Swipe4Free Reviews & Complaints

Overview

In this article, we provide a succinct yet thorough overview of Swipe4Free, a merchant account provider known for its cash discount pricing strategy. We'll explore key aspects such as their rates and fees, contract terms, and the unique dual pricing model which allows for different pricing for cash and card transactions. The review also covers the practicalities of their POS systems, cash payment incentives, e-commerce, and contactless solutions.

We assess Swipe4Free's customer support effectiveness, address common user complaints, and delve into the company's legal history and customer feedback. We also evaluate their marketing tactics and employee experiences. The aim is to offer a balanced perspective on Swipe4Free’s services, highlighting both advantages and drawbacks, to help businesses make an informed decision about their payment processing options.

About Swipe4Free

Launched in May 2017, Swipe4Free is a merchant account provider that specializes in cash discount pricing. The company is a DBA of Merchant Industry, a New York-based credit card processor that has been in business since 2007. Like other cash discount payment processors, Swipe4Free enables merchants to pass the costs of accepting credit cards directly to customers by adding a 4% per-transaction surcharge to all non-cash purchases. The company claims that this eliminates credit card processing fees for its merchants, which would make it one of the cheapest merchant account providers in the industry. Swipe4Free is a reseller of TSYS and First Data (now Fiserv) products.

Swipe4Free Payment Processing

Swipe4Free processes all major debit and credit cards for most business types. Their services include EMV card readers and swipers, POS solutions, access to virtual terminals and payment gateways, and mobile solutions.

Dual Pricing and Surcharging Platform

Swipe4Free offers a dual pricing platform, which allows businesses to display prices for goods and services in both cash and card amounts. For credit card transactions, a surcharge fee, not exceeding 3%, may be applied, which is displayed as a separate line item.

