TimePayment Reviews and Complaints

| Pros: | Cons: |

|---|---|

| Convenience for Customers: Quick, seamless transactions. | High Transaction Fees: Erodes profit margins. |

| Enhanced Cash Flow: Faster funds availability. | Chargeback Vulnerability: Risk of revenue loss. |

| Global Expansion: Worldwide market access. | Security Concerns: Ongoing cybersecurity investment. |

| Reduced Fraud Risk: Advanced security features. | Technology Costs: Implementation and maintenance. |

| Improved Record Keeping: Efficient financial management. | Dependency on Providers: Third-party reliance risks. |

Overview

In this article, we offer an insightful review of TimePayment, a subsidiary of Fortress Investment Group, known for its equipment lease financing services. We will examine key aspects such as rates and fees, contract terms, and customer complaints. The focus will also be on TimePayment's payment processing capabilities, including handling various credit cards and offering mobile payment solutions.

Additionally, we'll explore the technology tools and backend services provided by TimePayment, along with the training for selling lease financing. We'll also discuss the company's recent acquisitions and their market impact. This review aims to provide a balanced perspective, highlighting both the advantages and potential drawbacks of TimePayment's services, informed by customer reviews and legal proceedings.

About TimePayment

A wholly-owned subsidiary of Fortress Investment Group, TimePayment (timepayment.com) is an all-purpose equipment lease financing company that offers leases for credit card terminals and point-of-sale equipment as part of a much larger equipment lineup. Like Northern Leasing Systems, TimePayment does not itself process transactions or sell merchant accounts. Instead, sales agents will typically pair a TimePayment equipment lease with a newly opened merchant account from a credit card processor. Riverside Payments and Velocity Merchant Services are two merchant account providers that reportedly resell TimePayment leases. In 2022, TimePayment acquired competitor QuickSpark as well as Wheaten Financial, Diversified Capital Credit Corporation, and Briland Capital.

TimePayment Point of Sale

TimePayment offers equipment leases for many types of businesses. In terms of credit card processing, they specifically focus on point-of-sale systems for restaurants and salons/spas. They also offer the ability to become a reseller of this equipment.

Payment Processing

TimePayment offers payment processing services that allow businesses to accept all major credit cards, including Visa, Mastercard, American Express, and Discover. With TimePayment, businesses can accept payments in-store, online, and on-the-go using their mobile devices. TimePayment’s payment processing solutions are flexible, fast, and secure.

Equipment Lease Financing

TimePayment provides equipment lease financing options to dealers, buyers, and brokers. They offer a range of flexible terms and custom options to meet the needs of businesses, including approval for credit profiles down to a 550 FICO score.

Technology Tools

The company offers technology tools like InfoHub™, an online portal and dashboard for application entry and growth tracking. These tools are designed to integrate seamlessly with websites and shopping carts to boost online sales.

Backend Services

TimePayment can act as a back office for businesses, handling invoicing, pass-through billing, and customer service. This allows businesses to focus on their core operations while TimePayment takes care of administrative tasks.

Sales Tools and Training

The company provides training to staff on how to sell lease financing. They offer hands-on training in using personalized online portals and automatically generate paperwork to eliminate hassles at the point of sale.

Industry Coverage

TimePayment works with a wide range of industries including restaurant, auto printing, healthcare, and more. They claim to work with over 50+ industries, offering tailored financing solutions.

Video Summary

TimePayment Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | 150+ |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | Sales Tactics |

| Recent Lawsuits | Yes |

Understanding TimePayment’s Customer Feedback

TimePayment has amassed over 150 customer reviews that express dissatisfaction, with some labeling the company as a ripoff or scam. Such a complaint volume is consistent with the equipment leasing industry, where companies like Northern Leasing Systems, First Data Global Leasing, and Ladco Leasing are known for their contentious relationships with merchants. The similarity in lease terms between TimePayment and its competitors sheds light on the origins of these complaints. If you’ve had an interaction with TimePayment, sharing your experiences in the comments could provide valuable insights for others.

