Authorize.net Reviews & Complaints

Overview

In this article, we explore Authorize.net, a leading payment gateway provider, clarifying its role as distinct from being a merchant account provider or credit card processor. We delve into its functionality, including the facilitation of various payment methods like e-checks and phone payments, and its partnership with resellers in offering merchant service accounts.

Key topics include an analysis of Authorize.net's rates and fees, contract terms, and customer feedback. We also examine its integration with e-commerce platforms, the virtual terminal feature, and its Advanced Fraud Detection Suite. This article highlights mobile payment solutions, recurring billing, and subscription management capabilities, along with the availability of developer tools and API.

We round off with an overview of Authorize.net's customer support, its history, leadership, and a balanced look at its pros and cons, providing a comprehensive guide for businesses considering its services.

About Authorize.net

Contrary to popular belief, Authorize.net is not primarily a merchant account provider or a credit card processor. Instead, Authorize.net is what is known in the merchant services industry as a “payment gateway.” This means that the company provides software and applications that route credit card payments from the point of sale to the actual credit card processor. Payment gateway providers like Authorize.net are an additional but necessary service if a merchant wishes to use a virtual terminal, website shopping cart, or some mobile processing applications. Authorize.net also powers e-check payments, phone payments, and monthly billing.

Though the company specializes in gateway services, it partners with resellers to provide merchant service accounts to businesses. Working with resellers makes rates, fees, and other facets of a contract negotiable, which is an important consideration for any merchant considering Authorize.net to set up those services.

E-Commerce Integration

Authorize.net's payment gateway is designed to integrate seamlessly with a variety of e-commerce platforms and shopping carts. This ensures that businesses can offer customers a smooth and secure online shopping experience, with support for one-time and recurring payments.

Virtual Terminal

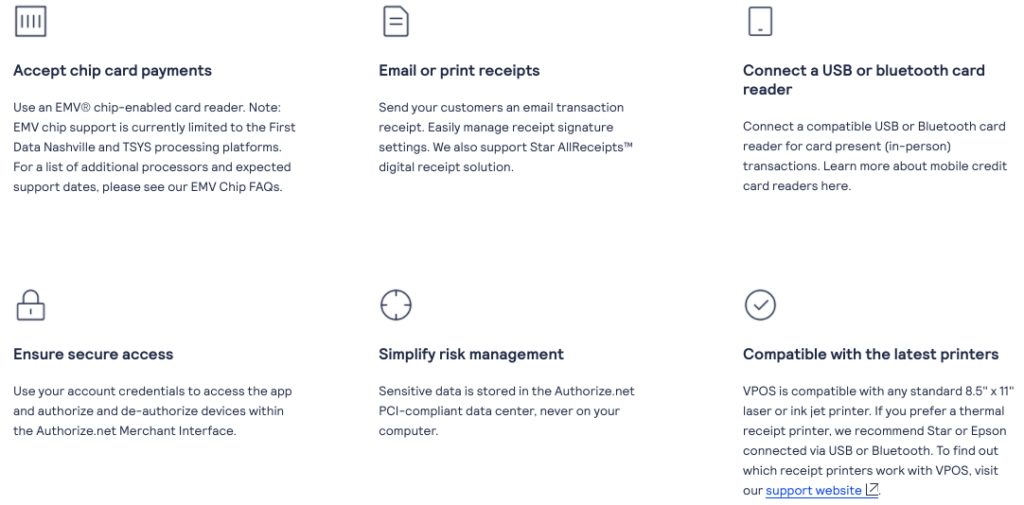

For merchants who don't need a physical card terminal or who want to accept payments over the phone or via mail order, Authorize.net offers a virtual terminal. This web-based application allows businesses to process transactions securely from any device with internet access, providing flexibility and convenience for various types of businesses.

Advanced Fraud Detection Suite

To help protect businesses from fraudulent transactions, Authorize.net provides its Advanced Fraud Detection Suite (AFDS). This suite of customizable filters and tools enables merchants to identify and block suspicious transactions, reducing the risk of chargebacks and fraud-related losses.

Mobile Payment Solutions

Authorize.net's mobile payment solutions allow businesses to accept payments on-the-go using mobile devices. The platform offers a mobile app and card reader that can be used with smartphones and tablets, making it easy for merchants to process transactions securely and efficiently at events, pop-up shops, or during in-person consultations.

Recurring Billing and Subscription Management

For businesses that rely on regular billing or offer subscription-based services, Authorize.net provides a recurring billing and subscription management feature. This allows merchants to set up and manage automatic billing schedules for customers, ensuring a steady cash flow and more efficient invoicing processes.

Developer Tools and API

Authorize.net offers developer tools and a comprehensive API to enable businesses to create custom payment solutions tailored to their unique needs. Developers can leverage the API to integrate the payment gateway with websites, mobile apps, or custom software, providing a seamless and secure payment experience for customers.

Customer Support

Authorize.net provides reliable customer support through phone, email, and live chat, ensuring merchants have access to assistance when needed. The platform's knowledge base also offers helpful resources and guides for troubleshooting common issues and maximizing the benefits of the payment gateway.

Location & Ownership

Authorize.net was founded in 1996 and acquired by CyberSource in 2007, and then both CyberSource and Authorize.net were acquired by Visa in 2010. Michael Walsh is the CEO of CyberSource, which is headquartered in San Francisco, California. Bob Donahue is the CEO and Alex Burgin is the vice president of Authorize.net.

Video Summary

| Pros: | Cons: |

|---|---|

| Recurring billing support. | Steep learning curve |

| Robust fraud prevention features. | Monthly gateway fee. |

| Extensive gateway integration options. | Complex setup process. |

| Reliable, established industry presence. | Higher overall costs. |

| Advanced customization capabilities. | Limited international reach. |

| Comprehensive reporting tools. | Chargeback fees apply. |

Authorize.net Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | 100+ |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | Poor Service |

| Recent Lawsuits | No |

Understanding Authorize.net Reviews

Our analysis has identified several negative Authorize.net reviews on platforms such as Ripoff Report, predominantly centered around customer service issues, functionality problems, fund holds, billing disputes, and unexpected fees. Although some reviews label Authorize.net as a fraudulent operation, the confusion often stems from the misunderstanding of Authorize.net’s role as a payment gateway rather than the merchant’s credit card processor. This misperception is frequently attributed to resellers failing to clearly define the relationship between Authorize.net and the credit card processing services. We encourage you to share your experiences with Authorize.net in the comments below to help clarify its services.

Legal Status of Authorize.net

There are no recorded class-action lawsuits or Federal Trade Commission (FTC) complaints against Authorize.net. Those looking to resolve issues without litigation are advised to report their concerns to the appropriate supervisory bodies.

Customer Support Offered by Authorize.net

Authorize.net provides a comprehensive FAQ and troubleshooting page, an email contact, and a 24/7 toll-free customer service number. The platform also offers live chat support, although it requires user login for access.

Contact Information for Authorize.net Support

- (877) 447-3938 – Toll-Free General Customer Service

- +44 (0) 203 564 4844 – UK/Europe Customer Service

- +61 1800 019 932 – Australian Customer Service

- (888) 437-0481 – Partner Support

- +44 (0) 203 564 5370 – UK/Europe Partner Support

- (866) 682-4131 – Affiliate Support

- +44 (0) 203 564 5370 – UK/Europe Affiliate Support

Additional Customer Support Channels

- Live chat support

Authorize.net’s array of support options aligns well with what is expected from leading payment processors known for excellent customer service, providing multiple avenues for customer assistance.

