Checkout.com Reviews & Complaints

Company Overview

Founded in 2012, Checkout.com is a merchant account provider that specializes in processing international payments for e-commerce businesses. According to the pricing section of its website, the company offers merchants interchange-plus , or flat-rate pricing options. The company is similar to Stripe or 2Checkout in that it bundles its payment gateway with a merchant account as part of an all-in-one software solution. Checkout.com was originally known as “Opus Payments” before changing its name to Checkout.com in April 2012.Checkout.com has partnered with a number of other businesses, including Mamo, Alchemy Pay, and NetEase Games. It has also purchased ubble, ProcessOut, Icefire, and Pin Payments.

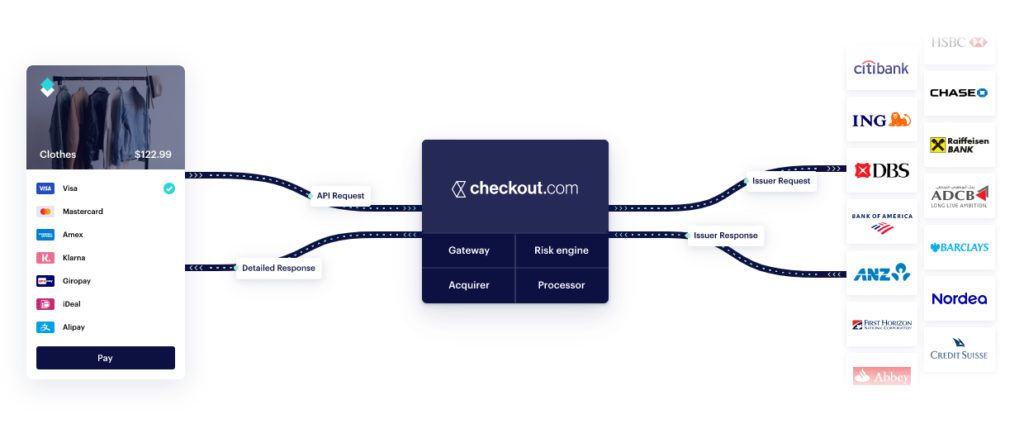

Checkout.com Payment Gateway

The company supports payments in 150+ currencies with around 18 different payment methods, including alternative payment methods such as digital wallets like Apple Pay and Google Pay. They also boast quick payouts, risk scoring, fraud protection, e-commerce solutions, and data reporting and analytics.

Subscription Payment Processing

For businesses with recurring payment models, Checkout.com offers a secure and easy-to-use subscription payment processing service. This service can support various international markets by accommodating major credit and debit cards for mobile payments.

Mobile Payments

Checkout.com caters to the mobile payment needs of customers across international markets. Their service supports transactions through all major credit and debit cards, ensuring businesses can process mobile payments efficiently.

Payout Services

They offer payout services which can be leveraged as a competitive advantage for businesses. This service provides a range of features that help to expedite the process of getting funds to customers, including card and bank payouts.

Authentication

To fight fraud and maintain compliance, Checkout.com offers flexible 3D Secure authentication which works across all your acquirers and is integrated as part of the Checkout.com platform.

Card Issuing Services

Businesses looking to launch and manage their own card program can utilize Checkout.com’s issuing services. This service enables the creation of custom cards, earning a share of interchange revenue and simplifying the card program management process.

Fraud Detection

Their fraud detection service helps to strike a balance between fraud prevention and approval rates, with a highly customizable fraud management tool that adapts to business needs.

Intelligent Acceptance

Checkout.com’s Intelligent Acceptance service aims to maximize conversion rates and lower transaction fees. It employs sophisticated AI, leverages Checkout.com’s global data network, and offers deep payment expertise to optimize the payment acceptance process.

Identity Verification

Their Identity Verification service is built to fight fraud and accurately identify users with a fast verification experience. This service is designed to convert identity verification into a competitive advantage for businesses.

Global Processing and Coverage

With Checkout.com, businesses can process payments worldwide in over 150 currencies and have domestic coverage in over 45 countries. This global reach is facilitated by their Unified Payments API which provides a flexible, fast, and reliable solution for payment processing.

E-commerce Payment Gateway

Their e-commerce payment gateway technology is consistent across all markets, aiding businesses in converting more sales and reducing payment processing costs. This service is available in over 150 countries, supporting diverse payment methods and domestic processing with expert support from teams on the ground.

Location & Ownership

Checkout.com has multiple offices throughout the world, but its headquarters is at Wenlock Works, Shepherdess Walk, London, N1 7BQ, and its U.S. mailing address is at 251 Little Falls Drive, Wilmington, DE 19808, United States. Guillaume Pousaz is the founder and CEO of Checkout.com.

Checkout.com Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | 12 |

|---|---|

| Live Customer Support | No |

| Most Common Complaint | N/A |

| Recent Lawsuits |

Low Complaint Total

We have found approximately 10 negative Checkout.com reviews, indicating that while there are some complaints, there’s no clear evidence suggesting that the company is a ripoff or a scam. The complaints primarily revolve around challenges with account activation, difficulty reaching email support, fund holds, and high costs for small merchants. However, these seem to be isolated incidents rather than indicative of a widespread problem with the company. If you have your own Checkout.com review to share, please feel free to do so in the comments below.

