Fiserv Reviews & Complaints

Overview

In this article we will provide an in-depth analysis of Fiserv, formerly known as First Data, detailing everything a business needs to know before utilizing the company's merchant services. We'll begin by detailing the company's history, including its significant acquisitions and mergers. Then, we will delve into the various services offered by Fiserv, such as credit and debit card processing, hardware sales and leasing, payment gateways, and e-commerce solutions. We'll explain Fiserv's role as a direct processor and its partnerships with various resellers and sub-ISOs.

We will then address the challenges and controversies that have surrounded Fiserv, including common customer complaints, legal issues, and government fines. This will involve a critical look at the company's customer support options, alongside providing essential contact information for different service needs.

Further, this article will explore Fiserv's online ratings and customer feedback. We aim to shed light on the common issues faced by its clients, offering a balanced view of the company's performance from the perspective of its users.

Additionally, we'll examine Fiserv's fee structure and contract terms, paying special attention to the implications of dealing with its network of resellers. The article will also scrutinize Fiserv's sales tactics and the impact of its extensive network of independent resellers on its overall reputation.

About Fiserv

Fiserv, also previously known as First Data, stands as a global giant among credit card processing services. The company primarily generates revenue by offering back-end card processing services to Independent Sales Organizations (ISOs), banks, and various merchant service providers worldwide. Fiserv has also made strides in the point-of-sale technology sector with its Clover POS system (see our Clover POS Review). A significant expansion occurred in May 2017 when Fiserv acquired CardConnect for $750 million, followed by the purchase of BluePay in October of the same year. In a landmark development, First Data merged with Fiserv in January 2019 through an all-stock deal valued at $22 billion, with Frank Bisignano, the former CEO of First Data, continuing as the CEO of the merged entity.

Continuing its growth trajectory, Fiserv acquired Radius8 for $14 million and Ondot Systems for $270 million in 2021, along with the purchase of BentoBox for an undisclosed sum. The company's acquisition spree didn't stop there; it also included Finxact, Merchant One, The City POS, and Yacare. Additionally, Fiserv has formed a strategic partnership with Central Payments, further expanding its influence and capabilities in the financial services technology sector.

Fiserv's Services

Fiserv offers a comprehensive range of products and services primarily focused on financial transactions, merchant services, and payment processing, catering primarily to U.S. businesses and financial institutions. Here's a summary of their key offerings:

- Credit and Debit Card Processing: Fiserv provides extensive card processing services, including authorization, settlement, and funding for credit and debit card transactions.

- Point-of-Sale (POS) Solutions: Fiserv offers a versatile point-of-sale solution with its Clover POS system, which includes hardware and software for processing sales transactions, managing inventory, and customer engagement.

- Mobile and Online Payment Solutions: They offer solutions for online and mobile payments, enabling businesses to accept payments through websites, mobile apps, and other digital platforms.

- Merchant Cash Advances: Fiserv provides financial loan products like merchant cash advances, offering businesses access to working capital based on their future sales.

- E-commerce Solutions: They offer a range of e-commerce solutions, including payment gateways and shopping cart integration, to facilitate online transactions.

- Fraud and Risk Management: Fiserv provides tools and services for fraud detection and risk management to protect businesses and their customers from fraudulent activities.

- Data Analytics and Reporting: They offer data analytics and reporting tools to help businesses track transactions, understand customer behavior, and make informed decisions.

- Financial Services Technology: Beyond merchant services, Fiserv is known for its financial services technology solutions, offering a wide range of products for banks and financial institutions, including account processing services, electronic bill payment, and digital banking solutions.

- Acquisitions and Partnerships: Fiserv's growth strategy includes acquiring companies like CardConnect, BluePay, and Ondot Systems, and forming partnerships to expand its service offerings and technological capabilities

Reseller Network & Banking Partnerships

Fiserv distinguishes itself in the merchant services industry as a direct processor with major credit card networks like Visa and MasterCard. This direct processing capability sets the company apart from many other merchant services organizations that rely on intermediary banks or processors like Fiserv to handle transactions. Being a direct processor allows Fiserv to have more control over the processing and, potentially, offer more competitive rates to high volume businesses.

While Fiserv does maintain a modest direct sales force, the company predominantly leverages partnerships with third-party resellers through a white label program that allows companies to market and sell merchant services under their own branding. This extensive network of partners has enabled Fiserv to reach a broad range of clients across various industries and geographical locations.

Furthermore, Fiserv has played significant role in the credit card processing operations of some of the largest banks in the United States, providing the underlying credit card processing services for Wells Fargo Merchant Services and, formerly, Bank of America Merchant Services which ended its joint venture in 2020 to provide its own merchant services. These partnerships, along with thousands of others, contribute to Fiserv's status as one of the largest, if not the largest, processor in the world.

Equipment Leasing Controversy

In addition to its core credit card processing services, Fiserv operates a POS (Point of Sale) leasing division through First Data Global Leasing. However, this division has received significant amount of negative reviews, with much of criticism directed at the terms and conditions of the leasing agreements and the quality of the leased equipment. In fact, a competitor offering nearly identical leasing services was was shut down by the New York Attorney General (see our review of Northern Leasing Systems).

Location & Leadership

| Address: | 255 Fiserv Drive Brookfield, WI 53045 |

| CEO: | Frank Bisignano |

| Phone: | (800) 872-7882 |

| Website: | fiserv.com |

| Pros: | Cons: |

|---|---|

| Broad service offerings | Potentially higher fees |

| Reliable network infrastructure | Complex pricing structure |

| Global reach | Lengthy contract terms |

| Advanced security features | Inconsistent customer support |

| Diverse payment options | Equipment lease commitments |

| Comprehensive reporting tools | Steep cancellation penalties |

Fiserv Customer Reviews

Here's What Their Clients Say

| Total Online Complaints | 1,000+ |

|---|---|

| Testimonials | Few |

| Most Common Complaint | Hidden Fees |

| Most Common Praise | Technology |

| Lawsuits | 10+ |

Public Feedback and Reviews

After conducting thorough research on Fiserv’s customer reviews and commentary, we’ve identified diverse trends and patterns in client satisfaction, offering insights into what to expect when engaging with this credit card processor. While there are commendable aspects of user experiences, there are also areas of concern.

Positive Aspects Highlighted by Clients

- Modern and Reliable Technology: Fiserv’s “Clover” payment hardware line garners widespread praise for its reliability and advanced features, providing efficient payment processing, robust security measures, and user-friendly interfaces.

- Support for Businesses of Varying Sizes: Fiserv is recognized for its support of small, medium, and enterprise-level businesses, tailoring solutions to meet diverse needs and offering tools previously accessible only to larger corporations.

- Customization and Flexibility: Clients value the customization and flexibility of Fiserv’s services, enabling them to tailor solutions to their specific business needs, even amid operational changes.

- Global Reach and Comprehensive Services: Fiserv’s global presence and extensive array of financial services under one umbrella receive positive mentions for the convenience they provide to customers worldwide.

- Positive Customer Service Experiences: Despite mixed reviews, many users report positive interactions with Fiserv’s customer support teams, citing knowledgeable assistance, efficient issue resolution, and proactive customer care.

Areas of Concern

Fiserv has faced a notable volume of customer complaints covering various aspects of the company’s fees, policies, and services. Our investigation revealed a significant number of negative Fiserv reviews, exceeding 600 within our comment section below and over 400 additional complaints on other consumer protection websites.

- Sales Practices and Transparency: There are consistent concerns about deceptive sales tactics, particularly from resellers and sales agents, leading to surprises and misunderstandings regarding contract terms and conditions.

- Customer Service Challenges: Numerous complaints revolve around difficulties in dealing with Fiserv’s customer support, including long wait times, difficulty in issue resolution, and perceived lack of attentiveness.