This content update aims to offer a balanced overview of Authorize.net, highlighting user feedback, legal information, and the quality of customer support. By incorporating SEO-optimized keywords related to “reviews,” “complaints,” and “customer service,” the revision seeks to improve discoverability and provide valuable insights for individuals and businesses considering Authorize.net’s services.

Authorize.net Online Ratings

Here's How They Rate Online

| BBB Reports | 92 |

|---|

Note: We have adjusted this company’s BBB rating according to our own standards. To better understand why we adjust BBB ratings, please see our Rating Criteria.

Over 70 Complaints

Authorize.net has been accredited with the Better Business Bureau since 2009 and currently has an “A+” despite 73 complaints filed against the company within the last 36 months.

What Merchants Say

In addition to the 73 complaints filed with the BBB against the company, Authorize.net has received 19 informal reviews on its profile. All but 2 of those 19 reviews were negative. The most recent negative review describes a client having difficulty processing payments:

My company had an extremely negative experience with Authorize.net. We reported 4 fraudulent e-check transactions to the company. Since it was too late to void the e-checks, Authorize.net advised us to issue refunds before the money cleared. 3 of the e-checks were charged-back due to insufficient funds. One e-check was both charged-back and refunded, resulting in a deficit in our available funds. Authorize.net had never received the funds from the bank, but mistakenly transferred the refunded amount from our existing pool of funds to the originating bank. Rather than return the funds to our account, Authorize.net advised our company to try to charge the same bank account again. The transaction cleared Authorize.net and the funds were transferred to our bank account. Later, Authorize.net reported that this transaction was charged-back due to insufficient funds. They are now attempting to retrieve this money back from us.Our transaction records prove Authorize.net was at fault. Authorize.net has refused to take responsibility for their mistake and refused to retrieve the money from the originating bank account. Overall, this negative experience shows a lack of accountability and responsibility on behalf of Authorize.net due to the mishandling of fraudulent transactions and subsequent errors in their refund and charge-back processes. Therefore, potential users of Authorize.net may want to consider this experience when deciding whether to use the company’s services.

Clients who find themselves in this situation may find our guide on How to Report Bad Credit Card Processors useful if they have exhausted all other options.

A “B” Performance Overall

The moderate complaint rate is mitigated somewhat by the company’s large size, but due to increasing proportion of negative reviews, we have adjusted its rating to a “B.”

Authorize.net Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | No |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | 2.9% + $0.30 |

| Equipment Leasing | No |

Negotiable Pricing

Authorize.net provides various pricing options tailored to clients’ needs, including an all-in-one option, payment gateway, or enterprise solutions. Businesses with existing merchant accounts might find the gateway-only plan suitable but are advised to compare pricing with their current service provider. For those requiring only Authorize.Net’s payment gateway, a per-transaction fee of $0.10 and a daily batch fee of $0.10 are applicable, alongside the $25 monthly gateway fee.

However, pricing may vary for clients opting for the all-in-one option. Typically, there’s a $25 monthly gateway fee and a per-transaction fee of 2.9% plus $0.30. Since Authorize.net operates through resellers with flexible pricing, negotiations can significantly reduce or eliminate many fees. Moreover, the company offers interchange-plus pricing as part of its enterprise solutions. While Authorize.net’s rates are transparent, they may not compete with those of the cheapest merchant accounts.

Be Mindful of Varying Contract Terms

Publicly filed complaints against the company often cite confusion regarding third-party resellers offering Authorize.net services. Some clients believed the reseller provided a proprietary payment gateway. Though these issues don’t directly relate to Authorize.net’s contract terms, it’s essential to note that terms can vary, and resellers may not disclose alterations from the original suggested retail price. Refer to the Authorize.net Service Agreement. Lease terms for POS terminals may vary depending on the third party offering the merchant contract.

Authorize.net Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | Yes |

|---|---|

| Telemarketing | No |

| Misleading Marketing | No |

| Discloses All Important Terms | Yes |

Clear Pricing Breakdown

Authorize.net’s website provides the suggested retail price of its services, and it clearly states that resellers may alter the costs as they see fit. The company’s pricing breakdown is complete with explanations of each term and is easy to access from the main page. As explained on their website, the Authorize.net payment gateway does not have a contract itself or early termination fees.

Transparency Wins

Because Authorize.net’s services are resold by a huge number of other businesses, the figures provided on its actual site are subject to change, but the company is being helpful by offering a suggested cost for clients to use in potential negotiations and is therefore awarded an “A.” However, if you suspect that Authorize.net is charging you undisclosed fees, we recommend seeking a third-party statement audit to eliminate hidden costs.

Our Authorize.net Review Summary

Our Final Thoughts

Authorize.net has a decent rating as a credit card processing gateway provider due to its size, market share, and time in business, and it is one of the most widely used payment gateways. The company provides an easy way for businesses to accept credit cards using just their computers and through their websites, and Authorize.net is widely accepted as one of the best gateway providers in the merchant services industry. Despite a low-to-moderate number of complaints by unhappy clients, the majority of the company’s customers appear to be satisfied with its services. It is evident by the type of complaints that Authorize.net has received that the company could stand to improve upon its customer service and reseller training. Business owners are advised to thoroughly read the agreement before signing and to consider choosing from the top merchant account providers for Authorize.Net.

If you found this article helpful, please share it!

Winter Wong , CEO/Owner (Tapatalk Forums)

Once I finally got an “in-person” rep about a large transaction. The rep could see all the information(transaction, order, pdf. invoice , merchant #, dollar amount) yet he would not “give me ANY information” ! He refused to help in anyway..basically being evasive, unethical, and using lawyer “stonewalling tactics” !

As a business owner and a consumer, I was completely unaware that they are a subsidiary and owned by Visa®️. I have been a NYSE: “V” stockholder and I attend quarterly meetings. Being a “Class A” stock owner and senior member for over three decades; I was appalled and plan to file not only with the DOJ, AIC, FTC, BBB, spam.org , IC3.gov , FBI.gov , and nationalcrimeagency.gov.uk; this company has repeatedly “violated rules and regulations” of each and every agency above. Authorize.net ‘s lengthy list of lawsuits filed and “arbitration” with merchants. My main focus is submitting my compilation of all their “unlawful /unscrupulous” history and background file (60MB worth). Two agencies (ICANN AND FBI first and foremost can shut down their website indefinitely while they investigate . I have seen multi-billion dollar owned wenbsite, forums, and SM Platforms get shut down for over 72hrs by ICANN and they have jurisdiction Worldwide!

0 zero stars for authorize .net Plus, any company that uses their merchant services including my distributors, manufacturers, and wholesalers’) received my case and have already offered me many other options so they didn’t lose my business.

