A Comprehensive Review of Stripe for E-Commerce Businesses

Company Overview

Stripe's founding in 2010 marked a significant shift in e-commerce credit card processing when the company launched a new approach to accepting credit cards online. Stripe's focus was to provide a robust web developer toolkit to quickly and easily enable credit card processing for apps and websites unlike anything available at the time. Stripe has since made it easier for online businesses of all sizes to accept online credit card payments. The company's toolkit includes code libraries, APIs, and other resources that are designed specifically for web developers that need flexible and seamless methods for incorporating credit card processing into their applications. Stripe has become one of the most popular merchant account providers for entrepreneurs looking to speed up the development of their online businesses.

Related: Not a web developer? Check out Helcim, Shopify, or Square for easy store-builders that don't require any coding.

Stripe's wide range of payment capabilities is also a significant advantage as compared to most traditional e-commerce merchant account options. The company offers an array of payment methods, including recurring billing, cryptocurrencies, ACH, international payments, SaaS integration, marketplace payments, and more. The breadth of payment options available allows businesses to offer their customers flexibility with choosing payment methods beyond just credit and debit cards.

As a major international feature in the payment processing industry, Stripe has made a number of acquisitions, which can be tracked here.

Stripe Compared to Traditional Merchant Services

Stripe is what is classified as a “third-party” payment processor, a non-banking processor, or an “aggregator,” within the payment industry. From a business owner's perspective, this simply means that Stripe will be easier to sign up for but may have higher transaction fees as compared to actual payment facilitators like Helcim, which use Interchange-plus pricing. Aggregators may also have strict fraud prevention protocols that could cause a legitimate business to have its funds held back due to overly sensitive fraud triggers.

Related: How to Get the Lowest E-Commerce Processing Rates

Stripe's Payment Services and Products

In addition to Stripe's powerful web developer tools, the company also offers a host of services available to people with a basic to intermediate understanding of HTML and CSS. In many cases, users can just copy and paste code into a webpage to begin accepting credit cards.

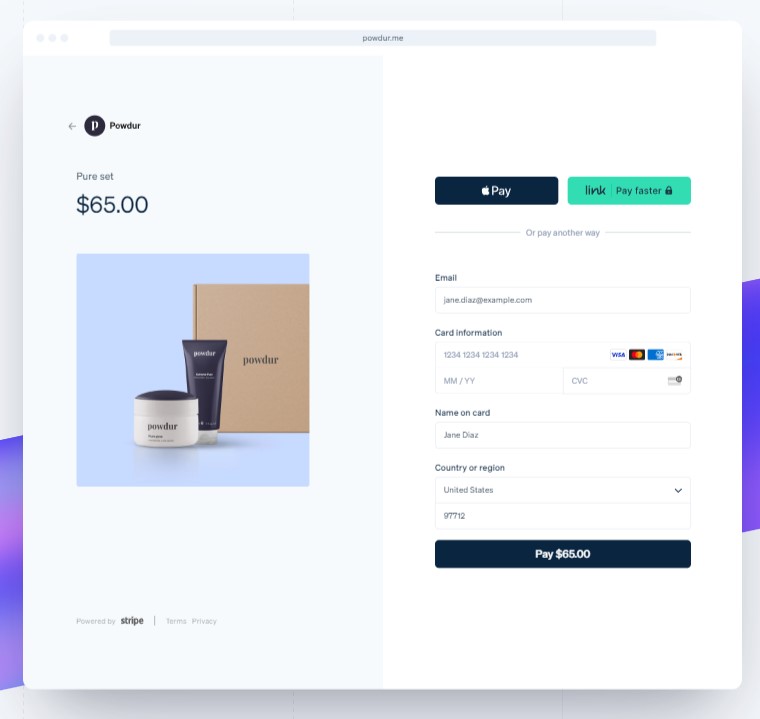

Stripe Checkout

Stripe's Hosted Checkout offers an accessible solution for businesses to accept online payments through a payment page hosted directly with Stripe. The primary advantage of this feature is its ease of integration, which allows business owners to simply paste a snippet of code into their website, which then takes the customer to a prebuilt payment page.

Improved Data Security

One of the key aspects of Stripe Checkout is data security. Stripe takes responsibility for handling sensitive payment information and ensures that transactions comply with industry standards. As a result, the business owner is removed from potential liabilities regarding customers' payment data on its own servers. Stripe assures its clients that card data is well-protected and PCI-DSS compliant.

Customizable

Stripe Checkout is also designed to be customizable, enabling businesses to tailor the checkout page to match their brand identity. This includes modifying the visual elements, such as colors, fonts, and logos, to maintain consistency across various platforms.

Sales Tax Calculations

Another notable aspect of Stripe Checkout is its capacity for automatic tax calculation. This feature simplifies tax compliance by calculating and applying the appropriate taxes based on the customer's location. The platform's localization and internationalization capabilities allow businesses to provide a localized payment experience for customers worldwide, supporting multiple languages and currencies.

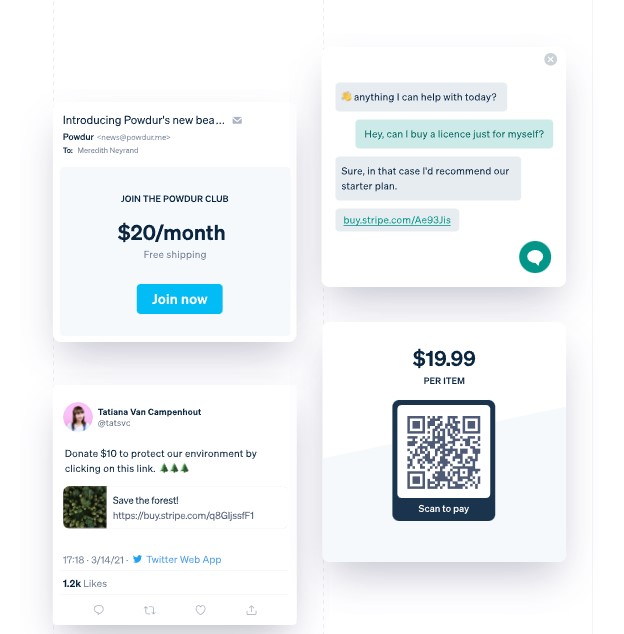

Zero Code Payment Links

Stripe's Payment Links feature enables businesses to quickly create shareable links and QR codes for accepting payments without the need for a website. This simple yet powerful tool is useful for businesses of all sizes looking to accept one-time payments, sell single products or services, or collect donations.

Key aspects of Stripe's Payment Links include:

- Easy to create: Payment Links can be generated directly from the Stripe Dashboard without any coding required. You can create a link for a specific product or service, set the price and currency, and even include a description and image.

- Shareable: Once you've created a Payment Link, you can share it with customers through various channels, such as email, social media, messaging apps, or even printed materials like flyers or business cards. Customers can click the link to complete their purchase using Stripe's secure Hosted Checkout page.

- No website required: Payment Links provide an accessible way for businesses without a dedicated website or e-commerce platform to accept payments online. This makes it an ideal solution for small businesses, freelancers, or individuals looking to monetize their products or services.

- Secure payments: Just like Hosted Checkout, Payment Links utilize Stripe's secure payment processing infrastructure to protect customers' sensitive data and ensure transactions adhere to industry standards.

- Multiple payment methods: Payment Links support various payment methods, including credit cards, debit cards, and popular digital wallets like Apple Pay and Google Pay, offering customers a convenient and flexible payment experience.

- Mobile-friendly: Stripe's Payment Links are designed to be responsive, providing a smooth user experience across different devices, including desktops, tablets, and smartphones.

- Customizable: Although no coding is required, you can still customize the appearance of the Hosted Checkout page that customers see when using Payment Links. This allows you to maintain brand consistency and provide a more personalized experience.

