5 stars on the Trustpilot site based on 8 customer reviews. Common themes in the reviews include fund-holds, issues with customer service, and unexpected fees.

Negative Feedback

I was asked to proivide them with invoices, customer contact info and receipts and I did. even though I gave them all information requested they still decided to close my account. I was told that the monies they owed me would be on hold for 120 days. I accepted that and patiently waited. A month after the 120 day mark I contacted them to see about getting my funds released. I was told a check request would be put in. I waited a month. When I called again I was told the request was never put in and one would be. I received an email aa week later explaining that my funds were not going to be released. I called and spoke with a manager who understood that by holding my funds they were not protecting themselves from anything and there was no reason why the funds should not be released considering I followed their instructions and request to the T. I then got an email saying that I should expect my funds withing 4-6 weeks. I did not. I called to find out what was wrong ands was told that they decided to not release my funds after all. No one informed or contacted me and this whole experience is unnecessary and aggravating. I did exactly what they asked me to do in a timely fashion without complaint. Even though I did what they wanted me to do they are still unwilling to give me my hard earned money that is not theirs nor does it serve any logistical reason to not do so. More importantly, i have in writing an email from them saying they would release my funds. If for no other reason than that they need to do what they said they would..

– Complaint from May 26, 2022

This company is the absolute worst. After a hold was put on my sales transaction for no explainable reason it was then deemed fraudulent by their “risk” department. I realized at this point that this was not the processing company for me. I requested to close my account and was told “no problem”. Well I continued to get charged their monthly fee. I called and was again bounced around as apparently NO ONE had the information and couldn’t explain why my account was still open. Eventually somebody said it was in collections!! Mind you this is a CCard processing company so how was I in collections?? Of course someone was going to get back to me or and an email would be sent, neither EVER happened. There is no record of any bill for the amount in collections and the explanation for the collection amount were processing fees that they had already taken out of the initial transactions. No matter how I asked “Claudia in collections” could never fully explain to me why I was getting this charge. She had her explanation which of course made no sense at all. So basically they were not going to stop charging me the monthly fee until I paid them their processing fees……again. I paid the $225.00 to close the account. This company is awful. This entire process took 2 months to resolve and had I not pushed from my side it wouldnt have been. Again I have had no bill for the money that was in collections. Unfortunately I read the negative reviews after signing on to this company. In those reviews, multiple times, there were situations described EXACTLY like mine.

STAY AWAY FROM THIS COMPANY!! THEY ARE FRAUDS!!

– Review from August 10, 2023

Positive Feedback

We personally use the PayAnywhere mobile card processing service for some time now with great results. Our funds are in our account the next business day in the morning every time! There was an issue with a batch report and customer service was on the line in two minuets. We found them most helpful as we are thrilled with the service!

– Review from June 13, 2023

PayAnywhere Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | No |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | Variable |

| Equipment Leasing | Per-machine cost |

PayAnywhere Pricing

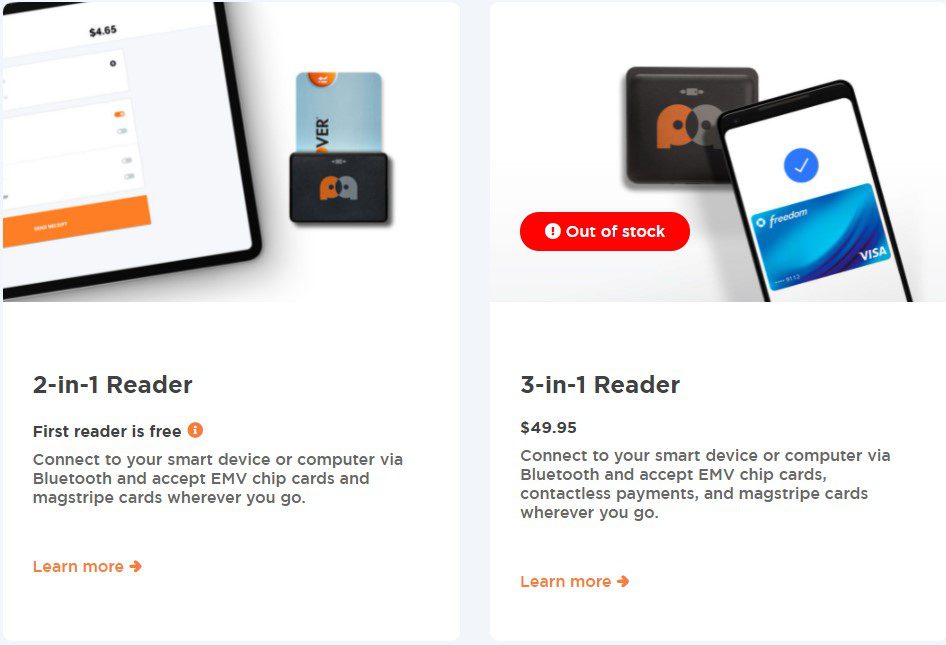

As of this review, PayAnywhere’s smartphone app entails no setup fees, monthly fees, or cancellation fees. Additionally, it provides a complimentary card reader compatible with smartphones. Extra 2-in-1 readers can be purchased for $29.95, and 3-in-1 Bluetooth Credit Card Readers are available for $49.95. Under the “Pay As You Go” plan, transaction fees are akin to competitors like Square and GoPayment, with a 2.69% fee for card swipes and 3.49% plus $0.19 for keyed transactions, applicable to all card brands. A monthly inactivity fee of $3.99 applies if no transactions are processed for over 12 months.

Standard PayAnywhere Plan

Merchants selecting the “Standard” plan and using PayAnywhere Storefront will face varying fees: 1.69% for Qualified swiped transactions, 2.69% for Non-Qualified swiped transactions, and 3.69% plus $0.19 for keyed-in transactions. Storefront users are subject to a $12.95 monthly basic service fee and a $79 monthly minimum fee for volumes at or below $5,000. PayAnywhere Storefront also offers a complimentary tablet to each client, compatible with most Apple, Android, and many Blackberry models.

Frozen Accounts and Fund-Holds

Recent complaints regarding PayAnywhere highlight issues with its cash reserve and termination policies. Similar to competitors, the company frequently freezes accounts or withholds payments in anticipation of potential chargebacks. This practice contrasts with the transparency and fairness expected from top credit card processors.

Client Complaints

PayAnywhere’s terms allow considerable latitude in establishing reserve accounts, including the right to collect interest on withheld funds. However, client complaints suggest inadequate measures to prevent merchants from exceeding their limits. Business owners seeking to avoid fund hold issues may find better options with a top-rated mobile credit card processing app.

PayAnywhere Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | Yes |

|---|---|

| Telemarketing | Unclear |

| Misleading Marketing | No |

| Discloses All Important Terms | No |

No Deceptive Advertising

PayAnywhere does not appear to use any deceptive marketing or sales tactics in its official sales materials. It looks as though the company primarily markets its service through advertising, public relations, strategic partnerships, and referrals from North American Bancard. This compares favorably to our list of best credit card processors.

