National Processing Reviews & Complaints

Company Overview

Based in Lindon, Utah, National Processing is a merchant account provider that specializes in ACH processing for small businesses. The company should not be confused with National Processing Company, National Payment Processing, or 1st National Processing, as it appears to have no affiliation with these similarly named providers.

National Processing Payment Processing

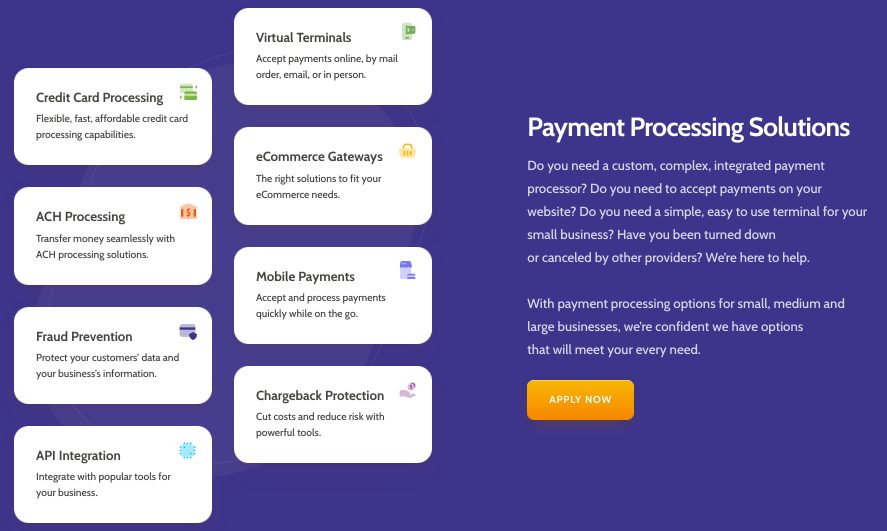

National Processing processes all major debit and credit cards as well as ACH payments. Their services include POS solutions, EMV card readers and swipers, ACH processing, mobile solutions, e-commerce solutions, access to a payment gateway and virtual terminals, QuickBooks integration, and fraud and chargeback protection.

Location & Ownership

National Processing is a registered ISO/MSP of Avidia Bank, Chesapeake Bank, Kilmarnock, VA. The company has its headquarters at 898 N 1200 W Orem, UT 84057. Wayne Hamilton is the founder and CEO of National Processing.

Video Summary

| Pros: | Cons: |

|---|---|

| Customizable plans for diverse businesses. | Less suitable for large businesses. |

| Transparent pricing structure. | Not ideal for high-risk industries. |

| Competitive rates for low-risk merchants. | Limited features compared to competitors. |

| Offers free SwipeSimple mobile reader. | Early termination fee in contract. |

| No set-up fees. | Potential connectivity issues with mobile app. |

| Quick onboarding, easy setup. | Higher fees for high-risk accounts. |

National Processing Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | <10 |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | N/A |

| Recent Lawsuits | Yes |

Low Complaint Total

There are around eight negative National Processing reviews available. Some of these label the company as a scam or a ripoff. A notable complaint (detailed here) involves a client’s claim of withheld funds by National Processing, with an alleged involvement of iCheckGateway. The situation includes rebuttals and counterclaims by both parties, and the exact circumstances remain unclear. Other reported issues include sudden account cancellations, machine functionality concerns, delayed deposits, and customer service complaints. We invite you to add your National Processing experiences in the comments below.

Questionable Fund-Hold Situation

The specific details of the fund-hold complaint are ambiguous. The situation might involve an unintentional signup for a third-party gateway, leading to a fund-hold by iCheckGateway. Alternatively, it may be a case of policy adherence by iCheckGateway and miscommunication resulting in misplaced blame on National Processing. Without conclusive evidence, we cannot definitively judge National Processing’s role in this issue. The company’s responses to the complaint seem focused on denial rather than resolution, although supporting documentation indicates some level of engagement with the customer’s concerns.

National Processing Lawsuits

In 2019, National Processing was involved in a legal dispute with MiCamp Solutions, revolving around licensing and financial agreements. The lawsuit spanned two years and was eventually dismissed, though the final outcome for each party remains unclear. Clients seeking non-litigious means to address issues with National Processing are recommended to report them to relevant supervisory bodies.

National Processing Customer Support Options

National Processing provides various customer support channels, including phone and email, as listed on their website.