Legal Encounters Involving TimePayment

TimePayment has faced legal challenges, including two lawsuits in 2019 from customers over equipment leasing agreements. One case alleged that the lease was effectively a consumer credit sale, resulting in a settlement, while the other, involving damaged equipment, was dismissed. These cases highlight the potential disputes within equipment leasing contracts.

For those seeking non-litigious resolutions to disputes with TimePayment, reporting the issues to appropriate supervisory organizations is recommended.

Available Customer Support from TimePayment

TimePayment offers a comprehensive suite of customer support options, including telephone, fax, and email communication channels, catering to a broad spectrum of customer needs.

Contact Information for TimePayment Customer Service

- (877) 868-3800 – Toll-Free General Customer Service

- (866) 994-7832 – New Business Inquiries (Buyers)

- (800) 872-1532 – Vendor Services & Transaction Support

- (866) 994-7260 – Broker Support & New Business

- (781) 994-4774 – Fax

Additional Support Channels

- [email protected] – General Customer Service

- [email protected] – New Business Inquiries (Buyers)

- [email protected] – Vendor Services & Transaction Support

- [email protected] – Broker Support & New Business

While these support options align with industry standards, the prevailing customer feedback regarding contract terms and sales tactics influences the company’s overall rating in customer service. Your detailed experiences can further enlighten potential clients and guide their decision-making process.

TimePayment Online Ratings

Here's How They Rate Online

| BBB Rating | 1.04 |

|---|---|

| Trustpilot Rating | 2.5 |

| ComplaintsBoard Rating | N/A |

| Average Rating | 1.77 |

BBB Rating Analysis

TimePayment Corp. has a customer review rating of 1.04/5 stars on BBB, based on 80 customer reviews. The company has also received 190 complaints closed in the last 3 years, with 78 complaints closed in the last 12 months. Common themes among the reviews and complaints include issues with billing and collections, and dissatisfaction with the overall service.

Negative Feedback

I borrowed $8,800 from Timepayment and it wasn’t supposed to go on my credit report. A few days later I got an alert that I had a new inquiry, sure enough, it was them but what really stood out was the amount borrowed of $19,000+, I didn’t borrow this much. So it either needs to be corrected on my credit report or they need to compensate the difference by check loan amount difference. Thanks and hopefully we can get this resolved soon.

– Complaint from October 6, 2023

My account was sold to this company without my knowledge. I was not contacted by either company to inform me of the change. My payment increased because I didn’t show insurance. The other company had my proof of insurance but I guess it was conveniently lost. After a year of paying I inquired about my balance and I was told it is now more than what I borrowed. This has to stop!!!! Crooks!!!!!

– Review from November 15, 2023

Positive Feedback

There are no positive reviews published about TimePayment Corp. on the BBB website.

Source: BBB

Trustpilot Rating Analysis

TimePayment has an average customer review rating of 2.5 stars on Trustpilot, based on 5 customer reviews. The reviews indicate a predominantly negative perception, with 80% of the reviews being 1-star. Common themes among the reviews include complaints about poor customer service, misleading or unclear terms, and issues with billing and charges.

Negative Feedback

Absolute 100% scam of a company. I had a copier lease with them for 60 months and at the end of the lease I had the option to buy the equipment at market value. Well, as a busy businessman I didn’t pay attention to when the lease was over and they never emailed me or got a hold of me. After 6 months I realized that my 60 month lease was over and called them to find out why they had been charging me. The rep Joan Daniel straight lied to my face telling me that I had 1 month left and then I can return the equipment or buy it out just to squeeze me out of another $174. I emailed and called left messages but no one replied or responded and they proceeded to steal my money. They went behind my back and bought the equipment without giving me an opportunity to return it to the company that i leased it from. After that, they tell me that if I don’t want to keep the equipment I had to return it to them in Massachusetts, even though when I leased the printer in Fresno California and I have to pay for the shipping of $1600. If I knew that I had to return the equipment myself across country I would’ve never even leased it in the 1st place. Now I have to pay the buyout fee and an additional 3 months of rental simply because they are nonresponsive.. after speaking with an attorney she said that she is with so many people like me that are getting scammed by this company that she doesn’t even know how they still in business. This is a complete and total scam of a company. DO NOT DEAL WITH THEM!!!! If you are financing or planning to lease something, find out who the lease company is and if it’s these scam artists, run away!!!!! I hope thus company goes out of business soon. A COMPLETE AND TOTAL SCAM!

