A Business Owner’s Review of Bank of America Merchant Services

Overview

In this comprehensive review of Bank of America Merchant Services, we will delve into the intricacies of one of the largest merchant account providers in the United States. Our analysis will cover the broad spectrum of services offered by BofA Merchant Services from the perspective of a business owner, including its role in credit card processing, electronic payments, POS systems and hardware, as well as its e-commerce payment solutions. We'll also further cover the Bank of America Merchant Services fees, rates, and contractual obligations, as well as the customer reviews and lawsuits that have come about in relation to them.

About Bank of America Merchant Services

Bank of America Merchant Services, also called BA Merchant Services, is one of the largest merchant account providers in the United States. Prior to June of 2020, the company acted as a reseller of First Data (now Fiserv) rather than processing payments directly with the card networks. However, in the joint venture has since dissolved and Bank of America acts as its own credit card processing service

Bank of America Merchant Services Payment Processing

Bank of America Merchant Services processes all major debit and credit cards for most business types. Their services include Clover POS systems, check processing, e-commerce solutions including the BigCommerce software, access to the Authorize.Net payment gateway, and MOTO. The main benefit of opening your business checking account and merchant account through Bank of America is that your credit card sales will usually be deposited a full day sooner than if you were with a third-party merchant account provider.

A Forthcoming End to its First Data (Fiserv) Partnership

Bank of America Merchant Services has had a contract with First Data (Fiserv) to service their payment processing needs. The contract ran until June 2020, at which time their partnership was not renewed. This will invariably change the landscape of Bank of America Merchant Services' rate and fee structure. As of this review, Bank of America Merchant Services is pursuing an independent merchant-acquiring solution yet to be disclosed, but the company has stated First Data (Fiserv) will continue as an “important service provider supporting Bank of America’s global payment solutions.”

In April 2021, BofA acquired AxiaMed, a payment processor that primarily focuses on health care. This seems to signal that BofA is attempting to build a stable of processors in the wake of the First Data split, and it is likely we will see more processors come under the umbrella of the BofA empire.

Location & Ownership

Bank of America was founded in 1930 and is headquartered at 100 North Tryon Street, Charlotte, North Carolina 28255. Brian Moynihan is the CEO of Bank of America and LinkedIn lists Guy Harris as the head of merchant services.

Video Summary

| Pros: | Cons: |

|---|---|

| Diverse processing options. | Limited pricing transparency. |

| Nationwide branch accessibility. | Higher fees possible. |

| Advanced security features. | Contract termination fees. |

| Integrated financial services. | Complex pricing structure. |

| 24/7 customer support. | Complaints about customer service. |

Bank of America Merchant Services Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | 100+ |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | Hidden Fees |

Overview of Bank of America Merchant Services Feedback

Given its substantial presence in the merchant processing sector, Bank of America Merchant Services has attracted a relatively small volume of complaints, few of which label the company as a scam or ripoff. Most grievances from merchants highlight issues with nondisclosure of significant fees and contract terms, particularly mentioning a $495 early termination fee. Additionally, there are reports of unsatisfactory customer service and challenges in resolving disputes via the company’s support channels. Some feedback also touches on confusion regarding services provided through First Data (Fiserv), impacting the clarity of service provision by Bank of America.

Legal and Regulatory Challenges Facing Bank of America Merchant Services

In 2019, Bank of America Merchant Services (BofAMS) faced a notable whistleblower lawsuit concerning allegations of non-compliance with Payment Card Industry (PCI) standards. The case highlighted concerns over data handling practices and misleading customer assurances about PCI compliance. Despite these serious allegations, no outstanding class-action lawsuits or Federal Trade Commission (FTC) complaints directly targeting BofAMS have been identified. Merchants with grievances are encouraged to seek resolution through appropriate supervisory bodies.

Bank of America Merchant Services Customer Support Evaluation

Bank of America Merchant Services offers a range of customer support options, including phone, email, and chat support, aligning with expectations for leading merchant account providers. Despite maintaining a low complaint rate, the nature of reported issues suggests an area for improvement in customer service practices. The presence of substantial fees and reported challenges in service cancellation have influenced the company’s customer service rating.

How to Contact Bank of America Merchant Services for Support

- (888) 296-3532 – Toll-Free Customer Support

Additional Support Resources

Bank of America Merchant Services features a comprehensive customer support infrastructure, including a support form and specific email addresses for various types of inquiries, ensuring merchants have access to necessary assistance.

This updated analysis aims to present a balanced view of Bank of America Merchant Services, incorporating SEO-optimized terms such as “reviews,” “complaints,” “customer service,” and more to aid individuals in conducting thorough research on the company. Maintaining all original links ensures readers can access detailed information and additional resources directly.

Bank of America Merchant Services Online Ratings

Here's How They Rate Online

| BBB Rating | 1.07 |

|---|---|

| Our Rating | 2.5 |

| Average Rating | 1.79 |

BBB Rating Analysis for Bank of America

Bank of America, headquartered in Charlotte, NC, is accredited by the BBB since 11/1/1949 and holds an “A-” rating. It should be noted that (outside of this review) there are few review sites that separate BofA’s merchant services division from the rest of its business, which is substantial. Thus, we’ll include a review from the BBB here as an example of the company’s services in general, but we will not include other reviews.

The bank has been in business for 76 years. It has an average customer review rating of 1.07/5 stars based on 962 customer reviews. There are 7,585 customer complaints closed in the last 3 years, with 2,609 complaints closed in the last 12 months. Common themes in the reviews and complaints include issues with customer service, problems with products/services, and billing disputes.

Negative Feedback

*** is trash recently my fiancé’s son passed away I have tried numerous times to get a payment deferred. They will not help at all just want to set up payments and charge late fees. Thanks for absolutely nothing and if you’re thinking of dealing with BOA save yourself a headache and don’t do it. If I could leave a 0 rating I would. – Review from December 6, 2023

On October 13th, at 1:01 p.m., I ******************* entered a Bank of America to withdraw money from my chime debit account. I attempted to withdraw $510 but in an attempt to grab my money from the dispense slot some of it slipped back into the machine ************************** the machine. I immediately asked help from one of the clerks and was told to dial the *** support number after I did so I was told to file a claim with chime. After I filed my claim with chime it was repeatedly denied based on the evidence provided by chime I was told that there was no error on chimes part and that the *** was not over or short in funds. This has led me to two conclusions One Bank of America’s *** was faulty or the audit was not done properly and my money was not accounted for or two chime financial investigation seems committed an error. I would like to request review of camera footage from the *** or any other camera that could have caught the instant and I would like Bank of America to reach out to chime and help rectify this issue. Bank of America under Reg E claims act should still be held responsible as it is their atm and establishment that is responsible for keeping track of all money that is over or short in their atm machines even touch Chime is the bank account I withdrew from. Below I will attach an image of my receipt and the money I was able to grab the metadata of the image would show that I took the picture shortly after 1:01 p.m. and camera footage could placee at the bank at the time. – Complaint from December 4, 2023

Positive Feedback

There are no positive reviews published about Bank of America on the BBB website.

Source: BBB

Bank of America Merchant Services Fees, Rates & Costs

A Closer Look at The Contract

| Swiped Rate | 2.65% + $0.10 |

|---|---|

| Keyed-in Rate | 3.50% + $0.15 |

| E-commerce Rate | 2.99% + $0.30 |

| Contract Commitment | Month-to-Month |

| Early Termination Fee | None |

| Monthly or Annual Fees | None |

Updated Rates and Fees

Bank of America has significantly modified its rate and fees since our last update. Prior to this change, the company faced considerable backlash over its use of confusing fee structures, hidden fees, and long-term contracts with high early termination fees.

In reviewing the updated pricing structure, new credit card processing customers of Bank of America Merchant Services are being offered much better terms and fees. It’s clear that the company aims to move forward with simplified and competitive pricing options, with an emphasis on transparency and no long-term contractual obligations. Their pricing model is marketed to cater to various business needs, whether operating in-store, online, or on-the-go.