Fund-Hold Issues

Some merchants have reported that, like Square, PayAnywhere fails to mention prior to account setup that it may hold funds to mitigate risk. Specifically, some negative PayAnywhere reviews state that the company holds large amounts of funds with no prior warning of its hold policies and that the company takes a long time to release these funds. We have lowered the score of this section to reflect merchants’ sentiment that PayAnywhere’s marketing is slightly misleading when it comes to its fraud prevention policies.

Our PayAnywhere Review Summary

Our Final Thoughts

PayAnywhere rates as an average credit card processing provider according to our rating system. There are currently numerous reports of clients experiencing holds, poor customer service, and fees outside of the company’s stated pricing. Some of these fee complaints may just be a misunderstanding of charges or confusion in the way PayAnywhere bills its fees. PayAnywhere is currently only available in the United States, so merchants based in the UK and elsewhere are tasked with finding other mobile processing options. It should also be noted that although our initial review of the company was positive, it contained outdated pricing and device compatibility information. North American Bancard’s approach was to threaten us with “legal redress” if we did not update it immediately. We have updated this review (as we do every 12 to 18 months) only in the interest of accuracy, and with new insight on NAB’s strategy for dealing with publishers.

If you found this article helpful, please share it!

Douglas Cragg Gillispie

They are refusing to release funds that have been paid by our customer. The equipment has been delivered and they have the customer contact Information. They are claiming they need to do audit and want access to our bank account. We have done many large transactions with them. There is no reason for their actions.

Dr. Mary Sabal

I was seriously deceived into switching over to pay anywhere with a “company review of its stable customers” to offer me a lower rate. OUTRIGHT LIES. My rate is higher than before, this, despite buying my own processing machine outright!

Rick Reineman

Unannounced app update wouldn’t work on older ipads. There was no way to use the older app, just stuck in a “need to update” loop. Their support said get a newer ipad, end of story.

No warning, nothing. Things work one day, everything broke the next. Instead of running my business I get to run around buying newer ipads, updating them, etc.

Been thinking of going to Square, probably will now even though I replaced the ipads. These people are very annoying.

Ss

Used them less then 3 weeks and we were hit one chargeback so they held back our deposits and after a week of going back and forth with their excuses and no responses or updates they decided to close our account leaving my money stranded. They are the worst company to deal with. Their customer service is unprofessional and rude. They never update you on the cases. Avoid at all cost this company. They will screw you over.

Jason

We used to use payanywhere. In fact we used them for over 10 years. We never had 1 dispute. Then I went to a customer’s house to give an estimate and I have a signed contract. After 4 weeks had gone by I called to get the downpayment. He gave it to me over the phone. I sent him a receipt and the next day I ordered the materials needed for the repairs at his house. Around 3 weeks had passed and he’s calling about getting his job done. The materials have not yet been delivered. He calls and files a dispute. Payanywhere called me I sent all the legal documents to them. Mind you I had chase bank calling me evwryday. This man went and told everyone he never gave me the info. Payanywhere gave his money back. They tried to take from my bank of America and I stopped payment. They agreed with me. He was in breach of contract. He now I’m having to pay it back. This is the most ridiculous thing I have ever heard. Why is this company incompetent?

Charlene Houle

DO NOT do business with this company! The sales woman never disclosed that there was a minimum amount of sales that I needed to make in order to not be charged a monthly fee. I told her I wasn’t even doing business at the time due to COVID so she knew I wouldn’t be making sales! And still didn’t tell me! I didn’t notice for 6 months that I was being charged! Then when I found out and called them to cancel the service, they said there was an 800.00 early termination fee!! Which I had no idea about! The sales lady never mentioned that either! They said well it was in the DocuSign papers. Ok that was my fault for not reading them through. I never do, I just always trust what the sales person says is true. All she had mentioned for fees was the tiny percentage per sale. I even asked her if that was all the fees and she assured me it was! I fought for the early termination fee to be waived and to get back the monthly fees, and they did waive the early termination fee but not monthly fees. So they got over 100.00 from me! Horrible company! Beware!!!

Ash Powers

Do NOT engage in business with this company.

We (my corporation) canceled services with this company as they were blatantly overcharging despite the terms within our contractual agreement. Communication with them is incredibly poor – emails go unanswered repeatedly and telephone calls are responded to with contempt.

After closing the account, this company continued to draw hefty amounts monthly in service fees over the course of 7 months thereafter. No attempt was made by them to respond to our requests to cease billing us and it required intervention through our financial institution in order to have these charges refunded back to us. An ACH block was also necessary in order to prevent further debits as they have been entirely unresponsive to our requests.

Based on the number of scathing reviews of this company I am surprised that this hasn’t turned into a class action suit yet.

——***** STAY AWAY FROM THIS COMPANY *****—–

jason

payanywhere is the worst company out there dont every waste yout time on this company there

Pam

This company has charged me over 900.00 with not once using , due to covid

I called last month to cancel and was told it was canceled, today they charged me 179.00 even though my acct says closed when i log in, called Bank to put a stop on all payments last month and today Bank said 179.00 was put through under another name, was told some companies will do that if they can get away with it, so today i filed a fraud against them, next i will sue them for my 900.00 back

Stay away from this company its horrible

Angela Fritz-Reyes

I have used this company for 15 years and I never paid attention to the fees. My bank account was breached so I had to get new bank accounts. I just received a very unprofessional message that sounded like a collection call from them. I tried to call them back and couldn’t get through. I am not sure why they called.

Pam

Thats me i didnt pay attention to my bank and they were charging me 179.00 a month and Ive never used the chip reader or their services at all

So angry with this company

Liz Porteus

This company claims to have a Pay as You Go program with a flat rate of 2.69% for swiped, dipped, or tapped transactions. However, they are currently billing me 2.69% + .19 per transaction. They claim that this was part of a repricing project due to my large volume of transactions (even though my total monthly volume does not exceed 6K). They claim to have sent me a letter regarding the fee, but I received no such letter. They refused to refund me the additional .19 per transaction and have not lowered the rate. I am switching to a new company. Their customer service dept is terrible. It’s impossible to get anything resolve right away. They say, “I’ll submit the request for you” and then you never hear back from them. You have to follow up on every issue.

Miguel R

Looking to see if I could use my card reader outside the U.S. I ran into this website; very interesting, and I’m really surprised to see so many negative reviews. I have used Payanywhere for 5 years now and no complaints whatsoever. No service or monthly charges, next or second day deposits, if I needed an extra card reader or if one stopped working, I just called and they sent them for free. I have a small seasonal business and so far I’m a satisfied customer and even recommended it to several people. However, after seeing all these reviews, I’ll keep an eye because if I ever see fees and charges that are not supposed to be there, I’ll cancel immediately and will return here to comment on that.

