Wells Fargo Merchant Services Reviews & Complaints

Overview

In this comprehensive analysis, we delve into the multifaceted aspects of Wells Fargo Merchant Services, a major player in the United States' merchant account provider landscape. This article aims to provide an insightful overview of the company's services, fees, and contract terms, as well as a critical examination of user and employee experiences. We explore the range of products offered by Wells Fargo Merchant Services, including its Point-of-Sale (POS) solutions, e-commerce services, online payment gateways, and business analytics tools. Additionally, we investigate the company's security measures and compliance protocols, and the specific advantages it offers to Wells Fargo banking customers.

Moreover, we address some of the most pressing concerns faced by users, such as the common complaints about fees and sales experiences, and the implications of recent lawsuits and fines levied against the company. Our article also provides insights into Wells Fargo Merchant Services' marketing strategies and customer support options. Lastly, we analyze the company's fee structure, contract terms, and the potential pitfalls of long-term leases. Through this article, readers will gain a nuanced understanding of Wells Fargo Merchant Services, helping them make informed decisions about their merchant service needs.

About Wells Fargo Merchant Services

Wells Fargo Merchant Services, a division of Wells Fargo Bank, is one of the top ten largest merchant account providers in the United States. Although Wells Fargo is an Acquiring Bank based in San Francisco, California, it uses First Data (now Fiserv) as its processor and has been doing so since 1971. It also uses First Data Global Leasing to supply its credit card processing equipment.

Wells Fargo Merchant Services Payment Processing

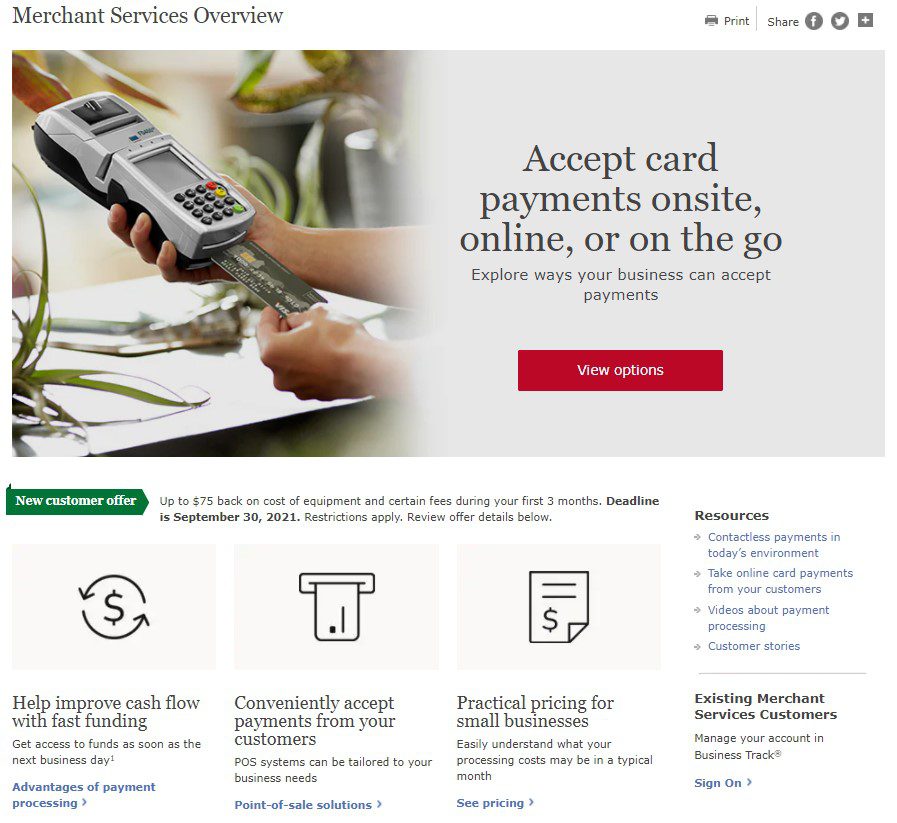

Wells Fargo Merchant Services processes all major credit cards and debit cards for most business types. Their services include POS systems from Fiserv's Clover brand, EMV readers, e-commerce solutions including virtual terminals and shopping carts, and next-day funding. We found very few Wells Fargo Merchants Services reviews regarding issues with equipment as most refer to complaints about fees.

Point-of-Sale (POS) Solutions

Wells Fargo Merchant Services provides a range of POS solutions, including traditional countertop terminals, mobile readers, and tablet-based systems. These solutions are designed to meet the needs of businesses of all sizes and can help streamline payment processing and improve the customer experience.

E-commerce Solutions

Wells Fargo Merchant Services offers a range of e-commerce solutions, including payment gateways, shopping cart integrations, and fraud detection and prevention tools. These solutions can help businesses expand their online presence and securely accept payments from customers around the world.

Online Payment Gateway

An online payment gateway is another service provided by Wells Fargo Merchant Services. This service integrates with a business's online operations to facilitate online credit and debit card transactions.

Business Analytics

Wells Fargo Merchant Services provides a suite of business analytics tools that enable businesses to gain valuable insights into their payment processing data. These tools include detailed reporting, real-time transaction monitoring, and fraud prevention tools.

Security and Compliance

Wells Fargo Merchant Services offers a range of security and compliance solutions to help businesses protect themselves and their customers against fraud and data breaches. These solutions include PCI compliance tools, encryption, tokenization, and more.

Faster Deposits for Wells Fargo Banking Customers

One of the benefits merchants receive when they have both a checking account and merchant account with Wells Fargo is a quicker deposit of funds from their credit card sales. Typically in the credit card processing industry, merchants who have their checking and merchant account through different providers will experience a delay of around 48 hours to receive deposits. Wells Fargo boasts that funds are usually available the next business day. This rapid deposit schedule is an attractive feature for some merchants, but it shouldn't be the only focus for merchants who are seeking the best merchant account.

Location & Ownership

Charles W. Schwarf is the CEO of Wells Fargo, while Colleen Taylor is the current head of its Merchant Services division, and its headquarters are at 420 Montgomery St San Francisco, CA. The Wells Fargo website also lists P.O. Box 6600, Hagerstown, MD 21741-6600 as an address for the Merchant Services division.

Video Summary

| Pros: | Cons: |

|---|---|

| Flat-rate for low-volume merchants. | High fees, poor sales experience. |

| Poor transparency and customer service. | |

| Limited product/service variety. | |

| Expensive equipment leases. | |

| Tiered pricing for high-volume merchants. | |

| Three-year contract, costly early exit. |

Wells Fargo Merchant Services Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | 90+ |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | Hidden Fees |

| Recent Lawsuits | Yes |

Fewer Complaints Than Expected

Considering Wells Fargo’s size, the company surprisingly has relatively few reviews concerning its merchant services division. Nonetheless, common types of customer complaints indicate areas where business owners are likely to encounter problems. If you have your own review of Wells Fargo Merchant Services to share, please do so in the comments below.

Poor Sales Experience

One of the most recurrent complaints involves customers reporting dishonest or deceptive practices by agents regarding terms, conditions, or costs of merchant account agreements, including additional services being signed up without consent. A business owner named Brad shared his negative experience in the comment section below this review.

“Just like many of the people below in this comment section, they offered the 2.2% rate, no fees, no contract, and $50 credit towards the credit card processing machine. The first 3 months went by with Wells Fargo sticking to the agreement…

Other Wells Fargo Complaints

Additional grievances include sudden and prolonged holding of business funds without explanation, nondisclosure of cancellation fees, and undisclosed non-cancellable policies regarding equipment leases. Clients experiencing fund withholding may benefit from consulting a high-risk specialist.

Wells Fargo Merchant Services Lawsuits and Fines

In August 2017, Wells Fargo faced a class-action lawsuit alleging deceptive practices in merchant processing agreements, resulting in a $40 million settlement in April 2021. A separate class-action suit in July 2021 accused excessive charges, leading to another settlement. In September 2021, Wells Fargo Bank was ordered to pay $250 million for deficiencies in its home lending loss mitigation program.

