Maverick Bankcard Reviews & Complaints

Company Overview

Maverick Bankcard is a merchant account provider that began operating under Maverick Payments in 2021. The change appears to be mostly cosmetic, as the company is still headed by Alan Griefer and still serves many high-risk merchant accounts. Maverick Payments offers online and in-person credit card processing, payment gateways, and is a reseller of POYNT POS products.

In 2022, Maverick Payments announced a partnership with Fluid Pay, with a focus on improving ACH payment options.

As Maverick Bankcard

Multiple online merchant complaints state that Maverick Bankcard and BankCard USA were either the same company or a parent company and its subsidiary, but representatives of both companies have vehemently denied any existing connection between their organizations. The confusion appears to result from the fact that the 2 companies shared senior management at one time, since the father of a Maverick Bankcard account manager served as the principal at BankCard USA from 2000 to 2011. In addition, the two companies were previously located within the same building but had different suite numbers.

More Evidence Surfaces

Prior to an August 2017 update of this review, we took the company representatives at their word and treated the 2 companies as separate entities. However, new evidence has come to light that strongly suggests that our original suspicion was accurate. In a complaint filed in July 2016 against Maverick Bankcard's Better Business Bureau page, a company representative replied to the merchant's complaint by stating, “A lot of times, merchants GOOGLE their processor's info, under ‘BankCard' because that is what appears on their statements and since our company name is BankCard USA, we are the #1 GOOGLE search.” The response is also signed by “BankCard USA.” It is difficult to understand why BankCard USA's customer service department would address new BBB complaints filed against Maverick Bankcard unless an operational or personnel overlap persisted between the two companies at least well into 2016.

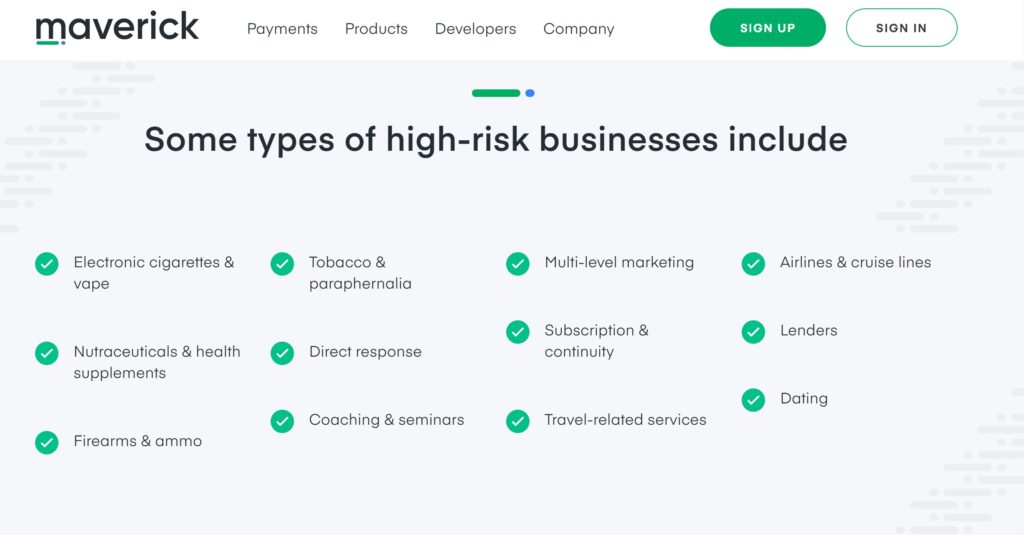

Credit Card Processing for High-Risk Merchants

Maverick Payments specializes in credit card processing solutions for businesses that are considered “high-risk” by traditional financial institutions. They offer customizable payment gateways that integrate with a wide range of e-commerce platforms and point-of-sale systems.

ACH and E-Check Processing

In addition to credit card payments, Maverick Payments provides ACH (Automated Clearing House) and E-Check processing services. This allows merchants to accept payments directly from bank accounts, offering an alternative to credit card transactions.

Fraud Prevention and Security

Security is a priority for Maverick Payments. They offer a range of fraud prevention tools, including Address Verification Services (AVS) and Card Verification Value (CVV) checks. These features are designed to safeguard both the merchant and the customer.

Virtual Terminal Solutions

For businesses that need to manually key in credit card transactions or process mail and telephone orders, Maverick Payments provides virtual terminal solutions. These are secure, web-based interfaces that allow for easy payment processing.

Mobile Payment Processing

Maverick Payments offers mobile payment processing solutions, enabling merchants to accept payments on the go using smartphones or tablets. The mobile processing solutions are compatible with both Android and iOS devices.