Rosemary J Barletta

I began with a dropped account at 8:30am this morning. After speaking with many of the most professional and helpful individuals my problem was solved. Whatever the error, most likely mine, each individual gave me the most helpful advice and went above and behind to get my service restored. I would totally recommend this company. Thanks again for all the help today. Rosemary

Donald Pickett

BEWARE. these folks tell you one thing and the agreement in fine print is another. This will cost you thousands of of dollars in fees and the .49% rate they sell you is really 3.75%

This post will help: Find and Eliminate Hidden Fees in Your Monthly Bill

-Phillip

Kyle Baker

Like everyone is saying below-STAY FAR AWAY FROM THIS COMPANY! You have been warned! I have been with them for almost 2 years.. Today I was reviewing my bank statement and found a charge from EPX (their billing branch) for $131 and change. I called to inquire about it and was told “it’s the annual charge for services $119 + your monthly charge of $12.95). It took the representative almost 10 minutes to figure out that it was a “annual fee”. Keep in mind there is NOTHING mentioned anywhere for Payanywhere that they have an annual fee. YES THEY DO! Even better, he said there are 2 annual fees that will be charged each year! Both for $119.. So, in actuality they have a bi-annual fee which equates to $238 PER YEAR just to use their service, in addition to the $12.95 per month ($155.40 annually for monthly fees). That means you are spending-at minimum, and BEFORE transaction fees $393.40 PER YEAR… You will be charged the 393.40 PER YEAR whether you ever process a single transaction. If you DO NOT USE the service you can be charged the $393.40 PLUS an “inactivity fee” EACH YEAR for the remainder of your contract term. People, I have not had any problems with them for 2 years until they hit me for an annual fee… DO NOT DO BUSINESS WITH THIS COMPANY. If you do, you are going to get robbed. Plain and simple. Further, if you read the reviews, even if you “cancel” they will still bill you and then try and extort money from you. You have been warned.

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

Pam

Yes far away have been charged 179.00 per month for 7 months and have never used the service, my bad for not paying attention to my bank, called company last month closed it down and today they put through another 179.00 under a different name, filed fraud charges against them, put stop payment on any further charges

This company needs to be sued BIG TIME

Going to look into it!!!

Danae Liechti

SO SORRY TO READ THIS. I LUCKILY AM GETTING OUT OF THE CANCELATION FEE BUT HAVE HAD THE SAME BAD EXPERIENCE WITH THIS COMPANY. CONSIDER CONTACTING THE NEW YORK BETTER BUSINESS BUREAU TO WRITE A REVIEW OR COMPLAIN. I PLAN TO TOMORROW.

Jasmine Smith

They charged me $3.99 a month for 4 months after I requested a cancellation. I called every month to request that they close it out and was told it would be closed but then was charged the following month. When I called and asked for reimbursement and for them to cancel it they said that it was canceled but they would not reimburse my money. Stay far far away!

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

Pam

Yeap same thing canceled and put 179.00 through today under a different name

We need to sue this company im so angry rigth now !!they have taken over 900.00 from me and have never used in the last 5 months

Staying with square

Marianela C

Pay Anywhere is the worst merchant services that I ever work with.

I’ve made a sale for a new client that was above my “ticket limit” and so they decided to “audit” my sale and asked me for documents to support the sale such as an invoice and my last 3 months of my bank statement, which I have no problem to turned into, after 24 hrs that didnt even start it to “audit” my sale just because the “analyst” was-not-on-her-desk. Turns out that I almost lost my client’s contract. And the worst part is that my client’s money is on lymbo just because his bank already released the money but PayAnywhere after 3 days decided to deleted the sale so now my client has to wait 3/5 days to get his money back.

Their customer service its horrible and they made me feel that my business was no appreciated it.

Needless to say that I wont recommended whatsoever…. They are a shame!

This post will help: How to Make Your Payment Processor Release Your Money

– Phillip

John Raniss

Outside agent signed me up promising no fees and great rates. After a few months monthly fees kept going up and up. She basically lied. PayAnywhere would NOT refund any fees charged. They also don’t send monthly statements OR email statements. So I had no idea they were charging me these fees for a few months. Don’t Bother. Other processors never charge fees.

From The Editor

This Post Might Help: Top All-Purpose Merchant Account Providers

Pam

Same here told me i would save more money then square omg what a nightmare 900.00 in 5 months cause i didnt pay attention to my bank🤬🤬🤬im looking to do a law suit against them , today they put 179.00 through again even though when i log in says closed account, Ready to file a class action lawsuit

All this money they are taking from people

Hailley Hawley

Save yourself some trouble and DO NOT use this company! They are scam artist! I signed up with them several months ago before finding a better fit for myself and my business. I called them and had them cancel my account so I wouldn’t be charged in the future told them I found something that worked better. Keep in mind, I NEVER even used the app, never made a charge with a client, never even downloaded the app. I cancelled directly after the account was even made. FIVE months later they charge me a ridiculous amount..over $100! I called the number associated with the charge and they use another merchant company to charge their customers I had no idea what this company was and was confused about the whole thing. I called them directly and told them the situation let them know I did call and cancel even had the email confirmation showing it was cancelled. They were very very rude about it! They told me everytime someone cancels they have to mark it down and so I couldn’t have called even with my email that wasn’t enough proof to get my funds back. Seriously?! What a bunch of bull crap. Employees can make mistakes that was not my mistake! Never used the app ever but yet I have this huge charge?! They can look at the account and it would tell you I’ve never used their services. I cancelled 5 months ago why do they get to take money whenever they please?! Absolutely horrible company, they’ll take ya for everything they have. Even with monthly charges it shouldn’t be that much money over a 5 month period when no cards were ever swiped and why wouldn’t they charge monthly small sums not one huge amount?!! Do not use this company go to Square or Quickbooks they aren’t complete asshats! What a great way to start December. Was about to buy my daughter some gifts but now I’m out the money and they say there’s nothing I can do!

From The Editor

This Post Might Help: Cancelling a Merchant Account Without Paying a Fee

Cecilia Chavez

Worst company ever… where nice enough to get the money from the cuatomers, but when it was time tl pay me they were asking for way too many documentations claiming that it would be for tax purposes on my part, mind you that we’ve only been opened less than a month. They owe me 2000.00 after constantly trying to get my money, i finally got very upset with all of their excuses and got the account closed, which i don’t care, and now have to wait 4 months to see if those jerks decide i will get my funds. Thieves, is what they are!!!

Lou

After not using this service for five years, I was suddenly hit today with an “inactivity fee.” I thought that my account was cancelled, so was very surprised when this charge showed up. One of the reasons I stopped using the account was an inability to connect via my iPad or iPhone when trying to put through a charge. It was embarrassing to be standing with a client, and not able to complete a transaction. Customer service was a useless drone who seemed to be reading from a script.