Wells Fargo Merchant Services Customer Support Options

Wells Fargo provides general customer service options via telephone support on its website. However, this falls short of the comprehensive support offered by merchant service providers known for excellent customer service.

Wells Fargo Merchant Services Customer Service Numbers

- (800) 451-5817 – Toll-Free Customer Service

- (866) 380-9828 – Sales

Wells Fargo Merchant Services Online Ratings

Here's How They Rate Online

| BBB Rating | N/A |

|---|---|

| Average Rating | N/A |

No Dedicated Review Profiles

The Better Business Bureau and other review websites do not have a separate report for Wells Fargo Merchant Services, but there are complaints related to merchant services that have been filed against its general page.

Wells Fargo Merchant Services Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | Yes |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | Variable |

| Equipment Leasing | Yes |

Wells Fargo Merchant Services Terms May Vary

The Wells Fargo Program Guide outlines pricing and fees for merchant accounts, indicating that rates may differ based on business type, processing volume, and the representative handling the account setup. According to the company’s website, it offers a swipe rate of 2.60% plus $0.15 and a keyed-in rate of 3.40% plus $0.15. Storefront businesses are charged a monthly fee of $9.95, while e-commerce businesses pay $24.95. However, business owners have consistently reported higher costs with Wells Fargo compared to previous providers, prompting many to switch to more cost-effective alternatives. To secure favorable terms, working with a reliable agent is advised. We recommend consulting our list of the best merchant accounts for businesses.

Three Years, $500 Termination Fee

Wells Fargo’s standard merchant account agreement, available below, entails a 36-month service commitment with an Early Termination Fee (ETF) of either $500 per location (for clients processing under $1,000,000) or $500 per location plus six times the cost of the business’ highest month (for merchants processing over $1,000,000).

Virtual Terminal and Payment Gateway Pricing

Wells Fargo mentions online payments in its program guide but does not disclose pricing for its virtual terminal and payment gateway services. Additional rates and fees, including gateway fees, technical support fees, batch fees, and additional transaction rates, are common for these e-commerce services.

Beware Long-Term Leases

Business owners are often encouraged to lease processing equipment through First Data Global Leasing, with non-cancellable lease agreements of up to 48 months. It is uncertain if Wells Fargo charges an annual PCI Compliance Fee, which is standard in the industry. Overall, these terms are less competitive than industry averages, making Wells Fargo less favorable as a low-cost merchant account provider.

Wells Fargo Merchant Services Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | No |

|---|---|

| Telemarketing | Yes |

| Misleading Marketing | No |

| Discloses All Important Terms | No |

Advertising to Existing Customers

Wells Fargo primarily markets its merchant services through the use of fully employed outside sales representatives as opposed to independently contracted agents. It also promotes and sells merchant accounts through its numerous banking branches. Negative Wells Fargo Merchant Services reviews have reported uses of deceptive sales tactics, specifically nondisclosure of important contract conditions and fees by the company’s agents. These complaints appear to be related to both the terms of Wells Fargo’s contracts as well as the terms of First Data Global Leasing’s equipment leases. This does not compare favorably to our list of best credit card processors. If you believe you are paying hidden fees from Wells Fargo, you should seek a fee-reduction analysis from an independent third party.

No Deceptive Ads

The company does not appear to utilize any intentionally misleading advertising or rate promotions that are apparent at this time. However, client complaints regarding hidden fees has lowered its rating for the purposes of this review.

Our Wells Fargo Merchant Services Review Summary

Our Final Thoughts

Wells Fargo Merchant Services is a large merchant account provider and credit card processing provider. Customer reviews complain of high fees and a poor sales experience, among other issues. It appears that processing rates may be on the high side, especially if clients do not properly negotiate their pricing. Additionally, the possibility of a long service agreement, early termination fee, and non-cancellable equipment lease negatively impact the company’s score. Business owners are strongly encouraged to read their service agreements prior to signing any documents or to select from one the best credit card processors we have reviewed.

If you found this article helpful, please share it!

Anas Salameh

The worst service ever, i made transaction from my client the transaction went through but because my account limit is 2500$!!! the cansel it and send the money back, so after days and days it canceled and they told me we cant raise your limit we advise you to close the account, i did close it. and after 3 months they put me in collection without any notice because of the fees of the transaction that never go through because if their policy, and now i am strugling with them to void this fees they keep saying it cant be void its under collection. THEY WANT ME TO PAY FOR SERVICE I NEVER RECIEVED BECAUSE OF THERE WEAK SYSTEM.

Jeffrey A Meyers

I am an attorney representing a flooring company. Wells Fargo has held my client’s funds for 15 months with zero explanation. I have sent dozens of emails and letters complaining to no avail. I have also had several phone conferences with the Wells merchant legal team pleading with the bank to release my client’s fund. The constant response has been: “Under the Contract, we can hold on to the money as long as we want.” Wells Fargo’s conduct is a disgrace to hard-working small businesses everywhere. Do NOT do business with Wells.

Michael Barr

Wells Fargo does not have the capacity nor desire to “do the right thing”. Wells Fargo refuses to follow guidelines set forth in contractual agreements to pay off merchant credit card purchases with no interest financing by a certain date. They slap you with interest charges although you pay off one item. CRIMINALS. REALLY!!!

June davis

Overdraft protection full sh** they wells Fargo they charge 35.00 lies to u all banks do. Chase does as something too wells Fargo charge 35.00 one time only they owe me money. Back now 200.00 dollars if they pay me I’m put lawsuit on them tomorrow morning.

Alan Shafer

Wells Fargo Merchant Services is operating contrary to supportive customer services. They obviously have no possible understanding of small business support nor of startup venture dynamics. For a company having only done $20-$30,000 per month, and having undertaken a dynamic new internet marketing campaign… we were so successful in July that we exceeded $750,000 in sales. However, because Wells Fargo for some reason did not believe that our success was real, they have been withholding the passthrough of our funds for now over 60 days. They say they are worried about customers wanting returns or refunds… and yet Well Fargo Executive Brendon Clark tells us that there were $24,000 in returns so far, so they are therefore holding almost $500,000 of our funds. A returns rate of 5% seems unreasonable to withhold all $500,000 funds. As a startup company we need those funds to replenish our inventories so we can maintain a high level of customer service. There is no logic behind holding a half million dollars for a 5% returns rate. Well Fargo is clearly keeping our monies to keep their own financial standing higher than what they have been experiences, especially since they lost the class action lawsuit that cost them $40Million. We their customer should not have to pay for Wells Fargo ineptitude.

Jon W

I feel your pain. I started a new LLC for a law practice, brought in a ton of clients almost immediately. Wells Fargo embargoed my account and eventually returned to the clients over $300,000. Bottom line, if you think you’ll have a successful business don’t bank with these clowns.

Charlotte Marcum

Beware signing up for Business Track. They encourage. If you don’t you are charged a statement fee and if you do you do not get emails from them. They fail to tell you that part. So you need to log in frequently to see if you have a chargeback. We had a chargeback received the monies back – Amex ruled in our favor. 30 days later customer changed the reason and Amex resubmitted we were never notified nor did the monies come out of our account until after the deadline to respond.

This post will help: New Chargeback Rules: What You Need To Know

-Phillip

Brenda Jones

For myself and all Accounts held with wellsfargo & Company on my behalf via Mobile products and services have all been denied access to me that meaning all money I’ve made has been kept from me for years without me ever reciving any payments what so ever . What do I think if you want a bank that will hold your money and keep it safe even from yourselfs then wellsfargo bank is the choice to make now they’ve gotta learn when its time to let go ….. wellsfargo let go my money its my time now after all im the company

This post will help: How to Make Your Payment Processor Release Your Money

-Phillip

Sagi levi

A complete joke! Wells Fargo has an online dispute manager and an email notification when a dispute comes, after 2 1/2 years of running my business with them and having zero disputes, my first dispute arrived, $800 a Debit- pin verified transaction. There shouldn’t be an easier dispute to win, right? wrong. I wasn’t even informed of this dispute. You can’t win if you can’t fight.