Multi-Currency and International Payments

To facilitate international business, Maverick Payments supports multi-currency transactions. Merchants can accept payments in multiple currencies, thereby broadening their customer base.

Recurring Billing Solutions

For businesses that rely on subscription models or offer installment payment options, Maverick Payments provides a recurring billing service. This feature allows for the automated collection of payments at predetermined intervals.

Custom Reporting and Analytics

Maverick Payments offers robust reporting tools and analytics. Merchants can easily track sales, refunds, and other transaction data, helping them make informed business decisions.

Location & Ownership

Launched in 2000, Maverick Payments is located at 26520 Agoura Rd, Calabasas, CA 91302. Alan Griefer is listed as the CEO of Maverick Payments. Maverick Payments registered ISO/MSP of Avidia Bank, Hudson, MA; Axiom Bank, N.A., Maitland, FL; Esquire Bank NA, Jericho, NY; and Mission Valley Bank, Sun Valley, CA.

| Pros: | Cons: |

|---|---|

| Positive long-term industry experience. | Unclear information on website about pricing. |

| High-tech payment processing solutions. | Complaints about fund withholding issues. |

| Customizable pricing for diverse businesses. | Varied contract terms; fees unclear. |

| Strong focus on high-risk accounts. | Reports of unresolved customer complaints. |

| Wide range of integrated services offered. | Early termination fees in contracts. |

| Strong security and fraud prevention measures. | Some negative sales tactics reported. |

Maverick Bankcard Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | <10 |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | N/A |

| Recent Lawsuits | Yes |

Low Complaint Total

Our current search reveals approximately 10 negative Maverick Payments reviews across various consumer protection websites. Some of these reviews label the company as a scam or a ripoff, with common issues cited including fund withholding, poor customer service, challenges in canceling services, and undisclosed or unauthorized fees. It’s important to note that misunderstandings often occur, especially with high-risk merchant accounts where fund withholding can be standard practice. On a positive note, Maverick Payments has garnered a number of verified, positive testimonials in the comment section below this review in the past two years, indicating a level of satisfaction among many clients. If you have an experience with Maverick Payments, we invite you to share your review in the comments below.

Maverick Payments Lawsuits

In 2023, Maverick Payments was involved in a legal case with Watch Rapport, although specific details of the case are not publicly available. Clients seeking non-litigious resolutions are advised to consider reporting their concerns to relevant supervisory organizations as an alternative to legal action.

Maverick Payments Customer Support Options

Maverick Payments provides phone and email support to its clients. While not yet recognized as a leading processor for customer service, the company’s customer support channels appear effective in addressing and resolving most merchant concerns in a timely manner. Given Maverick Payments’ relatively low complaint rate when compared to its size, we recommend potential clients conduct thorough research before choosing their services.

Maverick Payments Customer Service Number

- (800) 464-9777 – Toll-Free Support

Other Support Options

- Support form

- Email: [email protected]

Maverick Bankcard Online Ratings

Here's How They Rate Online

| BBB Reports | 20 |

|---|

Under 5 Complaints

Maverick Bankcard currently has an “A+” rating with the BBB and has been accredited since July 2018. The company has received 10 complaints in the past 36 months. 5 of these complaints were resolved to the satisfaction of the client. The other 5 were either resolved to the dissatisfaction of the client or received no final response.

What Merchants Say

In addition to 10 complaints, the Maverick Bankcard received 10 informal reviews on its BBB profile. 2 of the reviews were positive while 8 were negative, and the most recent one describes a large amount of held funds:

Maverick is a horrible company. They do not know how to take care of their clients. I have been using their merchant processing for three years and suddenly they dropped my account. We have a reserve balance remaining with them over $100,000. They kept that balance and terminated our account now they continue to draft funds out of our reserve balance due to various different reasons that they are making up. Ive called them several times to ask them to release my reserve balance, and they tell me they will not release it and instead they continue to draft fees out of it. Clearly, they are keeping the money and finding reasons to deplete the reserve balance, I would beware, if youre dealing with them or plan to deal with them, they are taking my companies money.

Researching the best available options for customer service is one way readers can assure themselves of being able to effectively resolve issues.

An “A” Performance Overall

In light of the low number of complaints, we agree with the BBB’s rating at this time.

Maverick Bankcard Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | Yes |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | 1.00% - 4.99%+ |

| Equipment Leasing | Yes |

Custom Pricing

Maverick Payments, known for providing merchant accounts tailored to high-risk businesses, adjusts its contract terms based on the specific needs and risk profiles of various businesses. A sample contract from First Data/Fiserv, related to Maverick Bankcard, outlines a $195 early termination fee, a $25 monthly minimum fee, a $25 chargeback fee, and a $10 monthly service fee. It’s unclear if these rates are consistently applied across all accounts today. The document does not specify a PCI Compliance fee, though it’s noted that contract terms can significantly differ between businesses. It is presumed that the terms under Maverick Payments may align closely with those previously set under Maverick Bankcard.