Lou

Follow up to my last comment. I received confirmation from Payanywhere on February 26th that my account was closed. I received an email today telling me that they were deducting another “inactivity fee” from my account. When I called, they had no idea why I was charged, and that they would reverse the charge. I wonder how many times they have gotten away with this scam? Stay far away from this company!

1

Helen

I’m having the same issue. Did you call or email to get the account cancelled? I’d love to get contact details you used for them. Thanks!

From The Editor

This Post Might Help: How To Get Out of a Merchant Account Contract

Jeffery Parrott

This company is horrible! Was lied to about fees to sign up. Apparently no one has a boss here. All they would say is there is nothing they could do about the money that was taken out of my account!

Hope

Do not waste your time or money dealing with this company! Our business has taken in over 30k in the last year via credit card transactions and the put a hold on our account for one $2500 transaction. Took me an hour to reach someone on the phone and they are requesting several documents in order to release our fund! If this was a fraudulent act why haven’t we had this problem wile processing the other 30k in transactions? We will be terminating services with them and using square from now on!

Lincoln

Service is non existent. They will limit your transactions to $20 per day. Who has a business that takes in $20 per day? I didn’t have time to argue with them just closed the account that took 4 hours literally being passed to phone numbers that either didn’t work or had no-one answering them. If I could give them less than one star I would

Roberto Victor Illa, M.D.

Wells Fargo Bank got me to use this service. I was in private practice in Chico. Because of ObamaCare and the Narrow network policy of Blue Shield of California (eliminating doctors from their “Preferred Provider list”) I lost so much income I had to close my practice. However although Global Payments was no longer providing a service, they continued to bill me several hundred dollars per month. I tried to reach them using the number Wells Fargo gave me. The person who answered gave me another number. This also did not work. Pay Anywhere contacted me to tell me I now owed thousands of dollars. I stated the fact that they stopped providing a service months ago, because I had closed my office. They said the contract said they could still bill me. They continue to bill me over a year later, and have ruined my credit.

Zayra

They do not are clear with fees.

I am looking for another service provider.

Jeff

Writing again to complain about PayAnywhere. Found out today they are still holding my money from me even after requesting higher limits and being authorized for it. I will say it again…I would steer anyone and everyone away from this company for cc processing. They are absolutely terrible. They have no concern or care for their customer, the people they make their living from.

Jeff

Absolute worst cc processing service we have ever used. After 3 years of using them they began(out of nowhere) telling us our deposits were “under review” every time we processed anything over $500.00. When this happens they have the right to hold your money for as long as they deem fit. I would never recommend this company to anyone. One deposit was held from us for 8 days. Absolutely rediculous company. Never, and I mean never, should anyone use this company for cc processing.

Yancell M Morales

Very frustrated, My 1st transaction is taking longer than 7 days, you email them, there’s no reply, you call them they ask you 100 millions questions over and over, the waiting its way too long and when they finally answer the phone they will ask you for the same documents, so this way the delay the process for anorher 48 hrs. If I would read the reviews I wouldn’t have gotten into this.

Gomana

Scamming..Scamming..Scamming Payanywhere scam company.

In the first call..very friendly with me and takes all my details SSN ,bank account number and all..!

After 2 weeks the company closed my account!!!!

When I asked them why?!

Told me we closed your account without any reason?!!!!

That company Scams to take your all information about you and your business details.

( Be carful)

Ronnie Johnson

I’ve been using this system : tablet, printer, and cash register in return i was suppose to receive the 3-in-1 but everytime i call to see what’s going on with it i get put on hold and i don’t get any response … so i have no choose but to go to another merchant for business because this is not working for me.

Stan Diggs

I agree with all that I have read so far, scam, scam, scam, scam. My initial call to setup account went great, wonderful support services, but after running two transactions through totalling just over $1000.00, all my funds were frozen by pay anywhere. They stated they wanted 3 months of my banking records and when I refused they held my funds. It’s been 30 days and o still have not received my funds. Run away.

Joe Walsh

I came here to say they place holds on your money for EVERYTHING. Sneeze and they’ll hold your money. Some of the customer service people are nice others are rude jerks. As others here have stated, don’t go with them you’ll be sorry. After seeing all these bad reviews I’m very surprised they’re still in business. I’ve used GoPayment and Paypal never a good easy to work with no issues with them.

wayne

they have my funds also, a $1000, had them almost a month. run from them scam company. I’m writing this while listening to there bad music the phone for 30 min

cindy hedberg

Customer service is really horrible. I have been trying to close my account with them for almost a year now and they continue taking a fee out of my checking account. I have emailed called and emailed again to no avail. I am beyond angry. Just Beware!

Karla Armstrong

Communication EXTREMELY poor. They were notified in 2013 that our business closed but still took money from our account. Received no notification of the $3.99 “activity fee” they set up in 2015. Supposedly notification was sent to a closed email account. No letter mailed to address on file and this is ok with their legal department. Did not receive ANY correspondence until the bank account was closed. Then we receive a collection letter in the mail. Why wasn’t this sent to the email???? So….they can notify you for fees by email but when it comes to collecting money they will mail a letter. They won’t refund the money and settle by waiving the $3.99 fee they didn’t collect. VERY UNETHICAL COMPANY!!! Stay away!!!!

Crystal K

Do not use PayAnywhere, it’s a scam. They put my account on hold and closed it without notifying me and kept the money that was in my account and would not deposit it. Bad company, use square or paypal instead.

Natale Harter

Pay Anywhere –

I canceled the account 4 years ago they charged me an inactivation fee of $3.99 per month and will not refund me. They stole money out of my account

Chad

Scam. just cancelled my account or accounts. Under my social there were 2. Guess the girl that set it up did that, one for each email she asked for. I noticed a 3.99 fee twice a month and googled it. I reviewed all my email accounts (even the spam folder). I never received one thing on either account about a fee.

This company is a complete scam. When I asked to cancel both, Flip canceled both without any questions. He said they send notice every month with a link to cancel. Complete lie.

Tadd Warner

NAB payanywhere is staffed with several rude people (at least the ones I have dealt with) who could really care less about getting new business. They wanted me to jump through so many hoops because my average charge is higher than most that I finally got disgusted and told them to forget it.

The worst of it is they have taken a withdrawal from my bank account for $348. that I never authorized, in fact I had them cancel my account before it was even set up all the way. Stay away folks!!!

Freddy hernandez

Hi my name is Freddy hernandez

I recently open in accord with pay anywhere credit card processing i I never ever ever ever recommend payanywere to anyone they have bad customer service you request a change in your icon and they all say you a month later I want to fly I give them the one they are suck

Timothy Agnew

Pay Anywhere is not a trustworthy company . They use fraud and deception to steal from clients.

Ronnie Johnson

I work as a independent contractor at a barbershop

An I’ve work with the tablet but it has been working the way I though it would . I’ve been having problems with it from day one. I’m on the verge of sending it back because it has been nothing but problems to me.