Bank of America Merchant Services presents a tiered pricing structure based on the type of transaction processing. For swipe, dip, and tap transactions, the rate is set at 2.65% plus 10 cents per transaction. E-commerce transactions are priced at 2.99% plus 30 cents, while keyed transactions cost 3.50% plus 15 cents. This clear delineation of rates based on transaction types will allow businesses to anticipate their processing costs more accurately.

Rate Discounts

Bank of America is also offering the potential for discounts on processing rates. Through the Preferred Rewards for Business program, businesses can earn a discount of up to 0.10% on their Merchant Services Simplified Pricing processing rate, with additional savings and rewards available. The tier rate discounts are categorized into Gold (0.05%), Platinum (0.07%), and Platinum Honors (0.10%), offering a range of benefits depending on the business’s enrollment level in the program.

Furthermore, Bank of America Merchant Services emphasizes the absence of hidden fees, early termination fees, and long-term contracts, underscoring their commitment to transparency and flexibility. This approach is particularly beneficial for small businesses and startups that require more adaptable financial arrangements.

In summary, Bank of America Merchant Services provides a clear and competitive pricing structure for new customers, with added benefits for those who participate in their Preferred Rewards for Business program. The absence of long-term contracts and hidden fees, coupled with tiered pricing based on transaction types, makes it a potentially attractive option for businesses seeking reliable and straightforward merchant services.

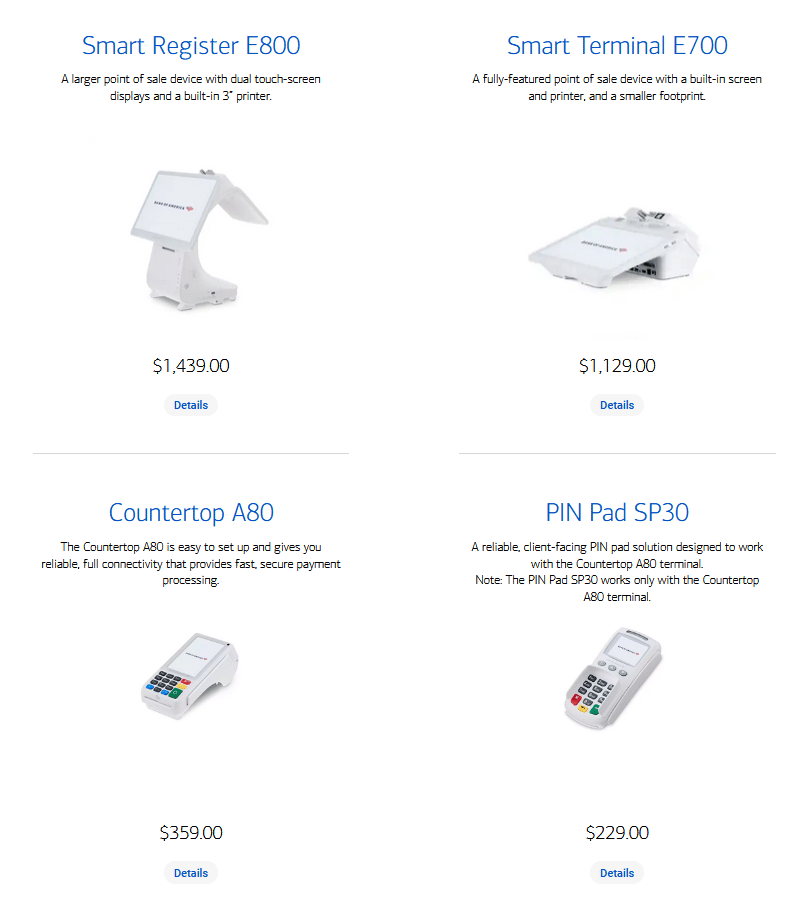

POS System and Payment Hardware Costs

Bank of America Merchant Services Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | No |

|---|---|

| Advertises Deceptive Rates | No |

| Discloses All important Provisions | No |

Bank-Based Marketing Channels

Bank of America appears to primarily market its merchant account services through its numerous banking branches and internally employed outside sales representatives (as opposed to independent contractors). Although the company uses its own sales force, merchants are reporting similar problems often found with independent agents, such as nondisclosure of fees or important contract conditions prior to account setup. This does not compare favorably to our list of best credit card processors. If you suspect that a Bank of America representative has added undisclosed fees to your contract, we recommend seeking an independent statement audit.

No Deceptive Quotes

Other than reports of deceptive sales tactics by agents, Bank of America does not feature any misleading advertising or rate promotions in its official materials. This has earned it a “B” rating in this category.

Our Bank of America Merchant Services Review Summary

Our Final Thoughts

An Average Option for Most Business Types

Bank of America Merchant Services is responsible for a large percentage of merchant credit card transactions in the United States, and the vast majority of business owners appear to be satisfied with the service. However, the company’s rating is suffering in this review due to reports of deceptive sales tactics, predatory policies regarding canceling service and leasing equipment, and high early termination fees. Despite Bank of America’s large market share, many small business owners may be better served by working with a top-rated merchant account provider.

If you found this article helpful, please share it!

Startersss

I’ve had a smooth experience with Bank of America Merchant Services so far, their customer support has been really helpful!

Pamela

I just found out with no advanced notice, that I have to adjust the tip for every transaction, even if there is no tip. I was told in my onboarding call for their payment processing device that batches can be automated, and so I set them up to be automated every day. I have two months of revenue through their processing that I simply didn’t receive. When I go back into my virtual terminal, after successfully going in 5 days ago, I get a message that my company doesn’t have permission to access the transaction list. A call to my rep has yielded no response 3 business days later.

Yvette Pavlick

I was told that when I signed up for their service that there were no fees to sign up and no monthly fees. I thought it was just like the Square credit card reader. Then I get a letter from a collection agency for $199.95. I called the representative that signed me up and she told me the fees were for NOT USING their services. WHAT A SCAM!!!! Ive never heard of something so ridiculous. I don’t recommend this service to anyone!

Anthony

Today is Sept 1 2020. BOA Merchant Services is holding my funds since March 4 2020. (5 Figure Amount). No explanations, not reason, account is still active but funds are not getting credited. basically i can still use the clover machine but the money never makesi t to my account. All while they continue to charge their merchant fees. No phone number to call. Customer service has no idea whats going on. Security department has no direct number, you are supposed to leave a msg and get a call back, no luck with that. called many times. . In short, they have essentially stolen my funds. Not sure if they think they can get away with this. Currently taking legal action. Will keep you updated.

Yogi

Please update me on this , I am also facing same sort of problem with BOA merchants services, funds are been held with no end in site, I call almost every day but no body returns call , no explanation.

My funds are in 6 figure, I went out of business doing business with them.

Leroy Ballard

I too am in the same situation. I do work for the Gov and take CC payment. The first one went through and no issue, but the 2nd one is being held since the 22nd of dec. I have called everyday and assured someone would call back. they are going to force small business such as myself to go under when you cant pay your people……

JB

THIS IS TERRIBLE. They are doing the same thing to me. Advice: DO NOT IMPLEMENT THIS SOFTWARE. Better luck with Paypal.

Ananth

BOA do not care about the customers. Customer service is one of the worse I even deal with. Long story short, I jus request a balance conformation letter and from the customer serve and they told 2 to 3 business days. I never received the letter and when i call customer service they treat you like a slaves. they says that the letter is not ready will email you before end of business day and no reply its Saturday. i call customer service and ask for manager he said the letter is not done correct and she cannot do any help want me to wait until Monday. When i call Monday they keep saying its not ready ( answer is they letter is not done correct and the person who do the letter is not available to help) we need to make another request and it will take 2 to 3 business days.

I was on call for more then an hrs on every call to just to get my account balance and Monday customer service manage manage to give me a partial letter which is not what i needed until today ( after a week) no letter been sent.

Please be away form this bank. I am in the process of moving my account to another bank. I really regrade why i use this bank in first place.