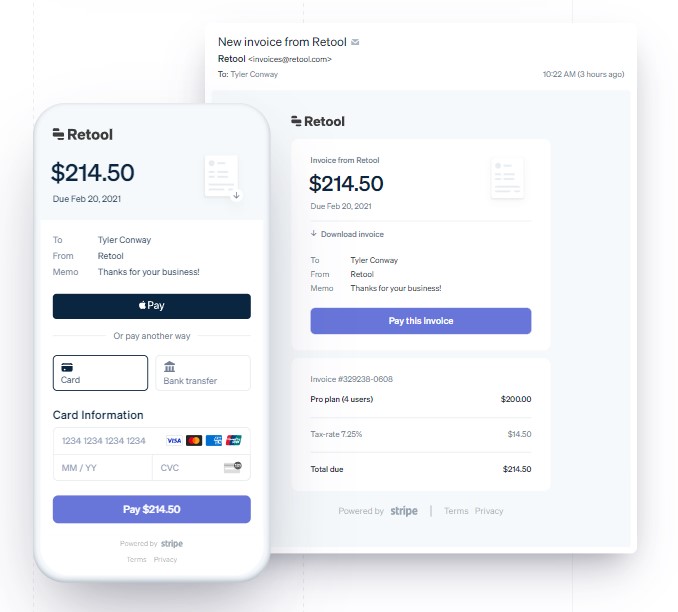

Send Invoices with Stripe

Stripe Invoicing allows users to create professional invoices quickly and send them to customers without any coding or technical expertise needed. The system is designed to reduce the time spent on manual billing tasks and to help get payments from customers quicker.

The advanced features of Stripe Invoicing make it an attractive choice for businesses looking to automate their accounts receivable processes. With its Invoicing API, businesses can integrate the invoicing system into their existing workflows or applications, enabling seamless communication between different systems. This integration helps automate various tasks, such as generating invoices based on specific triggers or syncing invoice data with accounting software.

Stripe Invoicing also prioritizes payment collection and reconciliation. The platform's support for multiple payment methods, including credit cards, debit cards, and digital wallets, ensures that customers have flexible options for settling their bills. As the platform is built on Stripe's secure payment infrastructure, businesses can trust that transactions are processed safely and adhere to industry standards.

Related: How to Send and Get Paid With Electronic Invoices

Subscription and Recurring Billing

One of the significant advantages of Stripe Invoicing is its ability to handle recurring payments for subscription-based services. This feature simplifies managing subscription billing cycles and helps businesses maintain consistent revenue streams. The platform also offers customizable payment terms, automated reminders for overdue invoices, and the option to accept partial payments, catering to the varying needs of different customers.

Related: This is How to Set Up Recurring Billing for Subscription Payments

In-Person and Point-of-Sale Transactions

Stripe has begun a foray into in-person, point-of-sale payment processing through partnerships with POS software providers, hardware providers, and by launching a card reader that resembles the Square Card Reader. Stripe can now integrate with several platforms, such as Shopify, Lightspeed, atVenu, Housecall Pro, and GlossGenius. Additionally, Stripe offers dedicated development tools to integrate with custom enterprise-level POS systems.

Stripe Card Reader

The Stripe Reader M2 is a mobile card reader designed to facilitate payment processing in various settings. Its battery-powered design makes it suitable for both in-store and on-the-go use, accommodating businesses with flexible payment locations. The device supports EMV chip, contactless, and swipe payments, offering customers a convenient shopping experience.

Security is a primary focus for the Stripe Reader M2, which features end-to-end encryption and is P2PE-ready. This ensures the protection of sensitive payment data and compliance with industry standards. The reader connects wirelessly via Bluetooth to compatible devices, such as tablets and smartphones.

Optional accessories like a charging cradle and tablet mount are available to improve usability. Additionally, a design file is provided for creating custom accessories, allowing businesses to tailor their payment setup to their specific needs. The Stripe Reader M2 offers a versatile solution for businesses seeking a secure and reliable payment processing tool at a small cost of $59 per card reader.

Related: How to Take Credit Cards on Your iPhone

BBPOS WisePOS E Card Reader

The BBPOS WisePOS E is a smart card reader featuring a 5-inch touchscreen display, making it suitable for both countertop and handheld use. It offers versatile operation with the option to use battery power or plug it in, catering to various business environments.

The device accepts EMV chip, contactless, and swipe payments, providing customers with a convenient payment experience. Security is a priority, as the WisePOS E includes end-to-end encryption and is P2PE-ready, ensuring the protection of sensitive payment information and compliance with industry standards.

The card reader offers WiFi connectivity, simplifying device setup and integration. An optional dock provides Ethernet connectivity for businesses that require a wired connection. The $249 BBPOS WisePOS E offers an inexpensive and flexible payment processing solution, ideal for businesses looking for a secure and adaptable card reader.

Stripe Fees and Other Costs

For U.S. businesses doing business with U.S. customers, Stripe's fees for regular card-present transactions such as those using a “Stripe Payment Link” on an e-commerce website or app, are easier to understand than traditional merchant accounts. For most transactions, the company charges a fee of 2.9% plus $0.30 per transaction but the fee can increase to 3.4% plus $0.30 if the card is manually entered. There are several methods that Stripe considers a card to be “manually entered” and there are additional fees for Stripe's optional services. There are also additional fees for international cards and currency conversion. In a few special circumstances using “certified” card readers with in-person payments, the fee drops to 2.7% plus $0.05 per transaction. There are also various other fees that business owners can incur with Stripe which we cover in more detail later in this article.

Related: How to Get the Lowest Credit Card Processing Rates and Fees

Global and International Payments with Stripe

Global and international payments refer to the process of sending and receiving payments across borders. However, accepting international payments can be challenging due to differences in payment methods, currencies, and regulatory requirements.

To facilitate global payments, businesses can use Stripe, which provides a range of features to simplify the process. Stripe allows businesses in 47 different countries to accept payments in more than 195 currencies, and it automatically converts the payment into the business's local currency at a competitive exchange rate. Stripe also supports a variety of global payment methods, including credit and debit cards, bank transfers, and digital wallets like Apple Pay and Google Pay.

In addition to payment processing, there are other factors to consider when conducting international transactions, such as compliance with local regulations and tax laws. Some countries have restrictions on certain types of payments, and others require additional documentation and verification before a payment can be processed. Stripe's documentation can provide guidance on these issues, but businesses should also seek the advice of legal and financial professionals with experience in international transactions.

Business Can Use Stripe in the Following Countries

- Australia

- Austria

- Belgium

- Brazil

- Bulgaria

- Canada

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hong Kong

- Malaysia

- Malta

- Mexico

- Netherlands

- New Zealand

- Norway

- Poland

- Portugal

- Romania

- Singapore

- Slovakia

- Slovenia

- Spain

- Sweden

- Switzerland

- United Kingdom

- United States

- Gibraltar

- Iceland

- Liechtenstein

- Monaco

- San Marino

- Isle of Man

- Hungary

- India

- Ireland

- Italy

- Japan

- Latvia

- Lithuania

- Luxembourg

Stripe's Supported Payment Methods

Stripe processes a large array of popular payment methods found across the globe:

Cards

- American Express

- Visa

- Mastercard

- Discover

- Diners Club

- Interac

- Cartes Bancaires

- NCB

- UnionPay

Digital Wallets

- Apple Pay

- Google Pay

- Microsoft Pay

- Alipay

- Click To Pay

- WeChat Pay

Stripe also processes transactions for bank debits, redirects, and transfers as well as “buy now, pay later” services Affirm, Afterpay, and Klarna

Common Software Integrations

Stripe’s built-in integrations are one of the big selling points for this online credit card payment service. You can link your Stripe payments with popular online ecommerce platforms like BigCommerce, OpenCart, MailChip, Squarespace, and Shopify. The company can also easily integrate with subscription and recurring billing platforms like GivingTools and Partial.ly. If you are tied to accounting services like Netsuite or Quickbooks, Stripe also offers methods for exporting and importing your sales data.

Stripe “Radar” and Fraud Protection

Stripe Radar is a robust fraud prevention system included with every account. It uses machine learning algorithms to analyze every transaction in real-time and identify potentially fraudulent activities. With Radar, businesses can customize their risk settings, create rules to block or allow certain transactions, and receive real-time alerts for suspicious activities. Radar can also use data from Stripe's global network to help identify and prevent fraud patterns before they even happen. Stripe Radar is an effective and reliable tool for businesses to protect themselves from fraud and reduce chargeback costs. It is also easy to set up and use, making it a popular choice among online merchants.

