Worldpay Reviews & Complaints

Overview

In this article, we provide a detailed overview of Worldpay, a major direct processor with a strong presence in the UK and Europe. We'll examine a range of topics including their rates and fees, contract terms, and a deep dive into the common complaints and reviews from both industry experts and employees. The discussion also covers Worldpay's history of acquisitions and mergers, notably their takeover by Vantiv and Fidelity National Information Services, and the recent spin-off in 2023.

We explore the variety of services offered by Worldpay, catering to both small and medium businesses as well as large enterprises, and highlight their collaboration with Masabi in public transit payments. This article addresses the controversies surrounding Worldpay, including customer complaints and a series of lawsuits alleging overcharging and misleading practices.

An analysis of Worldpay's customer support system and their online ratings provides insights into their service quality. Finally, we present a balanced view of the pros and cons of using Worldpay's services, aiming to equip readers with essential information to make informed decisions about their payment processing needs.

About Worldpay

Worldpay is a very large direct processor with an international presence in 40 countries, with a primary focus on the U.K. and Europe. Founded in the UK in 1989 under the name “Streamline“, the company's name was changed to Worldpay a few years later. In 2001, Worldpay began to offer U.S. merchant accounts in Atlanta, Georgia. Shortly after, the company was bought by The Royal Bank of Scotland (RBS) and rebranded as RBS Worldpay. In 2010, RBS sold its controlling interest in the company and RBS Worldpay was rebranded back to just “Worldpay.”

Majority Stake Ownership of Worldpay

In 2017, Vantiv acquired Worldpay for $10 billion. The combined entity has since assumed Worldpay's name and begun to consolidate its sub-brands into Worldpay. Less than two years later in March of 2019, Fidelity National Information Services, Inc. announced its agreement to purchase Worldpay for $35 billion. The Fidelity acquisition became finalized on July 31, 2019. 2023 saw an announcement that FIS would spin off Worldpay. Additionally, Worldpay put this note on their website: “As of 06th March 2023, Worldpay Online Payments Gateway (WPOP) has been decommissioned. After this date you will not be able to transact any MOTO, eCom and recurring payments.”

In late 2023, major fintech company FIS sold its majority stake in Worldpay to private equity firm GTCR in a huge $18.5 billion deal.

Worldpay Payment Processing

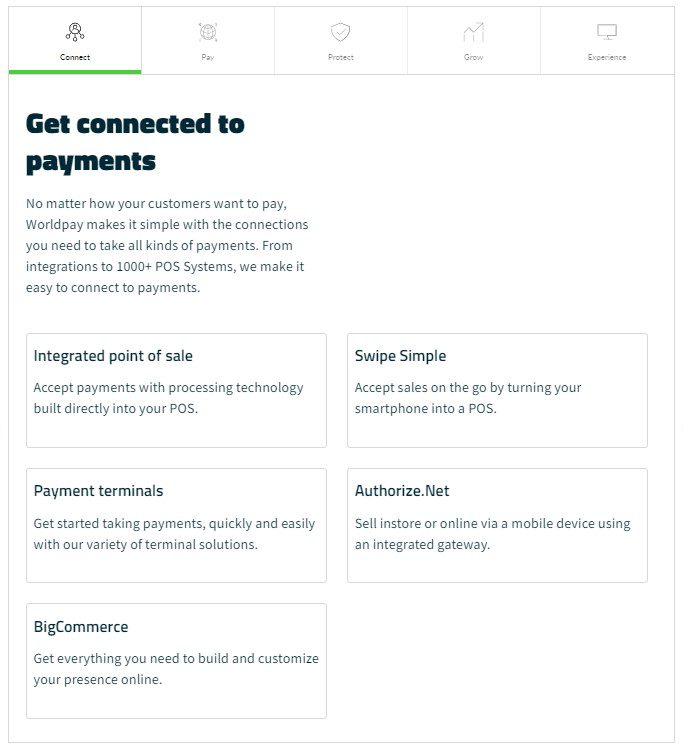

Worldpay processes all major debit and credit cards for most business types. For small and medium businesses, they offer POS systems, EMV terminals, the Authorize.Net payment gateway, digital and mobile wallets, FastAccess funding, extensive security features, gift card solutions, and data analysis and processing. For enterprise-level businesses, they also offer B2C and B2B e-commerce solutions. They claim to accept over 300 types of payments.

Collaboration for Public Transit Payments

Worldpay has collaborated with Masabi, a transit ticketing technology company. Together, they aim to deliver fare payment platforms for public transit.

Online Payment Service

Worldpay is an online payment service that allows users to transfer money. The service is accessible via mobile or desktop platforms.

3DS Flex for eCommerce

Worldpay offers a feature called 3DS Flex that aims to improve issuer approvals for transactions affected by PSD2. It also aims to reduce friction at checkout by supporting more authentication mechanisms.

Location & Ownership

Charles Drucker is listed as the president and CEO of the company and its corporate headquarters are located at 8500 Governors Hill Drive, Symmes Township, OH.

Video Summary

| Pros: | Cons: |

|---|---|

| Accepts many payment methods | Not transparent with pricing |

| Supports numerous currencies | Poor service for small businesses |

| Offers 24/7 phone support | Dated pricing practices |

| Large international processor | High customer complaint volume |

| Interchange-plus pricing option | Three-year contract, renewal clause |

| Broad network support | Early termination fee up to $295 |

WorldPay Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | 400+ |

|---|---|

| Live Customer Support | Yes |

| Most Common Complaint | Hidden Fees |

| Recent Lawsuits | Yes |

Understanding Worldpay’s Customer Feedback

Worldpay, a prominent player in the payment processing industry, has garnered attention for its high volume of customer complaints found across various online platforms. The criticism predominantly revolves around unexpected fees, cumbersome cancellation processes involving hefty fees, and deceptive sales tactics. Additionally, there are notable concerns about fund-holds, which might prompt businesses to seek services from a high-risk specialist instead.

Efforts in Addressing Customer Dissatisfaction

While Worldpay representatives have engaged with some publicly filed complaints, the effectiveness and consistency of these resolutions remain unclear. The brand’s connection with resellers complicates the attribution of certain complaints, contributing to a mixed overall perception of the company’s customer service capabilities. Despite this, the prevalent issues have influenced a “C” rating due to the uniformity of customer grievances.

Legal Challenges Facing Worldpay

Worldpay has encountered legal disputes, notably a $52 million settlement in 2017 over alleged overcharging. Further complicating its legal landscape, in 2019, Worldpay faced a class-action lawsuit challenging the transparency and fairness of a significant acquisition by Fidelity National Information Services. Additionally, the company settled for $15 million in response to accusations of fee misrepresentation. Recent legal actions include allegations related to fund holding and discriminatory practices, underscoring ongoing legal and operational challenges.

Exploring Worldpay’s Customer Support Infrastructure

Worldpay extends multiple customer service channels, including phone and email support. Despite this breadth of options, customer feedback suggests these channels may not meet the high standards set by leading payment processors in terms of effectiveness and responsiveness.

Contact Information for Worldpay Customer Service

- (866) 622-2390 – Worldpay Contact Center

- (888) 208-7231 – Customer Service & Technical Support

- (866) 435-3636 – Support for Former Element Merchants

- (800) 846-4472 – Support for Former NPC Merchants/Worldpay Integrated Payments

- (844) 843-6111 – eCommerce Merchant Support

- (866) 622-2907 – Merchant Activation Team (MAT)

- (800) 278-6888 – Worldpay EFT

- (800) 422-0733 – Worldpay Credit

Additional Support Channels

- Online support form

- Email: [email protected]

This detailed overview aims to shed light on Worldpay’s operational and customer service aspects, emphasizing the need for improved transparency and effective support mechanisms. Your experiences and perspectives are invaluable; please share your insights below.