CPO

Ananth

In respect to consideration of this issue for a future merchant account, this article should help: Best Merchant Accounts for Great Customer Service.

-Phillip

May Eudora Gilley

Horrible UI, support is non existent. Switched from using Square and have regretted it every day! Hidden fees, unclear “rewards” just skip it if you can!

Ruben Garduno

STAY AWAY. Loaded with hidden fees. long waits to reach customer service, they can hold your Money so it takes 10 Calendar day before it’s credited into your bank account. They would rather lose a customer rather than adjust a simple thing such as reduce the amount of time they hold your money.

This post will help: Eliminate Hidden Fees From Your Monthly Bill

-Phillip

William Lefear

Our company has been in existence for 4 years now. We recently received a payment of $12,500 from our customer using Bank of America Merchant services. This was our 2nd transaction through BOA merchant. The first transaction took place earlier that week. We have never to this day had a charged back transaction from a client to this day. Bank of America held the payment HOWEVER charged us the processing fee for the payment! It’s been 12 weeks and they are still holding the funds. There has been no charge backs no this payment or any other payments. They furthermore called our customer to verify the transaction. This made us look EXTREMELY BAD IN THE EYES OF OUR CUSTOMER. BoA merchant is also STILL TAKING MONEY FROM OUR BUSINESS ACCOUNT for merchant processing fees. We haven’t used their services since they kept the $12,500. We still have not received the money until this day. Never do business with them if you don’t want your business to go under or if you want to make sure you receive customer payment for your service. Fortunately we have funds available for use or we would not have been able to service our customer who paid US $12,500 in which Bank of America unfairly took from us. Had we not had the funds available from other sources we would have lost a client and credibility for our business. Many businesses don’t have capital to replace this issue like we do. BOA is a Horrible company to work with especially for small businesses. LISTEN NOW SO YOU DON’T REGRET IT LATER.

This post will help: How to Make Your Payment Processor Release Your Money

-Phillip

ryan anderson

its all good until you have a customer dispute a charge, the BOAM website for disputes is so awful. Like 1990 of websites I JUST WANT TO DISPUTE A CHARGE ITS NOT THAT COMPLICATED. have to “enroll” in dispute services (THE WHOLE REASON I LOGGED IN TO THE SPECIAL DISPUTE WEBSITE) then they didn’t attach it properly and I have to re-enroll on my end. shoot me in the face

This post will help: How to Fight Chargebacks and Win

-Phillip

mary flores

i puchased the clover go about 6-8 months ago, when i went to make my first transaction the machine was not connecting so i called clover and they troublshot my device and said it was not working i had to purchase a new one. I purchased another device which did not work either. but they had the nerve to tell me i cannot send it back and they charged me for shipping and handling which i was never made aware of. CANT WAIT TO GET OFF THIS LEASE

This post will help: Best Mobile Payment Processing Apps

-Phillip

Lucia Craciun

For anyone looking for a merchant account please stay away from Bank Of America Merchant. They make it loos so easy and it might seem fair price for your clover device but believe me they are ripping people off. They will sign you up for a long term contract and you won’t be able to get out of it for a long long time. I closed my store last year and I called BOA Merchant customer service to close my account immediately after I shut down my business. They were unable to cancel my account unless I pay over $500 cancellation fee so now I’m stuck to monthly fees until next year. They should be more supportive of small business as we are the ones who work hard to make the magic happen … but instead they will lure you in and if your business doens’t go according to your plan you will be stuck with long term fees. There are many other companies out there to chose from …. This is my experience and I would like to share with everyone. Please don’t make the same mistake I did.

From The Editor

This Post Might Help: Cancelling a Merchant Account Without Paying a Fee

raul reveron

BOA merchant “service”, total scam we have being hacked terminal and although we file a police statement, when thru all the procedures and even more the company is not answering> We call BOA and got told that they just sell the service but it is not them actually who run the whole show so we must call some shady company with a risk manager that does not answer its call , there must be something we should be able to do against this people.

From The Editor

This Post Might Help: How To Report a Bad Credit Card Processor

Artak Harutyunyan

I like BoA banking, but their merchant service is a total rip off. We came to them a start-up and all they did is hidden sold unbelievably expensive credit card machine.

And now, after making 33 payments for than $1000, I still owe them more than a $500. All being said, I never used the machine, ever. When I called them to send the machine back, they said they’ll waive the interest if I pay the remaining balance and send the machine. Robbery

rashmi patel

Stay away from BOA.

credit card industry is deceitful.

BOA is deceitful.

Their sales rep are liars.

My decision to go with BOA has been very expensive.

About to switch to Square.

Double checking everything to make sure i don’t jump from skillet to a frying pan

Clyde Swalwell

Bank of America Merchant Services in tandem with Clover Card Reader is a huge scam. Using Bank of America Merchant Services was a huge mistake and cost my company thousands of dollars. The support is horrible, there are hidden fees, and they do everything possible to steal from you. Using BofA and Clover was the biggest mistake my company made this year. Do yourself a favor and stay far away. Considering a lawsuit against BofA because of the awful merchant services.

Melissa

Can I ask what you need up going with? We “were” considering BofA, but not so sure after reading all the reviews including yours.

RDees

I have tried to cancel the card reader on my account for the past 2 years. I CALLED MBailey to inform her that I purchased a card reader from Best Buy and did not need the service. She told me that I would not be charged for the reader, but since then I have been billed monthly for their service. I have never swiped a card with this company but they persist on giving me the run around and threatening me with a huge cancellation fee. I no longer bank with BOA and the business account was closed years ago. Please let me know if someone is planning a class action lawsuit against this company.

T N Dinh

Do NOT do business with Bank of America merchant services. When you sign up with them, they will tell you that your fees will be less than 2%. However, they have a LOT of hidden fees. Even when you ask them directly about the fees, they don’t give you a clear answer. They tell you that many of the fees will vary. Then they tell you that the fees are not hidden because it’s written in the fine print of your contract. As an example, the last transaction I ran with them before cancelling was for $650. They charged me $65 in fees for the one transaction. There are a ton of other merchant services available. Avoid Bank of America merchant services at all costs! I am not the only one that feels the same way. Just do a search for their online reviews. Nearly every review is negative – see for yourself.

Dám tran

You are totally right

I’m closing my account today.

Karen

# 1 in cheating. They had all the hidden fees that you are not aware of. The customer service is horrible. No one is responsible for any mistake. Worse experience ever!

Shaun H.

My review is “Stinky Garbage”

I would have to admit, I was sold. All I wanted to do was change the name of my business on my Checking account, and B of A made me close and open a new account with my new name. That was fine, but then the agent said I should sign up with their Merchant Account, instead of what I was using (PayPal, and Square). He assured me it was much cheaper to go with BAMS, and he then rolled into a used car pitch, unfortunately I took the bait. Thinking it was easier and Cheaper.. IT IS NOT.

Now comes today: I had to close my business due to low income. I closed my Checking account, no problem, I call to close the Merchant account … $500 early termination fee. That’s right, don’t close your business, because Bank of America, will take you to the cleaners. I have paid them thousands of dollars in transaction fees over the last 2 years but yet, I still owe the man $500?!?!

I admit to not have read the 36 month term clause; my bad. I would have never signed that, as I don’t like signing a 24month on my phone, and I know for a fact I will be keeping that, but to charge a closing business $500 because we can some how foresee the future, is ridiculous.

It’s also harder to get information from them, then it is the IRS. If you have 1.5 hours to call their Customer service you will have to recite your account number a minimum of 7 times.

USE SQUARE or PayPal, you can cancel at any time.

Dave

BofA client for 12 years. BofA has frozen our merchant account claiming our terminal ‘may’ have been hacked and is withoulding 100% of our deposits… for SIX WEEKS. We have had 0 chargebacks in 12 years and they are now holding 100% of our batches in a suspense account for 6 weeks. We have no operating cash flow now. They NEVER notified us of this and we have been fighting with them every day. Hold times of 1-2 hours, customer service departments that do not talk to each other or can’t due to incompatible computer systems. NEVER A CALL BACK. NEVER AN EMAIL BACK. Just horrible. We have had to hire an attorney and are going to sue them.