Because of Radar, Stripe is considered to be one of the most secure payment platforms in the credit card processing industry. This means fewer chargebacks and less risk of preventable losses due to the ever-increasing sophistication of fraud. Radar has access to data partnerships with all the major credit card companies, providing real-time data regarding threats and trends in credit card fraud.

Preventing Declined Card Payments

One of Stripe’s unique e-commerce features, Adaptive Acceptance, also uses machine learning to dynamically retry declined transactions before completely rejecting a sale. If the sale should be approved, this feature is more likely to successfully transmit the card payment through another payment lane.

Adaptive Acceptance also carries over to Stripe's recurring billing system. In the event that a subscription payment is declined, Stripe will automatically check for card activity, changes, or updates to the card number. Stripe then uses that information to best approach another charge attempt at a more ideal time. Overall Stripe appears to be aiming to provide its customers with higher invoice payment rates, and heavily leverages its machine learning products and access to vast amounts of financial data to automate that process.

Location and Ownership

Stripe was founded by brothers John and Patrick Collison, and Patrick currently serves as the company's CEO. Stripe's headquarters can be found at 354 Oyster Point Blvd South San Francisco, CA 94080.

| Pros: | Cons: |

|---|---|

| Real-time reporting capabilities. | Potential account freeze issues. |

| User-friendly interface. | Higher fees than competitors. |

| Global payment options. | No offline payment support. |

| Strong fraud protection. | Limited customization options. |

| Efficient customer support. | Strict account stability rules. |

| Quick integration with websites. | Delayed fund settlements. |

Stripe Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | 300+ |

|---|---|

| Live Customer Support | No |

| Most Common Complaint | Fund-Holds |

| Recent Lawsuits | Yes |

Stripe Competitors & Alternatives

Key competitors to Stripe include PayPal and Braintree. PayPal and Stripe share some services but cater to different payment needs. Braintree, a subsidiary of PayPal since 2013, also competes closely with Stripe. A notable alternative is Helcim, offering developer APIs, ‘buy-now’ buttons, invoice payments, web-store builder, and mobile payment integration. Helcim offers competitive transaction fees, month-to-month agreements, customer phone support, next-day funding, and QuickBooks integration. Having consistently earned top reviews for nearly a decade, Helcim parallels Stripe’s functionality with enhanced customer experience. More details can be found in our comprehensive Helcim Review. For high-risk businesses, our list of high-risk credit card processors is available.

Stripe Holding Payments?

Issues reported with Stripe include sudden merchant account cancellations, unexpected reserves or fund holds, and slow customer support response times. These issues are common in the merchant account industry, but are exacerbated by Stripe’s limited live support. Business owners using Stripe via Shopify have reported challenges activating the “Authorize Only” fraud prevention setting, with both Stripe and Shopify attributing responsibility to each other.

Very Popular, But With Backlash

Despite its large user base and easy sign-up process, Stripe has seen a growing trend in negative reviews. Complaints often center around fund holds, unanticipated fees, and dissatisfaction with customer service.

High Amount of Refund Fee Complaints

Business owners have voiced concerns over being charged a 2.9% transaction fee by Stripe on refunded transactions. This policy is explicitly stated on Stripe’s website, indicating no fees for refunds but not returning Stripe’s initial fees. This standard practice in the payment processing industry can still surprise merchants accustomed to paying only the flat transaction fee on refunds.

Stripe Lawsuits & Fines

- Stripe faced a 2019 lawsuit from Boom Payments! alleging patent infringement, focusing on transaction processing technologies.

- A 2020 class-action suit challenged Stripe’s data mining via Stripe Elements. While part of the suit was dismissed, legality questions on sharing user information with third parties remain.

- Also in 2020, Stripe settled a lawsuit in Massachusetts, paying $120,000 over its risk monitoring and fraud prevention practices.

- The DOJ investigated Visa’s relationship with Stripe in 2021 for potential anti-competitive practices.

Stripe Customer Support Options

Stripe offers 24×7 phone support in English, but lacks a publicly listed dedicated support number. This limits its ranking as a top-rated provider. The company does have a help section, community forum, and email support, but user reviews have increasingly highlighted support-related issues.

Stripe doesn’t accept inbound customer calls. Users must request a call from Stripe through the customer dashboard.

Stripe Online Ratings

Here's How They Rate Online

| BBB Rating | 1.05 |

|---|---|

| Trustpilot Rating | 3.0 |

| Software Advice Rating | 4.7 |

| GetApp Rating | 4.7 |

| G2 Rating | 4.2 |

| Capterra Rating | 4.7 |

| SiteJabber Rating | 1.15 |

Stripe BBB Reviews

Stripe has an “A+” rating with the Better Business Bureau despite considerable number of complaints filed by current and former clients. A total of 959 complaints have been filed in the last three years with nearly half filed within the last 12 months. In addition to the formal BBB reports, clients have also left 158 customer reviews, the vast majority reporting a negative experience. Common themes among the BBB complaints include problems with sales funding and difficulty reaching customer support:

This company takes money from people and then does not give it to you. I started a non-profit company in March. Obtained Stripe in June to process donations for us. We are a very small non profit. I applied to Stripe. Gave them all the documentation they asked for initially. Had 3 donors donate through the Stripe App in June and still have not been credited the money even though it was taken out of the donors accounts. Stripe keeps asking for more and more documentation. Keeps asking for our 501c3 even though I tell them we do not have that as of now. They then send me an email telling me we are on their restricted business list. We are a group of grandparents dedicated to an academic education for our grandkids. How can we be on the restricted business list with **** businesses, pot shops, etc? You cannot call this company. After searching and searching I found a phone number but it doesnt take calls. I requested a phone call and had to make an appointment to talk to someone. She was zero help. I have written MANY emails over and over asking for this account to be closed. Asking them to credit back the money donors donated or to transfer the donations to us but they have not done so. This has been going on since June. Every time I write them an email a different person answers back. Why cannot they not just close the account and zero out the balance. What is so hard about that. They are a rip off company. Ripping off Grandparents. I am not sure what to do about this. I will continue to write emails and emails and leave bad reviews until they give up that money. How can this type of company be allowed to keep doing this. – Linda W 9/07/2023

SiteJabber Summary

Stripe has a rating of 1.15 stars from 380 reviews on SiteJabber, indicating that most customers are generally dissatisfied with their services. The most common complaints revolve around customer service, high risk assessments, and credit card issues. In the last 12 months, there have been 18 positive reviews, 2 neutral reviews, and 107 negative reviews. Many reviewers have expressed concerns about Stripe’s customer service and their handling of high-risk assessments. There are also mentions of issues with credit card processing and unexpected account closures or holds on funds.

Negative Reviews

“Computer says no. Clueless staff and systems which decided that we were a negative response marketing and telemarketing company which they do not permit to use facility. It’s a classic case of a poorly programmed computer and the ‘computer says no’. The customer service team were completely disinterested in providing any assistance. Go elsewhere, there are cheaper and more flexible facilities available.” – John H.

“Business owners beware! Do not use this company. Beware, this company is horrible and stealing business owners’ money. I have been going back n forth fighting to get my money that they’re still giving reasons that doesn’t even make sense. You’re not able to speak with a live representative and they communicate through emails that takes days to respond with the same generated responses.” – Ann Y.

Positive Review

“When collecting donations, using Stripe you don’t need to put full card details to collect donations. Very simple to use.” – Dr. R.

Trustpilot Summary

Rating and General Sentiment

Stripe has an average rating of 3.0 stars from 12,466 reviews on Trustpilot. The general sentiment of the reviews is mixed, with some users praising Stripe’s payment infrastructure and support, while others express frustration with verification processes, missing payments, and customer service.