- Billing and Contract Disputes: Billing issues, hidden fees, and unclear contract terms are recurring themes, resulting in dissatisfaction and financial burdens on businesses.

- Hardware Costs and Commitments: Dissatisfaction with the costs and lease terms of credit card processing hardware is common, along with reported functionality and reliability issues.

Concerns Regarding Resellers and ISOs

- Misleading Sales Tactics: Customers report encountering misleading or aggressive sales tactics from some resellers and ISOs, resulting in unfulfilled promises and incomplete information about services offered.

- Lack of Transparency in Contract Terms: Many complaints stem from a lack of transparency in contract terms, with customers locked into long-term contracts with high cancellation fees.

- Hidden Fees and Unexpected Charges: There are frequent reports of hidden fees and unexpected charges not disclosed during the sales process, leading to surprise costs for customers.

- Inconsistent Customer Support: Customer support provided by resellers and ISOs is inconsistent, with some customers experiencing difficulties in getting timely and effective assistance.

Fiserv’s Involvement in Legal Issues and Settlements

Fiserv has faced legal actions and fines, including lawsuits related to acquisitions, termination fees, authorization fees, and data breaches, along with fines for labor violations and settlements for fraud charges.

- Fiserv’s Acquisition of First Data: Valued at $22 billion, Fiserv’s acquisition of First Data marked a significant milestone in the financial industry. However, this expansion has not been without legal challenges. Here’s an overview of notable legal issues and settlements involving First Data, now part of Fiserv:

- Class-Action Lawsuit by Alan Skulsky: In response to the acquisition, Alan Skulsky, a minority stockholder in First Data, filed a class-action lawsuit in the Delaware Chancery Court. While the outcome of this lawsuit is undisclosed, it underscores concerns raised by stakeholders regarding the acquisition.

- Legal Issues of First Data (Part of Fiserv): In 2017, First Data, now part of Fiserv, faced a class-action lawsuit in New York, alleging the imposition of excessive termination fees on equipment leases. This lawsuit, demanding a jury trial, brought attention to concerns over unfair financial practices within the company.

- Lawsuit Against First Data by Peel Payments (2016): Peel Payments, a First Data reseller, filed a lawsuit in 2016 alleging a significant increase in authorization fees for some merchants, from $0.05 to over $0.60 per transaction. This discrepancy in fees, noted to exceed typical authorization fee standards, raised questions about fee transparency and fairness.

- Lawsuit Against Fiserv by Bessemer System Federal Credit Union (April 2019): In April 2019, Bessemer System Federal Credit Union alleged that Fiserv failed to address vulnerabilities in its platform for banking websites and online applications, raising concerns about the security and reliability of Fiserv’s digital infrastructure.

- Lawsuit Against Fiserv’s Bank of America Merchant Services Arm (July 2021): In July 2021, claims were made against Fiserv’s Bank of America Merchant Services arm, alleging the charging of excessive fees not included in merchant contracts. These claims highlighted ongoing concerns about billing transparency and fairness in Fiserv’s services.

- Lawsuit by Municipal Credit Union Against Fiserv (2022): In 2022, Municipal Credit Union alleged negligent and fraudulent practices by Fiserv, leading to a data breach exposing sensitive information of thousands of MCU members. Seeking compensation for protection costs and damages, MCU underscored the importance of data security in financial services.

- Repeated Fines for Labor Violations: Fiserv/First Data has faced multiple fines for labor violations, including wage and hour violations totaling $51,565 and economic sanction violations amounting to $23,336.

- Settlement for Fraud Charges: First Data, as part of Fiserv, settled with the Federal Trade Commission (FTC) for $40.2 million, resolving charges related to its involvement in four scams. These charges stemmed from alleged illegal actions committed from 2012 to 2014, highlighting the importance of regulatory compliance and ethical conduct in the financial industry. (Source: Reuters)

These legal issues and settlements reflect the complexities and challenges faced by financial institutions like Fiserv, emphasizing the need for transparency, compliance, and accountability in their operations.

Customer Support Options

Fiserv offers customer service directly to merchant account customers via a 24/7 call center, with resellers also providing assistance. However, confusion may arise regarding which entity is responsible for servicing accounts.

Fiserv Customer Service Numbers

- (800) 872-7882 – Sales

- (800) 877-8021 – CheckFree Online Bill Pay

- (800) 848-1337 – CheckFree Online Bill Pay Collections

- (800) 554-8969 – Debit Card Services

- (800) 564-9184 – MyCheckFree

- (800) 967-9649 – BillMatrix

- (877) 675-6378 – Popmoney

- (800) 676-6148 – Walk-In Payments/CheckFreePay

See the best merchant accounts for customer service before risking your payment acceptance with any merchant account provider.

Fiserv Online Ratings

Here's How They Rate Online

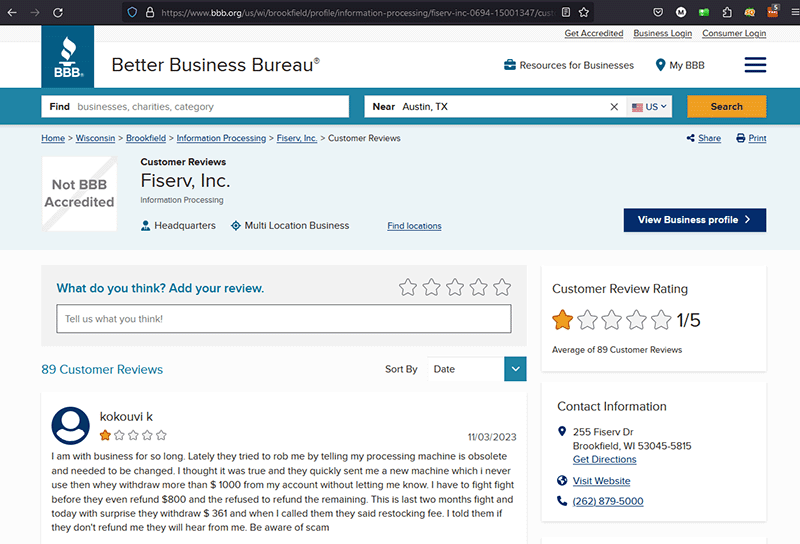

| BBB Rating | 1/5 |

|---|---|

| Trust Pilot Rating | 1.9/5 |

| Software Advice Rating | 4.3/5 |

| Average Rating | 2.4/5 |

Fiserv BBB Rating Analysis

Fiserv, Inc. has an average customer review rating of 1 out of 5 stars on the Better Business Bureau (BBB) website, based on 89 customer reviews. Common themes among these reviews include complaints about poor customer service, issues with account handling, and dissatisfaction with the company’s response to customer concerns.

Negative Feedback

I am with business for so long. Lately they tried to rob me by telling my processing machine is obsolete and needed to be changed. I thought it was true and they quickly sent me a new machine which I never use then they withdraw more than $1000 from my account without letting me know. I have to fight before they even refund $800 and they refused to refund the remaining. This is last two months fight and today with surprise they withdraw $361 and when I called them they said restocking fee. I told them if they don’t refund me they will hear from me. Be aware of scam.

– Review from November 3, 2023

This company (Clover) is a scam, they said that 3 of the deposit my company received were higher than our daily average so they put the funds on hold on 10/20 when I called back on 10/23 they told me that they decided to close the account and they would be releasing my funds and I would receive them within 24/48 hours. I still did not receive my funds on 10/26 so I called them back and they said that there was an issue but the funds were released I should be receiving them back on tomorrow 10/27. Tomorrow came and I still did not receive the funds and they said that there was a delay on their end and I would be receiving the funds by 10/30 or 10/31 at the latest and I don’t need to worry. Today 10/31 I called and they said that they were not sure who I spoke to and that there has been no attempt on their end to send the money to bank account and they were not sure because that is handled by a different department and the best she could do is send them an email but could not provide me with their contact info. Now I’m sitting here with my thumb up my A$$ and have no clue what to do or who to talk to and they are holding my $8835 with no timeframe of when I will get it back. I’m a SMB owner and not having this money is really going to put me a hole. Please please stay away from this company.

