Xenex Payment Systems Reviews & Complaints

Overview

In this comprehensive article, we delve into the operations and reputation of Xenex Payment Systems. We will explore a range of crucial aspects that define this company, from its payment processing capabilities, including the handling of major credit and debit cards, to its unique offerings such as the Zero Cost Program, which shifts credit card processing fees to customers. Special attention is given to their Gift & Loyalty Program and the various funding options they offer, including business financing and merchant cash advances.

We scrutinize the contract terms and fees associated with Xenex, highlighting potential pitfalls like cancellation penalties and equipment leasing costs. We also shed light on the company's history, ownership, and operational headquarters.

A critical part of our analysis focuses on customer and employee perspectives. We dissect common complaints, such as issues with hidden fees, and assess the authenticity and impact of these grievances. Moreover, we evaluate Xenex's approach to marketing and sales, including the use of independent resellers and their potential implications on service quality and customer satisfaction.

Finally, we provide an overview of Xenex Payment Systems’ standing in the industry, examining their ratings from various industry bodies and user reviews. This thorough investigation aims to equip readers with a balanced and informed view of Xenex Payment Systems, guiding them in making educated decisions about their merchant services provider.

About Xenex Payment Systems

Xenex Payment Systems is a New York-based merchant account provider. There is some indication that Xenex is a reseller of Global Payments contracts. Alternatively, there is also evidence that Xenex offers contracts through EVO Payments International.