– Review from September 29, 2023

NEVER deal with this company. I got a loan from them to get a new ToolBox and I wish I never have. They have had “Technical Difficulties” for over a month. I can’t get a buyout quote on the site but I was able to send an email. Once I sent an email somehow instead of $5,000 I now owe a little over $11,000 and they won’t help me. Also I made $800 in payments that are not showing up on the site that nobody can confirm with me. This place is a SCAM, Avoid at all costs..

– Review from October 5, 2022

Positive Feedback

There are no positive reviews published about TimePayment on the Trustpilot website.

Source: Trustpilot

ComplaintsBoard.com Rating Analysis

TimePayment has a range of customer reviews on ComplaintsBoard.com. The common themes among the reviews include dissatisfaction with customer service, unexpected fees, and issues with lease agreements. Many customers express frustration over the terms of their leases and the company’s handling of financial matters.

Negative Feedback

I leased a photo booth through this company. My due date is the 15th, set it up to be drafted on the 15th, and they draft sometimes 5 days before the due date. I called them, and they were like, give us a credit card number, and we will make sure to only draft on the 15th. I am like, why can’t you honor the agreement that we have? Their response was, those are your options. They suck at customer service.

– Complaint from October 13, 2019

I have never in my life have felt so ripped off. I thought I was purchasing a hot dog stand from Willy Dog through a payment program, but when I started getting bills from Time Payment Corporation, I was confused. It turns out they hold a lease on the hot dog stand that I purchased. The worse part is I will be paying $12,000 for a $3,000 hot dog cart. The $200 dollar payments that I was supposed to have been over $300. They won’t take the cart back, and if they did take the cart back, you still owe the full amount of the lease time. They will call and harass you all the time over the payments. Willy Dog and Time Payment Corporation are vultures. Shame on you all.

– Complaint from March 21, 2019

Positive Feedback

There are no positive reviews published about TimePayment on the ComplaintsBoard.com website.

Source: ComplaintsBoard.com

TimePayment Fees, Rates & Costs

A Closer Look at The Contract

| Processing Rates | 1.00% - 4.99%+ |

|---|---|

| Cancellation Penalties | Yes |

| Monthly & Annual Fees | Yes |

| Equipment Leasing | Yes |

Lease Contract Terms

The standard TimePayment agreement typically spans multiple years and is non-cancellable. The duration of the contract varies, usually lasting from 36 to 60 months. It enables businesses to lease equipment with fixed repayment schedules. At the lease’s end, businesses may have the option to purchase the equipment for an additional one-time fee based on its fair market value.

Virtual Terminal and Payment Gateway Pricing

Aside from its in-store payment processing, TimePayment also promotes its virtual terminal and payment gateway services. However, pricing details for these services are not provided. Typically, additional fees such as gateway fees, technical support fees, batch fees, and transaction rates are applicable to these e-commerce services.

Non-Cancellable Conditions

Attempting to cancel the agreement prematurely obligates the business owner to pay the remaining monthly payments for the lease’s duration. This outstanding amount may be withdrawn in a lump sum or monthly until the lease term concludes. TimePayment’s lease agreement is legally binding, superseding any verbal assurances provided by sales agents. Businesses should prioritize the contractual terms over any conflicting sales representations.

Purchase Instead of Leasing Equipment

In most instances, we advise against equipment leases. Many credit card terminals are available for purchase under $500, significantly lower than long-term lease costs. While leasing offers some benefits, they are outweighed by high expenses and contractual obligations. We recommend exploring our list of the best merchant services.