National Processing Customer Service Numbers

- (800) 720-3323 – Toll-Free General Customer Service

- (800) 803-4592 – Sales

Other Support Options

- Live chat option

- Customer support form

- Customer service email at [email protected]

National Processing Online Ratings

Here's How They Rate Online

| BBB Reports | 17 |

|---|

Under 10 Complaints

National Processing currently maintains an “A+” rating with the BBB and has been accredited since 2008. The company is showing 7 complaints in the past three years. 5 of these 7 complaints were resolved by the company to the satisfaction of the merchant. The remaining 2 were resolved to the dissatisfaction of the merchant or received no final response.

What Merchants Say

National Processing has also received 10 reviews, 7 negative and 3 praising National Processing’s customer support capabilities. The most recent review describes an alleged unauthorized credit check:

Do not use this company. They run your credit check without noticed on their website!

Clients in this situation would be better served by a company with great payment processing customer service.

A “B” Rating

Given the company’s growing complaint total, we have adjusted their score to a “B”.

National Processing Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | Yes |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | Interchange + (Variable) |

| Equipment Leasing | Yes |

Overview of National Processing’s Pricing Models

National Processing provides a variety of pricing structures tailored to meet the diverse needs of its clients, as outlined on its website and demonstrated in a sample of the company’s standard agreement.

Detailed Pricing Structure

For most transactions, National Processing applies an interchange plus model, charging 0.20% plus $0.10 for swiped transactions and 0.30% plus $0.10 for keyed-in transactions. These rates are adjustable for certain business sectors, like the restaurant industry, to accommodate their specific processing volumes and patterns. The company assesses a monthly PCI compliance fee of $4.95, along with a standard monthly service fee of $9.95. Additional fees include an AVS fee of $0.05 per transaction, a batch fee of $0.10, and notably, there are no monthly minimum or annual fees. However, a termination fee of $295 is applicable under certain conditions, such as business closure or failure to allow National Processing to counter a competitor’s offer.

ACH Processing Fees

National Processing’s ACH transaction service is subject to a monthly fee of $15 and a per-transaction charge of $0.48. Previously noted charges included a $2 per-return fee, which may still apply, indicating variability in ACH service costs. The company offers equipment leasing options through Clover, with terms potentially extending up to 60 months, and these agreements are non-cancellable according to some merchant feedback.

Contract Clarity and Feedback

While National Processing promotes the absence of annual contracts, there have been mentions of early termination fees and undisclosed charges in some merchant feedback. The extent to which these issues are prevalent is uncertain. For those with firsthand experience with National Processing’s current contractual terms, sharing insights in the comments could provide valuable clarity.

For additional options, we invite you to explore our comprehensive list of recommended merchant account providers, chosen for their transparent pricing and fair contract terms.

National Processing Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | No |

|---|---|

| Telemarketing | No |

| Misleading Marketing | No |

| Discloses All Important Terms | Yes |

No Sales Complaints

National Processing appears to market its services primarily through traditional advertising and strategic partnerships. There is no evidence that the company employs independent sales agents at this time; however, we have received some concerning National Processing reviews in our comment section below that accuse the company’s sales agents of unethical conduct. As of right now, these are fairly isolated, but it is a concerning trend. This compares favorably to our list of the best credit card processors.

Original Teaser Rate Quotes

At the time of our previous update, the National Processing homepage listed a couple of teaser quotes that promised “rates as low as $.10 for ACH” and “rates as low as .15% for credit cards.” These rates were significantly lower than the costs that were listed on the company’s Pricing page, which lowered its score in this section.

Transparent Pricing

Since then, National Processing has changed its marketing to promote either the company’s clearly listed interchange-plus pricing or its zero-fee program, both of which are much more transparent plans. These plans are plainly described with accurate sample rates, which has improved National Processing’s grade to an “A.” If you suspect that National Processing is charging you undisclosed fees, however, we recommend seeking a third-party statement audit.

Our National Processing Review Summary

Our Final Thoughts

National Processing rates as a reliable credit card processing provider according to our rating standards. The company is showing only a few complaints on public forums, and its contract terms and sales tactics have improved since our earlier reviews. Our rating for the company may change as we continue to receive client feedback about the company. National Processing’s transparency and support options stack up well compared to some of the best credit card processors, but buseinsses are still encouraged to read their contract terms carefully and to thoroughly research the companies they are working with, no matter the rating.