– Review from October 31, 2023

Positive Feedback

There are no positive reviews published about Fiserv, Inc. on Better Business Bureau.

Source: Better Business Bureau

Trustpilot Rating Analysis

Fiserv, Inc. has an average customer review rating of 1.9 out of 5 stars on Trustpilot based on 13 customer reviews. The common themes in the reviews include poor customer service, issues with their merchant services, and difficulties in resolving problems.

Negative Feedback

Don’t do business with Fiserv or any business they own. Their merchant services are the worst and their customer service is worthless. No one can ever actually resolve anything. Reports for merchants are terrible. No customer order number for the transactions. They used to have order numbers and they took them away and refuse to put them back on the reporting. After spending thousands of dollars to have custom code written to reconcile the merchant account, bank account and sales from my website they changed the reporting and all the money I spent is down the drain. Now I have to reconcile by hand one transaction at a time. It’s crazy! Today I tried to issue a refund and it won’t go through their Clover system. I called customer service and they cannot get it to go through either. Now they tell me I have to wait 3 days for them to figure out the problem. I am supposed to call my customer and tell them to wait 3 days. How does that make my business look to my customer??? I have been on the telephone with them for over 2 hours and am on hold to speak with a supervisor. This company is the worst company I have ever dealt with. Very unprofessional! Save yourself a ton of stress and stay away from anything Fiserv, First Data, Clover….

– Review from November 13, 2023

You are NOT important to us!! I quit Fiserve on 8/1/2023 – I received an email from customer service confirming my request to close my account on 8/4/23. NO WHERE in any of the 3 emails I received did it say “trickle fees” would show up, for up to 60 days, after closing. I’ve been charged a Visa month end fee for 2 months now. I gave them August as we did process for the first 3 days. Now I want my money back! All the customer service rep (Appropriately named Boycott) said “It’s a valid charge” (You say!!!) He requested my fee to be refunded, but I needed to wait, up to 72 hours, for a response.

After being on hold for almost 30 minutes – Nothing says “you’re not important to us” like being on hold – or being transferred multiple times from CSR to CSR.

My bank now does inhouse credit card processing. If they go back to using Fiserve as 3rd party – I will find a new bank!

– Review from October 3, 2023

Positive Feedback

There are no positive reviews published about Fiserv on Trustpilot.

Software Advice Rating Analysis

Fiserv has an average customer review rating of 4.1 stars on Software Advice based on 23 customer reviews. Common themes in the reviews include appreciation for its ease of use and integration with other software like QuickBooks and Shopify. However, some users mention issues such as system lag, difficulties with customer service, and limitations in software functionality.

Negative Feedback

LISA from the banking sector, who has been using Fiserv for more than 2 years, reviewed the service in July 2021. She finds the Maxxar software for phone banking very basic and antiquated, lacking advanced features and voice options. She also mentions frequent service disruptions and a general lack of support for this product.

– Review from July 2021

Ryan, from the computer software industry, using Fiserv monthly for less than 2 years, reviewed it in August 2023. He appreciates the robustness of the payment processor but criticizes the slow customer service response time, mentioning that they have had tickets open for months without answers.

– Review from August 2023

Positive Feedback

Eve, from the hospital & health care sector, using Fiserv daily for less than 12 months, gave a review in November 2018. She finds it quick and easy to take payments, appreciates the integration with QuickBooks and Invoice ASAP, and likes the feature of resending receipts easily.

– Review from November 2018

Dustin, from the medical practice industry, using Fiserv daily for less than 12 months, reviewed it in August 2018. He praises the ease of use, the simplicity of processing payments, and the fast processing of transactions.

– Review from August 2018

Fiserv Fees, Rates & Costs

A Closer Look at The Contract

| Processing Rates | Negotiable |

|---|---|

| Service Length Commitments | Possible |

| Early Termination Fees | Possible |

| Monthly & Annual Fees | Yes, Negotiable |

| Hardware Options | Purchase or Lease |

Fiserv Rates and Fees Breakdown

Fiserv discussing rates and fees on its website.[/caption>

Fiserv discussing rates and fees on its website.[/caption>

Fiserv provides direct merchant account services with a pricing structure subject to negotiation, impacting service length commitments and associated costs. Unlike some competitors, Fiserv doesn’t publicly disclose a standardized fee structure for its credit card processing services. Instead, the company grants considerable discretion to its sales representatives to set fees and rates. This approach yields a wide variation in pricing, often contingent on the business owner’s knowledge of prevailing pricing models.

Merchants well-versed in industry benchmarks stand a better chance at negotiating favorable rates. Armed with knowledge, they can challenge high fees or unfavorable terms, seeking reductions or modifications aligning closer with industry standards or their transaction patterns. Conversely, less informed merchants might accept initial offers, potentially incurring higher costs.

Impact of Sales Commissions

Fiserv’s sales representatives, incentivized by commission structures, may push merchant accounts with higher rates and fees. The commission system rewards representatives for contracts with higher costs, posing a potential conflict of interest. This dynamic could prioritize representatives’ earnings over merchants’ best interests, especially if merchants lack familiarity with fee structures.

Tiered Pricing vs. Interchange-plus

Fiserv’s representatives typically offer tiered pricing models, critiqued for opacity compared to Interchange-plus. In a tiered structure, transactions group into tiers, each with its rate, potentially costing merchants more due to higher markups and fee unpredictability. Interchange-plus pricing, conversely, offers transparency, separating interchange fees from the processor’s markup, aiding merchants in understanding transaction costs.

Hardware Expenses

Fiserv primarily promotes its “Clover” POS systems and payment processing hardware but also offers traditional options. Hardware pricing isn’t publicly disclosed, suggesting representatives retain flexibility to negotiate prices, potentially for higher commissions or to compete with rival offers. It’s uncertain if Fiserv still leases hardware via First Data Global Leasing, known for costly, non-cancellable leases.

The Contractual Landscape

Fiserv’s service agreements and terms appear variable, shaped by merchants’ knowledge and representatives. While Fiserv historically offered long-term, binding agreements with hefty termination fees, recent shifts suggest softened policies. However, reports of surprise cancellation fees and auto-renewing contracts persist. Concessions by Fiserv, often tied to equipment discounts, aren’t always commensurate with service commitments, as voiced by merchants.

Fiserv Reseller Pricing

Fiserv’s reseller costs vary significantly, driven by resellers’ pricing discretion. Resellers can set margins and fees atop Fiserv’s base rates, leading to a wide price spectrum. While some resellers transparently outline fees and margins, others may not, underlining the need for comprehensive research and comparisons. The financial impact of pricing differences underscores the importance of informed decision-making.

Reseller Contract Flexibility

Resellers, especially larger ones, tailor service agreements, adjusting contract lengths, cancellation terms, and hardware costs. This flexibility allows customized solutions but could yield less favorable terms. Some resellers might extend contracts, increase cancellation fees, or inflate hardware costs to boost margins. Customer service levels can also vary, contrasting resellers with Fiserv’s direct service.

Prospective Fiserv clients should thoroughly comprehend all pricing and contract terms. Simplified credit card processing alternatives are available among this list.

Fiserv Employee Reviews & Sales Tacitcs

Should You Work For Them?

| Independent Sales Positions: | Yes |

|---|---|

| W2 Positions: | Yes |

| Sales Tactics Complaints: | Yes |

| Glassdoor Rating: | 3.4 Stars |

| Indeed Rating: | 3 Stars |

We analyzed numerous employees reviews from various sources to gain insight into the company’s work culture, management practices, and overall employee satisfaction – variables that can also affect a business owner’s experience with the company.