I got a phone call from their In-house collection department trying to collect funds for this dispute, when I asked what they’re talking about they told me to call their dispute response center that they can give me detailed information, Two different agents can find any disputes record nothing shows up on their online dispute manager, I had to demand a 3 way call between the two departments, for them to inform me that they need to investigate the matter and I’ll get a call back..

This post will help: How to Fight Chargebacks and Win

-Phillip

Robin Sidbury

THE WORST can NOT get any customer service. they just notified me they’re doubling my rated tried to speak to a live person for over 45 minutes on the phone only to get disconnected and put on endless hold. I will NOT be treated like that anymore

Tomorrow i will go to the bank in person and transfer all of my savings to another bank and be in search of a new merchant processor

This post will help: Cancelling a Merchant Account Without Paying a Fee

– Phillip

octavio resendez

worst experience ever! they lose your payments, when you call to ask about the payment they push you off to our departments, after 1.5 hour they tell you to wait 24-48 hours for payments to be processed after already have waited 3 days for processing.

was told i could cancel at any time with purchasing the terminal upfront now im being charged a termination fee for not wanting to keep their horrible services

This post will help: Cancelling a Merchant Account Without Paying a Fee

– Phillip

KATE

Our company has been offering customers home improvement loans with Wells Fargo for years. We signed a contract with the customer to supply and install new windows, trim and capping for $5,500.00. We told the customer prior to starting that they would need to remove their curtains so we could do the install which they did not do. No biggie. As a courtesy my window installer removed and reinstalled the customers curtains. The customer then complained to Wells Fargo saying that they didnt want to pay their loan. As per Wells Fargos request, we reached out to the customer to see if their was anyway we could resolve the complaint. The customer told us to not “waste his time” and hung up on us. After cooperating fully with Wells Fargo, they withdrew $5,500.00 from our account and told us that we needed to find another way to collect payment from the customer. So the customer received brand new windows and because they didnt like the way their curtains were re-hung they got a full credit. Totally disgusting and outrageous, especially after we have given them years of business. I do not recommend this company

From The Editor

This Post Might Help: How To Fight Chargebacks

HB

2-14-18 Wells Fargo enrolled my business, without my knowledge nor consent, in their online bill pay service. They turned off my Quickbooks. They trolled my account and added a direct deposit employee into their bill pay system. They fraudulently claimed the employee did this- not so. Employee was not hacked, and there is NO ONLINE access to my Wells account. But for $14.99 a month, they will clean up the mess they made, and turn my Quickbooks back on. Let it sink in- they opened an online service account, in my company name, attached to my existing account that was neither authorized, nor even proposed. And, its not free. They turned off something I had that was free, but will give it back if I pay another fee. Never paid a fee before! Aren’t they still paying fines for this sort of bad behavior?? I remember the congressional hearings!

Steve Momot

So, I signed up for a Wells Fargo merchant services account earlier this year, used the card machine about 3 times for a total of under $100 revenue, and now Wells Fargo and their 3rd party provider tell me I’m stuck paying for two more years on a machine I just cancelled my service on. In total I will spend about $2500 for a service and a machine I used to collect $100 and Wells Fargo thinks that’s right? I will continue to post my story until someone helps me out.

Laurie

I have never had a more difficult time with customer service, getting information I need and transparency. This is the biggest scam, and what a rip off! Do not use their merchant services. You will not get help when you need it and you are guaranteed to be charged hidden fees!!!

Talal Barikhan

Worst customer service ever. It’s just a waste of time especially the merchant processing service office in Los Angeles. They have no value for your time and business.

Dean Thompson

So many hidden fees and charges not worth the hassle or the headache stay clear.

Motty Chen

What WFMS fail to tell you is that you are committed to 3 years with $500 penalty if you close your business or decide you no longer need the services. Even you have 0 transactions, there is a $40 fee just to be open

You find it out only if you read the small print, or trying to close your account because they will not tell you that.

Big disappointment from a big bank. Avoid them at all cost.

M. Brown

Wells Fargo Merchant services are a rip off. They processed me .5 percent to use their service and it ended up being 4.5 percent. Then they used a 3rd party hardware company, digital data I believe that locked me into a 4 year contract that was in breakable. Beware of bank merchant services.

Jason hutton

Hello,

I went with wells Fargo because I banked there and thought it would have been easy. Anyway after year and half. I finally switched due to outrageous fees. Like 20 and 30 percent. No I am not kidding. I was doing 7 to 15 k a month and paying crazy rates. To anybody that is considering. Wells Fargo merchant services. Please check around.

Beth Landry

I agree they are absolutely ridiculous they’re rip-offs they got me in a three-year contract which I was not aware of I was told I was going to have this this this and another thing and I got nothing just fees fees fees

jason burleson

I decided to use Wells Fargo Merchant Services because I use WF for our business checking. The salesperson bait and switched us in to a 4 year contract for the service and the equipment. (The equipment came out to $2208 over four years.) We also had initially requested a wireless capable terminal but were never given one, only a dial-up machine. We called and emailed several times and were never provided with the equipment we ordered. The rates went up after a few months so we were threatened with a substantial early termination fee if we canceled, so we just kept using the service until the last day of the contract. Then we canceled and will never do business with their company again. We found a new company with better service, lower rates, better equipment and no contracts. Avoid Wells Fargo Merchant Services, First Data and Securus.

Avi Leiberman

Please stay away from Wells Fargo Merchant Services. I have been with them for 2 years and I have nothing but problems with them. The company is too big to deal with customer service issues. The collections dept for chargebacks made an error on my account last week and to this day I still have not received my funds that they are holding. They keep making nothing but excuses. And try getting a hold of the collections dept 800-773-6589, all you get is a message saying that there is no one to help you at the moment and to call back again. Try calling the number yourself and you will see what I mean. After many attempts to resolve this matter with them, I forwarded this to my attorney for resolution. I can’t afford to fight with Wells Fargo because I am too busy running a business. I’ll let my lawyers handle this for me.

Adelita Valentine

I have been working with Wells Fargo for about four months and I hate it! I opened a merchant services account SVD was told it would only be used for processing credit cards at my business. To this day, they continue to charge my merchant account hundreds of dollars for unexplained reasons. When I call the bank, they have no idea what the charges are for. They transfer me to merchant services who either don’t answer or I get a rude representative with a miserable tone of voice who doesn’t know a thing either.

The representative who set up my account conveniently missed my phone calls, texts, and messages. Miguel never calls me back either.

The only reason I still have the equipment and the account is that I have a business to run and haven’t had time to research other companies and start all over.

I wish Wells Fargo would just do their job.

Cheri

I want to thank each and every one of you for taking the time to post your review. I was considering using their merchant services but NO WAY will I do this after reading all your comments. This is how we all look out for each other. Thanks again!

Stephanie Webb

STAY AWAY from Wells Fargo Merchant Services! They are grossly over priced, they lock you into a contract for a terminal where you pay over $2,000 (for a machine that is worth $500). PLUS I have yet to receive help when asked for it. A few months back I was transferred to over six individuals, left numerous voicemails, and still didn’t get my question answered. Grr!

Instead, I would recommend calling Heartland Payment Systems to find a rep in your area. They are honest, helpful, speak English, and charge FAIR rates for their service.

David

Not avail the next day. It becomes available the day after that.

There APP is down. Can’t accept payments.

