Overview

In this review of Square, we will provide a detailed overview of the company's credit card processing and business management services. We will cover the range of services they offer, including point-of-sale (POS) systems, mobile payment solutions, and e-commerce capabilities. The review will identify the types of businesses that might benefit from these services. Additionally, we will examine client and customer reviews to highlight common trends and potential concerns. The article will also address the company's pricing structure, contract terms, and specific features provided. By the end of this review, you will understand whether Square meets your payment processing and business management needs.

About Square Credit Card Processing

This article is focused on credit card processing using Square for established businesses and industries, such as retail, food service, and ecommerce. The article provides an in-depth review of Square's point of sale options and card readers, as well as an analysis of user reviews. It also examines common complaints and fees associated with Square's credit card processing, comparing them to traditional merchant services companies.

Square's Card Reader and POS

We will also provide an analysis of Square's card readers and point-of-sale options, including the Square Reader for contactless and chip as well the company's retail and restaurant POS. These hardware options are compatible with a range of mobile devices, including smartphones and tablets, making them an attractive option for businesses that require a portable payment processing solution.

Square's Additional Features and Services

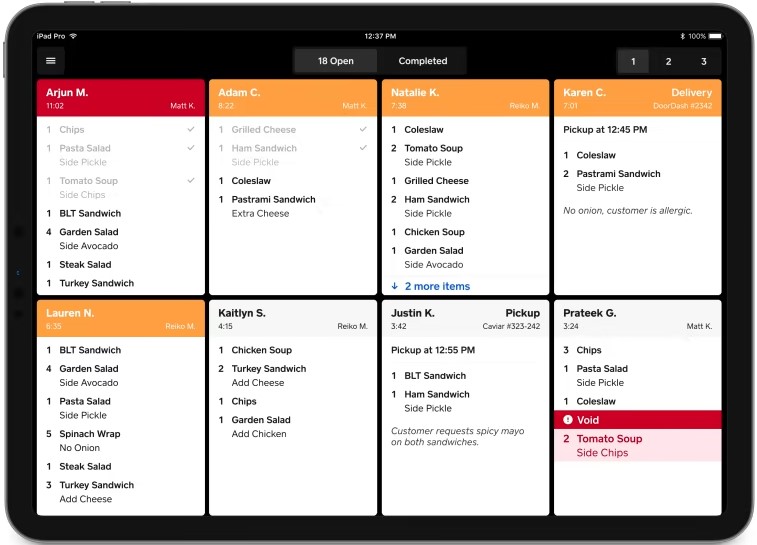

Additionally, we will cover various services provided by Square, such as its Kitchen Display System, Square Terminal, and Integrated Reservation and Waitlist Management. Readers who are interested in Square's specific services can find more detailed reviews through links provided in the article.

Square User Reviews

User reviews are a crucial factor to consider when choosing a credit card processing provider. This article provides an analysis of user reviews, highlighting the strengths and weaknesses of Square's services as reported by actual customers. We also cover common complaints about Square's services, such as issues with customer support, funding holds, and account stability. By highlighting these complaints, we aim to help business owners understand potential pain points and make informed decisions about whether Square is the right provider for them.

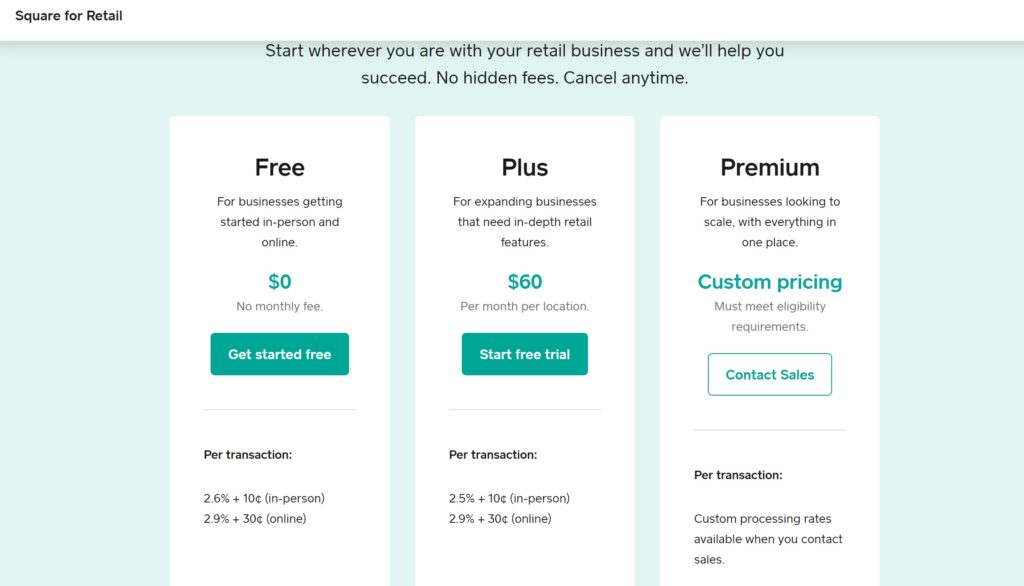

Square's Fees

Fees are an essential consideration when choosing a credit card processing provider. This article provides an analysis of Square's fees, including transaction fees, chargeback fees, and hardware costs. We'll compare Square's fees to those of traditional merchant services companies, providing businesses with a valuable benchmark for evaluating the cost-effectiveness of Square's services.

Started By The Original Twitter Founder

Square was founded in 2009 by Jack Dorsey who also founded Twitter before it was bought by Elon Musk. The company grew rapidly and Square became a public company in 2015 under the “SQ” ticker. The Square corporation rebranded to “Block Inc” in 2021 but continues to operate it's payment processing services under the Square brand. Much of the company’s success can be attributed to its then unique take on smartphone credit card processing (See: Best Mobile Credit Card Processing Apps) and by being the first to market such technology to small businesses owners as well as everyday people.

Quick Sign-up and Intuitive Design

Signing up for Square's payment processing is simple: users simply visit Square's website to fill out a short form and await approval, which typically happens instantly. Once approved, users can choose from hardware options such as a card reader that connects to a phone or tablet via Bluetooth, or a from dedicated point-of-sale devices that can be used on a countertop or taken to the customer. Square has been so successful in the mobile credit card processing industry that it has inspired numerous competitors.

Payment Processing Designed for Specific Industries

Square has placed particular attention on common industries with predictable sales patterns and low risk of fraud and chargebacks. Below are the business types that Square targets with its marketing.

Square for Restaurants and Bars

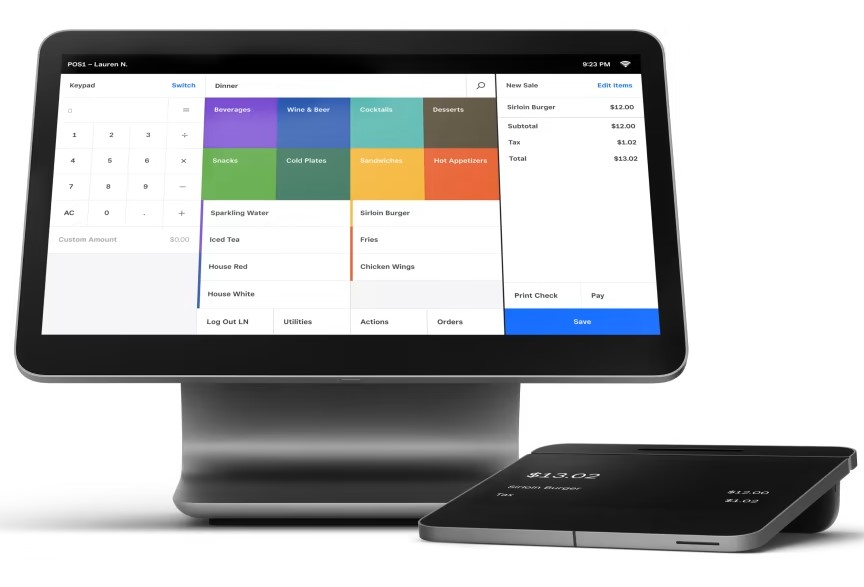

Square offers an extensive suite of services and products for the food and beverage industry, catering to various business types. Below, we explore Square's specialized features and solutions for quick-service restaurants, full-service restaurants, bars, food trucks, bakeries, and catering services. First we'll cover features that are found with all the industry specific POS options.