Work Environment and Culture

Employees often describe the work environment at Fiserv as fast-paced and dynamic, reflecting the company’s position in the rapidly evolving financial technology industry. Many appreciate the opportunity to work on challenging projects that push the boundaries of financial services and technology. The company’s commitment to innovation is frequently cited as a motivating factor, providing employees with a sense of being at the forefront of industry changes.

However, some reviews indicate that the fast-paced nature of the work can lead to a high-stress environment. Employees have mentioned the pressure to meet tight deadlines and manage large workloads, which can sometimes impact work-life balance. Despite these challenges, there is a general consensus that the work is intellectually stimulating and offers opportunities for professional growth.

Management and Leadership

The leadership at Fiserv receives mixed reviews from employees. On the positive side, some employees commend their managers for being supportive and fostering a collaborative work environment. They appreciate the open-door policy of some managers and their willingness to listen to employee concerns and suggestions.

Conversely, other reviews point to inconsistencies in management styles across different departments and locations. Some employees have expressed concerns about a lack of clear communication from upper management, leading to uncertainties about company direction and employee expectations. There are also mentions of challenges in getting recognition and visibility for achievements, particularly in larger teams.

Employee Benefits and Compensation

Fiserv is often recognized for offering competitive compensation and a comprehensive benefits package. Employees appreciate the health insurance, retirement plans, and paid time off policies. These benefits are seen as reflective of the company’s commitment to its employees’ well-being and long-term financial security.

However, some reviews suggest that the compensation may not always be commensurate with the workload or industry standards, particularly in junior or mid-level positions. There are also comments about the variability in pay scales across different roles and departments.

Sales Positions & Tactics

User reviews of Fiserv often touch upon the company’s sales tactics. These reviews, primarily from clients and customers, provide a different angle on how Fiserv trains it saleforce.

A recurring theme in these reviews is the mention of aggressive sales tactics. Some users have reported experiences with sales representatives who are highly persistent, sometimes to the point of being intrusive. There are accounts of representatives using high-pressure strategies to close deals, which can leave customers feeling overwhelmed or coerced.

Additionally, there are mentions of a lack of transparency in sales pitches, with some customers finding that the actual terms and conditions of services differ from what was initially presented. This includes discrepancies in pricing, contract terms, and the specifics of service offerings.

Actual Employee Reviews

People are great, not super demanding, great work-life balance, AMAZING maternity leave, and great benefits overall. Managers are wonderful and don’t micromanage.

I’ve worked for Fiserv for 10 years. I’ve been remote for the last 8. When leadership changed to Frank Bisignano the entire organization started on a downward spiral. This list is long so I will try to keep it succinct 1. Pay has not kept up with either the market or inflation. 2. No flexibility in work arrangements. Remote is no longer an option. Relocation is a requirement and working onsite from a local office instead of moving is not an accepted compromise.

Our Fiserv Review Summary

Our Final Thoughts

Fiserv, formerly known as First Data, stands as a significant player in the credit card processing industry, offering a wide array of services that cater to businesses of various sizes and types. While the company boasts a comprehensive suite of products and a global reach, the customer feedback and reviews present a mixed picture.

On one hand, Fiserv’s vast array of services, including its Clover POS product line, merchant cash advances, and online reporting tools, are appreciated by many businesses for their efficiency, ease of use, and comprehensiveness. However, on the other hand, concerns about transparency in pricing, contract terms, and customer service issues are noteworthy. The variability in experiences, particularly with regard to hidden fees, long-term contracts, and customer support, suggests that while Fiserv has the potential to be a powerful ally for businesses, the actual experience can vary greatly. This inconsistency highlights the importance for potential clients to approach Fiserv with a thorough understanding of their specific business needs and a readiness to negotiate terms that are most favorable to their situation.

Furthermore, the role of resellers in Fiserv’s business model adds another layer of complexity. The ability of resellers to set their own pricing and terms means that experiences can differ widely depending on the specific reseller. This underscores the need for businesses to conduct due diligence when selecting a Fiserv reseller. As with any significant business decision, it is crucial to thoroughly research and understand all aspects of any agreements with Fiserv, or Fiserv reseller, to ensure they align with expectations and business objectives.

If you found this article helpful, please share it!

Ilayda Aliyazicioglu

THIS COMPANY OPERATES DECEITFULLY! Not only did they deceive me with false promises of energy price discounts, but they also coerced me into a contract for 3 new card machines. To cancel these unused devices, they demanded a staggering £3000. This is a blatant scam preying on unsuspecting individuals. STAY VIGILANT and steer clear of their dishonest dealings!

I was astounded by the deceptive practices of this company, an unexpected turn of events in the UK. It’s alarming to discover that fraudulent companies operate legally worldwide, including in England. Stay alert and informed to avoid falling victim to such schemes.

Merchant from 2017

Stef, Can you please email me or share your info we need to make these guys correct and when I am seeing several company has same experience then we need to work together and get our money back from them reaching out to relevant authority in Canada and USA

Merchant

Don I aggree with you, Can you please work to coordinate with me to bring classaction lawsuit against the Fiserve or First data as whole

Merchant from 2017

Fiserve is a scammer company, worst company and completely scammer company and they have potentially from our business scammed more than $50000( Sum of Fifty thousands) in the name of reserve fund, and skimmed our hard earned sales money before settlement very worst tactics and not following code of conduct of payment processors, I am not sure how in Canada such companies are allowed to operate. It seems they are taking advantage of relaxed law for payment processors and financial institute. They do not inform charge back or any issue to merchant and keep the information not share with merchant, skim the merchant money before settlement in name of risk and allowed completely planned and staged fraud to Merchant and skim their money. I hope someone sue them as class action suit and contact us soon we will help with. As they are giving third party to sell, they only provide software and completely chaotic mode of operation, It is if Microsoft resellers or others are doing fraud in name of Microsoft it is Microsoft responsibility to investigate and restrict that partner or reseller to use Fiserve name. We had talk with USA corporate as well but at the end they said go to Canada office and complain them, all was useless, they could not explain that they have not scammed our money, just throw some data which had lots of discrepancies as we found while reconciliation done by data scientist. In their Business track software also they are removing some data at their discretion which indicate data discrepancies, when download their data in excel sheet transactions amount are showing in Text format, their Back office in Dominica or Philippines and not proper trained staff or no complete access to them of their third party service provider as well, Their bank in aggrement shows Wells Fargo bank Toronto, when we met to officer they said we have scotia bank tied up with us. We met canada office to their officer who after several complain meet us and at the end some one from remote session in same office skymark avenue as it seems to be a sort of showcase office only when it is needed. I really wants to someone from Goverment to help all merchants who are being Victimized by First Data or Fiserve and their all representative who are not honest and not following code of conduct as payment processors and scamming Merchant money!

Kimberly

I feel that this company is also a scam. They have horrible customer service. They debited $338.99 from my checking account and after 3 days of 2-3 hrs calls to every department couldn’t verify for what and would not return

Rajni Javed

Our bank said same thing. We will close our account if they don’t respond to our cancellation request. They are scammers.

Rajni Javed

They are doing same thing to us. I emailed [email protected] in dcember to cancel these services. Never heard back. We called them many times but nobody helped. They are still deducting money from our account. They are scammers.

Rajni Javed

They are scammers. One of their agent contacted us pretending from our old paymnet processing company. He claimed they are changing our machines as our old ones are outdated. This agent mentioned there is no contract and there will be a flat fee, no etra chrges will be deducted. I was so shocked to receive a lease agreement in the mail with all different charges. I emailed [email protected] in december to cancel this service they started on the basis of lies. I have text messages from their represntative when i asked him about lease and service charges. . I didn’t hear anything from them. We made few phone calls and they did care and keep deducting payment from our account. They are scammers.