Gen Kan

Pretty much whatever most people describe in here. I set up an account through their rep. A year and half after i close my business I keep getting phone calls to pay close to 1000$. I even sent them email proof with their rep that i asked him to close it and he came picked up everything. I closed my business without owing a penny to anyone. There should laws to protect people from this.

Melissa

Literally THE WORST. I’ve only used the device a handful of times – I make and sell art. The first time I used it was around Christmas and I was really hurting for money. I had to make multiple calls to customer service to receive my payment, and if I hadn’t caught the fact that it hadn’t gone through, I wonder if it ever would have! I waited weeks for it and it was MAYBE $40.00 total. The buyer had the transaction go through on her end, so it was just sitting somewhere in Payanywhere limbo, not helping me. Recently I started being charged the 3.99 a month maintenance fee. I canceled with them through an email link only to find out I was still getting emails and still being charged. Emailed customer service to tell them to refund the last 3.99. Sure, gave me a ticket number and told me 5-7 business days. I’m on day 8 and no refund, emailing customer service with no answers. Yes it’s only 3.99, but it’s the principle of the matter. AVOID AT ALL COSTS. Customer service has NO idea what they are doing. Not worth using whatsoever.

CHASITY LYNN HUFF

HERE IS THE EMAIL I RECEIVED. Mind you I had only used this one time, and was asked for all this information. I had previously used THE SQUARE and NEVER had a problem with them. Now I am fighting to get my account closed and worse yet, fighting to get my customer his money back. TOTAL SCAM…DO NOT USE THEM

[email protected]

7:45 PM (2 hours ago)

to me

This email is a courtesy notification and confirmation of

your recent inquiry. You may want to keep this notice for

your records, should any follow-up be necessary.

Notes:

—————————————

12-01-2016 07:40:48 PM by rd

Dear Merchant,

Please provide verification of your business (ex: business license, City, County or State license or certification, professional license, Federal Tax ID, etc.) and please include the method of marketing to potential clients, a description of products and/or services, a description of how sales orders are received and processed and the method of delivery for the product and/or service.

Please provide a copy of your invoice, receipt, work order or contract showing the card holders full name, billing address, contact phone number, and products or services provided for the transactions below.Please also provide verification of shipping and delivery if applicable.

A 100% funding hold has been placed on the account.

Please send the requested documentation directly to the analyst who is working on your account on or before 12/09/16 to avoid possible reservation of funds or account cancellation. Contact information is noted below.

Transaction(s):

card ending in **** $540.00

Agent: Rachel D.

Email: [email protected]

Fax: 248-283-6145

—————————————

REALLY, A company needs all this to process a damn credit card? REALLY? Paypal doesn’t do this, nor does the SQUARE. So why does this company DIFFER??? Because they HIJACK your Bank Account and Run wild with it.

Anthony

I’m going through the same thing same email and all the run around. Pay Anywhere is a part of Wells Fargo who just had some scams going on with them. I’m guessing it’s the same thing with them. I’ll be talking to a lawyer tomorrow and asking about a class action lawsuit

Claire Dixon

Do yourself a favor and avoid this company at all costs. We cancelled our account months ago and we are still being charged. Now I just received a collection notice saying we owe them money! I’m going to have to call a lawyer! They should be shut down.

Sindy

Same here I had a restaurant for only 3 months last summer and today I receive a phone call stating I owe $1000+ dollars because I had a contract for 3 years and cancelled. Before this they kept calling that I still had there tablet which I had returned a long time ago to the representative that signed me up. Now they changed to this story that since I cancelled my contract I am liable to pay fees for 3 years as penalty. The lady indicated that she was being nice and calling me before she puts it on my credit report.

C Lynn

I never did business with this company but received a letter saying I owed them money. I called them. They wanted my personal info over the phone. I did not give them anything but wow. Not sure where they got my name and of course will not pay. I am not a merchant nor had I even heard of this company. Scam is about the right word.

Matthew

STAY AWAY FROM THIS NIGHTMARE OF A COMPANY!

PAYANYWHERE IS A COMPLETE SCAM!

They processed a payment, refused to release funds to my account without first receiving months worth of prior bank statements and all kinds of other bs information. I refused to provide my bank statements and told them to just refund the customers money. they attempted to refund the customer 2 times pulling the money (over $1000) from my account (Mind you they never deposited the original transaction into my account) until I had to close out my bank account and file fraudulent charges. Now they send me monthly letters from their collections department saying that I owe them the money and threaten to report to credit agencies. Multiple phone conversations go nowhere.

Jessica Trout

Just purchased from CVS and was advised you have to be approved first. I contacted customer service and was advised I was declined due to the business I was accepting money for. What a waste and joke. I would not recommend to anyone.

Jesse Ruiz

This is the worst merchant company ive used and ive had intuit and another merchant company who i cant remember their name but too are thieves. Payanywhere will without hesitation refund a customers money without notifying you or giving you a chance to dispute the charge and then they keep trying to pull money from you bank and leaving you in negative. wish there were something i could do to stop this.

Paul Ford

I would run as fast as you can from this company. They put a hold on my funds which was only a $300 transaction. They wanted tons of paperwork including a detailed business plan and they failed to mention any of this before I started processing. I had to wait 6 months before they would release funds. OVER a year later I’m still waiting for a paper check which they said would take 4-6 weeks and that was 3 months ago! HORRIBLE, 10x worse than square.

Matthew Kelly

After making my first transaction ($1004.39) the company did not complete the transaction and requested information. I refused part of the information requested because I did not feel that it was needed or appropriate for them to have. In Which they refused to complete the transaction and closed my account. (No problem) I had to contact them directly to refund the funds to the customer. I went into my bank account and saw a pending transaction for 1039 more than what the transaction was for even for even though they NEVER completed the transaction and sent me the money! STAY AWAY FROM THIS SCAM OF A COMPANY!

Gena Fischer

I used my reader for the first time. Then got an email telling me i would get money in 3 business days. On third day still no deposit. I called and wad told my acct wad on hold i needed to fax them info i doesn’t have on the customer and then once they reviewed it they would pay more in 3 more business days!! Got a square reader and canceled acct. Worst reader ever unless you don’t want out need your money. Also contacting the bbb and anyone else who will listen. This is just a scam and a hoax!

Teri Boylan

Payanywhere, has been taking 3.99 from a closed account for years and refuses to put it back. Truth is I purchased the system that wasn’t compatible with the phone. The payanywhere system was returned, and never used. The biggest fraud going on. Payanywhere, is stealing money from the consumer, without services rendered. I rate them a F. They should be serving jail time for fraud.

Hayat Masudi

Beware of this company which it has partnered with a company called INSIGHTwhich is totally a bunch of con artists

They will bill you through PAYANYWHERE a monthly subscription of $29.99 and it is nothing but to rob merchants.