I hope they know about Utah’s revision of Utah Code Section 76-10-1602 Title 76 Chapter 10 Part 16 Section 1602 (July 2023)

Location of Authorize.net : 808 E Utah Valley Dr, American Fork, UT 84003-9707

Alan Saidi

On 9-24-2023 I finally accepted the terms and conditions and application form for Authorize.net to process my website’s e-commerce and online credit card processing. After a few days, I noticed that my funds were not being deposited into our company’s bank account. I contacted Authorize.net’s customer service to request an explanation and their representative told me that he has forwarded my request to the appropriate department, and I would receive an email with an account representative in charge to address my concerns and questions. Nothing was received and no email or call was made to me. I called again and discovered that the first representative never opened a service ticket and that this new representative, Sam, would now open a new service ticket. I then received an email from them asking for a Preprinted voided check to verify my bank account which had already been verified in the initial application and contract. I once again complied and sent the requested voided check to the email for the underwriters/Risk Department which had already approved my account. The next day I called again and I was told that it takes two business days to get a reply and a decision. Meanwhile $14,000 of funds were accumulating and not being transferred to my bank account. I explained that my application was already activated by the underwriters and I was using Authorize.net to process my online payments which now has summed up to over $14,000 and not been deposited into my account. I had been using PayPal with no risk issues for over 10 years and would gladly send them all the transactions reports for their information. The representative told me to wait for their decision and I would get a reply soon and there should be nothing else that they will need. I explained that the bank account had been verified in the initial application and why was I being asked to provide this information again which I once again and gladly offered with the voided check. He could not explain and once again asked me to wait for a representative to contact me. I also mentioned that two of their representatives during the application process promised and guaranteed a 3-day funding time for my account which has turned out to be false. Much to my surprise, I received an email after the call informing me that my account has been closed for no reason and that my funds will be held up for 120 days! I am the owner of this company and have been using PayPal for our e-commerce for over 10 years and due to some incompatibility issues with PayPal and my website e-commerce forms I decided to move on to Authorize.net and give them a try. My company has been in business for almost 30 years and to have been treated with such neglect by Authorize.net with no justification and to have my company’s funds frozen with no explanation is unacceptable and frankly fraudulent. My company has not violated any of their policies. I have provided them everything they asked for and have been approved for transactions. I have only investigated and to find out why my funds weren’t being transferred to our Business Bank Account and suddenly received a closure notice and the withholding of my company’s money. I request that Authorize.net explain why they closed my account without any reason and to provide that in writing to the FTC and to me and to release my funds as they had agreed to in 3 days for each settled transaction. I have all the paperwork, signed application form, which they approved, My Gateway ID and Merchant Account number and all the correspondence I have had with their representative. This type of fraudulent and haphazard method of doing business with an established company with excellent standing and reputation in the industry, such as my company, is unacceptable and shameful on their part. I hope and expect for Authorize.net to resolve this issue immediately and release our funds and transfer to our bank account. I have contacted my attorney and based on her advice, I have decided to contact the FTC, Department of Consumer Affairs, BBB first and hope for a resolution immediately. This company is the worst of the worst! I thought PayPal was bad. PayPal is the saint of processors compared to this sham of a company.

ELLIE WANG

I’m deeply disappointed and alarmed by my experience with Authorize. Their actions closely resemble those of a deceitful company. Without any legitimate reason, they withdrew nearly $8,000 from our checking account. Additionally, they’ve unjustly held over $50,000 of our funds. To add to the frustration, they continuously request documents from us, seemingly without end. It’s essential for businesses and individuals to be aware of such practices and exercise caution when dealing with this company.

Robert

Get this they tried to have a manager call me which is good start. But they leave no way to respond, no phone number and no email. If you miss the call too bad that the their attempt to resolve the issue. He tried to answer what thought was the problem which was wrong assumption. Problem is they have over $20,000 dollars of money by echeck they took from my customer and will not deposit in our bank because they had a representative that took an attitude and shut my echeck account down because they didn’t like how the charges were done to my customer. I tried to explain it and they could careless and the representative took a power trip and kept the money and wouldn’t respond to any further communication. Since then no way to contact them by email to Authorize.net about it and you get the representative that will say sorry can’t do anything about it and no you cannot speak to anyone but me? They say you can email them again and nobody responds. So tell me what company takes your money and has no way to talk to them after they take the money. I’ve never seen a company that will take your money and then have no way to talk to them after? I question the business ethics! If you do business with them beware they have representative that go over on powertrips!

Joe K

Authorize.net is nothing short of hot garbage. Do not use this service.

Worst reporting options ever let alone many other issues.

Robert

Worst company to do business with, they are holding over $20,000 and no management team will talk to me about it. The customer service personal tells you sorry they are not allowed to transfer or deliver messages to management. If you have a problem that you need a management to resolve because of poor customer service forget it they wont talk to you.

James L Hein

These a********* have been blocking a transaction with a company I have been doing business with for a number of years. I do not have an account with them never had an account with them. How they were able to compromise my account I have no idea. I will be sueing them.

Gregg

After a few years of using Authorize.net without notice or warning, they disabled our eCheck feature and still allowed clients to pay via ACH. They accepted the payment from our clients and then froze our funds for what they said would be 90 days after the last transaction via ACH. You would think it would be 90 days per transaction but they kept pushing the date to 90 days from the latest transaction. They claimed they sent an email to notify us that we can no longer take ACH and we can only use credit cards. No such email was received and they didn’t disable the feature until we called to question why our funds haven’t been sent. If you are going to use them to accept payments, keep a close eye on your funds as they will try to hold them without notice and features may or may not work depending on how they feel. And to top it off they will NOT give the reason that they took away ACH. We have been in business for over 17 years with a spotless record with D&B and have only once in those 17 years had a chargeback. Avoid this company if you like transparency!

Ryan Anderson

They closed our echeck after 1

Transaction,

Holding 5k for 90 days.

This seems preditory.

Never again,

They sux

John M

Stay out of politics, (second amendment) people don’t need big business to police their purchases.

Billie Keen

I’m trying to buy Ceramic wax product from Torque. When in put in all my credit card info and select complete sal I get this response “your purchase was refused by authorize.net (Error code 251).” I’ve tried several times on different dates but get the same response. What’s up????????

Varden Hadfield

Authorize.net has been holding $8097 in customer payments for more than 56 days and refuses to release the funds to me for 90 days. All customers have had the funds withdrawn from their accounts and have signed written agreements to have the funds transferred via ACH. I have never had one customer cancel a check or credit card payment, and I have excellent credit. I’ve already paid for and shipped all the products to the customers, and they’re satisfied with the products.

This is a painful dent in my small business cash flow. Business is hard enough without someone suddenly keeping your money for 90 days!

I first signed up for authorize.net as a payment gateway because I needed both credit card and ACH echeck services. I entered the first customer check payments as instructed, and the funds were withdrawn from the customers’ bank accounts.

Then authorize refused to give the money to me and said it was on hold for 30 days. I asked if there was a problem with the customers banks being able to pay, and they said no. I double-checked with the customers and they confirmed the funds had been withdrawn from their accounts and they were satisfied with my products.

After 40 days, I checked with authorize and they said authorize was now keeping my money for 90 days. Still no explanation or justification. I sent written signed agreements from each of the customers showing they had agreed to have the funds withdrawn from their accounts.

Getting desperate because of this painful dent in my cash flow, I called and emailed support, involved my payment processor and asked my bank for help. Each time, was told the funds remain on hold for 90 days.

Thankfully, I’ve found another gateway and payment processor and will avoid authorize.net like the plague.

Sasha Wang

They are currently withholding a little shy of 25k from me with the same 90 day hold and zero notification. Did you look into taking legal action?

Evelyn Cottrell

*********READ THIS FIRST BEFORE YOU USE THIS COMPANY ************

This is with our merchant credit card processing company Authorized.net

On Aug 21, 2019 we hired them for the gateway/credit card processing company that works with our Dispatching software Service Fusion. We have been using them for about a week now and there has not been a problem. The below email was sent at 11:36 am 8/28/19.

After reading the email I called them and asked them what this meant.

They told me there was a team of analysis that reviewed our account with them and decided to terminate the Credit card processing part. We can still use them as a gateway.

They did not call or give us a 24 hr notice and was told they did not have to. So in the meantime, I have service technicians calling and asking why they cannot accept payment on their pad.

We have done in a week around $7000 in business and the deposits are with Authorized.net. They are holding all the money for 120 days to make sure there will not be any charge backs. We are talking November! I asked them how they can hold my money for that long and was told they can. They just sent this email. Really???