Phoenicia salter

If I could give zeros I would. I have been waiting on my FSA/HSS spending account card through Healthways since December and I have yet to get it. All they keep doing is putting in cases that have gone unresolved. Flash forward 2 months later I have funds I can not access because no card has been shipped…smh.

Karl Colaguori

Stay away from this company, they are crooks total scam company. Can not get help in any way they just run you around in circles. Reach someone you think is normal then it always ends the same no answers no call backs . I incourage every person with a problem to file a report with bbb and let’s put a stop to this robbery

Don McLeish

When is theft not considered theft? Who owns your money anyway?

Often not you and not the people you attempt to give it to, it turns out, if you use Fiserv (formerly first Data).

The last time you bought a coffee or lunch in a café, did you use a debit or credit card? You probably assumed that that cute little card processing machine was transferring money from your account to the merchant. What you probably did not know is that there is usually an intermediary, a “payment gateway” that is supposed to promptly pass that money on from customer to merchant (less, of course, their 2% piece of your pie and a hefty charge to the merchant). Sometimes they do. Sometimes, however, they just keep the money for an indeterminate length of time without explanation. When commercial interest rates are over 10%, this is a potentially profitable strategy for companies like Fiserv.

The credit and debit card industry in Canada generally subscribe to a so-called “code of conduct”

https://www.canada.ca/en/financial-consumer-agency/services/industry/laws-regulations/credit-debit-code-conduct.html

which is supposed to limit their ability to simply absorb payments and provide timely resolution to disputes but it is apparently woefully inadequate. In the case of ……, a new business, all payments made by credit or debit cards have been held by Fiserv without explanation. They chose to neither to remit payments to the merchant to whom they were intended, nor, on request, return them to the individuals who made the payments. They did not respond in any meaningful way to repeated requests for an explanation, other than empty promises to respond later.

Under common law, and common sense, if A intends to pay B a sum of money and C acquires and holds the money without the consent of either party, this is simply theft. Now one can complain under the “code of conduct”, which specifies “If a merchant believes that its service providers’ conduct is contrary to the Code, they may report the issue to their acquirer. …..

The acquirer will review the issue with the merchant, undertake an investigation and respond to the merchant within ninety days.

If the acquirer’s complaint process is exhausted and a satisfactory resolution not achieved, the merchant may submit the complaint to the payment card networks.’’

In other words, every transaction is potentially 90 days free money for Fiserv. And then, you can begin to rewrite your complaint to an independent agency which will start a process all over again.

Still no response from these people after they simply stole our transactions!!!!!!!

Anita

The string of emails with no resolution from First Data:

” To whom it may concern:

I would like to cancel my contract with your company.

I have not received any support or help in setting up the payment process hardware or software, using clover machine.

I had also called several times and each time I was informed that someone from technical department would call me to sort out the issue. Till date, I have but received any call to transfer the inventory from one software to another, and no one has followed up via email asking if the system was running smoothly at all.

With this kind of poor services, I can’t imagine staying in a contract for any number of months.

Therefore, I’m demanding that you cancel my contract with no charges to my account for cancellation and no charges for monthly fee anymore.

Sincerely,

Anita

Atif .

Thu, May 18, 8:27 PM

to me

Thanks for your Email…!

After your email company started investigating your quer, there were two people who got in contact with you regarding your account issue, one is RM that’s me and second in our customer support, they offered you the resolution but you denied to pay 15$ for upgrading your account.

I will ask my team to give you a call on friday and again update about the upgrade of the account.

You are demanding cancellation of a lease contract which is not possible, as you have signed that contract willingly.

On behalf of my company, I request you that what happened happened, let’s have a new start to move things forward without any hassle.

I am Seeking to establish a long-term business relationship with you.

Cheers

Atif Mumtaz

Manager Priority Customers

Swipe Partners.

Mobile & Whatsapp: (469) 259-9706

Email: [email protected]

Website: http://www.swipepartners.com

Address: 4750 Yonge St Unit 341, North York, ON M2N 5M6, Canada.

Helpline: +1 855-232-9262

5:55 PM (9 minutes ago)

to Atif

This has been 8 weeks since I last emailed you and then spoke with one of your representatives and a supervisor. Your company would be considered a scammer if they are charging businesses under the shield of a contract, and not providing the services that were promised during the sales call and on the contract. As I said earlier, I am not benefitting from simply keeping your machine if I can’t use the software. Therefore, I am asking you to cancel my account effective immediately and stop debiting any monies from my account. I will be taking this matter to my bank, and then to small claims court.

Since the last time I spoke with a supervisor, she had promised me a call back from the technical department to see if they could help me with the software.Till this date, I have not received any phone call, voicemail, messages or email from your office regarding this matter. When your company had to sell this product to businesses such as ours, I was receiving calls everyday, almost 2-3 times a day, even when I would tell them I was busy. Now, after you have gotten acces to my account information and debiting my account on a monthly basis, there is absolutely no response from your side.

This is a scam and is unacceptable. The $15 upgrade that you mentioned in your email is not in my contract. I had told the rep very clearly that I am using Square right now and I will only move to Clover if I am getting the same convenience of itemized software that can be switched over to Clover from Square. He said that it was not a problem at all, and with this contract it will be included. And I remember that he had called me the next day after apparently finding this information from one of his seniors. I confirmed the fee for all the above and he mentioned it was $35 per month only, nothing more.

With unreliable people behind these services, I can’t be staying in a contract for any number of months.

Therefore, I’m demanding that you cancel my contract with no charges to my account for cancellation and no charges for monthly fee anymore.

Thanks,

Anita

kelly c

I will be looking for another credit card company. They hire people from other countries who can not speak english. I was on a call for over 1 hour and they just kept transfering me to someone else issue was not resolved. This is the worst credit card company I have had in 25 years. They have held my deposts for 1 week and have threatened I need to wait 2 more days for any money.

Dennis

Completely a scam company. I signed up for 4 years contract with first data ( now fiserv) and they covertly made me sign 6 years contract for the rental. Are you kidding? Why would I need 2 years extra rental when the contract is over? Not only that, they have so many hidden fees. Dont be fooled by their percentage rates. It’s a big lie and they still gonna charge you for hidden fees you don’t even know what you are paying for

Never sign up with First data or Fiserv

Chris Patch

Fiserv, through my credit union, ran an insufficient fund charge not once but three times thereby draining my account… further they then went over my head and paid the amount – I would not have wanted that and was planning on taking care of it myself a few days later – this lead to their suspending my ability to use bill pay and unable to pay any bills as my account was held hostage until I paid them for their mistake or it would be sent to collections; I am on a limited income (SSDI) and cannot afford this and their error in judgment! This suspension needs to be lifted ASAP! It will cost the credit union I use another member otherwise!

Frustrated in BC

Worst company of thieves. You can sign on but you cannot get rid of them. Continue to charge our account after speaking with multiple persons, including lease dept. Got to the arduous end of the process, they cut me off and did not call back even though asked for my number. Continued to charge the account. GO elsewhere!

ana

Hello from Vancouver BC. I can relate. I have not been able to cancel the service for the last 6 years!!!!! No restaurant for the last 6 years but paying the service, THIEVES. My bank tells me i cannot cancel/stop the automatic payment, because I set it up with first data.

Danny's Auto LLLC

I have also found out that at one point I was part of Bank of America Merchant Services. And for whatever reason was told that I was going to be transferred to Fiserv. I recently went to the Bank Of America Branch office to complain about my money that has been put on hold which is not as much as what some have reported on there complaints. But to me it has kept me from paying my bills on time. But Bank of America has dropped them and now Bank of America wants me back with them. But I want no more part of any of them I have chosen Square. I see what I am being charged for and not getting charged for using there process servers plus other hidden charges like having to sign up for validations ever so many months and if you don’t you get charged for not doing so.

R.I. Davies

I will not waste time, first data is the worst company I have ever had to deal with and I am having to still deal with it. I have seriously considered going to the fraud department of the federal government to straight out the ridiculous various positions first data has taken I am not sure yet if I am dealing with a clever fraud operation or not.