Staffing and Scheduling

Square's software solutions provide bars and restaurants with tools to manage their unique staffing needs more effectively. Time tracking and role-based permissions are two features that can help businesses manage their workforce more efficiently. Time tracking allows businesses to accurately track employee hours, manage payroll, and ensure compliance with labor laws. Role-based permissions allow businesses to assign different levels of access to employees based on their job responsibilities, ensuring that sensitive information is only accessible to those who need it.

Offline Payment Processing

Square's offline mode is a valuable feature that ensures seamless payment processing even without an internet connection. This feature is particularly useful for businesses that operate in areas with limited connectivity or are prone to internet outages. With offline mode, businesses can continue to process transactions and accept payments without any interruption, reducing the risk of lost sales or dissatisfied customers. When an internet connection becomes available, Square will automatically sync all offline transactions and update the business's records. This feature provides businesses with peace of mind, knowing that they can continue to operate even in challenging environments. Overall, Square's offline mode is a useful tool that provides businesses with flexibility, reliability, and seamless payment processing.

Insights into Product Performance and Customer Preferences

Square's software solutions provide valuable reporting tools that can help restaurants gain insights into their product performance and customer preferences. By tracking sales data, restaurants can identify which menu items are most popular, track inventory levels, and make informed decisions about restocking and pricing strategies. This can help restaurants reduce waste, optimize their menu offerings, and improve their profitability.

In addition, Square's reporting features can provide restaurants with insights into customer preferences and purchasing behaviors. By analyzing sales data, restaurants can identify trends and patterns in customer behavior, such as peak ordering times or popular menu items. This can help restaurants tailor their offerings to better meet the needs of their customers and improve their overall dining experience.

Customizable Menu Options

Square's software solutions offer customizable menu options and item modifiers that provide restaurant owners with the flexibility to manage a wide range of products with ease. These features allow restaurants to modify, add, or remove menu items quickly and efficiently, making it easy to keep menus up to date and to accommodate customer requests. With item modifiers, restaurants can add specific instructions or preferences to menu items, such as cooking preferences or dietary restrictions, improving the dining experience for customers.

Next, we'll cover features for specific food and beverage businesses.

Quick-Service Restaurants and Cafes:

Speedy Transactions for Fast-Paced Operations

Square Terminal and contactless payments are tools that can be beneficial for quick-service restaurants and cafes. Square Terminal is an all-in-one device that can process transactions, refunds, and print receipts. This device can help businesses save costs and streamline their checkout process. Contactless payments allow customers to pay quickly and securely without exchanging physical cards or handling cash. This not only speeds up the transaction process but also enhances the overall customer experience. Additionally, contactless payments can improve security and protect against fraud as sensitive payment information is encrypted and securely transmitted during the transaction process.

Mobile Ordering and Pickup Options

Square Online provides an option for quick-service restaurants and cafes to offer mobile ordering and pickup to their customers. This feature caters to the on-the-go nature of customers who want to quickly and easily order their food without having to wait in line or be physically present at the location. With Square Online, customers can place their orders remotely, and then pick up their orders at their convenience. This feature provides greater flexibility and convenience to customers, improving their overall experience with the business. For quick-service restaurants and cafes, this feature can help increase sales, reduce wait times, and improve operational efficiency.

Order Management with Kitchen Display System

The Square Kitchen Display System (KDS) is a tool that aims to help quick-service restaurants manage orders efficiently and provide fast service to customers. With the Square KDS, orders are displayed on a digital screen, allowing kitchen staff to prioritize and manage them in real-time. This helps to reduce wait times, increase order accuracy, and improve overall customer satisfaction. The Square KDS also provides features such as order tracking and timers, which can help staff manage their workload and ensure that orders are prepared and delivered in a timely manner. By streamlining the order management process, the Square KDS can help quick-service restaurants improve their operational efficiency, reduce errors, and provide a better experience for their customers.

Full-Service Restaurants:

Table and Floor Plan Management

Square provides a range of features and tools that enable quick-service restaurants to manage their dine-in services more efficiently. One of the key features of Square for restaurants is its comprehensive table and floor plan management tools. With these tools, restaurants can create and manage floor plans, assign tables to servers, and monitor table status in real-time. This allows staff to coordinate their services more effectively, ensuring that tables are assigned to servers efficiently and orders are taken and delivered promptly.

Pay-at-the-Table Functionality

Square Terminal's pay-at-the-table functionality allows customers to pay for their meals directly at the table with their credit cards. This feature reduces wait times and provides a more secure transaction process.

Integrated Reservation and Waitlist Management

Square's Integrated Reservation and Waitlist Management system provides quick-service restaurants with a useful tool to manage their reservation and waitlist processes. With this system, restaurants can manage their reservations and waitlists in one place, simplifying the process and reducing errors. Customers can easily make reservations online, and restaurants can manage them with real-time updates, reducing the risk of overbooking or other scheduling conflicts.

Bars and Nightclubs:

Inventory Management Features

Square's inventory management tools enable bars an nightclubs to track their alcohol and ingredient stock levels. This feature helps businesses monitor their inventory in real-time and ensures that they have enough supplies. Additionally, Square's inventory management tools provide insights into which items are popular and which ones need to be restocked, allowing bar owners to make informed decisions about their inventory management strategies.

Tab Management for Accurate Billing

Square's payment system simplifies opening and closing tabs, reducing billing errors and ensuring accurate charges. With features like tab management and easy payment processing, customers can quickly and easily start and close tabs without confusion or mistakes. This improves the customer experience and helps businesses avoid costly billing errors.

Food Trucks and Mobile Vendors:

Compact and Portable Hardware Solutions

Square Terminal offers a compact, portable solution for quick setup and teardown in mobile food and beverage businesses.

Location-Based Services

Integrate location-based services with Square Online to help customers find and order from mobile vendors.

Catering and Event Services:

Scheduling and Management with Square Appointments

Square Appointments simplifies scheduling and managing events and bookings for catering services.

Efficient Invoicing and Estimates Features

Square's invoicing and estimates features streamline billing and payment management for catering clients.

Square Restaurant POS Example

Learn more about Square's food and beverage POS here.

Square Credit Card Processing for Retail Businesses

Square offers a wide range of services and products tailored to the retail industry, accommodating various retail business types. Below, we delve into Square's specialized features and solutions for brick-and-mortar stores, online retailers, pop-up shops, and specialty retailers.

Brick-and-Mortar Retail Stores

Point-of-Sale System for In-Store Sales

Square for Retail offers a comprehensive POS system with inventory management, customer profiles, and employee management tools, streamlining in-store sales and operations.

Integrated Hardware Solutions

Square Register and Square Terminal provide seamless hardware integration, simplifying transactions and enhancing customer experience.

Advanced Reporting and Analytics

Square's reporting and analytics features deliver actionable insights into sales trends, inventory management, and customer behavior.

Online Retailers

Easy-to-Use E-commerce Platform

Square Online provides a user-friendly platform for creating customizable, professional online stores that integrate seamlessly with the Square POS system.

Shipping and Pickup Options

Square offer customers a variety of shipping and pickup options, including in-store pickup, curbside pickup, and shipping integration with major carriers.

Secure Payment Processing for Online Transactions

Square's focus on providing a secure payment processing system ensures safe and reliable online transactions for customers.

Learn more about Square's retail POS options here.

Other Square Services

Since the launch of the Square card reader and mobile app, the company has rolled out several other services for both business owners and personal use. Below are links to our specific Square reviews for these services.

- Square Register is a point-of-sale (POS) device that is intended as an all-in-one payment terminal for retail businesses. The company has options tailored for retail POS, restaurant POS, food truck POS, coffee shop POS, as well as a few others.

- Square Online Store is an Square's online store builder for selling products over the internet. The platform is simple to use and quick to set up. The service has no monthly fees and the only cost is the card transaction fees from your sales.

- Square for Retail is Square's point-of-sale system specifically designed for brick-and-mortar retailers. The service is similar to Square Register but includes a revamped checkout process as well as additional features such as enhanced inventory management, employee accounts, cost of goods sold, purchase orders, vendor lists, and more.