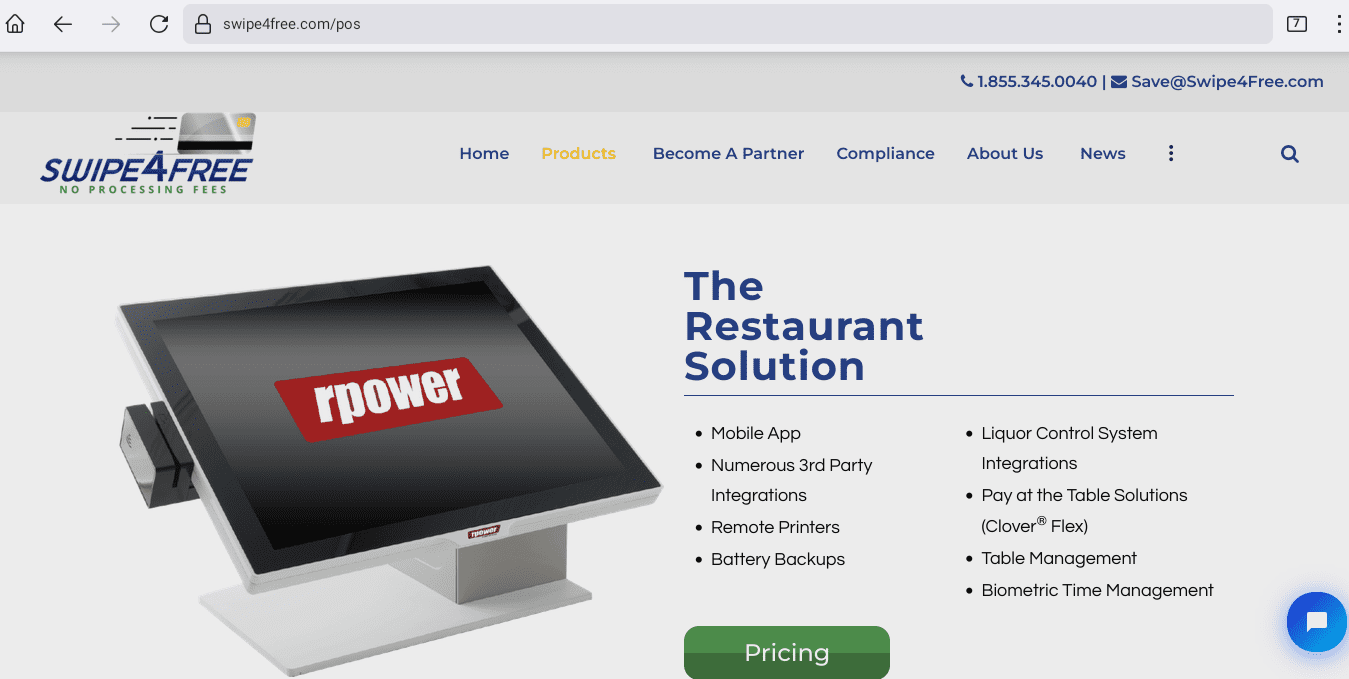

POS Systems

The service provides clients with point-of-sale (POS) systems and terminals that support payment acceptance in various locations, including on-the-go transactions.

Cash Payment Incentives

Swipe4Free encourages cash transactions by offering a lower price for cash-paying customers, which can help businesses avoid card fees. This approach is designed to reward customers who pay with cash, potentially reducing the business' costs associated with card processing fees.

E-commerce and Contactless Solutions

Swipe4Free also provides solutions for e-commerce businesses, integrating a convenience fee at checkout, compatible with platforms like WooCommerce. They also offer contactless payment options and equipment.

Locations & Ownership

Swipe4Free is a registered ISO of Wells Fargo Bank, N.A., Walnut Creek, California; and of Esquire Bank N.A., Jericho, New York. The company is headquartered at 36-36 33rd Street Suite 206 Long Island City, New York 11106, which is an address that it shares with Merchant Industry. Leo Vartanov is the CEO of Merchant Industry but is not publicly listed as the CEO of Swipe4Free. COO and co-founder of Swipe4Free Chris Benabu is also the CEO of Merchant Industry.

| Pros: | Cons: |

|---|---|

| No monthly fees | High fees |

| Transparent pricing | Slow customer service |

| Free equipment | Contract cancellation penalties |

| Fast deposits | Misleading marketing |

Swipe4Free Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | <10 |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | N/A |

| Recent Lawsuits | No |

Swipe4Free Customer Feedback Overview

Our exploration reveals only a handful of negative Swipe4Free reviews, a small portion of which label the company as a potential scam or ripoff. The complaints that are available typically mention higher-than-anticipated rates, non-disclosed costs associated with equipment leases, challenges with customer service, and difficulties in terminating services. These issues mirror those found in a larger volume of complaints against Merchant Industry. Additionally, while there exists a significant number of unverified positive Swipe4Free testimonials online, these have not been considered in our assessment due to uncertainty regarding their authenticity. We encourage you to share your own Swipe4Free review or customer complaints to contribute to a clearer picture of the company’s performance.

Legal and Regulatory Insights on Swipe4Free

To date, no class-action lawsuits or Federal Trade Commission (FTC) complaints have been identified against Swipe4Free. For clients seeking resolutions outside of court, reporting issues to relevant regulatory bodies is recommended as a constructive step.

Assessing Swipe4Free’s Customer Support

Swipe4Free prides itself on offering comprehensive support through direct phone lines, email, and live chat, although some services may be facilitated by Merchant Industry. The provision of live support signals the company’s commitment to customer service. However, the volume and nature of complaints received in its early operational phase suggest there’s room for improvement before Swipe4Free can be recognized as a leading merchant account provider for exemplary customer service.