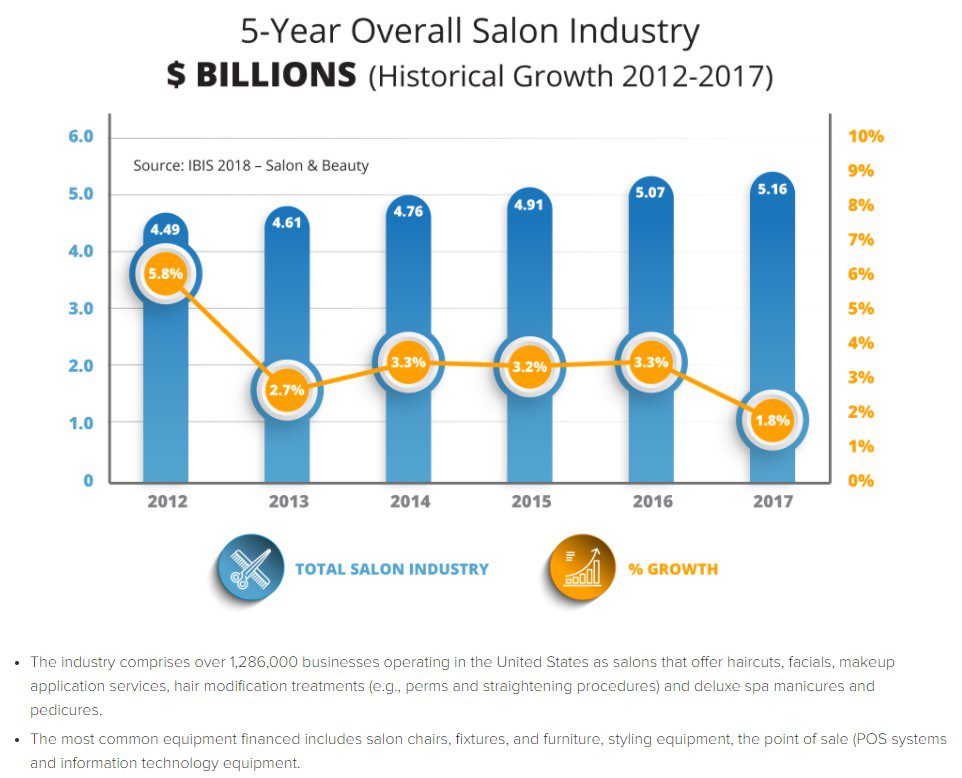

TimePayment’s main point-of-sale customers include salons, spas, and restaurants

TimePayment’s main point-of-sale customers include salons, spas, and restaurants

TimePayment Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | Yes |

|---|---|

| Telemarketing | No |

| Misleading Marketing | No |

| Discloses All Important Terms | No |

Third-Party Resellers

Business owners can apply for equipment financing directly through TimePayment, but TimePayment does not appear to market directly to business owners. Instead, the company primarily advertises to ISOs and independent sales agents who might be interested in reselling TimePayment lease agreements. This sales structure typically results in a large number of client complaints, and TimePayment is no exception. We have found a low-to-moderate number of TimePayment reviews that mention nondisclosure of lease terms by an independent sales agent. This complaint pattern is typical of providers like Northern Leasing Systems, First Data Global Leasing, and Ladco Leasing. This does not compare favorably to our list of best credit card processors.

Bundled With Other Contracts

As noted above, TimePayment has been cited as the equipment leasing partner of processors like Riverside Payments and Velocity Merchant Services. Both Riverside and Velocity are the subjects of numerous complaints related to misrepresentation of fees, aggressive sales tactics, and selective disclosure of contract terms. This is cause for concern due to TimePayment’s standard lease agreement, which is a non-cancellable, multi-year term that can cost thousands over the life of the lease.

Some Cause for Concern

TimePayment does not appear to engage in deceptive sales tactics on its own, but its marketing approach of partnering with independent resellers is an ongoing problem in the credit card processing industry. If you believe you may be overpaying on your monthly bill, we advise you to seek a fee reduction audit from an independent third party.