- Square Cash is a direct peer-to-peer cash transfer service that is linked to a user's debit card. Cash sends payments via email and smartphone and allows for free transfers of funds between users. The service is not targeted at business owners, but they may use it to make payments outside of a business setting.

- Square Capital is a Square's business loan program that can be activated from the dashboard in the Square Register. Square Capital allows merchants to receive a large upfront cash amount and then pay that total back over time with a fixed percentage of their daily credit card sales, similar to a merchant cash advance.

- The company has also recently launched several other service including a virtual terminal that can be used on any device, an self-serve orders app called “Square Order,” an online invoicing feature called “Square Invoices,” an online scheduler called “Square Appointments,” and an offline processing mode that enables merchants to capture payments even when their internet is down.

Industries Square Does Not Serve: Prohibited Industries

While Square offers an extensive suite of services and products catering to a wide range of industries, there are certain businesses that it does not serve due to legal, regulatory, or compliance reasons. This short section highlights industries and business types that are prohibited according to Square's list of restricted industries. Attempting to process payments with Square in the following business types will result in your funds being withheld and the termination of your account.

Regulated Products and Services

Square does not support businesses that deal in the sale or distribution of regulated products and services, such as narcotics, marijuana, drug paraphernalia, e-cigarettes, firearms, ammunition, and explosives. The company does, however, provide payment processing for CBD businesses (See: Best CBD Payment Processors)

Adult Content and Services

Businesses involved in adult entertainment, products, or services—including but not limited to pornography, escort services, and adult live chat features—are not supported by Square (See: Best Adult Industry Payment Processors).

Financial and Legal Services

Square does not cater to businesses offering certain financial and legal services, such as investment and credit services, bankruptcy attorneys, collection agencies, and payday loans (See: Best High-RIsk Merchant Account Providers).

Gambling and Betting

Businesses involved in gambling, lottery, or betting activities, including online gambling sites, sports forecasting, and odds-making, are not supported by Square (See: Best Merchant Accounts for Gambling Businesses).

Illicit or Unethical Activities

Square prohibits any business involved in illicit or unethical activities, including those that promote hate speech, harassment, discrimination, or that violate intellectual property rights.

High-Risk Products and Services

Businesses dealing with high-risk products or services, such as telecommunications equipment, prepaid phone cards, phone unlocking services, or those that pose a high risk of fraud or chargebacks, are not supported by Square (See: Best High Risk Payment Processors).

Michael rodd

Absolutely the worst experience if my life – square is holding my funds because they want to.. there is no chargeback – they claim they want me to provide a massive amount of information to them “in case of future incidents”

They are holding the money intrest free for as long as they deem necessary

Customer service calls are answered outside the united states and the representatives are very hard to understand and have no idea what they are talking about

It is clear they are just reading a script from the computer

Square claims they do this to protect the business and the customer – yet they have no complaint from me or the customer

Plain ans simple they are ripping businesses off by holding accounts for review intrest free for up to 90 days

Anna marchesani

They have canceled my account w no explanation.

Slow funding transfers up to 5 days without explanation.

No one to speak to or

Contact.

Very dissatisfied at this stage

Deborah Billings

DO NOT USE SQUARE – THEY ARE CROOKS!! I set up an account with Square to process payments specifically for Spa Finder Gift Cards. The account processes them seamlessly. I began in May 2023 and the funds never transferred to my account. I kept thinking I had something set up wrong and kept trying different settings and re-entering my account info. When I finally gave up and called them to ask for help setting up, they said they would have to refer me to another department higher up for review and they would email me. I instantly received an email stating my account has been deactivated. They stated that my funds will be released in February of 2024. (This was November 8, 2023). No explanation…nothing. Every time I call they say “the decision is final.” They will not forward me to a supervisor or anyone else… Always…the decision is final. I even had my banker call them and tell them the code and laws stating this is illegal to hold the funds for 10 months. I cannot speak with anyone and they only send generic email saying “account is deactivated”. They are holding over $5K of my money and I am a small, local business…this is literally my payroll. I do not know what else to do. How are they legally allowed to do this?

Karen O'Connor

Square is horrible! I used them prior to covid, but my business hit a bump. This year, I was able to start back up and I used Square – and now they are not only charging me the fees, they decided for no reason to hold onto my funds (significant amount) for 3 months before they will release the money into my bank account.

Now, I am basically screwed again. I tried calling Square, besides sitting on hold for so long – they said they could give me no information as to why they “deactivated” my account, but also they are holding onto over $20,000 of my client’s funds. I can’t hire an attorney, it is taking all my money to get my business started again. NEVER was I asked to give any information, in fact I continued getting information from Square stating to continue taking transactions. It wasn’t until after they accepted the transactions did they decide to ask for more information on my business. I supplied them with everything they needed. I went to transfer my money from the transactions into my bank but I got the surprising notice, “We are deactivating your account and holding your funds for 3 months”. This is outrageous. I even called my bank and they said they had never heard of a company allowed to hold funds for 3 months without any explanation at all. SCAM

Jo Carr

My Square system has been malfunctioning for over a year. I have been relentlessly trying to get resolution for a very VERY long time. Today I have told them I will hold all day to get to the bottom of my issues with Square. I am a small business owner who works 7 days a week. I know they are hoping I just go away and give up. I won’t. I had to purchase a new card reader for $50. They sent it to me. It did not work. I asked them to expedite a new one, they sent regular UPS. My system is now operating worse than it was before I tried to change out the card reader. I have lost thousands of dollars in sales from a glitch in their system. Merchandise that was “sold” to customers that we never received payment for, but I have had to pay my vendors. I have been sick over this and finally had a nice lady by the name of Maria tell me they would give me $3,000 in processing fees and I was so excited to get part of my money back. I am now being told I was misinformed. This is after months of promises that someone in management would call me back to help resolve issues. No one has ever called me back. Square is the absolute worst and I will be changing processing companies as soon as possible! BUYER BEWARE!

j

Squares was a decent company. if they reorganize their finances, they’d probably be OK, but other. than that, what they’re doing is fraud.

Tony

My comments are likely much that same as every other. Square is a mess.

I started with them several years ago, but at the time, we were doing MILLIONS of dollars in business with PayPal. Heck, I borrowed over $500,000 from PayPal, with the click of a button. Super easy. But, like all good things, PayPal had a hiccup with us, so we started using our Square account.

At first, things went quite smoothly, particularly for the middle of COVID in 2020. Then, fast forward to 2022, when we had a charge-back. Like every charge-back we have ever had, we lost, and the “customer” got all the money (and it was a sizable amount). This is shared by ALL the credit card companies… the customer will win 95% of the time.

Then, we had a two other charge-backs, both from the same customer. Both disputed amounts were “thousands” of dollars. We also had a charge-back on our PayPal account, too.

Square immediately cancelled our account. Here’s where is gets weird… we WON ALL THREE of these most recent charge-backs!!! Never in ten years of business have we EVER won a charge-back, and now we won three in a row.

But, we are fighting with Square to release the money. Of course, they TAKE the money IMMEDIATELY, as soon as they get the charg-back. You, the merchant, is a criminal until proven innocent.

And, even with a “win”, we will probably have to sue them to get our money. Then, I have no idea how we will collect it, WHEN we win.

Block, Inc.

Attn: Square Arbitration Provision

PO Box 427069

San Francisco, CA 94142

Joao Vieira

You report them to the attorney general ,if you can’t find an attorney to sue them , for violation of their advertising and antitrust laws, you complain to Attorney general, or State attorney.

Joao Vieira

I am involving AG , they are engaging in deceitful advertising practices.

They stopped my payment processing without any reason whatsoever, but I was getting pissed off this time, and they tried to save face.

They scam people when they promise instant transfers, that they don’t deliver/process.. initially, when I was setting up my account, I gave them some slack…but, no longer.. now , they have my money.. I lost yesterday $1,000 because of them.

John Creo

They have been holding my money for months. I get no where with them when I call. They just keep telling me my account is under review and the will expedite it but nothing ever happens. I’m out over $100K not good!

