Argus Merchant Services Reviews & Complaints

Overview

In this article, we provide an in-depth analysis of Argus Merchant Services. Our focus includes a review of their rates and fees, contract terms, and customer and employee feedback. We examine their payment processing solutions, emphasizing their security features and customer support. Additionally, we explore their POS solutions, check processing, cash advance services, and marketing and analytics capabilities.

We assess the pros and cons of Argus Merchant Services, along with the implications of recent legal developments involving Visa & MasterCard. Customer reviews, both positive and negative, are scrutinized to offer a realistic view of the company's performance. We also look at lawsuits, fines, and customer support effectiveness.

A critical part of the article is an analysis of Argus Merchant Services' fee structure, contract clarity, and sales tactics. We aim to provide a balanced view, helping potential clients understand the company's services, reliability, and overall suitability for their payment processing needs.

About Argus Merchant Services

Argus Merchant Services is a merchant account provider based in New York City. Argus Merchant Services claims to serve over 100,000 merchants and is a reseller of First Data (now Fiserv) merchant accounts and products.

Payment Processing Solutions

Argus Merchant Services offers payment processing solutions that allow businesses to accept payments from their customers securely. The company provides a range of payment processing options, including credit card, debit card, and ACH payments. The payment processing solutions come with robust security features, including PCI compliance, fraud prevention, and tokenization.

Customer Support

The company emphasizes strong customer support and is committed to making the payment processing experience as simple as possible for its clients. They provide dedicated support and claim to be available when needed.

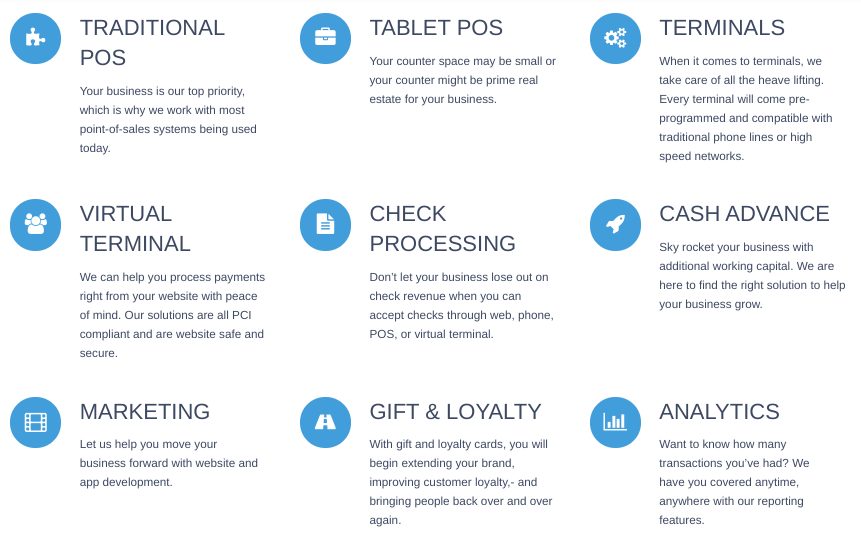

POS Solutions

Argus offers a range of Point-of-Sale (POS) solutions, including traditional POS systems, tablet POS, and virtual terminals. These solutions are designed to be compatible with both traditional phone lines and high-speed networks.

Check Processing and Cash Advance

The company also offers check processing services through various channels like web, phone, POS, or virtual terminal. Additionally, they provide cash advance services to help businesses grow.

Marketing and Analytics

Argus offers marketing services, including website and app development. They also provide analytics features that allow businesses to track transactions.

Gift and Loyalty Cards

The company offers gift and loyalty card services aimed at improving customer loyalty and extending a business's brand.