Contact Details for Swipe4Free Customer Service

- (855) 345-0040 – Toll-Free General Customer Service

- (877) 841-4818 – Technical/Hardware Support

- (516) 821-0484 – Risk and Underwriting

- (718) 834-6669 – Retention

Swipe4Free’s Additional Support Resources

- Online support form for convenience

- Live chat for real-time assistance

- Email support for various concerns:

- [email protected] – General Support

- [email protected] – Sales Inquiries

- [email protected] – Technical Support

- [email protected] – Risk and Underwriting

- [email protected] – Retention Services

By updating these details and maintaining a focus on SEO with key phrases like Swipe4Free reviews, customer reviews, and customer complaints, we aim to provide a balanced view that reflects both the positive and negative feedback, enabling prospective customers to make informed decisions.

Swipe4Free Online Ratings

Here's How They Rate Online

| BBB Reports | 34 |

|---|

Note: We have adjusted this company’s BBB rating according to our own standards. To better understand why we adjust BBB ratings, please see our Rating Criteria.

Over 20 Complaints

The Better Business Bureau currently groups Swipe4Free’s BBB profile with Merchant Industry’s profile. The combined organization has an “A+” rating and has been BBB-accredited since May 2015. It has received 30 complaints in the past 36 months.

What Merchants Say

Swipe4Free has also received 4 informal reviews from clients, 1 of which was positive and 3 of which were negative in tone. The most recent negative review cites a large amount in unexpected fees:

So when I signed a lease with ******(bad mistake) in 2015 they signed me up with this company. I used the machine one a week at the farmers market. We had months were we didn’t use the machine because of it being winter. They never once said anything about inactivity fees. They would never do anything about it. Our contract ended in March with ******(kept giving us the run around about the equipment) Finally in august I was able to close clover down. I assumed that since I signed with both companies at one time they would cancel both at one time. MY BAD! I haven’t used this machine for several months but yet get billed $125.00 (inactivity fees )each month. I found out that I had to cancel with this company too. I called and was told someone would call me back. I have yet to here from them. This has cost me around $900.00 so far. I guess the next thing to do is cancel my bank account. I will never work with this company,,,,

Situations like this make the need for excellent customer service an essential component of merchant account providers dedicated to serving them.

A “B” Performance Overall

The fact that Swipe4Free shares its BBB profile with Merchant Industry makes it difficult to separate complaints about the two businesses. However, this may not be necessary because they both share personnel and a location. We therefore feel that the BBB’s rating should be adjusted to a “B” given Swipe4Free’s complaint total.

Swipe4Free Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | Yes |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | 4.00% Surcharge |

| Equipment Leasing | Yes |

Swipe4Free’s Full Pricing

According to the latest available information, the standard Swipe4Free contract entails an unspecified term agreement with a monthly fee of $49.99, an annual PCI compliance fee of $119.99, and a monthly PCI non-compliance fee of $19.95. Additionally, the contract includes an early termination fee of $750 or liquidated damages, whichever is higher. Clients have reported that the company offers credit card terminal leases at $30 per month for non-cancellable four-year terms. Detailed per-transaction pricing by Swipe4Free will be discussed further below.

Swipe4Free’s Cancellation Policy

The termination fee imposed by Swipe4Free is notably substantial within the industry, potentially exceeding merchants’ expectations. The merchant agreement explicitly outlines the calculation of this fee, similar to practices observed in the industry. Some business owners have expressed dissatisfaction with such fees. If you intend to terminate your contract with Swipe4Free, we suggest exploring methods to cancel your merchant account without incurring fees.

Swipe4Free’s Per-Transaction Pricing

Swipe4Free’s pricing model has been legally permissible for at least a decade, garnering renewed attention due to innovative marketing approaches by merchant account providers. Essentially, Swipe4Free equips its clients with credit card processing equipment that automatically applies a 4% “service fee” to all items sold in the business. This fee is transparently displayed on receipts. Transactions paid with cash are exempt from this fee. By implementing this model, Swipe4Free replaces conventional per-transaction fees, potentially saving businesses the entirety of such fees.