As for rates—EXCESSIVE would be an understatement! You need a PhD in math to figure out their statements.

Arnaud

I used the merchant account of Bank of America and canceled it. If you want to see what an organized crime looks like, get their merchant account. And make sure you read the contract. They’ll charge you for things you didn’t even know exist. they have a horrible customer service and am just glad I won’t have to look at this account anymore. It was even worth it for me to breach the contract and get charged $500. Banks I tell you are just another version of the Mafia. If you need to accept credit cards just stick with Paypal or Stripe.

James

Beware, they raise your rates constantly and often. Even after agreeing to match a competitors rates, they quickly bait and switch you.

Joe Jitt

I contacted Bank of America merchant service as I’m expanding my business and I’m interested Clover station and to see if BoA will beat the rate I got from EVO I currently used. George Smith is your rep I talked to. I sent him my statements for a review and he stated that with EVO I got 0.22 + 0.05 V/MC or $0.20 For American Express and Discover. What he could do is 0.15% +$0.10 for all.

As you know, this number didn’t tell the whole story so I asked him to take one month of my statements, calculate and show me the break down number. I want to see how much and how I save money. He gave me a sheet. It showed it was saving my money but without Auth fee calculation included. Auth fee is a big factor and hardly be ignored to evaluate the credit card fee. Obviously with this fee, his offer won’t beat the EVO’s rate.

I’m very disappointed that George tried to deceive and I pointed it out. His excuse is he made a mistake and comeback with another lower rate. This experience told me that Gorge and Bank of America merchant services are not honest to the customer. The credit card rate is complicated and you take that advantage to deceive customers.

I’d wouldn’t be upset if this from crook people who called me every week, try to deceive me with a low rate. This is Bank of America and I expected far better.

Gorge Claims “We always win on price Joe and have lots of happy clients to prove, millions of clients actually.” Wow how many people fell to him and ends up paying more!

—

Are you with Bank of America? Learn how to resolve this complaint.

Jose Solorio

They teased me with interchange +.10 basis points and no swipe fee. Under the radar they suddenly sent notifications of rate increases by the time I finished I was getting charged .15 per swipe which was more expensive than the .05 I used to pay. Then they slapped me with a 139 dollar annual maintenance fee.

—

Are you with Bank of America? Learn how to resolve this complaint.

Brian Morgan

{{{ Broken Promises }}}

Merchant Omar Bogor stated that he would take care of all lease agreements on a buy out of the other bank merchant services accounts, Never Happened, those lease agreements went to First Data Global Collections Dept. After AmTrust Bank Merchant Services were not getting there payments after 90 days they had the collection dept send in a negative credit report. Now we have a bad hit on our credit, On going actions as we speak. Notifying proper authorities Any one eles with this problem please contact me.

—

Are you with Bank of America? Learn how to resolve this complaint.

The Spokane Shop

I have signed up for a month to month no contract merchant service and when i wanted to move on and then to find out that in small fine print i do have a contract and secretly charged me $500…. you know what.. That is a not a good business! would not ever recommend you to no one in fact i will make sure to educate them of what has happen to me so they don’t fall into the same trap.. No Thank you!

—

Are you with Bank of America? Learn how to resolve this complaint.

Tica

I’ve been trying to reach Bank of America services over the phone but they are backlogged and an automated message tells me to call back later.

I hope someone here can give me some insight on the following. In addition to processing fees I’m also charge a monthly wireless fee of $15 and a monthly transamor solutions fee of $19.95. Looking back at my statements I was also charged a $94 annual account maintenance fee in 2012 with the rate going up to $134 for 2013 and 2014. The monthly transamor solutions fee of $19.95 was added to my account in march of 2015. I’m wondering if this fee is in addition to my annual account maintenance fee or in lieu…I was expecting the annual account maintenance fee to be charged to my account today but it was not. All the other fees were. Anyone know about this?

michael pennington

I can not use BANK OF AMERICA MERCHANT SERVICES ON MY WEBSITE. They have no shopping cart even though I was told they did when I was strong armed into signing up. They expect the costumer to figure tax and shipping then enter that amount on their own. DO NOT USE THIS SERVICE the only way to get out of it is by paying the entire monthly service fee for the three year period you must sign up for. DON’T BELIEVE A WORD THEY SAY!!!!

Eric McNamee

Michael,

No credit card processor that I am aware of has their own shopping cart. The payment processor utilizes a payment gateway to integrate with the shopping cart you use for your site. If the site you use does not have it’s own shopping cart then you can use Volusion, Magento, QuickCart etc. eProcessing Network has their own shopping cart along with the payment gateway (which can interface with any payment processor). I however would recommend using Authorize.net and Volusion for security and ease of use.

Danny

Yes, Bank of America is ridiculously high in fees especially now with all these other payment systems coming out. I am wondering if I should just cancel. I have been with them for about 7 years. I initially opened the account with Chase which was a partnership with Chase and First Data, then the partnership stopped, it was serviced through First Data for 2 years then it was bought by BofA.

So the puzzling system they have me on is that the “Gateway” is still under Chase for the Orbital but it is serviced by First Data by managed by Bank of America. Getting anything resolved is a huge pain, because depending what you need you have to contact the right place.

Also with the Chase Payment Tech provided by First Data and owned by BofA the shopping cart solutions is also very user unfriendly, if you switch shopping cart you MUST contact Chase to add IP’s and go through specific protocols to make it work. As with Authorize.net you just need the codes.

Right now I am just with BofA due to my history of 7 – 8 years where I have a spotless record. I am not sure if I should just cancel and go somewhere else and if these additional fees are comparable, there is a statement fee of $20, transamour free of $20 per month, then you have an account fee of $15 plus the transaction fees.

—

Are you with Bank of America? Learn how to resolve this complaint.

Cinthia

The worst costumer service. The add on fees for using their mobile app. ($9.99) and $19.99 for monitoring. say they send you a notice and just charge you. Its a complete rip off. I will part ways with bao. Wort bank ever. Us bank is definitely better.

Carolyn's Hair Design

Do not go with Bank of America Mobile Pay! I have been a customer of Bank of America for 23 years. I have my personal accounts along with my business, credit cards and merchant services with them. They enticed me to move my merchant services over to them 2 1/2 years ago promising the lowest fees. That lasted a year and all of the sudden my fees were going up and up. Running the same amount of money the second year I was charged over $600 more in fees. Now an extra $26 a month has been added on top of that. My representative tried talking to the retention department after I threatened to pull all of my accounts with them and leave. They said that’s fine. WOW! That’s what I get after 23 years of loyalty.

Suzanne Nelson

Bank of America merchant services just canceled my account with out notifying me. I was charged $500 that that put my bank account in to overdraft with a $35 fee. I called bank of America merchant services to resolve this and was told there was nothing they could do to resolve this. The bank will of course return the $500 and merchant services will then charge a return fee which will also get returned and guess what they get to charge a return fee for the return fee! I went though this with them just 2 months ago, they will charge 3 or 4 return fees before it is sent to collections. The 2 reps. I talked to today would not even work with me, I was told I could set something up after it is sent to collections, that is only after more fees are racked up of course. If I had $500 I would have cancelled them myself. I to was lied to when I signed up for this account. There once was a time when someone’s word ment something. The merchant service sales rep. said nothing about the monthly fee, annual fee, getting security certified or the fact it was a 3 year contract with a termination fee. I asked questions about the fees and charges only to be assured that they would always be cheaper than square. I told them I had a seasonal business and would not use merchant services for 6 months out of the year, they of course said nothing about the $10 fee for not using them. I have nothing but good things to say about square, I’ve been using them for years without any problems! Has anyone tried to bring a law suit against them for all this?