Location & Ownership

The company is a registered ISO of Wells Fargo Bank, N.A., Walnut Creek, CA. Its headquarters can be found at 40 Exchange Place, Suite 1607, New York, New York 10005. They also list a location at 17700 Castleton Street Suite 458, City of Industry, CA 91748. Jacob Shimon is listed as the president of Argus Merchant Services.

| Pros: | Cons: |

|---|---|

| Competitive rates | Unclear fees |

| Diverse services | High early termination fee |

| Good customer service | Longer contract lengths |

Argus Merchant Services Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | 10+ |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | N/A |

| Recent Lawsuits | Yes |

Notable Increase in Customer Complaints

An examination reveals more than 10 negative reviews concerning Argus Merchant Services, with allegations labeling the company as deceptive or fraudulent. Issues frequently highlighted by merchants encompass misrepresented rates, undisclosed fees specific to Argus Merchant Services, prohibitive termination charges, subpar customer support, and erroneous charges post-cancellation. A specific grievance noted an early termination fee as high as $790, although an Argus representative countered, pointing to a $495 fee, which aligns with typical First Data (Fiserv) agreements. Share your insights or experiences with Argus Merchant Services in the comments section below.

Employee Feedback on Argus Merchant Services

Argus Merchant Services garners praise from its past employees, underscoring a potentially positive workplace culture. It’s noteworthy that many reviews, both from merchants and the company’s promotional content, indicate a targeted approach towards Chinese-American and Spanish-speaking merchant communities, with several reviews presented in less fluent English.

Legal Encounters Involving Argus Merchant Services

In a notable 2017 legal dispute, Argus faced allegations related to the acquisition of trade secrets by a then-current employee from a former employee. The case concluded in favor of Argus with a dismissal.

For those seeking non-litigious means to express dissatisfaction, reporting to relevant oversight bodies is advisable.

Customer Support Infrastructure at Argus Merchant Services

Argus Merchant Services provides customer assistance through telephone and electronic mail.

Contact Details for Argus Merchant Services

- (888) 459-0660 – Toll-Free Customer Service

Additional Customer Service Avenues

- Online customer service form

- Email for sales inquiries: [email protected]

Despite offering multiple support channels, Argus Merchant Services’ customer service framework does not meet the standard for ranking as a leading merchant account provider in terms of customer service. Your feedback on interactions with Argus Merchant Services can provide valuable context for potential clients.

Argus Merchant Services Online Ratings

Here's How They Rate Online

| BBB Rating | 4 |

|---|---|

| Average Rating | 4 |

BBB Rating Analysis for Argus Merchant Services

Argus Merchant Services is not BBB accredited and has an A+ BBB rating. The company has received an average of 4/5 stars based on 5 customer reviews. However, there are 15 customer complaints closed in the last 3 years, with 4 complaints closed in the last 12 months. Common themes in the complaints include billing and collection issues, with customers expressing dissatisfaction over charges for services not received or used.

Negative Feedback

Argus Merchant Service started to charge me monthly from 2018 August till 2021 September for their merchant machine and service fee. I did not notice that until my banker told me that they charged me $3,258.45 in all. But I did not receive their POS/Merchant machine. Therefore, I was not able to use their service. After I first contacted them, they blocked my phone number. And then, I tried to use a different number to discuss the refund again, they asked me to contact their agent whose name is *************, and blocked me again. Their agent ************* is also the person I contact to open the account for their merchant service. After I contacted him, he only refunds about $633.10. Since this problem happened years ago, my bank said that were not able to dispute it.- Complaint from December 19, 2022

A female representative from Argus Merchant Services came to my restaurant (****************************) to convince me to switch my credit card processing system to theirs. I was informed by the representative that there was going to be no contract, no early termination fee, no monthly fee, etc. I agreed to do business with them but everything changed after the sales representative assigned to my account left the company. I was assigned a new sales representative to take over my account. The rates that I was being charged started to increase higher and higher. Whenever I tried calling the new sales representative, he was always busy, always rushed me to sum up my questions, or just didn’t bother to pick up the phone. I notified him one month in advance that I would be closing my account and would no longer be doing business with his company. At that time, he told me that there was no early termination fee and I was free to cancel the account anytime. I even returned back the credit card processing machine that was given to us when using their services. But I recently have been receiving phone calls from a debt collector (*********) regarding debts from Argus Merchant Services. The debt collector sent me emails of documents with copies of statements with unpaid fees like an early termination fee, etc. There was no such information about these fees and unpaid dues when I decided to close my account with the company. I do not owe anything to the company or the debt collector. – Review from 12/01/22

Positive Feedback

I took over a restaurant during the pandemic, together with all the equipments and stayed with the same credit card processor the previous owner used. At first I was skeptical about this company, and was thinking of switching to another merchant service after settling in, because I only talked to their sales rep over the phone for a few times. Now that I’ve been using this company for a while, I can say that they know what they’re doing. The only issue is that they don’t have the terminal I used before, and they told me it’s the supply chain. I wish they could fix this.