Negative Reviews

“Years ago the situation was different and it was relatively easy to get your first payout. Nowadays, you need to go through hundred hoops before the first payment arrives. I’ve already verified myself with you multiple times and they keep requesting the verification over and over for every separate entity.” – Sandra Keenan

“3 payments are missing. They say they have paid out but nothing received in my bank. They keep saying I need to provide my bank tracer ID and my bank keeps telling me it’s not something they can check. It’s been more than 2 weeks and nothing has arrived. I have given them 2 more days to pay out or I will be forced to take legal actions against them.” – Jones Slim

Positive Reviews

“Stripe is a very good choice for payment infrastructure. I started working with Stripe and tripled my sales in less than a week with its ability to receive payments from different channels and user-friendly interface. In addition, you can get help on every issue you are stuck with fast-returning and solution-oriented customer service.” – Orkun B.

“The Stripe support team is the best. I know because of their correspondence. Even though my issue has not been resolved yet, they gave me a guide on how to resolve it. I applaud them and encourage them to keep it up.” – ProlificDanny

Stripe Review Summary from Software Advice

Rating and General Sentiment

Stripe has an overall rating of 4.7 stars from 2,958 reviews on Software Advice. Users generally have a positive sentiment about Stripe, praising its ease of integration, functionality, and support. However, there are concerns about Stripe Radar’s efficiency, the duration for payouts, and the processing fees.

Negative Reviews

“Our account with Stripe was closed on 4th May. At which point we had $28,362 in our Stripe account. Money which we had received from our customers and were waiting on Stripe to payout to our bank account.To this day (26th June) they are still holding all of this money.Stripe customer support send very generic emails with little specific information. They keep repeating that our account is under review (it’s already closed so what is there to review?) and they will update me when the review is complete.They refuse to say when the review will be complete and they also refuse to rule out keeping the money.This “review” has so far taken 7 weeks, I have no idea how long it will take (months, years?).We desperately need the money to finance our day to day operations and it’s causing an unbelievable amount of stress. Despite this they refuse to send us our money.I strongly recommend people to avoid using Stripe. Because they are so large you feel totally helpless when something goes wrong and there is nothing you can do. -Alex”

“Awful. If I could count on one hand the number of times I have screamed at my monitor seeing a response from my account manager, support, practically anyone at this organization. We were told we would pay 1x PCR fee per transaction by pricing analysts and when it turned out that the architecture they recommended produces over 2 PCR requests per transactions that even failed transactions are billable, no responsibility. The solution doesn’t work the way it was advertised, check the contract. The worst part is being treated like a child by flippant 20-something account managers who have been reassured that their product is perfect, their customers have no leverage, and that customers enjoy being treated like garbage.” – David

Positive Reviews

“Stripe integrates with a lot of software builders and customer management platforms out there. No matter your app builder, you are a lot more likely to find Stripe integration than other payment processors out there. It’s also very easy to manage and keeps tabs on everything happening on your account, even on your phone with the mobile app.” – Pius

“Not only is their system intuitive, but the customer service agents actually like to help you. No fake smiles over the phone or loud exhaling and strained voices. You know which ones I mean, the kind you get from employees that don’t like their job and it feels like it is a burden to help you. Yeah, never have I experienced this with Stripe. They have a beautiful online system, they have happy employees, that can only mean Stripe really knows how to stay in business and that is very important for my business because I use them on a daily basis.” – Nayeli

Stripe Reviews from GetApp

Rating and General Sentiment

Stripe has an overall rating of 4.7 stars from 2,958 reviews on GetApp. The majority of users have a positive sentiment about Stripe, praising its features and ease of use. However, there are concerns about Stripe’s refund policies, fees for same-country payments, and customer service.

Negative Reviews

“They refunded customers 3 months after the purchase without me knowing and they already have their items. My customers are also upset with this disgusting company.” – Randy A.

“Fees for same country payments are too high and once funds have been taken, they are then held for 14 days. Appalling customer service who basically said too bad.” – Verified Reviewer

Positive Reviews

“They have great features and the capital option is totally awesome. I wouldn’t trade them for the world.” – Marc S.

“Stripe is a great tool and platform. Very easy to use, easy to setup, and secure that clients can trust with their accounts.” – Freo B.

Stripe Reviews on G2

G2 has garnered 274 customer reviews of Stripe, most of which are positive in nature and many of which seem more like marketing language than actual customer reviews. Common themes praise the company’s global reach and ease of use, while others complain of abrupt account closures and funds being withheld.

Negative Experiences

While Stripe’s platform is indeed user-friendly and suitable for businesses of all sizes, these advantages lose their shine when small businesses face delays in accessing their payouts.

Stripe has been an absolute nightmare for me. I’ve been in an ongoing battle for more than a month now, just trying to get my account approved. Despite having all my company’s documentation meticulously prepared, I’m unable to take my business operations live due to the unresolved payment gateway through Stripe. It’s incredibly frustrating how they repeatedly provide incorrect links for me to re-upload my trade license, and they’ve insisted multiple times that I modify information that is already correctly provided. My patience has reached its limit!

Positive Experiences

Stripe provides the best gateway to handle any and all sorts of payments across locations and currencies. It supports over 50 currencies and seamlessly integrates with major platforms. We have used Stripe in connection with WooCommerce and Chargebee and the setup and configuration has been incredibly easy. We use Stripe on a daily basis to process payments of hundreds of customers.

Customer support doesn’t just tell you what to do but they also get involve and guide you, even when you are waiting for an answer you will get a message reminding you that they are working on it. The interface of the platform gives you details of what you earned, what you have been paid, and when are you getting paid. Integration is smooth, again the support team is always there to lend a hand. it doesn’t matter what services or products you are selling they have solutions for everyone.

Capterra Stripe Customer Reviews

Rating and General Sentiment

Stripe has an overall rating of 4.7 stars from 2,958 reviews on Capterra. The majority of users appreciate Stripe’s ease of setup, integration capabilities, and detailed transaction information. However, there are concerns about account suspensions, unclear policies, and challenges with customer service.

Negative Reviews

“Beware of Stripe. Review their BBB complaints. Do your research on BBB to see the truth. Not much at this stage was easy to implement but clear bait and switch. Approving our account then after $25,000+ of revenue is generating, locking our account without notice. Clear practice of bait and switch tactics. No official stance on why we were suspended other than citing a generic policy which we have adhered to. Why did you approve the account and only suspend after it generated revenue? Conflicting responses from multiple customer service agents.” – Tony D.

“It is truly unfortunate that an organization of your size has such poor customer service and fragmented policies. We have asked to speak to someone with actual authority but it appears we have been sent to another loop of customer service representatives with generic responses.” – Timothy S.

Positive Reviews

“A titan in the merchant processing world. Stripe has been a great tool for my small agency. They have been one of the few merchant processing softwares to enter into the banking world without losing their core services or dropping off in customer service. The ease of setup, it integrates well with so many other platforms and now you can send clients pay now links without any coding.” – Wendell J.

“5-star easy-to-use payment processing service and any time further detail is needed on a transaction to help a customer or resolve an issue, Stripe provides great detail on all transactions making it possible to provide valuable information to customers to resolve issues and ensure the customer gets what they pay for and the business receives the payment for goods/services as intended. The easiest to use, inexpensive fee structure, and top-notch fraud prevention. Stripe is hands-down the best payment processing system I have used in my 10+ years leading customer support teams.” – Patrick W.

Customer Reviews of Stripe on CPO

Over 500 reviews have been left at the end of this review in the comment section. Please be sure leave a comment about your experienceto help keep this review as accurate as possible.

Stripe Fees, Rates & Costs

A Closer Look at The Contract

| Processing Rates | Variable |

|---|---|

| Monthly & Annual Fees | Possible |

| Cancellation Penalties | No |

| Equipment Leasing | No (purchasable) |

Stripe Fees & Pricing

Stripe’s fees seem fairly straightforward on the surface, but there are numerous circumstances that can increase or lower a business’ transactions fees. Stripe also offers a few optional services that include monthly fees. The information below applies to U.S. businesses. If you are located in another country, pricing may vary.

Stripe’s Standard Transaction Rates

As stated in the “Company Overview” of this article, most card and digital wallet transactions will incur a fee of either 2.9% plus $0.30 or 3.4% plus $0.30. Businesses that utilize Stripe’s payment links or payment link API will enjoy the lower of the two fees. For nearly all other transactions using custom development, the fee will be the higher of the two.