WorldPay Online Ratings

Here's How They Rate Online

| BBB Rating | 1 |

|---|---|

| Trustpilot Rating | 4.6 |

| SiteJabber Rating | 1.1 |

| Average Rating | 2.23 |

BBB Rating Analysis

Worldpay has an average customer review rating of 1/5 stars on BBB based on 35 customer reviews. The company has received 168 complaints closed in the last 3 years, with 60 complaints closed in the last 12 months. Common themes in the reviews and complaints include issues with billing, charges for inactive services, and difficulties in getting refunds or responses from the company.

Negative Feedback

We own a restaurant and processed with Vantiv from 2015 to June 2018. We just caught that they have been charging us hundreds of dollars every month since then to the tune of about 15,000. They are unwilling to work with us on any of the money back, claiming that it was our responsibility to cancel and that it auto renews every year despite zero processing occuring. I asked for the contract and they sent a new world pay document, that I have never seen, stating it automatically renews. They told me the last deposit was over 5 years ago but it is not their problem. Do NOT do business with them. Feel free to reach out to me before you make a horrible decision to process with them. They will steal from you every way they can, and I can prove it to you. Please reach out before considering processing with them.

– Complaint from November 6, 2023

Terrible company! I have been using them for years, and I recently found out that they have been charging my business $79 a month for a service that has been inactive for over 2 years. When I contacted the company they said there was nothing they could do, even though they confirmed that the account had no activity since Nov 2020. I just need my charges returned for a service that was NOT provided!!!!

– Review from August 28, 2023

Positive Feedback

There are no positive reviews published about Worldpay on the BBB website.

Source: BBB

Trustpilot Rating Analysis

Worldpay has an average customer review rating of 4.6 stars on Trustpilot based on 6,080 customer reviews. The distribution of ratings is as follows: 64% 5-star, 4% 4-star, 1% 3-star, 2% 2-star, and 29% 1-star. This indicates a majority of positive feedback, with a significant portion of negative reviews as well.

Negative Feedback

Very slow to respond

After 17 days still waiting to hear if my application for new card readers has been accepted. Meanwhile our business is losing money as can only take cash.

Initial dealings with John O Neill excellent and told application would take 7-10 days to process. When i rang after 12 days it turned out they needed more info.

PLEASE HELP!! We cannot afford to lose money.

– Review from Nicola Edwards, November 03, 2023

I have been trying to sign up to Worldpay for over 2 months. I received 1 call where the agent said they would get back to me with an official offer, which I didn’t receive.

I then reached out again and spoke to someone who gave me the same conversation. 3 weeks later, no reply on both phone and email.

After eventually being able to sign up, I have now been ghosted again by my account manager for over 3 months.

– Review from M S, November 14, 2023

Positive Feedback

Great experience. I called Nikolas and had a response instantly with clear instructions on how to order and set up my account. I received the machine the same week and I had all the information that I needed to be able to set it up. My new card machine is great, easy to use and you receive your payments into you account the next day.

– Review from Beam Park, November 03, 2023

The advisor, Tony, was excellent. He couldn’t have been more helpful. He listened carefully and answered all my questions fully. He clearly outlined the steps I needed to take to resolve my problem and showed genuine insight. He is a real asset to his employer.

– Review from School, November 20, 2023

Source: Trustpilot

SiteJabber Rating Analysis

WorldPay has a rating of 1.1 stars on SiteJabber, based on 39 customer reviews. The majority of customers express dissatisfaction, frequently mentioning issues with customer service. WorldPay ranks 180th among payment processing sites. The common themes in the reviews include poor customer service, billing issues, and difficulty in canceling services.

Negative Feedback

I wish I could give them no stars. For the crazy amount of money they charge, WorldPay’s customer service is the worst. It seems like they are in the stone age when it comes to technology. My nonprofit changed bank accounts so we had to contact a lot of different vendors, and all went smooth until we contacted WorldPay. It took five phone calls and two emails, and the issue is still not resolved. Do not feed this beast.

– Review from February 27th, 2023

Scam, do not use this company. Terrible services, billed me for months without knowing. No services were used, and they did not ever contact me in any way due to my account being what I thought was closed. 10 months of fees and annual fees, only to be told they were not in the wrong. They had my contact and email info incorrect as to why I never heard from them. Save yourself the frustration and loss of your hard-earned money and shop elsewhere. Zero star.

– Review from March 16th, 2023

Positive Feedback

Was a bit worried about the payment process, bit all good. The website just looks strange somehow, nothing to worry about.

– Review from July 25th, 2023

Source: SiteJabber

WorldPay Fees, Rates & Costs

A Closer Look at The Contract

| Cancellation Penalties | Yes |

|---|---|

| Monthly & Annual Fees | Yes |

| Processing Rates | Variable |

| Equipment Leasing | Yes |

A Wide Range of Contract Terms

Worldpay advertises rates of 2.90% plus $0.30 for swiped transactions and 3.30% plus $0.30 for keyed transactions, with a slightly lower qualified rate at 2.70% plus $0.30. However, reports suggest that businesses may encounter higher rates and longer service agreements when signing up directly with Worldpay rather than through a reseller. Resellers often offer better deals due to pricing and contract flexibility.

Three-Year Standard Contract

Businesses considering a Worldpay merchant account should carefully review the contract, typically spanning three years with automatic one-year renewals unless a 90-day notice is provided. The contract includes an early termination fee of up to $295. Additionally, Worldpay charges a monthly PCI Compliance fee ranging from $15 to $25, above industry averages. Clients may also incur a $69 annual fee for IRS 1099 reporting. Equipment leases, offered through ISOs, range from 12 to 48 months with monthly charges based on credit score. Lessees have the option to purchase equipment at lease end. Business owners can explore our list of the best merchant services.

Virtual Terminal and Payment Gateway Pricing

Worldpay promotes its virtual terminal and payment gateway services for B2B and B2C sales, although pricing remains undisclosed. Additional fees such as gateway fees, technical support fees, batch fees, and transaction rates are common for these services.

Comparatively High Prices

The potential for high cancellation fees, auto-renewing contracts, and elevated compliance fees negatively impact Worldpay’s rating in affordability and hinder its status as a competitive merchant account provider.

Worldpay’s diverse e-commerce and in-person payment solutions

Worldpay’s diverse e-commerce and in-person payment solutions

WorldPay Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | Yes |

|---|---|

| Telemarketing | Yes |

| Misleading Marketing | No |

| Discloses All Important Terms | No |

A Global Sales Force

Worldpay markets its services both directly with its own inside sales staff and indirectly using independent sales agents, resellers, and sub-ISOs. This is a common strategy for the industry and usually leads to a moderate amount of complaints. In this case, we are able to locate hundreds of negative Worldpay reviews that describe nondisclosure or misrepresentation of fees by sales agents. These complaints cite all varieties of unexpected charges, including undisclosed termination penalties, higher-than-quoted rates, and unexpected monthly costs. If you suspect that you are being charged undisclosed fees, we recommend seeking a fee reduction analysis from an independent third party.

No Tricky Advertising

We found no uses of misleading advertising or rate quoting in the company’s official materials. This compares favorably to our list of best credit card processors. Given Worldpay’s complaint volume and the regularity with which these complaints have been posted, however, we have assigned the company a “C” rating in this section.

Our WorldPay Review Summary

Our Final Thoughts

Worldpay is a very large credit card processing provider that processes payments around the world. It rates poorly according to our rating criteria due to junk fees, non-transparent rates, and numerous complaints regarding predatory and unethical policies. Business owners may want to read our article, “How to Select the Best Merchant Account” prior to signing up with any merchant account provider.

If you found this article helpful, please share it!