Merchant

I too have experienced the fradulent practices of BAM Services. The sales rep told me that it would cost me absolutely nothing to cancel my services including cancelling the equipment lease. I found out I couldn’t cancel 2 months later. I’m livid because I have a 48 month lease. Their tactic is to persuade and lie to consumers about the lease terms hoping that you will not read the fine lines and hidden fees.

I WOULD LIKE TO SEE A LAW SUIT AGAINST THIS PRACTICE!

Eric McNamee

Your lease is held with First Data Global Leasing and your merchant account is held with First Data. As per the lease I see a lot of merchants fall victim to the promises of “no cancellation fees” which is a shame because it puts a damper on reputable companies.

As per the merchant account consult with your bank manager. Explain how the rep said you wouldn’t be under contract and misrepresented the offer. Most of the time they’ll help but if not consult the BBB and your inform the bank manager that you will be issuing a complaint with the FCC as well as the states attorney generals office for fraudulent practices.

As per the lease you may be in luck though. Every lease that’s written requires a verbal lease verification after the terminal is delivered. They contact you and verify you’re the account holder the go through the lease parameters line for line so you are fully informed on the 48 month term that is non-cancellable. If you didn’t verify the lease then the lease doesn’t get funded and the rep doesn’t make their commission. All lease verification’s are recorded too so First Data Global Leasing should have a that record. If not then you can decline the lease terms and get out of the lease agreement. Their phone number is 877-257-2094, make sure you have your merchant ID available and also get your leasing # from the bank as they should have that record on file as well.

Obviously if you did not verify the lease yourself and they have a recording of the lease being verified then you’re open for a pretty nasty lawsuit against the representative at Bank Of America. The same scenario happened a few years ago with a guy in my area where he was verifying leases for his merchants and raking in a LOT of commission. He’s still in prison for fraud.

Mr. Chippy

I totally agreed with many of the comments. BoA uses deceptive sales tactics. We were surprised by a lot of fees. Additionally, after months of repeating & broken promises, BoA still have not provided us with the Apple Pay Machine and Rebate.

Cal

Run, run and run a bit further. I cannot believe I didn’t do my research prior to getting into this. 1st when I opened my biz checking account (at the Midtown ATL branch) the guy was like yeah, you should speak to our BAMS rep to get switched from Square ( that I never had a problem with using and should have never went to BAMS and will be going back to them now). So I had him to have the BAMS rep call me. She called me repeatedly trying to get the sale. Being the snake they are, she persuaded me to go ahead and sign up (on claims that BOA swipe term was so advanced and secure than Square/PayPal. NEVER told me about a 3 year contract (I would have definitely said NO right then and there) NEVER said anything about early cancellation fee and totally miscommunicated with me on all the quarterly fees! Then she had me do all this over the phone. She sent me a long winded mobile contract and was like initial here, here, there and there. I didn’t even know what I was doing (my fault). Then after the 1st month, all these random fees with no clear description started to appear on my bill month after month. I could never get her to call me back at the same rate she was calling to sale/rip me off. So I had to pay the $500 ETF. Therefore, I will always be an A-hole when it comes to contracts (from anywhere and will start to record the transaction to combat BS later) and will be writing a detailed blog post on my site to do all I can to make other biz owners aware of BAMS.

In essence, just use PayPal or Square to swipe cards and pass applicable fees for use to them…otherwise tell them to use cash/check/MO.

Eric McNamee

As much as I agree with you that Bank Of America sucks the big one with merchant accounts I strongly disagree with your advice that merchants should use Square or PayPal. Square is backed by Chase Paymentech and they have no phone number for support. If you’re a micro merchant (less than $5,000) with sporadic sales then use Intuit’s GoPayment. At least they have a number for support and also cheaper than Square.

PayPal though is a joke. Same scenario with lack of support and they’re not even a processor nor a bank so they don’t have to follow and regulatory rules. They constantly freeze merchant accounts for no valid reason and their resolution process takes up to 9 months and usually favors the customer, not the merchant.

I work for a payment processor however I am not here to solicit business. You are correct that you should have researched the industry a bit first and a lot of merchants fall victim to the “well, I bank with XXX so they’re going to give me a good deal” routine.

If you’re a higher volume merchant Square isn’t the right solution. If do decide to open a merchant account with a bank or processor specifically request for “Interchange Plus Pricing” with a markup below 0.50% and a per transaction fee of $0.10. Also make sure you get a $0.00 early termination fee in writing.

If I were you I would also speak to the branch manager and tell him that the BAMS rep did not disclose the contract terms and pressured you into signing up. Then report the representative and the location to the FTC. They’ll probably issue you a refund on the undisclosed costs.

Cal

Thanks, I will be sure to add my complaint with the FTC because what they are doing is crazy/illegal, yet alone how they get bailed out and never look out for customers!

Sam

I think bank of america is a joke. I have encounters many issues related to my bank accounts and everytime they just make a lame excuse that its System Error and we are sorry about it. They have wasted tons of my time in calling their customer services why my account showing negative balance even though I have enough in my account.

Their working hours is like they are sleeping most of the time. In washington state their services start at 10 in morning..really

Stay away from BOF.

Wade Soul

I went in to bank of America on June 2014 to open up a business checking account and the manager who I was dealing with there asked me if I take credit cards and I said I do then she asked who was your provider and I said Square so she said we have Bank of America merchant services and we can beat squares pricing so I said well lets see what you have to offer, she made a phone call and put Assonta Lysius who was a representative from Bank of America merchant services. I asked her a few questions about there rates and if there was a long term contract, her exact words were we charge 1.9% for Visa & Master card and 2.75% for American express and there is no contract whatsoever and u can cancel anytime with no cancelation fees. As Assonta faxed the contract to Bank of America I noticed the rates were different on the contract, I pointed out that was not the rates I was told. So she said sorry it was a mistake on the form. Things were looking a little fishy but Assonta said have no worries we are cheaper and better then square. Long story short I ended up going with Bank of America merchant services and OMG they charged me $35 on $700 credit cards that I accepted. They have all these crazy fees that they don’t explain to you so they ended up charging me about 5%. So I decided to cancel and come to find out its $500 to cancel your contract that I should I have never been in the first place. Everything they told me was a lie and a scam. Thank god the person that I was dealing with when I went to go open my business checking account heard both of us talking on speaker and she heard the whole conversation. I called the manager at bank of America and explained my situation to her that she was there and heard the whole conversation with me and Assonta and she said you should have not had to pay that high of a percentage and that I shouldn’t have not been in a contract. So she contacted Assanta and said why did you lie to my client about the charges and contract. So she was able to cancel my contract with no fees. WHATEVER YOU DO DONT GO WITH THEM. I PRIMISS YOU YOU WILL REGRET IT. HOW IN THE WORLD DO THEY GETAWAY WITH THIS, IT SHOULD BE ILLEGAL. IM GOING TO TAKE THIS TO MY LOCAL NEWS AND EXPOSE THEM. STAT AWAY!!! STAY AWAY AS FAR AS YOU CAN!!!!!!

Eric McNamee

Wade,

From your scenario it seems that your branch of Bank Of America actually underwrites their accounts through First Data. First Data is the largest payment processor in the world and their pricing is often Tiered pricing. That 1.9% flat rate was more than likely your “Qualified Rate” and they failed to disclose the Mid and Non Qualified rate downgrades. And quoting 2.75% for AMEX is a load of crap considering AMEX wholesales at 2.89% swiped and 3.5% keyed. There is new AMEX program called American Express OptBlue which does offer much lower AMEX rates for all business types however I highly doubt the BoFA rep offered that because not all companies have access to OptBlue.

If you want a merchant account that is affordable ask for this exactly and you’ll be setup correctly.

Interchange Plus pricing model

Percentage markup: 0.25% (very fair for a new business)

Authorization fee: $0.10 (unless you’re small ticket <$25 then $0.08 authorization)

Monthly Minimum: $0.00

Industry compliance: MONTHLY at $7.95 (also very fair for a new business) Unless you use a signature capture pad then compliance should be waived.