Related: This Stripe Competitor Has More Affordable Fees

Stripe Hosted Invoice Fees

Businesses can send invoices directly with Stripe. The pricing for this service starts at 3.3% plus $0.30 per transaction. The cost of the transaction can increase if international cards are used to make the payment. International fees will be covered below.

Stripe ACH, Bank Debits, and Bank Transfer Fees

For U.S. businesses, Stripe offers several methods to be paid with direct bank transfers. Each of these methods will incur its own specific fee:

- ACH Credit: $1.00 per payment. This occurs when the customer initiates the payment to the business.

- ACH Direct Debit Standard Settlement: 0.08% per transaction capped at a $5 fee. Standard settlement clears in four business days

- ACH Direct Debit Two-Day Settlement: 1.2% with no fee cap.

- Bank Wire: $8.00 per wire

Interchange-Plus Pricing Available

Stripe will provide interchange-plus pricing plans to high-volume businesses. Interchange-plus is lower cost and more transparent. No official materials indicate how much a business must process to obtain Interchange-plus, but sources have indicated that consideration starts at a volume of $250,000 per month. Businesses must contact Stripe for custom pricing plans.

Not All Merchant Accounts Welcome

Like Square, the company’s standard policies regarding fraud prevention and prohibited business activities appear to be cause for complaint among many Stripe reviews. Business owners report two specific problems in the complaints below this review and on other consumer protection websites. In one scenario, owners apply for credit card processing with Stripe and are informed that they are approved and ready to go. After processing a few online payments, these businesses find that their payments have been frozen and their accounts canceled due to Stripe considering their industry as “high-risk credit card processing.” These cancellations appear to take effect with little or no warning, and businesses report difficulty resolving the unprocessed payments in a satisfactory and efficient manner.

Reserves and Fraud Prevention

In the second case, businesses express confusion over their card payments being held in a reserve account. This is a common fraud prevention practice that we don’t usually penalize processors for, but it seems that Stripe does not effectively communicate its reserve policies to clients. Business owners should be aware that Stripe’s merchant account agreement allows them to “suspend Instant Payouts to you at any time, including (a) due to pending, anticipated, or excessive Disputes, Chargebacks, Refunds, or Reversals; (b) in the event of suspected or actual fraudulent, illegal or other malicious activity; or (c) where we are required by Law or court order,” according to its terms of service. If your business could be categorized as “high-risk” or you have an elevated chance of chargebacks, we advise reading the company’s terms of use.

Stripe Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Uses Independent Resellers | No |

|---|---|

| Telemarketing | No |

| Misleading Marketing | No |

| Discloses All Important Terms | No |

No-Nonsense Marketing, No Gimmicks

Stripe appears to rely primarily on its website and advertising to market its services. The company specifically caters its advertising to web developers who would like to add an online payment application to the websites they manage. Stripe appears to quote its rates transparently and truthfully in its official marketing materials.

Watch Out for Stripe Fund Holds

The Stripe website does not prominently list any explanations of its cash reserve and account cancellation policies, both of which appear to be responsible for numerous negative Stripe reviews on this site and elsewhere. It is our opinion that more could be done to help businesses avoid fund holds. Any business owner who is considering doing business with Stripe is encouraged to read the company’s fraud policy (excerpted below), which is similar to most other payment processor fund-holding policies:

We may refuse, condition, or suspend any Transactions that we believe: (i) may violate this Agreement or other agreements you may have with Stripe; (ii) are unauthorized, fraudulent or illegal; or (iii) expose you, Stripe, or others to risks unacceptable to Stripe. If we suspect or know that you are using or have used the Services for unauthorized, fraudulent, or illegal purposes, we may share any information related to such activity with the appropriate financial institution, regulatory authority, or law enforcement agency consistent with our legal obligations. This information may include information about you, your Stripe Account, your Customers, and Transactions made through your use of the Services.

Related: Worried About Funding Holds? This Stripe Competitor has Live Phone Support

Our Stripe Review Summary

Our Final Thoughts

Stripe is a credit card processing provider with a focus on e-commerce and online payments. While it boasts a transparent pricing model, some Stripe reviews express concerns regarding slow funding or unsatisfactory customer service. As a result, Stripe is rated less than a 5-star merchant services provider due to limited customer support options.

Since our last update, Stripe has seen a significant increase in customer reviews and complaints. However, it’s essential to note that the overall complaint volume remains relatively low considering the company’s size. The majority of Stripe’s clients appear satisfied with its transparent pricing and ease of use. Nevertheless, the company’s reserve policy, cancellation policy, and customer support are the primary sources of dissatisfaction among customers.

Business owners are advised to thoroughly review Stripe’s terms of service and compare it with other e-commerce merchant account providers before making a decision. Considering the strengths and weaknesses of different providers can help businesses identify the most suitable option for their specific needs.

Our Other Stripe Articles

If you found this article helpful, please share it!

DANIEL HAHN

Did they hold the 12K for a long time, or just simply never pay it out?

DANIEL HAHN

Stripe = pondscum

DANIEL HAHN

This has been the most frustrating experience I have ever had with dealing with a payment processing company. They have been holding almost $10,000.00 of MY MONEY for 26 days. One of my best customers purchased hotel products from me and paid with a credit card 26 DAYS AGO, and Stripe will not release my money to me despite several chats, emails, and phone calls. If there is a class action lawsuit brought I will be happy to join. They can provide NO reason for holding my money other than “there could be a dispute” which is asinine as this customer who paid with their credit card has been an excellent partner to me for almost 2 decades. You also cannot get past the “front line” of people answering the phones to be able to speak directly with the “higher level” Stripe employees to get it rectified. If you are a small business and cash flow is critical for you, never consider signing up with them. I wish I could close the account but they will not allow it if you have funds, but they won’t release the funds to be able to close the account; classic catch 22 by design. These are predatory practices and should not be allowed.

Brady

Stripe has never help but hold the funds and stole from us. $12,000

Philip Golabuk

The email pasted below, sent to Stripe on 09 January and copied to Stripe’s CEO, explains why we felt it necessary to post this negative review as a cautionary note to anyone considering Stripe for payment processing. In short, our bank account was charged back with no notice, no explanation, no opportunity to contest an alleged dispute that Stripe claims was carried over from an account we had closed previoiusly. Despite our reaching out half a dozen times to obtain the details of this alleged dispute, Stripe ignored the issue for weeks. The regulations regarding payment processing prohibit any payment processor from unilaterally charging back funds without due process that provides the merchant with the information and time needed to contest any dispute. Since Stripe has chosen to ignore our numerous urgent attempts to obtain the details of this alleged dispute, including the email that follows below, we will be pursing the matter with the appropriate compliance agencies.

EMAIL BEGINS HERE

Dear Stripe:

On 26 December, Stripe charged back $125 to our account for an alleged dispute carried over from an account we had closed by mistake (and immediately reopened). Stripe took this action giving us no notice, no explanation, no due process, no opportunity to contest. That was two weeks ago. Despite half a dozen urgent requests for support including several emails and two hours spent on the phone with your agents, we remain in the dark. We were assured that this was a simple matter of your escalation team restoring the deleted account, so that we could log in, review the details of the alleged dispute, and contest it as we expect to do, since we have had no client complaints, requests for a refund, or any other indication that there was a problem that would have led one of our clients to file a dispute. In fact, in over 30 years of practice, PhilosophyCenter has not had a single payment dispute or chargeback. As it is, we have not even had the courtesy of an update.

We expect our payment processor to be a partner, not a problem, but at this point, it is clear that Stripe has failed to meet its regulatory and legal compliance obligation to provide merchants with notice and due process in the event of a dispute, and either cannot or will not provide the information we requested and to which we are entitled by the regulations governing payment processing disputes. We have tried repeatedly and in good faith over the past two weeks to get this information from you, so that we could contest this sudden, unilateral, and unexplained chargeback to our bank account. And while the amount is trivial, the issue is anything but. This is not the Stripe we know and have trusted since 2018.