Assessment of Pros and Cons

While transferring costs to customers may initially seem advantageous in bypassing transaction fees, Swipe4Free’s PCI compliance costs, termination fee, and equipment leasing policies are on par with or below industry standards. However, transitioning to a cash-discount plan necessitates significant operational adjustments, potentially alienating customers accustomed to fee-free purchases. This shift should be approached cautiously, considering potential savings and customer retention. The substantial termination fee restricts flexibility in experimenting with pricing models. Hence, there are valid reasons to approach Swipe4Free’s contract terms with caution. We recommend exploring our curated list of the top merchant accounts available.

Swipe4Free Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | Yes |

|---|---|

| Telemarketing | Likely |

| Misleading Marketing | Yes |

| Discloses All Important Terms | No |

Outside Sales Team

Like Merchant Industry, Swipe4Free utilizes in-house telephone appointment setters and independently contracted outside sales agents to sell its services. This approach has generated a large number of sales complaints for Merchant Industry, with clients reporting unfulfilled promises, misrepresentation of the agent’s identity, and undisclosed fees. However, we have found only a few Swipe4Free reviews that specifically mention the company’s sales team at this time. These reports describe higher-than-expected Swipe4Free fees and undisclosed costs. Swipe4Free’s low sales complaint total may simply be due to the short amount of time that the company has been active so far. This compares favorably to our list of best credit card processors.

Swipe4Free Marketing Tactics

The Swipe4Free website goes to great lengths to explain how its cash discount pricing plan works, but it fails to highlight other details of its pricing. For instance, a calculator on the Swipe4Free website shows businesses how much they could save by replacing the current total amount of their monthly merchant statement with Swipe4Free’s $49.99 monthly fee and no other costs. However, this estimate does not factor in the company’s $119.99 annual PCI compliance fee, inactivity fees, equipment lease costs, or the company’s $0.10 per transaction fee for EBT payments.

A “B” For Now

Swipe4Free’s affiliation with Merchant Industry, its organizational approach to sales, and the advertising language on its website are enough to lower its grade slightly in this section. However, the lack of client complaints that directly mention the company’s sales team has kept it at a “B” rating for now. If you suspect that Swipe4Free is charging you undisclosed fees, we recommend seeking a free third-party statement audit.

Our Swipe4Free Review Summary

Our Final Thoughts

Swipe4Free rates as an average credit card processing provider according to our rating criteria. The company’s cash discount pricing could potentially save merchants a great deal of money, but there are other costs in its contract that are nowhere near as low as the company’s competitors. Businesses will need to weigh the potential headache of surcharging customers against the savings they can realistically expect from Swipe4Free. Before locking yourself into a long-term contract with a huge termination fee, we advise you to first see if you can secure rock-bottom pricing on a month-to-month agreement through a top-rated merchant account provider.

If you found this article helpful, please share it!

Angelica Murcia

They didn’t deposit my money in my bank account saying that visa visited my store and I got a violation ( I never received any paper or report about that) putting a hold in my account until visa get $5.000 that is supposedly that amount of the violation …. And then I received mails from Sweep4free saying that they needs to replace their machine …. I searched with other merchants service and they told me the violation was for sweep4 free that’s why they needed to Change there machines….. and they took my money and so far I couldn’t get my money back …. It’s was their fault to fail to have the appropriate machine and then charge this to some costumer including to me

Faten Alsharif

They scammers charging too much money, bad bad, responding and professional the second you want to cancel the service they will hang up on your face. They will hit you with charges you never hear about it.

Naomi

Christopher Benabu was a really hard working and dedicated person. He never gives up. It was a pleasure working for Chris.