– Review from 4/14/22

Source: BBB

Argus Merchant Services Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | Yes |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | Variable |

| Equipment Leasing | Yes |

Unclear Contract Pricing

Currently, detailed information on the standard Argus Merchant Services rates or contracts is scarce. Available data suggests a 3-year agreement with an automatic renewal for a 2-year term. As a reseller of First Data (Fiserv), Argus’s standard contract terms might mirror those of First Data (Fiserv). Typically, these agreements involve a multi-year contract with an early termination fee of $495, a monthly PCI compliance fee of $19.95, and tiered pricing. Rate structures include a swiped rate of 2.69% plus $0.19 and a keyed-in rate of 3.69% plus $0.19 for businesses processing up to $50,000 monthly. Those exceeding $50,000 a month benefit from reduced rates. Furthermore, contracts might include non-cancellable, long-term equipment leases through First Data Global Leasing.

Argus Merchant Services may adjust these terms based on a business’ size, type, and processing history. Given the limited information available on the company’s rate and fee structure, businesses should consider the First Data (Fiserv) contract as a reference point.

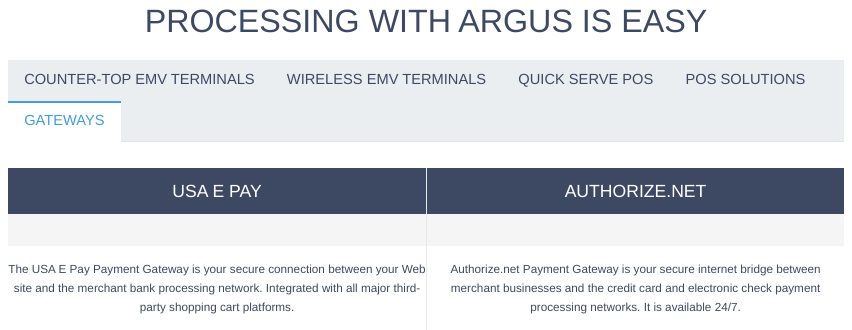

Virtual Terminal and Payment Gateway Pricing

Alongside its storefront payment processing solutions, Argus Merchant Services actively promotes its virtual terminal and payment gateway services. The pricing for these services, however, remains undisclosed. Common additional charges include gateway fees, technical support fees, batch fees, and higher transaction rates typically associated with e-commerce services.

Contract Complaints

Client complaints against Argus Merchant Services have highlighted issues such as leased terminals with potential penalties for late returns. One specific complaint mentioned an early termination fee exceeding $800, substantially above the industry norm, with other reported termination fees ranging from $495 to $750. Additional grievances include charges of an undisclosed annual fee within the first year and billing issues post-contract termination.

Average Contract Terms

The reported contract terms from Argus do not align with the industry’s most competitive offers, leading to a number of client complaints regarding the company’s contract practices. As a result, Argus Merchant Services receives an average score of “C” in this review. Readers with direct experience related to Argus Merchant Services contracts are encouraged to contribute their insights in the comments section.

For alternatives, consider exploring our list of best merchant accounts offering more favorable terms.

Argus Merchant Services Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | Yes |

|---|---|

| Telemarketing | Yes |

| Misleading Marketing | Yes |

| Discloses All Important Terms | No |

Telemarketing and Outside Sales Agents

Argus Merchant Services appears to primarily market itself through telephone appointment setters, ISOs, and independent sales agents. The use of independent sales agents is commonly tied to high complaint rates within the industry, as independent agents tend to receive less training and oversight than in-house, W2-employed sales reps. In this case, Argus Merchant Services is no exception, as there are several Argus Merchant Services complaints that mention the credit card processor’s sales tactics.

This compares favorably to our list of best credit card processors.