Xenex Payment Systems Payment Processing

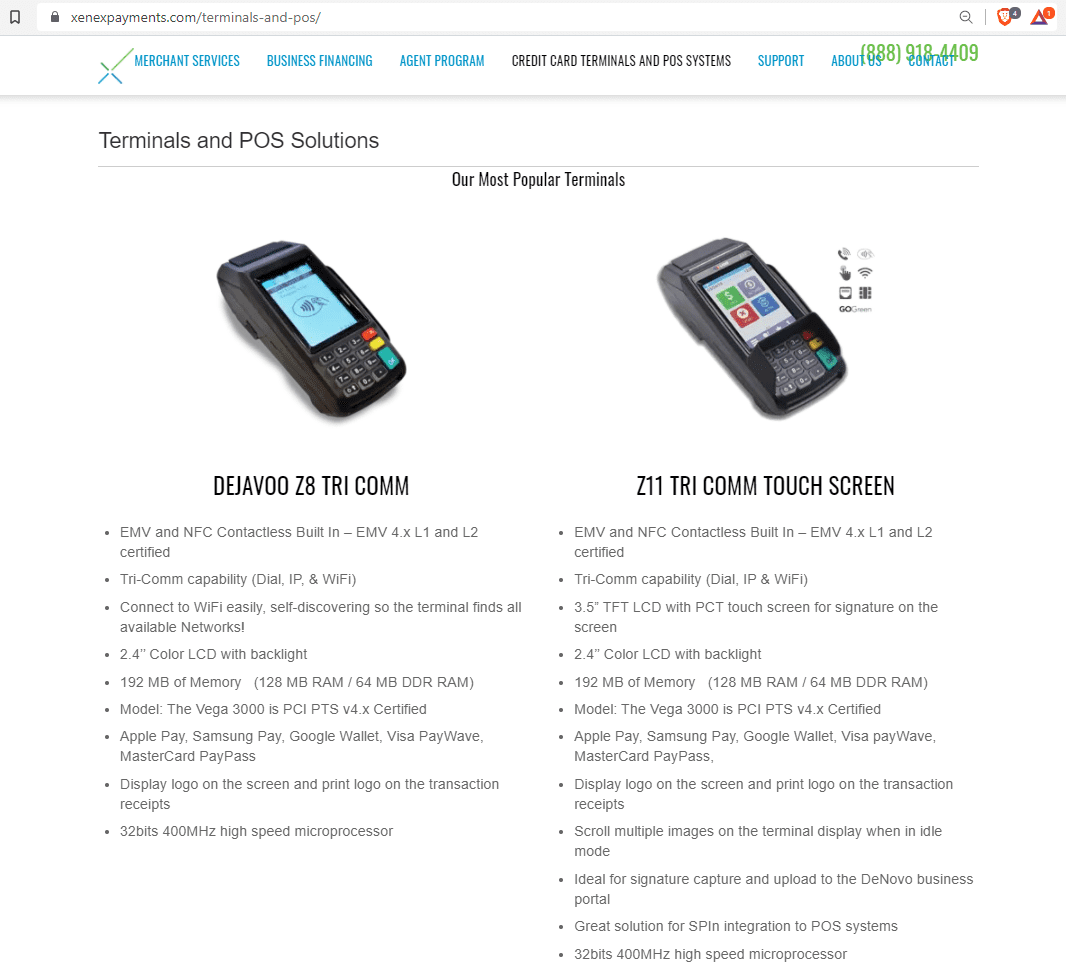

Xenex Payment Systems processes all major debit and credit cards for most business types. Their services include EMV card readers/swipers, POS systems, e-commerce solutions, gift and loyalty programs, ACH and check services, cash advances, and next-day and same-day funding.

Zero Cost Program

The Xenex Zero Cost program allows clients to pass on credit card processing fees to customers. Customers are given the choice to use cash, debit, or credit.

Gift & Loyalty Program

Xenex offers customizable gift and loyalty cards to boost future sales and improve customer retention.

Check Services

The company's check acceptance services include paper guarantee, point-of-sale conversion, and ACH debit. Additionally, EBT Card Processing caters to customers using government benefit programs.

Business Financing

Xenex collaborates with leading capital providers to offer up to $500,000 in business financing, aiming to support growth with a straightforward application process and rapid access to funds.

Merchant Cash Advance

The Merchant Cash Advance (MCA) provided by Xenex is an advance based on a business's credit card sales, not a loan. Businesses can apply for an MCA and potentially receive funds in their account within 24 hours post-approval.

Funding Options

Xenex offers various funding options, including Standard ACH, next-day, and same-day funding to ensure business operations are not disrupted.

Location & Ownership

Founded in 1993, Xenex Inc./Xenex Payment Systems is a registered ISO/MSP of Deutsche Bank Trust Company Americas, New York, NY. The company's headquarters was formerly listed at 1539 Broadway, Hewlett, NY 11517. The Better Business Bureau no longer lists a president or CEO, but Winston Sylvester was the last listed president and chairman of Xenex.

| Pros: | Cons: |

|---|---|

| Next day funding option. | Variable processing rates (1%-4.99%). |

| Accepts multiple payment methods. | High cancellation penalties. |

| Offers gift and loyalty programs. | Monthly, annual fees apply. |

| Provides eCommerce and check services. | Equipment leasing can be costly. |

| Zero cost program availability. | Three-year contract commitment. |

Xenex Payment Systems Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | 10+ |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | Hidden Fees |

| Recent Lawsuits | No |

Hidden Fees and Service Concerns

Our investigation uncovered over 10 Xenex Payment Systems reviews across several consumer protection platforms. A number of these reviews, primarily from individuals identifying as former employees, label Xenex as a scam or ripoff. The core complaints frequently highlight undisclosed fees, unresponsive customer service representatives, and issues regarding compensation for the company’s sales agents. It’s important to note that 3 complaints appear to originate from a single individual based on a singular incident with a sales agent; thus, for clarity, these will be consolidated into a single Xenex Payment Systems complaint. Responses from company representatives to some accusations have ranged from disputing the claims as character assassination to suggesting that the complainants might be competitors. We invite you to share your personal Xenex Payment Systems review or experiences in the comments section below.

Xenex Payment Systems Legal and Regulatory Standing

Our search did not reveal any ongoing class-action lawsuits or Federal Trade Commission (FTC) complaints against Xenex Payment Systems. For those seeking resolution without litigation, we recommend considering reporting any grievances to relevant oversight bodies, which can provide a constructive avenue for dispute resolution.

Xenex Payment Systems Customer Support

While there is speculation that Xenex may partner with Global Payments or EVO for some customer support functions, the company does assertively provide direct live phone and email support to its merchants. This commitment to accessible support aims to ensure prompt and efficient service resolution.