Rob

Appalling service from due diligence team, over an hou on hold to get through followed by operatives with pretty poor Englishbskills asking me to repeatedly provide documents which already been provided both by email and on dashboard for company verification process. Three weeks without receiving our money now and now cut off our ability to take card payments. They currently have 26k of our money that they are not handing over, which for a financial organisation is highly inappropriate. They seem to have a due diligence process in disarray and are not paying people their money. Avoid Worldpay at all costs if they can do this to us after 8 years then nobody is safe. Don’t respond or reply to phone calls or emails, due diligence team say they will pass information on and complaints department say they will take 15 days to investigate your complaint about their rank incompetence

Anuj Agrawal

They closed our merchant account on 28Jun2023 and also confirmed that no further account monthly fees will be debited from our bank account as also confirmed from their complaint team on mail. But on 19Aug they misused direct debit facility and debited monthly dashboard fee for Jul 2023. When the account is closed why still charging monthly fees. Next they are withholding almost GBP 2000 for our collected payment since 27Apr2023 and as per their confirmation on mail this is to be released after chargeback period of 120 days, which also completed on 25Aug but neither they have credited the funds to our bank account nor responding to our mails. The contact numbers listed by them is another fraud they are doing by charging excessively high call rates even for incoming calls which is always to be free. It’s a caution to all merchants to stop doing business thru this company else u will regret about ur decision. Also the reviews listed in favor of them are mostly fake so don’t trust them. They are cheats and unreliable. Must be termed as dacoits. And there complaint shud be made to the PM of UK to cease this company and recover funds from the employees assets too who are supporting this financial fraud.

Sharon Yelle

Worst payment processor ever. Want me to pay $495 to cancel something that I cancelled months ago and they continued to charge me for. When I called to cancel again said I needed to give 30 days notice to cancel but could not do that due to the fact I haven’t used the processor in a while. Scam scam scam just trying to make money off of you even though they continued to charge me after I cancelled.

Mitch Hickman

Worldpay stole my money. I closed the account and Worldpay kept robbing me of fees they didn’t earn.

John Roseweir

I have dealt with worldpay for a decade, and they have now decided to hold on to £30k of my business funds until they verify my account that they have been dealing with for a decade!!!! Been on the phone non stop to them, and yet nobody can authorise my account and give me no reason why not !!! There is a real chance my business will go under with these thieves stealing my hard earned money, and it’s happening all over the country, yet nobody does anything!!!! They have even been on watchdog due to them holding on to money that’s due to small businesses!!!

If you want your business to survive DO NOT ISE WORLDPAY!!!

Stephen

Have you resolved this with them. I had a similar issue with them on 2015 they decided I was a credit risk and stopped my daily settlements with immediate notice and said funds would be held for two years to cover any potential chargebacks, they ended up holding nearly £20,000.00 and this resulted in me having to close my business. For one reason or another I have not pursued the matter but I am just about to do so. Read many comments today from people with a similar experience.

Pamela

Doing the same thing with my company. Been dealing with them for 8 weeks now. Still don’t have my $11,000 I have two claim numbers that evidently don’t mean a thing. Every time I call it’s like I’ve never called before!!! Worst Company EVER. NEXT CALL IS FROM LAWYER. DONE.

Da

This company could be the subject of a truly fascinating and bizarre documentary on horrendous predatory business practices. I hope they all go to prison someday.

True things that have happened in my ongoing 6 month-long saga to close my nonprofit’s account with them (which has still not happened—they are still charging monthly fees):

-4 times customer service pretended they couldn’t hear me/the line was breaking up when I told them I wanted to cancel the account. When I told them to stop because someone had already tried that with me and I was documenting the call…they miraculously could hear me again.

-I called support at least 24 times trying to get information. They “accidentally” hung up on me at least 10 times “transferring” the call.

-12 times I provided my email and phone number to have someone followup since they said they didn’t have it on the account. No surprise, but one ever called or emailed.

-one of the customer support numbers their account team provided is just a recording saying you’ve just won a prize and asks you to divulge personal information to move forward

-when I asked for a copy of our contract and terms—they said that was sensitive account information that they were not at liberty to disclose.

-when I received written confirmation that the account was permanently closed and asked why they were still charging $100 per month—surprise, surprise they said that was sensitive account information that they were not at liberty to disclose 😂

-at different times different email signatures/account fees from this company have been under: Worldpay, Vantiv, FIS Global and Element Express. No one will tell you that they are all the same company unless you do some sleuthing.

I would recommend documenting every single interaction you have with this company, filing a complaint with the consumer financial protection bureau and calling your local representative. There is no way to hold this company responsible. It has been a nightmare for me!

Mick Gosney

I was issued a card reader on the Thursday, I was taking my first deposit over the weekend £13,000. I called Worldpay to see if I need to pre approve it as it’s a large payment, they said no and take the payment and it will be in your account on Mon/Tues.

Worldpay called me on Monday saying “my business model is outside their risk appetite “, and they would be keeping the £13,000 for a 120 days.

Absolute con men , it wasn’t outside their business appetite when they gave me the machine or when they said take the payment.

Do not use this company

faraz

Case Ref No PO2000444895

Dear Sir /Madam,

I would like to make a serious complaint regarding my account verification case handler.

He or She is not responding me about my account suspensions and stopping my payment processing since last three weeks. After making hundreds of calls and spoke to different customer services representatives, ( Jade , Lila, Norman, Mgr. Nita, vans, Embro and Cristine) no one has the information about who is dealing this case and didn’t have their contact no to speak with.

I am running a small business and have limited cash flow and my credit card payments have been stopped since last 21st of Nov22. I have no cash to pay salaries, bills and purchasing goods invoices .

This will leads to put my company in under administration. Please take action against the long delays and poor progress on this sensitive issue against the case handler and customer service team who were telling me same stories that, case has been forwarded to case handler since 2nd of Dec and giving me limited information’s about the case and manager or supervisors were not making any progress on that, asking me to wait.

Last person I spoke to was Supervisor Cristine who promise me that my money will be released by account department on Monday 19th Of Dec.

Kindly look into this delaying and poor responses, which causing me to go under administration or shutting down my company soon.

If that happened, I will take legal action against WorldPay and claim for company losses and compensation.

Waiting for your earlier respond.

Regards

Faraz Mirza

Merchant no 11414855

Al Shaheer halal foods pvt Ltd

Mobile no 07887766313

Wilson Sherman

Very unethical marketing practices. These people flat out lie about the purpose of their call.

Don’t trust or believe a thing the are saying and do not provide them any confidential info.

Roxanne

This Company does out right lie. They deduct fees from your account even after you have called numerous times to stop service and say account is closed then the next month fees deducted again to spend over an hour on the phone four months in a row to resolve the issue. Very unethical business practices. They should be put out of business.

Vincent Troncoso

I totally agree. Horrible company

Patty West

The customer service department is the worst. They are all foreigners that don’t speak english very well and they don’t understand it as well. I’ve got over 20 calls trying to get something handled and still haven’t found anyone to help. I am beyond frustrated. I wish I didn’t have Cryptopay and have to be locked into using them!! ARGH!

Adam Ritzman

Dealing with this company is like sitting on hold with the IRS, while in the waiting room at the DMV after immediately coming from having oral surgery at the dentist. Horrible customer service, no one ever answers the phone and if they do be prepared to repeat the same info to 4 people before being offered no answer or resolution to your problem. If this review helps ONE person stay away from this company, I will have made the world a better place.

Patti Drinville

I have never used World Pay. Over 4 years ago I had a short relationship with Vantiv who was bought out by WorldPay. 4 years later my bank charged me over $1,000 in 3 ACH charges. Like every story on this page, I have called and called, got the local rep involved and put in 3 claims. Nothing came of it. World Pay says my account has been closed for over 4 years and there are no charges. Yet my bank and the local rep say the charges came from WorldPay.

If there is an attorney out there who implements a class action lawsuit, please include me.