Kristin Stone

I’m very upset with Wells Fargo Merchant Services. I have a very small new business that I opened approx. 6 or 7 months ago. I did open up a business account in addition to my regular banking account so I could keep track of the income coming in. Well every time I went into the bank, I was hassled by someone to open up a merchant account, literally every time I went in. I have my car payment with them, my credit card, 2 banking accounts, and my son’s savings account all with Wells Fargo so I thought, why not? I should just keep it simple and use them as I do for everything else. BIGGEST MISTAKE!!!!!! My account has been badly taken advantage of. Holy smokes. I’ve been charged all these fees they ensured me when I initially signed up that if there was ever any fees on the account, to call them up and they would reverse them. I had initially gotten the Clove which I never used one single time as it wasn’t even going to work for my business. So I had to literally spend approx. 8 hours on various days calling to cancel and etc. Now there trying to hit me with a $220.00 restock fee. I was supposed to get the Clove for $250.00 due to a rebate. Well it’s like a bait and switch, the rebate would be applied once the Clove was actually used. I honestly wanna move all my accounts, I’m so scared to have money in my accounts now so I’m having to bank the old school way with keeping my money at home because I’m scared that it won’t be there because I’m still being charged all kinds of fees.

Lisa Strisko

I opened an account for my business with Wells Fargo merchant services in order to process card payments in February of 2016. Biggest mistake of my life. I have had nothing but problem after problem. First I was charged for to credit card processing options one being Internet and the other being the clover machine. This should have never happened because it was made CLEAR when the account was open that once the clover was received the Internet processing would be counseled. Needless to say that didn’t happen! I was doubled charged. I immediately went to my local branch to file a complaint/dispute. After working with the banker for HOURS he credit the Internet processing fee back to my account and said that the other fees I was charged due to what was now an overdraft would be reviewed for a credit as well. In the meantime I was double charged AGAIN and we were right back where we started. Month after month this happened which caused a hold on the account. Wells Fargo now all the sudden has no idea what I’m talking about so in conclusion…… I am in the bank again as I type this. However this time I am closing both accounts turning in the Clover and I AM DONE. If I had to make the decision to go with Wells Fargo again there would be no decision I WILL NEVER BANK WITH WELLS FARGO again in this lifetime…..I would suggest you heed warning. Unless you enjoy banking with problems n with a bank that lacks integrity stay away from Wells Fargo. Ultimately you are an adult and the decision is yours to make!

Jeff Hood

Wells Fargo are the biggest lying crooks on the planet. I have done very little business & am being killed by Wells Fargo. Even though I only have $170.00 left on my payments, they want $500.00 for me to terminate my account. First Data wants another $1,267.15 on my lease to terminate & I have already paid in $1,256.95 which is all towards a $300.00 machine. Wells Fargo Merchant Services is a company that NO ONE SHOULD EVER USE. Wells Fargo should be sued for $millions.

Janet Baldwin

Like you, Jeff Hood, I have had nothing but more fees from Wells Fargo Merchant Services and First Data. I cancelled my account Aug. 2017. I am now paying for a credit card terminal for 24 months for First Data and just today got a collection letter from Wells Fargo Merchant Services saying I owe another $100.44. Why did they turn something over to a collection agency when they have not tried to contact me not the first time for whatever this charge is for?? DO NOT USE WELLS FARGO MERCHANT SERVICES NOR FIRST DATA!!! BEWARE!!!

KATHY HALL

I received my 2015 Payment Processing Report and had a few questions. I called the number listed and was directed 4 times to a new menu before I was able to speak with someone. I only had 3 questions. What can I do to lower the cost of Non-swiped fees? What is the difference in fees for swiped verses non-swiped? Which cost the company the least, credit or debit? They put me on hold numerous times for up to 3 minutes at a time to try to answer these questions. I finally asked them if they had my information in front of them since I gave them my merchant account number. They said yes but could not explain why they could not answer my questions on a timely basis. I never got complete answers to these questions. They told me I would have to wait for my statement. I said I’m looking at the summary Wells Fargo just sent me, what more could you possibly need to answer these questions. I finally requested for them to look at last months statement to look up my fees and explain to me what each fee meant. It was a lost cause.

Now I feel like I should look into other processing companies because I believe these questions should be able to be addressed timely and efficiently.

sally jones

Were you calling the number on the merchant service statement and speaking with an account specialist and merchant services or customer service?

tmccain

There is a complete disconnect between your friendly branch manager whom you start your regular business account with and the call center for Merchant Services. When I realized the one credit card per month we processed was costing us more than 10% in Merchant Services fees I bumped into the $500 cancellation fee. Did you know Merchant Services also doesn’t offer processing so you must use another vendor, such as Authorize.net, and pay their fees as well? I missed that detail, and the 3-year clause detail, buried in the original paperwork sent via the Merchant Services team and now face a dilemma of continuing the non-competitive highest market rate fees or swallowing the cancellation fee. Again my friendly banker who accepts my check deposits everyday was no help at all because this is not a Wells Fargo company. The call center was, of course, rude and throwing up as many hoops as possible for me to go through the cancellation process. I have a bad taste in my mouth and will consider moving my business banking elsewhere. In the meantime, Quickbooks offers the exact same processing service for only $40 per month. This is a bad and deceitful business practice on the part of Merchant Services and Wells Fargo Bank is guilty by association and the way they recommended this service to a new business customer.

—

Are you with Wells Fargo? Learn how to resolve this complaint.

Eric McNamee

Authorize.net charges $20 per month for the gateway. First Data also has their own payment gateway that you can use however I’m not sure what they charge for it. Wells Fargo is a reseller for First Data which is one of the worlds largest payment processors and typically put new merchants on the Tiered pricing model. Tiered pricing for accepting plastic is almost always the most expensive way you can process transactions in almost every instance.

QuickBooks is a product of Intuit Merchant Services and you will run into the same scenario in terms of fees. If you only process one transaction a month I would recommend calling First Data and switching your account to an ARU account, which means you call a call center to process your transactions. The authorization fee is higher (usually around a dollar per auth) but with very few transactions you’ll be better off. I would also request to convert your pricing model to Pass-Through pricing and to have First Data reduce your surcharges to 0.25% & $0.10 because if you process ARU on Tiered pricing I’d bet that all your transactions would downgrade to the MID or NON qualified price bucket.

sally jones

Wells doesn’t do tiered pricing. They are a processor not a gateway. Gateways are the same as purchasing a terminal that sends the funding information to the processor. Banks are not processors and do not have the information merchant services has and merchant services doesn’t have the information banks have. They are not the same business.

Robert

An absolute ripoff! I was told it would be a $45 monthly fee. It’s over $300 for a service I use once every 6 months! They will lie to you to get you to sign up then rip you off constantly!

sma

I am experiencing the same problem. I am utterly beside myself. Did you find any solutions?

—

Are you with Wells Fargo? Learn how to resolve this complaint.

Hamid

I used to work with elevon and was happy for years. I was approached by wells fargo merchent services agent claiming they can beat theses rates for sure. Three months goes by I check they rates way higher than elevon. call the agent and he tells me that he will take care of ir.another three months and I check no change still much higher than elevon. I call the guy again he says he will talk to his manager. waited several weeks never calls back left him several messages does not bother to call back. contacted the wf merchant services to cancel they charged me $500 dollars early termination fee. I am still getting charged $50 per month for the credit card leasing fee they say my contract is for 48 months and I can not return nor buy the machine from them.Big scam.stay away from these people they are not honest and do not care about their customers.

sma

Did you find any way to break the lease? This is a nightmare for small business!

—

Are you with Wells Fargo? Learn how to resolve this complaint.

Colin Miller

I could not find a way out. After a long time trying, pleading and begging it was to no avail. I paid the early term. fee,

This industry is not regulated by the feds, so they can do what they want. You actually have more rights buying a box of cereal than signing with this lying, deceptive company. My bank was in cahoots with them too. I am now using https://paysimple.com its not perfect, but it allows customers to pay me with a CC. AND there is no contract, no setup fee.

Stay away from PayPal too. I have been with them for 9 years and all of a sudden they started putting one to two weeks hold on my money.

I have taken the PayPal option off my invoices.

—

Are you with Wells Fargo? Learn how to resolve this complaint.

phat

same as me, guy sold me contract did’t tell me about 48 months leasing equiment.

after pay $500 early termination fee, still have to pay $48 for device for another 2 years and half or pay straight 1000.

