Square for Retail Merchant Services Reviews & Complaints

Company Overview

Square for Retail is a POS application offered by Square. Square for Retail uses the same hardware as Square Register and shares many of the same features. However, Square for Retail is a paid monthly mservice that bundles additional retail-specific services along with the Square Register app so as to better serve conventional brick-and-mortar retailers.

Square for Retail Point of Sale

“Square for Retail” refers to Square's original iPad-plus-stand payment terminal plus a whole host of hardware and software products, including a bar-code scanner, receipt printer, and cash drawer. “Square Register” is a newer all-in-one POS product that represents the future of Square's POS strategy. “Square Terminal” is a cordless, portable payment processing terminal that connects to Wi-Fi or Ethernet. One notable difference between the traditional Square Register app and Square for Retail is that Square for Retail's checkout flow is based on a smart search feature rather than selecting items from a prebuilt inventory display. Square for Retail is only available for the iPad.

Inventory Management with Square for Retail

Square for Retail provides advanced inventory management tools. These help retailers track their stock levels, manage their supply chain, and forecast demand more effectively. It assists in making informed decisions regarding purchasing and stock optimization.

E-Commerce Integration by Square for Retail

Recognizing the growing trend of online shopping, Square for Retail offers seamless e-commerce integration. Retailers can manage their physical and online stores simultaneously from one unified system, ensuring consistency and efficiency.

Square for Retail's Customer Relationship Management

Square for Retail also includes a customer relationship management (CRM) feature. This allows retailers to manage their customer database, track customer preferences and purchase histories, and use this data to improve their marketing strategies.

Employee Management in Square for Retail

Square for Retail offers employee management features, helping retailers schedule shifts, track employee performance, and manage roles and permissions. It aims to make the workforce management process more streamlined and transparent.

Reporting and Analytics from Square for Retail

Providing insights into business performance, Square for Retail's advanced reporting and analytics tools offer data on sales trends, popular products, and overall performance. These insights can guide strategic decision-making and help drive growth.

Square for Retail's Security Measures

Square for Retail prioritizes security in its operations. The system incorporates a range of security features, including fraud detection, encryption, and adherence to PCI DSS standards, to protect the business and its customers.

Location & Ownership

Jack Dorsey is the founder and current CEO of Square Inc. It is headquartered at 1455 Market St #600 San Francisco, CA 94103.

Square for Retail Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | 3,000+ |

|---|---|

| Live Customer Support | Active Merchants Only |

| Most Common Complaint | Fund-holds |

| Recent Lawsuits | Yes |

Low Complaint Volume for Square for Retail

Square for Retail, as a newer addition to Square’s offerings, has relatively few dedicated reviews at this time. In evaluating Square for Retail, we’ve considered general complaints about Square, with a notable emphasis on fund-holds.

Mid-size retailers already using Square may find the service’s array of features, including enhanced inventory management, employee tools, and accounting integrations, to be beneficial without significant drawbacks. New users might appreciate the advanced inventory options and hardware compatibility, easing the transition from traditional registers to a cloud-based system. The integration of the iPad app with Square Stand and EMV/NFC reader dock offers a simplified checkout experience, which should be user-friendly for both employees and customers.

Square Legal Challenges and Lawsuits

Square settled a class-action lawsuit in 2018 regarding its food delivery service “Caviar,” where it was accused of improperly withholding tips from 2012 to 2015, resulting in a $2.2 million settlement.

Multiple lawsuits have been filed against Square in recent years. A 2019 lawsuit accused Square of mishandling payment information for medical procedures, but it was dismissed with prejudice.

Square is currently involved in another class-action suit over allegations of withholding funds from clients deemed high-risk. This case is ongoing and has attracted considerable attention.

In 2021, Square faced a class-action suit alongside other major credit card processors, accused of price-fixing related to interchange fees.

Another significant lawsuit in 2021 targeted Square CEO Jack Dorsey, involving allegations of privacy breaches. This suit could have broad implications for Square, seeking major reforms and Dorsey’s removal from Twitter.

Square for Retail Customer Support Analysis

A consistent point of contention with Square is its limited live customer support. Active users can reach support by phone from 6 a.m. to 6 p.m. PST upon obtaining a customer code (How to Contact Square), but deactivated users lack this option. This has led to prolonged unresolved account issues, especially regarding fund-holds. While Square is effective for businesses without such challenges, those facing problems often experience delayed resolutions.

This article, enriched with SEO-optimized phrases like “reviews,” “complaints,” “customer reviews,” “customer complaints,” and “Square for Retail review,” aims to offer a comprehensive and balanced overview of Square for Retail’s services and challenges. Your insights and experiences are invaluable, so please share your own Square for Retail review in the comments below.

Square for Retail Online Ratings

Here's How They Rate Online

| BBB Reports | 5,054 |

|---|

Note: We have adjusted this company’s BBB rating according to our own standards. To better understand why we adjust BBB ratings, please see our Rating Criteria.