I cancelled my account with them yesterday and you should do it today, tomorrow will be too late

Rena A

Ps. I closed my account. Make sure you do that as I read that this company Pay anywhere likes to charge inactive fees too.

Rena A

I own a very large transport company. I was needing another payment processor because I am exceeding my volume with my other. I signed up with company it was fast and easy. I charged 600 the first day got it the next. Then boom I got emails asking me for my other deposits and proof of bills. I sent them over what they asked for. They said I charged one customer 2x and gave a card that wasnt even the card I charged 2x. I charged a different one 2x. But one charge was voided because they were adding tax and I couldn’t remove it and my industry doesn’t charge tax. Because their emails were so screwed up and wrong cc #’s for wrong amounts I just sent them proof for all my transactions. Then they sent me an email and said none of my stuff matches. One of the customers has been my customer over 3 years. I have delivered over 20 cars to his business. I have even been to his busineess and his info was indeed correct. It seems the risk manager was too lazy to print out all the information for the billing and match each charge to each bill. Its been going on 3 days no email after email and them holding my funds. I opened an account with paysimple and they have been so nice. I fully expect my first few transactions with them will be verified and I have no problem with that but they seem to really be professional and know what they are doing. This really was one of the worst customer service experience ever as a business owner with Pay anywhere. Stay away.

Nazli Ucar

Payanywhere has the worst customer service. I have been promised to get a call back from supervisor 3 times and no call back. They re holding my funds for 11 days and I can’t even get a hold of supervisors.

Use PayPal no problem, any problem perfect customer service.

Rae

Do not use this company. Although the company said no monthly fee, but they will charge your bank account without receive any notice. When I sign up for this credit card reader, I was sign up for pay as you go with no hidden fee charge. I find out few days ago, this company start charged my bank account since December 2015. They said they sent out email and notice for the charge, but I never receive any email from them not even a mail. Just like I told them no one cannot just go on the street and send out a letter to everyone said if you did not response my letter. I will start send you a bill or charge on your bank/credit card account.

This company already charge my bank account for seven times. I call in May to cancel the account, during that time the customer representative agree to refund me one month. In June, I not only did not see the refund, but also see addition charge from this company.

Leslie Bonilla

After we processed a payment over $2000, we noticed that the transaction was not deposited into our account after 48 hours. We contacted customer service with our concern and they said they would hold the payment for 180 days?? when I requested management, because this was not mentioned before or during our waiting period for the payment, management tried brushing off the complaint and switching me over to people who were rude and unprofessional. After all the frustration I called back again to see if i could get help with my account and another representative lied and said my account was closed, after then being switch to another manager I requested a refund for the customers transaction and they tried to change what they said previously to avoid giving a refund. Never doing business with them ever again.

Matt

Did you ever receive your funds?

Adam Apalategui

Like so many other reviewers, I wish I had looked here FIRST.

Their software has serious compatibility issues, including super popular Samsung tablets. They charge differently than you were promised and try to keep you from changing. When they did open a new account for me to get the flat rate they didn’t close the old account I am stuck with their PCI compliance fee. I had to stop payment on their access to my account and nave now filed a complaint with the Oregon Attorney General…like so many others have…

Switched to Square four months ago and still cleaning up this mess…

Allisa M. Clarke

I supposedly opened this account on my own back in 2011, when I asked them to tell me when I last used the account it took them a very long time to tell me that I NEVER used it. And yet they kept the account open for 5 years and after 5 years of holding onto all of my bank information they are going back into my account and withdrawing funds. A real bank will not keep an account open for years with no activity it just doesn’t make sense. When I asked to get a refund for the fees they told me they couldn’t do that due to the inactivity charge….really Pay Anywhere is Pay Anytime All the Time because they will keep your bank account information for their own use and when cash flow is tight they are just going to dip into everyone’s account and make up some lame excuse.

Quinton McDonald

I own 17 hair salons and use payanywhere up until two weeks ago when I got the worst service from the operators of payanywhere. When I asked to speak to a supervisor or someone higher than an operator all I got was children laughing and switching my call from one operator to another until I got so pissed off, I hung up and ordered the Square. Now I wish to close my account with payanywhere and nobody wants to handle this problem. If I practice business like pay any where I would be out of business in a couple months. So I whish to jump ship before they steal more money from me and also I don’t deal with people who cant conduct them self in a proper manner. Winning peoples respect by doing good business is how companies and people grow. Even if my typing is awful my RESPECT for my customers is whats makes me a better person.

Jack Williams

Finally used PayAnywhere for first time and they froze my account asking for additional documentation two days after the charge was approved. I am now working on that and will throw away their card reader.

Tracy

I wish my wife and I would have read the reviews about this company prior to sign up!. The previous reviews are so accurate. Customer service is horrible! After being placed on hold for hrs, the representatives will likely hang up on you 80% of the time. As another review mentioned, its like you are speaking on the phone with a bunch of PM’sing adolescent girls. After holding for 20-30 mins and then being told that only a senior rep can help me, I was transferred to the “senior rep” Nakisha 5 different times right to her voicemail. When I was finally able to get a hold of her, I explained our concerns, she then placed me on hold, I held for another 15 min only to find out she went to lunch when I hung up and called back! I called back numerous amounts of times wasting well over 2 hrs of my day before reaching her again, she told me to fax in some information, I complied and no return call! I’ll be spending another 2+ hrs to get a hold of someone who can help me if that persons even exist there. Multiple charges were charged to our account after cancellation without our knowledge. Charge after charge which caused multiple over draft fees. The equipment they sent was faulty, then they sent another and it was faulty as well. This company is very unethical to say the least. BEWARE! Don’t trust them with your bank information. And don’t expect to get help from their so called “customer service.”

Jade

This should be ILLEGAL! I signed up impulsively with “Pay Anywhere” 3 years ago, while I was waiting for the card scanner in the mail I read reviews and was horrified! I canceled my account and tossed the scanner in the garbage when it came. I finally noticed this $3.99 fee twice on my bank statement. I called and told them I never used their service and canceled. They claimed I had not 1 account but 2, and the fee was not hidden since they apparently emailed at one time to let me know about it. Even though I canceled they keep charging me inactivity fees. They advertise no hidden fees but they are the kings of the hidden fee! Upon further inspection, I’ve been charged these fees every month for 3 years! (I feel like an idiot for not catching this sooner) Pay Anywhere is like inviting a vampire into your home, they suck you dry no matter how much you say no! I finally closed that checking account , which was a major hassle. The supervisor I got on the line credited me $25 supposedly. Gee thanks! I bet the check won’t even come. DO NOT SIGN UP WITH THIS COMPANY. I hope a class action law suit gets their ass! I will sign up for that!

—

Are you with PayAnywhere? Learn how to resolve this complaint.