Checkout.com Lawsuits

We haven’t come across any outstanding class-action lawsuits or FTC complaints filed against Checkout.com. For dissatisfied clients looking to address issues with the company, it’s advisable to consider reporting concerns to the relevant supervisory organizations.

Checkout.com Customer Support Options

Checkout.com provides various customer support options on its website, including an email form, a knowledge base, and phone numbers. However, it’s uncertain whether these channels offer direct communication with a Checkout.com representative. Complaints about slow email responses suggest that email may be the primary mode of customer support. As of now, Checkout.com does not meet the criteria to be considered a top-rated credit card processor for customer service.

Checkout.com Customer Service Contacts

- (415) 691-4688 – U.S. Support

- +44 207 323 3888 – Headquarters/UK Support

Other Support Options

- Support form

- Customer service via email at [email protected]

Checkout.com Online Ratings

Here's How They Rate Online

| BBB Reports | 1 |

|---|

No BBB Complaints

Checkout.com currently has no rating with the Better Business Bureau. The company has received 0 complaints in the past three years.

What Merchants Say

Checkout.com has received 1 informal review to its profile, which is negative. The 1 review is from a former employee who claims they were never paid for their work:

I worked for Chekout for 6 weeks, I never recieved a pay check from them.

This appears to be an isolated incident.

An “A” Performance

In light of the company’s complaint total and resolution ratio, we have adjusted the BBB’s grade to an “A”.However, we will caution merchants against blindly trusting the grades that the BBB assigns.

Checkout.com Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | No |

|---|---|

| Monthly & Annual Fees | No |

| Processing Rates | Interchange + |

| Equipment Leasing | No |

Straightforward Pricing

Checkout.com’s merchant agreement details a month-to-month contract approach. This includes no early termination fee, absence of monthly fees, and transparent per-transaction pricing. All Checkout.com clients have access to flat transaction fees: 0.95% plus $0.20 for European cards, and 2.90% plus $0.20 for non-European cards. For businesses qualifying for the Enterprise plan, based on sales volume and history, the fee is interchange plus 0.10%-0.40% plus $0.08. These rates are competitive within the industry, offering flexibility and minimal commitment to clients.

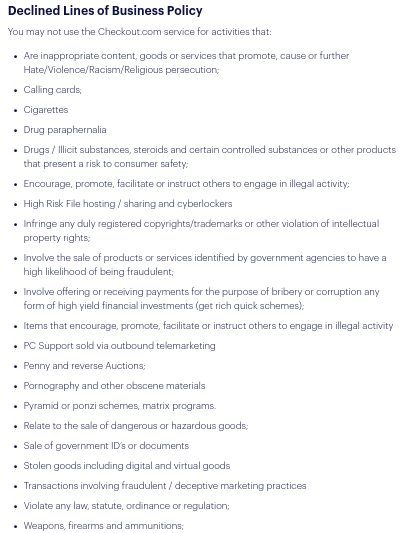

Prohibited Businesses

It’s important for potential users to review Checkout.com’s list of prohibited business types before registration. While the company has faced some online complaints, many appear related to account deactivations due to violations of these prohibited business policies.

Considerations for Small Merchants

Feedback from smaller merchants suggests that Checkout.com’s screening process and pricing may not be ideally suited for very small businesses. New or low-volume businesses are advised to consult with Checkout.com before engaging their services. While Checkout.com may not be featured among the cheapest merchant accounts, it does provide a robust, international payment processing platform at a reasonable cost.

Checkout.com Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | No |

|---|---|

| Telemarketing | No |

| Misleading Marketing | No |

| Discloses All Important Terms | Yes |

No Deceptive Conduct

Checkout.com appears to utilize its website and conventional advertising to market its service. There is no evidence that the company relies on a team of independent sales agents, and we are unable to find any Checkout.com reviews that accuse the company’s sales team of deceptive conduct. Like its competitors, Checkout.com must appeal to developers as well as clients and therefore is less focused on using low price points to attract new users.

Interchange-Plus Pricing

There are no misleading rate quotes on the Checkout.com website, and the company even offers interchange-plus pricing, which is the most transparent pricing model available. This sets it apart from its U.S.-based competitors, which typically offer a flat per-transaction fee such as 2.9% plus $0.30, and it should be attractive to businesses that prefer to know exactly what they pay for. If you suspect that Checkout.com is charging you undisclosed fees, we recommend seeking a third-party statement audit to eliminate hidden costs.

Our Checkout.com Review Summary

Our Final Thoughts

Checkout.com rates as a reliable credit card processing provider for international e-commerce businesses. The company may have some shortcomings when it comes to customer service and very small businesses, but its overall product offering appears to be fairly priced compared to competitors. Readers are encouraged to review the company’s list of prohibited businesses before signing up for a Checkout.com account and to compare its contract costs to those of top-rated e-commerce merchant account providers.

If you found this article helpful, please share it!

Luke

They are a dishonest partner which will block your funds without a single word.

This post will help: How to Make Your Payment Processor Release Your Money

-Phillip