Contracts sourced from First Data/Fiserv may also involve long-term, non-cancellable equipment leases via First Data Global Leasing, often leading to costs exceeding direct purchase prices.

Virtual Terminal and Payment Gateway Pricing

Maverick Payments also promotes its virtual terminal and payment gateway solutions on its website, though specific pricing details for these services are not disclosed. Merchants can expect additional fees, such as gateway fees, technical support charges, batch fees, and further transaction costs for these e-commerce solutions.

Risk Mitigation Policies

The majority of customer feedback regarding Maverick Payments pertains to its fraud prevention measures, which may involve establishing a cash reserve or freezing accounts due to suspicious transactions. Such policies are commonplace among providers servicing high-risk accounts, aimed at safeguarding against fraudulent activity. However, better upfront communication regarding these fraud prevention strategies could potentially reduce related customer complaints.

Maverick Bankcard Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | Yes |

|---|---|

| Telemarketing | Likely |

| Misleading Marketing | No |

| Discloses All Important Terms | No |

Inside and Outside Sales Reps

Maverick Payments appears to partner with independent agents and resellers to market its services, although whether or not these agents are W2-employed is unclear at this time. We are currently able to locate two negative Maverick Bankcard reviews that describe nondisclosure of fees or misrepresentation of rates by the company’s sales agents, but these complaints represent a small percentage of the total number of reviews posted about Maverick Payments.

No Deceptive Quotes

As an additional point in Maverick Payment’s favor, the company’s official materials do not appear to utilize deceptive advertising strategies. We do not see any serious red flags with Maverick Payment’s sales approach at this time, but if you suspect that the company is overcharging you, we recommend seeking a third-party statement audit from an independent professional.

Our Maverick Bankcard Review Summary

Our Final Thoughts

Maverick Payments rates as a decent credit card processing provider according to our criteria. The company is showing a fairly low complaint rate at this time, but evidence linking Maverick Bankcard to BankCard USA continues to surface long after the company has denied any such connection. Considering only the company’s services and client feedback, Maverick Payments has earned a high overall rating. However, after factoring in the persistent evidence that the company’s executives may have misrepresented their relationship with another, poorly rated provider, we advise readers to be sure to read and review all relevant documentation before signing up.

If you found this article helpful, please share it!

Bill Hoidas

Best Acquirer I’ve ever dealt with!

I am an ISO and been in the credit card processing Industry for over 20 years. Maverick is by far the very best acquirer that I have ever used. I first started using them because they board Ticketbroker Merchant accounts and when I noticed and appreciated how great their entire serve is including swift Communication, Underwriting, Support, Risk, etc. are I now board all my Merchants with them.

Rahul Ahuja

I have been working with Steve from Maverick Bankcard and I have to tell you he’s amazing at what he does. Not to mention the incredible customer service Steve and his company provides to us as their customers. If you are looking for a new merchant processor, Maverick Bankcard is the way to go!

Andy

I looked and compared several processors and decided to give my business to Maverick because I found them very friendly and professional.

Their rates are competitive and they have an amazing customer service. Emails are answered very fast and they are to the point. They do not waste your time and they have been very accommodating.

CPO

Hi Andy,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!

Jack

Maverick has revolutionized the merchant services industry. They do not charge hidden fees like other providers, put their proposal in writing, and guarantee to save you money. Their customer service is top notch as they treat you like family. Getting approved is easy and their underwriting department moves quickly. I cannot say enough about my interactions with them.

CPO

Hi Jack,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!

Terry M

I’ve been a referral partner with Maverick Bank Card for over 3 years now. Their staff is extremely professional, knowledgeable and fair. We plan on using Maverick indefinitely, very solid company!

Jason Wei

We are very happy with Maverick. We’ve been with them for over a year, and have no complaints. We were processing with our bank before, and Maverick has been saving us over $200 each month. They even paid our termination fee from Wells Fargo. They are very accommodating to our needs and even placed us on next day funding. For a pretty large online business, this has been very helpful for cash flow and helping us grow. Very professional company and we would recommend them to anyone looking to switch.