No Dedicated BBB Profile

The Better Business Bureau does not have a designated profile for Square for Retail. BBB does maintain a profile for Square, which represents its merchant accounts across all of its services.

As of this update, the Better Business Bureau is reporting an “A+” rating for Square despite 4,523 complaints filed in the last 36 months. This is a drastic improvement over a previous update, where Square Inc scored an “F”. Square maintains this deluge of complaints is due to the recent popularity of its CashApp service. Only 1,149 of these 4,523 complaints were resolved by the company to the satisfaction of the merchant. The remaining 3,374 were resolved to the dissatisfaction of the complainant or received no final response.

Responses to the Complaints

The BBB previously added a note stating that it has received many complaints regarding Square’s fund withholding procedures. Square responded by quoting its Terms of Use policies and referring to the help section of its website. It does not seem to have made any tangible change to its fund-holding policy in response to this notice.

What Merchants Say

Square has also received 531 informal reviews to its BBB profile, only 7 of which were positive on tone, meaning 524 are negative. The most recent review describes fund-holds and bad customer service:

My small business is an LLC facility maintenance company and has been using square for about 5 yrs or more. My customer paid ******** for work I completed and square put a hold on the money then said my account is under review and i needed to provide documentation providing the customer and work performed. I provided Name of card holder my customers name address and the invoice and work order and after all this Square is still holding my money and I need to pay my team for labor so square will be getting sued if they don’t release my money and make it available. You are damaging my business how are you getting away with this

This client might be better served by a processor with a history of excellent customer service.

A Pattern of Complaint Notice

The BBB previously prefaced Square’s profile with a notice of the pattern of complaints that the company has received. Following a review of its profile, Square’s customer service issues have caused the BBB to offer businesses a forwarning:

Pattern of Complaint

Square, Inc. came to BBB’s attention in December 2010. A review of the company’s complaints on file was done in October 2019. Based on BBB files this company has a pattern of complaints. Complaints on file state a lack of customer service specifically; a lack of timely response to urgent issues, assistance, and communication.

BBB reached out to the company so that they may respond to the complaints currently on file and explain the process of handling support tickets. To date, the company has not responded.

A “C” Performance

Due to the company’s high complaint count compared to its relatively short time in business, we have adjusted the BBB’s rating to a “C” for the purposes of this review.

Square for Retail Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | No |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | Variable |

| Equipment Leasing | Yes |

Cheaper Rates Than Square App

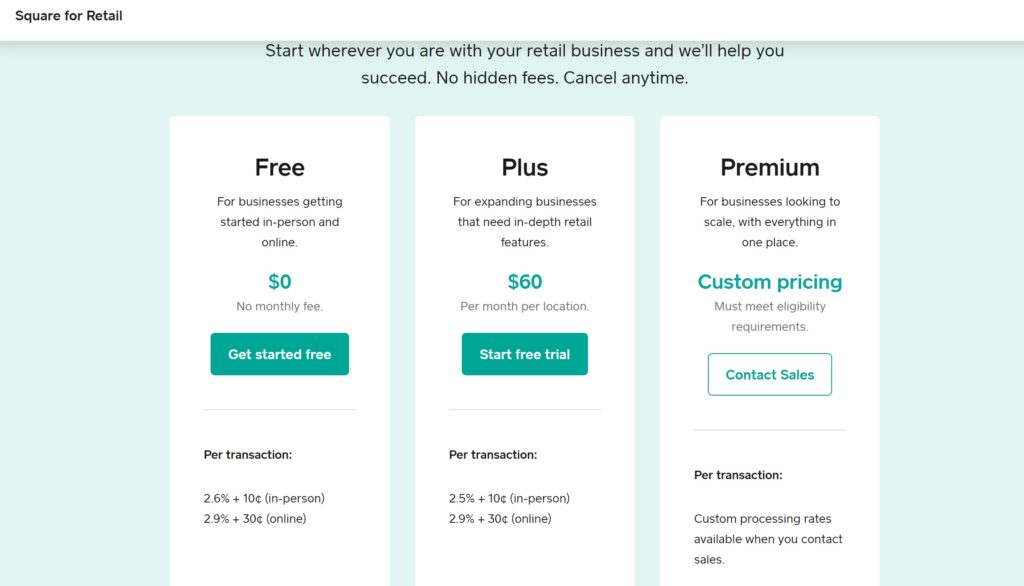

Square for Retail provides a pricing model that includes a $60 monthly fee and charges of 2.5% plus $0.10 for each tap, dip, or swipe transaction, and 3.5% plus $0.15 for every keyed-in transaction. Additionally, e-commerce transactions and online invoices via the Square Online Store incur a fee of 2.9% + $0.30. While the $60 monthly fee per register may seem high compared to Square’s standard POS app, which is free to download and only charges per transaction, Square also tailors custom pricing for businesses making over $250,000 annually with average tickets above $15.