Someone on this page said BBB was next … that is where I am going next …

Has anyone taken them to small claims? I was online looking to see if they are registered in CA for just that reason when I came across the site …

Lee O'brien

Company will charge you thousands of dollars in processing fees per month. It’s like paying off a mortgage. Also very hard to terminate.

j. brickey

Worldpay service center is so poorly staffed and resolving a complaint is apparently an impossible task. We had issue with a bank withdraw by Worldpay for a shipment of their credit card processor. They wanted us to pay for shipping a credit card processor that was to replace an original one that never worked. It has been three months and the issue has not been resolved. 12 + hours of holding, being transferred, hung up on, told credit was coming and never did. It makes my stomach turn to know this company operates in 40 plus countries. We are in the process of transferring credit card companies. Once we transfer our business I may actually throw a party.

Mrs M Kotecha

A company that rips you off, I am a struggling small business and even though had given notice got charged and even though have not been operating for over a year they have slapped another fee fir compliance without even clarifying. Do not trust them . I need to complain about them, does anybody know who I can contact and take this further. People need to know.

Ersin

I wanted to cancel it because for around 6 months my business was shut due to law( lock-down), i was charged £45 a month. then you pay 1 months extra to cancel it and send the terminal back, they find reasons to change you extra when cancelling such as £376+vat for the terminal. (I use POS system from square now, with cheaper rates and NO monthly fees)

Alfonso Larriva

They add new fees and then lie about the composition of those fees.

They lie when you renew, lie after you renew, and lie while you are on contract with them.

Kev-O

Stay far away from this company. Their customer service is horrible. I’ve been without a terminal due to *tamper* issue caused by power outage for over 2 weeks now. Pretty hard to do business without a POS terminal. You just get transferred around their service department and never get a real answer. Hold times at all times of the day are usually a hour, and that’s if you don’t just get disconnected. Once you finally get to the deployment department, it goes straight to voicemail and they don’t call you back; ever! Crappy company, with under-trained workers.

Mark Coakley

We hear a lot about WorldPay but we use them through our website as part of a service they made with the designers Booking Online Ltd, and we haven’t really experienced any issues. Once it was set up, it worked, and it’s been reliable since.

Sarah Ford

Worldpay experienced a shut down in Nov of 2020. We were unable to process credit cards, batch out, etc. Worldpay was unavailable by phone or internet (email, chat option). I requested online through a customer service portal to close the account. Seven months later, I am still dealing with their unauthorized charges on my bank account. I have called multiple times and have been left on hold for hours. Finally on May 3, 2021, the account is closed. June 8, a new charge appeared on my account for $5.95. I called to see what this is for – they say it is for an account I opened in 2008. I haven’t had this account for years, and now I see that they have charged my account randomly since July of 2020. Their customer service is horrible, and they should be held accountable. I am also making a complaint to the BBB.

Laurie Heistand

They have been stealing money from me since 2019. I have followed all instructions to close my accounts and still am being charged. I have spent at least 20 hours per month since January on the phone with their reps. No change. Every month the charges are different amounts. Any attorney out there looking for a class action lawsuit? I see from the comments that I am not the only one this company has been fleecing illegally.

Nikki herrin

Beware! They will steal your money.

Julayne harris

Worst service. Do not use this company. They are not providing the service they offer. The software to run reports is awful. No return calls for help. One month later I was called by a rep that lied stating I was offered an alternative processing portal not IQ. No tickets made for repeated requests for help and the tickets they did have were a month old and had been ” resolved” by closing the account before the date the rep says i was offered help? Awful and they want us to pay early termination fee.

All sales I completed had held funds and did not post due to address and zip code not correct? Had I entered that info no. I was told I just didn’t understand how it works. I had only gotten an ” approval” when I ran payment for services. Awful

Lana Bass

This is 100% SCAM Co., They charge with out any contracts , nobody knows in there customer service. Spending second working day to be on a phone with them, nothing, so dissapointed , wiil open a claim agains them and 3/5 bank who is halping them to clear my account.

Gary Jenkinson

avoid at all costs nothing but lies worst customer service ever no accountability no callbacks no nothing just dissapointment

Patti Anderson

Horrible! Their contract automatically renews and even after 8 years, they charge you $495 “early termination fee” to leave. Yes, I should have but the date out on my calendar and renegotiated it when it automatically renews but for most business owners, we don’t even think about it.

Laura Heistand

We have not used WorldPay for credit card processing for years. According to the people I talk to on the phone, our accounts are closed. They are still deducting money from our accounts. Filing a complaint with BBB next.

MARTIN ONONUJU J OBIOHA

This company is a grave yard for small businesses. The are a big fraud. The make you submit your your banking details which they take out as they wish irrespective of your business situation. We closed due to the Covid since March last year and I called them to suspend my accounts, for some reason the guy I spoke to never did so, they kept taking out money from our account up until January of this year. Just spoke to a lady today and she claims that there was no call to them so they took the money legally.

This is another Big company’s way of feeding off little companies. Government should stop these wicked selfish way of running businesses. Why should there be contracts, Why should people have to keep their credit card details or bank details with any business. Why can’t they just send your bills and you pay.

Pat Wiley

horrible service, duplicate accounts created false charges , no resolution, run away do not use this company !!!!

MUKESH V SHAH

The worst experience I got from worldpay. Local rep is not willing to help at all. He want me to call customer service for any issues. They deduct money from your account because of ACH.

If you call them, they said everything is right and not willing to listen you. They are rude to response and many times they hangup the phone. Rep told me that it was good company before but since it merge and become big, it is a nightmare. Being a big is not my problem.

Al

If you want to be considered a thief when receiving larger wire transfers, or if a dispute they’ll just take money from your account (don’t expect a real “dispute”)!

I bet there is a lawsuit coming for those thieves and I’ll be part of it !

Who wants more details I’m ready

Pat Wiley

i’ll be right on board with you

Kristie Lowetz

DO NOT USE WORLDPAY!! Customer service is incredibly poor, actually it’s been the worst customer service experience of my life!! Each time I call I get transferred at least 3 times, each time having to restate who I am and why I’m calling. Calls have been dropped 45 minutes into the ordeal and they don’t bother to call you back so you get to start all over again. I finally got through to someone I thought might actually be able to help me cancel our account, but he actually ended up threatening me with a $495 cancellation fee which I thought was ridiculous after doing business with them for YEARS. When we finally did get the right person that could cancel our account, we later got hit with the draft on our bank account for $495. Sadly I’d rather be out the $495 than have to call them again, they are that horrible.

Ayhan

I believe every little thing you said

Kate Jackson

World pay have to be the most complicated, least professional service.

I cancelled my card machine due to complicated invoices and hidden payments.

I cancelled in september and they are still trying to take direct debit and hounding me for payments.

Avoid avoid avoid.

CPO

Kate,

This article should help: How to Cancel a Merchant Account Without Paying a Fee.

-Phillip

Tom

Kate – Call your bank and have them put an ACH debit block on your account for the worldpay collection. That will stop them from debiting your account.

C Scott McCorkle

After reviewing my account, I realized they had been charging me more than 5% per transaction. I cancelled my account in October. November 4 I received 2 more charges on my account totaling almost $400. I contacted my out of state representative who told me it was the last fees I owed and they bill a month behind. November 7, I received another $37.45 charge and contacted him again and he emailed me saying “This is the final payment, you will not be charged anything else.” Yesterday, I get hit with another $199 and $37.45 and the rep will not answer my call or emails. I visited the bank who they are affiliated with and showed the manger the emails. He made a call to a special line for banks only. He was told he didn’t have a clearance code and they could not help him. The bank manager was no help. I’m still getting ripped, 6 weeks after canceling these folks. It’s unreal. It’s theft. Brian Blake, the representative is a Snake.

CPO

Mr. McCorkle,

This article should help: How to Cancel a Merchant Account Without Paying a Fee.

-Phillip

kris

your only getting hit at 5%? we are getting it at about 8.9%. we will be talking to our bank asap.