I asked them since they were going to hold our money for 4 months if they were going to pay me interest and they said no. I asked them what if I needed the money you are keeping to make payroll and had to use a line of credit would they pay interest for the loan? They basically told me we do not payout interest.

DBA:

GID:

MID:

Dear Merchant,

Authorize.Net is dedicated to supporting your business needs and we work hard to deliver the highest quality financial products and services. Unfortunately, a business decision has been made to close your merchant account immediately. Closure of your merchant account in no way impacts your access to or use of the Authorize.Net Payment Gateway.

Closure of the merchant account does not affect your access to or use of the Authorize.Net Payment Gateway.

Based on our review, all processed funds may remain on hold for a minimum of 120 days from the last processing date.

Sincerely,

Matt

Authorize.Net Merchant Services | http://www.authorize.net | 855.477.1190 | [email protected]

Hours of Operation for Risk and Underwriting: Monday-Friday 8:00 am to 5:00 pm MST.

This post will help: How to Make Your Payment Processor Release Your Funds

-Phillip

Marchela Retana

Do not use them! Horrible customer service!! It’s been over 2 months since we got approved for Authorize.Net but my account is still on test mode. I have tried to call to get help to activate it over 6 times no one HAS EVER PICKED UP!!!! Each time I have waited over 45 minutes! It was easier to find another company and do another application than waiting for someone to help from Authorize.Net!!! I do not recommend them at all!!!

This post will help: Best Payment Processors for Great Customer Service

-Phillip

Caleb Bay

At the very onset I disagreed with the terms. They wanted to dictate my return policy and wouldn’t allow me to refuse American Express (online payments). So I didn’t process one single solitary transaction. Not one. No service was ever provided. They proceeded to steal $25 from my bank account every month for almost a year before I noticed. The flat out, straight up, STOLE hundreds of dollars from me.

This post will help: Best E-Commerce Merchant Accounts

-Phillip

Maryann Ray

I had used Authorize.net as my gateway account for 10 years and was thrilled when I learned they had full merchant processing capabilities and I was excited to expand the relationship.

Conversely, they apparently didn’t see it as a business relationship at all. From the beginning I have been treated as an unknown and untrusted merchant. They have questioned the “quality” of my charges, placing me on an extended deposit plan without informing me. They have out hold after unfounded hold on my account. For example, 3 days after they told me everything was set to go, I got an email saying there was a funding hold because they wanted a copy of my business license and a couple of other things that could have been provided the day the account was opened. I provided it the same day, but then there was some other hold, that I was not informed about and then another and then another – none of them for any good reason.

It has been nearly a month since signing with them and to date I have received only 14% of the charges I have submitted – all of which they claim have “settled.”

They have used excuse after excuse and promise after promise telling me the funds will appear in 3 days. It is now nearly 3 weeks since the first of these promises. Every time I talk to them they say the hold is lifted and the funds will “pushed today.” The funds never show.

Every time I call I get the same runaround and every rep says they are a manager. The one today (David), said flat out, “Too bad. I’m the highest you’re going to get.” He said the release was sent today, but because it is such a big amount, it needs a manager’s review (apparently he isn’t the right kind of manager). Once the manager’s approval is received, it will take 3 days to receive the deposits. Remember, the amount is this big because they have held all the money. The person I talked with 2 days ago (Austin) said it would be pushed that day.

At this point, they have completely stopped my cash flow, strangling my business, and none of their phone “managers” seem to have any comprehension of the impact their deeply flawed process has on a merchant.

My advice to anyone considering working with them is to think twice. This is not an ethical or competent, or customer-oriented merchant processor. I’ve worked with several and have never experienced anything like it. The last deposit I received was on 3/27 and it only covered charges made between 3/15 and 3/18 – so 9 days to get the first 2 deposits, then nothing for the last 14 days.

Any other merchant processor would have been up and running on day 1. Authorize.net is a big mistake!

This post will help: How to Make Your Payment Processor Release Your Money

-Phillip

Chelsea Rogers

I have not used my authorize.net account at all, as I was not able to qualify with any card processing companies. Customer service was awful. I had never set up an account like this before, so I had No clue what I was doing and apparently neither did they. It’s taken me 2 months to try and get qualified with a processor for my website and I am officially giving up, because I honestly don’t have time to run around all day going back and forth with these “companies” and back and forth to and from the bank for multiple letters that needed to be signed by Chase Bank. I spent a fraction of the time in a dealership and walked out with a new car. This has been a total and complete joke. not to mention that the processing companies Insisted on having someone do an in person inspection of my work place, aka My home. even though I run an online print on demand business…. so, there is literally nothing to look at, besides my laptop. And well, I’m not gonna just let some company look through my laptop because they say so. Oh and apparently they “needed” to know my address history for the past 10 years? Wtf? Why? Just run a friggen credit report, look into my business via the website and verify my bank account info! You’d think I was being vetted to board Air Force One, with all of the information they “needed”.

I will say that the customer service was pretty good when I needed to close my account and they refunded me for April’s charge.

This post will help: Best E-Commerce Merchant Accounts

-Phillip

Bobby Bautista

I have been in business for over 7 year and have never dealt with a company so corrupt and dishonest like Authorize.net. I opened an account with them and they approved the account after making several transactions. I received an email from them saying that my merchants account will be closed with absolutely no explanation. I requested in writing the reason for why the account is being closed and they couldn’t even give me a reason. They said all funds may remain on hold for up to 120 days from the last processing date. This corrupt company wants to keep my customers money and not refund them back. We requested a refund to our customer and this company also denied to do that. DO NOT USE THIS COMPANY THEY ARE SCAMMERS.

This post will help: How to Make Your Payment Processor Release Your Money

-Phillip

Leslie DuClos

No Way to stop billing

From The Editor

This Post Might Help: Cancelling a Merchant Account Without Paying a Fee

Nick

The rates changed so I had to cancel my account – however, they TOLD me it was cancelled, but they didn’t cancel it. They were charging me monthly for NOTHING for a while before I noticed. So keep an eye, they are very shady.

From The Editor

This Post Might Help: Cancelling a Merchant Account Without Paying a Fee

Nick

Absolutely disgusting. They closed my account, refuse to release funds and tell me that doing business with law enforcement and the Federal Government does not align with their policies.

Anti American Trash!

From The Editor

This Post Might Help: How to Make Your Payment Processor Release Your Money

Andy Mcway

We are going to quit Authorize.net soon, Because:

We signed up with Authorize.net for our online processing and later learned that Evo Payments handle our online processing. We sold some products on our website and expected the funds to be in our bank account and sent a check to a University at which we are holding a summer camp. While we were comfortable with our payment to the university, the money processed online on our site has never showed up in our bank account in over a week. But, in the meantime, Evo deducted it’s own commission from our bank account for these transactions as if the money was already transferred to our bank. Finally, after waiting long, I called them 4-5 times. I talked to different people including supervisor Jess (or James) and Melissa at Underwriting Dept. First they asked me for our bank statements. Since this is a new business, I sent bank statements from my old business as they told me to. I did. Then, next day when I called, they said they need me to email them credit card processing statements from my old processor. I did that too. Then, they asked me to email invoices for a split payment on our site. I did that too. Next two times I called, they were not able to locate some of the files I sent them earlier (either bank statement or invoices, etc. something different every time.) And finally today, Melissa promised me that she would call me and get this handled before she leaves for the day. They are now closed and she didn’t.