Sales Complaints

We are able to locate a few negative Argus Merchant Services reviews that allege nondisclosure of fees and misrepresentation of rates by the company’s sales team. A number of complaints from former and current employees also admit to persuasive, aggressive sales tactics and over-promising on rates, and one former employee even openly suggests that the company scams its customers.

Some Red Flags

Sales complaints against Argus Merchant Services have been on a steady increase since we first reviewed Argus and could indicate that the company has some new issues with its sales team. The content (more than the quantity) of the available complaints is concerning enough to warrant a “C” grade in this category for the time being. If you suspect that Argus Merchant Services is charging you undisclosed fees, we recommend seeking a third-party statement audit to find and eliminate hidden costs.

Our Argus Merchant Services Review Summary

Our Final Thoughts

Argus Merchant Services rates as an average option for credit card processing services according to all available information. The company has a low-to-moderate number of complaints online, but it’s difficult to determine the exact details of the company’s pricing at this time. Business owners are encouraged to inquire about all possible costs before signing up for service through the company and to compare Argus’s pricing to top-rated merchant account providers to get the best deal.

If you found this article helpful, please share it!

Jason

Stay away from this company. They greatly raised the fees without notices. They even denied the charges made by them. Moreover, they would get excuse to charge you even after you cancel the service. The customer service is not professional at all. We should file a class lawsuit against this company!

Thitima Suwannthat

This is CHEATING COMPANY. They will charge a lot of fees and try many way to take the money from your bank account. When he first come (Jake Zhou) he said everything is free with lower rate. After that the company will charge a lot of fee. I talked to him he said that’s the company fault not him?? Also bad customer service. They promised to call back by 24 hours. But they NEVER do that. A lot of waiting time.

NEVER EVER USE THIS COMPANY!!

Jessica Kim

Actually, my experience with Argus is pretty good. I only come to my store in the late evening for money close. I called my agent Frank Fan sometimes around 11pm, he still picked it up. Very professional and nice services. I even referred my cousin to him. We both like him!

CPO

Hi Jessica,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!

Matthew

Argus merchant service is a good company. I use it for almost 2 years, nothing extra charge fee. sale keep often contact us, try to keep a good relationship with us, and also give us a great market total rate

CPO

Hi Matthew,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!

Marie Singletary

Customer line is a little bit busy and you will need to wait for a while but they gave me a good price compared with my previous provider.

Ray Su

This credit card merchant service company keep on Cheating us and continuing stealing money from our bank account, We had their charge card machine which already returned on Dec, 2017, we had proof the return and requested close account, but they still continue withdraw the machine fee $52.92 from our account, we even sent a warning letter to them on Feb. 2018.I am going to take legal action to against this company.

From The Editor

This Post Might Help: Cancelling a Merchant Account Without Paying a Fee

Malki David

Here’s my experience with Argus Merchant Services.

On December 3rd, 2015. I met with Jessica Railey, a local representative for Argus Merchant Services. She promised us low rates and next day funding. As a small business, we rely on next day funding. Next day funding was a huge technical issue for Argus. One day we had next day funding and the next we didn’t. Rectifying the situation was a HUGE nightmare with numerous calls back and forth to Jessica on an almost daily basis and Argus still couldn’t get things right. Then, one day, Jessica fell off the face of the earth and we had no-one to help us. A true business professional would have provided a a name of someone who could help in their absence. With mounting frustration, we started using a different merchant service that truly funded the next day and that was far more responsive. I have been trying to get out of my contract with Unified Payments, the contractor of Argus, for almost a year now, with no luck! Last year, I called and was given the run around. Jessica finally contacted me, saying that her boss, John Maker, refused to cancel the contract. I explained to her that John Maker only heard one side of the story. Her response to me was “He doesn’t care what your side of the story is”.

