USPAY Group Reviews & Complaints

| Pros: | Cons: |

|---|---|

| Video training available. | No public pricing. |

| No startup fee. | Early termination fee. |

| Interchange plus pricing. | Monthly fees charged. |

| 24/7 customer service. | Three-year contract. |

| Offshore technical support. | Important terms undisclosed. |

Overview

Welcome to our comprehensive review of USPAY Group, a distinguished merchant account provider. This article delves into the intricacies of USPAY Group's offerings, including their specialized services in healthcare, hospitality, and restaurant sectors. We will scrutinize the rates and fees associated with their services, dissect the terms of their contracts, and highlight common complaints and industry ratings. Additionally, the piece explores USPAY Group’s various payment processing solutions, emphasizing their mobile payment options and compliance standards.

Our analysis extends to additional merchant services such as loyalty programs, dissecting the finer details of their offers. Our article also addresses the company's ownership and location, providing insights into its leadership and corporate structure. We investigate USPAY Group’s customer reviews, lawsuits, and fines, providing an unbiased viewpoint on their customer support effectiveness.

As we dissect USPAY Group’s online ratings, fees, rates, and contract specifics, we offer a clear perspective on the pros and cons of their services. This article aims to provide a thorough understanding of USPAY Group's position in the market, including an evaluation of their marketing tactics and employee reviews. Our goal is to offer a well-rounded review, aiding businesses in making informed decisions about partnering with USPAY Group for their merchant account needs.

About USPAY Group

Based in Levittown, New York, USPAY Group is a merchant account provider that formerly operated under the name “Premier Merchant Processing.” A company representative has asked us not to refer to Paya as the company's backend payment processor in this review, but the USPAY Group website listed Paya Services as one of the company's partners for a long time. USPAY Group's specialty areas include healthcare merchant accounts, hotel merchant accounts, and restaurant merchant accounts.

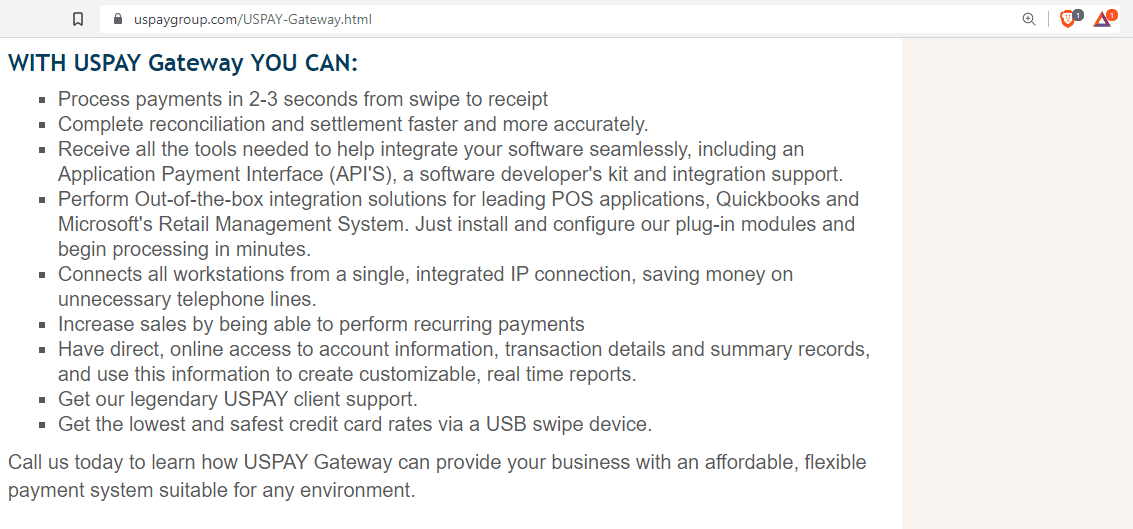

USPAY Group Payment Processing

USPAY Group processes all major credit and debit cards for most business types. Their services include POS solutions, ACH and check processing, mobile solutions, access to the USPAY Gateway for online payments, the VIMAS online merchant account management tool, and gift and loyalty programs.

Mobile Payment Solutions and Compliance

The company offers mobile payment solutions, enabling merchants to accept payments via mobile devices. They also provide check services and emphasize PCI compliance, which is a set of security standards designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure environment.

Additional Merchant Services

USPAY Group extends its services to include gift and loyalty card programs, which are designed to enhance customer retention and increase sales. They also have a referral program, although details of this program are not specified online.