Xenex Payment Systems Contact Information

- (888) 918-4409 – Toll-Free Customer Support

- (516) 295-8851 – Fax

- (800) 999-8674 – Chargeback Center

- (800) 944-1111 – Emergency Authorization (Enter Bank ID: 067600)

Additional Support Channels

- Customer support form available on the company’s website

- Email support for customers and agents

- [email protected] – For Customer Service/Technical Support

- [email protected] – For Sales Inquiries

This updated content not only addresses concerns and feedback found in Xenex Payment Systems reviews and complaints but also provides accurate contact and support information, ensuring readers have the necessary resources to make informed decisions or pursue further action. We aim to maintain a balanced narrative that recognizes both customer experiences and the company’s response to service commitments.

Xenex Payment Systems Online Ratings

Here's How They Rate Online

| BBB Reports | 0 |

|---|

No Complaints Filed

An accredited business of the BBB since 2011, Xenex Payment Systems receives an “A+” at the BBB at this time of review. The company has received 0 complaints to its profile in the past three years. It also has not received any informal reviews.

An “A” Performance Overall

Readers should always be aware that there is reason to be skeptical of the BBB’s reviews. Given the company’s clean complaint record, we will not adjust the BBB’s rating at this time.

Xenex Payment Systems Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | Yes |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | 1.00% - 4.99% |

| Equipment Leasing | Yes |

Three-Year Agreement

The standard Xenex contract outlines a three-year agreement facilitated by EVO Payments International, including a $595 cancellation fee, a $99 annual fee, a $20 monthly minimum fee, and tiered pricing. While the contract specifies these fees, complainants have reported varying amounts, suggesting potential differences in contract terms between agents.

Virtual Terminal and Payment Gateway Pricing

Aside from its in-store payment processing services, Xenex Payment System also promotes its virtual terminal and payment gateway services. The company partners with Authorize.Net, eProcessing Network, and NMI as its gateway providers, with pricing contingent on the chosen provider. Additional Xenex Payment Systems fees, such as gateway fees, technical support fees, batch fees, and transaction rates, typically apply to these e-commerce services.

Be Wary of Equipment Leases

Several Xenex Payment Systems reviews highlight non-cancellable, 48-month equipment leases through Northern Leasing Systems, costing $50-$60 per month. This long-term expense often surpasses the equipment’s purchase cost over the lease period. Business owners should exercise caution and explore alternatives. We recommend consulting our list of the top merchant services providers.

Not Competitively Priced

Xenex Payment Systems’ contract terms slightly exceed industry averages and do not align with the rates of the cheapest merchant accounts. Businesses should meticulously review all contract terms and negotiate for favorable rates.

Xenex Payment Systems Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | Yes |

|---|---|

| Telemarketing | Likely |

| Misleading Marketing | No |

| Discloses All Important Terms | No |

Outside Sales Agents

Xenex appears to hire independently contracted sales agents to market its services. This is a standard practice in the industry that often results in a higher complaint rate for a company, as it is difficult for any business to monitor and regulate the activity of independent agents. This hiring practice appears to be the cause of multiple negative Xenex Payment Systems reviews, with clients reporting nondisclosure of contract terms and former agents accusing their employers of withholding compensation.

Motivated by Commission

Xenex compensates its independent agents on a 100% commission basis, which may motivate them to lock businesses into long-term equipment leases or processing agreements. While Xenex does not require agents to meet a sales quota, it only provides leads based on performance, encouraging agents to close sales in any manner possible. This does not compare favorably to our list of best credit card processors.

No Deceptive Advertising

To its credit, the company does not appear to engage in any deceptive marketing strategies in its official materials. However, the nature of Xenex Payment Systems complaints prompts us to award the company a “B” at this time. If you suspect that you have had undisclosed charges added to your Xenex Payment Systems contract, we recommend seeking a third-party statement audit to eliminate hidden fees.