Our TimePayment Review Summary

Our Final Thoughts

TimePayment is currently rated as an average credit card processing provider. While the company boasts a relatively low complaint rate compared to its peers, it doesn’t stand out in its contract terms, which appear largely similar to others in the industry. This rating is subject to change as we gather more client feedback and assess the company’s ongoing performance. However, businesses already bound to a lease agreement with TimePayment may still find savings by switching to a merchant account from a highly-rated payment processor. By exploring these alternatives, businesses can ensure they’re receiving the most favorable terms and services available.

Location & Ownership

Jay Haverty is the president and CEO of TimePayment, which was founded in 2006 and is headquartered at 200 Summit Drive, Suite 100, Burlington, MA 01803.

If you found this article helpful, please share it!

Diana owen

Time payment I feel does predatory lending. I thought I was financing. I paid half of the amount when ordering and thought I was financing the remainder. Well they have got me in a lease that my original money went to nothing I still owe the original amount and will still have to pay 3 more payments to buy out equipment. Total scam.

Alex

We paid them 3 times more then we took and after last payment they sent us letter to buy equipment or sent it back. I had 30% down payment for equipment and finally still we paid two times more than it cost. Also they will charge you every payment $100 processing fee + sales tax (we took from them $6,500 and paid for 18 month $13,270). Do not recommend work with them.

Rachel Hampton

This company is a scam. You fulfill your loan with the company, then 4-5 months later they pulled out another 700.00. Small print, if you do not send back the equipment, they get to decide what it’s worth and pull the money out of my account.

Not to mention they went through two different companies to withdraw out of my account.

Do not use this company.

Bruce

Several months after the lease was paid off, Timepayments contacts me to say a final buy out payment was still due? I settled the amount and after the account was settled, they agreed to report the account as paid.

Instead they added multiple past due entries to my credit report causing a plunge in my credit score.

This is second time they misrepresented the actions or agreement. They did the same thing with Covid Payment Agreement after saying payments would be deferred for 6 months, after I resumed payments, they added several negative entries to my credit report.

Joelle Sissons

This is a lousy company. They keep harassing me to pay my deceased mom’s payment. She had trouble with her house alarm. The ALder company was supposed to come fix it but never did. This happened in Feb.2022. This company has taken out $250 from my mom’s account. I cancelled her auto deduction. They are trying to get another $250 from me. WHAT A SCAM.

Rickey Johnson

Time payment along with currency capital is a sham and both of these companies need to be put out of business.

Aaron Verrett

I am surprised this company is still open and ripping people off. I have a vendor come in my dental office to allow us to TRY out his company’s water machine. We tried it out and was unhappy with the product, told company to come pick it up. It took them a week but they eventually picked it up. A month later, we received a bill from this bogus company stating we owe 36 payments of $200. I called them to let them know that we no long have the product. They didn’t seem to care, all they saw was our signature on a form that was signed prior to the trial period starting. When I called the vendor, they magically went out of business. Even though we had no product and the company went out of business, they still wanted to send us a water machine that we didn’t like, from another company. Crazy right. To make a long story short, these people don’t speak anything but legalese. Eventually had to spend money on an attorney to make them go away. As soon as there’s a purge…I know many people will be sitting right outside their headquarters.

Kathleen lynch

I’m dealing with this company now. Was told at the end of the contract I would own the equipment. It’s grooming equipment. I get a letter today in mail saying I have to renew or send back equipment. It was a grooming tub retailed 1300. I have paid 5400 already. Is there a class action suit against this company? This is sickening. I was dealing with groomers choice who advertised financing available. I was not aware it was a leasing program. The sales person told me it would be mine end of term. I have made every single payment on time. What can be done. This is robbery.

Nuno

I am dealing with the same exact thing ! I’ve literally have 18 payments left and they are telling me I have over 20 and at the end of the lease there is some balloon payment that’s over 6k! This company is so hard to get a answer from and I don’t know what else to do since I’ve stopped the payment coming out of my bank because they were charging 2 payments a month!

Shawn

I have to agree with you. This is predatory lending at its core.