Consequently, we are directing Stripe either to reverse the $125 chargeback to our account or provide us with the promised information so that we can proceed with contesting the dispute by week’s end, failing which, we will pursue the matter with the appropriate third parties, as we no longer have confidence that Stripe intends to provide the needed support to get this resolved.

We have copied this email to Patrick Collison, your CEO, as we feel such outreach is warranted, in the hope that he will feel the same way that we do about this mishandling of our account, and do whatever he feels is necessary to remedy this situation.

Sincerely,

Philip Golabuk

Director

PhilosophyCenter

END EMAIL

Brady

How can STRIPE even be allowed to do business? They are a complete fraud. I had 2 fraudulent charges where I sent items and the people did charge backs. I lost my merchandise and money, all the while STRIPE did nothing to help me.

In return and to my surprise all they did is freeze thousands of dollars and take 25% of my ongoing sales.WTH! I did nothing wrong here, I was ripped off by the consumers and now im the one being punished.

This is probably the biggest bank scam in history and they’re getting away with it.

tbh I am even scared to leave any of my information connected to my business on here in fear that this is a phishing scam all set up by STRIPE.

PLEASE GET A CLASS ACTION GOING AGAINST THEM THEY’RE LITERALLY RUINING LIVES!

Michael Robbins

We used Stripe in a fundraiser to bring hemp to Ethiopia. It’s early stages, raising money for paperwork. We were rejected for being “cannabis related,” we appealed, we lost and were given a deadline to cease using Stripe for this purpose. We complied with the deadline, but Stripe kept the funds raised before the deadline.

Michael Robbins

What do you know – a week after I started publishing these reviews, Stripe released our money from [link removed – promotional] About eight months after seizing funds. This is why Stripe is at least 2 star. It can be pushed into doing the right thing eventually.

Hope

Stripe is AWFUL. I did all the things I was supposed to do. They have a ridiculously long hold time for your payout and despite that my financial institution account was authenticated, Stripe sent it who knows where and would NOT do anything to fix it or help me. I finally chased down the problem and got a letter from my financial institution stating the funds never went to my account and I still do not have my money. I doubt that I will ever get it. Do not trust this company.

Bomi

Does anyone have the legal department’s contact information?

We are owed 20,486.00 by stripe that a customer paid through a virtual ach account number listed on the bottom of the invoice. And stripe is saying they can’t find the money nor have helped to figure out the problem.

Wolf

Stripe are flat out evil. No mention of all the circles you have to go thru until you process the first card. Then the floodgates open. After days of submitting every personal document they determine your a high risk and the customer declined the charge then lock your account with the first transaction in pending which they have already charged the customer for and refuse to refund or release it. The customer happens to be a close friend so that was a lie. Before the 30 days my friend disputed the transaction and was told that this is common with stripe.

Stay far far away…dave

Lawrie Hollingsworth

this company is exploding. After a year of successfully using the portal, settling my funds are being held up for weeks. It’s not possible to talk to a live person, and I received email after email saying that the links my websites weren’t working, they didn’t have the correct information, for me etc. His only when I threatened to file a complaint with the California States Attorney that certainly all my problems were solved. I can’t get away if this can be fast enough, and if you’re having problems I suggest you also advised them that you’re going to talk to the California states attorney since are headquartered in San Francisco

abraham schwimmer

I used STRIPE to process payments and when i reached approximate $16.000 i realized that the money was not paid out by stripe to my bank account i called them up and they said that because i don’t have a business website they cant verify my business so everything is paused for 90 day so the story is still in process i am now taking legal action against them

Janine

This company is repressive and deep state, An arm of the far left woke ism…not to be trusted with your time or hard earned dollars.

Carla

After using my Stripe account for a year, they are now saying they need proof I’m a beneficial owner of my business. I’ve uploaded four documents to prove it, and they still are holding my money and now are not even getting back to me anymore. I don’t have any disputes and a great track record. Is seems like they’re making up fake reasons to hold onto people’s money to manage cash flow. All you have to do is look on social media and better business type sites to see the thousands of complaints, it’s growing more each day. Are they about to go under?

Claudio

I withdrew (they call it Payout) USD 280.99 and my bank received USD 226.84. When I asked where my USD 54.15 were, I was told in an online chat:

“Diving deeper, since this is a USD payout, Alternative Currency Payouts are paid out via our banking partner, and depending on the receiving bank, it might be routed via several intermediary banks depending upon the recipient bank. Some of these intermediary banks might charge additional fees, resulting in a discrepancy in the payout amount versus the received amount.

Stripe has no control or visibility over these fees, and therefore cannot assume liability for them.”

What a SCAM! Basically what they say is: We can pay you what we want, and we are not responsible.

Before making the payout I asked what the fees are and they said there aren’t any. And then they keep $54.15.

It’s a SCAM! Stay away from Stripe.com at any cost!!!

Shani

Stripe are scam artists. I used Stripe as a payment gateway to process funds through my e-commerce website. Everything was fine up until stripe sent me an email saying that they will reserve 10% of my funds. The email states, in other words, since my account had a high dispute rate, they would reserve 10% of my funds.

Mind you, I only had ONE dispute DUE TO THE FACT the customer was trying to scam my business. He put in a dispute after I sent him a tracking number so he could get his money AND receive the item. He purchased July 3, 2022 and waited the day after receiving the tracking number (July 6,2022) on July 7, 2022 to do a chargeback. I contacted the customer and he didn’t respond so I refunded him.

After that, I didn’t have anymore disputes. All customers placed their orders and their items were shipped. Once I seen stripe was holding my funds and I couldn’t cover the shipping cost because of this, I stopped using stripe completely so there was no activity such as risk, disputes, or anything of that matter that was raised.

I saw that they were holding $757.58 of my profit and $240.49 in reserve. This is after September 9, 2022 btw. They said they would RELEASE ALL MY FUNDS SEPTEMBER 9,2022. This is all in email! I didn’t have no additional disputes so extending my reserve wasn’t necessary. I have been in contact with several reps and they kept telling me to send in pictures of my inventory. I told them I was no longer selling so I don’t have that much but regardless I was promised a release of my funds Sept 9. They disregarded and kept asking for pictures. They also said they would extend my reserve.. FOR NO REASON! Just today, I received a email saying my funds will be held for 120 days and they also won’t be taking payments because of “non-authorized payments by customer” when clearly all payments were authorized. I want my payouts!

Marilia

Who gives Stripe the entitlement to freeze our money and keep it forever in their hands? when a client paid USD 4700 the funds were blocked, for 90 days.

It’s a Ponzi scam, why is the financial authority not investigating?

Dissatisfied Customer

They closed our clinic account because we test for, and treat COVID, in the every early stages when progression can be halted. We are one of the only resources in our rural community, and they made this decision without consulting us, or, any knowledge of care or urgency of care to base their decision on. Appeals were met with auto-responses.

This is not the only issue with Stripe, though, and had we read the reviews prior to purchasing their service, we would not have chosen Stripe. Yes, they can integrate with most anything, but they are no help in setting it up. Customer service is virtually non-existent, and really, you need to contract someone to set it up with your existing tools for maximum efficiency.

Ian Eversley

Square, Stripe, Paypal and WePay are not real credit card processors. These are money transfer companies claiming to be credit companies. Please, please do business with a real credit company. These companies actually steal your money and with no oversight agency they will continue to do so. You need to go with companies like [company names removed due to our non-promotional comment policies]. These are real credit card companies and have to abide by the credit card association rules. Square is own by Jack Dorsey, the owner of Twitter. These guys don’t card about Square’s customers. When you file a suite against Square, it never makes it to the top unless you are asking for five million or more. They treat customers like animals and just continue to take their money. The percentage rate will tell you these companies steal from honest hard working people. 30 cents plus 2.70% this is actually 3.00 per hundred dollars they they take. A regular credit card company charges about 15 cents plus 1.30% normally that is about $ 1.45 cent per every hundred dollars you make. Please, please these companies are only robbing merchants every day. They come with slick equipment and flashy websites to lower merchants in. Do not fall for the bs, regular credit card companies offer the same or much better.