After that:

I spoke to three different departments (Customer Service, Underwriting and Lost Prevention) many times after my initial complaint. They don’t call me unless I call them and they continue putting a hold on our funds. They keep requesting new documentation, coming forward with new terms. Eventually, they said, they are going to hold on to our funds because some of the payments was for a trip and they said they don’t process travel payments because we were approved for only classes. I told them it’s not for travel, it’s the east coast trip for students coming from far and oversees and it’s a product that we sell. After pressuring much, they eventually agreed to release the funds other than the trip payments if I sent them an email confirming that I agree to their terms. I did and requested an email confirmation of what they told me. Melissa at underwriting rejected sending me a confirmation email. Melissa also told me that they would keep 10% of our funds since our classes are in summer, in 5 months. I told her that we were never told about that. She just said it’s policy. Then I was referred to the Lost Prevention Department. I told Meghan what I spoke with other departments again. Meghan told me that she will connect me with a supervisor today. I told her that based on my previous experience, I don’t believe that he would get back to me. After an hour, she sent me an email that the supervisor will review and will do his best to get an answer by the end of the business day to me.

This is the last email I got from EVO. Yet, they came back with a request for more documents. I asked them to refund the entire split payment and release the remaining payments , they said no to that too. One of the documents (Cross Corporate Guarantee) is asking for my old company to accept responsibility for all the debts of my new company, which is impossible considering there are different shareholders at two companies (I am no longer the owner of my previous company). Why would another company guarantee another company’s debts?

Hello Omer,

Per our conversation, please respond with the below requested documents and answers to questions:

Documents:

– Completed the attached Cross Corporate Guarantee so that bank statements and processing statements for …. can be accepted

– Documentation tying …. and ….. and yourself together

Questions:

– The application was submitted requesting a monthly volume of $5k which as we can see is not correct. Please provide an accurate monthly volume estimate for the credit card processing portion of your business.

– I found that you are listed as the previous president of ……… Are you still involved with this company? If so, how?

– Please confirm once the travel portion of the sales have been refunded. Per the invoices provided, this will be in the amount of $11,700 – $3900 x 3 back to your customers card. If you need assistance with the refund process, please contact Authorize.net at 877 447 3938.

Please respond quickly with all requests to that we can expedite the finalization of your account. Thank you.

Regards,

Jessica Gastin

I asked her again to release the funds other than the split payment and that we will quit them. She said, they would refund all payments and we would have to process cards on our own.

james

i recently signed up in authorize.net, oh my god, this is the theft on steroids, I barely used their platform, they said please wait for an account review, and you gonna hear from us within 48H, I waited for 13 days , I finally got an email from them, stating that I need to provide a supporting documents , honestly, because of the way they answered me and the duration for their reply, I’ve already lost interest in them, so ignored their email, but today, I checked my Gmail account to find a mind boiling email, saying they tried to charge me for a $75 ( set up fees+ monthly fees) for a service I didn’t have the chance to use it not for once, and threatening me that they gonna close my account, charge me an additional $20 for late fees and hire a debt collection agency. well, I’ve seen a lot in my life but this is what’s called a COMBO !.

again stay away from these burglars (they shouldn’t be called a company), and hell no! they can dream about their $75 because I’m not going to let them rip me off with my consent!

be aware!

Jennifer Crowson

The same exact thing happened to me however, the tried to charge me over $400 for I don’t know what because they were not able to process any of my transactions. Additionally, the super kind sales person has not returned any of my calls since he signed me up for this great service which was nothing but lies. Unbelievable they can remain in business.

tommy Bahams

It took them 1 he to answer there phone. What a joke. There customer service sucks. I’m still pissed I waited that long.

Nicole

Stay away from Authorize.net! For the past month, I have been dealing with a nightmare situation in which they managed to merge my business’s account with another business’s account. They have the wrong owner information and tax ID number. I’ve had three phone calls with them trying to explain the situation. All three times I have been advised to fill out and submit the same form online (an application to update the tax ID number). However, the form keeps getting rejected because they don’t have the correct company information in their system. I’ve tried to explain this, but their customer service is terrible and incompetent.

It’s a blessing that they’re just a gateway provider and my merchant processor is depositing the funds in the correct account.

Hickory Arms, LLC

Firstly, the company doesn’t allow you to have one account for online and POS sales, so you have to pay the fees twice a month. Most of our sales are direct, so the monthly online sales fees are exorbitant, sometimes as high as 10%.

Secondly, as I said, you have to set up two different accounts for online and POS sales and pay the monthly fees twice – in our case, $37 – $40 plus the percentage of sales they take.

Thirdly, they send you three emails every time there is one online sale. Consolidating this information would go a long way to saving room in the inbox.

Fourthly, you can not generate sales reports or download .csv or quickbook information, so you must do it all manually.

That’s about it. We are going through the time consuming process of switching our online credit card processing to another company, but we thought others should know the nitty gritty, after all is said and done, with this company.

Mona

The worst customer service. when I asked them to explain to me about the monthly charges on my credit card they responded ” I don’t know” when I asked for refund they said “we can’t refund you and we will make a thicket for the billing department”

I called after 3 days and they said that my thicket got rejected. I asked if I can talk to someone about that and they simply said No and hung up.

Angelica

Be careful, they charge you for the service you never asked for or used without your permission, and if you contact them they will say “it is your responsibility to check your card and make sure no one stills your money”

Purchasing Department

AUTHORIZE.NET ARE NOTHING MORE THAN A BUNCH OF THIEVES THAT NEED TO BE SHUT DOWN IMMEDIATELY! AUthorize.net are the biggest con artists around! Never supply these thieves with any banking account information. They will debit your account immediately after approving you for 30 seconds. They will approve you and a matter of hours later they will close your account just to debit your account $50. Make sure if you give them a checking account make sure you give them a personal account so you can immediately dispute the charges.

What makes Authorize.net bigger scumbags, is that they will distribute your application along with all your personal information (bank account, social security number, etc) to everybody. Then in a matter of weeks you’ll see your bank account being debited from different sources including Authorize.net.

Got a demand for money owed by EVO Merchant Services that these scumbags gave our information to without our permission demanding that we folk over 4 months worth of fees, for an account we didnt even know we had. They never emailed us, they never sent us anything, the fact is we even documented calling Authorize.net demanding they shut everything down and we even got written statement from these lying scum. It turns out these theives will send your information (social security the works) to every scumbag processing company around. No signed contract, no terms, no phone call, they just start debiting your account.

Bob

I feel for everyone of you who have posted here. I was to look into another avenue of payment on eBay; after reading thee reviews and how I see the same thing repeatedly, there is no way I would do business with this company.

I am NOT happy with PayPal about a few issues, but reading this makes what I have gone through look like nothing. The generic (if any) answers, the rudeness, the insane fee’s!

They work for you not the other way around. I would suggest if anyone ever continues with them, do not give a REAL SS#. To save your credit and reading the one where they sell off your info, there HAS to be a lawsuit waiting to happen and NOW for giving your SS# to ANYONE. That is ILLEGAL 100%.

Question, can you go directly to a Credit-card company and have them do this, or do places say like Sears, Wal-Mart have to use scams like this too. There MUST be a better way. I have not seen any resolve other than a couple saying PayPal, who lately gives refunds to buyers with ZERO proof and MONTHS after the delivery. I just had one yesterday (2nd in 1 1/2 months) where I dont even know what the item was, and they dont either yet found for the buyer. Are you kidding me. They ALL $UCK if that is the case. You get as high up the food chain there on disputing it and best they can say is, yes we should have done a better job and we will train our employees better. But nothing we can do now. BULL$HIT!

There if you happen to use to buy, it is open season on sellers to be ripped off just by making a false claim. Robot employees, management that KNOWS they screwed up but tough attitude.

I dont sell 10K a month but it is item to either drop selling on eBay (2nd income) or figure I have to add another 20% to my prices to cover for the thieves and it is growing.