Square Hardware Costs

Square provides a range of hardware options, including a countertop iPad stand for $169, an NFC/EMV chip card reader for $49, and additional accessories like a cash drawer for $109, a barcode scanner for $119, and a receipt printer for $229. For retailers, Square also offers hardware bundles, tailored for businesses with or without routers. Square stands out for its transparency and minimal commitment in the realm of credit card processing contracts, aligning with practices of the most recommended payment processors for retail merchants.

Lack of Underwriting

Square’s streamlined signup process, excluding a comprehensive underwriting procedure, might be appealing for business owners looking for ease of access. However, this approach necessitates Square to implement immediate holds on funds for large or unusual transactions as a fraud prevention measure, a policy that has led to numerous customer complaints. This aspect of Square’s service, while it aims to protect both the platform and its users, highlights a significant consideration for businesses evaluating Square for Retail. Business owners seeking alternatives are advised to review our selection of the best merchant services available.

Square for Retail Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | No |

|---|---|

| Telemarketing | No |

| Misleading Marketing | No |

| Discloses All Important Terms | No |

Transparent Pricing

As a product offered by Square, Square for Retail is advertised in the same way that Square credit card processing is advertised. When it comes to transaction fees, contract terms, equipment costs, and add-on services, Square is exceptionally transparent. The company maintains a very simple pricing structure and does not bury hidden costs in a complicated contract. Its quoted pricing for Square for Retail hardware and software additions is clear.

This compares favorably to our list of best credit card processors.

Unexpected Policy Drawbacks

However, Square does have two major shortcomings: its restricted live customer support and its fraud management policies. These two aspects of Square’s service are not fully addressed in its promotional materials, and thousands of clients have reported that they were blindsided by problems related to fund-holds by Square. This can be described as either a marketing issue or a service issue. Since customer support and fund-holds are generally unrelated to the Square for Retail product itself, they will not count against the company in this review.

Our Square for Retail Review Summary

Our Final Thoughts

Square for Retail rates as a solid cloud POS credit card processing solution for brick-and-mortar retailers. The service marks a clear upgrade from the base Square app due to its features targeted toward mid-size and larger retail locations, but each business will need to determine if the improvements are worth $60 per month. Square offers a free thirty-day trial (excluding per-transaction fees) for Square for Retail which should provide a simple way for existing Square users to test the service. Business owners are encouraged to test Square’s performance against other top-rated iPad POS systems.

If you found this article helpful, please share it!

Heidi

money was stolen out of my account by theses ppl. I don’t own a business. someone used their equipment to hack my account and withdraw money now I have to persue this issue through my bank and the police dept. TRIED contacting them when I finally reached a live agent I was transferred 3 times and then hung up on. lovely customer service. I would love to sue this company.

Barbie

Customer service needs considerable improvement. After a confusing and complicated process to get a code to even call in to customer service and the 20 minute wait time, we finally reached Victoria. She was rude throughout the conversation with snide little remarks stating she needed to speak to the account owner (I’m the manager and authorized representative), which I said was fine, would she mind calling him. At first said she would call him, and asked for his number, I asked her to hold for me to text him first so he would answer, to which she said yes. I texted and while we waited I asked why if I’m authorized representative why I could not verify the account (we had a fraudulent attack, which rerouted our funds to another bank account). She responded that she didn’t like how I was speaking to her so he would have to call in and wait on hold for another representative. I told her that was not fair and he was expecting her call and I wanted to speak to a manager, she said there was no phone management support, then she hung up on me!

This post will help: Best Payment Processors for Great Customer Service

-Phillip

Pamela Mercer

OMG. Square gets an F rating from me. I applied for Square Merchant’s account in May of 2018 or or around May 18 – May 23, 2018. When I got my bank statement in June I was billed for a Merchant’s Account for March, April, May and June. I could not find a phone number or e-mail complaint line for Square but I did find someone who tried to sell my associate the same service. Sadly my bank said it was a legal charge. IT WAS LEGAL TO CHARGE ME FOR A SERVICE THREE MONTHS BEFORE I RECEIVED THE SERVICE. !!!!i I called the website provider and told them to remove my merchant’s account. They were kind enough to verify the web site start up date. My e-mails verified when I added Square. It was three months later! I would continue to encourage my associates to avoid Square. It cost $24.90 per month for an account that I did not have and $24.90 per month for an account I only used once when I set it up to test it’s activation with a $1.00 charge. I have searched the internet and have yet to find a number to recover my money from SQUARE. One dishonest merchant to another my own bank called it a legal charge by way of a form letter with no name or signature. Sounds pretty shady. YOU KNOW IT. I don’t know how in the heck Square could get a B from BBB. I read the complaints. I am going to continue to complain about Square in writing and to everyone that will hear me until they return my four months of payments that they charged me for an account I never used and was charged three months before I actually set up and activated Square. Theft or Fraud it certainly isn’t honest!

From The Editor

This Post Might Help: Best Credit Card Processing Apps for Real Businesses