Navinder Kaur singh

your service is not good you do not send monthly statement and never answer phone

Daniel Rivera

Beware this merchant Service has been in litigation with the Federal Trade Committee. For scamming customers I was charged twice for equipment I never purchased. Also charged $100.00 for collection fees.

Merchant

Fiserve has RUINED FirstData, their weekend support is absolutely atrocious! trying to retrieve full credit card information for customers is nearly impossible, the poor English speaking individuals in various countries where you get routed have no clue what they are doing. Typically acquisition fallout, I’ll be dumping them and going with another processor. FirstData/Fiserve/CardConnect one in the same.

Patrick

Horrible company scammers there in Canada Toronto Ontario, going through brokers, scamming small businesses for their money. I recently signed and changed over with your fast, talking sales representatives from the broker. I made a mistake and changed my merchant service now after two weeks, they are holding 30 K of my money. The risk department has no consideration. If there even is a risk department they were based in the US will not respond to me, asking me questions and want to three months of bank statements now they will not reply to me, nor give me my money I can no longer use my portal for transactions as I will not get the money. I did not know all this, especially with clover first data and changing their name. I did a few transactions everything went through. I did a bigger transaction and they held it now they will not talk to me nor give me my money I keep talking to the broker and they say I’m gonna get paid, but I never have yet. It has been almost 3 weeks and nothing in reply. The American government needs to come down on these crooks for good and I’m glad they got sued for all their money, and I hope they lose everything the people working for them. Yes I understand. They have a job and getting paid, but they should have some morals. The American government should get down to business with these people and I’m so happy for the people suing them for millions of dollars for overcharging because they are fraudsters in scammers and they will pay for everything they’ve done sincerely a small business in Toronto Ontario.

Patrick Boily

Do not use this company!! They freeze accounts that have been with them for years and provide some of the worst customers service imaginable. Incredibly rude customer service. Tens of thousands of dollars have been frozen from my account and I’m not sure when I’ll get it back. Based on other stories from previous customers, it’s not looking good.

Robert L.

Ee have been in business for 35 years, Huntington recently set up our merchant account for us, the first transaction we ran was flagged, all legit sales, we provided fiserv with everything, our product is gone, they have our 9,000 and said that they are holding it for 60 days upon further review. the huntington merch rep now conveniently wont answer her phone and we cannot pay our bills and our employees this week before christmas. If anyone can help please let me know!!!

Geri B

One of our customers asked if we would resell his 10 Clover Duo complete systems for them. Fiserv/ First Data told them they had to buy all new systems if they wanted to use a different credit card processor. They paid almost $2000 for each system, these were not “free” for using their processing service. The systems were not even a year old. No one will help or even answer questions as to why these can’t be used by another company. Even if they agree to use the original cc bank, Clover refuses to allow people to reuse them.

I know people who work in the concessions business who say that they can wipe these units to be reused. Many sports and entertainment venues that use Clover are able to update regularly and are not forced to purchase new equipment.

What a waste! Are we expected to just dump them all in landfills?

Marc

I called customer service and they could not find my acct.. Absolutely could not understand the tech and after 10 minutes of trying to get customer service and giving all my info i hung up. Now I switch bye bye

John Wilson

I told that i could keep an account on hold fir only $5 because i wasn’t using it. First thing they did was charge me a $125 fee. I then closed the account and they refused to refund any of the money. Gave me the run around.

Francisco Cid Del Prado

I made a contract with SDCCU bank, but they used Clover for merchant services and Clover uses first data. I decided to move to a smaller bank because it looked like a good deal with what they were offering over at San Diego County Credit Union.

On the first day of using these new terminals my first transaction, made on November 24, was for $1 and we saw that it worked but we didn’t see the deposit because normally it gets deposited the next day. So I continued to make charges with the terminal with no issues processing thousands of dollars per day until I noticed there was no deposit into my account. ( A total of $21,000 ) I got ahold of Clover and they said there was a security hold of my account. I was left to talk to their risk management department (someone named Terrance) stated that I needed to fill out some extra documentation. I finally called on December 6th, and they stated that my funds would be released within 24-48 hours. I then got a Letter from First data, which was dated the 2nd of December. I tried calling and was only able to leave a voicemail to Mr. Justin Benbow and all he stated was that he was going to conference with them on the 14th. I called on that day, no one answered. Ten minutes later Mr. Justin Benbow, stated that they were closing my account because of supposed ” Potential fraudulent charges.” I didn’t know why they were doing that because I was just trying to do business with a local bank. They stated that it was within their jurisdiction that they could hold my funds for up to 60 days. At this point in time, it has been more than 60 days and I can’t talk with anybody from the first data. I then spoke to Mr. Tony Rodriguez who was very aggressive. He stated that I would not get back my money and that my business was at risk. He also stated that he did not care. I am missing the $21,000 that rightfully belong to me still. I also stated that this was killing my business because I had no cash flow. He stated he did not care. I can’t get anyone to help me. These are a bunch of criminals and thieves who only use your money to make more money. I understand that this is a business, but what they are doing is stealing from people for no reason.

A

For several weeks first data has been stealing a large percentage of income from me. Clover reports show 1 figure that’s supposed to be sent directly to my bank, instead first data sends me much lower numbers. So far in the last 5 weeks they’ve stolen over 12k that I know of. At first I thought I was going bankrupt or tons of gift card clients were coming in. No turns out you cannot trust your merchant processor. I’m not only a small business but I’m a single woman who currently cannot pay her buildings rent or bills because of first data. I want my money back.

JACOB

Fiserv took 15% of my total profits last month. Only 68% of that was actually shown in bank statements. There is literally 32% fees, which are simply missing. It is time to drop this merchant. I would rather pay the early cancellation fee that continue to be robbed by these guys every month. To top it off, they planned on increasing my fees by 0.10% across the board for all card types, and I had to call them to tell them I am not ok with it, or they would just make it part of my terms of service. So basically, If I am not watching them like a hawk, they will try and pull a fast one on me without me noticing. What the hell is this company?

jerry

Bunch of criminals work at First Data or their new name fiserv. First the salesman lied to me telling me the equipment was free, no charges. Then after I got the machine, turns out I have to pay for the machine for 48 months. They also told me you only need a internet connection to hook up the gate way. turns out , I needed a landline to hook up the gateway. So, I decided to return the equipment to First Data and cancel the equipment, than 6 month later, they tell me they did not receive the machine, I sent it in a return package they sent me to ship it to. They said they will need to charge me for 4 years to pay off the machine. I said ok reluctantly because I did not want to damage my credit, it is now 6 years and they are still charging me for the machine every month. Tried calling them multiple times, but cannot get in touch. These guys are outright criminals. Don’t deal with these guys, they will steal your money and hold your money for months before paying you. Get more reliable company like Square.

Sue

The worse!!! I had over 11g taken out of my account because they said my TIN/FEIN was incorrect! They said the IRS required them to do so. The IRS doesn’t have my money and 1st Data says they do but don’t know.

I’m a sm business that got nothing from the pandemic..now this. Going to shut down my business. I can’t get anyone to help me…

Do not do business here.

Anonymous

Three words. Legalized scam company. Last year, Bank of America partnered up and handed their customers to Fiserv (First Data) for merchant services. I am absolutely FURIOUS at my own bank to do this to us. The company practically AND SECRETLY signed us up an additional contract without our knowledge and we were paying for unnecessary fees and equipment lease payments. Took us 3 months to cancel because they kept beating around the bush and sent us on different call departments that could hardly speak English.