Purchasing Department

The answer is simple. Since the biggest fear is these companies losing money because the way the laws are set up. Buyers more and more commit fraud because credit card companies encourage it and they do nothing to stop it. The merchant is the one that gets screwed every single time. When a chargeback happens, the only thing these merchant processing companies worry about is the loss. Regardless if the merchant is right or wrong, these merchant processing companies will always screw the seller over every single time to protect themselves. Their moto is we have a lot of customers, so we dont need you petty account. What can the seller do, there are so many enemies against the seller that your only course of action is to sue everyone involved. Chase is the worse one of them all, they promote fraud and do nothing about it. All our chargebacks this year, no joke, was all from Chase card holders. So we now block cards from chase. But the bottom line is that if you do everything right when taking business online, is that everyone is out to screw you over – including your own processing company!

Charles Mitchell

I set up an account with Authorize.Net last November (2015). I agreed with their sales person on a set fee. When I was reviewing my stats and charges (which I did not do often enough), I discovered that they had duped me and more than doubled my fees. Someone indicated that in the small print on the top of page 4 of their application I checked a box which permitted them to charge me over 6 % in fees. When I explain this was obviously an error, then promised to make it rightt. It has now been over two months… they should over me @ $5000 in over charges. Last I heard, they wanted to offer me $45. My next step is to file a complaint with not only the BBB but the any state regulators where they are doing business. Boo-Hiss on them.

Robert

authorize.net needs to be shut down. I received several thousand spam text messages from them on behalf of Rent in Marin, neither of which are companies I have ever done business with. I contacted authorize.net and told them to stop spamming texts on my cell phone several times and they gave me the response “We don’t do that here, you need to contact the vendor who is our customer.” I contacted Rent in Marin who are apparently a derelict company with no way to contact them via email or phone. Subsequently, Rent in Marin vanished from the internet and their website disappeared while the text messages continued. Authorize.net continued to give the mentally incompetent, robotic response “This is none of our business, contact Rent in Marin.” I finally figured out to start a profile with my phone service online and changed my text settings to stop the thousands of receipt spam texts from authorize.net. No thanks to you authorize.net

Duanea Myers

I’m a consumer and purchased vitamins through Dr. Mark Hyman and Authorize.net charged my credit card twice. I complained to Hyman’s customer service, they denied responsibility and said it was all Authorize.net’s fault and that they were working on the issue (apparently it happened to a LOT of transactions. Two weeks later, the charge is still on my card. Seems like it could be solved by now. To not fix a “glitch” like charging someone’s card for something they didn’t buy just seems like theft. I hold Dr. Mark Hyman and Authorize.net both responsible. It’s not a huge charge, but it pisses me off.

Greg Anderson

This company is TERRIBLE. They are owned by Cybersource which was purchased by VISA. Their corporate office telephone number on their website is disconnected. I am a merchant who uses this company (but not for long). They have double billed my customer now twice in less than 4 months. It is impossible to get to someone who can actually help you. My customers are n=being double billed and they told me their support group is too busy to assist me. STAY AWAY FROM THESE GUYS!!!

DONTUSEAUTHORIZE.NET

AUTHORIZE.NET IS A SCAM. Authorize.net uses the same $49.00 gateway setup fee to scam merchants out of money. Authorize.net will approve you for an account, just so they can debit your account $49 even when they haven’t provided you anything. They will approve you for an account, and then immediate the same department will close your account. They do this so they can obtain your bank account and routing information so they can illegally debit your account the $49 gateway setup fee. When you call them you have to talk to sales and immediately these scumbags will say no. They say they will refer you to 3 other processors they deal with and these processors are bigger scam artists than Authorize.net. Authorize.net sent us one so called merchant provider that when you Google’d their 800 number, it came up with a bunch of complaints of telemarketers and other things. When you looked up their domain it was nothing more than a website that looked like a 2 year old bought it. Authorize.net knows that if you have a business checking account, there is no way to dispute a non authorized transaction, only for personal accounts. So that’s one reason why they ask for your banking information immediately when your not even approved. DO NOT GIVE THEM THIS INFORMATION UNTIL YOU KNOW AFTER A FEW DAYS THEY DIDNT CLOSE YOUR ACCOUNT. AUTHORIZE.NET ARE SCUM!

Lloyd Marcum

Read the fine print of your contract with them carefully. To Cancel your account you must call on a specific day of theyear, Wait on hold for an hour, and then pay a $250 cancellation fee. Otherwise you have to pay the monthly service fee $42 for another year, and then remember to call again to cancel your account, or pay it in advance to be allowed to cancel your account.

These guys are crooks!!!

Lea

I have signed up for gateway and completed the application however they were asking for documents that I couldn’t provide. The representative emailed me that I have to provide the documents otherwise they will not provide the gateway service. After a month they wanted me to pay for the gateway that they didn’t provide. They emailed me mutliple times and I called them multiple times to resolve the issue and told them that I am willing to pay for it – I got tired of dealing with them. The representative told me that he will email me the amount to pay and I agreed to mail them the check. I have waited for the email but instead later on they sent the bill to the collection agency. I decided to just pay the collection agency because I no longer wanted to deal with Authorize.net – worst customer service ever!!!!

John

These are really far out there complaints.. I have used Auth.net since 1999. I have ran millions of dollars through Auth.net with FIVE different corporations… I have NEVER ran into a single problem logging in, refunding transactions, or getting customer support.

It seems like if there is a “freeze” on your account, then you have had too many chargebacks or complaints against you.

CPO

Hi John,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!

David

Maybe your considered a valuable client. However…us “pee-ons” were treated badly.

Mark Florida

Authorize.net Scammers! Don’t use them, you’ve been warned. Authorize.net IS NOT a merchant provider, is just a gateway services provider. Even PayPal with all the horror stories still is 100% better.

Their hamburger flipping customer service is terrible, They can’t tell from a simple credit card transaction to how to transfer funds.

Stay away!

peter

Authorize.net are unprofessional in their business dealings and utilize a cunning business model. They let you sign up and pay $49 set up fee. Then after you make one business transaction they reject YOUR business model, terminate your account, and pocket your $45 plus another $25 for other processing. They let you make one business transaction so that they don’t have to refund your $45. They just say that you “used their services once for a business transaction” so you cannot get a refund. How cunning is that? Why can’t they be like Paypal who first assess your account and business model and only charge you if you’re cleared? If Paypal can do it, so can authorize.net. The difference is, authorize.net WANTS to take away your money. F***ing piece of s**t company. I suggest you go with Paypal Pro (2016 version). When I went with them, they had a personal customer service professional discuss my company over the phone with them, and since I was opening 2 companies even waived the monthly subscription for one of them! How customer friendly is that? Good on Paypal!

Joy Clark

The Absolute Worst Customer Service!!!

Absolutely one of the worst customer service providers I have ever encountered. I have a small business and you are allowed one free card reader…Make the right choice because they are non refundable and not exchangeable. I have an iPad I was going to use for my business so I choose the one the inserts into the iPad (I did look to make sure my model was workable with the system) For some reason the card reader would not work on my iPad but did work on my iPhone (I wanted to use a bigger device). I talked to technical support, their conclusion…My speaker jack did not work. However when I would put headphones into the jack it would work. I tried to just exchange it for the computer version and they would not. $75.00 for the device. I chalked it up on sometimes things just don’t work out. Then I was trying to close out the bank account the I original set up with Authorize.net, I needed two items to complete this process, an application and either a letter from the back, an online summary page with the bank logo with full account and routing numbers or a voided check. I did not order checks, because I do not need them. My bank does not give out letter like they were requesting so I printed and send the summary page (with my banks help) and the application. Summary page was not good enough. The customer service rep said that “IF, it came from my bank it basically was not good enough. So I was told to take a screen shot which I did from my phone, the phones screen shot is not good enough. The run around and the words that were in the emails from the service rep was by far the most unprofessional I have encountered! I wish I would have read up on the reviews before this headache began.