—

Are you with Wells Fargo? Learn how to resolve this complaint.

MF

I used an ISO under Wells Fargo by the name of Preferred Merchant Services. My business used them for a couple of months and they were okay, until they ended up overcharging us over $250 without an explanation. We have been going back in forth with them, first getting the run around and now more recently being threatened by an illegitimate contract. From the comments above and my own experience, I would say to stay clear of Wells Fargo and any of their funded companies/businesses.

Eric McNamee

MF,

As much as I dislike Wells Fargo, this post doesn’t pertain to Wells Fargo. Preferred Merchant Services is indeed an ISO with Wells but they just act as the acquiring bank where First Data is the actual payment processor. I’d say almost 90% of ISO’s are with Wells/First Data so it’s not them that caused the increase in charges it was Preferred Merchant Services. They probably put an annual fee + annual PCI compliance fee on your account which is where the excess surcharges came from.

The best thing you can do is contact First Data directly, have your Merchant ID number ready and ask them where the $250 came from. If they don’t see it on their side then Preferred Merchant Services ACH’d you outside of your merchant agreement (usually for equipment or a setup fee that’s wasn’t disclosed) so I would submit a certified letter to them demanding a reason for the additional charges.

AshoK

We are a small business that uses Wells Fargo Merchant Services. They unilaterally decided to hike the service charge of credit card processing by almost 400%. This is not done. This is absolute fleecing of the customer. A typical increase should not be more than 10% ever. How can they do something like this and get away with it. I will put this all over the place in internet and also explore going to court if this is not addressed and fixed. What would happen if the rent/mortgage you pay sudddenly gets increased by four fold?

Eric McNamee

How is a 400% increase in fees even possible? What kind of volume do you typically process?

Buddy

Do not use Wells Fargo merchant service. We process several million each year and deal with thousands of consumers. Consumers have found that it is easy to get their money back by filing a charge back, even if they have the product! Our product costs several thousand dollars. Customers sign several documents that they accept the product and that it is as they expected. They also waive their rights to file a charge back.

In one year we have had around 40 charge backs, all of which we have won due to our extensive paperwork. We lost only two. These two people have our product and got away with stealing it with the help of WG! WF did not care whatsoever.

In fact, the blame it all on the customer’s credit card company. I just found out that the rep we though worked for WF in fact works for First Data. WF is a shell game.

To cap it off, WF (First Data) all the sudden without notice, starting deducting extra 25% for each transaction! When we called them they said it was due to our high volume of charge backs. When I pointed out we have won 99.999% of them, they said they do not look at the ones we won any differently than the ones we lost. CAN YOU BELIEVE THAT! I can’t put in print what I said to them on that conversation…

Now they have our money and causing us to not make payroll, and continuing to deduct 25%.

There needs to be a class action law suit filed against these companies. Where are the hungry law firms at when they are really needed?

Eric McNamee

What they did was put you on a 25% rolling reserve which usually stays for a 6 – 9 month period. I sell merchant services and any time I come across a prospect who banks with Wells I do my best to warn them about how Wells Fargo operates. The reps in the bank are always so nice and merchants trust them because they can walk into the bank. I primarily deal over the phone so I lose a lot of prospects this way. Unfortunately Wells reps aren’t training on merchant services, they sell what they’re told to sell. Being that Wells is a First Data reseller the merchants get locked into the agreement that Wells has with First Data.

Arguing with the First Data chargeback department won’t get you anywhere. If you berate them continuously about the reserve you run the risk of being black listed which would prevent you from being able to accept credit cards all together with any payment processor. Unfortunately in your scenario all you can do is wait six months and then put in a request to have the reserve lifted.

Anna MCGEE

TERRIBLE CUSTOMER SERVICE!! I signed up for the service 2 years ago and canceled the service with a Wells Fargo banker a year and a half ago. Turns out the account was never canceled and I have been charged ever since. I have never used their services and was under the impression my account had been canceled. I have been charge around $2,000 and the reimbursed $90 from Wells Fargo Merchant Services. I have always had a great experience with my local Wells Fargo Bank and satisfied with their customer service, happy to recommend friends, family and college to them. . .because of this terrible experience, I am now questioning if I want to be part of their bank, this is ridiculous!

Gabe

I started my own business two years ago and the biggest mistake I’ve made so far is signing a contract with wells fargo merchant services for credit card processing. I had been a Wells Fargo customer for several years and figured they would treat me well. I thought I did due diligence when I read the paper contract that the wells fargo rep showed me at the wells fargo branch, but there are at least a hundred pages attached to the contract that are not included with the paper contract that you get when you sign the lease. The contents of this “hidden” contract are kept away from customers because they mention cancellation fees and penalties. From beginning to end the wells fargo merchant services rep did whatever he could to hide the true costs of signing up with them for credit card processing. He told me that smart phone devices weren’t secure and sold me on a mobile credit card machine. I was sorry that I had signed the contract within a month but there wasn’t anything I could do. I was charged monthly amounts that equaled between 15% and 30% of the total credit card amounts that I was processing. I had all my accounts with them including a brokerage account, mortagage, and long term savings. Despite my lengthy patronage to their bank, they had no qualms in cheating me and due to their actions, I cancelled all my financial accounts with them and will most likely never bank with them again.

My advice to anyone wanting to process credit cards for their small business is to stay far away from Wells Fargo merchant services and/or leasing mobile credit card machines. I cancelled my credit card machine with First Data and Wells Fargo merchant services at great expense and went with a smart phone device through another bank and this time I was very careful with the contract. I had no sign on fee, no cancellation fee, purchased the device for $30 and the monthly account maintenance fee is a flat $10. Also, my percentage fee is about 2.5% and now I pay 1/3 of what I used to pay wells fargo.

There is no justification for what wells fargo charged me, except of course for greed. But this is how credit card companies become so rich, and while they often do it by extracting high fees from people who are carefree with their spending, they occasionally get people who are usually careful like me. As I said, this is the worst financial decision I’ve made since opening my business and hopefully the last. If this story can help prevent them same mistake by one or two people I’ll feel better about my mistake.

Eric McNamee

Gabe,

I work for direct payment processor. I come across a lot of merchants who want to sign with their bank and I’d say that out of every 100 or so I come across maybe 1 or 2 listen to me that banks rip off their clients with merchant accounts. Wells Fargo is a reseller for First Data and yes they’re driven by generating as much revenue as possible to themselves.

Using mobile card readers are fine when it comes to security. Just make sure your device isn’t rooted or Jailbroken where 3rd party malware can capture card information.

Paying 2.5% is still pretty high for a swiped merchant. I would contact the bank you are currently using and request your processing account to switch to Interchange Plus pricing (you’re probably on Tiered pricing or flat rate pricing now). Interchange Pricing gives you true wholesale cost plus a small markup to the processor and it is the most cost effective type of merchant account available.

Maria

You have well written exactly my experience. I wish I had read this poor to my biggest mistake. Through your process can you advise me please on how to terminate first data and merchant services from my life?

—

Are you with Wells Fargo? Learn how to resolve this complaint.

Abbaas

Never open merchant account or credit card reader with Wells Fargo, because they are very dishonest about it. They hired people that they are not telling a single truth and they bring to sign like 50 page contract, they explain different that for you what is really in that contract. So you cant read all these 50 pages you have to take mostly their word.

Eric McNamee

Can you give a detailed review of what happened with Wells Fargo? I work for one of their competitors and I have been coming across a lot of new merchants who bank with Wells and have been told one thing and what they ended up with was completely different to accept payments.

Brad

Wells Fargo Merchants Services is a ripoff and a fraud!

