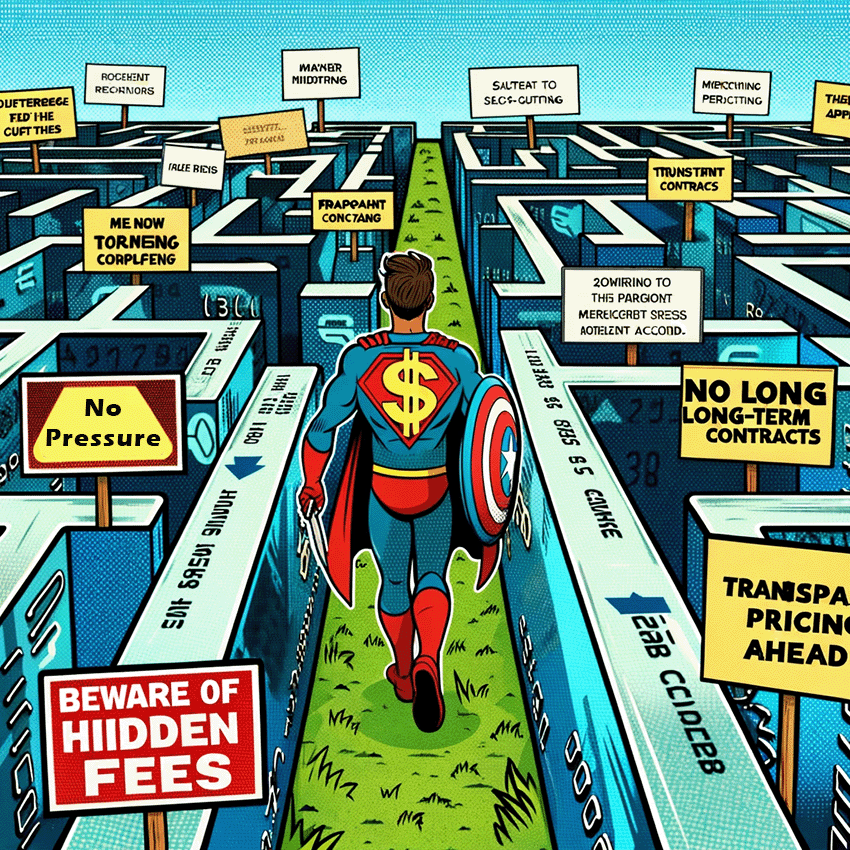

Learn How to Avoid Common Fine-Print Merchant Account Contract Scams

Steer Clear of Hidden Traps: Smart Strategies to Avoid Excessive Fees and Unwanted Commitments with Your Credit Card Processing Services”

Get EducatedRecent Credit Card Processing Research

Press Inquiries

Are you a journalist covering a payments-related story and need an expert source? We’ve been quoted in publications including INC Magazine, Los Angeles Times, Computer World Magazine, and several others.

On a deadline? No problem. Let’s talk today.

Learn More