Shawdon Javadizadeh

I own a wholesale razor blade company. I originally set up my merchant services through one of Authorize.net’s preferred processors but decided to see what else was out there. After getting a few quotes, I decided to go with Maverick BankCard because they are also family-owned and saved me the most money. They gave me a detailed side-by-side comparison and even pointed out some hidden fees that my previous processor was charging me. Since they are local, I decided to give them a try. So far my experience has been great. They approved me in just a few hours, and I was able to start processing the same day I applied. Maurice helped me get everything integrated to my website very quickly and easily, and even saved me money on my Authorize.net gateway too. All around I am very satisfied with Maverick, and they have exceeded my expectations.

Clark Claydon

Saved me money, had a great customer service team, and made my life easier. Couldn’t ask for more. Thanks Maverick!

Brian West

These guys are great to work with. Extremely responsive and quick to answer and handle any questions or concerns that come up. Great rates and easy to contact!

E. Morrow

Can’t say enough about this company! More than accommodating and great options! Moments notice assistance! Love this service!

CPO

Hi E. Morrow,

Please reply to this comment with your business name and location in order to authenticate your testimonial. Thanks!

Lindsey Duffield

For fun, I allow competitor companies try to meet or beat your services through Maverick. They all start off real arrogant, knowing that they can beat your rates. Then they look at a Maverick statement and their eyebrows shoot up. “Wow, you’re getting a great deal!” “I’ve never seen a processor charge this low of rates!” “How did you get them this low?”

Haha… like I told the last kid that left the office, sometimes it is just nice to hear from a third party that you’ve done a damn good job. ;-)

Thanks for your help and Maverick’s service. We are proud to be with you guys.

PS-Maverick has beat out the YMCA’s preferred Merchant Services provider (Bank of America), Singular, Yoozy, Merchant One, AND Transfirst. They cut our previous Merchant Services Provider bill IN HALF.

-No looking back!

David

Wow certainly a lot of information retained by a customer… not fishy at all.

Christian Moore

Helped us get started with our business in a professional and streamlined way. No runaround, gimmickey, annoying conversation, and very reasonable. We recommend Maverick to 110% of the way and are in debt to these guys. Thank you!

Metamoris International

Maverick is my only choice, they’re a family business with outstanding professionalism and service.

Alexandra

I was very impressed with Mr. Jeffrey Pedigo he is the Senior Account Executive at Maverick BankCard, Inc. He is very professional, knowledgeable, energetic, reliable, and punctual. He is a man of his word! I really enjoyed doing business with him and would recommend him to anyone who is in need of Merchant Services. He is amazing and will make sure you are well taken care. He is very trustworthy and truly cares about his clients. I really appreciate him delivering over 100% customer satisfaction. So if you are in need of Merchant Services give him Jeff a call today because Maverick BankCard is the best!

Corey Kemp

Maverick was able to have me approved quickly and painlessly, They are available to me 24/7, always very helpful and honest. My customer service rep, not only made me feel like a valued client, he made me feel like he was a long time friend who had my best interest at heart. I look forward to a continued relationship with Maverick.

Priscilla Rojas

Maverick was able to have me approved quickly and painlessly, they are available to me 24/7, always very helpful and honest. Also very friendly! Customer service is awsome!! Thank you Maverick for everything!

Shalini Tuscano

There are always obstacles and hurdles when one starts a new Venture. There are

many unknown and unforeseen variables and factors. On those occasions, without

someone to guide and assist you, one tends to get frustrated and give up the whole

enterprise.

I am writing this letter to highlight Mr. Jeff Pedigo’s – Account Executive – Maverick

Bankcard Inc., invaluable help and inputs during our Merchant Application process.

As a first time business owner there were lots of grey areas that I encountered during

the application process with other Merchant Providers. They were not always very

forthcoming in terms of information. Jeff was always one step ahead, in terms of

knowing what my requirements were and what was suitable for my business plan. He

was always on the ball and available to provide honest, straight forward information

and answers to questions.

A go getter, Jeff never gave up on looking for all possible solutions for my business. As

a foreign company looking to set up a merchant account within the United States it

was somewhat of a challenge. Consistent and persistent, ultimately Jeff was successful

in finding a solution for the company.

I highly commend Jeff for his outstanding work ethic, professionalism, pro-activeness

and over all pleasant personality. It was a pleasure to work with Jeff as he instilled a

sense that I was working with someone I could count on. He is a great asset to your

organization. I am confident that he will continue to do the good work for a long, long

time for your organization and act as a great brand ambassador.

Allen Morton

my online business sells numerous natural products for working out and weight loss- i was declined at most processors but maverick got me approved and accepitng cards in 4 days. they really know the high-risk processing world and im paying higher rates but it is definitely worth it!

Phillip CPO

Hi Allen,

In order to authenticate this testimonial, please reply to this comment with your business URL and contact information. Thanks!