Kier Delaney

One of the worst companies I’ve ever had the displeasure of “not” working with. They’ve charged us for months for a service we’ve never used. How they were ever able to do that, I’m not sure. I tried repeatedly to have the fraudulent account they’ve been charging us for cancelled to no avail. “FINALLY”, after four tries again today, I was able to get a nice customer service rep named Layla to send me a form to get the account closed. Whether or not they actually close the account remains to be seen. It’s very likely I’ll have to file a small claim against them to recoup my money, for a service that we never signed up for and never used that they did everything they could to not let me cancel…until there was Layla. Layla was great on the fourth try. If you get a rep named Lee on the phone, just hang up and try again. She failed me three times today and hung up on me the fourth time after leaving me on hold for a good while. This, after giving me a bad number, twice, to a a “group” that was supposedly going to try to help me close the account that was a fraudulent account in the first place. Do not use this company for anything. You’ll regret it!

CPO

Kier,

This article should help: How to Cancel a Merchant Account Without Paying a Fee.

-Phillip

JOHN HART

I have never in my life dealt with a company as ridiculous as this one, i truly recommend you run as fast as you can from these thieves

Al

Beware of there fees

Also sold my store closed my account with them. And they are still trying too Take $64.95 out of my account every month

Trying calling them on hold for 2 hours

joe

RUN, do not walk.

RUN AWAY!

Eight year customer – two years go everything TANKED. Technical/Support depts are CLUELESS, zero accountability, zero followup with issues. All support tickets are “marked closed as resolved’ no matter what. Unable to escalate issues or receive basic responses.

We’re soooo excited about moving to a different platform this year! GOODBYE!

Jeff Kressin

Effective processing rate increased by 45%!! With no explanation and no willingness to refund the difference to bring back in line with normal rates.

After checking my July statement for Ocmulgee Brewpub and finding it at nearly 4% fees, I contacted customer support, on or around 27 August 2019 and spoke with Jasmine Johnson who is identified as a Sr. Merchant Liaison (970) 335-4949 Phone and [email protected] For more than 2 years we have processed at approximately 2.7% After reviewing processing for both of my businesses (Ocmulgee Brewpub and Just Tap’d) she stated that Ocmulgee Brewpub should be processing at a slightly lower rate than Just Tap’d (Which is around 2.5%)and that she would make the changes to implement this right away. She could not tell me why the sudden 45% increase to my rate. I also asked for a refund of fees of the difference between the normal rate and the increased rate. When I checked my statements for both businesses for August, I found my Just Tap’d business was now also at a 4% effective rate. I called and sent emails to Jasmine and her only response was that the new rate (lower rate)would take affect in October. I have not been able to obtain a reason for this as in the past any rate adjustments are immediate, why was this going to take months to change and why did she now also change my other business (Just Tap’d) to the higher rate? I can’t get anyone to now respond to me with answers. To date, my rates for both businesses have increase by 45%, I have not been able to get anyone to refund the difference for the overcharging and still am processing at a ridiculous rate on nearly 2.2 million dollars in sales combined and an average ticket of approximately $25. I am now going to have to look at changing my POS vender (PointOS) because they only use them and one other processing company that is also shady in their practices. Had I known PointOS works with BBB processors with a D- rating I would not have chosen them in the first place. To date I have not been able to get anyone from WorldPay to resolve this problem.

Consumer’s Desired Resolution:

I want my rates for both businesses processing at an effective rate of 2.5% and I want a refund for the overcharging that took place for the past couple months while I have tried to seek a resolution with WorldPay.

Sandy Baker

My husband cancelled his account with WorldPay for credit card processing for his small auto repair business on February 13, 2019, and switched to a different company. He verified that the equipment he’d purchased from Worldpay was paid in full and was told that his account was closed, and he didn’t need to return the equipment or do anything further. Worldpay continued to charge for March ($155.84), April ($155.84), and May ($140.85) despite my husband cancelling his account in February and no credit cards being processed through WorldPay for March, April, and May. My husband passed away in May, and that’s when I discovered that WorldPay had made the unauthorized withdrawals from his account. In my first communication with Worldpay, I was told the account from which the money was being withdrawn from was not on file with their company. When I asked how they were pulling the money from that account, I was told that they could not speak with me about the matter. The second time I spoke to Worldpay, I was told that they did not have a record of any communication from my husband to cancel his account. I also received the following email verbatim from WorldPay, “Hello. After Futher review of account, I do not see ant calls about closing your merchant processing account or a CLose form sent in. If you would like your account closed you will need to fill oit a close form and send it back it. To this case. With not info on wanting to close account i can not refund your fee’s, I have attached a close form to this email and put the case in the correct department, When you Reply back it will come to this case and we will Process the close as long as everything is correct Any questions, Please call Merchant support at 877-744-5300 and they will be able to assist you. They are open 24/7.”

My husband called February 13, 2019, and was told his equipment was paid in full and that his account was closed at that time. Worldpay continued to deduct a total of $452.53 in unauthorized withdrawals, even though there have been no credit card sales processed through Worldpay since February 13, 2019.

I filed a complaint with the Better Business Bureau, and WorldPay responded with the following message verbatim,

“Good Morning,

After additional research on the account, we have been unable to find a closure form filled out by Mr. Baker. It states in the contracts that are signed before processing with Worldpay that all account closures must be done in writing. We were unable to find a closure form or request to close the account back in February 2019. It has been confirmed that there has been zero processing on the account since February 2019. The closure form has been sent into worldpay as of 6/13/19 and the account has been officially closed as of 6/25/19.

As a courtesy to Mr. and Mrs. Baker, we are prepared to offer them the last 3 months of processing that was charged to the account. The last 3 months of charges on the account are April ($155.84), May ($155.84), and June ($140.85) for a total of $452.53. Please respond to let us know if you accept this offer as soon as possible. We apologize for any inconveniences you may have encountered and look forward to hearing from you.

Thank you,

Worldpay

Ereico Essex

US Operations Service Excellence Team

Service Manager

Cincinnati”

WorldPay did refund the $452.53 on July 3 to my husband’s business account, then withdrew anther $49.95 on July 9 and another $.20 on August 8. When I called WorldPay, I was told this was my last charge for June. The guy kept saying it was a valid charge, even though I reminded him that they’d refunded me the original charge for June via my BBB complaint. He said valid charge 5 different times like I was just going to accept it if he said it enough. I filed another complaint with the BBB, to which WorldPay never responded. Do not use this company. Read the complaints on WorldPay; they are almost all the same.

Michael Mazzucca

I have had many merchant accounts through out the years, some good and some not so good. I originally started with swipesimple and payment depot. All was right with the world, fees were ok, payments processed quickly and as they were promised. Then one day my banker from Fifth Third suggested I meet their merchant services provider. I did, I was told that I would be able to process and batch out to receive payments within 5 hours. It was a good selling point, so I switched. A huge mistake. The transition should have been seemless from swipesimple to swipe simple ….nope not with worldpay. They processed 2 payments and then started holding my money telling me it was a “risk assessment” and that they had to verify where the monies were coming from. They challenged 2 payments from the same card that was processed. Then decided to hold money from an unrelated transaction. With no one to assist, and no 24/7 service I was left with no funds, an angry client, no help a bank holiday and a weekend to add insult. It took over a week to finally get my money and the sad part is, over a $1600 charge. I wish I could say it was the only time this happened, but it isn’t. It happened a few weeks before this incident and again over the weekend no help, no sense of urgency, nothing….that incident cost me $1700. They felt justified because they sent one email asking me to call them. The email sender then proceeds to ask me to call him, only to find out that his voicemail goes to an entirely different individual. After several emails, phone calls and customer service calls….I find out this guy isn’t even in the office for several days, he’s “working from home”. Ok well doesn’t that mean your still working? Nope not this guy….and apparently as big as worldpay is, only he can solve my issue. He is the one sole person in the entire company that can solve it….and he’s off. This is by far the worst merchant service company I have ever dealt with, it is also the worst company I have ever dealt with. I wouldn’t process a thing with this company and I advise to stay away and use payment depot…they have an A rating and have fantastic service, always someone to speak with and get answers….worldpay is a complete joke….everything they tell you is a play on words and double talk….but then again this is simply my experience with them..