Remmy

Timepayment cooperation is a ripoff, they finance an equipment which I pay them $380 every month for 2years and coming to the last month to pay off, they are now telling me that I have to pay additional $900 in order to keep the equipment or return it in good condition.

This is crazy, please be wise and look very before you sign anything.

They claimed that the $380 I paid for 2years is for their company, and the $900 is the flee market value to purchase the equipment.

What a shame on them!

Lesson learnt!

Sonia

This is a very tough lesson for me, but i will warn the public to be extremely careful about dealing with this company because once they have your credit info, you are forced to keep paying, no one will explain or be nice to you on the phone, my account manager just said ” there is nothing you can do but pay the bill”, then he hung up on me. I have tried to talk to them many times but they dont care.

Ashley Bonds

TimePayment is a shady company who do not care about is customers. Every few months this company is adding random fees to my account out of no where. Today i recieved a fee for processing my credit card. I have had the same debit card on file since last September and I recieve a charge today for have a credit card on file. Then on top of that I call to get the issue resolve and the rep tells me to screen shot my bank statement to provide that I was actually drafted the processing fee, even though you can clearly see the additional amount on my billing history. THIS COMPANY IS UNPROFESSIONAL, RUDE, SHADY, AND DUMB. I WOULD NOW RECOMMEND UTILZING THEM FOR ANYTHING. They will try and find a way to screw you over and then justify it with some BS policy in your contract. They are a ruthless company and then need to be put out of business.

Genevie M.

I AGREE, THEIR COMPANY SUCKS ! I’VE BEEN OUT OF BUSINESS SINCE MARCH 2020. I’VE TRIED TO MAKE PAYMENT ARRANGEMENTS WITH THEM BUT THE DEFERRED ME ONLY 1 MONTH. HOW THE HELL DOES THESE PEOPLE NOT UNDERSTAND THAT WE WERE IN A PANDEMIC ? ALSO I EVEN TOLD THEM THAT I HAVE OTHER PAYMENTS I NEEDED TO TAKE CARE OF BUT YET THEY WANNA COLLECT $1500+

AT FIRST I WAS TOLD THE EQUIPMENT I WAS FINANCING WAS AROUND $6,000+. THEY TOLD ME HOW MUCH I WILL BE PAYING EVERY MONTH WHICH I WAS OKAY WITH. IN THE END I DIDN’T KNOW THIS WHOLE TIME I WAS PAYING FOR WAS DOUBLE THE COST I WAS SUPPOSE TO BE PAYING FOR. I WAS RECOMMENDING OTHER PHOTO BOOTH SERVICES WHERE I GOT MY EQUIPMENT BUT SINCE I’M PAYING MORE THAN WHAT I THOUGHT I WAS TOLD IN THE BEGINNING I TOLD ALL THOSE VENDORS THAT THEY ARE A SCAM. IF THEY TOLD ME HOW MUCH THE TOTAL WAS IN THE BEGINNING OF THE CONTRACT BEFORE I EVEN AGREED I WOULDN’T GET MY EQUIPMENT FROM THEM. DOING RESEARCH ON THEM A LOT OF PEOPLE HAD WORSE EXPERIENCE.

I EVEN TRIED GIVING THEM BACK THE EQUIPMENT BUT THERE IS A CHARGE TO CANCEL THE ACCOUNT WHICH IS THE PRICE YOU STILL NEED TO OWE THEM $8,000 SOMETHING. THAT WAS EVEN MORE RIDICULOUS AND RIP OFF !

jorge ordonez

They used a third party company that sold me with lies their credit card terminal, bad for me, they told me that the contract could be cancelled at any time, and the montly service fee would be always the same, first mont new additional debits started to come, then they said that will be waived by next month but next month new bills started to come, then the person that sold me the service told me that everything was part of a fraud and got fired after that. From that point my credit score started to drop and do not know what I should do next.

R. Burnett

Same here. I used quickspark Brandon was real sweet while he assured me this was the best way to go for my restaurant. You sign the papers before you get the equipment. Then if some of the equipment is faulty they say you have to payment for it anyway… Time Payment is a rip off. Don’t use them. You will be sorry.