Travis

I use Weebly for my website and was forced into connecting with Square. I made one or two sales through Square before deleting my shop from my website. Then Square got hacked and my account was deactivated. Now I cannot log into Weebly or Square and there’s no method of contact for either. Today I received an email from Square stating they plan to take $488 from my personal bank account due to a dispute over sales made while my account was hacked. I did not even have an online shop when I was hacked! Now what??!

Mike

Square is a totally rip off company. My wife is being denied her money. Someone should put this company out of business once and for all. Non US based terrible customer support. Next stop: Attorney General office in California.

P. Julian

Unfortunately, we’ve also become a “victim” of squareup. They’re ‘blackmailing’ us with our own money for info that their rep told us they wouldn’t need. Our 1st charge went thru with no probs. Now, the 2nd and 3rd charges (the big $ ones) are being ‘held’ until we provide more info. They even did this info request in a shady way: they started it with 7 questions. We answered them, now they have 5 more. We specifically asked the sales rep if they would need bank statements and other financial data. We didn’t want to have to provide this info (too time consuming) and were excited when she said “no, just sign up and start accepting payments.” Technically, she didn’t lie. We didn’t have to provide any of this during the sign up. Morally, she lied her butt off. Once we signed up and had some charges in our acct, they slapped a hold on our pay outs. They’re not only asking for bank info, tax records, gov’t licenses; but they also want our customer info too. Including: names, addresses, email addrs, phone #s, etc. You might not think this is a big thing, but their terms make little provision for safeguarding this info. I’m not a lawyer, but I’ve read over the terms (general & payment) again and I see nothing that indicates they would or could do this. This is truly nothing short of blackmail except they have the money upfront. Now they want all of our company data to resell. Honestly, there’s no other reason they’d need this info. We have a physical card reader and service with another major worldwide company who didn’t require any of this. This is a scam of the first-degree! If you don’t mind having your funds held hostage and giving up all of your company info…by all means…sign up today. As a side note: the BBB isn’t much better so don’t use their A+ rating of this company to base your decision. They protect the company that pays them for the rating, not the consumer. If a company isn’t listed with the BBB, they’ll be all over them with bad press and a low rating. The San Fran BBB has 520 bad reviews on their website, but they give square an A+ rating. Can you smell the rotten fish???

Ralph Bevilacqua

this company is a scam do not trust them i have been trying for three weeks to get my 3,000 dollars and they keep giving me the run around this is a bad choice to do business with them they will keep saying you will get and email but it never comes well you Stoll from the wrong company and a city credit card im going to my governor to let them know that the city of Tallahassee should not use SQUARE any more and let the district manager for every one who sells SQUARE KNOW what i have been threw i have recordings of their bad customer service and they admit to not even being in this country.

MIKAEEL ABDUL-MALIK

Make sure you get your refund before you deactivate. I signed up for this service. I was so excited about starting my online store. After about an hour of fiddling around with the service, I realized it was not good for me.That’s another story. Anyway in my confussion I for got to deactivate/cancle the account. Then I noticed they debited my bank account the folowing month. I immediatly deactivated the account. But when i attempted a refund, I could not get it because I am no longer allowed into my account even though I’m paid up for the month. I tried to call them, but if you can’t log in they won’t talk to you. This company has some shady business practices. I’m in the process of disputing it with my bank, but have to wait for the funds to clear. At that time I will let you know what happened.

Lorie Bridges

I have recently been charged $440 by square for one of my client’s delinquencies. They have associated our accounts saying I own them both. I have sent all the paperwork they asked for – but they won’t accept any of it and will not tell me why. They just keep sending me the outline of what documents are acceptable. I would love to join a lawsuit against them. My business is helping others set up their business – and with that reasoning – they could declare me responsible for any and all client debt pertaining to that client’s square account. I am flabbergasted. They refuse to offer phone support. I never received a notice of funds due or owing until the day they withdrew those funds from my personal account. My account has never been in debt in all the years I have been with square. How can we get involved in a class action?

Dr. Tonia Renee Lee

I too have experienced a similar problem. Two customers charged $30.00 each for my services. Instead of crediting my account with the money, they deducted the $60.00 stating that I owed them $230.00 for a Lawn Care Service connected with my school. Thankfully, I did not have that much money in my business account, so unfortunately though it made me overdrawn by $172.00. I put a stop payment on it with my bank. They went as far as to say I owned the Lawn Care Service. I have never owned or had business with a lawn care service. It is frustrating! I had to send them the same legal papers. It is an insult to tell me I own something that I don’t and that I am going to have to pay the bill even though I don’t even own the Lawn Care Service. If you file a class action lawsuit, I will join it with you!

David Saunders

Square card processing service are actual thieves.

I opened an account, received my first payment.

Had to wait for account verification for a week. The day before the balance would of been transfered I get an email saying my account has been deactivated and I would receive my balance in 90 days.

I replied asking why and was told they can’t tell me why and can’t send my balance for 90 days.

I called customer support, and was also told they can’t tell me why the account was closed. I asked to escilate my call to a specialist and was told they can’t escilate calls from deactivated accounts. I asked for a phone number to their legal department and was told they can’t give out any information to calls from deactivated account and that she has to end the call…

So your telling me,

There is a problem,

I can’t fix it, you can’t fix, I can’t tell you what it is, I can’t tell you who can fix it, I can’t tell you who can tell you about it, and I can’t tell you how to reach our legal department to explain why square is robbing you…

This isn’t over….

Sam Land

Square’s customer service is terrible! Suddenly they have held our deposits for all transactions almost $25,000 without explanation. When we called we were told that 2 transactions needs to be refunded to our customer without any explanation even though they are legitimate transactions. We provided all the customer information along with invoices. They have not provided any response since. What is puzzling is why they’re holding all the transaction funds not just the 2 transactions in question. We’ve contacted them several times for details, none are provided. Even in the account where we log in, there is no information provided on charge backs if any. They sent us a no-reply email saying our funds will be held for another 15 days without any details.

Looks like they don’t have enough money to run their operations and they’re holding all merchants money to use for their business.

This is very frustrating and we are considering switching to another company.

Even prior to this, the customer service never had answers on how to troubleshoot the software issues or provide any solutions. They’re not trained at all. This company is fradulent, they should be investigated by FCC, FTC and Bureau of Financial Protections.

Anthony Mediate

We recently lost money because we charged on the magnetic strip of a card and that card had a chip. I inquired to Square and said that the consumer took our product, but was informed that any time that you use the magnetic strip when the card has a chip, the retailer is at risk. The consumer can take your product and deny payment to the card company because you did not use the chip. As a retailer, there is nothing you can do. I thought Square should have informed their customers. We have now switched to SumUp; they charge less per transaction and offer a chip reader for $20.

Mel Welch

We are a small, startup business which provide extraction services for botanicals – including hemp/CBD. My business also sells several CBD products. As the General Counsel for the company, I work to ensure that our products are compliant with FDA requirements – as well as standard regulatory requirements. Square is – soon was – our company for credit card processing.

After working with them for several months, Square began withholding money from our transactions and claimed that we were non-compliant with regulatory requirements in statements made on our product website; I responded to their assertions and requests for information – but with every response, I received a proforma response asserting the same information. I was promised specific examples of the noncompliant parts of the website, along with screenshots, and a response within 24 hours – none of which I received. This has been repeating form now for over a week without any advancement, any accountability, and any evidence is support.

After digging for a dozen hours, I was able to suss out that Square actually imposes a more restrictive requirement than the FDA relating to CBD therapeutic effects. The FDA does not allow companies manufacturing and selling CBD to make claims related to “structure and/or function” as to how CBD affects the body, however it does allow sales puffery. Square exceeds this requirement, disallowing any salesmanship in marketing which complies with the federal regulations but creatively markets the product. In doing so, Square asserts some plausibility behind its theft of its customer’s funds. This was made all the more difficult because Square says that the reviewing department actually cannot communicate with anyone via phone nor do they communicate via email – but only through the online form; couple that lack of communication with their refusal to identify the problem with specifics, and you can see that the department is designed to not actually fulfill its alleged function of “investigating” and correcting errors.

If Square is going to have antipathy to CBD products, which are fully legal under Federal and State laws, it should advertise that it is not a Hemp/CBD-friendly business; instead it has caused our business to rely upon its assertions of speedy and responsive service while it has not provided the same. In doing so, it creates a risk to our business and to our employees who rely on our business. This is absolutely wrong.