Phillip CPO

Many of the rate quotes in this comment are unrealistic. We encourage you to get quotes from 5-star rated credit card processors for competitive fees.

Mon Nasser

BEWARE OF LARGE HIDDEN FEES

We were excited to implement stripe.com in our site as they provide good APIs for software developers. The integration was smooth and we were up and running in a short time. Once we started using Stripe for credit card transactions, we quickly discovered a huge problem with their service. Here is what happened:

One of our clients accidentally double charged their credit card when they ordered one of our products. I am not sure how they did this, but they contacted us to report that they have a duplicate charge on their credit card statement. Of course we immediately refunded one of the charges via Stripe online console. This worked fine, but we noticed that Stripe did not refund us the 2.9% credit card transaction fee when the payment was refunded. In our case, this was a considerable $116 fee. When we contacted Stripe about this, they had a canned response that states that their policy is to keep your transaction fee even if the payment was refunded!

Think about this from a merchant point of view for a second. Not only you have to pay Stripe 2.9% of all sales you process via their service, but also you have to pay them 2.9% of sales you DID NOT make! Its not enough that you lost the sale, profit, and maybe shipping fee and got an open box as a result of the return / refund, but also you are getting penalize by Stripe for the refund!

Refunds are normal part of the credit card business, and for Stripe to penalize its client for it is outrageous. Other merchant accounts companies we used in the past did NOT do this. Rather, they refunded all the fees and only charged us $0.30 (30 cents) transaction fee for the refund. That was it. They did not keep 2.9% of the sale amount.

Needless to say, we are shopping for a different credit card processing company. We are totally disappointed with Stripe and the fact that we wasted so much of our time implemented their lousy service.

Former Employee

Stripe is terrible do not trust with your information they use a third part called. Sykes that allows anyone to work there even criminals. They the worst people to work for and good luck on getting support every is working from home and instead of responding to customer concerns there watching Netflix and smoking weed all day I would leave stripe today your information will be compromised

Blake

Waiting over a month for my $1500 nowhere insite , no replies to emails , no calls nothing DO NOT RECCOMEMD , DO NOT USE STRIPE

Emily Martin

Stripe has the worst customer service that I’ve ever encountered. I chose to order their verifone and chipper readers after signing up with floral next. After receiving the products they refused to speak on a phone and insisted I needed an integration system that at the end of the day was not required. Furthermore, they sold me a verifone which is not even compatible with floral next. When I originally signed up with Stripe they assured me I’d be able to speak with someone with any customer service issues verse email. When I emailed my concerns about setting up my Stripe equipment this is the message I received.

“While I would love to jump on the phone and have a chat with you, currently myself and my team do not have the ability to accept or make phone calls, due to the nature of Terminal queries, as they tend to get complex quite quickly. I completely understand any frustrations this may cause, as I understand technical questions can be answered that much quicker over a phone call.”

I’ve decided to stay with my previous credit card processor and only use Stripe for a back up on the holidays.

Michael

Hey, if you’re looking to start a business or need to transfer money for the love of God please just NEVER use stripe. Spread the word. They don’t deserve to be open they can keep your money forever by law so please keep you and everyone you love safe and use anything else its not worth it I promise you.

Michael

I take this back I emailed the vice president and they refunded my money. Still not able to use stripe but hey got my 4140 US refunded !

Jose cano

NEVEE USE STRIPE! I been waiting so long for my money to clear ,and is not the first time,it doesn’t matter if it’s small amount or large amount,takes almost a month for you to have your money…no number to contact only vie chat or email. I’m tired, I will never use it again in my lifetime! Period!

Madeline Caldwell

Stripe are thieves. Avoid this service at all costs.

Rhonda Bignell

sed Stripe for 3 months. My product had only two prices, but Stripe’se hold-backs and amounts sent were completely random which made tracking amounts and bookkeeping a complete nightmare. The amounts were so random it was next to impossible to figure out if I was receiving what I should from them. Will never use them again.

Shanelle Graham

Stripe is terrible

Stripe is terrible. I have used it for 2 separate companies and both times I have encountered issues. You can process regular payments every week for months, then suddenly they lock your account down and claim they need more information to verify your account. You oblige, jump through some hoops and expect to have your payout processed. But then they set those hoops on fire and expect you to jump through those if you want to see your money! How can a company possibly be fine processing the same payment week in, week out for 6 months, and then suddenly there are issues??? When you try to speak to support via email they decide to ignore you and show they have little care for your ability to pay your employees or keep your company operations running. I will definitely be taking my business elsewhere. I DO NOT recommend Stripe.

David Robert

Stripe can hold 25% of money for 2 months on your first transactions. They notify you of this procedure AFTER you opend your account !

I had to open an account for the money transfers of a crowdfunded artistic project. I am still waiting for the missing 25% to finish it. No need to tell you that i pay interests right now on my credit card for that amount while they are probably doing interests on the money of thousands unadviced custumers like me…

I recommand anything elsa but Stripe

Jess

I booked a stay at a townhouse that used stripe as their payment processor. I’ve never used that credit card for anything else. The next day there were 3 charges that I did not authorize. Luckily capital one caught the 3rd one and alerted me. They declined that purchase, refunded one, and are investigating the last one. But the only way anyone could’ve gotten my credit card information was through Stripe. Now I have to go file a police report because they have a of sensitive information which is terrifying. Stripe obviously breeds fraud, stealing money from merchants and then trickles that down to the customer. One charge was for a fraudulent business that doesn’t even exist. I would stay away as a consumer and a merchant. If you have used them, keep an eye on your credit cards.

Jessica Rahn

As a consumer I recommend any other service. I found a charge on my card that came from stripe. I reached out to see what it was for only to find it was for a gym in another country. Stripe recommend contacting the company directly, I emailed the only listed contact. . . And of course no response. Stripes response was essentially your SOL nothing we can do. How about looking into companies you allow to set up to make sure they are legit not just scams!

Mehmet Akif

Stay away from Stripe;

1. If you have a startup company

2. If you are selling untangible goods like software, hosting etc.

3. If you will need to code to integrate (any business)

First of all they can suddenly freeze your account even if you have zero disputes,refund,charge-backs.

They are very unprofessional, they will review everything, approve and they suddenly cancel without any reason after you work a lot to integrate your sytem. And this interruptions will make you lose money, time and reputation.

You will think that we have something wrong so we encountered such issue with them. Clearly, No!. Any requested document were supplied and approved, our business model is very clear and there are millions of companies do what we do, we sell domain/hosting with a free shopping cart. This company is a Scam. They may not be for all types of businesses, but if you are one of above; they will be a SCAM for you. They are not startup friendly, they are not tech friendly. Very bad experience during this pandemic they damaged our business plan! Shame

godihatecreditcards

Processed a few ten grands with Stripe over a few months and haven’t gotten burned yet. Hoping it stays that way.

Shanelle Graham

Just wait. We got caught in that net as well. 6 months down the track, making the same regular payment every single week and BAM! They suddenly lockdown our account for no apparent reason. The hilarious thing is, it is my business partner’s credit card being charged to add funds to our company account. So they have locked down our money paid by us (not even charging a client or third party) and refuse to give it up. Support asked for a bunch of information which we provided so then they decided to dig up more info they require and have since just stopped responding. Be careful.

MaryEdna Salvi

Hey there, I am not a business though I am or might after reading this, am signing up to a site that offers courses and they take payments from Stripe (never heard of them so started a search) and paypal, and I really don’t like them, so as being on the other side as a customer I am concerned by the written complaints how it might effect me. it is a bit confusing with the videos backing Stripe as a decent company and then reading the complaints. Makes me wonder if the people are being compensated somehow, just wondering. I will say your upfront with the negative experiences of your past customers.

Jenny Hansen

Absolutely recommend staying away from Stripe. Their customer service is completely unapproachable, Most word of mouth is less than satisfactory, many glitches occur and quite frankly, there are just so many better competitors out there. Life is hard enough when things run relatively smooth. Do yourself a favor and steer clear of STRIPE !!

Saad H.

Hello,

I had a very bad experience with Stripe.com Payment Processor for my ecommerce business and would like to share it.