Just like everybody else on this board, Wells Fargo lied and decieved me into believing there would be no fees other the the Discount Fee and Card Swipe Fee. There first offer was like 5% on transactions + the card swipe fee of $0.25. I said this was ridicoulous and said I will pass on that, as I own a small construction business, and 5% of the total bill really cuts my profit margin in half. While still in the bank finishing the paperwork on a business checking account, the Wells Fargo Merchant Services rep called the personal banker back, and said she had a new offer for me if I wanted to do the card swipe. Just like many of the people below in this comment section, they offered the 2.2% rate, no fees, no contract, and $50 credit towards the credit card processing machine. The first 3 months went by with Wells Fargo sticking to the agreement. I only ran 3 cards, with the transactions totaling about $3,000. I first noticed a couple extra fees, like Bank Interchange Fee, however they were relatively small in amount of about $10.00, and I figured what’s 10 dollars to be able to take cards.

After the first 3 months, I went 2 months without running a card through the machine, no fees. Then I get a $3,800 job in January, paid for with a credit card, same brand and bank as the others. Having used the card before, I think nothing of the $10.00 interchange fee applied in February with the agreed upon fees. Then comes March, no credit card transactions, yet here pops up a $5.00 interchange fee. I think nothing of it, as it wouldn’t be worth $5.00 of my time to go to the bank to argue the fee, as we all know banks are only open when your at work as well, in addition to thinking I swiped the final payment after the January cutoff. Then comes April, and another $64.17 bank interchange fee, with no credit card swipes in February, March, or April. This high fee warranted a visit to the bank where I signed up for the merchant services. To my suprise, nobody in the branch, not even the manager can handle my complaint. I’m referred to a telephone rep., and no suprise, the rep isn’t in the office. 3 days pass, still no word. Finally I take to the internet and post a similar post on another website, and another, and another. Boy was I suprised when they called me back the next day.

Upon a unsucessful interaction with the phone rep and manager, I was told the Bank Interchange Fee is set by the credit card companies and then passed on to me. Not only was I not told this when signing up, I also recieved a letter stating changes to my services. Just like many others on here, I also found out I was in a 3 year contract, subject to changes, and could not cancel the service. Had I been happy with the services and explanation, I probably would have left it at that and never used the thing again, take my money out of Wells Fargo, and close the account in 3 years. However, I wasn’t happy, and did further research on these interchange fees. I went to MasterCard and Visa websites to research this, since this is who I was told made the rules, and to my suprise MasterCard and Visa prohibit “acquirers’ or banks from charging interchange fees to merchants, as these fees are suppose to be included into the MDR or Monthly Discount Rate. When reading MasterCard and Visa’s policy word for word to Wells Fargo Merchant Services, there response is “everybody does it” and “that’s not true”.

Long story short, Wells Fargo will not do anything to help you, will try to destroy your credit. My only comparison to services like this would be the mobsters in old gangster movies extorting people for more money. At least with the mob, you’d get to talk to somebody face to face. All in all, I would not bank with Wells Fargo if your looking for a bank, and definitely don’t use there merchant services. My hope from posting this comment on this board, is others will take action and notify MasterCard, Visa, Discover, and the rest of the credit card companies that Wells Fargo Merchant Services is misrepresenting their card services. If enough people complain, and MasterCard or one of the others gets enough bad press, they’ll cancel Wells Fargo as a acquirer for there services, which would really financially damage Wells Fargo Merchant Services enough to start dealing with their customers fairly and honestly. With the 41 comments before mine, there are tens of thousands of dollars Wells Fargo Merchant Services has fraudentely made off of small business merchants.

Eric

Brad,

What you experienced is known as Enhanced Billback. They quote you the 2.2% for ALL transactions which they charge for that months billing cycle. Then the following month they review the previous month and add the excess charges that weren’t covered by the 2.2% and tack those fees on to the following month. The “Interchange” rate is the true wholesale cost to accept cards and the rates vary based on the card category. It’s difficult explaining this and it’s unfortunate that you had to experience this. You should lodge a formal complaint with the branch manager at the bank and renegotiate the terms of your contract. Tell them you want the Interchange Plus pricing model (make sure the surcharge isn’t above 0.50%), monthly discount, no Billbacks at all and for them to waive the early termination fee if they don’t honor your requests. Most of the time they’ll make the changes.

-Eric

Stacee

This is a follow to my initial post back in March. I got the run around and some bullying from WF in the first month post contact signing, when I started asking questions about the contacts I signed. I truly believe that the only thing I had going for myself is that I never used the terminal, not even once. For a recap, I signed those slave contracts in Jan after being deceived by our personal banker at Wells and the WFMS Rep. Jennifer Baxter and when I got a mysterious draft of $141.04 out of my business checking account for a “bank card fee”, and having not used the terminal (it was still in the box) and when I looked online for what that term meant (as I couldn’t get a straight answer from the Merchant Sevices rep) I learned that the fee was associated with a credit card transaction! So I called the WFMS Rep back and said, “look I haven’t even graduated or started my business yet and they are taking money that I hadn’t even made a yet!”It was only then that I learned about not one, but THREE “non-cancellable” contracts with three different (WF, WFMS, and First Data) companies I was now dealing with! When I asked the branch manager about this, her only response “well, you signed a contract”. Well, I did some digging online and guess what I found, “failure to disclose important information on a business contract IS A FORM OF FRAUD. So the first I did was close my account. Unfortunately, we also had our person accounts with WF as well, this was sadly a big fight with my husband as we had to close all the accounts. Then I contacted the BBB and filed a formal complaint against WF, WFSM and First Data Global Leasing. These three companies for failure to disclose important information to me regarding the contacts were in collusion to rip my new business off before it even started! So finally I stopped getting the run around and WFMS Corporate agreed to waive the early termination fee, but said I was on my own with getting out of the contract with First Data, even though they opened the lease on my behalf without my knowledge!! I said bullsh*t! So I told the BBB, absolutely not and I would only accept WFMS cancelling their fraudulent contracts (and the ones they opened on my behalf without my knowledge) waive the termination fee, AND buy back the lease from First Data and refund the $141.04 they took for a bogus “bank card” on a terminal that was sitting in the box it came and was never used. you know in hindsight, I remember once I got the terminal, I was bombarded with calls from First Data abd WFMS “why are you using the terminal? Is there something wrong? Which I thought was weird. I was like what’s the hurry, but that’s the hook, had I used that damn thing, I think I would had a tougher time getting any out of this situation and finding any recourse. WFMS finally, reluctantly agreed to buy back the lease from First Data as soon as I returned the terminal back into their possession. Which I promptly did with signature required upon receipt. Btw, I also filed a complaint with the FTC which prompted communication from the First Data Legal dept. :) I apparently got their attention..I felt vindicated, but I didn’t get my $141.04 back, but that’s fine, I will never do business WF again, EVER. So it was a $141.04 lesson. Bottom line, you don’t have to a victim of these unscrupulous, predatory companies. I sincerely hope my story helps someone avoid this situation because I have seen that it doesn’t always workout for people :(.

Philip S

Wells Fargo Merchant Services is one of the very worst merchant services providers available to merchants.

1. Beware of the terms within the contract, as you could be subject to a MINIMUM $500.00 fee for any termination of the agreement within the 3 year contract term. Yes…a 3 year minimum contract term.

2. Further, Wells Fargo Merchant Services reserves the right to INCREASE YOUR FEES at any time within the contract period. EXPECT THIS TO OCCUR WITHIN THE FIRST 6 MONTHS OF THE CONTRACT PERIOD!

3. POOR BUSINESS ETHICS: Be careful of early merchant services termination and concurrent bank account termination, as there may be fees to be paid from a period of more than 45 days past your bank account termination date. In which case, their merchant services unit will NOT notify you of any outstanding balance and will immediately transfer your account to their collections unit incurring a minimum of $100.00 collections fee in addition to the outstanding balance due. The only way to regard this practice is extortion.

There are many banks/merchant services providers that you will find providing seamless and cost effective merchant services, with a much higher standard of business ethics than Wells Fargo Merchant Services.