Andrei coste

An abuse over me and income

I have my payments held since 14 of November 2018; the reason was why the same customer made a split transaction with a difference of some hours. I told them that the client was visiting from Sri Lanka, he was seeing a girl I was living with, he purchased 2 massages and 10 fitness training sessions for both of them, he made one payment according to the limit of the bank from Sri Lanka and the second payment was right after the midnight of SriLanka`s time. Does anyone believe that they understand that from WorldPay? No, not at all. Asked me to send them degree proof, business premises, why the transaction was split in two, evidence that the services exchange had a place, but what do they want me to take pictures of my clients on my massage table? No matter what I try to explain, what pictures I send these not smart persons to seem not to understand, I feel I’m getting crazy, I tell like id explain to a mentally disabled person, and they have not enough intelligence to comprehend simple things. I don’t want to work with them anymore, but can anyone advise me what I can do? If I could give them stars would be -1, an evil and abusive company, low IQ employees, a disgrace and disgust for business owners.

I`ve been contacted by WorldPay asking my details to have a look at my case when I replied as Reference I wrote my name and my merchant number; I believe that should be enough.

They replied that I did not give them the information needed for further investigations. Really? Haven’t I? I managed to get copies of the incriminated transactions, not with any help of that agent, he never mentioned I could get them from the terminal. These are not enough proof either, well I only can wish him Rest In Peace because it’s clear that his only purpose on earth is to keep shade to the ground, and nothing else.

But YOU Worldpay since you are so advanced in technology to prevent fraud and money laundering, you don’t have the technology and the smart people needed to figure it out yourselves: this is, this is not a legal and genuine transaction? How can you advertise and ask people to trust you, when in 9 months you could not figure it out. If the only way you can tell there is a fraud or not is by waiting 18 months to see if the one who made the payment is asking for a refund or not means your total unprepared for this world, not a trustful company, not updated with the new technology, they are not a trusty company by far.

Molly

Worst Company to work with. Refused to accept our PCI compliance. Charged us $50 a month in non-compliance fees on top of our monthly fee. Plus other hidden fees: transaction fee, enablement fee, transmission fee, nabu fee, fanf fee… the list goes on and on and on and these are all on top of our 2.15% processing fee. You cannot speak to anyone there. You get transferred and transferred and transferred and then told the team will look at your account and call you back. We had an issue with all credit cards being rejected on our site. It took 8 days for them to call me back and tell me it’s not them… which it was. We changed companies and all cards have been processed since. I only wish I had changed 6 months ago. Please do not use World Pay!!

This post will help: Eliminate Hidden Fees From Your Monthly Bill

-Phillip

Elizabeth

The absolute worst! Took hundreds of dollars for no reason. Given the complete run-around when trying to get answers. Passed from department to department. Extremely unprofessional

This post will help: How to Make Your Payment Processor Release Your Money

-Phillip

Parker's Hot Dogs (Denise Wilson)

Since moving to the new platform on 6/17/19 WorldPay has been taking 24% of our daily settlements. This 24% was a split where 76% went our checking account and 24% went to another financial institution. This had been happening for close to 10 years. When put on the new platform Worldpay continues to take the 24%, but does not send it the financial institution nor do we see the money. There have been many call to customer service. Many cases have been opened. Each time we are told that it will be escalated and we will hear something. That has not happened yet. To date Worldpay owes us close to $15,000. In addition, I am also being charged for 2 terminal by not only the New Worldpay, but the Old WorldPay as well. I only have and have ever had 1 terminal. Watch out. I won’t go into all the calls and how long I was hold to only be disconnected. Be careful doing business with this company.

This post will help: How to Make Your Payment Processor Release Your Money

-Phillip

Chrissy Bohnhoff

Horrible Horrible Horrible!!!!

Processing fees jumped 1200.00 in one month. I tried calling to see what the reason was and nobody answered my call or would return my call from my messages. Its like the entire company ghosted me.

I would never trust them!! Complete scam artists. I was paying 1700 a month too much in cc expenses.

This post will help: Find and Eliminate Hidden Fees From Your Monthly Bill

-Phillip

Tina O'Sullivan

Rates go up as you are in contract. Watch the non-qualified transactions in your contract. On top of the V/MC fees, they want to charge “up to 2.95%”. What is unqualified? Really, anything. When asked, it can be as simple as a company card. They are crooks.

This post will help: Find and Eliminate Hidden Fees In Your Monthly Bill

-Phillip

Abbi Lewis-Smith

After selling my business nearly 2 years ago and terminating my 3 Worldpay accounts, received correspondence from my old business today to say Worldpay are demanding over £400 for the terminals we closed in Nov 2017 – invoices are dated in 2018 & 2019!

I’ve got letters from Worldpay confirming closing the accounts back in Oct 2017 and the accounts would be closed (card machines) on 10th Nov 2017. How come nearly 2 years later, suddenly there’s threatening arrears letters for non-existent terminals from Dec 2017?! To make matters worse I tried to call today but couldn’t get through the security process because I don’t have the business bank account details to hand. Of course I don’t. It was closed nearly 2 years ago! For clarity whoever from Worldpay sees these reviews as well as anyone else thinking of using Worldpay in the future, I’ve sent my merchant ids with this review. Ironically the new business owner tried to go with Worldpay when she took over but too many issues with them meant she went with another company, no problem. Way to lose over three quarters of a million pounds worth of transactions each year Worldpay. I’ve emailed Worldpay today with the letters from themselves, closing the accounts back in 2017. Let’s hope this gets resolved but what a stupid mistake to make and I see I’m not the only one!

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

Katherine Yates

Worldpay has been applying charges to every statement I have received since October 2018 which are complete theft of my money. Such as a monthly statement fee of $4.99 every month although I opted out of receiving statements and do not receive statements. Another fee we are charged every month is Chargeback Service Fee T1. This fee is reportedly a monthly charge in case anyone requests a chargeback that month. That has never happened with us and we have opted out of this service in favor of paying a per-chargeback fee should one occur. Although we opted out of that program, we are still charged $7.50 every month. On the last page of my statement dated May 6, 2019, in a section marked “This Month’s News”, I read:

You have been enrolled in a free trial of Worldpay Bizshield, a third party data intelligence tool designed to protect your online reputation and grow your business. Worldpay Bizshield’s 24/7 monitoring software helps protect your business from critical activity like negative online reviews and incorrect business listings, and delivers real-time alerts directly into your email inbox. Your free trial is effective 5/1/2019 to 6/30/2019. If you don’t opt out before 6/30/2019, you will be charged $19.99 for July, and you will be charged for each subsequent month until you opt out. You may opt out of this product and service at any time by calling 800.846.4472.I contacted them 6/12/19 and opted out of this service. On my bill dated 7/6/2019, I was charged $19.99 for Bizshield. I called Worldpay and they did admit that I had opted out. They opened a case to have the charge returned. This is probably the 15th call I have made to them to correct various charges. They have 6-12 cases open for my account but not one of them has corrected any of the issues or been closed. That being said, I have two accounts with them and another whole set of problems with them and cases opened on the other account too. Complete theft. I will get out of this asap.

This post will help: Find and Remove Hidden Fees From Your Monthly Bill

-Phillip

nancy l de los rios

I was customer of Vantiv, we closed our accounts years ago. My checking accounts are being hit 50.00 per month. I’ve tried to reach out to my old rep, who sent me to “customer service”. I have never ever ever been told it will be 175 minutes in the queue, and their serious. I left my number the first time, but i couldn’t take the call. Now I’m on hold, it’s going on 45 minutes, it’s after 5 pm, so hopefully there is someone there. The phone tree is so not helpful. This company was hard to work with years ago, the new merger didn’t help. Nancy

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

jacqueline Borkowski

Worse costumer services experience. Nasty attitudes reps.