WE FINALLY GOT RETURN LABELS TO SHIP BACK THE EQUIPMENTS, AND THEY SAID THEY NEVER RECEIVED OUR EQUIPMENTS UNTIL WE THREATEN TO BRING THIS TO COURT AND SUE THEM. DO NOT!!! DO NOT!!! DO NOT GET FISERV!! SCAM. COMPANY. TAKES ADVANTAGE OF SMALL BUSINESSES.

Zac Creel

I agree they are the most crooked in the business they should be held accountable for all the harm they have caused to small family owned business they have scammed ( robbed for all they could )

Dan Jones

Sent a written notice and called and never had my account cancelled. They’ll bring you through multiple loopholes and charge you.

Charles Flanders

worst company i have ever dealt with of any kind i am 77 years old and have dealt with many good people but this is not one of those i have always maintained perfect credit when these people want you pay charges you don’t owe they immediately threaten to turn you over to the credit bureau i have paid them way more than originally agreed on and paid my lease off way in advance to get rid of their deceptive practices , for approximately 3 and a half years i paid them without ever using their products or services even after they agreed to cancel my contact within 2 weeks after signing also it is almost impossible to get them on the phone and when you do they pass you from 1 agent to another and you never get one who acts like they know what your talking about if you do business with them you will be signed to an unbreakable lease and even if you never once use them or their equipment you still have to pay dearly to them and they throw charges on you that is not in the contract i was never late paying them but i had no choice or risk a negative report on my credit which is otherwise perfect. i understand they are being sued by several companies right now , i would sue them and have legal grounds to do so but the cost to sue them would be more than i could get from them and they realize that

Maggie Smith

I am currently shopping for processors. I have heard good and bad things about this company so im still on the fence. Though, i will say as i read these reviews id mark some of them unfair because i see a lot of reviews that only shows the business owners lack of accountability , all you have to do is read what youre signing. I dont think its a companies fault because u didnt care to read your terms.

REG THIESSEN

I strongly advise not to do business with this company. We made a huge mistake switching to them. Shortly after signing on we started getting false declines and had several customers that double paid. Called First Data and they blamed the consumer or user error which was an easy cop out. I could see that on one false decline but 5 in one day out of a total of 40 transactions? We made a mistake of ordering a second terminal which we realized we wouldn’t need after. They refused to take it back and gave some BS answer on how it was programmed for our business. These guys are crooks, they see nothing as their fault. DO NOT DO BUSINESS WITH THEM PERIOD.

T.A Mcbride

Very disappointed to see that this company, though out all these lockdown, knowing there is no trading going on, are still happy to take your money. Absolutely disgusting.

Stef

We recently became a victim of First Data’s unethical tactics. We had a bot try and run several different card types over 65k times. We were told that we were not PCI compliant nor did we have security measures in place at the time. All which were false.

This has been a nightmare for my wife who has put all her blood sweat and tears into her 9+ year business to have it come to this. They took every single cent she had in her business account. Forcing her to have to close her business. All in a pandemic no less.

After 10 or so calls to FD we got nowhere. Just the run around. We don’t have the money to sue and don’t know where else to turn. We’ve reached out to local news stations, anywhere to shine a light on this horrendous nightmare. Companies like FD should not be able to get away with this.

Michael Engberg

Fiserv / Payeezy Absolutely , the worst business I have ever done business with. The same thing happened with my small business and I have been doing business with First Data since 2009 , never once have we ever had an incident like this occur . We had 25k authorizations first night run through and we automatically shut down the site. Spoke with the Payeezy gateway and fiserv for hours and hours putting things in place to make sure that this would not happen again . Lo and behold 72 hrs later through the middle of the night 11k authorizations run through again. All in all this has cost us $2300.00 and its our fault for allowing a unsafe website. Nobody seems to account for this and when you call all they do is transfer you back and fourth between the 2 and then tell you how sorry they are. And that they will hope to do better next time. They are raping the small business and they know it. All i can say is in the end God does win so continue to do what you do you will have your day of reckoning not by me.

Susan Kayser

I made a credit card payment thru another bank (not Regions) and they charged me a late fee and an interest penalty. As I had made the payment through Regions Bank Bill Pay which I found out is run by Fiserv, I was understandably upset as I have an excellent credit rating and always pay ahead of time. Needless to say, I made two more payments, each time hoping the other bank would receive the payments. The payments had the correct account number and address. Regions refused to help. We had a conference call with the other bank, which also did not resolve the issues. Finally, the other bank sent me two letters in the mail, stating that they had conducted a thorough investigation, and never received the money for either payment. I took these letters into Regions bank and they were finally credited back to me after my having to fight for over a month. This past weekend I attempted to use Bill Pay which was blocked. I do not think it was even legal, as I have $6858.50 in my account. I wasted 40 minutes waiting on the phone and calling Regions. I then was told to call Bill Pay Fiserv again and wasted another 1 hour, 9 minutes and 10 seconds before the phone rep turned on the bill pay. I attempted to find out why it had been blocked and she could give me no reasonable answer, while a previous person had told me that there was still an issue with a payment. So instead of charging me again for the $132.61 (which had been previously reversed as the other bank had never received the payment) they blocked my account leaving me with NO ACCESS TO MY $6858.50 FOR 4 DAYS!!!!! I do not believe this is even legal! I am worried that I may be blocked again as there was no reasonable explanation, only that it concerned these payments. If Fiserv does not have my money (as the one rep claimed) and they issued the check to the other bank for $132.61, (which the other bank states they never received thus never cashed, then Fiserv needs to find out who stole my money. It is very simple, whoever stole the money, had to endorse the check. There is a record. Instead, Fiserv has been giving me a run around for over a month and being blocked was a horrific experience, placing me at risk for not paying a bill on time. Also, I had to pull teeth to get the information that Regions Bill Pay was run by Fiserv. After some research, I discovered that Fiserv changed their name after receiving over 1000 complaints. I found an article titled, “Fiserv subsidiary paying $40 million to settle fraud allegations,” as of May 20, 2020. They have received 813 complaints in the last 3 years (and most people are too busy to complain). They also received a D rating. So why is Regions Bank using them for the Bill Pay. Unethical company, with possible Illegal activity for blocking me from my funds. THEY SHOULD BE OUT OF BUSINESS! If there is a class action suit, please contact me.

Stef Serafin

We just got taken for $5k. You should list a database of lawyers willing to file suit against First Data.

I’m so glad to know we’re not alone in this. Our business will have to close due to this insanity. I can’t believe they’re allowed to stay in business.

Kevin

Can’t process transactions! Is anyone else experiencing an outage?

Clay Travis

Absolutely stay away from First data, since they were bought by fiserv they have ZERO ability to talk to me about my account or online features. I haven’t been able to contact a representative in a year.

Instead they constantly call offering high interest predatory loans. I’ve asked them to stop treating me like I’m entering a Money tree… But they just keep on coming. Finally I shipped around and Moneris has lowered fees and isn’t owned by a predatory loan company.

Do NOT agree to these loans they are 300% worse than a regular bank loan no matter how they spin it.

Cynthia Ott

How come this dumb company scam called me under the name of FedCreditunionHawaii and I don’t own a big or small business or any business or credit card? I block the number(s) now.

Mike Rolle

This has been the ABSOLUTE WORST company I have EVER worked with. VERY poor communication capability both with the Clover side and the Firstdata/Fiserv support side.

I don’t see any way the company could be worse. Once the term is up we are gone.

We did not go through a broker so this does not reflect on any broker.

The last straw was trying to get our deposit account changed to our new business banking account. We initially set it up to deposit to our personal account and the company was well aware that we were in the setup process for the business bank account.

Turns out that, unlike every other processor I have ever worked with, the end-user cannot change their own deposit account though we were told we could do so before we purchased. There is a ridiculous and tedious “process” to go through before they will change the account to the correct one. This has literally been 7 weeks trying to get this done. They “require” a new document signed and sent in to some unknown individual or department to complete. We did sign the document but it was not a “wet” signature. We used the same signature on our origin documents without problem. We sent it from the same email address used to open the account with them. I am at the number used to set up the account, but they so inept that they cannot operate the same way to change the account over.