A phenomenally poor business, with poor customer service, poor communication, poor department structure, and an owner that is a tyrant. I’m currently looking at whether there are active class action lawsuits related to Square’s theft of its customer’s funds, noncompliance with its terms and conditions (i.e., breach of contract), unjust enrichment, or other bad business related actions. If anyone is familiar with one, I would be greatly appreciative if you would inform me at Nemadji.co

Stephanie

Following. We were recently informed we are paying a 6% CBD related card processing rate although our restaurant does not sell any CBD related products. Do you think you can share with me the process for signing up to sell CBD products with Square? My bet is we were enrolled without our permission so they could charge 6% instead of what should have been .6% we are also a small woman owned, hispanic business on its first year and Square decides to do this. Delinquent behavior indeed

Sarah

ACH is a nightmare with square but honestly my complaint is the complete lack of any customer support….3 weeks in and they still haven’t gotten back to my “respond within 24-48” email and there is NO OTHER WAY TO CONTACT them, the last 5 days I have sent an email everyday thinking that maybe that 1st email was lost but nothing. I have never had a problem with them before but we have switched everything in all 4 of my businesses away from square this week. I can’t be with a company that has NO CUSTOMER SUPPORT because when we need it…!

The sad thing is this was a donation order for teens for “Fill Santa’s Sleigh” with gifts for foster kids. We are delivering today and tomorrow and we don’t have any donations for the teens because these funds didn’t come in. And no one pulls tags for teens, no one wants to shop for teens, its not “FUN” so we rely on our funds donations for these gifts! I am so frustrated, I am in tears!

Robert Maroulis

We are a new Food Truck business as of June 2021. We used Square without incident until 12/22/21 when we booked a large account/holiday party. The client paid for all of their employee’s meals in the amount of $3,450 via credit card. Square then came to us after using them all of this time to process credit cards without incident, asking us to verify our business. We supplied all of our business documents including all bank statements. Square then reviewed and sent an email stating they are unable to support our business needs right now and inactivated our account stating their decision is final and is now holding OUR money paid by OUR client without giving us a reason. This should NOT be legal and certainly does not seem ethical by any standards.

Scott Heintz

If you are looking to grow your business past only being able to process $100 tickets then DO NOT USE SQUARE they will take any large payment you process and freeze it while they audit you and request sensitive personal information from bank account statements to seeing all your invoices asking particulars about your clients. While you jump through all of these hoops just know that they are going to keep any money that you have had them process for a minimum of 90 days. On top of that no matter how much you comply THEY WILL CLOSE OUT YOUR ACCOUNT. NO MATTER WHAT. If you get to the point where they put a hold on your funds or they request any additional information know that there is no way to retain any of the money processed for 90 days and they will lock you out. All it takes is for you to have a customer pay you any large amount like $700 or $1,000. As soon as you run a high amount they seize it. EVERY TIME. They will not work with you, you can’t reason with them. I had all of my documentation down to videos of the project and they shut me down costing me OVER $4,700! Not to mention making my company look bad when they held the funds so that I couldn’t buy the material I needed for the job. After 3 days of waiting the customer backed out. If you want your company to lose thousands and look like a complete jack wad then sure use square if you actually want your buisness to get somewhere and grow USE ANY OTHER MERCHANT. Square doesnt even have live customer service!

Elizabeth McQueen

We got square for the same thing they are holding my funds. I will never use square again and I will never tell anyone to use them

Ed Lounds

I’m a new business as a vendor at a Farmers market each Saturday. We have missed some business because we don’t take cards. We’re small with limited weekly income at the market. Is there a card reader company that we can use that can service a small company like us?

Thanks for all the info about Square and what to look for in other companies.

ED

R a D

Lost money with square. Over 50 hours no response to my emails. (855) 700-6000 everyone please note their phone number they do not provide anywhere. When they answer ask to be directed to the debit card or checking dept. And they will transfer you…. Debit card stops.working. no warning no message that anything is wrong no explanation just the usual push off, work ticket , someone will get back to you blah blah . Blessings, I had previously linked another bank account so I was able to transfer my funds away from them today after 50 hours they still.havent done a thing or communicated a thing to me. Report them to who? No federal regs on online banking services. BBB is only an advertising service for their pay to play customers. So report to who? Queen Elizabeth?

Rick Luppino

I’ve been waiting over three month for $10000 they held, my only transaction and they said in 90 days I’d get it. The deactivated my account and now say another 30 said due to resent charge backs and this was my only transaction and they held it and deactivated so how are there charge backs. Total availability, affiliate awfully customer service, can’t get in touch wth them, they won’t answer an email. No one should use them.

Dan B.

We went through the onboarding process and we used the services. We were able to use the card processing services but Square had been holding our funds. They said Square needed more financial documents to authorize the transaction. We provided the documents but no response for a week..

Later, we got a note they could not support our business needs and they will deposit the funds into our account within 2 business days, probably because we are a tour operator and the pandemic places us in a high-risk business. Why they did tell us that before?? Customer service rating is 0. The account rep was clueless.

Then they sent us another note a week later saying our funds will be held for 90 days with no explanation. This is not a 5* star company and we moved on to Stripe. Square has terrible customer service and poor crisis management. I wish we had never contacted this bad company. If you choose them be AWARE at your own risk they might hold your funds with no plausible reason .

ABSOLUT SPORT INC.

Jennife

Square is awful. I had them for over a year, then all of a sudden they had to verify my company. I sent in all my documents, tax ID, and everything they asked for. I waited the two days for them to process it, just for them to deny me and hold all my money for 90 days. When I called customer service they did not help me at all and were very rude. DO NOT USE THEM!!

James F Fleming

There are some major things wrong with Square Inc. Please see below for where to complain and a few notes about my experience.

California Department of Businesss Oversite

https://dfpi.ca.gov/file-a-complaint/

FTC:

1-877-FTC-HELP (1-877-382-4357), or use the complaint form at

AND

https://www.ftc.gov/policy/public-comments

California Attorney General:

https://oag.ca.gov/contact/consumer-complaint-against-business-or-company

ADA- How to file a complaint:

https://www.ada.gov/filing_complaint.htm

To file a complaint with the BBB:

https://www.bbb.org/file-a-complaint

There’s something very, very wrong at Square. They are abusing their Business customers, withholding funds for unreasonable amounts of time, unfairly closing accounts and all without warning or reason. They have people calling you and using their name to invest money. Have a questionable stranglehold on the market. In bed with Facebook to the point of Censorship.

Discrimination built into their verification process. No help for the disabled anf Refusal to accommodate the disabled.

Square is also in violation of the Credit Reporting Act or the Fair Credit Billing Act.

If you look, thousands of citizen consumers are all having these issues.

It seems Square thinks it’s all powerful and can do this en mass now.

And when someone needs assistance and complains, there is purposely no way to get ahold of anyone.

Some one should do something about this. Probably time for someone to look into a class action lawsuit.

Earl

This company should be investigated and the ones running it put in prison! They basically stole my money! Been a year and still can’t get my money.

Earl

Been holding my money for a year. Won’t let me talk to anyone. Stay away.

ANONYMUS

Beware…..if you want your money do not i repeat do not use square or square up

Company business practices should be investigated……..class action lawsuit should be

made

Beware beware beware

Elijah

Same as everyone else. They have witheld funds multiple times. But today in the middle of 3 projects I’m starting they froze the payments I took and the money in the square account and I was on E about 50 miles from home. I couldn’t pay my workers and I couldn’t finish buying supplies. This might actually ruin my business and reputation that I worked hard to build. They are withholding over $9k from me. Today was the last strand with them. I am beyond upset and tired of their bad business practice. I’m not sure if I’ll get the funds back. Just when I finally got ahead of things I probably have to refund these owners and still will owe my workers. Square ruins your business, it doesn’t help it. They should seriously be sued and shut down.

graham mueller

Square is hiding in the bushes waiting to rip businesses off just when they get some momentum; they hold funds for no reason, don’t have customer service and turn a blind eye to small business. Square is bad for small business.

Paradise

Square has took money from my business, and refuses to tell me what account they have sent my funds too! They won’t even acknowledge that they have charged me a fee to instant deposit and still haven’t given

Me my funds,

Dr. John W. Radke M.S. PhD.