Kerry Sibley

Same, Bankcard-8563 started to show up on our statement last August. Visited Wells Fargo today and they have put in a claim for the full amount as I actually have my cancellation email and proof of the rep, Shaun Firtell, stating there there will be “NO CHARGES” after I cancelled back in June 2023 before signing anything with them. I never received any of their equipment either, so I’m guessing they think that they can keep a customers bank account information and charge it monthly when they are not even our Processor. I know Wells will get us our money back, however others should be made aware of this company and the way they operate and steal from people. Ill be glad to see them go down! Side note: Even though they state they are with Clover whom is part of Wells Fargo, Wells Fargo has repeatedly stated they have no clue who Swipeforfree is and they have nothing to do with them. I’m sure the future of this company will be interesting as soon as Wells Fargo decides enough is enough.

jack lyn

Swipe4Free has been the best for our business. Since implementing their dual pricing platform, we’ve been able to keep 100% of our profits by eliminating credit card processing fees. The dual pricing system, which displays both cash and credit prices, provides transparency to our customers, and the cash discount has been a real incentive for them. The best part is that the dual pricing fee is automatically waived when customers pay with cash, debit cards, or gift cards. It’s legal in all 50 states, and Swipe4Free provides signage and stickers to ensure customers are aware of the fee. We highly recommend Swipe4Free to any business looking to boost its profitability.

Phillip CPO

Our comment system has identified this to be a fake testimonial. To protect how we identify fake testimonials will cannot disclose how it was detected. However, it is unclear if this action was condoned by the the company that is the subject of this review.

Peggy

I am so disappointed. I was a new business owner when I open my business. They sold me on this Processing. My sales person Nico set all the right things. When I had a personal emergency, forcing me to close my business, I was unaware of all the cancellation fees, and all of the steps I had to go through to cancel. Here I am six months later still trying to cancel. Hopefully this will be the end.

Robert Valdez

Swipe4Free has been an invaluable partner in our business growth. Their cash discount pricing model has reduced our credit card processing costs significantly. Their mobile payment processing service is perfect for our food truck business, providing a convenient payment option for our customers. The virtual terminal service has streamlined our phone orders. Their e-commerce payment gateway integration made our online transactions seamless. We appreciate the security measures they implement to protect our transactions. Swipe4Free is a trustworthy and cost-effective payment processing solution!

Phillip CPO

Our comment system has flagged this submission as a fake testimonial. To preserve the integrity of our detection methods, specific details about the detection process cannot be disclosed. It is currently unclear whether the action was sanctioned by the company subject to this review.

johny fisher

Swipe4Free has simplified our payment processing and reduced our overhead costs. The cash discount pricing model is transparent and easy to understand for both us and our customers. The mobile payment processing option has been a game-changer for our business events and trade shows. The customizable POS system has enhanced our in-store operations. The virtual terminal service allows us to process orders from customers who prefer to pay over the phone. Swipe4Free’s focus on security gives us peace of mind in handling transactions. We’re impressed and satisfied with their services!

Phillip CPO

Our comment system has flagged this submission as a fake testimonial. To preserve the integrity of our detection methods, specific details about the detection process cannot be disclosed. It is currently unclear whether the action was sanctioned by the company subject to this review.

Kinsley

swipe4Free has truly revolutionized the way I handle credit card transactions in my business. The dual pricing feature allows me to clearly display cash and credit amounts, ensuring transparency

for my customers. By offering a small surcharge on credit card transactions, I can cover the

interchange, authorization, and transaction costs, while still keeping my profits intact. The

provided signage and stickers help inform customers about the fee, avoiding any surprises. I

appreciate Swipe4Free’s commitment to supporting merchants and their dedication to providing

cost-saving solutions. It’s a win-win for both my business and my customers.”

Phillip CPO

This appears to be a fake testimonial.

Julie Smith

“Swipe4Free has been a great partner for my business. By implementing their surcharge service, I can apply a small fee of up to 3% on credit card sales. This fee is clearly indicated as a separate

line item on customer receipts, ensuring transparency. With Swipe4Free, I no longer have to

worry about credit card processing fees eating into my profits. It’s a relief to keep 100% of the

transaction value for credit card sales. The provided signage and stickers help educate customers

about the fee, and the legal compliance across all states is a significant advantage. My business

has benefited financially from using Swipe4Free, and I’m pleased with the results.”