I started using Stripe as a payment processor for my ecommerce website On July 2020, and I made about $20K through their payment processor.

I have been providing them with all required tracking numbers and was handling customer service very well and all of a sudden they decided to deactivate my account

and put a hold on %100 of my money for 4 months.

So, I waited 4 months to get my money back which was supposed to be at December 2nd. 2020.

Since then, they’ve been postponing withdrawl EVERYDAY and I have been contacting them several times over email and they always get back with the automated replies!!

I changed my payment from automatic to manual, and whenever I click “Pay out to bank” they show a warning sign “Can not create payouts” and I have to contact support!!!

I will keep emailing them till I get my money back.

But, hope you guys stay away from them. I don’t recommend Stripe at all.

Thanks.

Kind regards

L. Clay

Same here. Stripe deactivated my account on December 14, 2020 and has frozen my 100% payments. I received an email from them saying that they refunded my customers but my customers have not received any refunds. No one has contacted me, I just keep getting automated responses that someone will contact me soon. DO NOT USE STRIPE!!!

Jenny Hansen

Totally agree. STRIPE is a disaster !!

Robin

Worst company EVER!!!

I signed up for their CC and ACH services upon recommendation by my accounting software. The very first transaction had an issue that could have been resolved by a 10 minute conversation with a human being. THERE IS ABSOLUTLEY NO WAY TO CONTACT STRIPE except by email which returns you an automatic response indicating they will follow up within 24 hrs….THEY NEVER DO!!!

So over a month later and countless attempts to contact them INCLUDING BY A DETECTIVE WITH THE ALBUQUERQUE POLICE DEPT… There is still no resolution. Stripe is still holding on to nearly $10,000 of a customers payment…and the customer who thinks I have his payment has spent all that time completely trashing my reputation. DO NOT USE STRIPE!

Kim C.

I hosted a personal fundraiser on Facebook to help save my home from foreclosure.

Now Facebook and Stripe are giving me the run-around. They are not depositing my funds into my bank account.

They claim wrong account numbers etc, when I know it is correct (and was correct) I sent the proof, yet they are still not paying. I hear different excuses and they contradict themselves on the same msg thread.

I am at my wits end. I will lose my home bc of Facebook and Stripe.

$1800 from my family and friends GONE.

Ariel R Young

No we didn’t my cousin set up a fundraiser for our family on Facebook, Facebook uses stripe for payment. We raised 1665 dollars on the fundraiser we were thrilled bc we lost everything in the fire and thought that would help with finding a place. But the first payment of 1,222 dollars that was supposed to be deposited in to the account was never deposited. We only received 482 dollars of the 1665 we were supposed to receive and when we contacted stripe they had no clue how it happened stating it was probably something with our bank. I have copies of my bank statements and my cousins bc they tried to say it was deposited to my cousin’s then tried saying it was deposited into mine. It was never deposited into either. Bc of this we had to live with my cousin and her family for over a month. We had a hard time getting any clothes for my children bc we had to spend my husband’s checks on food. We had and they deposited the other payments slowly and only 90 dollars or so sometimes only 20 dollars every other or ever couple of days. I want the 1,222 dollars I was supposed to get. It’s not fair that we were already suffering in the position we were in but for them to ot pay us the money other people donated to us is ridiculous.

CPO

Ariel,

This article may help: How to Make a Payment Processor Release Your Funds.

-Phillip

Harward Cheung

ATTENTION. Stripe does NOT have the seller protection as PayPal does. The chargeback protection is a joke, which is not the seller protection. If the package is delivered, even signed by the buyer, the buyer can still claim an “item not received” case. And Stripe will charge you, the seller, the processing fee and you will lose the case, because the decision is done by the buyer’s credit card company. Stripe only forward “information”. There is No support or no help from the Stripe customer service. This is what they reply “Unfortunately, proving that the product was delivered is not enough in these cases, and you need specific evidence to show that the cardholder received it.” GOOD JOB. I pay the service fee, and my money is never undercover. I only received and lose two such cases. $500 were gone and the fraud took my items. Bye Stripe.

CPO

Harward,

This article should help: How to Fight Chargebacks and Win.

-Phillip

Miranda

Payed for a Nintendo switch through this company and still have not received it!

Mouad

I will never recommend stripe to anyone.

We are a small business with 0 chargeback for hundreds of transactions and stipe limited our account for 90 days, they say it’s because of the potential high risk of our business. We are selling kids toys, in which world is it considered as a high risk business

We talked to their support to explain that we are not considered as a high risk business i. Stripe’s policies but they don’t mind, after making such decision, they can’t restore the account and if no customer opens a dispute they may release our money in 45 days.

We are not the only company that got limited for no reason, there is a lot of connections who got the same problem in the same month.

No recommending them to anyone.

Bill

Stripe customer support appears to be operated by robots overseas that have zero power or discretion to address customer complaints or processing issues. Obviously this policy starts at the top and let the small business owner beware as Stripe will get their fees regardless of whether a transaction is cancelled, reversed or rejected by the vendor or customer!

Sherry

We are disgusted with Stripe and will be leaving their service as soon as we are paid all of our money. Every time we get a customer payment, we literally are waiting 10 to 12 days to get paid for it. They are only supposed to hold your money in reserve for 7 days, and that’s only after your very first customer transaction. We would never encourage anyone to use their services.

This post will help: Best E-Commerce Merchant Accounts

-Phillip

Jeffery Hill

Shocking lack of concern for Fraud. Someone opened a merchant account in my name. Stripe does not care. They will not do anything.

So someone out there, is charging stolen credit cards in my name and they don’t care. My business is as risk and consumers and facing fraudulent charges on their credit card and Stripe will not even talk to me.

I think their actions are criminal.

This post will help: Best E-Commerce Merchant Accounts

-Phillip

Starkmaids

As a small business owner, I will not recommend Stripe and possibly will rank it as the worst payment gateway we used. We are still trying to remedy the situation, no respond from Stripe, other than an account revisit. Look we understand, they have terms we (i.e merchants) need to follow, we had some refunds, we run a cleaning business. When we sign up for Stripe, we ran some customer via an interface which appeared well in our business. This company that provides software also recommended and only integrated with Stripe. A few weeks later, and Stripe disrupts our business by stopping all payments, revoking access and closing our account with the exception of the data on there. We quickly moved our clientele to our credit card terminal and former SaaS. When we needed to refund two clients that canceled before all of this, Stripe wasn’t there for us, not even via email. No respond anywhere and BBB has several, if not very common robot like responses from Stripe. On BBB you would find things like; “Stripe identified strong signals that the Complainant’s account was in violation of the Stripe Terms of Service.”They also quote things like their ToS, Agreements and such, many articles are not revised witin Stripe Legal Terms, some cut into things like risky businesses and then they provide lists of industries not accepted or restricted, but they worked with many. Stripe just doesn’t quite provide a policy in place that would give enough trust to small businesses. They’ve been hurt in the past by the lack of vetting and fraud control, that now they’re skeptical of everyone. Listen, we run a small cleaning business, zero bad customer reviews to data! They said we had unauthorized transactions and then admitted we really were to risky for them. A cleaning company too risky for a payment processor when was such a thing true? My staff and I, are preventing two of our biggest clients from leaving us after the disruption, because they won’t take anything but a refund to their card, we don’t expect anything from Stripe. But we think that they should stick to software startups and even them, these companies are simply to scare of Stripe.

This post will help: Best Merchant Accounts for Cleaning Services

-Phillip

Stripe scam ppl

The worst company I ever had to deal with, support team that gives wrongful information, full of mistakes and not synchronize with each other.

Stripe closed my account cause I login outside the USA, the company US LLC entity finished the form to get an account, the whole process was with their representatives, and everything was as they requested, they got all the forms.

They approved the account!

A few weeks later, after successful payment, they decided to close the account, with NO REASON.

My advice for you guys, STAY AWAY.

There are a lot I alternatives.

Only after they will lose a huge amount of costumers/businesses – maybe they will check themselves and stop acting like a scam company.

This post will help: Best E-Commerce Merchant Accounts

-Phillip

Ja Mason