Square is a bad company. They took money out of my customers Credit Card $805.00 and put it my Bank. Then I had to refund the money and they charged me a transfer fee for their mistake. I emailed them 20 times and they never answered. I called them with a customer code and they said it was not vallid. What a rip off Company. If your thinking about them forget it. Go with Pay pal.

mickey L koelling

Very poor customer service real clowns for what they charge. Beware they are a horrible company to be involved in your finances

Thomas McEniry

Square took money from our new business…

Square took money from our new business account. A recent new startup business. They claimed it was from a different business that was closed long ago, that was in someone else’s name. It had nothing to do with us. We provided them with all the documentation they requested yet they kept trying to debit the account, costing us a lot of money in fees. We were eventually forced to close the account just to stop them from attempting to debit it. Fortunately the bank manager had been through this with customers who use Square before and sided with us.

The Square “Customer Success” team was absolutely horrific. It literally took weeks to speak to a real person. They lied to us multiple times, on recorded calls. Even telling us, more than once, that the “Recovery Team” doesn’t have phones (yes, they actually said that) So, were have never been allowed to talk to anyone who knows why they are taking money.

We have, to date, spent over 40 hours trying to resolve this issue with Square. Finally, after nearly two months a real person called. He, even said that the “Recovery Team” doesn’t have phones. Ridiculous!

The end result of the conversation was they still refuse to pay us back what they cost us and still insist we somehow owe them money, but they’d give us a credit and forgive us our debt.

The thing is, we DON’T owe them. Never have. Quite the opposite.

Square refuses to square up with us.

J dynak

Have had square for years and had fraudulent charges on my account and they knew about them and they still let it happen and now they said sorry your out the money

Victoria

Square is a rip off I’ve been selling mask and now more apparel. They freez my account 2 weeks now. Unlock it 5 hrs. Then freeze it because of a 200 sale. Money is missing from my account. Dont use them!!! No way to call in without there fake code that doesn’t exist…

Mohammad zakzok

The worst processor I’ve ever used in my life. It seems like they just want to make quick money off of their customers and then kick you to the curb and hold your money for months after working with them for years.

Nathaniel Pownell

Withholding $2,000 for “possible fraud”. Trying to get my business started but they’re screwing up my operation.

Robert

Their withholding 20 k

Claudette Pagano

Square have been the most misleading, professional and illusive company that I have ever attempted to work with. Against my better judgement I gave them an opportunity and I sincerely regret it. Unacceptable and unethical business practices.

Samuel Cipolloni

They are the worst company that I have ever dealt with. Impossible to get a live person on the phone. They hold your money for no reason

Amanda

Sold a car to a lady. $2500. Square is holding my funds. I’ve submitted everything they ask me for and they keep coming back saying they need more info. So I submit it and 2 days later they can’t verify the Info. What they can’t verify the xustomers address. Bull crap. Don’t use them. They will just take your money

Jeff N

Let’s be frank. When one business has another business handling > 90% of its revenue processing, it’s a business partnership. More-so when it’s been on-going for more than two years.

For one of the partners to declare, without any warning or advance notice, that the business relationship is immediately ended, no further discussion permitted, our decision is final, is scurrilous behavior. The Small Business Community shouldn’t tolerate it. It’s unacceptable.

During the 30-months or so I used Square for processing credit card payments to my small business, I received frequent e-mail and phone call solicitations from other payment processors. “Let’s talk!” they’d say. “We can save you money.”

“No, Thanks.” I’d always reply. “I’m happy with Square.”

Then, on April 20th, I was taking payment from a customer who had already received our service. I couldn’t get the card reader work. I tried again, and noticed the app was asking for my business address and banking info – as if I was just starting with Square. This was how I learned Square had deactivated my account. I still don’t know why.

Square Customer Service says “Refer to the email we sent to the business email address on file with Square.” I looked in every folder of that email address. I was never sent an email regarding a violation of terms or deactivation of my account.

The abrupt halt to my company’s ability to accept card payments has caused real, but probably short term, harm to my small business. Shame on you, Square. You should be ashamed.

Virginia Quade

We are a brand new business and Square has held our funds on our first transaction for over 2 weeks! We are an active account ( I assume since they accepted the payment from our customer), but I cannot get a customer code to contact support! Any suggestions would be greatly appreciated. How do I get this resolved?

Tonka Varga

I get maximum satisfaction any time I use kloviactools

They are simply the best and reliable

loannroe

I have a terrible time trying to file sales tax for 2 years. The numbers does not match. Sales tax percent does not match. And customer service doesn’t know either. I have a hard time proving my numbers to the IRS because it is all wrong. Does anyone have this problem.?

Brian

Signed up with Square thinking it was a simple and less costly option than my traditional card processor. The virtual terminal looked simple and first transaction when as expected – funds transferred to bank account just fine. The very next day processed $700 of charges – bad news as I was informed our account was disabled and funds would be held for a minimum of 90 days. It’s a hopeless situation as they don’t have customer service. I hope I get the funds after the 90 days, but after reading the reviews, I don’t know. I guess I’ll contact my representatives and senators to alert them of the bad business behavior of this company. Don’t be lured by the simplicity, and simple fees – DO NOT USE SQUARE FOR YOUR CREDIT CARD PROCESSING!

ROCKY ALAN BURGESS

Square got me. I used them for years and now they want info they already process and keep asking for it over and over. Holding nearly 4k. They are thieves. I called 855-700-600 put in my customer code( a problem in itself) and was put through to account services only to be insulted and accused of being a possible criminal. If you have them leave now. Your turn is coming. This company is a ripoff. Time for a class action.

Bill

Back in October I enabled Square Payments on my Big Commerce website. Everything was fine the 1st two months, then in December I sold an item to someone who used Square Pay (mind you, this is THEIR OWN application). Before I had a chance to pack and ship it out I got an email from Square requesting all sorts of verification information…

Hello William,

Our system noticed some unusual activity on your Square account. To make sure we’re keeping Square a safe and transparent payment system for everyone—buyers and sellers alike—we’re suspending transfers to your bank account until we can confirm some of your information.

1. Please provide a copy of the customer(s) credit card processed for the transaction listed below:

• $96.50 MasterCard 2352 on 12/9/20, 12:10 pm

2. Please provide your customer’s state or government-issued identification. We’re able to accept these types of IDs: Driver’s License, Passport, Passport Card, State-issued Identification Card

• $96.50 MasterCard 2352 on 12/9/20, 12:10 pm

Again, this was an ONLINE sale, on my own website, using Square’s plug-in app for the Big Commerce platform… how would I have access to any of this information?! I emailed with someone from support named “Paris” but they never responded to my email after answering thier questions.

I sent them a follow-up email a few days later:

Hello Paris,

Due to this experience I have disabled Square as a payment method on our website. I may re-enable it, it depends upon the outcome of this horrible ordeal. Why did Square approve the transaction, then act like I am the one doing something wrong? It was a website payment for a toy using the Square integration with Big Commerce. I’ve never had anything like this happen with PayPal, whom we’ve been using for 15 years! Invoice is attached, it is now 8 DAYS OLD!!

I never received a response, but the next day I got this email from “Joseph”:

Hi William,

Your account is currently under review due to some changes in your activity. While under review, we place a temporary hold on your Square funds to ensure that everything is safe. To release this hold, we’ll just need you to confirm a few account details for us.

They wanted the same 2 pieces of information that I do not have access to as it is an eCommerce website!

My response:

Hello Joseph,

This is RIDICULOUS! It was a website order, therefore I do not have a copy of the customer’s credit card or identification! I’ve submitted the invoice online and also via email yesterday to ‘Paris’. WHY is Square harassing me about a transaction approved and authorized via the Square integration for my Big Commerce website?! I have been using PayPal on our website for 15 years without one single problem. I enable Square a couple of months ago, and now my funds are frozen!!!!

His response:

Hi William,

Thank you for taking the time to reply my email. We are more than happy to help!

Unfortunately, we weren’t able to fully confirm your account details with the information you provided. Until we receive a completed request form from you, we cannot transfer funds to your linked bank account.

That was on Dec. 18th with no further communication either way.