Phillip CPO

This comment appears to be fake review. To authenticate your testimonial, please reply with your business information.

Jonny t

” I’ve been using Swipe4Free for my business for over a year now, and I must say it’s a game-changer. With their dual pricing platform, I can display prices in both cash and credit

amounts, providing transparency to my customers. The best part is that when customers choose

to pay with cash, debit card, or gift card, the dual pricing fee is automatically waived. This means

I can eliminate credit card processing fees and keep all my profits. The provided signage and

stickers make it easy to inform customers about the fees, ensuring transparency. Swipe4Free has

significantly boosted my business’s profitability, and I highly recommend it to fellow merchants.”

Phillip CPO

This comment appears to be fake review. To authenticate your testimonial, please reply with your business information.

Misti

Swipe 4 Free and Michael Tisdale are shysters!!! We wanted to cancel our account with them prematurely because we were closing our business. I understand that I will owe a fee for this. I then saw where I was getting a $500 draft from my account from Merchant Services. I did not recognize that company name or the amount so I got that stopped at my bank. Now I get an email two days after stopping it from Merchant Services using “CLOVER” as their logo who have sent me to collections for the $500 that in two days has now grown to $750. I called those people and they are in some foreign land. I told them I am not dealing with the and I will speak to Michael my rep and pay what I owe his company. I am not paying them over the phone when they could take my bank info and do God knows what.

I then tried emailing Michael. I tried calling the two phone numbers listed for him. One says it is a nonworking number. The other says the voicemail box is full. He doesn’t answer his emails. I’m turning them in in their state and mine for fraud.

RUN RUN RUN RUN

Janet Wilmore

Our experience with Swipe4Free has been extremely costly. The PCI annual fee of over $100 (which is not required per Square.com), and the S4F annual fee of $129.99, S4F monthly statement fee of $7.45, and the monthly Valor equipment fee of $4.95 plus the monthly Valor Wireless Fee of $18.00, and to top it off, if you do not use the machine there is a monthly “inactivity fee” of $29.99. In order to cancel this service, which has direct access to our checking account, we had to pay a cancellation fee of $750. After complaining, the fee was discounted down to $500. On one occasion of complaining to “customer service (which is difficult to get ahold of)” the youngish man laughed at me and said that I should have read the contract more closely. RUN RUN RUN!! December 2022 total fees charged and deducted from our checking account were $220.33. January 2023 we uploaded the Square.com app, which does Not require a contract, and does NOT charge any of the above fees.

Fraidoon

SCAM WARNING

” DO NOT DO BUSINESS WITH THESE GREEDY SNAKES ”

They got me on free Clover Flex which cost to buy is over $500 after signing the contract they told me they are going to give me another brand (a much cheaper machine)I simply did not want to go further with them and wanted to cancel my contract, which Michel T (sells person)agreed (lied) and had said he will cancel my account, I thought this is finished, I noticed they were showing on my bank statement taking monthly 69.99 plus once a year $189.00 as ” Bankcard.8563 ” name, FOR 18 Months undetected because unfortunately, I had mistaken them for another legitimate company that I had a contract with the same name different 4 digit number for many years. I think they know exactly what they are doing, I called them for a refund they are saying they had to be notified of canceling by email (BS) and they don’t have one from me. looks like I am not the only one getting cut in their net I am talking to my lawyer trying to put together a lawsuit. they are going to hear from us soon for sure.

DO NOT DO BUSINESS WITH ((swipe for free )) THey are GREEDY SNAKES.

jerome Smith

This Marc at Swipe for free is full of s***. Stay clear from this company. they will charge the company as well as the customers each month.