Garenne Bigby

The worst payment processor on the planet. Their Automatic Recurring Billing has been charging my customers on a daily basis for monthly subscriptions since their ARB on April 9, 2016. DO NOT USE!!!!!!!!!!!!!!!!!!!!!!!!!!! They are a nightmare to work with. I have not received a callback from management for 7days.

Joe

I have been with Authorize.net for about 5 years, in my opinion, these people are truly bad news and their practices are questionable. Do yourself a favor and look into other options, you will be very happy you did. Please note the following:

1. Their technology and options is outdated.

2. Most of the newer system will automatically update a credit card expiration date, however as far as I know, this is either not an option on Authorize or they don’t appear promote it.

3. Their in-house merchant bank charges significantly more than the competition.

4. The service is bad, they appear to really not care.

5. I once had a security issue that was reported by their own system, they didn’t even have a security department to review it, they blew it off and I was not sure if there was a security breach or not to this day.

6. This is the worst, when you leave and want you re-occurring credit card data, they will charge you a minimum of $1000, at least as of the date I am writing this. I was told by a former employee that it takes them half hour at most to extract this data, but their rates are $250/hour with a 4 hour minimum. I was further told they do this to make it very difficult to leave.

My opinion is that this is really a horrible company in every-way, there is almost nothing good about them. They just don’t seem to care and will seam to stick it to you when they can. I highly recommend to stay away, my experience and opinion leads me to conclude that I aM not dealing with highly ethical people who don’t appear to want to improve their produce.

Greg browness

“Scammers! Don’t trust Authorize.net or total merchant services” – Authorize.net and total merchant services. High pressure sales pushing me to use their mobile device. I was VERY reluctant and happy with my square device and service. The decision to try them out cost me $114.00. I spent hours setting up the device. The card reader never worked. I called customer service and we supposedly got it up and running. But it still didn’t work. I called again, and they told me it should work … But nope! So I gave up. I cancelled authorize.net and didn’t cancel total merchant services. I was getting charged $38.00 per month for 3 months when I haven’t even used the device yet. I was offered no refund I asked to talk to supervisor and he was more rude then the c.s. I was talking to. This is the first review I have left for any company. Hopefully this will help you. Crooks , scammers

Not Happy

Been with them for years, hated them for years. My biggest complaint with Authorize.net is zero proactive communication with merchants. We don’t matter. When their data center caught fire and the gateway went down, they didn’t make a peep. Merchants were left in the dark, so contingency plans couldn’t be executed. We all lost money. More recently they made a change to their security certs that hosed thousands of carts, ours included. Their support was terrible, even dumping a lot of the support burden on a third party company that had nothing to do with their changes. I was pretty mad about it the whole thing. Their response; “We sent you an email a month ago and posted an announcement to our website. We believe it’s your responsibility to review your account for updates.” They are a prime example of too big to care. It would be easy to make sure every merchant knew about the upcoming changes, or was alerted in case of a fire or other emergency effecting their business, but Authorize.net doesn’t care. That’s why we’re shopping for a new gateway.

Thomas Fischer

Terrible customer service. Would consider other options. Service has been down two days and can not access software.

Peter Wolf

Stay away from Authorize.net! We tried their services and the integration to our cart was a nightmare compared to other services. We got charged almost immediately nearly $100. When we canceled with two weeks and asked for a refund (without ever using their services) – we only got half back. What a rip-off.

David

I have read others complaining that authorize.net claims multiple charges and accounts. Our issue is similar in that they can not get their stories straight with the card merchants on why there are multiple accounts. After multiple requests for the account to be closed, they continue to bill and send the balances to collections. They then make no effort to resolve the multiple accounts issue and want you to have to go through their collections company. No customer service really, you would get a better response from a corpse.

Gab

DO NOT USE AUTHORIZE.NET – I have had nothing but problems with them from errors, poor transaction handling, worthless arb system, and terrible customer service – not to mention how out of date their system is. Save yourself the awful experience of authorize.net and go with some one else. I don’t know how they even became the ‘#1’ processor – don’t believe the ads its a terrible system

Aaron Coleman

In December of 2013 Authorize.net began withholding funds owed to my company from completed transactions without notifying me. When I contacted them about this matter they did not even give me any reasoning or justification in regards to why they were withholding my funds. Ironically, they continued to charge my bank account for processing fees for funds they were withholding. This is basically theft in my mind. As a result, I contacted my bank and changed my account information. A few weeks later someone in risk management contacted me and told me that my funds would be released and my account taken off hold. However, this person also informed me that for some reason I would not receive all of the monies in total that were being previously held. When I asked to talk to someone in risk department management I was told that because I changed my bank account information that punitive fees were “eating up” my funds. When I proceeded to explain to them that I only changed my bank account information because some unauthorized fees were being taken out of my account when the only merchant service provider I was currently doing business with was on hold I was told by Authorize.net “we have nothing to do with that.” So as a result of Authorize.net unjustifiably putting our account on hold, fees in excess of $400.00 were stolen from my company by Authorize.net. This issue has never been addressed nor have these funds ever been reimbursed by Authorize.net.

Recently, I would say about two months ago our company was experiencing an unusually high volume of charge backs (which in any business processing credit cards on-line is very bad). What I realized was that Authorize.net had our customer contact phone number and information incorrect. When I contacted them to have it changed I was initially given the runaround by Authorize.net simply to change the customer contact number on the charge back forms received by the customers when wanting to discuss their transaction with our company. Eventually I talked to someone in customer service who transferred me to someone in “Information Update” who supposedly changed our customer contact phone number. For some reason as recent as 6/19/14 our customer service contact number has not changed. This is unacceptable! When customers are not able to contact the company of whom they have done business with, their tendency is to charge back due to belief that some suspicious behavior has taken place with this particular company. This is not the first time I have attempted to change or update my company information with Authorize.net. And in their usual fashion they lied to me stating that they had addressed the issue when in actuality they never did. This incompetence has cost my small company a considerable amount of money. I have reported Authorize.net to the BBB and am still waiting for a response. I intend to follow up on that complaint this week and pursue it to the fullest extent until someone takes the initiative to contact me from Authorize.net and not only addresses the problem but also explains to me why they are so unprofessional in their practices especially with the little guy.

Ken R.

Has anyone considered a class action lawsuit against this company? I’m not in business; I just tried to pay for an item through Authorize.net last September, and it took until December for me to get my money back. It was the worst shopping experience I’ve ever had and nearly ruined Christmas. My problem with Authorize.net escalated to the point that they locked the account of the vendor I was trying to buy from, resulting in lost income for the vendor and frantic efforts on my part to save the job of the salesman who’d been trying to help me out. It was a ridiculous thing. Here I am, the wronged customer, trying to keep a guy from getting fired at Christmas because his boss uses Authorize.net, which is, to my mind, a fraudulent and criminal entity.

Maxine

Hi Ken, I am having a lot of issues with them. They are stringing me along and not giving me the things I requested for the last 4 months. If there is a class action lawsuit, I would like to contribute my story. Did you ever figure this out?

Thank you.

—

Are you with Authorize.net? Learn how to resolve this complaint.

Vicky

I posted somewhere on here on my opinions concerning a class action and I have to say that I’m in unless they award me the $325 they owe me for charging me $25 a month since May 2015 for a service that I haven’t even used or knew anything about!