LEONIDAS T.

THEY SUCK, AND THEY JUST HAD THEIR LAWYERS GARNISH $9K DOLLARS OUT OF MY ACCOUNT, NO LESS ON CHRISTMAS EVE, FOR A F***** TERMINAL THAT COSTS ABOUT $500 BUCKS, MIND YOU, THAT I RETURNED AND THEY WOULDN’T TAKE BACK BECAUSE OF THEIR RIDICULOUS LEASE TERMS. THEY SHOULD BE ASHAMED OF THEMSELVES AS WELL AS THE LAWYERS THAT REPRESENTED THEM….IF ANYONE OUT THERE HAS EVER COUNTER SUIT THESE HIGHWAY ROBBERS AND GOTTEN RESULTS, PLEASE LET ME KNOW ASAP.. THANK YOU FOR LISTENING/READING…..

garza

Terrible! I purchased a machine using TimePayment and I wanted to pay it off within 12months. They set a 12month payment plan, at the end of the contract they said I was short one hundred and something, and I ended up paying over one thousand dollars of interest fees. They said I should have called in for the balance. Don’t use them, they add all these fees and if you don’t call to get balances you will get screwed. The contract does not state you have to call in for balances, plus their website does not give you the balance amount. Terrible! I will never use them again. I am very disappointed, because I wanted to purchase another item with them but not anymore…..

Tara Shiffert

SCAM

Stay away from this company.

You get charged for the price of the unit regardless of cancel. There is not cancel. You must pay the full price. No early payoff

Stay away the Company is not fair.

CPO

Tara,

This article may help: How to cancel a merchant account without paying a fee.

-Phillip

Kiimberly Muhammad

This company is awful. Our non profit wanted to get a photo booth to use as a fundraiser. It hasnt worked since we got it. It came with damages and the program is in chinese. Which i cant read or understand. We filed a complaint to get out of our contract and they declined. Whats sad is they want to hurt a small non profit rather than help resolve this issue. The legal team has declined my claim and they dont care.

J. WINELAND

Scandalous. They talk fast, the phone representative does not answer questions politely. Initially the QuickSpark representative was very sweet but became increasingly impolite with each correspondence. Eventually the replies became only a few words, generally directing me over to TimePayment when I had never actually spoken to anyone there, only to Nicol at QuickSpark, the company used by Webstaraunt to handle financing of their equipment before passing it along to TimePayment (and where my process began). I had a concern at the very beginning because once my paperwork was finally sent to me for signing there was an additional month added onto the schedule. It was agreed to be a 12 month schedule of payments yet in the paperwork, they had it as 13 months in one spot and 14 months in another (totaling more than $1200 in additional payments). Not to mention, it should have been only 10 months on the agreement as I had to advance pay 2 months + tax & processing fees. I was told by Nicol that TimePayment would not edit the documents again and that it was definitely only a 12 months lease (even though the paperwork I was sent said otherwise). I was in a pinch and like an idiot signed the papers, believing her and knowing I had email correspondence to back up any necessary future claims. So far, my monthly payments have been $53.48 more than what I signed up. I understand that there is verbiage written into these documents to protect TimePayment in the event they want to overcharge, upcharge or change a fee I am being auto-drafted, but it is scandalous to do so with no reasoning! When I submitted my insurance documents showing TimePayment as the loss payee (one way to avoid an added monthly charge of $25) they responded that they do not always approve these insurance documents; and I am still waiting on them to do so. I added them to my insurance binder as they requested, with the same amount, name, & address they advised. Still no response. I do not expect one here, nor do I care about any response which may be submitted here. My paperwork indicates I own the equipment at the end of my lease and if this is not the case I will be handing these papers over to my lawyer. I really wish I had read reviews & the BBB website before agreeing to work with either QuickSpark OR TimePayment. I will never recommend them to anyone, and am hoping to save others in the future. Do yourself a favor and find any other means to pay for your equipment than through either of these organizations!! I am very disappointed in Webstaraunt that they choose to use such a poor financing company for their leasing and financing needs.