This post will help: Best Payment Processors for Great Customer Service

-Phillip

Galen Niehues

WorldPay decided to update their ebt, ewic, and gift card processing software on July 10th, 2019, right in the middle of people getting their ebt. The update caused a small percentage of stores, including mine, to be rendered unable to process ebt. It is still down as I write this on July 14th. This has cost my store thousands of dollars in business and untold future business. Every other store in my immediate area was still able to process ebt, so many of my loyal customers believe I was lying or discriminating.

This post will help: Best EBT Merchant Accounts

-Phillip

Angie

World pay had fraudulent activity that affected my account. They have been no help, are very rude, all they do is transfer my call, and now saying I owe the processing fees and chargebacks for the fraudulent activity and until I pay they are holding all of my processed funds since 6/7! I am looking into an attorney!

This post will help: How to Make Your Payment Processor Release Your Money

-Phillip

Leo

WorldPay, Vantiv, Virtual Terminal Plus, etc. they have changed companies names 5 times now. I have been asking for months now to let me transfer to them about 1000 customers from my other credit card service and vice versa since I need to utilize two systems for my customers but they do not let me or they don’t understand how to do a vault PCI compliant transfer. Obviously they know how to do it as we did it initially and the company that does the transfers is willing are ready to do the transfers but he needs the green light from (WorldPay, / Vantiv, / Virtual Terminal Plus). I have put in about 20 hrs on the phone talking to different departments and no one can facilitate this or they say it can’t be done. That is obviously ridiculous that is what they do for new accounts all the time I don’t know what to do. Here I am trying to give them more business and they can’t facilitate a simple request. I am forced to end service with them.

This post will help: PCI Compliance Questions Every Merchant Should Ask

-Phillip

Richard Lynch

Worst Merchant Service I’ve ever seen. HORRIBLE HORRIBLE HORRIBLE COMPANY. They had a business down unable to process cards for a week and it didn’t seem to bother anyone at all, constant run around sat on hold twice for 2 hours and finally gave up. DON’T USE THIS MERCHANT

This post will help: Top-Rated Merchant Account Providers

-Phillip

Nai

This company is best at giving customer runs around

Catherine Williams

BE AWARE of World Pay they completely rip you off. We changed our bank account details with them and they have charged us £2400.00 for this as an admin charge !!! Absolutely disgusting. They will be having their machines back all six of them and we will go to Barclaycard. Don’t join this rip off company

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

andrei coste

Why would anyone trust or collaborate with Worldpay? I have my funds blocked since November 2018, indeed I admit, might have lost those damn original receipts, it can happen to anyone, there are days I cannot find my socks. I don’t have a secretary, and I work ambulatory, all the chances that I can lose some small paper.

For us, the merchants that have a short memory or broken pockets, there is Worldpay, that is supposed to be so advanced and offer such security for your business that some lost papers won’t make the difference. Is not like that at all, if you lost a piece of paper you going to have the money from that transaction blocked…The only way this multinational multilateral highly developed company can only tell if a purchase is OK: if you present the receipt and 2. If the one who makes the payment does not require a money refund in 18 months. That’s it? Anyone can do that, you don’t need a computer for that, or a team, or anything … Why do they get paid for if in 9 months no one from their team was bright enough to figure it out or to buy a software that can make the job for them when all the employee are no smarter than a 6th-grade pupil, sorry kids if offended, I know your smarter than WorldPay anti-fraud elite team

Bottom line..if you thought they are a good idea for your business, give it up because you might end as I do, looking at the money in their account, money looking at me, but not enough intelligence in the company to solve the issue.

This post will help: Why Credit Card Processors Hold Funds

-Phillip

Andrei coste

I have my payments held since 14 of November 2018; the reason was why the same customer made a split transaction with a difference of some hours. I told them that the client was visiting from Sri Lanka, he was seeing a girl I was living with, he purchased 2 massages and 10 fitness training sessions for both of them, he made one payment according to the limit of the bank from Sri Lanka and the second payment was right after the midnight of SriLanka`s time. Does anyone believe that they understand that from WorldPay? No, not at all. Asked me to send them degree proof, business premises, why the transaction was split in two, evidence that the services exchange had place, but what do they want me to take pictures of my clients on my massage table? No matter what I try to explain, what pictures I send these idiots to seem not to understand, I feel I’m getting crazy, I tell like id explain to a mentally disabled person, and they have not enough intelligence to comprehend simple things. Obviously, I don’t want to work with them anymore but can anyone advise me what can I do? If I could give them stars would be -1, a bad and abusive company, low IQ employees, a disgrace and disgust for business owners

This post will help: How to Make Your Payment Processor Release Your Money

-Phillip

Susan Kelly

I canceled my relationship with this company in August 2018. They told me they needed it in writing and sent me an email with the form to fill out. I filled out the form and faxed it back to them per their instructions. They continued to take money out of my bank acct. I called them Dec 1, 2018, and asked why they were continuing to take money out. Their representative claimed it wasn’t the right form and I said it was the one they sent me. He re-sent it to my email, and when I received it, it was the same one except for the top said WorldPay and not Vantic. He explained that WorldPay bought out Vantic and assured me that they would reimburse me. Asked him to make sure he didn’t debit my account for December but he claimed the ACH was already in the works, and he couldn’t stop it, but they would reimburse me. But, when I got my December statement, they took more money out. When I called back to find out why they debited more money out and why they hadn’t reimbursed me, they claimed it was denied and had no intention of repaying the money they took out after I notified them in August by fax of my termination.

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

Justin

Worldpay is quite possibly one of the worst service providers I have ever used. Absolutely nothing is clear from the start with them. Settlement charges, fees and monthly statements are a nightmare to reconcile.

Customer service is a straight up F. Not only have I been hung up on by Worldpay CS agents but each individual I speak with tells me different/conflicting information. It really seems like they just make things up on the spot to get off the phone. When you are running a business its the worst feeling in the world.

Recently after years of being a reluctant customer I got chewed up and spit out in their “integration” and “migration” from their legacy platform to their new platform. As far as I can tell to Worldpay those words

mean “truncation” “amputation” and otherwise a severing of your customer information from one system to the next. I have lost 100’s of saved customers all of whom have subscribed to auto billing to receive regular shipments of products from my store. These customers are relying on us to get paid and ship them their products without further interaction. in 2019 who decides that not supporting subscription products and auto-billing is good business sense?! Worldpay thats who. wow. what. a. mistake. best of luck to them i suppose.

This post will help: Best Merchant Accounts for Subscription-Style Businesses

-Phillip

ELIF SUNAR

It is so obvious how they become big company just RIPPING OFF people. They have suspended my account, advised not to use but they keep charging over the service I was not able to use. You cannot imagine how they are careless about their clients. From sales to customer services, all were just saying it is not their problem. DONT WASTE YOUR TIME AND MONEY WITH THEM.

This post will help: Top-Rated Merchant Accounts

-Phillip

Catherine Greenhalgh

High fees and hidden fees. When you don’t use their service for payments they will charge you non-compliance fee. They ask you to go into their website for things to do. There are better providers out there. Don’t use this company.

This post will help: Find and Eliminate Added Fees From Your Monthly Bill

-Phillip

Jeff Eckart

Worldpay probably states it has an early termination fee up front but what is early termination? Is it returning the card terminals, reducing your daily charges, calling up and telling them you want to terminate? You will end up paying an early termination fee – period. You will be contacted by someone who at first is very ingratiating and then will tell you with an oily voice that “well , you know, we have an early termination fee”. This comes right out of the book of used car salespeople 101.

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

GREG OCONNER

If you’re looking for a credit card processing company do yourself a favor & stay far away from Worldpay. If you do however decide to go with them be prepared to watch your statements every month like a hawk & be prepared to spend lots of time on the phone every month disputing fees. If you’re someone that enjoys paying premium rates, Hidden fees, & overall liked to get ripped off Worldpay is for you. For me the best experience I ever had with Worldpay was terminating my agreement with them.