Isabella

Swipe4free is the worst merchant company I’ve ever encountered in my life time. There are multiple law suits against this company. They took more than $2600 from my business account during pandemic when my business had so much financial problems. They also charged over $1000 when I was using their service when they said everything is free with swipe4free. Liars!!! When you call the company they always pass you around to different department and hang up the phone call on you. This company is a scam. I’m surprised they are still in business when they have that much complaints and lawsuits. They also sent me to collections which later I was off because I didn’t give up fighting these thieves! Don’t give up if they steal your money. Report it! Make sure to dispute if these scammers charge your business. If I come across anyone who is interested to use swipe4free service I will definitely stop them from using this service.

RTaymond Hlubik

we cancelled our swipe for free account before it was ever finished with signup

they are still trying to collect fees ever though we never received equipment

Misty McCullah

Swipe for free is a horrible company they have taken money out of my account unauthorized multiple times now when asked about it I’ve been told that it was an audit month and or they will refund my money which they never have. They are an absolute scam do not trust them with your bank account my bank is currently going after them for fraud.

Leo Wang

Did it refund you? How do you stop swipe4free taking money from your bank account?

MB Sakho

They 0 processing, it’s not true

They charge you more than what you can imagine, they stole almost 50% of what I processed in 1 month, it’s a scam Be careful, they know how to get you they are professional in stealing. Never Never Never it’s a Tramp

Brianlyons

Everyone BEWARE This company is a mess.They stole money from my account on several occasions and when question, they say we are working on the problem and we will refund the money. Guess what never got anything back,Anthony has no idea of whats going on..BEWARE SCAM COMPANY

JOSE LUIS CACERES

We are a small tax office and because of Covid-19 looking to save some money on merchant services, we called Swipe4free around October 2020 and spoke to Michael T, we went ahead and explain our situation. He immediately told us that we were paying too much and that he can definitely save us money if we switch to them. I asked him many times about the fees because we already had some bad experiences with other Processing companies, he gave me the numbers that were more affordable than the one that we currently have 2.25% for key transactions, 0.99% for using the terminal device, 1.6% for using a credit card and a $10 monthly fees, which I made sure to write down in case of numbers change in the future. After the first month, I noticed several transactions made on 12/31/2020 for a total of $57.94, we called Michael T to asked him about the charges and he told us that he would take care of it, that the system was charging us because it was a new account and other reasons that didn’t make much sense, another 2 weeks went by without getting a refund and more charges. We called Michael again but this time to cancel the service and he told us that we were going to take care of it, that they were taking longer to process everything because of covid and that by the next day the money should be in our account, the money never appeared in our account and call again to speak to a manager, we spoke to Oscar the “manager”, we told him what happened and that we have everything in writing, he pretty much did nothing to solve the issued and made even more difficult for us, told us that they cannot refund any money because we need to send an email to request cancellation that Michael T told us he didn’t need it to do.

Please Guys do not trust this company!! Save yourself the time and money!! No integrity at all.

JOSE LUIS CACERES

DO NOT GET SERVICE WITH THIS COMPANY, THEY ARE THE WORSE

Roman

Saved me a ton of money. This is a no brainer. These guys came in set everything up reprogrammed my equipment and increased my bottom line by 22%. The consumers don’t even notice or care. I was worried but its the best thing I did in years.

CPO

Hi Roman,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!

Amy Bove

I could not be happier with the experience I had with Swipe 4 Free. From the first conversation, I was very impressed with the level of professionalism and the the time the team took to answer all questions and inquiries so that I could grow my business. Equally impressive was the customer care experience after making the decision to proceed on with Merchant Industry. The service provided was above and beyond my expectations. I encourage any and all small to medium sized companies to reach out and work with this amazing team!!!

THE BOTTOM LINE

There are multiple reasons to opt for Swipe for Free. From their approval rate and fast turnaround, to their customized processing solutions and state-of-the-art equipment, they offer tons of benefits and cater to multiple types of businesses. Whether your business is online or in-store, it’s likely they’ll be able to provide the right solution for your payment and processing needs.