Our Xenex Payment Systems Review Summary

Our Final Thoughts

Xenex Payment Systems rates as an average credit card processing services provider according our rating system. The company is showing an average complaint rate for its size and time in business, and the contract details we were able to obtain are not especially competitive. This credit card processor can improve its overall rating by improving its hiring practices and more closely monitoring the behavior of its agents in an attempt to limit complaints. We will continue to monitor the company’s reputation to determine whether it will become one of the worst-rated providers or a worthy competitor to the top-rated providers.

If you found this article helpful, please share it!

Kiana

I’ve had an account with them since 2009 and appreciate working with a small company where I can call and get the support I need for my business financial transactions.

James michel

total scumbags! ripoff and complete lies! stay far away from this chop shop. just google there address and you will see no corporate headquarters just a chop shop in a strip mall in the attic.

From The Editor

This Post Might Help: Best All-Purpose Merchant Accounts

Barry N Company

Be aware that Xenex Payment Systems customer service is less than adequate when it comes to their long term customers and providing the necessary information to make sound business decisions regarding their services. Over the past 6 years of being one of their good standing customers, we were not given notice to a termination fee that would be deducted from our account due to us terminating our services with them. We were unaware that we were still in any contract with them that would negate a termination fee of any kind. We were taken for $495 fee plus 3 months of inactivity on our account. Leave it to the banking corporations to once again go after the small business’s bottom line. How can they keep getting away with this? “Government” needs to step in and make some changes. Xenex management, feel free to contact me regarding any corrections you can provide for my injustices.

—

Are you with Xenex? Learn how to resolve this complaint.

Andrew

This company has a sales representative named Ryan Anderson, he is a crook, he leased a credit card terminal to me, I am paying 57.46 on every month, he never explained I was in a contract for 48 months, now I’m hooked, I have 4 other merchants that he did the same thing to, we are getting a class action lawsuit against him, anybody else interested please blog this site!!

Katie

In defense to Ryan Anderson, he has always been a great guy to work with and Im pretty sure that this is his old employeer and now competition trying to slander his name and business.

Ryan

Hi Andrew,

It sounds like there could be a misunderstanding with the agreement you signed and I apologize for that. Unfortunately there is no way for us to identify your business so we can redress the wrong and remedy the situation. Please leave some way for us to identify your business below or you can reach out to us anytime from 9-5 Monday-Friday.

Best Regards,

Management

Xenex Payment Systems

Dena

Same exact problem with the same exact person. He doesn’t explain that you are actually signing two contracts, there is nothing on the service contract that says you are entering into a 4 year contract for service ALONG with the contract to lease the machine.

william Fosmer

We have been doing business with Xenex for about 3 years under the impression we did not have a contract because when we switched to them 3 years ago the person representing Xenex told me it was only a one year contract and after that I could cancel or switch without any cancelation charges, because that was a big issue last time I switched. Which brings us to present day. We had a few transactions that caused us a lot of greif, we are a small business and cash flow is very important to us, on a couple transactions they withdrew refunds before the oringinal money was ever credited to our account causing a overdraft on a couple of occasions in which they would only refund my tranaction charge and do nothing about my banks overdraw charges caused by them. they also held funds for two weeks that had nothing to do with the botched transactions.I decided to leave them and go with someone else and when I told them I was canceling they told me there would be a $495.00 cancellation fee as stated in my contract on page 3. I told them I did not have a page 3, it turns out there represetitve only gave me page 1 and 2 of 6 pages. End of story they got there money I am with my bank my transactions are quicker and my bank is crediting me the amount of the cacellation fee for switching. I am glad I switched.

Lajoya Roy

I’ve been doing business with xenex for 3 yrs. I have a serious complaint. I full filled my contract and when I tried to cancel with proper procedures, they gave me the wrong information. They told me to cancel one month prior because there service automatically renews. I called and the personal gave me the wrong information. After they took my $250 they told me it was 30 days after your contract. Since my contract is up they have no interest of giving me my money back. Since my contract is up less than 30 days, what happened to being prorated?? You still have to take my whole $250. What a rip off! Who wants to give money away?? Don’t go with this company