Aiman abujudeh

I owne a used car lot and my contract with Wells Fargo was the funds will be in my account the next day that never happen security is allways taken the money even though none of my transaction was fruidulant I think there service is garbage. I called on Monday sep/30 to check on a 6000 fund and I was send to lakisha voice mail she was off until Tuesday and all the customers have to wait until lakisha come back on Tuesday from the beach or where ever she went . Also Wells Fargo merchant services called me from 714 5515501# to check on my call to merchant services and wen there heared my complain they hanged up and didn’t take the serva

Cafe Owner

When we had a need for credit card machine Wells Fargo agents didn’t stop blowing up our phones but when we wanted to cancel the service within 30 days with no penalty nobody want to take our calls. Wells Fargo goes through a 3rd party for the actual machine which was not made clear when placing the order. We returned the machine and were still getting charged for it and the monthly fees would be totally random amount. When we called the 3rd party company they said they sometimes charge for multiple months. Clearly this was because we were canceling our account so they started withdrawing whatever amount they wanted. We were told all the money will be returned in 60 days. After 60 days had passed we were still getting charged and Wells Fargo would tell us we need to contact the 3rd party and the 3rd party would say Wells Fargo needs to initiate the termination. This was months after we initiated the termination and nobody would tell us if our account is still active or not this led us to terminated. Only way to stop these thieves was to cancel our business account with Wells Fargo and believe me Wells Fargo will never get my business again. Till today we don’t know what is the status of the merchant services. Stay away !

Jeff

We were hustled into dropping another merchant card provider we had for 6 years by a agent from Wells Fargo. What a bad decision. Wells Fargo started us at a rate with fees of about 2.5% under a contract that couldn’t be cancelled for 3 years. After 3 years, unknown to us, the rate went to 3.8% the highest in the industry. They told us they informed us by mail of the rate increase but we never got the word until statements starting arriving. It took us10 months to get an explanation. We dropped WF and were advised we would also have to pay the $500 cancellation fee. We went with BofA that has about a 2.5% overall rate and no contract commitment.

We are filing legal action against WF for overcharging and the cancellation fee.

Stay away from this bank and any services they try to hustle.

Kris

One loophole around the contract is if Wells Fargo raises your rates you have 2-3 weeks from the notice where you cancel your contract with no early termination fee. The reason being that they are breaking the intial contract with you so at that point you can leave. It’s highlighted in their program guide in the section that mentions the contract terms. When they send you the letter stating your new rates it does state that you can cacel within a certain time period.

Rachit

I do bank with wells fargo and I switch to wells fargo merchant account service not long ago. All I need to say is never sign anything with them. They will rip you off. Whatever they say to help you safe that’s true. but they keep adding so many fees to your account. And what I regret the most is when I signed with them they said everything is done, once I got cancelation fee from the previous credit card company they will refund it to me. Boom! they’ve gone with no follow up. I totally lose almost $400 out of my pocket. Just switch to wells fargo if you want to know how easy your money can go out of your pocket.

Sohail Chaudhry

Like everyone else on this review, i have to agree. These guys are a huge scam. I have been a customer since 1995. I left them and they charged me the $500 fee. Did not disclose the fees to us at the time of the contract. 19 page contract does not mention the $500 – simply says “See Section 39.3 of the Program Guide for early termination fees”. BTW, you dont get this program guide until after you sign up and get it in the mail. i am still not sure if i got it or not.

The reason i left them is even more serious besides the extremely high fees:. ChargeBacks. We had a fraudulent tranaction on one of our sites. It looked suspicious. So we issued a refund right away to the card as we called the number provided and it was not a real number. 4 months down the road, the card holder filed a complaint and wellsfargo merchant serivces deducted 4460 dollars from our bank account – without sending us a notification or looking at the fact the original transaction was refunded. Now they say that they cannot do anything about it. So we are out of pocket for $460. the lady on the phone said may be i should call the card holder to see if he will pay me back. Unbelievable. This should be a class action lawsuit.

John Kabashinski

Warning – Stay Away From Wells Fargo Merchant Services!

I am sorely disappointed that Wells Fargo Merchant Services, as part of one of the largest financial instituions in the United States, appears to have a regular business practice of widespread deception of their ETF (early termination fees) which is only discovered when cancelling a merchant account. When discussing this account with the sales person on setup, there was no mention of this (ETF) or even the term itself. Apparently this is not just an isolated incident based on the amount of complaints of a similar nature. The customer service agent, David, let me know that the only way these ETF’s are ever rescinded are through bankruptcy, natural disaster or if a business is sold and the new owner picks up the account.

Much like the now bankrupt Blockbuster video, Wells Fargo seems to have a business model based on punishment of the customer rather than real service or value. While I am sure they have a team of lawyers who will defend the small print deception they regularly undertake, in principal and practice this non-disclosure and deception of their EFT fees is a big red flag to all who read this considering a merchant account and to all who might invest in Wells Fargo stock.

Pam

So, I didn’t get the 50 page Program Guide I see people talking about here. I also did not receive a copy of a lease with First Data, I thought they were just a division of Wells Fargo that did their equipment handling. Reviewing my documents I see where I signed some pages acknowledging some fees and in relatively small print a statement that my signature on this page also constituted my signature for the First Data lease agreement. My rep told me it was a 24 month lease and I did not check the filled in blanks on the documents I did sign, which detailed a 48 month lease. Lot’s of question here about Wells Fargo business practices, I am surprised to see no legal action being taken by individuals, groups, or consumer protection agencies. Small business owners are know as the back bone of the American Economy because everyone is standing ON our backs!

Tami Davies-Coleman

This is not just Wells Fargo. the PNC Merchant Services Rep did the EXACT SAME THING to us. We are trying to fight it, but they are saying this contract I “signed” is non-cancellable. Does anyone know if this is accurate? We want to fight this, but I had to personally guarantee the account, since we haven’t been in business 2 years yet.

chris lee

My father in law owns a Japanese restaurant, and he has been using independent credit card company who has been charging him about average of 2.65% rate overall. After changing to wells fargo on oct 12, wells fargo has been charging him 3.75% + 40 dollar machine fee, which is costing him an additional 500 dollars a month. The rep has told him that they will lower the fee than what he is paying but the rep isn’t there any longer and no where to be found. now is stuck with an additional 500 a month. since nov 12, the manager said that they will resolve and lower the rate but now we are on march and no one seems to care about the rate and no one is doing anything but he is getting charged.

I see so many people are being fraud by the same question and i want to find out if anyone is filing class action law suit. this is totally outrageous as i asked him to get wells fargo….

they are the worst banking of all

Stacee

I was also scammed by Wells Fargo. My husband and I sat down with a personal banker for 2 1/2 hrs she new I was a brand new business, and I not even out of college and they steered me toward merchant services. There was no mention of leases or penalty fees or anything a month and a half later 141.04 was drafted out of my account and that when everything came to light. I have since closed my accounts but I still have a join checking my husband. I have never used the service and the terminal is in the box, I am still waiting to find out where to return the terminal. Any advice? I have also filed a complaint with the BBB and I am asking for the leases to be cancelled, the termination fees waived and the 141.04 set up fee returned. I will NEVER to any business with Wells Fargo Again!

Hong H.

As a new nail salon owner, I failed to properly do my homework as outlined on this site before signing what I thought was a 2-yr contract with WFMS, via a local WF bank agent. So currently I’m paying 1.89% plus 15 cents per swipe, with a bit over 2 years to go on the contract. Also rented a FD-100 terminal from WF Global for $30 a month, 48 month contract, which amounts to almost 4X what I could buy the same terminal for on Amazon.com, and I don’t even own the terminal at the end of the contract. Anyway, I got a letter from WFMS stating that as of April 1, they want to charge me 2.196% plus 20 cents per swipe. When I called their customer service rep, they very quickly decided to waive the fee increases as I was a “valued customer’, but obviously they don’t want to invalidate their pricey contract with me. Since the letter states that use of their services after April 1 constitutes agreement with the higher prices, I’m guessing that WFMS is hoping I ignore or forget about their letter or that I haven’t wised up enough to compare their prices with other processing service providers. Or that being Vietnamese-American, my language skills are such that I don’t understand the contract or letter.