Early Termination fee: $0.00

Setup Fee: $0.00

Equipment: Purchase a terminal. Don't lease one, it'll eat you alive in true cost. There are terminals for a couple of hundred bucks you can buy just make sure it's EMV ready and NOT locked. Keep in mind Free Equipment = Inflated surcharges and early termination fees.

Also make sure the fees are taken out monthly versus daily. This is called the Monthly Discount. It will make it easier for you to determine your effective cost each month.

[Redacted section – Promotional/contact information not allowed.]

ralph t foster

After decades dealing with this most incompetent group of people I have ever had the horror of associating with — BANK AMERICA MERCHANT SERVICES and the terminal is now in the trash. I do not know how they train those people but they can waste your time faster with so much misinformation that it borders on criminal intent–One comment was words to effect that “Your must change your system for the new and much more costly one — as Congress has mandated it in some new law or you could go to Federal prison if you do not”–OK I WILL GIVE THEM THE BENEFIT OF THE DOUBT–THEY ARE JUST STUPID–the pit of the labor force. THE BEST COMMENT WAS “YOU HAVE TO GIVE THE COMPUTER TIME TO THINK” FIVE HOURS WASTED TO GET A $108 CREDIT THAT WAS EVEN AUTHORIZED. THEY STINK!!

Eric McNamee

Hey Ralph,

Unfortunately this is the most common scenario with merchants who opt to use their bank as a payment processor. Think about it, reps at banks are trained for one thing: Generate as much revenue to the bank as possible. They aren’t trained on the true workings of payment processing whatsoever. That’s why it’s best to deal with ISO’s as they tend to offer the best pricing to accept payments. Never accept a merchant account unless it is the Interchange Plus pricing model, is a month to month agreement provided in writing ON the paperwork and that you have more than one phone number for support.

Also it’s important to note that there is no such thing as free equipment. If the terminal comes at no cost they’ll charge for it somewhere else. That’s a guarantee.

Wendy hobbs

BOA merchant services are terrible. They are not for small businesses; charge lots of fees and offer faulty equipment. Their services or lack of cost me a lot of inconvenience, time and money for me and my clients. Awful!Just awful.

Nicholas

Horrible, confusing, and expensive. You’ll be charged more fees than you can imagine, and it is IMPOSSIBLE to figure out what rates you are actually paying. And the $500 termination fee is just plain predatory. STAY AWAY!

brian

I was mislead and am now stuck with a costly device for 4 yrs. The hidden fees were never

discussed and the monthly fee is twice as much as the original price. Crappy customer service that

ends up transfering 6 times each time I call. I received nothing as promised. Look before

you leap.

Eduardo

All of our accounts with Bank of American were closed by the bank in February. We were given no reason other than it was permissible under our contract. 2 business and 1 personal account, totaling 6 accounts and 2 credit cards. We lost a lot of business but quickly moved to another bank.

Much to my surprise I received a collections notice from Bank of America Merchant Services in late May. They kept charging fees and didn’t close the account until early May. They claim to be separate from BofA and that it was OUR RESPONSIBILITY to notify them that they had closed our accounts. They also charged a $500 early termination fee even though they are the ones that closed the account. There were no notifications of fees over the last 3 months.

Edgar Magallanes

My name is Teresita Magallanes, I owned Manila Florist HQ, a Home Based Flower Business. I signed up for Bank of America’s credit card processing using their smart phone attachment similar to “SQUARE” and “INTUIT” credit card reader. The contract that I electronically signed specifically states that there is no monthly fee for the service, after a month of doing so, BOA started charging our bank account $25.00 a month, I disputed this to no avail, finally I want the service to be discontinued, because this the same service is available for free with SQUARE. Now BOA charged me another $100.00 for early termination. And so I requested a copy of the contract that I signed which they sent thru Fedex. I found out that THIS IS NOT the contract that I electronically signed (I saved & kept the email contract stating there’s no monthly fee) Can they do this? Please we need help.

Edgar & Teresita Magallanes

Edgar Magallanes

We have a home based Flower business and I needed a way of accepting credit cards.

I have SQUARE and INTUIT card reader (which is FREE) that I have used in the past.

I signed up with Bank of America because we have our checking and savings there.

Our business account was with them too.

I was specifically that the service has no monthly fee just like SQUARE and INTUIT just certain

percentage of the total amount everytime that we have to use it.

After a month Bank of America started charging $25.00 a month for merchant services.

I wanted to cancel the service now they wanted me to pay another $100.00 cancellation fee.

DO NOT SIGN UP TO THIS SERVICE. THE REPRESENTATIVES WERE VERY DECEPTIVE.

THEY WILL CHEAT AND LIE JUST TO GET THE COMMISSION

Sharon

I have had a horrendous experience with Bank of America merchant services. I have never had a charge back yet because I had a better then expected month in January they called and told me that they would need to keep 50% of all of my transactions up to the value of $50,000 as they now deemed this money at risk. I asked when this would be returned and they said perhaps in a year but it all depends. I cancelled my account in February and despite STILL NEVER having any chargebacks they are still holding $5,000 of my money 8 months later.

I have used Square for 9 months who have been FABULOUS!! I get paid out in less the 24 hours in all cases and have had none of the issues that were created by Bank of America.

Jerry

I had very bad experience with Bank of America Merchant Services. It’s a scam ! The first salesperson promised not commitment by use their services. She give me a promotion” not charging for device ($100), monthly service fee ($10) ”and flat rate 2.75% by using their device at least one year” when I decided between B-square and Bank of America Merchant Services. She called me , and said B-square has bad customer service and high rate transaction charging fee. They are “ THE BEST” company. After I signed the papers, the first salesperson disappeared. There was other guy contact with me after that if I had questions. Today the accounting manager called me, tell me different store… I bring all my documentation to the bank of America this afternoon. The personal account manager called merchant customer services. but they believe I signed the papers that mean I agree with 3 years contract , even they can’t provide any paper I signed with words ‘3 years commitment’ … All four people from bank of America merchant services have their different stories I can’t even trust one! The only thing they want to do is taking your money from your pocket! If you want your life become worse TAKING THEIR SERVICES! AMEN!

Navin Johnson

I loathe BofA. I started with BofAMS for mobile card processing so I could accept cards. They lied about being able to cancel as well as the fee schedule. Their promised 2-2.25% became 3.5-3.75%. DO NOT US THEM!

Jackson

Bank of America Merchant Services “SOLD” me on the fact that I could cancel at any time. Once I cancelled I had a bill for 1200 dollars, stating I owed for the terminal. Upon reading the contract carefully I found out they had contracted another company to lease me the machine. And that company would not cancel the contract. I was a victim of a classic fast talking salesman scheme. The Representative Vijay Givens, intentionally mislead me to make a sale. Not the type of service I expect from Customer Service.

G

I was a prior sales rep for the company in 2012 covered 3 markets and the organization is terrible to work for. When I first started working for the bank, they cared about the client. Now all they care is about POS revenue and bill-back surcharge pricing, which kills the client and leaves a bad name for the personal bankers that refers the clients.

The leadership comes from Wells Fargo and looks like they just hire Wells Fargo reps the last 3-6 months. I worked 50-60hrs a week and it was so not worth it. Dealing with uncooperative banking center managers and personal bankers that can’t sell or consult makes this job even harder to do.

Now that I’m still dealing with HR for Nov/Dec commissions for over a month now, it’s made my experience even more a challenge and I’m very upset that I put that much work in. I feel squeezed and embaressed to be apart of that organization that I help built and made a name of.

I feel bad for all the bank clients and business owners that have to deal with an organization that only cares about revenue not the client. It left a bad industry taste and I will never work for corporate environment again. I wonder why they aren’t on the BBB, they are just a partner to the bank that kills relationships.