Gordon Freeman

Their SimpleCheckout function (nor their website) hasn’t been updated in decades. Customer Support is very poor, with most customer service reps having no clue about anything. E-mail support takes days to respond. It’s an antiquated system with no new features added in years.

Drew

I tried Authorize.net three times and every time I asked to myself – What The Heck? Their system is just not working! It is ridiculous! And they are Top # 1 processor? Really? Are people that naive? How in the world are people able to use them? I use LinkPoint (First Data) and it’s all good and their website is fine, just have to check every 6 months for suddenly increased discount rates. You negotiate with them for a few minutes and they usually put back rates where they should belong. Do this every 6-12 months.

Lilly

Authorize.net is HORRIBLE! Aweful customer service, rude team members and poor processing. We have lot thousands by using their service!

Destiny T

This company is horrible and needs to work on their customer service. I started an account and cancelled it the same day due to a misunderstanding. I was told I would recieve my 100 startup fee because it happened in the same day. About 5 days after, they took the money out of my account. So when I called to get everything straightened out, the man who helped me (financial advisor) was very rude and even hung up on me. Im am very happy I cancelled the account.

Ken

At this point, I’m fairly convinced that Authorize.net has stolen about $800 from me. I’m not a merchant or reseller. I’m a guy who bought something off Ebay, paid through Authorize.net, never received my item and supposedly was issued a refund through Authorize.net a week ago. Only problem? There’s no sign of my money. I have some useless transaction number (I say useless because as far as I can tell, there’s no way for a regular guy to talk to anyone at the company) and that’s it. I have filed a disputed transaction claim with my bank. Trouble is, if that $800 doesn’t show up, there goes Christmas.

Dan

I am in an identical situation. The seller says they refunded and their money was taken, authorize.net gave a transaction ID, but no money has shown after almost 6 weeks. Did you ever resolve your problem? If so, how?

ray

Signing up for Authorize.net was the worst business decision I eve made. They hold on to your funds even after items have been delivered to customer satisfaction. Their risk management department does not answer questions about why they hold on to your funds. Don’t use these guys if you ever want to see your money.

Jenny

Authorize.net has HORRIBLE customer service!!!!! I signed up on July, and cancelled my account with them right the next day. They told me everything was fine, and that the cancellation was approved and nothing will be charged. A month after (August) I see a $99 set up fee charge on my debit card. When I called to have them return my money, they said I needed to contact my account manager “Mike” so he can refund me that money back to my account. I called him for weeks and weeks, left many many messages/voice mails, and he NEVER called me back nor emailed me. Every time I called no one was helpful, until finally a month and 10 days after (September), a manager picks up the phone and transfers me to Mike, and supposedly that money will be back in my account, but I have to wait 10 business days to get it back. So I have had to deal with this headache for two months now, and still no money back. DO NOT USE THEM!!!!! HORRIBLE HORRIBLE SERVICE!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

ap online

decided to stop doing with authorizenet after 7 years because my monthly fees went from $15 at time of setup to $100-150 a month, for gateway only that is ridiculous. last few months they would keep adding those surcharges, when i had my bank do chargeback authorizenet put the amount of the chargeback on my authorizenet bill. way to loose half a million account!

Denny Lien

Fees, fees, fees, and when you get fed up with the fees, there is a cancellation fee.

Service is poor, no returned phone calls, emails unanswered meanwhile the fee meter keeps chugging along.

I will never do business with this company again.

D K

Used Authorize.net for less than a week . My Merchant service moved me to a different gateway. Since I no longer had an account, i could not look at transactions that I needed. Called support twice, one email, gave them every thing they needed to get me my records. Never sent the records.

They WOULD NOT debit my card either for what ever fees own, so I paid it via a check. THEY DO NOT TAKE CREDIT CARDS FOR PAYMENTS OWED. Strange to say the least. How does a business like this even survive? One bright side, I learned really fast how flakey their support and business ethics are.

John

Account never opens and I’m being charged for it. I had attempted to open an account with authorize.net. I had been conditionally approved and after reviewing the conditions I had decided not to open the account. I then received an email stating that the amount due was $125. I made several attempts after speaking with their billing department ad our sales rep to have the balance settled since the account was not opened. The billing department said they would be able to remove all fees aside from the $99 non refundable application fee. I was informed to contact my sales rep to have this fee cancelled. After contacting him he refused to do this and said only under special conditions would this be removed. I had informed my bank to not allow any drafts from authorize.net or cybersource I have now received a notice of collection on march 16th all since the 7th of march.

This company is bad news period!

Angela

Hi John,

I am experiencing similar things with you. They enrolled me to e-checking service without our consent. I am very mad of the practice they are using. Now I have been informed that the balance has already sent to collection agency.

Are you interested in forming a class action to sue authorize.net? Please let me know.

Vicky

I am for a class action law suit. This company has been charging me monthly for a business that I don’t even own! I remember attempting to set up an online business because for a while I was selling stuff through e-bay but I have since stopped but this authorize.net company keeps charging me $25 a month! I couldn’t figure out why until after doing some research and now I do remember that I cancelled my website …at least I thought I did but apparently there is some loophole I failed to catch or something. I’m not very business or money savvy so I’m sure there’s some fine print I forgot to read or something. Anyway, I filed an unauthorized charge dispute through my bank and the next few days received some emails from this company telling me there has been a transaction situation and they can’t get money from me, blah blah blah and that they’re closing my account etc. Well, guess what?! I never even knew I had an account with them in the first place! I honestly thought these charges were from a company I used to work for who charged us for data that we used on the company smart phones that they provided to us. But now I’ve realized that I’ve been tricked by authorize.net. wow….wish I would have clued up a long time ago. So I don’t know what to do at this point. If I did go after them with a law suit there would more than likely be some loophole that I don’t understand or whatever…..I did manage to get back $75 and overdraft fees that my bank charged me but authorize.net still owes me at least $200.00. But yes, I would be in for a class action suit against this company if anyone else is.

Dennis Russell

Sent: Mar 1, 2013 7:11:16 AM

Subject: RE: Authorize.Net Merchant Billing Notice RE: 1050309

This account was closed last year as we closed the business. What is the $20.00 for if no service was provided from your company.??? Looks lie a rip off to me.

Sent from Windows Mail

From: [email protected]

Sent: March 1, 2013 12:55 AM

To: [email protected]

Subject: Authorize.Net Merchant Billing Notice RE: 1050309

Your Authorize.Net ID is: 1050309

Dear Authorize.Net Merchant,

According to our records, we are unable to collect fees for your payment

gateway services. As a result your account is now closed and a 25.00 USD

fee is required to reactivate your account.

The total amount due on your account with us as of the date of this e-mail

is: 20.00 USD.

We hope to avoid any further action. Please contact our Customer Support

Department immediately at 1-877-447-3938 to make arrangements to pay the

balance due.

You may also send a check or money order payable to Authorize.Net to:

Authorize.Net

Accounts Payable

808 East Utah Valley Drive

American Fork, UT 84003

Please include your Authorize.Net ID (listed at the top of this e-mail) in

the memo of the check or money order.

Should your account remain unpaid past the end of the month, the total

amount due will be transferred to a collection agency and may be reported

to credit bureaus as an unpaid collection item. Your account will remain

closed until your account is paid in full, including the 25.00 USD

reactivation fee.

If you have any questions regarding this notice, please contact Customer

Support.

IMPORTANT: DO NOT RESPOND TO THIS E-MAIL WITH SENSITIVE ACCOUNT

INFORMATION.

Thank You,

Andrew