This is not any way for a large company like WFMS to conduct their business – taking advantage of small business owners. We already have enough problems in today’s economy and tax climate – predatory behaviour like that of WFMS is not in our interest or even in WFMS’s interest, as they could lose some customers who give up or are forced out of business due to all the fees and taxes & regulatory increases. However I suspect WFMS is run by managers only interested in bonuses and quarterly profits rather than long-term strategic volume increases.

louis hubaud

i signed up for wells fargo merchant services, completed my service contract and cancelled my account . i then learned i had a 48 month contract with first data.the contract was non cancellable so i had to pay for 24 months for the first data equipment that i returned . my wells fargo representative never advised mye of the 48 month contract .i signed all required forms as advised by representative. i felt i had a contract with wells . only later did i learn that i had a contract with first data .my representative never advised me of the 48 month obligation. i contacted wells merchant services and they supported first data .so i am out over five hundred dollars .i trusted my banker.but never again i am disgusted with wells sales tactics.all you of signing up wells beware

Julie Opp

Write to BBB, you will get a response. I just got my fees waived after reporting them all (First Data, Wells Fargo Corporation and the branch it was done at) to the BBB and US Treasury department.

Julie Opp

I own a vacation home in NV that I rent out. I use VRBO.com and Homeaway.com for all transactions and paypal if needed. When I opened the business account the banker offered merchant services, I told him my business was only online, some guy from merchant services called me, offered me a good rate and monthly fee. I told them I had no idea how I could use it online that I didnt even really use my website that I used Homeaway.com and VRBO.com. They said they would be able to help me get it online. So the banker signed me up, I asked him if there was anything in the contract I should know since there was so much legal mumbo jumbo that I did not understand and he said no. Well I could not get their services on my website nor did I know how. I went into the bank the same week a couple of times tellng them I did not know what to do with it and it was useless to me and to cancel the account. They said they would call me and try to help me, someone called and started giving me instruction in what seemed like a different language, I told them I have no idea what you are talking about I’m not a web designer. They called again and I just said to cancel because there is nothing I could use them for. I own a home I rent out to my friends and students. I finally called after getting billed 35.00 for what i still dont know and I was told I was in a 3 year contract and it was 500.00 to get out. I was shocked. I called the banker and he claimed (Beau Roquemore) he doesnt know anything about that side of the business, but he is the one who initiated it and signed me up and said there was nothing that stood out on the contract that I should know. I told him in phone calls and going in that I did not need this service. I never used it or knew how to use it nor needed it. Now I am stuck with a 500.00 fee???? Because I trusted the banker?? This is a scam.

You're Fired!

Unbelievable! I have been a loyal customer of Wells Fargo for 13 years. They have robbed me for the last time. WF is holding nearly $20,000 in credit cards sales they are supposed to process. WF has not made a deposit on these orders since November 21, 2012 due to a spike in fraudulent chargebacks generated by a vendor who enraged a finite number of customers. The chargebacks totaled about $5K. WF has now cause the checking account (which funds my day to day operations) to go negative. On top of that, they hit me with a $35 overdraft fee for every transaction that hits the account. This account is now growing negatively exponentially while WF holds an excessive amount of cash hostage. I’ve never felt so helpless!

WF will not allow me to transfer my customers to a new processor (their competitor Chase Paymentech.) I have to pay Authorize.net $750 to extract the data which takes 4-8 weeks before I can manually input the customers information in digit-by-digit. In the meantime, all revenue is lost.

I have called Alex at WF risk management for updates once a day for the last two weeks. He left me a voice mail yesterday with no details only, “call me back.” To which, Alex did not pick up his phone when I called him four minutes after his voice mail.

Wells Fargo is a SCAM and a BULLY!!!

Victor

i just recommend you to stay away from wells fargo merchant services, I opened an account with them

about 6 months ago and already lost about $1000 and fees they charged me for no reason

and when i call them for an explanation they simply say it is for an adjustment of the last month fee

that was not charged to your account.

they forced me to retired my money from wellsfargo bank……i was really mad and frustrated

all i can say is keep away…………..0 stars for them……very bad company.

MRs DR

I too also was scammed by wFMS, a rep named Adam Renner signed me for a higher rate then his collegue gave me another rate better 2 months later. But both reps never cancelled their deals they wrote so I’ve been double charged. When you call them the two little pricks never call back. This guy adam is a piece of work and so his his collegue. Dirty slimey scum. Needs to a law suit

Jessica

I feel validated! Like everyone else on this site. I have experienced the duplicitous side of Wells Fargo. They were not forthcoming when I opened my merchant account. i assumed I was opening an account like any other, not signing a binding 3 year contract. The banker did not tell me I was signing a contract or go over terms of the contract. I have learned my lesson. Do not trust anyone to tell you upfront what you are signing up for. Only honest business people like myself would do something like that! Not Wells Fargo!

I only learned that I had signed a contract some 18 months after the fact from someone who uses the same service at my office. They found out when they tried to cancel. Isn’t that a nice slap in the face?

As for paperwork, we did not go over anything other than rates before I signed and I do not recall receiving a 52 page anything in the mail.

I called and gave two reps an earful about their shabby business practices and they wouldn’t budge on the $500 fee. I think each client who has experienced this should write to the president of Wells Fargo before they close all associated accounts. I will probably close early and rip the band-aid off quickly rather than continue doing business with this bank. I have one year left of the “contract” plus another annual fee coming up, it will be a wash for me.

I am surprised there is not a class-action lawsuit over this. Withholding and concealing important information from potential clients seems illegal to me and at least highly unethical.

Dustin

I signed up with wells Fargo merchant services account about three or four months ago. I can honestly say i feel i have been deceived and given false information. The Representative that set up my account DID NOT go over all the fees with me just told me about the fees that i asked about. This was my first time getting a credit card machine so obviously i didnt know the correct answers. Now unfortunately in locked in to a multi year contract and can do nothing about it. Beware of there services and try anyone else before going with Wells Fargo for theses services.

William

I opened a Coffee Cart business that was located within a building, I needed a way to process credit cards and I was new to opening a business. I did not do any research prior to searching for credit processing services and went straight to Wells Fargo. I sat down with a Business Banker Specialist to open an account; He opened three Business, Merchant and Spending “yes” overwhelming! He then set up an appointment with a Merchant Account Rep. I Met with both of them the following day, I must say that they were very customer oriented and seemed to be all about doing the best for me. The Wells Fargo contract came out and as I was trying to review the application, the Merchant Rep. kept summarizing the contract for me and telling me to sign here and initial there. I felt comfortable and trusting at the time. “Big Mistake on my part” I found out later that I was getting a hard line card processing machine that required a phone line, I made it work but I was not happy about it. My business did not take off as expected and I had to close doors within the first 5 months. So, now financially in the hole I went to close the business accounts and was advised that they are charging me an early termination fee of $500 dollars for the WFMS processing. Here is the kicker; I also have a contract with a third party that provides the machine to process the payment. The company First Data wants me to pay $40.00 month for the lease for the next 4 years. WOW! The Business Banker Specialist and Merchant Rep. were no help to me, their customer service appearance went right out the door and they were worthless. I was advised to call an 800 customer service line. I would place my experience with Wells Fargo in the same category as buying a used car, driving off the lot and having the motor blow-up. Then when you take the car back they tell you to bad so sad. I suggest that you do your research first, and then whatever you do “AVOID WELLS FARGO”! Thanks for reading and good luck!

Anna

My husband had the exact same experience. He is a new attorney working independently literally went through what you explained step by step. The representative at Wells Fargo didn’t go through any of the details of the contract and never explained that this was a 4 year lease. We thought we were just trying the service out. We even talked about how we could see if it was necessary in the type of business he does and cancel if it wasn’t. The rep said nothing. We feel so scammed every month when we see over $100 each month in service charges for about $500 a month in credit card transactions. So disappointing.

jennifer