I received this email today:

Hello William,

We’re sorry to inform you that we’ve had to deactivate your account. Based on the information you provided about your business, we’re not able to support your business needs right now. You won’t be able to process payments with Square. Unfortunately, this decision is final.

Is this some sort of sick joke?!

I disabled your platform over 3 months ago, and now you’re dropping me? As the owner of a physical retail store and a successful eCommerce website, I had already determined that your system cannot be trusted. LMAO

Everett L WALLER

We have been square customers for over 6 years and today they cancelled or service without any notice. The email they sent at 9am this morning said we were not compliant with section 3 and some other section. We tried to call them and find out what we did or what we can do we couldn’t even get connected. As soon as you enter your customer code they tell you your account has been deactivated. This has got to be the worse company I have ever dealt with. I advise no one to do business with them . Now we are having to scramble to find a vendor so we can continue to operate. If I had the money to spare I would sue the hell out of them.

Hazel C. Andrews

DON’T USE SQUARE,

AFTER PROCESSING WITH SQUARE FOR SOMETIME – MY ACCOUNT WAS DEACTIVATED, AN EMAIL WAS SENT STATING THAT THEY WONT BE ABLE TO SUPPORT MY ACCOUNT ANY FURTHER. AT THAT POINT I HAD A LITTLE OVER 2,500.00 IN MY SQUARE ACCOUNT. THEY NEEDED 90DAYS TO VERIFY CHARGEBACKS. THE 90DAYS WAS TODAY, I GOT AN EMAIL FROM THEM STATING THAT THEY WILL NEED AN ADDITIONAL 45DAYS TO RELEASE THE FUNDS DUE TO THE CHARGE BACKS. I HAVE NEVER HAD A CHARGE BACK, AS THE CLIENTS THAT INITIALLY PAID FOR THE SERVICE HAS CONTINUED WITH OUR SERVICE. THE RECORD ALSO DOES NOT REFLECT NEITHER WAS I MADE AWARE FROM SQUARE THAT ANY CUSTOMER HAS REQUESTED TO A REFUND, OR BANK RETURN. IF YOU ARE WANTING TO LOSE MONEY DURING THIS TIME AND HAVE A COMPANY TURN YOU OFF AND HOLD ON TO WHAT IS YOURS, GO FOR IT – OTHERWISE SEEK ANOTHER PAYMENT GATEWAY.

Thomas Tetreault

Why in the world have you not made a compatible reader for Samsung galaxy note 20. This phone has been out for over a year now get with it people. Apple sux

Elizabeth

Square is the WORST credit card processor. I would not walk but run far away from them. After processing around 10-20K/month for 6+ months and purchasing their POS system, they placed a rolling reserve on our account at 20% of our processed sales for 120 days and a payment processing limit of 20K – so not only are they holding 8K worth of our sales for 4 months, we cannot process anymore credit cards this month. This was with ZERO chargebacks and submitting all the supporting docts for their review which was approved. We are a storefront retail business, and not on their prohibited list either. When I called their support line, their response was literally to find another processor which is what we did. Square is a complete scam and should be held accountable for the strangehold they are placing on small businesses during a pandemic.

Keith Thomas

Today I received a email telling me we were not in compliance with section 3 of there terms of service. Also telling us they were terminating our service. We have been with Square for 6 years and really enjoyed working with them. Never a problem. They terminated my service on a Friday without warning leaving my company I one hell of a mess. The mental anguish was the most difficult to swallow because we have been operating our business the same way for 6 years. And….you can’t call them and ask questions about their reasoning. One of the worst days of my life…..thanks Square!

Jeff N

Your story sounds just like mine. You stated it very well.

Ruth

They have kept our first sale from October 26, 2020. They initially said they would release the funds after January 25, 2021. Now they came up with another excuse not to release the funds. I am in the process of reporting them to every governing site available. It really sucks because the customer received the goods but we have not been able to receive our payment.

Darren McKee

Let’s get a class action suit against square foe unfair processing fees and holding money for 120 days. They are only holing cash to increase their cash on hand for shareholders! I’ve attempted to close my account and get my money out and they refuse. They are holding over 10k of my money and not even paying interest!!

Annoyed

Just want to remove my name from their mail list. You go round and round on their website. I do not want to provide them with my email address. You can not talk to anyone on the phone.

Michael woods

This company is the worst they steal money from your account took a card payment they Rev the charges then I get a email saying it came out in my favor and would be putting it back in my account well that’s been a month and they just keep changing the release date. In the mean time they closed my account said they couldn’t handle my business to many large card payment. This is after being a customer for 5 years with no complaints or refund.

Mukul Agarwal

Square issue funds to an unauthorize activity without any consent from card holder. Merchant make hand entry to system and gets the funds based on fraudulent invoice. No driver license verification. I am surprised to see this crime is happening every day and Square is participating.

AMM

Square allowed a customer to charge back $700 a month after service render. The customer Gregory Jackson a REal estate broker in cobb county ga. Hired movers for 12 hrs. A month later. Submit a charge back to square and said they had no knowledge of charge…. And guess what. After 3 months of dispute…. Square send a email saying the customer bank award them the money. $700. How . This company allow customer to take your hard earn money and DOES ABSOLUTELY NOTHING TO FIGHT. EVEN WHEN CUSTOMER SIGN ON SQUARE APP. THEY DO NOT BACK THEIR OWN APP AS PROOF. THEY ALLOWED SEVERAL OF MY CUSTOMER WHO PAID WITH AMEX TO COMMIT FRAUD AND DO CHARGE BACK. MAKE UP AMY BS AND THEY WILL GIVE THEM THEIR MONEY BACK. NO MATTER WHAT PROOF YOU SUBMIT.

Charles

All I can say is RUN, RUN AND RUN FAR AWAY! This company is a joke. In fact, they should be shut down IMMEDIATLEY! They shut my account down for NO REASON! And they have held my $2,000.00 for 4 months now. And the worst part is, you can not speak to a live person about it. I really believe this company may be ran by one guy out of his basement. I will be taking my issue with them to the attorney general.

Joe Ryan

Yes they are doing the same thing to my accounts but it’s over $20,000 and they will not release any funds. We have contacted our attorney.

Jeanine Carlton

Who is your lawyer

Hazel C. Andrews

I WANT IN ON THIS – THIS IS A JOKE

Jeanine Carlton

Me too I am suing them leave me ur nfo if u want to join in on this law suit I’m trying to contact CNN about them

Nina

They are doing the same thing to me. I’d like to get in on this.

Dorrean Grant

I am going through the same thing!!!

ROCKY ALAN BURGESS

After 6 years they got me too. Basically stole my money. I am contacting customers to dispute charges so I can get paid.

Laura D'elia

Did the Attorney General Help? Here in GA, it seems we have no recourse. No one to help. And The have held all my transfers for past month.

terry Sipes

SQ, squareup a Jack Dorsey company is a business support company let down in biblical proportions. Don’t just take my word for it…you can read 10’s of thousands of complaints. The BBB of San Fran only list 1 out of 8 complaints on SQUARE and are more than a month behind , lawsuits are filed, the SEC is looking into a fintech Interpol of sorts… I am working on day 253 of held funds by SQ…I have a landscape construction business in Denver, Co …never had a issue until “We need more information”, then deactivated my business account, never had a complaint on any of my business practices, until SQ. I’ll take a trade for every $38.00 of my money (SQ stock price on day of seizure) Ill take a share (per $38.00) at today’s market price of $218.00…that return works for me…the rest is just a joke, JD your not God, nor do you play one (false god) on TV or in the movies…ATS-Denver

Greg R

For all those who use the Square device for payment systems

!!! BEWARE !!!

I am now looking for another payment solution as Square no longer works on any of my phones!!!

Having used Square devices for several years, they have now stopped working on all phones.

Square have told me that my devices are not compatible. Hmmm.

Having worked for several years if I choose to use this payment system into the future I have to upgrade all three of my phones.

Most likely a software update by Square has stopped the app from connecting to my device – Square won’t be trying to solve the problem, leaving me without a payment system!

Outrageous!!

Be very careful if you choose to purchase this device, if it is not on the compatibility list it may stop working unexpectedly if they change their software.

Don’t expect any support to solve the problem from Square either.