GABRIEL

Pay Anywhere is a complete scam. DO NOT sign up with this company. They charged my business account $3.99 without my permission and when asked about it they said that they sent me an email telling me to close my account or they would charge me and that when i checked the box on the “sign-up” portion of the website, within the small print it states that “you will be subject to charges if any changes may apply” . This is how they work around the law to charge you at will.

BE VERY CAREFUL WITH THIS COMPANY. THEY ARE NOT ON THE UP N UP.

—

Are you with PayAnywhere? Learn how to resolve this complaint.

r cunningham

Payanywhere is the worst CC processor in the world. We are a legitimate business with good credit. We have never had a chargeback or a fraudulent purchase. Our account has been frozen 4 times in the past year for audits. They are difficult to get on the phone and are never helpful. I would never use them again. We are closing our account tomorrow. Please do not use them.

—

Are you with PayAnywhere? Learn how to resolve this complaint.

Margaret

Payanywhere is the worst CC processor in the world. We are a legitimate business with good credit. We have never had a chargeback or a fraudulent purchase. Our account has been frozen 4 times in the past year for audits. They are difficult to get on the phone and are never helpful. I would never use them again. We are closing our account tomorrow. Please do not use them.

—

Are you with PayAnywhere? Learn how to resolve this complaint.

Tanya Mel

Hello! I actually just had same problem and sooo upset ever used them. They opened an account for my company and i was charging customers at food show. Then next day i got an email stating that my account is closed! When i called they told me they will hold funds for an audit and once i send proves of all transactions, they will send a check! After tons of phone calls and emails, NO reply! This has to be illegal to hold other cutsomers money. i want to sue them for damages. have you ever gor your money back? If there are lots of us that they hold funds, we will definitely win a case! This is just biggest scam! my email is [REDACTED – personal contact information]. Thank you!

Evan

I also got charged $3.99 from PayAnywhere. How can they just charge this inactivity fee and still advertise their product/service saying that “No setup, monthly or hidden charges”?

$3.99 is small but this is simply bad business practice. If I know about any class action lawsuit against this company, I will definitely sign up!

—

Are you with PayAnywhere? Learn how to resolve this complaint.

D Brewer

Same experience; as far as I know that stole $8.00 from me. Count that times the 1M they did it to and that’s a good racket.

—

Are you with PayAnywhere? Learn how to resolve this complaint.

Dave Ward

Terrible — impossible to login and use, so when you find a reputable company like Square or Paypal and use them instead, they start charging your bank account (which they hold hostage) a 3.99 monthly ‘inactivity fee’ which you can’t stop block through your own bank. Fraudulent and dishonorable….users beware.

—

Are you with PayAnywhere? Learn how to resolve this complaint.

Keith Maxwell

Poor experience, lame fees. Customer service puts you on hold like you have nothing better to do. I.m way happier with the 4 sided figure.

—

Are you with PayAnywhere? Learn how to resolve this complaint.

K. McMillan

I used this service to process Amex, Visa and MC for 3 years. I had zero problems up until 2015. During 2015 there were suddenly big delays in receiving funds, transactions that read as “approved” would disappear into thin are and the customer service is very disorganized and scattered. I left them for squareup recently and am so relieved. As a small business, the amount of stress that payanywhere caused me is completely unacceptable. I would never recommend this service to anyone.

—

Are you with PayAnywhere? Learn how to resolve this complaint.

Kelly Nestler

After being charged $3.99 & $1.99 for an inactive account, I closed out my accounts. After receiving confirmation that my accounts were closed, Payanywhere still charged my business account and my personal checking account.

They are SCAMMERS!!

—

Are you with PayAnywhere? Learn how to resolve this complaint.

PAYANYWHERE SUCKS!

This happened to me! Can’t believe this company is charging an old account some $4 fee – their recordings say an email was sent explaining how I can prevent this from happening. 1st of all I have not used Payanywhere in 5+ years – don’t have the same email I had when I initially set up for this and they are going into my bank account!!!

DON’T USE THIS COMPANY THIS IS HORRIBLE BUSINESS PRACTICE!

—

Are you with PayAnywhere? Learn how to resolve this complaint.

Charles Brown

I am in the same boat.

—

Are you with PayAnywhere? Learn how to resolve this complaint.

Larry McCloskey

Account closed for 3 years after using them one weekend (which resulted in a horror show of unexpected holds and HORRIBLE customer service interaction), now they want a $3.99 monthly “inactivity charge” unless I cancel AGAIN. Cited a previous email which I never got. About the only thing they ever get right is accepting charges so they can hold the funds, and charging unannounced fees. Oh, and holding onto the bank account numbers of former customers so they can take a dip whenever they want.

—

Are you with PayAnywhere? Learn how to resolve this complaint.

Jason

Stay away from this company! PayAnywhere may say there are no monthly fees, but they definitely have monthly fees! And then they’ll say that they told you about them!

—

Are you with PayAnywhere? Learn how to resolve this complaint.

David nomack

Stay away from payanywhere…they hold the money and their customer service sucks…their app always kicks you out…stay away..spend bit more and try different processor….but please stay away of these horrible people

—

Are you with PayAnywhere? Learn how to resolve this complaint.

Maila

They took out a $3.99 fee from my checking account without my consent for an inactive 1 yr old Payanywhere account. A little more than a year ago I signed up but found another venue that was more suitable for my business needs. One year later they charged me a fee for not using it instead of just deactivating my account or giving me timely warnings?! I searched through my e-mails and found that they only sent one e-mail to me back in Oct announcing the fee somewhere in the paragraph. When the account was inactive in November, they should have contacted us or have done something so that we would have been made aware of the new fee. That is bad business practice. I only found out about it from my bank statement. Did they look at the number of inactive accounts and thought “There’s ‘x’ number of inactive accounts out there, if we charge a $3.99 inactive fee = profit.”

—

Are you with PayAnywhere? Learn how to resolve this complaint.

I urge people to choose another payment processor because PayAnywhere do not value the account holders.

Marvin

They overcharge on transactions. They will not work with you on chargebacks. They will keep charging your account with fees.

Terrible company to deal with. If anyone will go ahead with a class action lawsuit, Im willing to join and put my name there.

For the sake of your small business finances, stay away from these thieves.

—

Are you with PayAnywhere? Learn how to resolve this complaint.

Shak

same here they charged 4 dollars and when I call insist saying we email you 60 days ago that close your account or we will charge you so we can not refund you.er And I am very strict about my emails if any saying you have to take this action I do I remember that was an offer if you use payanywhere we will wave your transaction fee and in past when I fall for that offer they charged me double fee when I call and mention offer they said fee you need to pay and we are closing your account from today’s date in 2013. Now after two years they charged me fee. when they refuse I call my bank and they stop payment even they were saying this is not fee this is a bank card transaction. but thanks to them I got my 4 dollars back

—

Are you with PayAnywhere? Learn how to resolve this complaint.

Donald McCrary

Do not go with this credit card processing company. They will not work with you with any transactions you may dispute. GRADE F

—

Are you with PayAnywhere? Learn how to resolve this complaint.