John Maker, incidentally, is listed on my contract as the agent, though I have never met him. I waited a few more months and attempted to cancel the contract once again by contacting Unified Payments. They directed me back to John Maker at Argus Merchant Services. John is always “out of the office” and refuses to returns calls. Again, Jessica contacted me, via email, to say that we would be stuck unless we started using their services and she offered us a “deal”. I am not interested in a deal; I’m interested in canceling my contract. I received a copy of the contract from Jessica, which makes no mention of terms. The terms are contained in another document, not part of the contract. Oh- by the way, Jessica conveniently cannot “get her hands” on the attachment. And, if that doesn’t sound majorly shady, it is! I have no clue what the terms of the contract are because Argus Merchant Services are scammers and they don’t want you to know. By not providing honest information, they can continue their scam. I entered this agreement with Jessica Railey in good faith. I operate an honest, above board company. Clearly, Argus Merchant Services is anything but honest and above board!

kim

This is a CRAPPY company! DO NOT use this company! We used them for 3 months and everything was wrong! Very TERRIBLE experience! Whoever owns the company can’t operate and manage the company in correct way. Employees are not properly trained to do the job! Whenever I have a problem with my credit card machine or transaction, it took FOREVER to reach a customer who can really help! Every time each customer service told me something different and I had to keeping calling them back to get the problem solved. Some customer service will always refer to another customer service or another person. It was wast of my time, so I switched to another merchant service. Additionally, the sales personnels from the company were liars. The one I had was trying to sell me the product, but she couldn’t follow what was originally promised. Every month my merchant services fees were higher and higher.; many misc fees were added for no reason. I called my sales rep many times and she said she will solve this issue. It has been over 4 months and I still was not able to get my refund from all the misc charges on the account. I called company and customer services said I have to speak to the sales reps, but sales rep told me to speak to customer service. I was really FRUSTRATED dealing with these people. I even asked for manager, but manager couldn’t do anything too! I didn’t have an agreement with the company when I first setup the account and I was able to cancel my account any time. I called multiple times to cancel the account and up to date (it has been 5 months) my account is still active. My bank has been charged a few times after I cancel my account, I report to my bank and bank put a ban on this company charges. I just want to let you know DO NOT waste you time dealing with these jerks.

Chan

Very disappoint this company, join in 2 month, something happen to me and need to close my store, call the representative, she told me she will cancel it for me but need me to keep few transaction, finally, I do not any transaction (my store was close, no customer) and call them back one month later, find out that representative was not working there anymore, and because of I don’t have any transaction, they cannot close my account and need me to pay the early termination fee. The only way I can waive this penalty is I refer customer to them. I did refer my friend company to them, but I so regret, my friend have an unhappy thing happen to her with Argus Merchant service.

Evelyn

I am the customer for Argus Merchant Services company. The staff is helpful and nice. They solve my penalty of my previous merchant company. The machine and paper roll is free. When I come across some troubles, I contact with the sale who sells the machine to me. He addresses the problem as soon as possible. They also provide Chinese language for me,. It is good for foreign people.

CPO

Hi Evelyn,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!

Ann

One of “Argus Invision” agent approached our business in Mountain View, California on October 2015 and offered to switch to them. This “Argus Invision” agent made claims such as:

1. They will reduce the amount of credit card processing fees compared to our current Merchant Account provider (after inspecting our previous bills).

2. The service they provide has 1 month Free trial period during which we can terminate service without any risk.

Unfortunately, contrary to their agent claims Argus Invision turned out to be more expensive (charging ~3% fees) compared to our previous merchant provider (charging ~2% fees). So we decided to cancel their service before this 1 month free trial period expires. Then they charged us Early Termination Fee of $840.09 which is ridiculous and something else than what their agent promised to us under this “1 month free trial period”.

Also, their customer service is not very supportive and we will be report this accident to Better Business Bureau and FTC. If there are other merchants who were scammed just like us please get in touch.

—

Are you with Argus? Learn how to resolve this complaint.

Lee

WOw..theives indeed. Not only do they sneak in annual payments – they DOUBLE it and takeout the payment from your account 6 months in! how “annual” is that? It caused me to no be able to pay my staff. These guys are tricky, sneaky and being reported

—

Are you with Argus Merchant Services? Learn how to resolve this complaint.

danielle tsai

A lot of hidden fees. Processed $7512 for a take-out restaurant, and charged $331 fees, made it a 4.3%., not what they promised to be cheaper than my previous one 3.2%. When I asked to cancel my account, they claimed that I had a 3-year-contract with them and had to pay for early termination fees. I asked them to show me the non-existing contract, they never did. They took money from my account before the monthly statement was posted online, totally sneaky.