Disgraceful customer service and problem solving.

Paul

WORST customer service ever….especially during these COVID times when people need online services (AND SUPPORT) now more than ever.

Signed up to Square this year, did one (ONE) transaction. They have now held my $230 since Aug 27th and will not allow it to be transfered to my bank. I have gone through multiple attempts to resolve this, via their chat system (terrible) and on phone with at least two reps who tried to help. It ends up I need to work with their account service department (who you cannot contact via phone, only email). I finally got this yesterday…..actual words. WTF?

“Upon review of your account there were ref flags that appeared to be fraud activity, and so the account was closed. Square will hold any funds debited for a period of 60 days from the time we stop facilitating your account. If you’d like to receive the funds sooner, please reach out to your financial institution for their funds return policy.”

Mim Jorrison

He’s right they do suck…I used to work there…we would hold your money so we get a free loan off you, make a quick market buy, stall on paying…..A real Piece of S**t business, and the people that work there know it, .

Leslie Yankaway

this is the worst service i have ever had they held my money and would not release it because i had all of my money being instantly deposited into my bank, then when i asked could i use my square card to get the funds off i was told no the blocked card to because they put under review, now its my money and i couldn’t even get my own money i will never use square again

Ruth Lucero

I was sent an email saying that I requested $1000 refund to a customer with the card ending in numbers that were 7772 I thought it was a scam the next day I see that my bank account has been deducted $964 with the charge of over $35 all was only viewed in my checking account never did it show up in my transactions on Square I spoke to square today but did not realize that my bank account had been deducted I am now at a negative balance.

lee

Will never ever deal with square again.. costumer service is the worse. I called and try to explain to some dude and he straight up said dude if u don’t shut up im gone hang the phone up on u out of nowhere..

Floridian

WORST COMPANY EVER! They will steal your money. They are a bunch of scammers. They will put your account on hold for a fraud review and then lock you out without having access to your funds. They need to be SUED

Scott

I had a simple misunderstanding, or I suppose problem, with the square app on my phone. For some reason, somehow same day deposit was turned on, even though I was sure it was turned off. When I got a large payment this week, to my surprise not only did I have my processing fee removed but there is an extra large fee removed because of the same day deposit.

I got on a chat with customer support to see if I could get that fee reversed, due to the issue with the app. I found absolutely no assistance their customer service. And a lot of hot air.

I’m very disappointed with this company solely because of the customer service. Instead of refunding the misunderstanding, a small amount of money in comparison to my sales fees.. I have now decided to steer most of my sales to a different and more reliable company.

Moral of the story here. It would have cost them a small amount make the customer happy if they had done that they would have been earning thousands of more dollars, that they are now loosing.

Ernest Bustos

I had a Square account for over 6 years without any complaints or issues, on Friday I received an email informing me that my account was deactivated claiming transactions prohibited by “Section 35 of the Payment Terms” which are vague to say the lest. With no customer it was impossible to find out why transactions that have been approved over the last 6 years have now been deemed prohibited. The email states that I will no longer be able to process transactions using square, it appears that my account has been closed without notice or explanation…. for this I would rate them as an “F”

C. Susan Keen, Esq.

I had Square for two years. Sudddnly, they intercepted a payment of a deposit and I found the experience a nightmare trying to get them to pay me. I think they hsve changed drasically to become a predatoy financial service. I have filed a Complaint with the Office of Business Oversight in Cslifornia for their unscrupulous conduct. Square plans to move into banking next. Heaven help us if they are approved by the FDIC.

Michael Mann

I own a recording studio/online retailer and used Square as my credit card processor briefly. Some of the products I sell are digital downloadable software serial numbers. The customer purchases a serial number ONLY which is displayed immediately after the transaction completes. They use this serial to unlock software which is downloaded from the manufacturer. There is NO chance to catch fraudulent purchases before it is too late. These are not physical goods.

Only problem is Square allowed multiple fraudulent purchases to clear for software serials. When I called about the disputes I got, ‘Well, we cannot verify the identity of the cardholder. You need to take additional steps to verify proper credit card usage.’ So… What am I paying for then? Exactly how the f@ck am I supposed to do that via eCommerce? What Earthly good as a company are you if you can’t do the ONE THING I NEED YOU TO DO? I mean, I can close my eyes and pray every eCommerce transaction is legit cheaper than it costs me to pay Square to do it. How is it the merchant is responsible for this fraud? I’ve built the marketplace, advertised it, provide customer support, and maintain it. Might as well make verifying credit card payments my job, too? What am I paying for? This business model may be legal, but it is NOT RIGHT.

Now I’m stuck paying for Aashir Stokes (lives in Manhattan – @shiirsoul Twitter & Instagram profiles if you’re curious to know what a criminal looks like) to use 2 pieces of software to ‘make sick beats bro’ on my dime because Square couldn’t protect me and offers ZERO fraud protection. Not only that, but they couldn’t guarantee it wouldn’t happen again. Of course they couldn’t. How could they? They don’t even know what happened this time.

Customer service rep (took 45 minutes) got noticeably less helpful after I told him I wouldn’t be using Square any longer. Also, don’t believe Square will fight for the merchant. THEY DO NOT CARE ABOUT YOU. They simply remit your dispute evidence to the customer’s bank and wipe their hands of it. It’s not worth your time to even think about it. You’d be better off spending your energies getting a prostate exam. Same results but at least you’d feel the touch of a human during the procedure instead of the cold imagery of a multi-million dollar company using the same rules to govern transactions from a small business as they would for CostCo or Home Depot.

I looked into it and I think Stripe offers fraud/chargeback protection for .4% + $.02 per transaction on top of the standard 2.9% + $.30 per transaction. If that’s true, I’ll be going with them. I’ll pay the extra to never worry about this happening again.

Here’s a direct quote from Stripe’s website “Defend your business from the unpredictability of disputes. With Chargeback Protection, Stripe will cover both the disputed amount and any dispute fees—no evidence submission required.”

Sounds too good to be true, but then again all credit card processors are criminals as far as I’m concerned anyway.

David

Square took my money and has been saying they are “ reviewing” my account for more than 2 weeks but keep making excuses as why they haven’t done or completed the review, I would never do business with square, I currently have to wait for who knows how ling to continue my business until it is completed but never will I do business with square

Jason woods

This company has no support for it’s clients whatsoever. You WILL NOT be able to speak to a person about your money or your acct. I’ve been trying for 6 months to get my money after a dispute was ruled in my favor, they are still holding my money for no apparent reason. I am So frustrated with this company I almost want to tell them to keep my $1000!!

Andrea Nochez

I just want to say that we use this service for several things within our company and that system is kind of coos as you get to know it. The problem is customer services. There hasn’t been a time where I call in and I don’t get super upset. they never answer the phone, they are rude, they have no willingness to help and it’s overall just a pain in the *** to call. HORRIBLE CUSTOMER SERVICE.

This post will help: Best Payment Processors for Great Customer Service

Amanda

THIS COMPANY DISGUSTS ME!!!! THEY SHUT DOWN MY ACCOUNT WITHOUT EVEN GIVING ME A REASON WHY!!! Then to top it all off they claimed my money would be paid out according to the normal pay schedule and yet 78 days have gone by now and my money is still being held. I’m a single mother of 2 and this put a big hurt on my family for the first few weeks as I was unable to even provide anything. They say in the phone recordings to reply to the email with any questions and that your funds will be released in the date specified in said email and yet there is not date in the email, responses to the email get ignored, phone support is completely blocked, and here we are after 78 days with me now filing suit against them as I have ben advised to do for the full amount PLUS interest as what they have done is illegal. I sell jewelry ffs how is any of that a “liability” enough for them to hold my money?!? It isn’t!

This post will help: Best Jewelry Merchant Accounts

-Phillip

Kimberly

It’s been 5 years for me.

Bankrupted business of 20+ years

You can not sue them.

You meditate 1st (per contract)

It’s a nightmare and I’ve lost EVERYTHING

I’m considered a THIEF now, and in 2014 NOT ONE SINGLE PERSON believed this was happening, not ONE. I called every newspaper, television station, 20/20, Good Morning America, FBI, FTC you think of it I tried it.

SPENCER SOPER, BLOOMBERG NEWS