Casey Benefield

I’m also a victim of this inactivity fee scam. It didn’t stop there. I had to contact them EIGHT times to get them to confirm that they even RECEIVED MY REQUEST TO CLOSE THE ACCOUNT! I was even taunted by reps. One of those, I was smart enough to have someone from my credit union who was willing to be a WITNESS.

—

Are you with PayAnywhere? Learn how to resolve this complaint.

Trent

watch out for inactivity fees I had to close my bank account to get them to stop they will continue to steal under the guise of inactivity fees or maintenance fees they are part of wells fargo bank and they are famous for applying extra fees on an account beware and can’t say you were not warned poor business practice on their part

—

Are you with PayAnywhere? Learn how to resolve this complaint.

Barbara Heintzelman

They charge a $3.99 INACTIVITY FEE. I signed up with them initially, but they were difficult to use. I went to Square Register instead. Am I glad I use Square!!

They said they sent an e-mail saying that they were going to do this. After searching, there was no e-mail.

STAY AWAY from Payanywhere!!! Far, Far Away!!!

Use Square Register instead!

—

Are you with PayAnywhere? Learn how to resolve this complaint.

Barb

Watch out for the surprise fees!! After a pause in my business, Payanywhere docked my linked account for a $3.99 “monthly inactivity fee” without notice. I went online and could not find way to close my account or unlink my checking acct. I did online chat where was told my account would be closed but they would not restore the $3.99 fee.

—

Are you with PayAnywhere? Learn how to resolve this complaint.

Shak

call your bank and ask them to stop payment. Bank of America did not charge me stoppayment fee for this amount but I hope they won’t be able to charge me again.

Andrea

It’s our first day of business and none of their equipment even works properly. Some how both the store front and the phone swiper don’t read the credit cards. Called into customer service and was treated horrible. I called 7 times and heard “all circuits are busy”. Then when it finally went through I waited on hold for 11 minutes until a human answered. When I asked for a supervisor I was told “let me see if they are willing to take your call because we are very busy”.. Really? I am not impressed and searching for a better option ASAP. Pay anywhere is terrible.

—

Are you with PayAnywhere? Learn how to resolve this complaint.

Amanda

Their circuits are busy because there are hundreds of people calling them right now due to a $3.99 inactivity fee that hit December 1. You totally chose the wrong merchant processor!

—

Are you with PayAnywhere? Learn how to resolve this complaint.

Paul Scott

I tried to use pay anywhere before I saw this site and it was the worst experience I have had with a company.

I sent them an itemized list of my issues with them and they seem unwilling or unable to resolve any of them. I went back to Square where my experience have been good.

Here is the list of issues I had with pay anywhere, mind you I had them for 1 week and processed one small test transaction. Never even got to roll it out.

1.) Limits were too low to be useful. I could initially only sell $10 or less at a time.

2.) emails are poorly phrased and don’t make requirements clear, I had a three day delay because they said they may ask for a document. They never asked for it just expected me to send it.

3.) My first interaction with the chat system listed the wrong business hours and disconnected me when it was stated to be open but were not really.

4.) First support person I talked to lied to me and told me Square doesn’t have a customer service line. I didn’t know that I never needed it. (It was a lie they do have one and they were helpful)

5.) It has taken days to get any sort of response which has slowed my ability to do business and take payments.

6.) When requirements were finally made clear I was asked to email or fax my bank statements. I don’t own or use a fax machine anymore and haven’t for the last decade. Tech suggested I go out and pay Kinko’s or someone else to fax it for me. Would you want to give your bank statements to strangers to fax? Email isn’t secured or offer an encryption option. So the bank statement request is protection for you but not for the merchant. It would be trivial to put an upload button on the secure site to upload a document that is requested.

7.) Second support tech was kind and tried to be helpful but wasn’t really able to do much or advance the issue.

8.) Finally raised my limit but to a lower limit than what my transactions with you are likely to be. I bill clients on a monthly basis so depending on the amount of work I could bill them anywhere form $150 – $2,000 dollars. Just last night I had 2 $1,900 charges which Square processed happily with no issues. If they have questions they will ask me but none of their procedures seem to be designed to impede business.

9.) Promised $5,000 in free transactions for using Apple Pay. Used Apple Pay for the first transaction and got charged for it.

Paulette

The worst customer service I’ve ever had from any company. I have had to contact them five times to resolve crediting my account back. It was supposed to have been resolved last week and then I got another message stating I never contacted them and the issue was closed. I wrote yet another time and was told I have to call again. For more than one month, this company has kept nearly $2000 that is duly mine. It’s been the most unbelievable experience I’ve ever had with a company. Don’t use them.

Scott Hayes

I wish I had read this page before processing a transaction through this company. they now have over $3K of my money and won’t release it. I really don’t know what to do at this point. i can’t ask my client to pay twice and put them on the hook. Avoid them at all costs.

Tara Arena

Filed a complaint with the BBB and the Michigan and California Attorney Generals Offices. Both offices are aware of the complaints filed against PayAnywhere and are investigating them. If you have been victimized, please fill out consumer complaints online at the Attorney General’s office in Michigan and the state you reside in. Also, fill out a complaint to the BBB. Venting on a website about your experiences will do nothing to close down this unethical business, nor will it get you your funds.

Paulette

Thank you. This company has held my funds since August 18 2015. I have tried nothing less that 8 times to get it from.them.with no resulution. Inwill.do as you.have done. Agree that this is an unethical company.

jb skaggs

I signed on with Pay Anywhere to get their tablet and cash drawer for my food truck. They did provide the equipment and quoted me $30 / mo and 1.79% per swipe if over $5000 in gross charges or 2.67% under $5000 gross.

I got my first bill and it was $111.22. They apologized for not telling me they would charge an extra $80 a month if I did not have $5000 in credit charges. But this policy is a deal breaker for me because I was already paying $30 a month in equipment rentals an extra $80 is unfair.

They said they will cancel my contract with no other fees. We will see what happens.

CJ

Please keep us posted. I am in the same situation now. Did not know about the additional $79/ mo if sales is under $5k

jb skaggs

They did cancel the contract, I sent machine back to them. We actually fought over a $300 withdrawal for equipment fees. They eventually refunded it after reported them to my local bank (great thing about small banks!) who filed formal letters of intent to sue. But it was a pain.

Mike

I have been using a Wells Fargo PayAnywhere credit card processing service for a year and recently when we had a customer pay $4,750 Wells Fargo refused to pay me the proceeds. They requested all sorts of documentation including an invoice which they then said it did not match the person paying the bill. Since they refused to give me my customer’s payment I asked that the transaction be returned to the customer and they said they were charging me $167.97 for collecting the money that they refused to give a me and then would charge me another $167.97 to refund it. They are charging me $335.97 for not giving me the proceeds from a sale to my customer.

Chris