HKK

Our local BOA banks were purchased by a local bank but I had decided to stay with BOA merchant services since I’ve been with them for 10 years. When I called to give them the new account information they said it’s all good and everything’s updated. Until I realized my batches were not transferred to my new checking account. I called and they said they don’t update such information over the phone so I need to send them a voided check to show proof. I did. I called back again and everybody was giving me the run around. This was 03/27 batch which I still haven’t received the funds for. Today, I called and spoke with more idiots who kept giving me the same answer : “We’ll send an e-mail tour reject department. ” Basically, my 03/27 batch was submitted to my old bank account which is closed since 03/25 so they sent the funds to their reject dept. Now I can’t get my money back. As soon as I get my funds, I will switch to another merchant company.

Ed

I agreed to my BofA Merchant Services account over the phone with a Merchant Services rep. I was never told about the $95 yearly service charge which made my account overdrawn. The Merchant rep sent me a copy of the paperwork which had my signature on it but it was a cut and pasted signature. My lawyer says this is fraud. Has anyone else experienced this cut and paste signing of the contract? Also I was not told about the $500 termination fee. Has anyone else taken BofA to court over this? What was the out come?

Karol

I talked to their Legal Dept. on a chargeback issue, and the lady in the Legal Dept said I signed a contract and that she had a copy of it. So I demanded that she send me a copy (I know I didn’t sign anything). Then she just sent me a copy of the form transition letter claiming that we had entered into the agreement by completing the terminal software update. It seems that they are hoping that you’ll go away by just telling you that you have signed an agreement, like “saying so makes it so” — it’s either arrogant or incompetent, or both. Have their Legal Dept ever heard of Statute of Frauds?

Jerry

I am trying to cancel my BofA merchant service account and was shocked to hear about the $500 early termination fee. I was shocked because we specifically told the sales agent we did not want a long term agreement due to a bad experience with another company and we have no record of ever signing a three year agreement. Somehow, BofA came up with an agreement that they claim I signed but it does not look exactly like my signature. Furthermore, the sections of the agreement that should have been hand written by me are all typed. We are now considering a lawsujit against BofA for fraud and forgery. I would be very interested if others have had a similar experience with BofA.

Whitney

Jerry, I have had the same problems. I used Bank of America because they promised that if I could find a better/cheaper service then I would get $500. They told me about what they charge per transaction and that I would NOT have any monthly or yearly fees. My sales associate told me that I would only have a $35 start up fee. Since then, I have only used my merchant services account ONCE for $50 but I have been given over $340 in fees. I have been in tears because I’ve felt so defeated dealing with them. When I received my mobile equipment, someone called to walk me through how to use the app. He had me get one of my own cards and charge $1 on it, which we then refunded. A month later I received a collections notice for $135. The $35 was for the start up fee, the $100 was because when I rang up the $1 there was not a correct acct number to deposit in. My sales assoc had entered in the WRONG acct number to link to my mobile card reader. They tried to charge me $100 for her mistake. I also tried to get them to waive the $35 fee because of this mistake. What if I had actually charged someone a substantial amount? That NEVER would’ve made it to my account AND I would’ve been charged another $100 fee! They finally agreed to waive the $100 fee but would not waive the $35 fee. One month later, I noticed that my business account was drained. I am trying my best to open a new bail bonds business. Just like any new small business, money doesn’t come easy. I had a very small amount in my business account but Bank of America took $95 without notice for a “yearly charge”. My sales associate NEVER mentioned that I would have to pay $95 a year, NEVER! When she met me for breakfast to just “apply” for the service (which I now realize that she had me signing a contract that I was never given the opportunity to read because it was on her laptop and she would just have me type things here and there and then I signed an electronic pad, I thought I was just signing the application). So now everything I have worked for has been taken by BoA. This weekend I received ANOTHER collections notice saying that I owe them $200 for past due monthly fees. 1) I’ve never gotten a bill from them, only collections notices and 2) I was told that there would be no monthly fee. Luckily, the customer service rep this time was very friendly and after listening to my story she agreed to waive the fees. I said that I just wanted to cancel my account and she informed me that there is a $500 early termination fee. WHAT!?! I would have NEVER signed a contract agreeing to that if I would have known. Apparently it is a 3 year agreement. I am trying to start a new business that I don’t know if it can make it ONE year, let alone THREE. This is robbery! I was duped into signing a contract when I believed that it was only an application. There should be criminal charges brought against these sales people and this evil cooperation. If all else fails I will just close all BoA accounts and never pay them. I have outstanding credit and I hate to ruin it over these crooks, but I’ll be damned if I give them another dollar. If you get a class action lawsuit going, you let me know! I’m in!

Jackie

Jerry:

I have also been misled by BofA whom I trusted because I have all of my personal accounts there. I was actually with another merchant services company. The salesman asked me to bring in what I was currently paying and he promised to beat that. I was not told about the yearly fee or the additional monthly fees even if I am not using the service — or the biggie — the $495 cancellation fee and the 3 year contract. I did not agree or was I aware of any of these but they informed me that I signed off on everything.

Where are you in your battle? Any suggestions?

Eric McNamee

Here’s your best bet. When you sign a merchant account application with Bank Of America you are actually signing with First Data. First Data has what’s called a “Program Guide” which outlines the rules and regulations set by the card networks. It’s about 28 pages long but there is a clause in there that states the contract terms and termination fees. I bet when you signed the three page agreement with Bank Of America there wasn’t a section that had the “schedule of fees”. You basically went with the word of your banking rep. Banking reps don’t set up the accounts, they call the “merchant services” department who then sends down the paperwork. So you may have signed an agreement that pertains to the program guide without ever seeing the program guide.

Bring in the bank manager on that and say “well if I signed an agreement without ever seeing that part of the agreement and you didn’t disclose that to me then isn’t that fraud?” Then demand they cancel your service without the termination fee (trust me, all processors have the option to waive a cancellation fee) and you should be good to go. If they refuse, file a report with the BBB and your state attorney generals office and the FTC.

Irene

Do not use Bank of America Merchant Services, its the worst business decision I ever made in my life.

I was told there was no contract this is why I started using there merchant services.

There’s a $500 early termination charge, if you decide to discontinue the service before 3 years. They do not tell you this when you signup.

There are a lot of hidden fees that are not explained during the signup process. I was told there was only a 1.64% and an additional 1.00% if you do a manual entry.

At first the card would slide just fine then after a month of using the equipment I had to enter most of my cards manually and I started getting additional fees.

If you have less than the agreed monthly transaction, then a flat fee of $25 be applied to your account monthly. This is what is told. I was getting charged $15 fee even when i was meting the required transactions. plus other fees.

I have business accounts and personal accounts with BOA and it is the time to cancel them now.

Jerry Rega

The exact same thing happened to me regarding the $500 termination fee. To make it worst, BofA presented a “signed” contract that I never signed.

[redacted contact information]

John F. Burke

Due to the ineptitude of a local BofA manager, we closed our corporate accounts and moved them to another bank. We also advised Merchant Services that we wanted to close the account (we had been First Data for years before moving to BofA at recommendation of our bank). They said it would be a $500 cancellation fee — I said leave the account open, send us monthly bills, and we’d wait out the term without using the account. We then followed that conversation up in writing requesting that billings be sent to us, since the checking account was closed.

At the end of the month, they tried electronically debiting the closed account and it was refused. When seeing that we again sent them a letter saying to send us the bills by mail or email. Today we get a bill from collections for the $44.95 fees and $100 penaltty. We will now be closing all remaining accounts with BofA and moving them elsewhere while we fight this outrageous billing practice. Our new bank, by the way, has no penalties for terminating merchant agreements — and they’re less expensive. By the way, we were a totally electronic account — no hardware or equipment.