USPAY Group Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | 10+ |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | Hidden Fees |

| Recent Lawsuits | No |

Analysis of USPAY Group Feedback

In our review, we found more than 10 negative USPAY Group reviews. However, none label the company as a scam or ripoff. These reviews also encompass complaints regarding Premier Merchant Processing due to the apparent close relationship between the two entities. Recurring issues highlighted by customers include persistent telemarketing efforts, lack of transparency in contract terms, and dissatisfaction with the professionalism of the sales process. Despite these issues, the overall volume of USPAY Group complaints is relatively low, showing a modest decrease since the introduction of the USPAY Group brand. We invite customers to share their experiences and post their own USPAY Group review in the comments section below.

Legal and Regulatory Status of USPAY Group

There have been no significant class-action lawsuits or Federal Trade Commission (FTC) complaints identified against USPAY Group. Clients seeking alternative resolutions are encouraged to report their concerns to relevant regulatory bodies, which can aid in achieving a fair outcome.

Customer Support Offered by USPAY Group

USPAY Group is committed to providing robust support through phone and email for all its merchants, indicating a strong emphasis on customer service and satisfaction.

USPAY Group Contact Details for Support

- (866) 725-8500 – Toll-Free Customer Support

- (888) 796-7738 – Fax

Additional Channels for Customer Support

- Online customer support form

- Email support available at [email protected]

While USPAY Group has been rated a “B” in this category, it’s important to note that it does not yet meet the criteria to be classified as a leading merchant account provider for customer service. To enhance its position, USPAY Group may consider expanding its support options and increasing transparency regarding its service terms, which could positively impact USPAY Group reviews and customer satisfaction.

USPAY Group Online Ratings

Here's How They Rate Online

| BBB Reports | 8 |

|---|

Under 10 Complaints

USPAY Group currently has an “A+” rating with the Better Business Bureau and has been accredited since July 2010. The company has received 4 total complaints in the past 3 years. None of the complaints were resolved to the satisfaction of the merchant.

What Merchants Say

In addition to 4 complaints, USPAY Group has acquired 4 informal reviews on its BBB profile in the last 3 years, 3 of which are negative in tone and 1 of which is positive. The most recent review details issues with customer service:

Absolutely horrible service! I have been a customer since 2018 and haven’t used the processor in over 2 years. I called to cancel and they are charging me the $495 because my contract auto- renewed 2 months ago. Then they send me an e-mail telling me that they value me as a long time customer and would like to earn my business back. I am in the customer service business too and I can assure you that is is no way to earn anyone’s business. AVOID AT ALL COSTS. In addition, their fees are very high and they change you a high authorization fee and surcharges.

Clients who find themselves in an expensive contract may obtain some relief by seeking a third-party statement audit to renegotiate undisclosed fees.

An “A” Performance Overall

In light of USPAY Group’s complaint total and resolution ratio, we agree with the BBB’s rating.

USPAY Group Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | Yes |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | 1.00% - 4.99% |

| Equipment Leasing | Yes |

Three-Year Agreement

Based on client feedback, it seems that the typical USPAY Group contract entails a three-year commitment with an annual account fee of $79, an early termination fee ranging from $250 to $495, an annual PCI compliance fee of $99, and a monthly non-compliance fee of $14.95. These fees may fluctuate based on business size, type, and processing history.

Prior Relationship with Northern Leasing

Previously, USPAY Group’s “Partners” page listed Northern Leasing Systems as its equipment leasing provider. Northern Leasing Systems is ranked among the lowest-rated providers on CPO, known for imposing long-term, non-cancellable lease agreements resulting in substantial costs. For context, most payment terminals can be acquired for under $500. A USPAY Group representative has informed us that the company has “no connection to Northern Leasing whatsoever.” However, we find it pertinent to mention USPAY Group’s past association with Northern Leasing in this review. While it seems that USPAY Group has severed ties with Northern Leasing, prospective clients are advised to verify this before enrolling. We also recommend businesses explore our curated list of the top merchant accounts.

No Significant Red Flags

Overall, USPAY Group’s contract terms seem to align with industry standards. There have been few complaints regarding USPAY Group’s rates and fees. Consequently, we have assigned it a “B” rating in this category.

USPAY Group Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | No |

|---|---|

| Telemarketing | Yes |

| Misleading Marketing | No |

| Discloses All Important Terms | No |

In-House Sales Team

USPAY Group appears to primarily utilize telemarketing, inside sales representatives, and online advertising to market its services. The company does not advertise openings for independently contracted sales agents, and there are no complaints that describe a typical “hiring mill” environment at the company. This compares favorably to our list of best credit card processors.