Absolutely pathetic.

Kandice Moore

I don’t know how this company stays in business! They removed $$ from my account 3 times for 1 customer return! I have been fighting for over 4 months trying to get the fraudulently withdrawn $$ back from them! I authorized them to remove the $$ from my account 1 time to refund the customer, not 3! Glad I went back to Square!

Travis

First data renamed as Fiserv coz they know they are a scammer. Highly recommend that you avoid leasing your equipment, as you’ll get locked into a noncancelable contract, which will cost you many times more than what the equipment is worth over the life of the lease.

Mark Erwin

Allow me to echo the criticism of a terrible company. The portal was designed in 1999. I expected a green DOS prompt to pop up. Trying to get online statements took 4 days with no resolution. We would get encryptic emails of the failure the day after attempting. Phone service with “Precious” (That is really her name) was voicemail and never a returned phone call. First Data was recommended by our bank, MidFirst. Great bank… terrible merchant service provider. We opted for Century Business Solutions because they integrate with QuickBooks. Wow! Night and Day difference. Bye Bye FirstData/Clover/Payezze!

Gazell. Stewart

I don’t know how First Data Global and velocity can treat people So bad. Velocity sends their slick talking salesman out telling you to switch your machines for better rates and put you in a 4 year contract. They had me paying both contracts for over 7 months. Then tell me I would get a refund, but what about this contract that they lied and put me in. Then tell me they are sending me a check and send them the rest ,why. Then send me another check registered mail. I am so fed up I told them to send it to first data global lease. I send all their machines back and then they sends me a email asking about machines that they got back in April. They are so messed up over there first Data and Velocity. I am 62 years old too old for their Games they are pulling on consumers. I am done.They can do what ever they want., But I am done. G.s.

CPO

Stewart,

This article should help: How to Cancel a Merchant Account Without Paying a Fee.

-Phillip

Jason

Horrible customer service and accountability. This company is not there when you need them. Customer service are under trained, do not listen and don’t know how to respond to issues that aren’t in their script.

The sales reps are your best buddies until they get there contract signed. The contract I had was sent by DocuSign as Daniel Peake, the sales artist was not available to come to my shop which is protocol for them to do with new accounts. The insurance portion was crossed out.

When my machine was stolen in a police reported robbery First Data were nowhere to be found for customer support

A truly greedy and non-professional organization that has cost me thousands in business and even more to break contract…

Run, don’t walk from this horrible company

CPO

Jason,

These articles should help: How to Cancel a Merchant Account Without Paying a Fee and Best Merchant Accounts for Great Customer Service.

-Phillip

Debbie Stolidakis

worst company ever!!! the biggest crooks I have ever met!!!!! Do Not Do BUSINESS WITH THIS CoMPANY

Karen Clark

Worst customer service experience ever! I had never heard of First Data until they started sending me collection notices. They claim I signed a non-cancellable contract, but they can’t give me a copy of it. Customer service is worthless and ends difficult calls by hanging up and snarling, “Have a nice day.” Of course no supervisors are ever available to escalate concerns. I’ve filed a complaint with the Better Business Bureau (as have hundreds of others). This company needs to be stopped.

Craig D.

I can understand a $9.95 monthly lease fee, like other providers but NO I am being charged $245.00 a month for 4 years. That’s $11,760 total. I’m a small business( 5 Employee’s) and I thought i was going to be saving money going through FirstData but instead I’m being robbed by FirstData. Read your contract VERY well before signing.

Ted

Everything was going fine until I had a streak of large transactions and instead of welcoming the boost in sales volume, I got several calls from processing telling me that they were going to cancel my account unless these types of transactions stopped occuring. Then the paperwork came and all the hopes started to stack up that we had to jump through and of course as a merchant we have no control over this and I ended up having to find someone else that could handle our processing needs.

This post will help: Best High Volume Merchant Accounts

-Phillip

Latricha

Worst leasing company ever!!! I no longer have a business therefore I no longer need to utilize their product. There IS NO WAY OUT OF THIS CONTRACT if you no longer need their product! They believe you should continue to pay even if you send them back their product! That’s wicked and insane! Run! Run! Find another company!! God bless

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

DEL

I was employed by FDMS some years ago. I worked in HR in the Hagerstown office. I witnessed some of the most unethical, immoral, and illegal practices that I have ever seen. Although I refused to perform any of these ridiculous acts, I was asked not only to shred (“negative feedback”) employee surveys, but also to fill out a bunch of “positive feedback” surveys. I witnessed employee layoffs based on reasons other than performance and/or department needs. I witnessed layoffs based on race, popularity, and other personal reasons. I witnessed managers who wrote discriminatory remarks directly onto resumes of people interviewed. For example, notes were written on resumes that supposedly helped management remember which candidate was which. Notes included references to race, weight, height, foreign accents, and other notable attributes. I witnessed firing of employees with reasons noted in the employees file that weren’t true. For example, 1 employee was fired for insubordination – which was a complete lie. I could go on and on about how horrible this company was while I was there – and I was there for less than 9 months. Remember, I refused to perform the illegal, immoral, and unethical practices that I was asked to perform however some colleagues did not refuse.

Defeated

I am experiencing this now as an agent for Citizen’s One. I can’t reach out to anyone and I feel alone for standing up for my teammates. Management is a joke and do not know their jobs and because I voiced my opinion, I am now being labeled hostile. So many unethical things happening and I may lose my job for standing up and saying something…

Alycia

Worst company EVER! do not do business with them. they take random amounts of money out of your account and they cant even explain WHY!

Their chargeback process is a headache and one first data agent says one thing and another says different. useless

This post will help: How to Fight Chargebacks and Win

Brooklynn K.

I cancelled my merchant services, three months later still received charges (was thinking 60 days tops for ending charges may still pop up) but at 90 days and $200 later, for being charged to use the First Data processing, although no transactions were being done in my account, I called to cancel again. After the rep had done so he informed me I would not be refunded as the account was closed. My first complaint to him was I needed a refund. This company is awful! I knew fees were high but was reassured by my bank this company was the best out there. They were so wrong. Adding up fees and lease charges and merchant charges, I lost A Lot of money in my small business with this company. I agree this company should be shut down!

There has to be someone who can help us!

This post will help: Cancelling a Merchant Account Without Paying a Fee

Steve's Tech

The backend is not easy to use. FD makes deposits each day for each different style of card that was batched meaning more deposits meaning higher bank fees. Cancellation fees are very high.Basically this company is horrible if you are a small to mid size company.

This post will help: Cancelling a Merchant Account Without Paying a Fee

-Phillip

Gary Wilds

First Data…

Well the rep came in very nice guy, went over all the legal stuff & contract stuff. I never remember him saying that I would be leasing the terminal! but apparently I am for $39.00 per month, I am also in a 48 month contract,

so in 48 months I will be paying $1,872.00!!!

I now see I can buy this terminal online D Javoo Z11 for wait for it… $100.00.

I called customer service, that was a nightmare.

Finally got to talk to a Woman in India, she had no answers, just read stuff off her computer screen.

The Rep I had of course never takes my calls or calls me back.

I strongly would NOT recommend this company.

Find someone else

This post will help: Cancelling a Merchant Account Without Paying a Fee

Olivier P.

I used the clover flex for an event. it worked well.. until it was time to receive my funds!!

They decided to freeze more than 100,000$ in sales without any reason. it brings me lot of consequences, stress and troubles with my clients.

the team at first data did not answer my emails, my calls, etc. the service was awefull from the begginning to the end (i’m still waiting for my funds!)

I wish that any business owners and entrepreneurs will have to ever deal with a company that freeze his own money without any good reason.

Olivier P.

This post will help: How to Make Your Payment Processor Release Your Money

Rob Hayes