Aliya

I had 3 merchant accounts with BOFA for the last two years. At our first location we have used FD50 terminal which we leased, although when we opened second location our merchant card specialist recommended wireless terminal FD 400 ti. We signed all papers; he said that we would pay $43 a month for leasing it and since our location is only for summer-winter season we could save money on equipment . We switched to the wireless terminals, and I sent non wireless terminal to them with no problem. In December 31st I called to our credit card specialist to ask about sending back all two terminals. He said that (surprise) we couldn’t return them since we signed lease for 48 months! Then he said that it is his fault that he didn’t let us know about terms of contract and he would try to help us. In two months he e-mailed us that we could buy them for $795 each, how nice, we paid $43 for leasing them for a year and now have to buy them for the price much higher than they are on the market. We agreed to pay $1600 for these terminals, signed papers, I sent them on time. In a month there wasn’t any e-mails from our merchant assistant about it. We closed business in January 31st, I called to BOFA merchant services to cancel all our services with them, double checked if we have any outstanding balances since we were not going to keep money on our business account, and I didn’t want them charge my account and get overdrafts. In March 15th my account was charged for terminals and some extra fees but we didn’t have enough money because NOBODY told us that they will debited our account automatically with no invoice or statement. I called to BOFA collection department and asked why they charged us not only for terminals but got extra “fin, charges” for $75.54 and $50. After staying on the line for thirty minutes she couldn’t find any explanation of these “addl fin. charges” and said that they would reverse $75.54 and $50. On Friday my account WAS CHARGED for $75.54. They didn’t reverse anything, instead they stole $75.54 from my account . I call them 6 times and nobody helped me, they couldn’t even “see” these amount on their system! They stole $200, and on 04/04 they charged me for leasing terminal! Terminal we bought month ago! BOFA stole $245 from us, and I am so tired and upset to call them every morning, nobody cares, we paid them over $1000 a month last two years for their services! Do not trust your business to BOFA merchant services!

Paula Ferreira

Terrible service. I had unexplained fees taken out of my account, and to have them refund me the money took a lot of time and phone calls. To the point where I had to start blocking my phone number so the person that deals with my account would actually pick up the phone. So I finally had the refund to my account. I thought it was not going to happen again. But they again overcharged me just yesterday. So I picked up the phone and called (anonymoulsy) and complained, have not heard a peep from them yet. I would like to know if there is a penalty for canceling the service.

Amanda

Yes, I canceled my merchant acct with you guys back in Dec. I didn not breach my contract. Tuesday the 17th, you guys took $500.00 out my personal checking acct. I called and thought i had all squared away with you guys and i was told i would recieve it back with in 48-72 hrs. I did not receive it. I called again on the 20th and actally talked to an Acct Specailist (Adam) and he told me that nothing was ever processed and it was an early termination fee. He looked into it more and saw that my contract was not breached. No one could tell me why it actually happened, that it just did. So he told me that he would put a rush on it because i was givin the run around by several different people and to call and check on Mon which is today Jan 23rd. I called, got throught to a customer representative named (Tasha), she called the acct specailists for me to try and connect me and she then got back to me and said the sometimes don’t like taking phone calls. I said i was told to call them and i need to talk to someone on the status of my refund and she said she would try and call them back. So I was on hold for awhile this time, she got back to me and talked so fast that i couldn’t understand her and I said “what?” she then quietly said “Oh my god” and then repeated herself. Very extremely RUDE considering the whole situation. You guys take $500.00 from me for no reason, so im out that money for a week now when I have to pay bills and you guys have been giving the run around and then a very rude customer service representative tells me i should get it by later today or tomorrow morning. I will be reporting you guys to the Better Businsess Bureau.

Neil Horsfall

Bank of America cost my business thousands of dollars! When we were first opening PNS we decided that we were going to use BOA as our credit card processor. Like alot of people when they start a small business our credit wasn’t excellent, but not terrible either, so we were told that we should do a credit exception, which would take 24-48hrs to be approved. At which point i explained to the representitive (Vijay Givens) that we were in a rush and had already been approved with a third party processor, she assured me that it could be done quickly.

48 hours later i had received no phone calls from her, so after leaving 5-6 messages for her i finally got a return call, at which point she told me that the credit exception had been approved and that i now had to fill out the application and it would be 5 days to process, I again explained that we were in a big rush now and that 5 days would be close, she again assured me that it had already been approved and that it would be 5 days maximum. So we filled out the application and faxed it back and waited 5 days, again no phone calls. I left 10 messages a day for the next 6 days and got no response. Finally 15 days after i filed the application i got a phone call telling me that our application was denied!

I then spent the next 2 days trying to get in contact of any executive that could help me, I finally get a hold and executive and explain that my advertising is running but i have no way of taking peoples money!

She tells me that it is not denied that i just need to send them a business plan and in 24hrs everything will be ready and assures me that we will be compensated for our loss of advertising. So we send them the business plan, and again, no phone calls. after calling again all day, i finally get a phone call telling me again that our application is denied!

So we ended up telling them that we didnt want the merchant account through them and moved to a different processor! We are yet to see any compensation for the thousands of dollars we lost in advertising.

This is the worst customer service i have ever dealt with in my life!

Mark

Horrible pricing. That minimum discount rate, plus the account fees, plus the service charges had me running more than 5% per month. When you ask for a rate review, you’re told that you’re at 1.6% – but almost NO CARDS EVER QUALIFY for that rate. There’s always some excuse why they have to charge more. Plus $400 upgrade to equipment.

Customer service was always good, and processing times reasonable, just not very competitive on the pricing for a small business. If you’re a large business who can routinely meet the minimums and are willing to pay top dollar for good service, then they’re a good fit.

Ivan

BOA has the worse merchant service at least it is not a good one. The customer service rep tried to push away all the problems made by boa system error, and they claimed it was all our fault.

It was because of the system error causing the duplicated transaction and my company did not get paid from the duplication error. However, boa took the money out of my account for the money i never received. They insisted the duplication money went into my account, but there was no extra money at all except the actual sale amount. I told them I could show them the bank statement and all the credit card sale record for the date and anything else they wanted. But they said they could not do anything because their system showed the duplication money ( second-time charge) was summited to my account. But I only get paid for what i sold. I did not get double paid even the transactions were duplicated. I requested to see an supervisor and the supervisor told me I got the duplication money and they could not do nothing else. i called the BOA Merchant guy who sold me the merchant service. He was nice at the beginning, but he lost his patient as things go complicated and told me he was not able to help me anymore and also claimed i got the duplication money. I mean BOA should not treat their customers like this. I have business accounts and personal accounts with BOA and it is the time to cancel them now.

Mark

I have used BOA for 2 years with no problems. The customer support has exceeded other third party processors. The rates are competetive, and the money hits my account the next business day.

ivan

I have been using boa for 1 year now and, yes, you are right about boa merchant service and I totally agree with you only when not hurting their benefits. They treat business owners like us very well until things really happen. I cant believe what they did to me. They took my money out of my account with no permission or notice for the mistake they made because of the system error. I tried to explain what was going on and they insisted they were right about their decision and refused to talk to me. The sale guy who sold me the service told me not to call him because it is not his business. I am not gonna use their services anymore. Worse after-sale service ever.

Dave

This is a marketing gimmick and even an outright lie, “A main benefit of having your business checking account and merchant account through Bank of America is that your credit card sales will usually be deposited a full day sooner than if you were with a third party processor”.

It takes 3-4 business days to get the money deposited into the bank account after the transaction is approved.

There are a lot of hidden fees that are not explained during the signup process, which always happen over the phone.

Contracts are faxed, and have poor quality (even if you receive it via email), small prints are hard to read, and hidden fees are placed in small prints.

There’s a $495 early termination charge, if you decide to discontinue the service before 3 years.

If you have less than the agreed montly transaction, then a flat fee of $30-40 will be applied to your monthly bill. REALLY BAD for startup business.

Do not use Bank of America Merchant Services, its the worst business decision I ever made in my life.

Phillip CPO

Hi Dave,

Thank you for the comment. The benefit I mentioned may be a marketing gimmick, as you have suggested, but it is definitely not a lie. I know many merchants who use Bank of America Merchant Services just because they get their credit card sales deposited into their BofA checking accounts the next business day. From what I understand, it’s done by means of a “memo post” which is a notation posted to the checking account which indicates a credit has been received from the merchant account, but has not yet been posted to the checking account. It allows the merchant to go on about their business as if the money has actually been deposited.