Some Negative Reports

There are a few USPAY Group reviews that mention persistent, aggressive telephone calls in which the caller attempted to mislead the business about their identity and intentions. Other USPAY Group complaints cite misrepresentation of per-transaction rates and nondisclosure of fees, particularly early termination fees. If you suspect that you have been charged undisclosed USPAY Group fees, we recommend seeking an independent, third-party statement audit.

Complaints From Agents

The Glassdoor profile and the comment section on this profile for USPAY Group include a handful of complaints that describe the inside sales environment as unprofessional and prone to high turnover. These factors in combination have lowered the company’s score to a “B,” which is consistent with our grade for Premier Merchant Processing.

Our USPAY Group Review Summary

Our Final Thoughts

USPAY Group is currently recognized as a better-than-average credit card processing provider. The company has accrued relatively few complaints, which primarily focus on issues surrounding the sales process. Pricing and fees offered by USPAY Group are typical for the industry, lacking standout features that would classify them as particularly economical or competitive compared to lower-cost options available in the market.

For businesses contemplating utilizing USPAY Group for their processing needs, it is advisable to avoid entering into long-term equipment leases. These leases can often prove to be financially burdensome over time, tying businesses to unfavorable terms that might not align with their evolving needs. As part of their due diligence, business owners should thoroughly review all contract terms and consider alternatives that offer more flexibility and potentially lower costs, ensuring they choose a credit card processing solution that aligns with both their current and future financial strategies.

Location & Ownership

USPAY Group is a registered ISO of Synovus Bank, Columbus, GA, and is headquartered at 525 Broadhollow Rd 2nd Floor, Melville, NY 11747. Gary Ramesberger is listed as the CEO of USPAY Group on their website; however, former COO Kristy Richardson is named as CEO as of 2021 by multiple online sources including LinkedIn.

If you found this article helpful, please share it!

Melanie Farris

Sorry Philip but you need to report on their employment issues what a scam.Number of complaints .

Ashley Mayland

They pulled funds from our account that were not authorized as we sent them written notification of such, they charged us a termination fee after our initial contract of the three years was over. Compared to the processor that we switched too the PCI compliance fees and processing fees are a lot higher. Their customer service was extremely rude and unhelpful.

This post will help: Find and Eliminate Hidden Fees From Your Monthly Bill

-Phillip

Andy Dick

Do NOT bother working for this company. It is a turnover factory – straight from the interview w the VP Shawn, he lies to you. Pretty much ALL he does is lie. Examples –

We are only hiring you, I like what I see!

Lies – First day training, theres 8 other new hires in the conference room.

Its not sales, its member services!

Lies – Its straight cheesy telemarketing. And the “in” with customers is they are part of a mysterious “group purchasing organization” which 9 out of 10 have NEVER heard of.

Next – micromanaging to the nth degree. The middle management jump on your call and listen when someone is interested and they mouth to you what to say. Even if you get the customer to schedule a web demo, they tell you 11 things you should have said or done. Its NEVER good enough. Also they practically stand on your lap during the call, it is EXTREMELY annoying.

The owner Gary sits in his office and watches the cameras and listens to recorded calls. He does not go after big accounts or do much of anything to grow The business. He fishes a lot. I digress. The cameras are EVERY where. You will get spoken to about how many times you get our of your seat, critique on your BODY LANGUAGE, and yes…discuss how many times you used the bathroom and counseled on WHEN you should go. Not kidding.

You get a script to read off of. Shawn and Gary will push for you to not use the script as a crutch and encourage you to make your pitch your own…but after they listen to your call, guess what? “See, you missed this, this and this. Why didnt you use the script, that’s what its for??”

As for the high turnover rate – its simple: get some accounts for them amd within 3-6 months they let you go and no longer have to pay the commission. You served your purpose. This is how they build their client base. Its SO shady and just a really rotten say to do business.

There are hidden fees that rip off the customer.

Cannot use your cell phone at your desk which is fine, but the 4 managers sit in their phone all day, NONE of which is work related.

And thats scratching the surface.

Avoid this cesspool at all costs

This post will help: How to Report Bad Credit Card Processors

-Phillip

Scott Doorn

USPay Group has been a great processor for us. We just had a chargeback dispute. They went to bat for us. We lost the case, however, Sharii spent an hour on a phone call with me to educate on Chip Card rules, etc. and we are now in process of modifying our account so we don’t lose the next case. The education she provided was worth far more than the $60 dispute we lost. Thank you Sharii, John, and Jessica for your help through this process.

CPO

Hi Scott,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!

Anne Swift

I ran into poor customer service when closing a business. Letters to return equipment arrived 2 weeks after the date of writing, with just days to comply. Calls were unreturned or unresolved, and without notice I was turned over to collections. Be careful with this company!