This post will help: Monitor Your Monthly Statement And Eliminate Surprise Fees

-Phillip

George Asmar

Be-careful World pay big thief

They can steal your money legally as they did stole mine

they have a clause under the terms and conditions of service with me which they are quick to quote and email a copy over stating they have the right to “indefinitely” hold funds. A company as big as worldpay I am afraid act legally. I am not sure if the best route is solicitor and court or financial ombudsman at this point, but I need to make a formal complaint prior to involving them.

The actual wording they put

“Thank you for the documents that you have previously provided. We have now conducted our final review of the transactions, business and documents provided. The outcome of this review has determined that Worldpay are not in a position to release these funds.

Worldpay are entitled to withhold sums under the terms of the contract, specifically clauses:

5.4 In addition to our rights under clauses 5.2 and 5.3, we may defer any amount we are obliged to pay you:

(C) without limit in amount or time, if we become aware or reasonably believe that you are in breach of or likely to be in breach of your

obligations under this Agreement.

Funds may be retained by Worldpay in the event that it cannot be confirmed that a genuine transaction has taken place. The contract definition of a “Transaction” is any payment by a Buyer for goods and/or services purchased by a Buyer from and provided by you, using either:

(A) a Card, a Card number or otherwise to debit or credit the applicable Card account; or

(B) an Alternative Payment Method,

If you wish to make an official compliant, please see our complaints procedure (attached) Please be advised that in making a complaint, this will not change the outcome of this decision.

If you want to dispute this decision we would advise that you may wish to seek legal advice. If you take the decision to seek legal advice, all further communication must be made through your, and Worldpays legal representatives.

This post will help: Best Merchant Accounts for Contractors

-Phillip

Ridity Hassan

Name of my company is DBA – CYBERNATICS,(GROUP OF FUTURE FIFTY), I signed up with WORLDPAY (Formally Known As “SECURENET“) July 2015. Everything was smooth till the Dec 2017, we were processing credit cards, batch was being settled & fund were deposited in my account & even when there was a chargeback it was deducted from my account, along with monthly fees. But from January 2018 till date, none of them funds that i have processed has been deposited in to my accounts, but rather WORLDPAY has deducted funds from the account in the name of MONTHLY CHARGES & CHARGEBACKS (From Jan 2018- till date), surprisingly it is same account that was receiving funds earlier, no detail with the account was changed. I called up the company on the Feb 21st, 2019 requesting to find out what exactly happened. They started giving a run around from one department to another, keeping on hold for 30-45 mins on each call,no body could point me to the right direction or which department i need to call. I called them atleast 25-30 times to figure, which department i needed to speak to but they were themselves not sure of it, just confirmed that i has to wait, since then i’m still waiting.I have even have them conferenced with my bank, where the bank clearly states that no funds were deposited since the January 2018. I have also emailed them all the month wise banking statement since the January 2018, but till today they have been claiming that they have not heard from the concerned department yet. When i asked them to allow me to speak to the concerned department, who ever is taking care of it, but bluntly told me, they do not accept any calls or emails directly from the customer, i have to go through them. When i started tracking my total processing since January 2018 to till date, it is well over $18000. When i started pursuing with my complaint, WORLDPAY has locked me out from all their portal, they are also stopped providing any Processing Statement for the month of February 2019. Luckily for me i had downloaded the DEPOSIT SUMMARY & SETTLED TRANSACTIONS STATEMENTS since January 2018 to FEBRUARY 2019.

CASE NO GIVEN TO ME ever time i called: 24928017 / 24936137/ 24949905

People I spoke to in WORLDPAY:

1. TENEKA WEARY (SECURITY HELPDESK)-

PH: 1800-859-5965 option 9 & EXTN: 4234

2. WILLIAM WHEELER

3. ALEX (ID NO: 11422200)

Alt. PH NO: 770-396-1616 / 770-353-4267 / 888-231-0060

Can you please tell me, what steps can be taken against such companies?

This post will help: How to Make Your Payment Processor Release Your Money

-Phillip

Noeyoni

Worldpay has been debiting money from my checking account for months and I cannot stop them. Even though after much persistence I got a WP agent to shut my account in December they charged over $400 in late December, January and Februrary to my checking account. Please shut them down!

This post will help: Cancelling a Merchant Account Without Paying a Fee

– Phillip

Mike

Noeyoni-May I suggest that you go to your bank and have them put an ACH debit block on your bank account specifically for Worldpay.

At same time be aware that WP might charge you a fee for blocking them from your However they will no have access to your account to take the fee directly. At that point everything is negotiable

This post will help: Cancelling Your Merchant Account Without Paying a Fee

-Phillip

Mark VenHuizen

Avoid this company at all costs. We have been a customer for five years, only because they system we converted to in 2014 was integrated with WorldPay (then known as Mercury). Signing a contract with them is worthless as they will not honor the terms. Our contract with them specifically stated which fees were allowed to be charged, yet every few months they would start adding junk fees. The first three times I complained to them, they refunded the overcharges, but this latest time, they offered a fraction of what we were owed and when I said that was not acceptable, they refused to refund anything. Their reps have told me they audit their accounts every few months and if the accounts are not as profitable as they would like, they start adding fees and padding the interchange rates. Again, not allowed with the contract we had in place but contracts apparently mean nothing to them. Needless to say, we are in the process of finding a new provider.

This post will help: Best Merchant Accounts for Boat Rentals

– Phillip

Demanding honest businesses

Fraud and scam! Do not use or support! Am managing a nonprofit that servers orphans and deals with food scarcity. We never entered into a contract with Worldpay but rather a 2 organization ago predecessor that merged with them. I was not informed of anything, have no credit card reader and never used their service, but they are removing multiple fees directly from my bank account and acting like I have a contract that allows them to do so. They are even trying to get me to sign one with them now. Customer Service is abominable, including with the bank who works hand in hand with Worldpay and won’t stand up against them. We need a different system that does not give companies direct access to our bank accounts! When these companies sell out they sell the access to your bank account! This could be to anyone even someone you may not even know about, and they can claim they have a contract with you! In this case they are robbing from orphans and the poor! Please help us stop them!

From The Editor

This Post Might Help: Cancelling a Merchant Account Without Paying a Fee

Ravi Dalal

Do Not Use WorldPay! WorldPay are thieves, I had an account with them as had just started my business at the beginning of August and all was fine for a month, in September I made some larger sales and took payment by card through WorldPay done the banking at the end of the day as per usual, then I receive an email that the money is being held until I provide more proof that my business actually exists I provided all of that and got told that they will be holding the money for 120 days it’s now 126 days and they are still holding it. I have called them several times to be told that the person that is dealing with it is on lunch they will call me as soon as they get back so far it has been a 6 day lunch break. What I did not understand is that WorldPay have held the money for 120 days they could have done everything in that time a released the money that they owe me when it was due but no. I have now ad to make a complaint to the financial ombudsman. When you start a business for the first time the idea is to make money for your business and yourself not for it to be stolen by a at a guess multi million pound company like Worldpay.

As I said do not use!

From The Editor

This Post Might Help: How to Make Your Payment Processor Release Your Money

billy caldwell

This is the worst provider ever. They have cost my company a large amount of money due to their inept handling of our business account.

From The Editor

This Post Might Help: Top-Rated Merchant Account Providers

James

We began using worldpay as our credit processor in October 2018. For nearly two and a half months we have not been paid out for ANY of our visa transactions, which comprises about 2/3 of our Direct To Consumer dividends. After many phone calls, emails with no responses, and a TOTAL lack of communication on thier part, we were finally able to resolve the issue of our VISA transactions not going through.

However, this is not the end of this fiasco. They batched all the transactions and withdrew the money for them from our clients on December 13th, nearly two months later. I now have EXTREMLEY dissatisfied customers who are complaining about these transactions, and some of them are quite sizeable (700-1000 dollars).