If you found this article helpful, please share it!

kathy jacobs

DO NOT USE THIS COMPANY. THEY ARE THIEVES READ ALL THE OTHER BAD REVIEWS OF THEM BEING SCAMMERS

They hold your money and will not put it in your account. They are holding over $5400 of my money for no reason other than to be thieves Capitol One paid them but they will not put the money into my business account. I have done nothing wrong. Capitol One has issued a dispute against them for me and I am going to be filing a police report about them. They have also threatened me a man by the name of James Whitmore ( who is a green haired, look up their executives) who is an alleged supervisor. They are threatening to boycott me for all other credit companies to never do business with my company so that my company cannot take credit cards. They are saying the reason is I put in a charge for more than the paperwork said permitted and they received the money they just won’t put it into my account. If that were true why did they approve the sale and accept the money from Capitol One but not give the money to me or back to Capitol One?. Save yourself some hassles and find a reputable company before they attempt to steal from you as well.

These people are thieves. As of the writing of this they will not give me the $5400 or give it back to Capitol One they were given by Capitol One and are now attempting to take ANOTHER $5400 OUT OF MY BUSINESS BANK ACCOUNT. They will not allow me to do a credit and Capitol One is now involved in a dispute. As stated they are thieves. BEWARE

ADDTIONAL INFO TO THERE ANSWER.

I charged on my BUSINESS ACCOUNT and the money was to go into my bank business account.. The bottom line is they were given the money by Capitol One and refuse to give it back to Capitol One or me. There path to a resolution is this. They want me to give the thieves another $5400 wait 180 days and then they will give me back the $10800. Bottom line is they are thieves and want to keep the $5400. They told me when I spoke to them the second time that they knew Capitol One would do the dispute which I put in and give me my money back and they would see to it that no other credit card company would allow my business to do credit cards. They also told me they were going to take another $5400 out of my bank account. WHY? They have MY $5400. Does that sound like a reputable business? Liars, cheats and blackmail. All they had to do was one of two things give me back my money or give it back to Capitol One. STAY AWAY FROM THEM AND PROTECT YOUR BUSINESS

Like

Share

Response from the owner 6 days ago

It is unfortunate that you have not had a positive experience with National Processing. Running a

Elizabeth

I just got my first statement from this company. Well, I got conned. Was told my monthly fees would be dramatically lower than my current set up. I asked several different times on different days if there were ANY other fees as this seems to good to be true. Told over and over, no you will be saving about $1300 to $1400 a month. There aren’t any other fees. Well guess what? There are. I’m sure he lied to me about the cancellation policy as well. Stay away from this company. Mickey was the sale rep. Nice guy who is a fast talker. I cannot believe I fell for it.

Jax Hart

This business is the WORST. Their website feeds you all of these empty promises about wanting to yelp small/medium sized businesses when all they mean by help is SCAM. I reached out because i was promised free equipment with a 3 year contract, the sales person confirmed this. after the equipment took weeks to arrive, the pandemic headed into another shut down and i was told that they could put me on “pause” with no consequence. all the while, they were charging me non compliance fees of $100/mo. How is that eithical?! I didn’t catch it right away because we can’t afford an account and business has been rough. When i finally caught it, all i got was a “there’s nothing we can do” and would you like to cancel your account. No follow through, no service, and NO concern for the success of small businesses. Only concern in scams and sales commissions.

Michel Arvin

A deceitful company. I would give no star to this company. Contrary to what they claim in their site, “We will not hold you to a contract. We will not raise the low rates we provide you. We guarantee your 100% satisfaction.

None true for all three claims. They locked us for 4 years, find out they are stealing from our account, raise the rate / fee without our consents contrary to the contract, when we show them what offer we have from other company, since they promised to match it, they said we sold the book to Fist Data you are on your own. Con Artists in deed. Deceitful. No etiquette no shame. We are filing complains to different institutions.

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

Robin Burnett

These people have screwed up opening my ski lodge restaurant both years I’ve used them.

Then after I got rude this second year in a row with them, they turn off my credit card processing capabilities in the middle of business.

Charged me twice what competitors are charging for the same set up!

They are a rip off and have the worst customer service I’ve seen in my 47 years of life. They tell you what you want to hear to get you off the phone and their follow-up is about 20 percent.

DO NOT USE THEM!

Robin Burnett

My business is The Fall Line

Casper, Wyoming

We operate in the ski lodge as The Fall Line Cafe in the Hogadon Lodge!

Ron Bray

I have found the agents who are in charge of the merchant accounts to be very polite and prompt with their quotes. They act in a professional manner which is impressive to prospective clients.

CPO

Hi Ron,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!